Market Overview

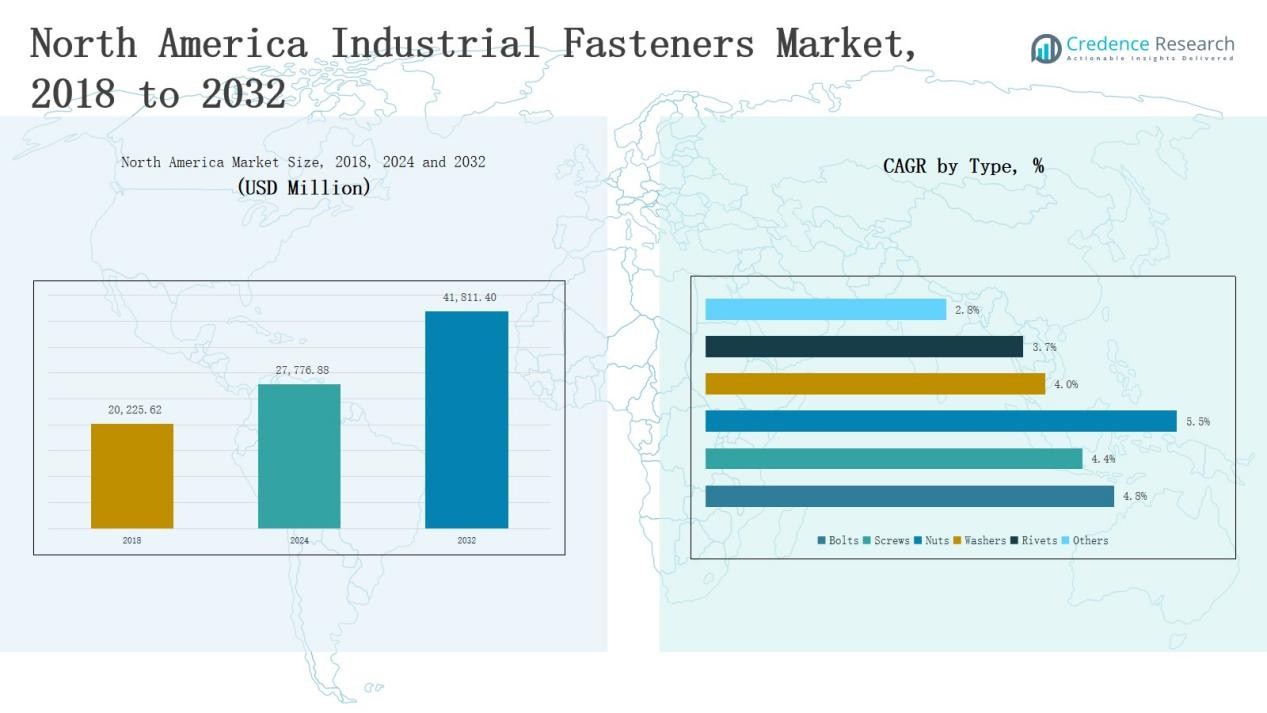

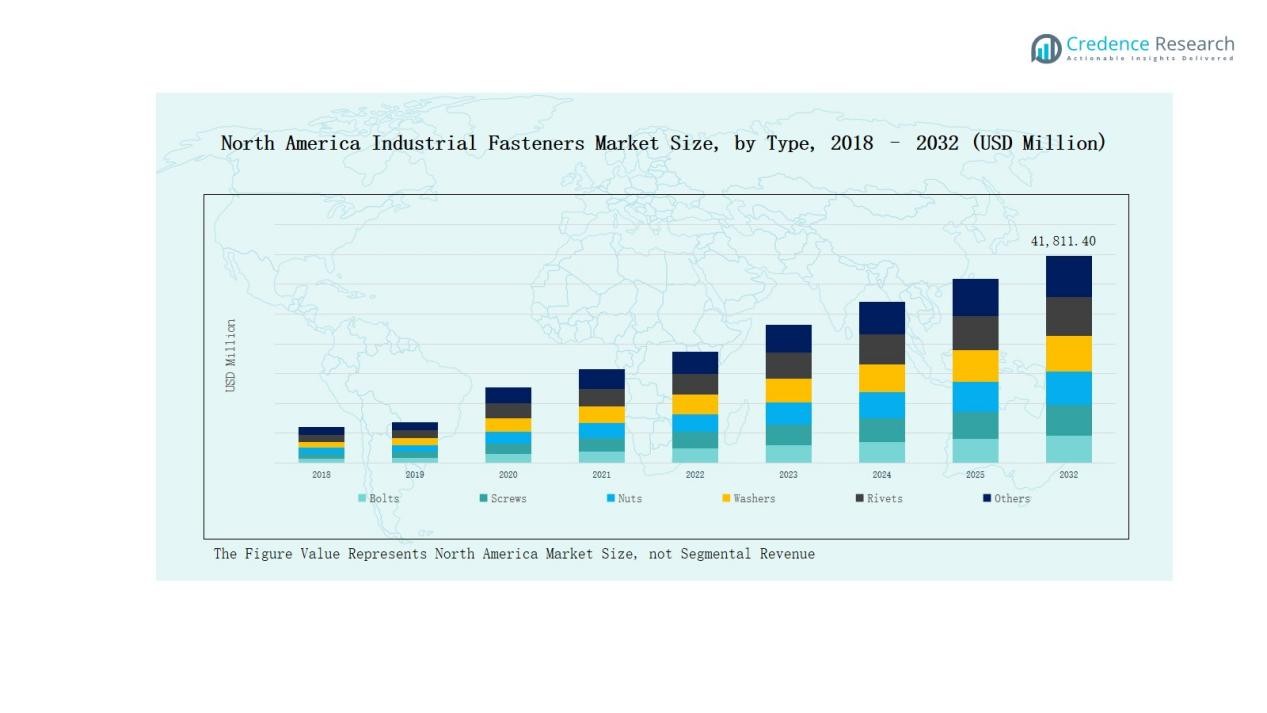

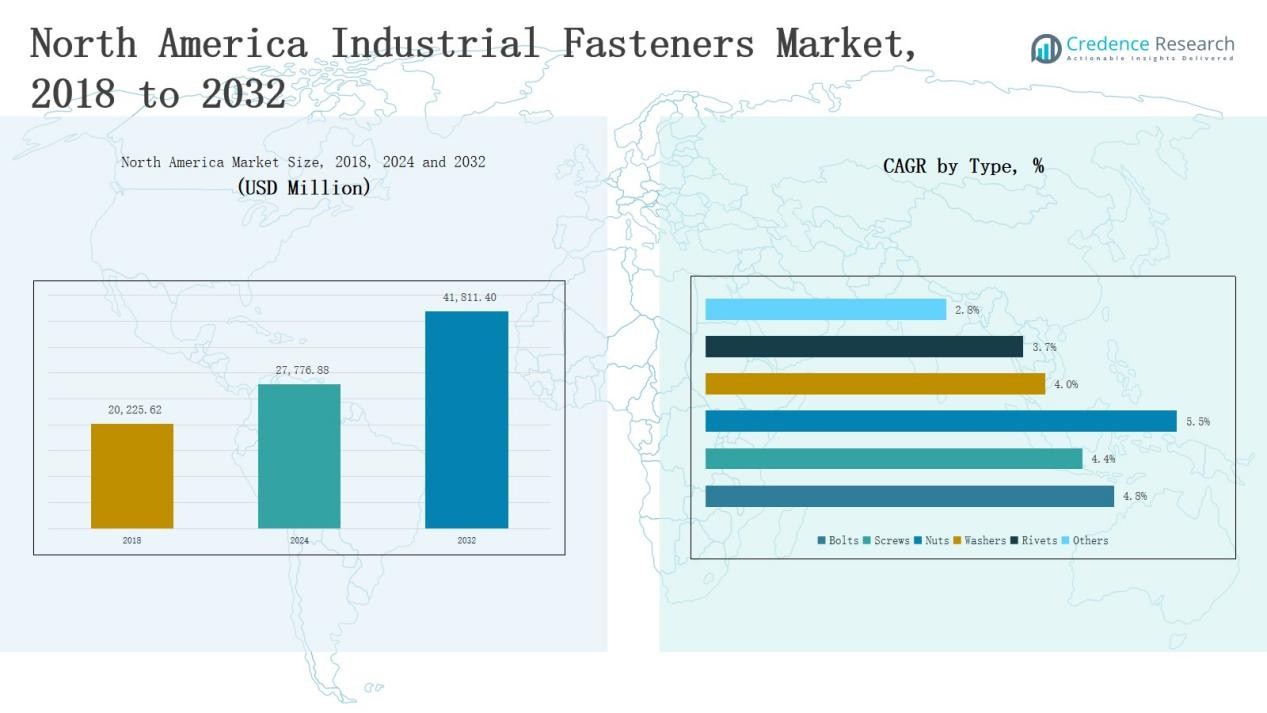

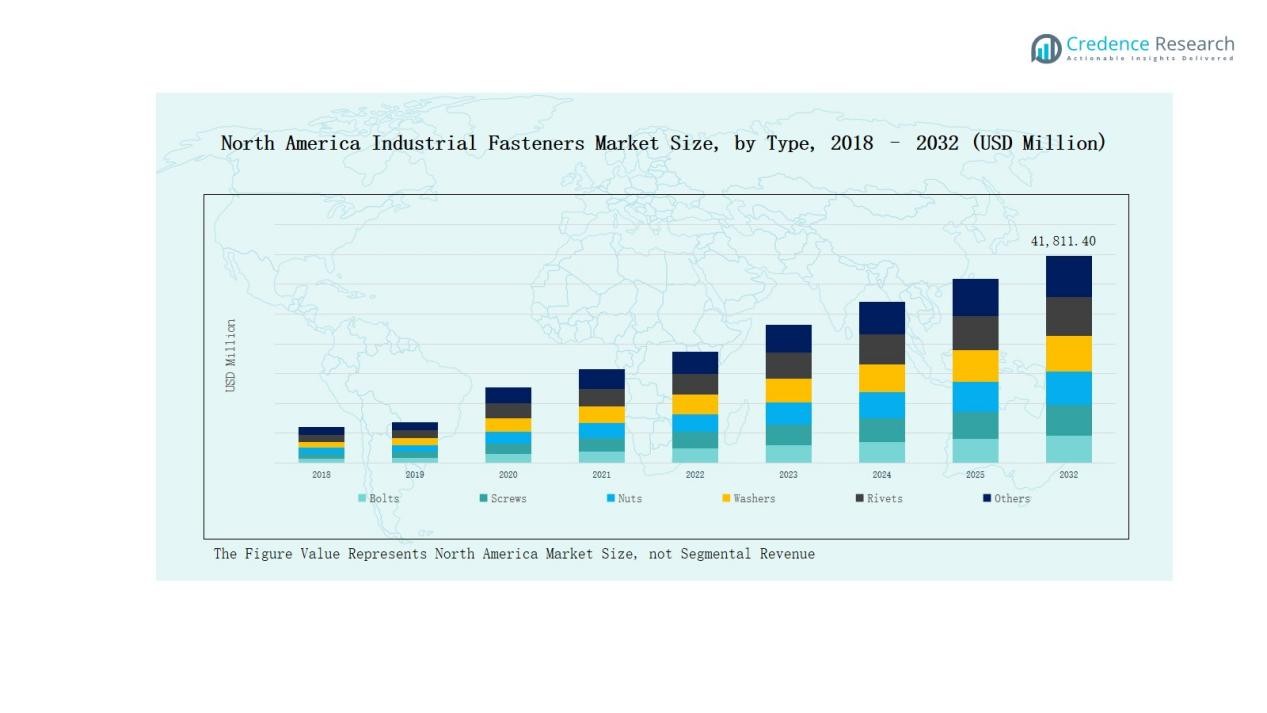

North America Industrial Fasteners Market size was valued at USD 20,225.62 million in 2018, grew to USD 27,776.88 million in 2024, and is anticipated to reach USD 41,811.40 million by 2032, expanding at a CAGR of 4.88% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Industrial Fasteners Market Size 2024 |

USD 27,776.88 Million |

| North America Industrial Fasteners Market, CAGR |

4.88% |

| North America Industrial Fasteners Market Size 2032 |

USD 41,811.40 Million |

The North America Industrial Fasteners Market is led by prominent companies such as ARaymond Industrial, Marmon Holdings Inc. (Berkshire Hathaway), Fontana Gruppo, Illinois Tool Works Inc., Stanley Black & Decker Inc., and LISI Group. These players maintain leadership through advanced manufacturing technologies, extensive product portfolios, and strategic partnerships across automotive, aerospace, and construction industries. Continuous investment in lightweight, corrosion-resistant, and high-performance fasteners strengthens their competitive edge. The United States emerged as the leading region in 2024, capturing a 76% market share, driven by strong industrial infrastructure and expanding production capabilities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The North America Industrial Fasteners Market grew from USD 20,225.62 million in 2018 to USD 27,776.88 million in 2024 and is expected to reach USD 41,811.40 million by 2032, expanding at a CAGR of 4.88%.

- Bolts dominated the market by type in 2024 with a 32% share, driven by their high tensile strength and wide use across automotive, aerospace, and construction industries.

- Externally Threaded Fasteners held the largest product share of 41% in 2024, supported by their reliability, easy maintenance, and use in structural and machinery applications.

- Pre-Applied Fasteners led the category segment with a 57% share in 2024, boosted by automation in assembly lines and growing demand for vibration-resistant, time-saving fastening solutions.

- The United States led the regional market with a 76% share in 2024, backed by robust manufacturing, infrastructure investment, and innovation in high-performance and coated fasteners.

Market Segment Insights

By Type:

Bolts dominated the North America Industrial Fasteners Market in 2024 with a 32% share. Their high tensile strength, versatility, and suitability for heavy-load applications drive adoption across automotive, aerospace, and construction industries. Continuous innovations in coated and stainless-steel bolts improve corrosion resistance and durability. Expanding infrastructure projects and vehicle production further strengthen demand, while customized bolt manufacturing for specialized machinery applications enhances market penetration across the region.

- For instance, Hilti North America introduced its new line of HUS4‑H 3/4″ screw bolts, engineered for enhanced load-bearing capacity and simplified installation in structural concrete applications.

By Product:

Externally Threaded Fasteners accounted for the largest market share of 41% in 2024. These fasteners are widely used in automotive assemblies, machinery, and structural applications requiring strong mechanical bonding. Their ability to provide high clamping force and easy maintenance supports their dominance. Increasing use of advanced materials and precision-engineered designs also improves load-bearing performance. Rising investments in aerospace and defense manufacturing further stimulate demand for high-strength externally threaded fasteners.

- For instance, Ankit Group manufactures high-grade aerospace fasteners from materials like alloy steel and titanium, meeting stringent NADCAP quality standards to withstand extreme environments in defense and satellite systems.

By Category:

Pre-Applied Fasteners led the market in 2024 with a 57% share, driven by rising automation in assembly lines and growing focus on reducing installation time. These fasteners come with pre-applied adhesives or sealants, ensuring consistent torque and vibration resistance. They are increasingly preferred in automotive, electronics, and industrial equipment manufacturing. Demand is supported by cost efficiency, enhanced safety, and reduced maintenance needs, making pre-applied solutions the preferred choice among OEMs and large-scale producers.

Key Growth Drivers

Expansion in Automotive and Aerospace Production

The North America Industrial Fasteners Market grows steadily with increased automotive and aerospace output. Rising production of electric vehicles, aircraft, and defense systems fuels fastener demand for precision and high-strength components. Manufacturers adopt lightweight alloys and corrosion-resistant coatings to meet performance standards. Continuous R&D in advanced fastening technologies ensures structural safety and supports automation. This industrial expansion, combined with government-backed manufacturing initiatives, significantly strengthens fastener consumption across the region’s transportation and aviation sectors.

- For instance, in aerospace, major players like Boeing and Lockheed Martin continuously require advanced fastening solutions; Howmet Aerospace introduced new high-performance fasteners tailored for aerospace applications in the recent years, emphasizing innovations in lightweight alloys and corrosion-resistant coatings.

Increasing Adoption of High-Performance Materials

Demand for durable and corrosion-resistant fasteners drives market growth. Industries prefer stainless steel, titanium, and engineered polymer fasteners for superior performance under extreme temperatures and stress conditions. The shift toward lightweight materials in aerospace and electric vehicles enhances fuel efficiency and sustainability. Moreover, the integration of smart coating technologies improves longevity and maintenance cycles. These innovations enable manufacturers to meet strict quality and safety standards, fostering greater adoption of high-performance fastening solutions in critical industrial applications.

- For instance, Boeing expanded its use of titanium fasteners in the 777X aircraft program to achieve higher strength-to-weight ratios and improve performance under thermal stress.

Infrastructure Development and Construction Activities

Rising infrastructure investment across North America creates strong demand for industrial fasteners. Public projects in transportation, renewable energy, and commercial construction use heavy-duty bolts, nuts, and anchors for long-term stability. Increasing adoption of prefabricated building systems also boosts fastener consumption. Governments in the U.S. and Canada continue to fund highway, bridge, and energy infrastructure upgrades. This sustained construction momentum directly contributes to the expansion of the regional fastener market, supporting both domestic production and import opportunities.

Key Trends & Opportunities

Shift Toward Smart and Coated Fasteners

Manufacturers increasingly focus on developing coated and sensor-embedded fasteners for predictive maintenance. Smart coatings reduce corrosion and enhance load monitoring, enabling real-time data collection on stress or fatigue. This technological shift aligns with Industry 4.0 trends in connected manufacturing. The aerospace, automotive, and renewable sectors benefit from enhanced safety, reduced downtime, and longer component lifespans, creating major opportunities for innovation-driven fastener producers across North America.

- For instance, CORROSHIELD®, CS Series coating offers superior anti-corrosion protection, enduring over 1000 hours in salt spray tests and 15 cycles in sulfur dioxide chambers, making it ideal for outdoor use in automotive and aerospace sectors.

Growing Penetration of E-Commerce and Direct Distribution

The digital transformation of supply chains fuels growth opportunities in online fastener distribution. E-commerce platforms simplify bulk ordering and improve supply visibility for industrial buyers. Direct-to-customer models reduce procurement time and expand manufacturer reach. Growing preference for digital inventory management, coupled with the availability of customizable fasteners, strengthens sales networks. This trend enhances competitiveness among local suppliers and encourages integration of logistics automation across North America’s fastener industry.

- For instance, MSC Industrial Supply upgraded its e-commerce interface with advanced search filters for specification-based fasteners, improving product accessibility and accelerating procurement for industrial users.

Key Challenges

Fluctuating Raw Material Prices

Volatility in steel, aluminum, and alloy prices poses a persistent challenge for fastener manufacturers. Supply chain disruptions and global trade tensions influence production costs, affecting profit margins. Many suppliers struggle to balance pricing with customer demand amid market instability. The industry increasingly relies on long-term supplier contracts and recycled materials to stabilize expenses. However, continuous price fluctuations remain a critical barrier to achieving consistent profitability in the North America Industrial Fasteners Market.

Rising Competition from Low-Cost Imports

Manufacturers in North America face growing competition from Asian producers offering cheaper alternatives. These imports exert pricing pressure and challenge domestic firms to maintain quality and delivery efficiency. Local companies respond by emphasizing customized products, faster lead times, and advanced materials. However, the cost gap remains substantial. Strategic trade policies and investment in automation are crucial to sustaining the region’s competitiveness against foreign fastener manufacturers.

Labor Shortages and Production Constraints

Skilled labor shortages in manufacturing and metalworking continue to hinder productivity. Advanced fastener production requires precision machining and process expertise, which are increasingly difficult to source. The ongoing labor gap leads to delays, reduced output, and higher operational costs. Automation adoption offers partial relief but demands high capital investment. To address this challenge, companies are expanding training programs and exploring robotics integration to maintain steady production levels and meet growing regional demand.

Regional Analysis

United States

The United States dominated the North America Industrial Fasteners Market in 2024 with a 76% share. Strong industrial manufacturing, expanding automotive output, and aerospace advancements drive market growth. The country’s established supply base and high investment in infrastructure projects sustain demand for metal and specialty fasteners. It benefits from the presence of major manufacturers and distribution networks supporting diverse industrial needs. Growth in electric vehicle production and renewable energy installations further strengthens market expansion. The U.S. also leads innovation in coated and high-performance fasteners, reinforcing its competitive edge.

Canada

Canada accounted for a 24% share of the regional market in 2024, supported by rising construction activities and industrial automation. Its fast-growing aerospace and energy sectors generate consistent demand for durable fastening solutions. Increasing investments in green buildings and transportation infrastructure create new growth opportunities for local producers. It benefits from cross-border trade and technological cooperation with the U.S., ensuring stable supply and product diversification. Manufacturers in Canada focus on stainless steel and corrosion-resistant fasteners for long-term performance in harsh climates. Expanding distribution channels and government-backed industrial modernization initiatives continue to enhance market potential.

Market Segmentations:

By Type:

- Bolts

- Screws

- Nuts

- Washers

- Rivets

- Others

By Product:

- Externally Threaded Fasteners

- Internally Threaded Fasteners

- Non-Threaded Fasteners

- Aerospace Grade Fasteners

By Category:

- Pre-Applied Fasteners

- Post-Applied Fasteners

By Material:

By Application:

- Automotive

- Aerospace

- Building & Construction

- Industrial Machinery

- Electronics & Energy

- Others

By Distribution Channel:

By Region:

Competitive Landscape

The North America Industrial Fasteners Market is highly competitive, with global and regional players focusing on product innovation, material advancement, and expansion of manufacturing capacities. Leading companies such as ARaymond Industrial, Marmon Holdings Inc. (Berkshire Hathaway), Fontana Gruppo, Illinois Tool Works Inc., Stanley Black & Decker Inc., and LISI Group dominate through wide product portfolios and strong client relationships across automotive, aerospace, and construction industries. It experiences growing consolidation as firms pursue mergers, acquisitions, and partnerships to expand geographic reach and technological expertise. Manufacturers increasingly invest in lightweight alloys, coated fasteners, and smart fastening systems to meet evolving industrial requirements. Emerging players strengthen competitiveness by offering cost-effective customized solutions and digital procurement platforms. Strategic collaborations, automation in production, and focus on sustainability remain key differentiators shaping the long-term competitive dynamics of the North America Industrial Fasteners Market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- ARaymond Industrial

- Marmon Holdings Inc. (Berkshire Hathaway)

- Fontana Gruppo

- Illinois Tool Works Inc.

- Stanley Black & Decker Inc.

- LISI Group

- Nifco Inc.

- Birmingham Fastener Inc.

- Portland Bolt & Manufacturing Company Inc.

- BTM Manufacturing

- L3Harris Technologies Inc.

- Astronics Corporation

- Ducommun Incorporated

- KD Fasteners Inc

- Buckeye Fasteners Company

Recent Developments

- In July 2025, Spartan Fastener acquired American Jebco to expand its specialty fasteners and rivets portfolio across North America.

- In April 2024, TR Fastenings launched its new Plas-Tech 30-20 screw designed for high-performance plastic applications.

- In July 2025, Signature Engineered Solutions entered a partnership to distribute Unbrako fasteners throughout the North American market.

- In July 2024, Lamons completed the acquisition of Auge Industrial Fasteners to enhance its global fastening solutions portfolio.

Report Coverage

The research report offers an in-depth analysis based on Type, Product Category, Material, Application, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for lightweight and high-strength fasteners will increase across automotive and aerospace industries.

- Manufacturers will focus on automation and robotics to improve production efficiency and consistency.

- The adoption of corrosion-resistant coatings will expand in marine and construction applications.

- Digital procurement platforms will streamline supply chains and enhance customer accessibility.

- Smart fasteners with embedded sensors will gain traction in advanced manufacturing systems.

- Sustainability goals will drive the use of recyclable materials and energy-efficient processes.

- Infrastructure investments across the U.S. and Canada will create steady demand for heavy-duty fasteners.

- Partnerships between OEMs and fastener suppliers will strengthen localized production networks.

- Expansion of e-commerce distribution will improve market penetration for small and mid-sized producers.

- Continuous innovation in design and materials will define competitive advantage among leading market players.