Market Overview

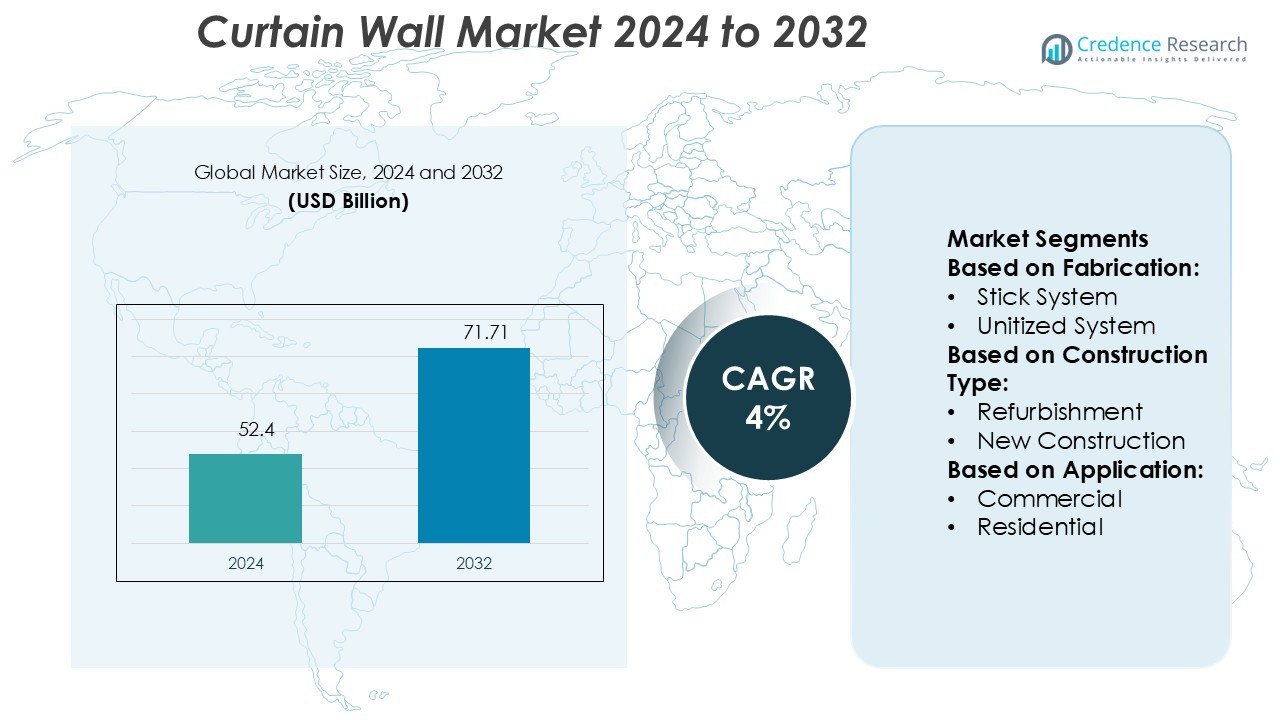

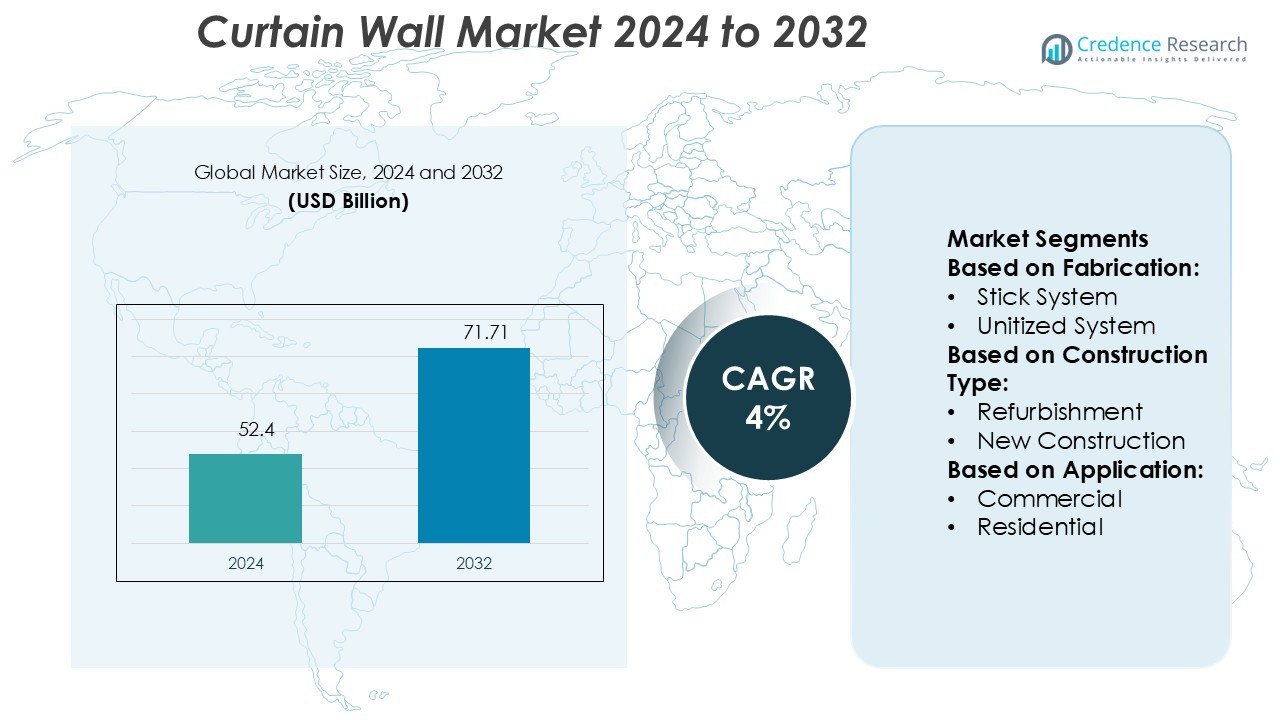

Curtain Wall Market size was valued USD 52.4 billion in 2024 and is anticipated to reach USD 71.71 billion by 2032, at a CAGR of 4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Curtain Wall Market Size 2024 |

USD 52.4 Billion |

| Curtain Wall Market, CAGR |

4% |

| Curtain Wall Market Size 2032 |

USD 71.71 Billion |

The curtain wall market is driven by major players including Guardian Industries Corp., Reynaers Group, Saint-Gobain Group, Schott AG, EFCO Corporation, Nippon Sheet Glass Co., Ltd, Central Glass Co. LTD, EFP International B.V, Elicc Group, and AGC Inc. These companies focus on innovative façade systems, energy-efficient glazing, and smart building integration to strengthen their market positions. They actively invest in advanced materials, automation, and digital technologies to enhance performance and reduce installation time. Asia Pacific leads the global curtain wall market with a 33.8% share, supported by rapid urbanization, large-scale infrastructure projects, and strong government initiatives promoting green buildings. This regional dominance offers key growth opportunities for both local and international players.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The curtain wall market was valued at USD 52.4 billion in 2024 and is expected to reach USD 71.71 billion by 2032, growing at a CAGR of 4%.

- Market growth is driven by increasing demand for energy-efficient façades, rising commercial construction, and strong adoption of smart building technologies.

- Advanced glazing, prefabrication, and lightweight materials are key trends enhancing building performance and reducing project timelines.

- Leading players focus on innovation, automation, and strategic expansion to strengthen their global market position, facing restraints such as high installation costs and strict regulatory compliance.

- Asia Pacific dominates the market with a 33.8% share, followed by North America and Europe, while the unitized curtain wall segment leads overall demand due to its faster installation and superior energy performance.

Market Segmentation Analysis:

By Fabrication

The unitized system segment holds the dominant market share of 63.8% in the curtain wall market. Unitized systems are pre-fabricated in factories, enabling faster installation, lower labor costs, and improved quality control. Their high thermal performance and seamless aesthetics make them ideal for modern high-rise projects. Strong demand from commercial developers and smart city projects drives their adoption. Stick systems are used in smaller buildings, but slower installation and higher on-site labor costs limit their growth compared to unitized systems.

- For instance, Guardian’s SunGuard SNX 70 gives a U-value of 1.0 W/m²·K in insulating glass units. Strong demand from commercial developers and smart city projects drives their adoption.

By Construction Type

The new construction segment accounts for 69.5% of the total market share. Rapid urbanization, infrastructure investment, and commercial development fuel strong demand for curtain walls in new buildings. Developers prefer curtain walls in new projects to improve energy efficiency, natural lighting, and architectural appeal. Growth in green building certifications and sustainable design standards also supports adoption in new structures. The refurbishment segment is expanding gradually, focusing on retrofitting old facades for improved energy performance and visual upgrades.

- For instance, Reynaers’ technical information confirms the ElementFaçade 7 has an air permeability performance rating of AE 1200, which means it resists air leakage up to 1,200 Pascals.

By Application

The commercial segment leads with a 72.1% market share. Curtain walls are widely used in offices, malls, hotels, and institutional buildings to enhance building aesthetics and energy efficiency. Strong investment in corporate infrastructure, smart buildings, and urban business hubs drives this demand. Architects favor curtain walls for their ability to support large glass facades and natural light integration. The residential segment is growing steadily, driven by luxury apartment projects and sustainable housing trends.

Key Growth Drivers

Rising Demand for Energy-Efficient Building Envelopes

Curtain walls play a major role in enhancing energy performance in modern buildings. Developers prefer curtain walls due to their ability to reduce thermal transfer and support sustainable design goals. High-performance glazing and aluminum framing help maintain temperature control, lowering operational energy costs. Governments are enforcing stricter green building codes, pushing developers toward energy-efficient façades. The trend is especially strong in commercial projects, where operational efficiency matters most. This focus on energy savings and environmental compliance is driving rapid market adoption worldwide.

- For instance, Saint-Gobain’s Cool-Lite XTREME 70/33 glazing achieves a light transmission of 70% while limiting solar factor to 0.33, improving indoor thermal comfort. High-performance glazing and aluminum framing help maintain temperature control, lowering operational energy costs.

Accelerating Commercial Construction Activities

Growing investments in commercial buildings significantly increase curtain wall installation. Rapid urbanization and infrastructure expansion across major cities create a strong demand for modern façades. Office spaces, malls, airports, and hospitals use curtain walls for aesthetics and energy efficiency. Developers favor these systems due to their flexible design and faster installation timelines. In addition, large-scale smart city projects are boosting demand for advanced façade solutions. This rising commercial construction activity directly supports market growth and expands supplier opportunities.

- For instance, Schott’s PYRAN® Platinum fire-resistant glazing can provide fire protection for up to 90 minutes in windows and up to 180 minutes in doors. The glass-ceramic is certified to meet standards such as those by Underwriters Laboratories (UL) and supports safety compliance in commercial structures.

Technological Advancements in Façade Systems

Technological innovation improves curtain wall performance and installation efficiency. Advanced unitized systems offer better sealing, higher thermal insulation, and reduced labor costs. Integration with smart building management systems enables real-time monitoring and improved energy optimization. Manufacturers are also using automation and prefabrication to speed up production and reduce errors. These innovations enhance structural strength and lower maintenance needs. As a result, modern curtain wall systems attract developers seeking durability, safety, and long-term operational savings.

Key Trends & Opportunities

Growing Adoption of Smart Façade Technologies

Smart curtain walls with embedded sensors and dynamic shading are gaining popularity. These systems automatically adjust to external conditions, improving building energy performance. Integration with HVAC and lighting controls reduces energy consumption and enhances occupant comfort. The trend is strong in high-rise and commercial buildings where performance and design integration matter. Companies investing in intelligent façade solutions gain a competitive edge. This technological shift creates new opportunities for manufacturers and solution providers.

- For instance, Nippon Sheet Glass’s SPACIA® vacuum glazing achieves a center-of-glass U-value of 0.7 W/m²·K, enabling advanced thermal control in intelligent façade systems.

Rising Use of Sustainable and Recyclable Materials

Sustainability is becoming a key factor in material selection for curtain walls. Manufacturers are increasingly using recycled aluminum and low-emission glass to meet green building certifications. These materials reduce environmental impact and improve building energy ratings. Global regulations on carbon emissions and resource efficiency support this trend. Developers benefit from reduced lifecycle costs and improved compliance. The growing demand for eco-friendly façades offers a strong opportunity for innovative product development.

- For instance, AGC’s SunEwat™ energy-generating glass integrates thin-film photovoltaics within façade panels, enabling power generation densities over 120 W/m² under standard testing conditions.

Increased Demand in Emerging Markets

Rapid infrastructure growth in Asia Pacific, the Middle East, and Latin America is boosting curtain wall demand. Urban expansion and rising disposable incomes support investments in modern commercial and residential buildings. Governments in these regions are launching large-scale development projects, including airports and business hubs. Developers prefer curtain walls for their design flexibility and energy performance. This creates lucrative opportunities for both local and international manufacturers to expand their market presence.

Key Challenges

High Initial Investment and Installation Costs

Curtain wall systems require significant upfront investment compared to traditional façades. High-quality glass, aluminum frames, and advanced sealing technologies increase project costs. Installation demands skilled labor and specialized equipment, raising construction budgets. For smaller developers, these costs can be a barrier. The long payback period, despite energy savings, further limits adoption in cost-sensitive markets. Overcoming this cost barrier remains a critical challenge for wider market penetration.

Stringent Regulatory and Performance Standards

Curtain walls must meet strict structural, thermal, and fire safety standards. Compliance with diverse regional building codes can be complex and expensive. Testing and certification processes delay project timelines and increase costs for manufacturers and developers. Non-compliance risks lead to heavy penalties or redesigns. These regulatory pressures require continuous innovation and investment in R&D. Meeting evolving standards remains a significant challenge, especially for smaller market players.

Regional Analysis

North America

North America holds a 31.2% share of the global curtain wall market, supported by advanced construction standards and strong demand for energy-efficient façades. The U.S. dominates the region, driven by extensive commercial construction, particularly in urban centers. Developers favor unitized systems for their faster installation and compliance with LEED standards. Major projects include office towers, airports, and educational facilities. Regulatory emphasis on green building codes accelerates market adoption. Leading manufacturers in the region are investing in smart façades and prefabricated systems to reduce costs and improve building performance, strengthening their competitive position.

Europe

Europe accounts for 27.6% of the global curtain wall market, driven by sustainability mandates and modern architectural trends. Countries such as Germany, France, and the UK lead the region with large-scale commercial infrastructure projects. The European Green Deal and strict energy efficiency regulations encourage the use of high-performance glazing systems. Refurbishment of aging buildings also supports steady demand. Lightweight unitized curtain wall systems are gaining traction due to ease of installation. Strong innovation capabilities among European façade solution providers help meet advanced design standards, supporting stable market growth.

Asia Pacific

Asia Pacific leads the global curtain wall market with a 33.8% share, fueled by rapid urbanization and infrastructure expansion. China, India, Japan, and South Korea are key contributors, with large-scale commercial and residential projects driving adoption. Rising investments in smart cities and green buildings further enhance market demand. Governments are promoting energy-efficient façade systems to reduce carbon footprints. Cost-effective manufacturing and strong local supplier networks make the region highly competitive. International players are expanding their presence through strategic partnerships and joint ventures to meet growing project volumes.

Middle East & Africa

The Middle East & Africa region captures 4.2% of the global curtain wall market, driven by rapid infrastructure development in Gulf countries. The UAE and Saudi Arabia lead with high-rise commercial and hospitality projects integrating advanced façade systems. Mega developments such as smart cities and mixed-use complexes boost demand for durable, energy-efficient solutions. Extreme climatic conditions push developers to adopt high-performance glazing for insulation and solar control. Africa is emerging with gradual investments in commercial construction, presenting future growth opportunities. Regional demand is supported by international suppliers partnering with local contractors.

Latin America

Latin America holds a 3.2% share of the global curtain wall market, with Brazil and Mexico as primary contributors. Urban development and modernization of commercial infrastructure are key growth drivers. Developers increasingly adopt curtain wall systems to enhance building aesthetics and energy performance. Economic diversification efforts and government-backed construction projects are creating steady opportunities. However, high installation costs and limited local production capacity pose adoption challenges. International façade solution providers are expanding their presence to meet regional demand. The market is expected to grow steadily with upcoming urban infrastructure initiatives.

Middle East & Africa

The Middle East & Africa region captures 4.2% of the global curtain wall market, driven by rapid infrastructure development in Gulf countries. The UAE and Saudi Arabia lead with high-rise commercial and hospitality projects integrating advanced façade systems. Mega developments such as smart cities and mixed-use complexes boost demand for durable, energy-efficient solutions. Extreme climatic conditions push developers to adopt high-performance glazing for insulation and solar control. Africa is emerging with gradual investments in commercial construction, presenting future growth opportunities. Regional demand is supported by international suppliers partnering with local contractors.

Market Segmentations:

By Fabrication:

- Stick System

- Unitized System

By Construction Type:

- Refurbishment

- New Construction

By Application:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The curtain wall market is shaped by leading players such as Guardian Industries Corp., Reynaers Group, Saint-Gobain Group, Schott AG, EFCO Corporation, Nippon Sheet Glass Co., Ltd, Central Glass Co. LTD, EFP International B.V, Elicc Group, and AGC Inc. The curtain wall market is highly competitive, with companies focusing on innovation, efficiency, and sustainability to strengthen their market positions. Manufacturers are investing in advanced glazing technologies, lightweight materials, and high-performance insulation to meet modern architectural standards. Automation and prefabrication techniques are being adopted to reduce installation time and project costs while ensuring high structural quality. Strategic collaborations, mergers, and acquisitions are helping firms expand their global reach and increase market penetration. Many companies are aligning their offerings with green building regulations, emphasizing energy-efficient façade solutions that enhance thermal performance and reduce operational costs. This approach creates strong differentiation in a fast-growing construction landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In July 2025, Saint-Gobain increased its local production capacity and committed to opening more facilities in the second half of the year to better support its sustainable glass offerings and competitive positioning.

- In May 2025, Emirates Extrusion Factory (EEF) which is fully owned by Dubai Investments, and UCS Green Solutions Building and Construction Materials Trade (UCS) which is an innovative façade and cladding exploitation solution company entered into an exclusive Memorandum.

- In November 2024, AluK India is revolutionizing high-rise buildings with the introduction of its W75U Unitized Curtain Walling System, an elegant, innovative solution that not just makes building tall but seen. Designed to draw attention and constructed to last, it is the perfect solution for every skyscraper.

- In May 2024, Dow Chemical International Private Limited (Dow India) and Glass Wall Systems India signed an agreement for Dow to supply DOWSIL™ Facade Sealants from Dow’s Decarbia™ portfolio of reduced-carbon solutions.

Report Coverage

The research report offers an in-depth analysis based on Fabrication, Construction Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily due to rising demand for energy-efficient building envelopes.

- Adoption of smart façade technologies will increase across commercial and residential projects.

- Modular and prefabricated curtain wall systems will gain wider acceptance.

- Green building certifications will drive investment in sustainable façade solutions.

- Emerging markets will play a larger role in expanding global demand.

- Digital design and BIM integration will improve installation speed and accuracy.

- Advanced glazing technologies will enhance thermal and acoustic performance.

- Strategic partnerships and mergers will strengthen global supply networks.

- Product innovation will focus on lightweight and durable materials.

- Regulations on energy efficiency and building safety will shape future product development.