Market Overview:

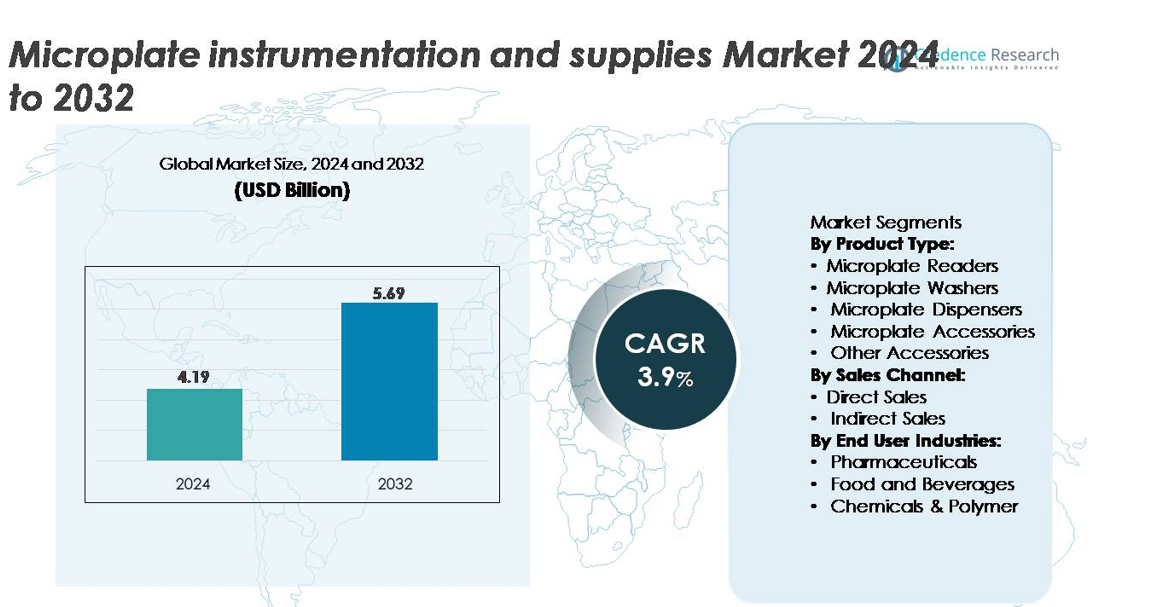

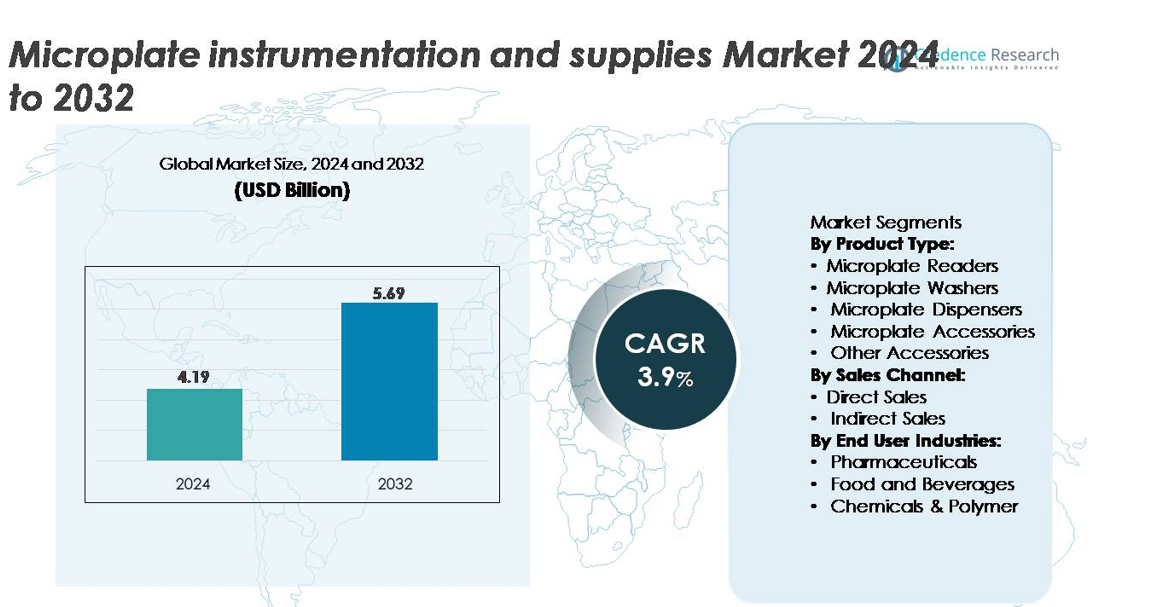

The global microplate instrumentation and supplies market was valued at USD 4.19 billion in 2024 and is projected to reach USD 5.69 billion by 2032, reflecting a steady CAGR of 3.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Microplate Instrumentation and Supplies Market Size 2024 |

USD 4.19 billion |

| Microplate Instrumentation and Supplies Market, CAGR |

3.9% |

| Microplate Instrumentation and Supplies Market Size 2032 |

USD 5.69 billion |

The microplate instrumentation and supplies market is shaped by strong participation from key players such as Corning Inc., Hudson Robotics, BMG LABTECH, Promega Corporation, and Tecan Group Ltd., each contributing specialized strengths across detection technologies, assay chemistry, consumables, and automated workflow integration. These companies compete by advancing multimode detection systems, high-precision microplates, robotics-enabled processing, and high-sensitivity assay reagents to support pharmaceutical research, diagnostics, and industrial testing. North America leads the market with approximately 35% share, supported by a mature biotechnology ecosystem, high laboratory automation rates, and strong demand from pharmaceutical and clinical research institutions. Europe and Asia Pacific follow closely, driven by expanding research infrastructure and growing diagnostic requirements.

Market Insights

- The global microplate instrumentation and supplies market was valued at USD 4.19 billion in 2024 and is projected to reach USD 5.69 billion by 2032, registering a CAGR of 3.9% during the forecast period.

- Market growth is driven by rising adoption of high-throughput screening, increasing automation in pharmaceutical R&D, and expanding use of ELISA and cell-based assays across clinical and industrial laboratories.

- Key trends include advancements in multimode detection, growth of miniaturized high-density plate formats, and increasing integration of robotics and digital connectivity for streamlined workflows.

- Competitively, leading players such as Corning, Tecan, BMG LABTECH, Promega, and Hudson Robotics focus on optical innovation, automated liquid handling, and high-performance consumables, while market restraints include high instrument costs and variability in assay standardization.

- Regionally, North America holds ~35% share, followed by Europe at ~28% and Asia Pacific at ~25%; by product type, microplate readers dominate with the highest segment share due to their central role in analytical workflows.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Microplate readers account for the largest share of the product-type segment, driven by their essential role in high-throughput screening, enzyme kinetics, and absorbance/fluorescence/luminescence-based quantification across research and diagnostic workflows. Their expanding integration of multimode detection, automated calibration, and advanced optics reinforces widespread adoption in both academic and industrial laboratories. Microplate washers and dispensers support workflow efficiency but trail readers in overall penetration due to narrower application scopes. Accessories and other consumable components continue to grow steadily as laboratories scale microplate-based assays and require reliable plate handling, sealing, and fluid-management solutions.

- For instance, BMG LABTECH’s PHERAstar FSX can read a full 1536-well plate in 27 seconds and supports up to 3456-well ultra-HTS formats with advanced TR-FRET and AlphaScreen modes. Microplate washers and dispensers support workflow efficiency but trail readers in overall penetration due to narrower application scopes.

By Sales Channel

Direct sales represent the dominant channel, supported by strong manufacturer–customer relationships, bundled equipment–consumable procurement, and the need for specialized installation, training, and service support for sophisticated microplate instrumentation. Leading suppliers increasingly use direct engagement to promote multimode readers, integrated automation modules, and long-term maintenance contracts, driving higher retention and repeat purchases. Indirect sales channels, including distributors and scientific equipment resellers, maintain relevance in emerging markets and smaller laboratories where price sensitivity and broader product availability influence purchasing decisions, but they generate a comparatively smaller share than direct B2B engagements.

- For instance, Tecan reports that its direct-installed Fluent® Automation Workstations can process up to 384 samples per run and execute liquid-handling steps with a typical precision (CV) of \(\le 4\%\) at 1 µL for the MCA 384 head. Optimal performance with these systems is dependent on proper on-site calibration, adherence to system care instructions, and appropriate user training.”

By End User Industries

Pharmaceuticals hold the largest share among end-user industries due to intensive adoption of microplate-based assays for drug discovery, compound screening, bioassays, and cell-based analysis. High-throughput screening workflows, rising biologics development, and stringent quality-control requirements strengthen the reliance on advanced readers, washers, and dispensers. Food and beverage companies use microplate systems for microbiological testing and allergen detection, while the chemicals and polymer sector employs them for material stability analysis and colorimetric evaluations. However, neither segment matches the scale, assay volume, or instrumentation sophistication demanded by pharmaceutical R&D and QC laboratories.

Key Growth Drivers:

Expansion of High-Throughput Screening (HTS) and Automated Workflows

The growing emphasis on high-throughput screening in pharmaceutical and biotechnology research remains a core driver of demand for advanced microplate instrumentation. As organizations accelerate assay development, lead identification, and compound profiling, they require microplate readers, washers, and dispensers capable of handling large assay volumes with precision and consistency. Automated platforms integrated with robotics, liquid-handling systems, and multimode detection are increasingly preferred to minimize human error and optimize throughput. The push toward miniaturized assays and faster decision-making further supports adoption, as microplate-based systems deliver reproducible, scalable results at lower reagent consumption. Rising utilization of 96-, 384-, and 1536-well formats across drug discovery, genomics, proteomics, and toxicology studies reinforces this momentum. Together, these trends position microplate technologies as indispensable tools in laboratory automation ecosystems.

- For instance, BMG LABTECH’s PHERAstar FSX can read a full 1536-well plate in 27 seconds and supports ultra-HTS formats up to 3456 wells, enabling rapid compound profiling in screening labs.

Rising Adoption Across Clinical Diagnostics and Molecular Testing

Clinical laboratories increasingly depend on microplate-based workflows for immunoassays, enzyme activity testing, serological screening, and molecular diagnostics, driving consistent market expansion. The shift toward early disease detection, expansion of infectious disease panels, and rising workload in hospital laboratories elevate the need for reliable, high-throughput microplate readers and washers. Automated ELISA processors and flexible multimode platforms help labs achieve improved accuracy, faster turnaround times, and reduced manual intervention. Microplate instruments enable scalable testing during public health emergencies and routine surveillance programs, supporting both centralized and decentralized diagnostic settings. The adoption of advanced assay formats, including chemiluminescence and fluorescence-based detection, further expands usage. With clinical labs prioritizing workflow standardization, traceability, and digital integration with information systems, microplate instrumentation becomes a critical enabler of diagnostic efficiency.

- “For instance, Promega’s GloMax® Discover can detect luminescence signals as low as 3×10-213 cross 10 to the negative 21 power 3×10−21 moles of luciferase, enabling highly sensitive screening of viral and immunological biomarkers in clinical labs”.

Growing Use of Microplate Systems in Food Safety, Environmental, and Industrial Testing

Beyond pharmaceuticals and clinical diagnostics, microplate technologies are rapidly gaining traction in food safety, environmental monitoring, and industrial quality-control laboratories. Rising global scrutiny over contaminants, allergens, microbial pathogens, and chemical residues necessitates high-throughput analytical tools that can deliver accurate and reproducible results. Microplate readers and washers support ELISA-based testing for toxins, adulterants, and spoilage organisms, enabling faster sample screening and compliance with regulatory standards. In industrial sectors such as chemicals and polymers, microplates facilitate colorimetric, turbidity, and enzyme-based assays that support formulation testing and stability analysis. Environmental labs employ microplates for water quality, toxicology, and biochemical oxygen demand assessments. As these industries shift toward automated and miniaturized workflows to reduce costs and improve analytical throughput, microplate instrumentation and consumables experience strong long-term demand.

Key Trends & Opportunities:

Advancements in Multimode and High-Sensitivity Detection Technologies

The market is witnessing increasing innovation in multimode detection systems that combine absorbance, fluorescence, luminescence, and time-resolved detection in a single platform. Laboratories seek versatile instruments that can adapt to evolving assay requirements without additional capital investment. Opportunities arise as manufacturers introduce improvements in optical architecture, enhanced spectral resolution, and improved dynamic range, allowing researchers to detect low-abundance analytes with higher confidence. Integrated features such as temperature control, CO₂ regulation, and kinetic analysis broaden application scope into cell-based assays and live-cell imaging. Growth in biomarker research, gene expression studies, and precision medicine further enhances market opportunity for advanced, flexible detection systems.

- For instance, BMG LABTECH’s CLARIOstar® Plus offers monochromator-based spectral scanning with 1 nm wavelength resolution and fluorescence detection sensitivity down to 0.2 fmol FITC, enabling precise low-signal quantification.

Integration of AI-Driven Analytics, Connectivity, and Digital Lab Ecosystems

Digitalization is reshaping the microplate instrumentation landscape, creating new opportunities for smart, connected laboratory environments. Instrument manufacturers are increasingly embedding AI-based analytics, real-time data processing, and automated quality control to help laboratories improve analysis accuracy and reduce operational variability. Cloud connectivity enables seamless data transfer, remote monitoring, and multi-instrument coordination, aligning with broader adoption of Laboratory Information Management Systems (LIMS). Opportunities emerge as labs prioritize audit-ready data, automated reporting, and predictive maintenance capabilities. These advancements support large-scale screening programs, decentralized testing networks, and integrated R&D pipelines, driving adoption of next-generation, digitally enabled microplate platforms.

- For instance, Tecan’s LabNavigator™ platform supports automated workflow guidance and integrates with Introspect™, which tracks instrument utilization and records operational metrics at 1-second intervals, enabling traceable, audit-ready data capture across connected devices.

Expansion of Microfluidics and Miniaturized Assay Formats

Miniaturization trends in research and diagnostics are creating new pathways for growth within the microplate ecosystem. Microfluidic-based plates, low-volume well formats, and high-density plates (such as 1536- or 3456-well) support greater throughput while reducing sample and reagent consumption. As sustainability and cost-efficiency become major goals, laboratories increasingly adopt these advanced consumables and compatible dispensing technologies. Opportunities also arise from the convergence of microfluidics with 3D cell culture, organ-on-chip systems, and multiplexed assays, enabling higher biological relevance and experimental depth. This shift toward miniaturized workflows expands the functional boundaries of microplate instrumentation.

Key Challenges:

High Equipment Costs and Budget Constraints in Academic and Small Laboratories

One of the most persistent challenges in the microplate instrumentation market is the high capital cost of advanced multimode readers, automated washers, and integrated dispensing systems. Many academic institutions, small research laboratories, and diagnostic centers operate under limited budgets and cannot easily justify investments in sophisticated platforms. Maintenance contracts, software licensing, and calibration services further increase the total cost of ownership. As a result, procurement cycles become prolonged, and buyers often opt for refurbished instruments or basic single-mode devices. This constraint hampers broader adoption of cutting-edge technologies and limits penetration into price-sensitive regions.

Variability in Assay Standardization and Inter-Laboratory Reproducibility

Despite widespread use, microplate-based workflows often face challenges related to assay standardization, reproducibility, and cross-laboratory consistency. Differences in plate materials, well geometry, reader sensitivity, and liquid-handling precision can introduce variability in assay outcomes. Laboratories conducting enzyme kinetics, cell-based analysis, or quantitative immunoassays may experience inconsistent results unless workflows are rigorously validated. The absence of universal guidelines for plate selection, pipetting techniques, and instrument calibration adds to the complexity. This variability increases the risk of experimental error, reduces confidence in data comparability, and demands additional resources for method optimization and validation.

Regional Analysis:

North America

North America accounts for around 35% of the global microplate instrumentation and supplies market, driven by its strong pharmaceutical R&D ecosystem, extensive biotechnology capabilities, and high adoption of automated laboratory workflows. The presence of leading manufacturers and CROs, coupled with substantial federal and private investment in drug discovery and molecular diagnostics, strengthens regional demand. Clinical laboratories increasingly deploy advanced microplate readers and washers to support immunoassays and infectious disease testing. Favorable reimbursement frameworks, established regulatory standards, and rapid integration of digital laboratory systems further reinforce North America’s leading position.

Europe

Europe holds approximately 28% of the market, supported by robust biomedical research infrastructure, strong academic–industry collaboration, and high adoption of ELISA and cell-based assay technologies. Countries such as Germany, the U.K., France, and the Netherlands drive significant demand due to active pharmaceutical manufacturing and stringent regulatory requirements for food safety and environmental monitoring. The increasing modernization of diagnostic laboratories and expansion of high-throughput screening programs strengthen sales of advanced multimode readers and automated liquid-handling systems. Europe’s emphasis on quality assurance and sustainability also supports demand for precision microplate accessories and consumables.

Asia Pacific

Asia Pacific represents roughly 25% of the global market and is the fastest-growing region due to expanding pharmaceutical production, rising clinical diagnostics volumes, and growing investment in life science research. China, Japan, South Korea, and India lead adoption as laboratories modernize testing capacity and incorporate automated microplate workflows for drug screening, infectious disease surveillance, and quality control. Increasing government funding for genomics, proteomics, and translational medicine further accelerates equipment upgrades. The region’s rapidly expanding biotechnology startups, contract research organizations, and food safety testing laboratories continue to boost demand for microplate instruments and associated consumables.

Latin America

Latin America accounts for nearly 7% of the market, driven by increasing adoption of microplate-based assays in clinical diagnostics, food safety monitoring, and pharmaceutical quality testing. Brazil and Mexico dominate regional demand due to their expanding healthcare infrastructure and growing investment in biotechnology and public health programs. Laboratories are gradually transitioning from manual ELISA workflows to automated and semi-automated systems to improve accuracy and reduce turnaround time. Although budget constraints limit high-end equipment procurement, rising awareness of assay standardization and regulatory compliance is steadily supporting demand for microplate readers, washers, and consumables.

Middle East & Africa

The Middle East & Africa region represents about 5% of the market, with growth concentrated in the Gulf Cooperation Council (GCC) countries and South Africa. Increasing investments in hospital laboratories, infectious disease testing facilities, and food safety programs support adoption of microplate readers and washers. Government initiatives to strengthen diagnostic infrastructure and expand molecular testing capabilities contribute to rising instrument installations. However, the market remains constrained by limited R&D activity and slower adoption of high-end automated platforms. Demand is gradually increasing as healthcare modernization accelerates and international manufacturers expand distribution networks across the region.

Market Segmentations:

By Product Type:

- Microplate Readers

- Microplate Washers

- Microplate Dispensers

- Microplate Accessories

- Other Accessories

By Sales Channel:

- Direct Sales

- Indirect Sales

By End User Industries:

- Pharmaceuticals

- Food and Beverages

- Chemicals & Polymer

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape:

The competitive landscape of the microplate instrumentation and supplies market is characterized by a mix of global analytical instrument manufacturers and specialized laboratory technology providers competing on innovation, performance, and workflow integration. Leading companies focus on expanding multimode detection platforms, automated washing and dispensing systems, and high-quality consumables to meet the demands of pharmaceutical R&D, clinical diagnostics, and high-throughput screening. Strategic priorities include enhancing optical sensitivity, improving assay reproducibility, and integrating digital connectivity for data traceability and remote monitoring. Suppliers increasingly pursue mergers, partnerships, and OEM collaborations to broaden geographic reach and strengthen product portfolios. Consumable manufacturers compete through material innovation, well-design optimization, and reliability in high-volume assays. With rising emphasis on automation, AI-driven data analysis, and miniaturized assay formats, competitive differentiation increasingly depends on technological advancement, application versatility, and long-term service and maintenance capabilities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Corning Inc. (Providing high-quality microplates and assay surfaces)

- Hudson Robotics (Advancing robotic solutions for microplate processing)

- BMG LABTECH (Specializing in multimode microplate readers)

- Promega Corporation (Innovating in luminescence and fluorescence assays)

- Tecan Group Ltd. (Developing automated liquid handling and detection solutions)

Recent Developments

- In May 2025, Tecan expanded collaboration with HP to release the Duo Digital Dispenser™, combining single-cell and reagent dispensing capabilities enabling significantly faster reagent dispensing and cell isolation workflows for drug discovery and single-cell applications.

- In April 2025, industry-wide reports highlighted advances in microplate reader throughput and accuracy, with the latest multimode readers supporting high well densities (up to 1536- and even 3456-well formats), offering faster read times and enhanced assay versatility a trend that benefits companies like BMG LABTECH and others.

- In January 2025, Tecan launched Veya™, a new liquid-handling platform designed to deliver scalable, automated workflows for labs of all sizes

Report Coverage:

The research report offers an in-depth analysis based on Product type, Sales channel, End-User industries and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Adoption of fully automated microplate workflows will accelerate as laboratories prioritize higher throughput, precision, and reduced manual intervention.

- Multimode detection platforms will continue advancing with improved sensitivity, broader assay compatibility, and enhanced optical engineering.

- Integration of AI-augmented analytics will strengthen data interpretation, quality control, and predictive maintenance capabilities.

- Demand for miniaturized, high-density microplates will rise as research organizations focus on reducing reagent consumption and increasing assay scalability.

- Growth in cell-based assays and live-cell analysis will drive innovation in temperature-controlled and CO₂-regulated detection systems.

- Digital connectivity and cloud-enabled monitoring will expand, supporting remote access, LIMS integration, and streamlined documentation workflows.

- Sustainable microplate materials and low-waste consumables will gain traction as laboratories adopt environmentally responsible practices.

- Expansion of clinical diagnostics, food safety, and environmental testing will broaden the application base for microplate instrumentation.

- Regional manufacturing and localized distribution strategies will strengthen supply chain resilience and reduce procurement lead times.

- Competitive differentiation will increasingly rely on software ecosystems, modular automation compatibility, and long-term service support.