Market Overview

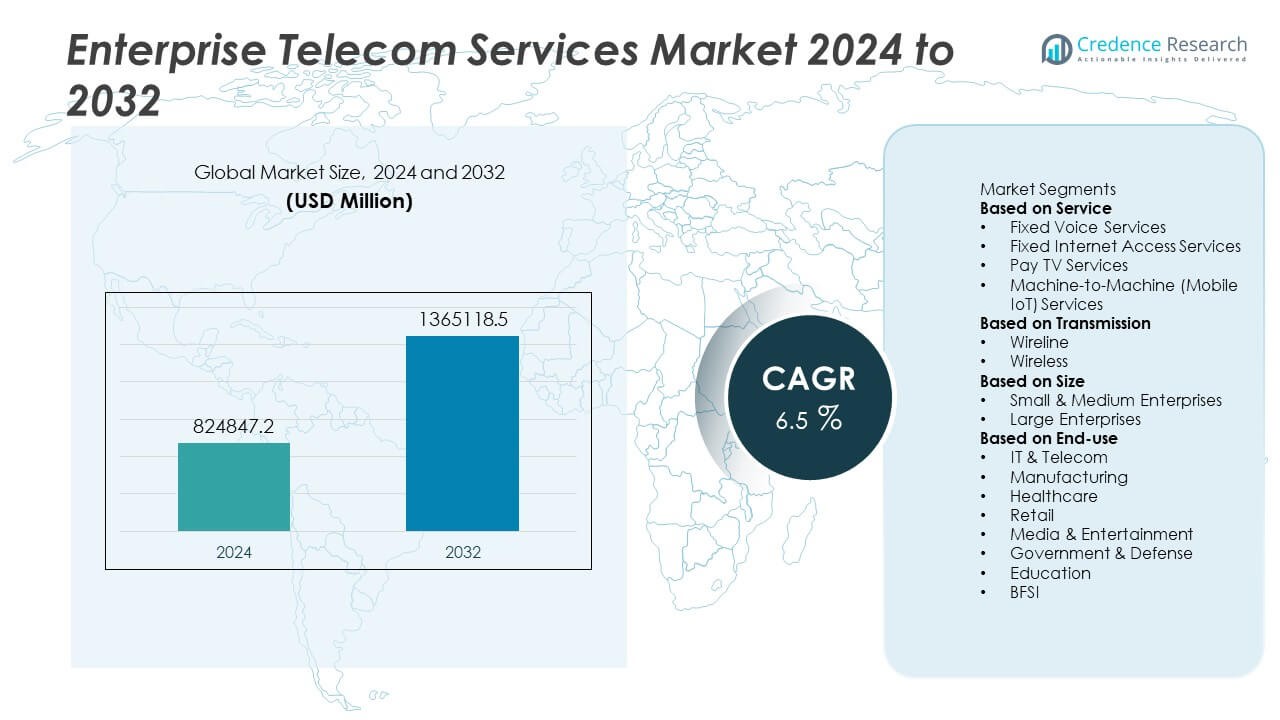

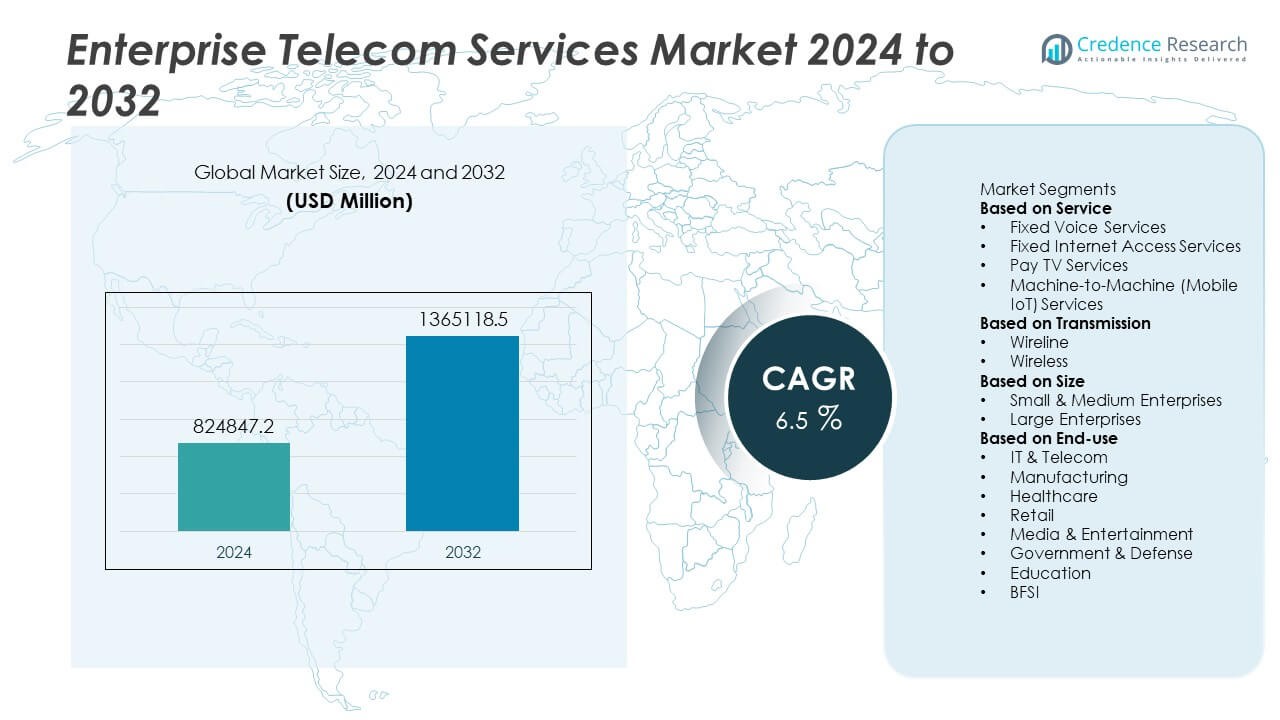

The Enterprise Telecom Services Market size was valued at USD 824,847.2 million in 2024 and is expected to reach USD 1,365,118.5 million by 2032, growing at a compound annual growth rate (CAGR) of 6.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Enterprise Telecom Services Market Size 2024 |

USD 824,847.2 Million |

| Enterprise Telecom Services Market, CAGR |

6.5% |

| Enterprise Telecom Services Market Size 2032 |

USD 1,365,118.5 Million |

The Enterprise Telecom Services Market experiences strong growth driven by rapid adoption of advanced communication technologies such as 5G, cloud computing, and unified communication platforms. Enterprises increasingly demand scalable, flexible, and secure telecom solutions to support digital transformation and remote workforces. The expansion of cloud-native services and AI-powered automation enhances network efficiency and customer experience.

The Enterprise Telecom Services Market spans multiple regions, with North America, Europe, and Asia Pacific leading adoption due to their advanced digital infrastructure and rapid technology deployment. North America benefits from early 5G rollout and strong enterprise demand for cloud and managed services. Europe focuses on regulatory compliance and sustainable telecom solutions, while Asia Pacific drives growth through expanding digitalization and increasing SME adoption. Key players in the market include Verizon, Vodafone, Cisco, and BT Group. These companies invest heavily in network upgrades, cloud-native services, and cybersecurity solutions to meet evolving enterprise needs. Their global presence and continuous innovation position them at the forefront of the competitive landscape, enabling them to address diverse industry requirements and regional challenges effectively.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Enterprise Telecom Services Market was valued at USD 824,847.2 million in 2024 and is projected to grow at a CAGR of 6.5% through 2032.

- Growing demand for high-speed connectivity and cloud-based communication solutions drives market expansion.

- Adoption of 5G networks and AI-powered automation enhances service quality and operational efficiency across enterprises.

- Increasing focus on cybersecurity and data privacy creates strong demand for secure telecom infrastructure.

- The market faces challenges due to high infrastructure costs and complex regulatory compliance in different regions.

- North America, Europe, and Asia Pacific lead market growth, supported by advanced digital infrastructure and rapid technology adoption.

- Key players such as Verizon, Vodafone, Cisco, and BT Group drive innovation through investments in network upgrades and cloud-native services.

Market Drivers

Technological Advancements Accelerate Demand for Enhanced Communication Services

The rapid adoption of advanced communication technologies drives significant growth in the Enterprise Telecom Services Market. Businesses increasingly rely on high-speed internet, cloud computing, and unified communication platforms to enhance operational efficiency and support remote workforces. The integration of 5G networks improves data transmission speed and reliability, enabling enterprises to deploy innovative applications such as IoT and real-time analytics. These technological advancements encourage organizations to invest heavily in telecom services to maintain competitive advantage and foster digital transformation.

- For instance, Verizon reported that its 5G network covers over 230 million people across the United States, supporting IoT connections exceeding 15 million devices.

Scalability and Flexibility in Telecom Solutions Cater to Dynamic Business Needs

Demand for scalable and flexible telecom solutions propels market expansion across diverse industries. Enterprises require customized communication services that adapt to fluctuating workloads and business needs. Cloud-based telecom offerings and software-defined networking provide the necessary agility, reducing infrastructure costs and simplifying management. It allows companies to streamline communication across multiple locations, ensuring seamless collaboration and uninterrupted connectivity. This flexibility proves essential for businesses aiming to optimize resource allocation and improve customer engagement.

- For instance, IBM Cloud operates 60+ data centers worldwide offering scalable telecom and cloud services with provisioning times of under 30 minutes.

Heightened Cybersecurity Requirements Elevate the Importance of Secure Telecom Infrastructure

Increasing cybersecurity concerns elevate the importance of secure telecom services in enterprise environments. With growing cyber threats targeting communication networks, organizations prioritize the implementation of robust security protocols within their telecom infrastructure. Enterprise Telecom Services incorporate advanced encryption, threat detection, and access control mechanisms to protect sensitive data and maintain compliance with regulatory standards. Strengthening network security safeguards business continuity and enhances trust among customers and partners, encouraging further investment in these services.

Digital Transformation Drives Demand for Integrated and Unified Communication Platforms

The rising adoption of digital transformation initiatives among enterprises fuels demand for integrated telecom solutions that support diverse communication channels. Companies seek to unify voice, video, messaging, and data services into comprehensive platforms to improve user experience and operational workflows. It simplifies communication management and drives productivity by enabling real-time collaboration and faster decision-making. This growing trend prompts service providers to innovate and expand their offerings, supporting enterprise requirements for seamless and efficient telecom connectivity.

Market Trends

Expansion of 5G Networks Transforming Enterprise Connectivity and Service Capabilities

The rollout of 5G networks significantly reshapes the Enterprise Telecom Services Market by enabling faster, more reliable communication. Enterprises leverage this technology to support bandwidth-intensive applications such as augmented reality, virtual meetings, and IoT deployments. It drives service providers to upgrade infrastructure and offer low-latency solutions that meet enterprise demands for real-time data exchange. This evolution promotes the development of smart offices and enhances mobile workforce productivity through improved network performance.

- For instance, Ericsson reported that their 5G solutions enable latency as low as 1 millisecond, critical for real-time data exchange in smart office applications. This evolution promotes the development of smart offices and enhances mobile workforce productivity through improved network performance.

Rising Adoption of Cloud-Native Telecom Solutions Facilitates Agility and Cost Efficiency

The shift toward cloud-native architectures marks a critical trend in the Enterprise Telecom Services Market. Enterprises increasingly migrate telecom workloads to cloud platforms to benefit from scalable, flexible, and on-demand services. It reduces dependence on physical hardware and lowers operational expenses by enabling pay-as-you-go models. Service providers focus on delivering unified cloud communication suites that integrate voice, video, and messaging to streamline enterprise communication and collaboration.

- For instance, Twilio powers more than 250 billion programmable communication interactions annually, offering pay-as-you-go models that reduce upfront infrastructure costs for enterprises. Service providers focus on delivering unified cloud communication suites that integrate voice, video, and messaging to streamline enterprise communication and collaboration.

Integration of Artificial Intelligence and Automation Enhances Telecom Service Management

Artificial intelligence (AI) and automation adoption in telecom operations improves service delivery and customer experience within the Enterprise Telecom Services Market. AI-powered analytics help identify network bottlenecks and predict potential failures before they impact performance. It facilitates automated troubleshooting and dynamic resource allocation, minimizing downtime and optimizing network utilization. This trend empowers enterprises to maintain high service quality while reducing manual intervention and operational costs.

Growing Emphasis on Cybersecurity Solutions in Telecom Infrastructure Protects Enterprise Assets

The Enterprise Telecom Services Market increasingly focuses on embedding robust cybersecurity measures within telecom networks. Rising cyber threats targeting communication channels force enterprises to demand enhanced protection against data breaches and service disruptions. It drives providers to implement multi-layered security frameworks, including encryption, intrusion detection, and secure access controls. This trend ensures the confidentiality, integrity, and availability of enterprise communications, fostering trust and regulatory compliance.

Market Challenges Analysis

Complex Regulatory Landscape and Compliance Requirements Pose Significant Barriers for Market Growth

Navigating the complex regulatory environment presents a major challenge for the Enterprise Telecom Services Market. Enterprises and service providers must adhere to varied regulations across regions, which complicates deployment and operational consistency. It requires constant updates to comply with data privacy laws, spectrum allocations, and cybersecurity mandates. Non-compliance risks heavy penalties and reputational damage. The challenge intensifies with rapid technological advancements that often outpace regulatory frameworks. Service providers invest considerable resources in legal and compliance teams to mitigate these risks and ensure seamless service delivery.

High Infrastructure Costs and Integration Difficulties Limit Adoption in Diverse Enterprise Environments

The Enterprise Telecom Services Market faces challenges related to substantial capital expenditure on network infrastructure upgrades and integration with legacy systems. Enterprises often struggle to balance the costs of adopting new telecom technologies with expected returns. It involves significant investment in hardware, software, and skilled personnel for maintenance and management. Integration complexities arise when merging advanced telecom solutions with existing IT environments, leading to potential disruptions and prolonged implementation timelines. These factors hinder the rapid adoption of innovative telecom services, especially among small and medium-sized enterprises with limited budgets.

Market Opportunities

Expansion into Emerging Markets Presents Significant Growth Potential for Telecom Service Providers

The Enterprise Telecom Services Market holds substantial opportunities by targeting emerging economies with expanding digital infrastructure. Rapid urbanization and increasing smartphone penetration drive demand for reliable and advanced telecom services in these regions. It allows service providers to capture new customer bases by offering tailored solutions that address local connectivity challenges. Investments in developing network infrastructure and affordable service packages can accelerate adoption. Emerging markets also provide opportunities for partnerships with government initiatives aimed at bridging the digital divide, further boosting market penetration and revenue growth.

Development of Industry-Specific Customized Telecom Solutions Enhances Market Differentiation and Value Creation

The growing need for industry-specific telecom services creates opportunities to develop specialized solutions for sectors such as healthcare, manufacturing, and finance. The Enterprise Telecom Services Market can benefit from designing offerings that cater to unique communication and security requirements in these verticals. It enables providers to establish deeper client relationships through customized service models and dedicated support. Tailored telecom solutions improve operational efficiency and compliance for enterprises, increasing customer retention and opening avenues for upselling advanced features. This trend encourages innovation and diversification within the market.

Market Segmentation Analysis:

By Service

The market divides services into voice communication, data communication, and managed services. Voice communication remains a core component, providing traditional telephony and VoIP solutions to support enterprise connectivity. Data communication services experience robust growth driven by the increasing demand for high-speed internet, cloud access, and secure data transfer. Managed services, including network management, security, and support, gain prominence as enterprises seek to outsource complex telecom operations. It allows businesses to focus on core activities while ensuring telecom infrastructure efficiency and reliability.

- For instance, IBM’s managed security services protect more than 1,200 clients globally, allowing businesses to focus on core activities while ensuring telecom infrastructure efficiency and reliability.

By Transmission

Transmission segments include wired and wireless technologies, each catering to different enterprise needs. Wired transmission, encompassing fiber optics and copper cables, delivers high reliability and bandwidth, particularly for fixed-location businesses requiring stable connections. Wireless transmission gains momentum due to the flexibility it offers, especially with the widespread deployment of 5G and Wi-Fi 6 technologies. It supports mobile workforces and remote access, enabling enterprises to maintain seamless communication across multiple locations. The increasing adoption of hybrid transmission models reflects a trend toward optimizing performance and cost-efficiency.

- For instance, Corning’s fiber optic cables have been deployed in over 40 million kilometers globally, supporting high-speed wired connections for enterprises. Wireless transmission gains momentum due to the flexibility it offers, especially with the widespread deployment of 5G and Wi-Fi 6 technologies. Qualcomm’s Wi-Fi 6 chipsets power over 1 billion devices worldwide, enhancing wireless connectivity for mobile workforces.

By Size

The market further categorizes enterprises into small and medium-sized enterprises (SMEs) and large enterprises. SMEs often prioritize cost-effective and scalable telecom solutions that support growth without extensive capital expenditure. It drives demand for cloud-based and subscription services that offer flexibility and ease of management. Large enterprises focus on comprehensive, integrated telecom infrastructures that accommodate complex communication requirements across global operations. They invest heavily in advanced technologies and customized solutions to enhance productivity, security, and collaboration. Both segments present significant opportunities for service providers to tailor offerings based on specific enterprise demands.

Segments:

Based on Service

- Fixed Voice Services

- Fixed Internet Access Services

- Pay TV Services

- Machine-to-Machine (Mobile IoT) Services

Based on Transmission

Based on Size

- Small & Medium Enterprises

- Large Enterprises

Based on End-use

- IT & Telecom

- Manufacturing

- Healthcare

- Retail

- Media & Entertainment

- Government & Defense

- Education

- BFSI

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a significant share in the Enterprise Telecom Services Market, accounting for approximately 35% of the global market in 2024. The region benefits from advanced telecom infrastructure, widespread 5G deployment, and strong demand for cloud-based communication services. Large enterprises and SMEs actively invest in unified communication platforms and managed services to support digital transformation initiatives. The presence of key telecom service providers and early technology adopters further strengthens market growth. Continuous innovation in AI-driven network management and cybersecurity solutions drives adoption across various industries. North America’s well-established regulatory framework and increasing focus on network security contribute to sustained market dominance.

Europe

Europe represents around 28% of the Enterprise Telecom Services Market share, reflecting steady growth fueled by extensive fiber optic networks and growing 5G coverage. Countries such as Germany, the UK, and France lead telecom adoption due to their robust industrial base and digital infrastructure development. Enterprises in the region emphasize compliance with stringent data privacy regulations like GDPR, driving demand for secure telecom services. The region witnesses significant uptake of cloud-native telecom solutions and AI-enhanced network automation. Expansion of remote work models and increased investment in Industry 4.0 technologies propel demand for flexible communication services. Europe’s focus on sustainable telecom infrastructure also influences market trends.

Asia Pacific

The Asia Pacific region accounts for approximately 25% of the global Enterprise Telecom Services Market and displays the fastest growth rate. Rapid urbanization, rising smartphone penetration, and increasing digitalization in countries like China, India, Japan, and South Korea stimulate telecom service demand. Enterprises in this region embrace 5G adoption to enable smart manufacturing, e-commerce, and digital government initiatives. It experiences strong investment in telecom infrastructure expansion, cloud services, and managed communication solutions. The growing number of SMEs drives demand for affordable, scalable telecom offerings. Regional government policies promoting digital connectivity and innovation create a favorable environment for market growth.

Latin America

Latin America holds roughly 7% of the Enterprise Telecom Services Market share, supported by expanding broadband networks and rising adoption of cloud-based communication platforms. Brazil and Mexico dominate the regional market with ongoing investments in telecom infrastructure upgrades and increasing enterprise digitization. Businesses seek to improve collaboration tools and cybersecurity frameworks to enhance operational efficiency. However, challenges such as regulatory variability and economic fluctuations impact growth pace. The region benefits from partnerships between local providers and global telecom companies to expand service reach and introduce innovative solutions.

Middle East and Africa (MEA)

The Middle East and Africa (MEA) account for about 5% of the Enterprise Telecom Services Market share. Growth in this region stems from infrastructure development in countries like the UAE, Saudi Arabia, and South Africa, focusing on 5G rollout and smart city projects. Enterprises increasingly adopt telecom services to support digital transformation and remote work. It faces challenges related to uneven infrastructure distribution and regulatory complexity but benefits from government initiatives aimed at improving connectivity. The MEA market offers opportunities for telecom providers to introduce cost-effective, secure, and scalable communication solutions tailored to diverse enterprise needs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Vodafone

- Cisco

- Comcast

- Verizon

- IBM

- TMobile US

- BT Group

- Telefonica

- Charter Communications

- NTT

Competitive Analysis

Leading players in the Enterprise Telecom Services Market include Verizon, Vodafone, Cisco, BT Group, T-Mobile US, Telefonica, NTT, Comcast, Charter Communications, and IBM. These companies maintain competitive positions through continuous investments in network infrastructure, technology innovation, and service diversification. Verizon and Vodafone focus heavily on expanding 5G capabilities and offering integrated cloud communication solutions that cater to large enterprises and SMEs alike. Cisco leverages its strong presence in networking hardware and software to provide end-to-end telecom solutions, emphasizing AI-driven network management and security services. BT Group and Telefonica capitalize on their extensive regional footprints in Europe and Latin America by delivering tailored telecom services compliant with local regulations and industry needs. T-Mobile US and Comcast concentrate on expanding wireless and broadband services, targeting mobile and fixed communication markets with competitive pricing and flexible plans. NTT and IBM enhance their offerings by integrating advanced managed services and cybersecurity solutions, addressing growing enterprise concerns around data protection and operational reliability. These key players continuously engage in strategic partnerships, mergers, and acquisitions to expand market share and enter new geographic regions. Their focus on innovation, customer-centric service models, and scalable telecom platforms drives competitiveness. By adapting to evolving technology trends and enterprise demands, these companies position themselves to capture growth opportunities in a rapidly transforming telecom landscape.

Recent Developments

- In June 2025, Verizon secured a contract to deploy private 5G networks at the UK’s Thames Freeport, aiming to support advanced industrial applications.

- In April 2025, Comcast Business completed its acquisition of Nitel, a provider of Network-as-a-Service technology, to expand its networking and cybersecurity capabilities.

- In February 2025, IBM released a study highlighting how telecommunications service providers are leveraging AI, cloud, and security investments for network modernization.

Market Concentration & Characteristics

The Enterprise Telecom Services Market exhibits a moderately concentrated structure dominated by a few global players such as Verizon, Vodafone, Cisco, and BT Group, who command substantial market share through extensive infrastructure investments and broad service portfolios. It operates in a highly competitive environment where technological innovation, service quality, and customer experience serve as key differentiators. Market participants focus on expanding 5G networks, enhancing cloud-based offerings, and integrating AI-powered solutions to meet evolving enterprise demands. The market also features numerous regional and niche players catering to specific industry verticals and geographic segments, contributing to diverse service availability. Pricing strategies vary widely, influenced by service customization, scale, and technological complexity. Regulatory compliance and cybersecurity standards shape market dynamics, compelling providers to maintain robust and secure networks. The Enterprise Telecom Services Market continues to evolve rapidly, driven by the digital transformation of enterprises across industries and growing adoption of unified communication platforms, fueling both competition and collaboration among key stakeholders to capture emerging growth opportunities.

Report Coverage

The research report offers an in-depth analysis based on Service, Transmission, Size, End use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily driven by increasing enterprise demand for high-speed connectivity and cloud services.

- 5G adoption will accelerate, enabling new applications in IoT, smart manufacturing, and real-time analytics.

- Cloud-native telecom solutions will gain prominence due to their scalability and cost-efficiency.

- AI and automation will enhance network management, improving service reliability and reducing operational costs.

- Cybersecurity investments will increase to protect enterprise data and ensure compliance with stricter regulations.

- Customized telecom solutions will grow in demand to address specific needs of different industry verticals.

- Hybrid transmission models combining wired and wireless technologies will become more common.

- Emerging markets will offer significant growth opportunities due to rising digital infrastructure development.

- Strategic partnerships and mergers will shape competitive dynamics and expand service portfolios.

- Focus on sustainable and energy-efficient telecom infrastructure will influence market innovations and investments