Market Overview:

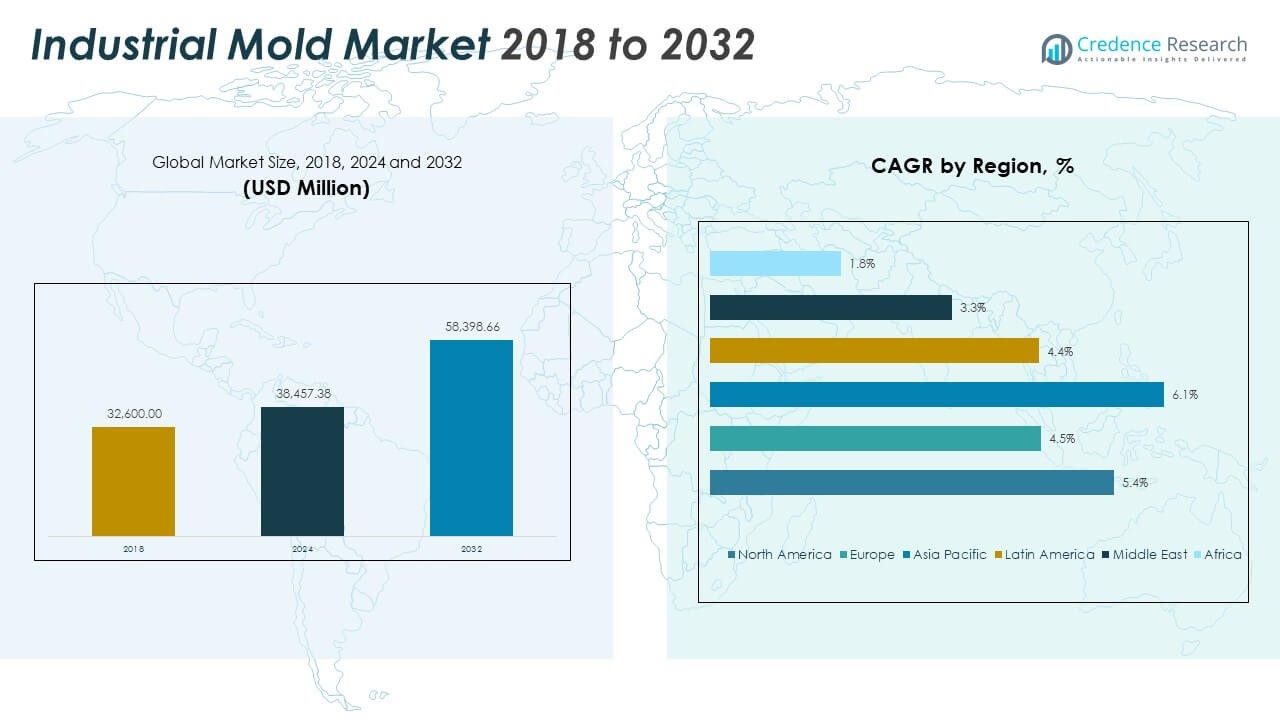

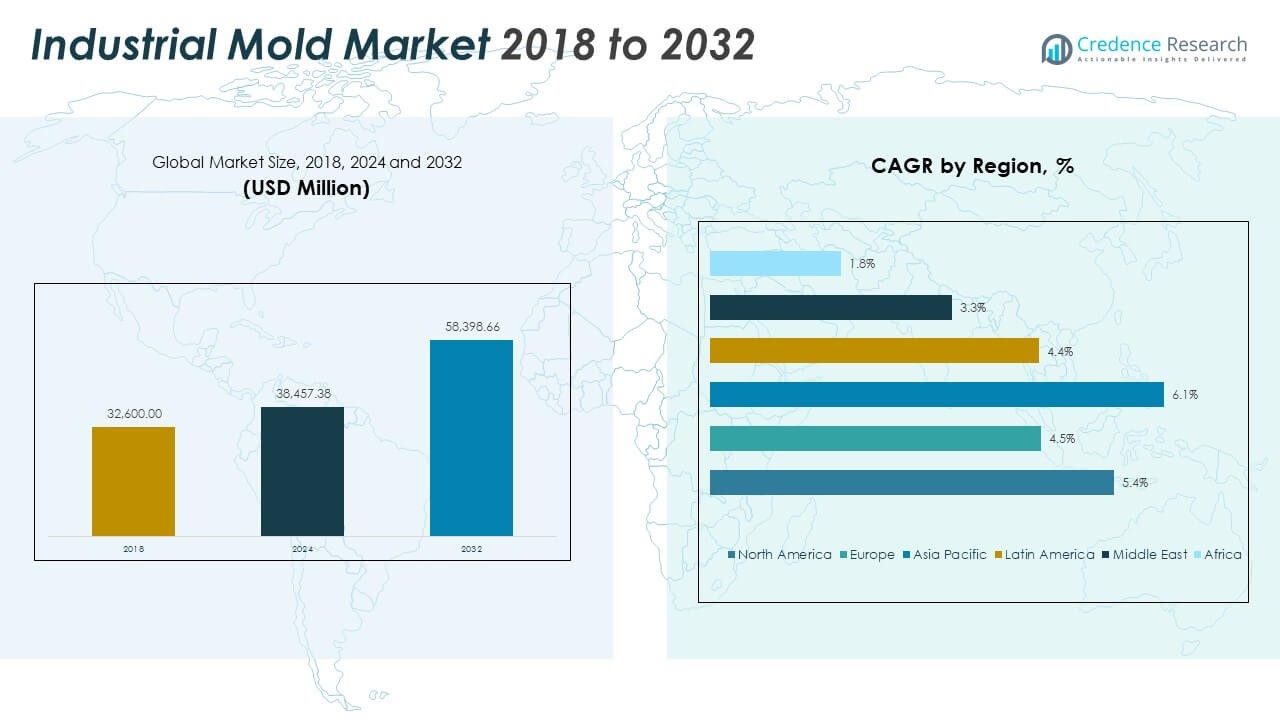

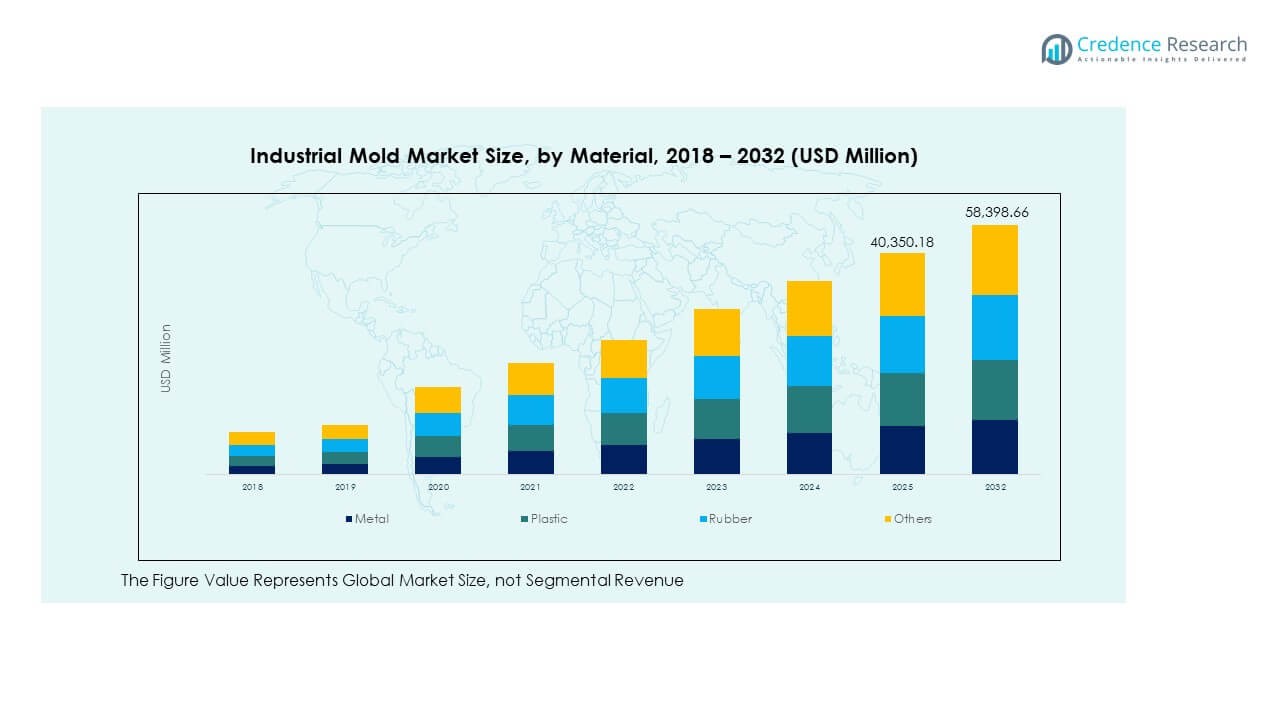

The Industrial Mold Market size was valued at USD 32,600.00 million in 2018 to USD 38,457.38 million in 2024 and is anticipated to reach USD 58,398.66 million by 2032, at a CAGR of 5.42% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Industrial Mold Market Size 2024 |

USD 38,457.38 Million |

| Industrial Mold Market, CAGR |

5.42% |

| Industrial Mold Market Size 2032 |

USD 58,398.66 Million |

Market growth is driven by the rising demand for precision-engineered molds across automotive, electronics, and medical industries. Manufacturers are increasingly investing in advanced injection, compression, and blow molding technologies to improve production speed and accuracy. The growing adoption of automation, AI-based design tools, and rapid prototyping enhances efficiency and quality. It benefits from the expanding use of lightweight materials and sustainable manufacturing practices that optimize costs and minimize waste.

Regionally, Asia Pacific dominates due to large-scale manufacturing bases in China, Japan, and South Korea. North America remains a key market led by technological innovation in automotive and aerospace applications. Europe focuses on sustainability and digitalized production, while emerging regions such as Latin America and the Middle East witness steady growth with increased industrialization and modernization efforts.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Industrial Mold Market was valued at USD 32,600.00 million in 2018, reached USD 38,457.38 million in 2024, and is projected to achieve USD 58,398.66 million by 2032, expanding at a CAGR of 5.42%.

- Asia Pacific leads the market with a 52.11% share due to its strong manufacturing ecosystem in China, Japan, and South Korea, supported by large-scale production and cost-efficient operations.

- North America holds 20.99% and Europe 17.94% market shares, driven by technological innovation, precision tooling, and sustainability-focused production.

- Asia Pacific remains the fastest-growing region, fueled by industrial automation, rising exports, and the expansion of electronics and automotive industries.

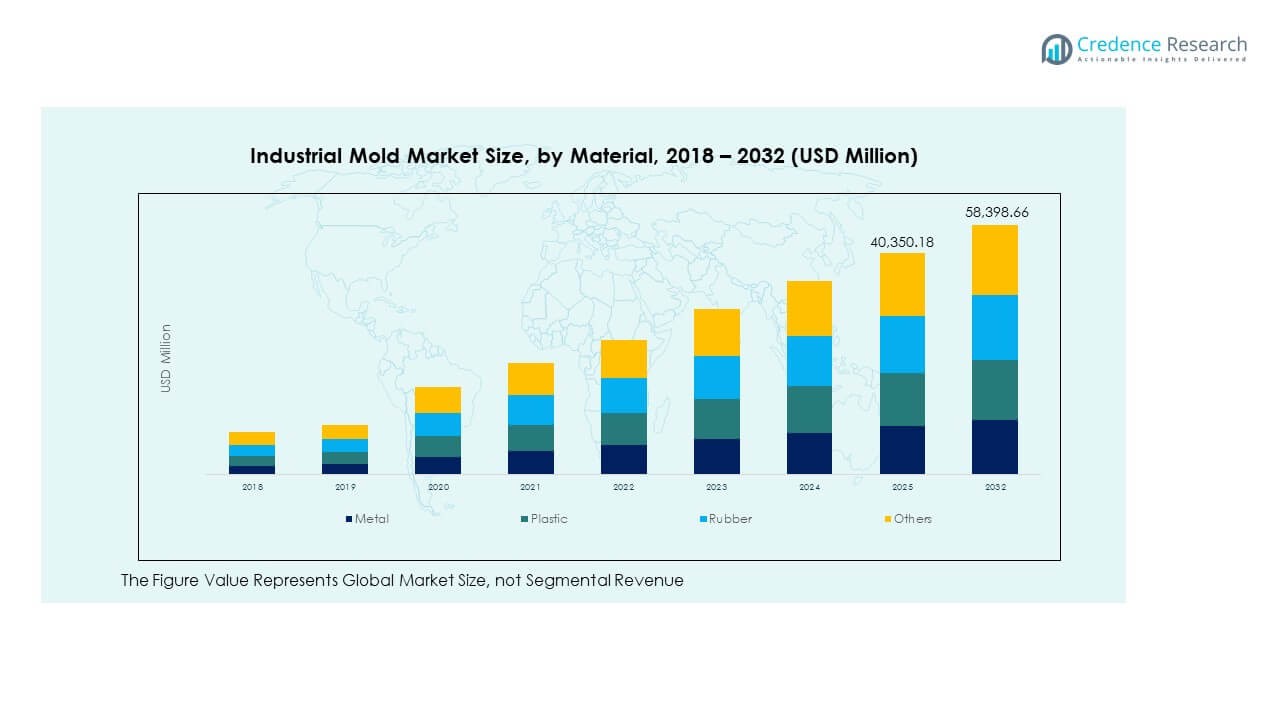

- By material, metal molds hold 34% of the market share, plastic molds account for 29%, while rubber molds capture 21%, and others represent 16%, reflecting diverse demand across manufacturing applications.

Market Drivers

Growing Demand for Precision Molding in Automotive and Aerospace Applications

The Industrial Mold Market is expanding due to rising demand for precision-engineered molds used in automotive and aerospace components. Manufacturers focus on lightweight materials and tighter tolerance requirements to enhance performance and fuel efficiency. Injection and compression molding technologies support the production of complex parts with high repeatability. Automakers increasingly use molds for advanced polymers, carbon fiber composites, and metal alloys. Aerospace manufacturers emphasize mold durability and dimensional stability for critical components. The integration of smart sensors in molds allows real-time monitoring, improving quality control. It drives the adoption of digital manufacturing and automation across production lines.

- For example, AMT Pte. Ltd., based in Singapore, is a certified manufacturer specializing in precision engineering and advanced manufacturing. The company holds ISO 9001, ISO 13485, and IATF 16949 certifications and provides high-precision plastic injection molding solutions for diverse industrial applications.

Technological Advancements and Adoption of CAD/CAM Integration in Mold Design

Advancements in computer-aided design (CAD) and computer-aided manufacturing (CAM) are transforming mold design processes. Digital modeling reduces design cycles, improves prototype accuracy, and enhances efficiency. The integration of AI-driven simulation tools allows engineers to optimize cooling channels and reduce defects. Manufacturers benefit from better resource utilization and reduced downtime. Automation in mold machining ensures consistency in complex geometries. The use of 3D printing for rapid mold prototyping shortens lead times. It helps firms accelerate product development and customization capabilities. This technological progress is reshaping competitiveness across global molding industries.

Rising Industrialization and Expansion of Consumer Electronics and Packaging Sectors

Rapid industrial growth and urbanization increase demand for consumer electronics and packaging products requiring precision-molded components. Molded parts ensure lightweight, high-strength, and cost-efficient structures for mass production. Smart devices, home appliances, and electrical systems rely on intricate plastic and metal molds. The packaging sector benefits from mold innovations that enable complex shapes and sustainable materials. Automation supports high-volume, low-defect manufacturing cycles. Increased investments in new production facilities strengthen supply chain capabilities. It enhances the market’s resilience and responsiveness to dynamic customer demands. These factors collectively accelerate industrial mold adoption globally.

- For example, according to the International Federation of Robotics (IFR), global robot density in manufacturing reached 162 units per 10,000 employees in 2023. The plastics industry is increasingly adopting industrial robots to enhance efficiency and precision in high-volume production environments.

Focus on Sustainability and Development of Eco-Friendly Mold Materials

Environmental regulations and corporate sustainability goals drive innovation in recyclable and energy-efficient molding materials. Manufacturers focus on bio-based polymers and water-assisted molding to reduce waste. Mold makers adopt advanced coatings and alloys to extend tool life. Sustainable production reduces carbon footprints and improves cost-efficiency. The use of renewable energy and closed-loop recycling systems enhances competitiveness. Digital monitoring ensures optimal material use and predictive maintenance. It supports compliance with green manufacturing standards. Sustainability-focused strategies are increasingly shaping investment priorities and procurement decisions across mold manufacturers.

Market Trends

Adoption of Smart Manufacturing and IoT-Enabled Mold Monitoring Systems

Smart manufacturing is becoming a defining trend in the Industrial Mold Market. IoT-enabled molds equipped with sensors track temperature, pressure, and cycle performance. These systems enhance process transparency and minimize production defects. Data analytics help manufacturers predict wear and schedule maintenance before failures occur. The integration of cloud-based monitoring tools supports remote management and real-time adjustments. Smart molds contribute to higher operational efficiency and lower downtime. It enables firms to maintain consistent quality standards across global facilities. The rise of Industry 4.0 adoption continues to expand this trend worldwide.

Increased Use of Advanced Materials and Multi-Material Molding Techniques

The industry is witnessing rapid adoption of advanced materials such as carbon fiber composites, reinforced thermoplastics, and high-performance polymers. Multi-material molding combines different materials in one cycle, improving functionality and aesthetics. These techniques enable manufacturers to produce durable yet lightweight components for automotive and electronics applications. Enhanced material compatibility broadens the range of possible product designs. The development of corrosion-resistant and heat-stable molds ensures longer tool life. It reduces maintenance costs and enhances production efficiency. Global mold manufacturers continue to invest in R&D for material innovation to meet industry-specific demands.

Growth of 3D Printing and Rapid Tooling for Mold Prototyping

3D printing has revolutionized mold prototyping by reducing production time and tooling costs. Additive manufacturing enables faster design validation and mold customization. Rapid tooling techniques offer flexibility for short-run and specialized component production. Hybrid mold fabrication combining additive and subtractive methods enhances surface precision. The technology supports on-demand manufacturing and reduces material waste. It allows quicker response to changing customer requirements. Manufacturers benefit from shorter lead times and enhanced product development agility. The trend aligns with the broader shift toward digital transformation in manufacturing operations.

- For example, Siemens and Stratasys have partnered to advance additive manufacturing by integrating Stratasys’ FDM technology with Siemens’ digital factory solutions. The collaboration focuses on incorporating additive processes into industrial production environments to enhance automation and scalability.

Rising Investment in Automation and Robotics for Mold Manufacturing

Automation and robotics are becoming central to mold manufacturing operations. Robots handle precision machining, assembly, and inspection tasks with high accuracy. Automation reduces human error and production costs while improving consistency. Advanced CNC machines perform complex mold shaping with minimal supervision. Collaborative robots assist operators in tool changes and finishing processes. The use of robotics enhances production throughput and safety. It promotes continuous operation in high-volume manufacturing settings. The trend toward full automation continues to reshape competitive dynamics in the molding sector.

- For example, KUKA Group’s Shunde facility in Guangdong, China, produces one industrial robot every half hour. The plant has an annual output of around 30,000 units and integrates full manufacturing of core components such as motors, controllers, and reducers. It also houses R&D operations, showcasing KUKA’s high level of automation and self-sufficiency in robotics production.

Market Challenges Analysis

High Capital Investment and Complexity in Mold Fabrication Processes

The Industrial Mold Market faces challenges from high initial investment and operational complexity. Mold fabrication requires advanced machinery, precision tooling, and skilled technicians. Small and medium enterprises struggle to match the capital requirements of large firms. Customization and design accuracy further increase costs and lead times. Mold maintenance and frequent retooling add operational burdens. The high cost of specialized materials, such as hardened steels and coatings, limits flexibility for smaller producers. It constrains capacity expansion and technology upgrades. This challenge often impacts profitability in cost-sensitive manufacturing sectors.

Shortage of Skilled Workforce and Slow Digital Transition in Traditional Manufacturing

A lack of skilled mold designers, machinists, and engineers continues to hinder productivity. Many traditional workshops are slow to adopt digital technologies such as CAD/CAM or IoT-based systems. Training costs and limited technical awareness delay modernization. The shortage of skilled labor affects design optimization and production accuracy. Delays in adopting automation lead to higher error rates and inefficiencies. Global competition requires rapid technological adaptation, which smaller firms find difficult. It creates disparities in production capabilities and limits innovation. The gap between technology advancement and workforce readiness remains a major industry constraint.

Market Opportunities

Expansion of Electric Vehicle Manufacturing and Lightweight Material Applications

The Industrial Mold Market benefits from growing electric vehicle (EV) production and lightweight component demand. EV manufacturers require precision molds for battery enclosures, connectors, and structural parts. Mold innovations allow integration of lightweight composites and thermoplastics for energy efficiency. Collaboration between mold designers and automotive OEMs strengthens supply chain flexibility. 3D-printed molds and digital twins enhance prototyping and speed up design validation. It opens opportunities for specialized mold producers catering to EV platforms. The market expansion is supported by rising government policies promoting clean mobility solutions.

Rising Demand for Automation and Customized Mold Solutions Across Emerging Economies

Emerging economies present new opportunities driven by industrial automation and consumer product diversification. Manufacturers invest in smart mold technologies to meet large-scale production needs. Customized mold solutions address varying design requirements across electronics, packaging, and healthcare sectors. Digital manufacturing ecosystems reduce downtime and optimize output quality. It promotes the adoption of Industry 4.0-ready molding systems. Government initiatives supporting domestic manufacturing create favorable conditions for local suppliers. Expanding exports from Asia and Latin America strengthen the global mold trade network. These developments position emerging markets as key growth frontiers.

Market Segmentation Analysis:

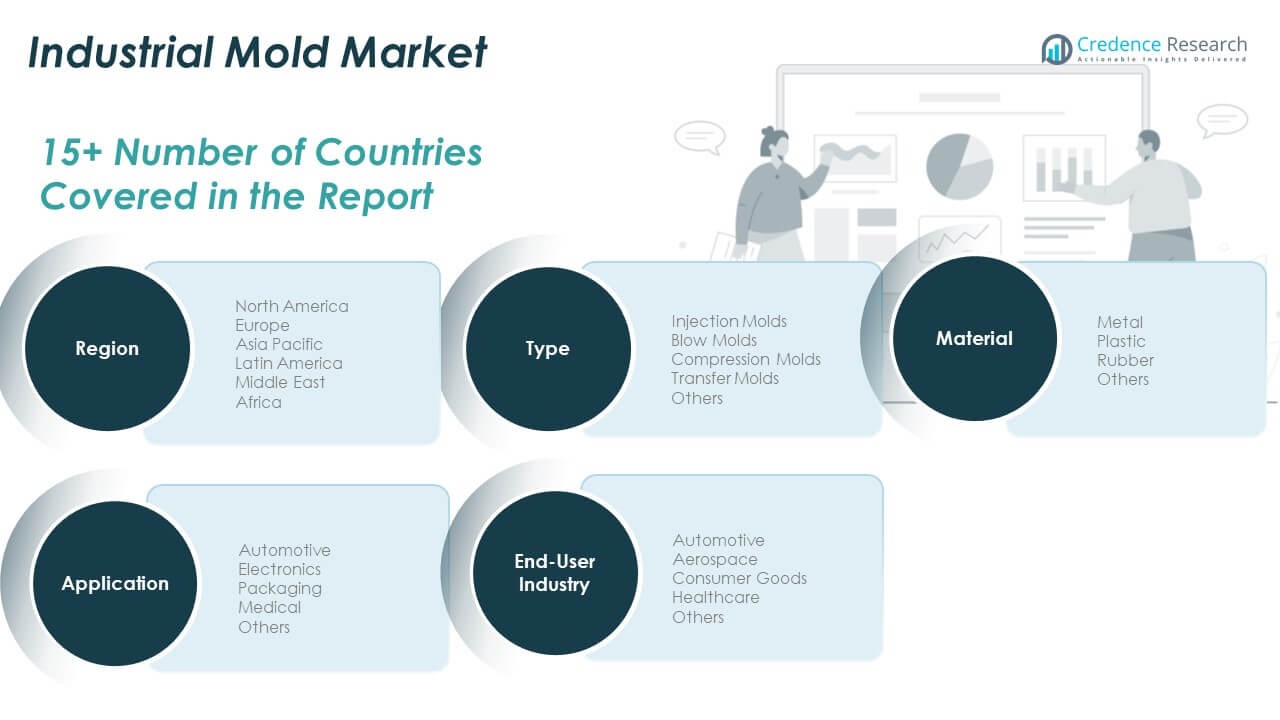

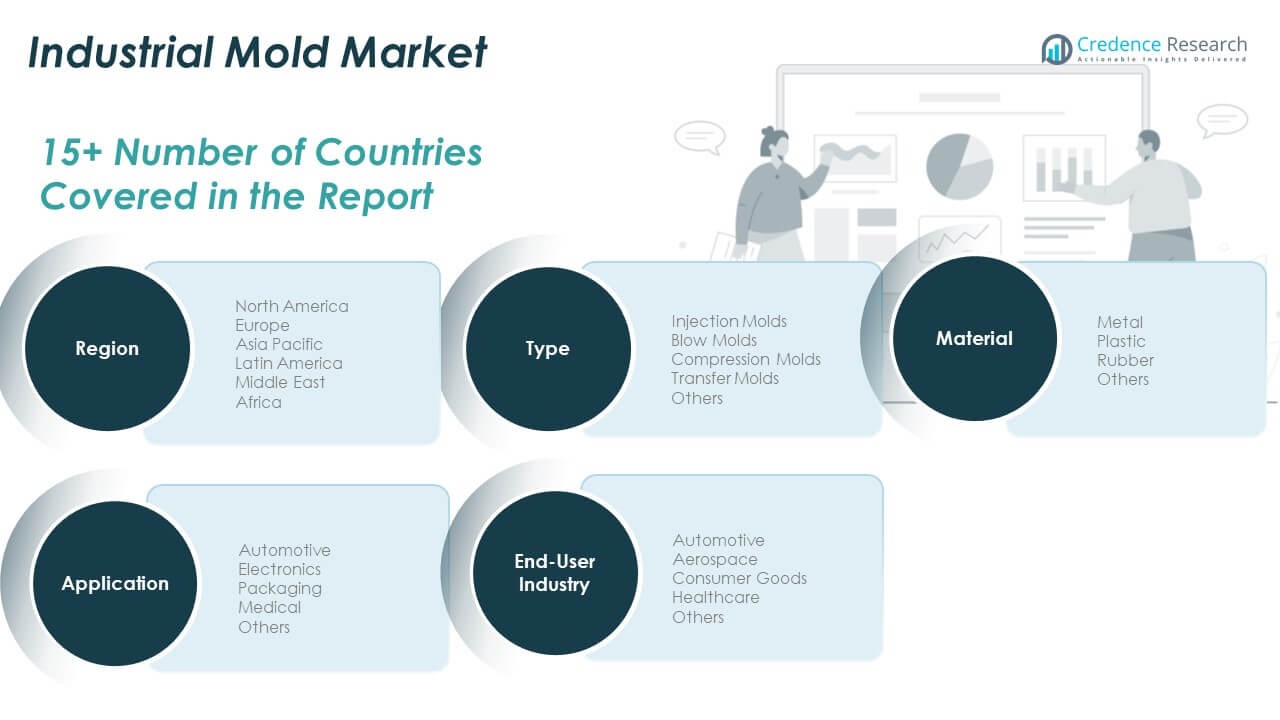

The Industrial Mold Market is segmented by type, application, material, and end-user industry, reflecting its wide industrial relevance.

By type, injection molds hold the largest share due to their high precision and efficiency in mass production for automotive, electronics, and packaging applications. Blow molds and compression molds follow, serving sectors that require hollow or durable molded components. Transfer molds are gaining traction for complex part geometries, while other mold types cater to niche and customized production needs, supporting flexible manufacturing requirements across industries.

- For instance, Husky Injection Molding Systems produced a lightweight 5.89 gram PET preform at a 4.5 second cycle time on a 144-cavity mold in 2024, enabling up to double the production output for global beverage packaging clients.

By application, automotive leads due to demand for lightweight and complex parts supporting vehicle performance and design. Electronics and packaging segments show strong growth, driven by miniaturization trends and eco-friendly packaging materials. Medical applications are increasing with precision molds used in device and equipment manufacturing.

By material, metals dominate for their strength and long service life, while plastics gain importance for lightweight, cost-effective solutions. Rubber molds serve specific industrial and healthcare needs.

- For example, DME Company supplies pre-hardened tool steel known as DME #7, with a hardness range of 32–36 HRC. The steel is engineered for use in injection, compression, and blow molds, offering durability and consistency for demanding mold and die applications.

By end-user industries, automotive and aerospace remain key adopters, followed by consumer goods and healthcare sectors. It continues to benefit from increasing industrial automation and precision engineering across these categories.

Segmentation:

By Type

- Injection Molds

- Blow Molds

- Compression Molds

- Transfer Molds

- Others

By Application

- Automotive

- Electronics

- Packaging

- Medical

- Others

By Material

- Metal

- Plastic

- Rubber

- Others

By End-User Industry

- Automotive

- Aerospace

- Consumer Goods

- Healthcare

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Industrial Mold Market size was valued at USD 7,009.00 million in 2018 to USD 8,098.89 million in 2024 and is anticipated to reach USD 12,269.66 million by 2032, at a CAGR of 5.4% during the forecast period. North America holds a 20.99% share of the global market, driven by high demand from automotive, aerospace, and electronics sectors. Strong manufacturing capabilities in the U.S. and Canada support technological advancements in mold design and material innovation. The region benefits from extensive adoption of automation and digital manufacturing technologies. Increasing investment in precision tooling and high-performance polymers drives product innovation. It experiences rising demand for sustainable mold materials meeting environmental standards. Growth in electric vehicles and healthcare equipment manufacturing further boosts mold applications. Regional players continue to focus on R&D to enhance accuracy and reduce production cycles.

Europe

The Europe Industrial Mold Market size was valued at USD 6,637.36 million in 2018 to USD 7,436.61 million in 2024 and is anticipated to reach USD 10,473.95 million by 2032, at a CAGR of 4.5% during the forecast period. Europe accounts for a 17.94% share of the global market, supported by advanced automotive and industrial manufacturing sectors. Germany, France, and Italy are key contributors due to strong engineering expertise and sustainability-focused production. The region emphasizes energy-efficient and recyclable molding materials to meet strict EU regulations. It benefits from automation in mold fabrication and growing use of 3D printing in prototyping. Aerospace and consumer goods industries drive precision mold demand. Continuous investment in research supports lightweight and hybrid material development. The transition toward green manufacturing and digitalized processes continues to shape growth.

Asia Pacific

The Asia Pacific Industrial Mold Market size was valued at USD 15,752.32 million in 2018 to USD 18,999.71 million in 2024 and is anticipated to reach USD 30,396.55 million by 2032, at a CAGR of 6.1% during the forecast period. Asia Pacific dominates with a 52.11% share of the global market, driven by rapid industrialization and expansion in China, Japan, South Korea, and India. The region benefits from large-scale automotive, electronics, and packaging production bases. Strong government initiatives supporting manufacturing and exports enhance industrial growth. It witnesses growing adoption of automation, robotics, and AI-based mold monitoring systems. Cost advantages and high production capacity attract global investments. Increasing use of composite and plastic molds accelerates market penetration. Continuous innovation and technological collaboration strengthen regional competitiveness.

Latin America

The Latin America Industrial Mold Market size was valued at USD 1,988.60 million in 2018 to USD 2,322.44 million in 2024 and is anticipated to reach USD 3,262.73 million by 2032, at a CAGR of 4.4% during the forecast period. Latin America holds a 5.59% share of the global market, led by Brazil and Mexico’s growing automotive and packaging sectors. Expanding manufacturing activities and foreign direct investment foster mold demand. Governments encourage industrial modernization and domestic production through supportive policies. It benefits from rising consumption of consumer goods requiring molded plastic parts. The growing focus on cost-efficient molds supports small and mid-sized enterprises. Adoption of digital design tools enhances accuracy and reduces rework costs. Industrial diversification continues to boost long-term growth potential.

Middle East

The Middle East Industrial Mold Market size was valued at USD 815.00 million in 2018 to USD 868.89 million in 2024 and is anticipated to reach USD 1,115.74 million by 2032, at a CAGR of 3.3% during the forecast period. The Middle East represents a 1.91% share of the global market, driven by industrial diversification efforts and rising manufacturing investments. The GCC countries lead in mold imports and local fabrication for construction and automotive applications. Energy sector diversification promotes new opportunities in molded components for infrastructure projects. It benefits from increased collaboration with European and Asian mold manufacturers. Technological adoption remains gradual but consistent in high-value industries. Demand for lightweight and precision molds in electrical and packaging sectors is growing steadily. The regional outlook remains positive with continued focus on local industrial development.

Africa

The Africa Industrial Mold Market size was valued at USD 397.72 million in 2018 to USD 730.85 million in 2024 and is anticipated to reach USD 880.02 million by 2032, at a CAGR of 1.8% during the forecast period. Africa accounts for a 1.46% share of the global market, with South Africa and Egypt leading regional adoption. Growing industrialization and construction activities are driving gradual mold demand. Limited manufacturing infrastructure and technical expertise restrain expansion. It benefits from government efforts to promote industrial self-reliance and technology transfer. Local mold production remains small-scale but is improving through public-private partnerships. Increased foreign investment in automotive and consumer goods sectors fosters long-term potential. The region’s industrial growth depends on infrastructure improvement and skilled workforce development.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Shin-Etsu Chemical Co., Ltd.

- Husky Injection Molding Systems Ltd.

- Milacron Holdings Corp.

- Roehr Tool Corporation

- StackTeck Systems Ltd.

- Omega Tool Corp.

- Mold-Masters (Canada) Limited

- Cavaform International, LLC

- Rex Plastics, Inc.

- Nissei Plastic Industrial Co., Ltd.

- Hasco Hasenclever GmbH + Co KG

- Meusburger Georg GmbH & Co KG

- MISUMI Group Inc.

Competitive Analysis:

The Industrial Mold Market is highly competitive, featuring global and regional players focusing on precision, efficiency, and innovation. Key companies include Shin-Etsu Chemical Co., Ltd., Husky Injection Molding Systems Ltd., Milacron Holdings Corp., StackTeck Systems Ltd., and Nissei Plastic Industrial Co., Ltd. These firms invest heavily in advanced mold materials, automation, and digital simulation tools to enhance productivity and reduce defects. It emphasizes sustainable manufacturing, integrating recyclable materials and energy-efficient technologies. Strategic mergers, acquisitions, and product launches strengthen market positions and expand geographic reach. Companies also focus on customized solutions for automotive, electronics, and medical applications to meet evolving client needs. The growing integration of AI-driven design and predictive maintenance further differentiates leading players. Continuous R&D efforts and technological collaborations define the competitive landscape, driving innovation and reinforcing long-term market leadership.

Recent Developments:

- In October 2025, Mold-Masters® introduced its new Integra system at K-Show 2025, an event renowned for showcasing innovations in the plastics and mold-making industry. Developed in partnership with Primaform, the Integra system aims to redefine injection molding for small parts, offering molders enhanced part quality, higher productivity, reduced cycle times by up to 25%, and material savings through high cavitation capabilities and elimination of cold runners.

- In May 2025, Shin-Etsu Chemical Co., Ltd. launched new silicone products—KF-6070W and KF-6080W—tailored for personal care applications, offering improved texture and reduced stickiness in cosmetics, and these products highlight the company’s ongoing efforts in silicon chemistry innovation for various industries.

- In February 2023, SyBridge Technologies acquired Cavaform International, LLC, a specialist in tight-tolerance precision tooling and molding, enhancing SyBridge’s life sciences and consumer sector capabilities.

Report Coverage:

The research report offers an in-depth analysis based on Type, Application, Material and End-User Industry. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Automation and smart manufacturing will enhance mold precision, efficiency, and production speed.

- Integration of AI and IoT in mold monitoring will drive predictive maintenance and performance optimization.

- Demand for lightweight molds and composite materials will rise across automotive and aerospace sectors.

- Sustainable and recyclable mold materials will gain preference due to stricter environmental regulations.

- Growth in electric vehicles and renewable energy sectors will increase demand for advanced molding tools.

- Rapid expansion of 3D printing and hybrid mold fabrication will shorten design and production cycles.

- Digital twin technology will strengthen design validation and operational transparency across manufacturing plants.

- The healthcare and electronics sectors will boost adoption of micro-molding technologies for precision components.

- Strategic partnerships and acquisitions will expand global production capacities and innovation capabilities.

- It will witness steady regional diversification, with Asia Pacific remaining the central hub for mold manufacturing.