| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Fat Free Yogurt Market Size 2024 |

USD 542.59 Million |

| France Fat Free Yogurt Market, CAGR |

9.44% |

| France Fat Free Yogurt Market Size 2032 |

USD 1116.34 Million |

Market Overview

France Fat Free Yogurt Market size was valued at USD 542.59 million in 2024 and is anticipated to reach USD 1116.34 million by 2032, at a CAGR of 9.44% during the forecast period (2024-2032).

The France Fat-Free Yogurt market is driven by the rising health-conscious consumer base, with an increasing preference for low-fat and nutritious dairy alternatives. Growing awareness about the health benefits of fat-free yogurt, including weight management and reduced cholesterol, is further fueling demand. Additionally, the surge in fitness trends and a shift towards healthier eating habits contribute to the market’s growth. The availability of diverse product varieties, including flavored and probiotic-rich fat-free yogurt, caters to a wider audience, enhancing market appeal. Innovations in packaging and distribution channels are making fat-free yogurt more accessible, while the increasing adoption of plant-based alternatives also plays a role in market expansion. As consumer interest in functional foods grows, fat-free yogurt is positioned to benefit from its nutritional value, convenience, and alignment with modern dietary preferences, ensuring sustained market momentum throughout the forecast period.

The France Fat-Free Yogurt market is characterized by strong regional demand across various areas, with key players like Nestlé, Danone, and Yoplait leading the industry. These companies offer a wide range of fat-free yogurt products, catering to diverse consumer preferences. Nestlé and Danone dominate the market with their extensive distribution networks and well-established brands, ensuring their presence across major retail outlets. Smaller but significant players like Chobani, FAGE International, and Lactalis are also contributing to the market’s growth with innovative products, including flavored and plant-based fat-free yogurts. Regional preferences vary, with southern France seeing a higher demand for healthier alternatives, while northern regions show a preference for both organic and conventional fat-free yogurt. The market continues to grow as manufacturers introduce new flavors, functional ingredients, and convenient packaging to meet evolving consumer needs for nutritious, low-fat snack options.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The France Fat-Free Yogurt market was valued at USD 542.59 million in 2024 and is expected to reach USD 1116.34 million by 2032, growing at a CAGR of 9.44% during the forecast period (2024-2032).

- The rising health-conscious population is a major driver, with increasing demand for low-fat, nutritious, and probiotic-rich yogurt products.

- The trend towards plant-based and dairy-free fat-free yogurt options is expanding the market, catering to consumers with lactose intolerance and those adopting vegan diets.

- Growing consumer interest in functional foods, such as fat-free yogurt enriched with vitamins and probiotics, is pushing innovation in the market.

- Intense competition from regular yogurt and other dairy substitutes poses challenges to fat-free yogurt growth.

- Price sensitivity and the perceived value of fat-free yogurt can hinder market expansion, especially in cost-conscious segments.

- Regional growth varies, with Northern and Southern France leading demand, influenced by urbanization, health trends, and climate preferences.

Report Scope

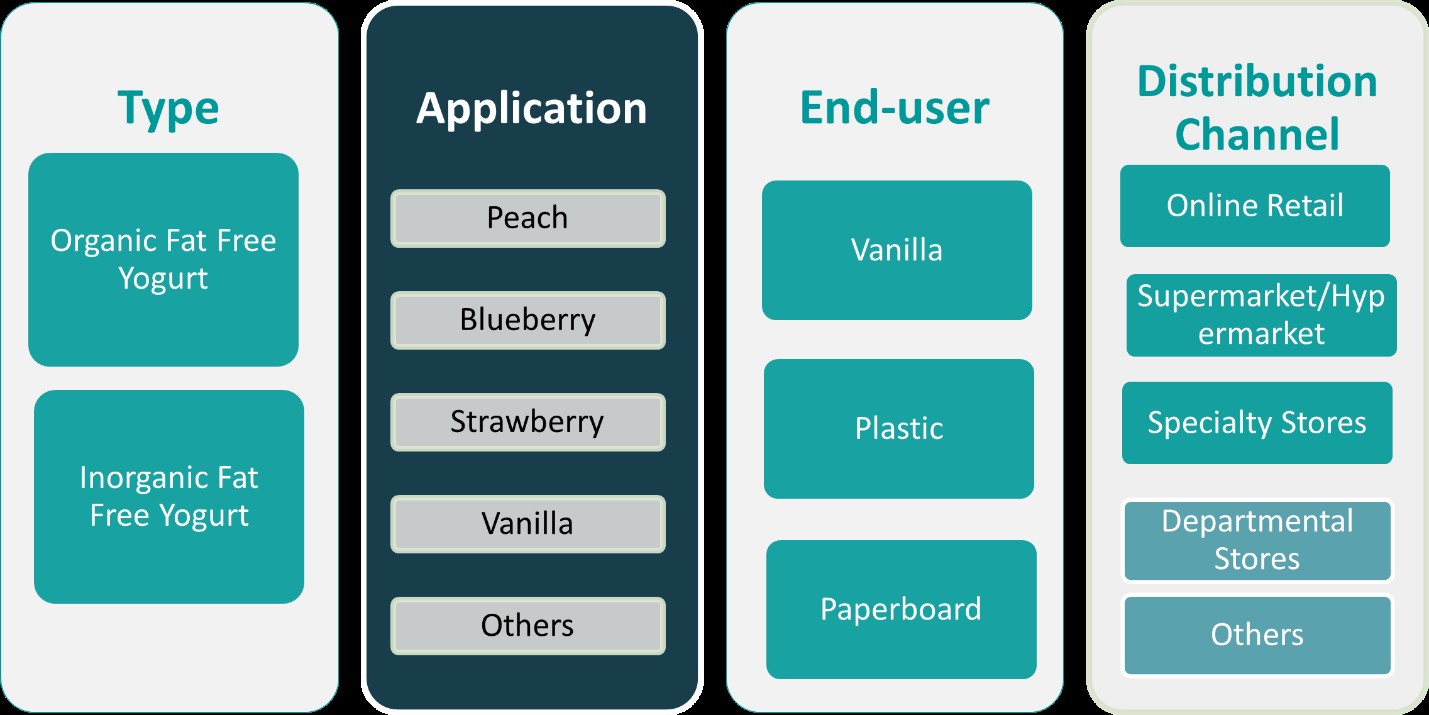

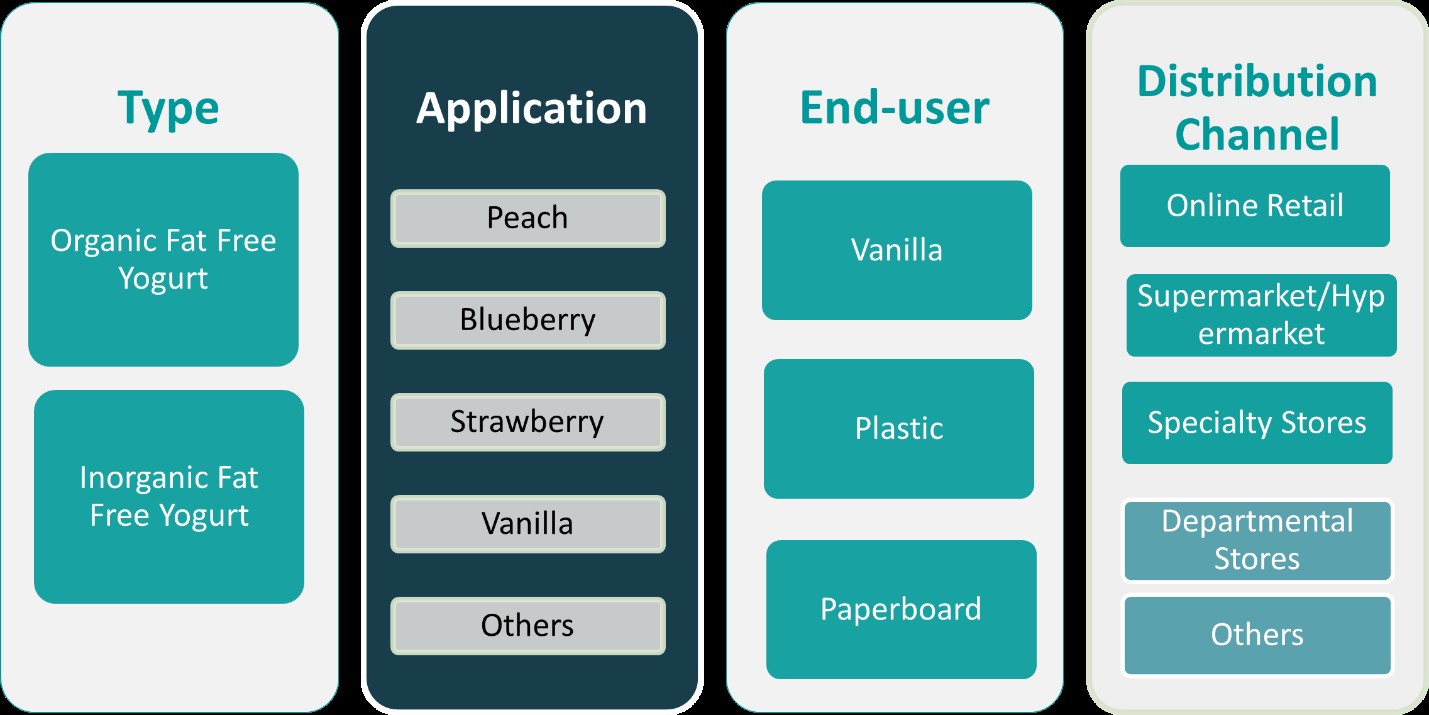

This report segments the France Fat Free Yogurt Market as follows:

Market Drivers

Growing Health-Conscious Consumer Base

One of the primary drivers of the France Fat-Free Yogurt market is the increasing health-consciousness among consumers. With rising awareness about the importance of a balanced diet, consumers are actively seeking healthier alternatives to traditional dairy products. For instance, health trends in France show that a significant portion of consumers prioritize balanced nutrition to manage weight and improve overall health, aligning with the demand for low-fat, high-protein snacks like fat-free yogurt. As people shift toward healthier lifestyles, fat-free yogurt offers a viable solution, meeting the demand for low-fat, high-protein snacks that align with fitness and wellness trends. This growing health-conscious demographic is expected to continue driving market growth throughout the forecast period.

Rising Demand for Functional Foods

The growing trend of functional foods also plays a significant role in the increasing demand for fat-free yogurt in France. Consumers are increasingly turning to foods that offer additional health benefits beyond basic nutrition. Fat-free yogurt is rich in probiotics, which are known for promoting gut health and boosting the immune system. As digestive health becomes a priority for many, the incorporation of probiotics in fat-free yogurt makes it an attractive option. Moreover, fat-free yogurt is often fortified with essential vitamins and minerals, such as calcium and vitamin D, further enhancing its appeal. The focus on functional foods is expected to continue driving the growth of the fat-free yogurt market, as consumers look for products that contribute to overall health and well-being.

Increasing Fitness and Wellness Trends

The growing popularity of fitness and wellness culture is another key driver for the France Fat-Free Yogurt market. As more individuals adopt active lifestyles and prioritize physical health, they are seeking products that support their fitness goals. For instance, the rise of fitness-focused social media influencers has increased the visibility of fat-free yogurt as a go-to health food, particularly among younger generations. Fat-free yogurt, with its high protein content and low fat, has gained favor among athletes, fitness enthusiasts, and those looking to maintain a lean physique. The product’s convenience, portability, and ability to complement workout routines make it a favored snack option. Furthermore, the rise of fitness-focused social media influencers and wellness trends has increased the visibility of fat-free yogurt as a go-to health food. This shift towards wellness and fitness is expected to continue driving the demand for fat-free yogurt, further expanding its market share.

Innovation in Product Offerings and Varieties

Innovation in the product offerings and varieties of fat-free yogurt has also contributed significantly to the market’s growth. Manufacturers are introducing a wide range of flavors and formulations to cater to diverse consumer preferences. From fruit-flavored fat-free yogurts to those enriched with added ingredients like chia seeds or oats, the variety of options available on the market today is broadening the consumer base. Additionally, with increasing demand for plant-based diets, several companies have introduced plant-based fat-free yogurt alternatives made from almond, coconut, or soy milk, further boosting the market’s appeal. These innovations allow fat-free yogurt to cater to a larger demographic, including vegans, lactose-intolerant individuals, and those seeking new and exciting product variations. The continuous innovation in the sector is expected to sustain the market’s momentum and attract a wider range of consumers.

Market Trends

Flavored Fat-Free Yogurts Gaining Popularity

Flavored fat-free yogurts are becoming increasingly popular among consumers in France. While traditional plain fat-free yogurt remains a staple, consumers are gravitating toward flavored varieties such as berry, vanilla, and tropical fruit blends. For instance, brands like Yoplait have introduced low-fat flavored yogurts such as French Vanilla and Strawberry that combine indulgent taste with healthy attributes like live cultures and no artificial flavors. The addition of natural fruit flavors and healthier sweeteners like stevia or honey meets the growing demand for indulgent yet healthy snack options. Manufacturers are also introducing innovative combinations such as honey and almond or coconut and lime to appeal to diverse taste preferences.

Expansion of Convenient and On-the-Go Packaging

The trend towards convenience continues to shape the France Fat-Free Yogurt market, with more brands offering on-the-go packaging. As busy lifestyles lead to an increased demand for portable, ready-to-eat snacks, fat-free yogurt producers are responding by providing single-serve containers and easy-to-carry packaging options. For instance, single-serve yogurt cups have become highly popular among French consumers due to their portability and ease of use during busy routines. Such packaging solutions are particularly popular among younger demographics, busy professionals, and families seeking quick, nutritious snacks. This shift towards convenience-oriented packaging is expected to play a crucial role in expanding the market and attracting new customers.

Increasing Popularity of Plant-Based Alternatives

One notable trend in the France Fat-Free Yogurt market is the growing demand for plant-based alternatives. As more consumers adopt vegan, vegetarian, or lactose-free diets, the market for dairy-free fat-free yogurt options is expanding. Brands are increasingly offering fat-free yogurt made from plant-based ingredients like almond milk, coconut milk, and soy milk. These alternatives not only cater to those with lactose intolerance but also align with the rising popularity of plant-based diets. This trend is helping to diversify the market, attracting health-conscious consumers who seek dairy-free options that provide similar nutritional benefits as traditional fat-free yogurt.

Focus on Functional Ingredients and Health Benefits

Another key trend in the France Fat-Free Yogurt market is the focus on functional ingredients and added health benefits. Beyond its low-fat content, fat-free yogurt is increasingly being marketed as a source of probiotics, vitamins, and minerals that promote digestive health, boost immunity, and support bone health. Manufacturers are fortifying their products with additional nutrients such as fiber, calcium, and vitamin D to cater to a health-conscious consumer base seeking more from their food. This emphasis on functional benefits is attracting consumers who are not only interested in low-fat options but also in foods that contribute to overall wellness, aligning with the broader trend of health-focused eating.

Market Challenges Analysis

High Competition from Regular Yogurt and Other Dairy Alternatives

One of the main challenges facing the France Fat-Free Yogurt market is the intense competition from regular yogurt and other dairy alternatives. Traditional full-fat yogurts, which offer a richer taste and texture, continue to dominate the market due to their long-established consumer base and familiarity. Many consumers remain loyal to full-fat versions despite the health benefits of fat-free alternatives. Furthermore, the growing popularity of non-dairy substitutes, such as plant-based yogurts made from almond, coconut, and soy milk, is intensifying the competition. These alternatives, which are often perceived as healthier or more sustainable, are challenging the market share of fat-free dairy yogurt. As a result, brands must continuously innovate and differentiate their products to stand out in a crowded market.

Price Sensitivity and Perceived Value

Another significant challenge for the France Fat-Free Yogurt market is price sensitivity and the perceived value of fat-free yogurt. While fat-free yogurt offers health benefits, it is often priced higher than regular yogurt or other dairy products. For instance, data from France Agrimer shows that rising production costs have led to higher retail prices for fat-free yogurt compared to traditional options, impacting affordability for budget-conscious consumers. Additionally, while fat-free yogurt is marketed as a healthier option, some consumers may not see it as offering significant benefits over regular yogurt or other cheaper dairy alternatives. This perception can limit the growth potential of fat-free yogurt, especially in price-sensitive segments of the market, where consumers prioritize cost-effectiveness over perceived health benefits.

Market Opportunities

The France Fat-Free Yogurt market presents several growth opportunities, particularly driven by the increasing health-conscious consumer base. As more people focus on healthier lifestyles, the demand for low-fat and nutritious food options continues to rise. Fat-free yogurt, known for its health benefits like weight management and improved digestion, is well-positioned to capitalize on this trend. Additionally, the growing popularity of functional foods offers a significant opportunity for manufacturers to enhance their fat-free yogurt offerings with added benefits such as probiotics, fiber, and fortified vitamins. By incorporating these functional ingredients, brands can appeal to consumers seeking both taste and health benefits, further expanding their market reach.

Another promising opportunity lies in the growing demand for plant-based and dairy-free alternatives. As plant-based diets become more mainstream, there is a significant shift toward non-dairy fat-free yogurt options made from almond, coconut, or soy milk. Offering dairy-free fat-free yogurt caters to a broader range of consumers, including those with lactose intolerance, vegans, and individuals seeking sustainable food choices. Furthermore, the trend toward convenient, on-the-go packaging presents an opportunity to target busy consumers looking for quick, healthy snacks. Brands can explore innovative packaging solutions such as single-serve containers and portable pouches to enhance convenience and accessibility. By tapping into these emerging trends, fat-free yogurt producers can position themselves for sustained growth in a competitive market.

Market Segmentation Analysis:

By Type:

The France Fat-Free Yogurt market can be broadly segmented into organic and inorganic fat-free yogurt, each catering to distinct consumer preferences. Organic fat-free yogurt has gained significant traction due to the rising consumer demand for clean-label products free from artificial additives and preservatives. As consumers become more health-conscious, they are increasingly turning to organic options, which are perceived as more natural and environmentally sustainable. Organic fat-free yogurt also appeals to individuals seeking products that align with their ethical and health standards. On the other hand, inorganic fat-free yogurt remains dominant in the market due to its affordability and availability. Inorganic options often offer a broader range of flavors and come at a lower price point, making them more accessible to a wider audience. While organic fat-free yogurt is growing in popularity, inorganic fat-free yogurt continues to hold a significant share of the market, driven by its cost-effectiveness and mass appeal.

By Application:

The application segment of the France Fat-Free Yogurt market is driven by a variety of flavors, with peach, blueberry, strawberry, vanilla, and other fruit-based options leading the way. Among these, strawberry and blueberry fat-free yogurts are particularly popular due to their appealing taste profiles and health benefits. These fruit-flavored variants are often seen as a refreshing snack option and are favored by consumers looking for a sweet yet healthy indulgence. Vanilla-flavored fat-free yogurt also holds a significant share, as it is a classic flavor that appeals to a wide demographic. Additionally, the increasing demand for exotic flavors, such as peach and other tropical fruits, is expanding the range of fat-free yogurt options available in the market. Manufacturers are also innovating with other unique flavors, such as coconut or mixed berry, to cater to diverse consumer tastes and preferences, enhancing the overall market diversity.

Segments:

Based on Type:

- Organic Fat-Free Yogurt

- Inorganic Fat-Free Yogurt

Based on Application:

- Peach

- Blueberry

- Strawberry

- Vanilla

- Others

Based on End- User:

Based on Distribution Channel:

- Online Retail

- Supermarket/Hypermarket

- Specialty Stores

- Departmental Stores

- Others

Based on the Geography:

- Northern France

- Southern France

- Eastern France

- Western France

Regional Analysis

Northern France

Northern France holds the largest market share, accounting for approximately 30% of the total market. This region’s dominance can be attributed to its higher urbanization, greater health awareness, and a larger concentration of health-conscious consumers. Cities like Paris, Lille, and Nantes are at the forefront of this trend, with consumers gravitating towards low-fat and nutritious dairy products. The region’s significant market share is also driven by the availability of both organic and inorganic fat-free yogurt options in major retail chains and supermarkets, catering to varying consumer demands.

Southern France

In Southern France, the market share for fat-free yogurt is around 25%, with the region showing a growing preference for healthier food choices. The Mediterranean diet, which emphasizes fresh and healthy ingredients, aligns well with the demand for fat-free yogurt. Southern France, with its affluent population and active lifestyle culture, sees a higher consumption of functional foods, including fat-free yogurt enriched with probiotics and vitamins. The region also benefits from a warm climate, encouraging the demand for refreshing, low-calorie snacks like fat-free yogurt. The rising trend of fitness and wellness further drives this segment, as consumers seek products that complement their active lifestyles.

Eastern France

Eastern France accounts for approximately 20% of the market share, with a strong demand for fat-free yogurt in regions such as Alsace and Lorraine. The growing health consciousness in this region is fueled by an increasing number of young professionals and families opting for low-fat, nutritious alternatives. Additionally, Eastern France has seen a rise in the popularity of organic products, with organic fat-free yogurt making up a significant portion of the market share. This shift toward organic and natural food products reflects the region’s focus on sustainable and healthy living, supporting the overall growth of the fat-free yogurt segment.

Western France

Western France holds a market share of around 25%, driven by a rising preference for fat-free yogurt among both urban and rural populations. Cities like Bordeaux and Rennes are key drivers of this growth, where there is an increasing demand for healthier snack options, particularly those with functional ingredients like probiotics. The region has a well-established retail infrastructure, ensuring that fat-free yogurt products are widely available to consumers across different demographics. The growing focus on family-oriented health products, coupled with the expanding availability of plant-based and flavored fat-free yogurt options, is fueling the region’s market growth. As consumer demand for convenient, nutritious, and indulgent snacks rises, Western France continues to see strong growth in the fat-free yogurt market.

Key Player Analysis

- Nestle

- Almarai

- Arla Foods amba

- ASDA

- Brummel & Brown

- Chobani, LLC

- Danone S.A.

- FAGE International S.A.

- Graham’s Dairies Limited

- Iceland Foods Ltd.

- Jalna Yoghurt

- James Hall & Co.

- Kemps LLC

- Lactalis

- Lancashire Farm

- Nature’s Fynd

- Nestle, S.A.

- Riverford Organic Farmers Ltd

- Sainsbury’s

- Stonyfield

- Target Corporation

- The Hain Celestial Group

- Wm Morrison Supermarkets Limited

- Yakult Honsha

- Yeo Valley

- Yoplait by General Mills Inc.

Competitive Analysis

The France Fat-Free Yogurt market is highly competitive, with several prominent players striving for market leadership through product innovation and strategic expansions. Leading players such as Nestlé, Danone, Yoplait, Chobani, Lactalis, Arla Foods, FAGE, and Stonyfield are continuously introducing new variations of fat-free yogurt, catering to diverse consumer preferences. Major players in the market focus on product variety, catering to a wide range of consumer preferences, including flavored, organic, and plant-based fat-free yogurt options. Companies are increasingly introducing functional ingredients like probiotics, fiber, and vitamins to tap into the growing demand for health-oriented foods. In addition to product innovation, the competitive landscape is shaped by pricing strategies and distribution channels. Larger companies benefit from extensive retail networks and economies of scale, making their products widely available to consumers. Smaller brands, on the other hand, are focusing on niche segments, such as organic and plant-based fat-free yogurt, to cater to specific consumer needs. The market also sees frequent collaborations and partnerships to enhance product offerings and expand geographical reach. With the growing demand for convenience, companies are also focusing on offering single-serve packaging and on-the-go options to meet the fast-paced lifestyle of consumers. Quality, affordability, and continuous innovation remain crucial factors for maintaining a competitive edge in the dynamic France Fat-Free Yogurt market.

Recent Developments

- In October 2024, Nestlé Lindahls expanded its high-protein range with new flavors, including fat-free protein yogurt pouches. However, these are not specifically labeled as fat-free yogurt but are part of a broader health-focused product line.

- In July 2024, Nestlé developed a technology to reduce fat in dairy ingredients by up to 60% without compromising taste or texture, though this is not specifically for fat-free yogurt.

Market Concentration & Characteristics

The France Fat-Free Yogurt market exhibits a moderate level of market concentration, with a few large companies holding a significant share, while several smaller players cater to niche segments. The market is characterized by intense competition among leading brands, which focus on product diversification, such as offering a wide variety of flavors, organic options, and functional ingredients like probiotics and fiber. Larger companies benefit from economies of scale, enabling them to offer competitive pricing and ensure widespread availability through extensive distribution networks. On the other hand, smaller brands emphasize innovation, unique flavors, and sustainability to differentiate themselves in the market. The market is also increasingly characterized by the demand for healthier and more convenient snack options, driving the popularity of on-the-go packaging and dairy-free alternatives. As consumer preferences continue to evolve, the market is expected to see further segmentation, with players targeting specific dietary preferences and health-conscious consumers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The France Fat-Free Yogurt market is expected to continue its robust growth, driven by increasing health consciousness among consumers.

- The demand for organic and plant-based fat-free yogurt alternatives is likely to rise as consumers shift towards more sustainable and ethical food choices.

- Innovation in flavors and functional ingredients, such as probiotics and added vitamins, will drive product differentiation and appeal to health-conscious buyers.

- The growing trend of convenient, on-the-go packaging will make fat-free yogurt a popular choice for busy consumers seeking healthy snacks.

- As dairy-free and vegan diets gain popularity, the market for non-dairy fat-free yogurt options made from almond, coconut, and soy will expand.

- Increasing awareness of the benefits of low-fat, high-protein yogurt will further fuel the growth of fat-free yogurt in fitness and wellness communities.

- Distribution channels will continue to expand, with a stronger focus on e-commerce and online retail platforms, improving accessibility for consumers.

- Product pricing will become a competitive factor as brands strive to offer affordable, yet high-quality fat-free yogurt options.

- Increased demand for clean-label and natural ingredients will prompt companies to reduce additives and preservatives in their fat-free yogurt products.

- The market will see greater regional variations as companies tailor their offerings to meet local taste preferences and dietary trends across different parts of France.