| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| India Protein Based Sports Supplement Market Size 2024 |

USD 216.54 Million |

| India Protein Based Sports Supplement Market, CAGR |

9.58% |

| India Protein Based Sports Supplement Market Size 2032 |

USD 450.23 Million |

Market Overview

India Protein Based Sports Supplement Market size was valued at USD 216.54 million in 2024 and is anticipated to reach USD 450.23 million by 2032, at a CAGR of 9.58% during the forecast period (2024-2032).

The India protein-based sports supplement market is primarily driven by the growing health consciousness among consumers, particularly urban millennials and fitness enthusiasts. Rising disposable incomes and increased participation in fitness activities such as gym workouts, running, and yoga are boosting demand for high-protein nutritional products. The expanding presence of fitness centers and e-commerce platforms has enhanced product accessibility and consumer reach. Additionally, the market benefits from the growing popularity of plant-based protein supplements, aligning with the rising vegan and lactose-intolerant populations. Social media influence, celebrity endorsements, and targeted marketing campaigns are further amplifying consumer awareness and product adoption. Manufacturers are innovating with diverse flavors, formats, and personalized nutrition solutions to meet evolving consumer preferences. Moreover, the government’s initiatives promoting health and wellness under programs like “Fit India Movement” are fostering favorable market conditions. These combined factors are positioning protein-based sports supplements as a key component of modern, health-focused lifestyles across India.

The geographical landscape of the India protein-based sports supplement market is shaped by the increasing adoption of fitness and wellness trends across urban and semi-urban regions. Northern and Western India lead the market in terms of consumer demand, driven by greater health awareness, access to fitness infrastructure, and widespread availability of supplements through retail and online channels. Southern India is rapidly emerging due to growing fitness culture and increasing influence of local health influencers, while Eastern India, although still developing, shows promising potential with rising digital access and health consciousness. Key players actively contributing to market growth include Herbalife Nutrition Ltd., Nestlé Health Science, Bright LifeCare Pvt. Ltd. (MuscleBlaze), Yakult Honsha Co., Ltd., Oziva (Zywie Ventures Pvt. Ltd.), Dymatize, and Wipro Consumer Care and Lighting. These companies are focusing on product innovation, regional expansion, and digital marketing to strengthen their presence and cater to the evolving preferences of Indian consumers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The India protein-based sports supplement market was valued at USD 216.54 million in 2024 and is expected to reach USD 450.23 million by 2032, growing at a CAGR of 9.58%.

- The global protein-based sports supplements market was valued at USD 7,372.05 million in 2024 and is projected to reach USD 13,140.51 million by 2032, growing at a CAGR of 7.49%.

- Rising health awareness, increasing gym memberships, and growing interest in fitness among millennials and Gen Z are major drivers of market growth.

- A notable trend is the growing demand for plant-based and vegan protein supplements due to shifting dietary preferences.

- Consumers are increasingly opting for convenient formats like protein bars and ready-to-drink beverages for on-the-go nutrition.

- The market is highly competitive with key players such as Herbalife Nutrition Ltd., MuscleBlaze, Nestlé Health Science, and Oziva focusing on innovation and digital outreach.

- Market restraints include high product costs, limited awareness in semi-urban areas, and concerns about counterfeit supplements.

- Northern and Western India are leading regions, while Southern India shows rising demand and Eastern India presents emerging opportunities.

Report Scope

This report segments the India Protein Based Sports Supplements Market as follows:

Market Drivers

Rising Health and Fitness Consciousness

One of the primary drivers of the India protein-based sports supplement market is the increasing awareness of health, fitness, and wellness among the Indian population. With the rising prevalence of lifestyle-related diseases and obesity, individuals are proactively seeking preventive health solutions. For instance, a survey conducted by the Indian Council of Medical Research highlighted that over 60% of urban Indians are actively engaging in fitness activities such as running, yoga, and strength training to combat lifestyle-related health issues. The younger demographic, especially millennials and Gen Z, are taking a more active interest in maintaining physical fitness, which has led to a significant uptick in gym memberships, fitness center enrollments, and participation in activities such as running, yoga, and strength training. This shift in mindset has elevated the demand for nutritional support in the form of protein-based supplements, which help in muscle recovery, endurance enhancement, and overall health improvement. As fitness becomes an integral part of modern urban lifestyles, protein supplements are increasingly being incorporated into daily dietary routines.

Growing Disposable Incomes and Urbanization

India’s expanding middle-class population, coupled with rising disposable incomes, is another crucial factor fueling the growth of the protein-based sports supplement market. As urbanization accelerates and more consumers adopt global lifestyle trends, there is a noticeable shift towards convenient and premium health products. The affordability of protein supplements has improved significantly over the years, making them more accessible across Tier I and Tier II cities. Consumers are now willing to invest in quality nutrition products that offer tangible health benefits and align with their wellness goals. Furthermore, the influence of Western dietary practices and exposure to international fitness regimes through digital platforms have strengthened consumer preference for high-protein diets, further boosting the demand for supplements tailored to Indian palates and nutritional needs.

Expansion of Distribution Channels and E-commerce Penetration

The widespread availability of protein-based sports supplements through multiple distribution channels particularly online platforms has played a vital role in market expansion. For instance, a study by the Federation of Indian Chambers of Commerce & Industry (FICCI) found that over 70% of urban consumers prefer purchasing health products online due to convenience and access to detailed product information. E-commerce giants, along with specialized health and fitness websites, offer a wide variety of protein products with transparent ingredient information, customer reviews, and discounts, which help consumers make informed decisions. This convenience is especially appealing to the tech-savvy, time-constrained urban population. Additionally, the rise of direct-to-consumer (D2C) brands, influencer marketing, and fitness apps has allowed companies to build closer connections with their target audience. Offline retail presence, including pharmacy chains, supermarkets, and fitness centers, has also strengthened, ensuring widespread product reach across metros and smaller cities alike.

Shift Toward Plant-Based and Personalized Nutrition

The increasing demand for plant-based and personalized protein supplements is significantly shaping the Indian market. A growing number of consumers are adopting vegetarian, vegan, and lactose-free diets due to health, ethical, or religious reasons. This has created a surge in demand for plant-based protein alternatives like pea, soy, and rice protein. At the same time, advancements in nutritional science and technology have enabled brands to offer personalized supplement solutions based on individual fitness goals, body types, and dietary restrictions. Consumers are now seeking products that offer specific health benefits such as weight management, muscle gain, or immunity support. This demand for tailored nutrition is pushing manufacturers to innovate and expand their offerings, further driving the growth of the protein-based sports supplement market in India.

Market Trends

Increasing Popularity of Plant-Based Protein Supplements

A notable trend shaping the Indian protein-based sports supplement market is the rising preference for plant-based protein sources. With increasing awareness of food intolerances, allergies, and sustainable nutrition, more consumers are shifting from traditional animal-derived proteins like whey and casein to alternatives such as pea, soy, brown rice, and hemp protein. For instance, a report by the Good Food Institute highlighted the growing adoption of plant-based diets among urban Indians, driven by ethical considerations and health benefits. This shift is particularly strong among vegan and lactose-intolerant individuals. The clean-label movement and demand for organic, non-GMO, and ethically sourced ingredients have also contributed to the growth of plant-based offerings. Manufacturers are responding by expanding their product portfolios to include dairy-free, gluten-free, and sugar-free variants that align with evolving consumer preferences, further driving product adoption.

Rapid Growth of Ready-to-Consume Protein Formats

The Indian market is witnessing a strong demand for convenient and ready-to-consume protein formats, such as protein bars, shakes, and ready-to-drink (RTD) beverages. For instance, a study by the Federation of Indian Chambers of Commerce & Industry (FICCI) revealed that urban professionals are increasingly opting for RTD protein beverages due to their convenience and portability. These products cater to busy urban lifestyles and offer on-the-go nutrition for fitness enthusiasts and working professionals alike. Unlike traditional protein powders that require preparation, RTD formats provide a quick and accessible solution, enhancing consumer appeal. Companies are investing in product innovation to offer high-protein snacks that are not only functional but also flavorful and satisfying. This trend is accelerating due to the increasing consumer inclination toward portable, time-saving, and versatile nutrition options that support their fitness routines and dietary goals.

Rising Influence of Social Media and Fitness Influencers

Social media platforms and fitness influencers play a significant role in shaping consumer behavior and brand perception in the protein supplement industry. Influencer marketing has emerged as a powerful tool for companies to connect with their target audience, especially younger consumers. Fitness enthusiasts, personal trainers, and nutrition experts are frequently endorsing protein supplements through engaging content such as workout routines, product reviews, and transformation stories. These digital endorsements help build trust, provide product education, and drive brand loyalty. Moreover, user-generated content and online fitness communities foster peer recommendations, making social media a key driver of brand discovery and consumer engagement.

Adoption of Personalized and Functional Nutrition

Personalized nutrition is gaining traction in the Indian sports supplement market, as consumers seek products tailored to their individual health needs and fitness objectives. Brands are incorporating technology-driven solutions, such as online quizzes, fitness apps, and AI-powered recommendations, to suggest customized protein supplements. Additionally, functional benefits such as immunity support, muscle recovery, and energy enhancement are being integrated into product formulations to cater to specific health outcomes. This trend reflects the growing demand for targeted, science-backed nutrition that goes beyond basic protein intake, enabling consumers to optimize their health and performance more effectively.

Market Challenges Analysis

High Product Cost and Limited Consumer Awareness

One of the primary challenges hampering the growth of the protein-based sports supplement market in India is the high cost associated with quality supplements. Premium pricing, especially for imported or specialized products, often places them out of reach for a significant portion of the population. For instance, a report by the National Sample Survey Office (NSSO) highlighted that affordability remains a significant barrier in Tier II and Tier III cities, where disposable incomes are lower compared to urban centers. Additionally, a lack of awareness about the health benefits and appropriate usage of protein supplements limits market penetration. Many consumers still associate protein intake solely with bodybuilders, ignoring its broader nutritional and recovery benefits. This misconception, combined with limited product education, restricts the adoption of protein supplements among the general population, particularly in rural and semi-urban regions.

Prevalence of Counterfeit Products and Regulatory Gaps

The Indian market also faces challenges due to the widespread availability of counterfeit, substandard, and adulterated protein supplements. Unregulated products often contain harmful substances or fail to meet declared nutritional standards, leading to serious health risks. The lack of stringent enforcement by regulatory authorities further exacerbates the issue, undermining consumer trust in the category. Moreover, inconsistent labeling practices and inadequate quality checks create confusion regarding product authenticity and safety. This market fragmentation discourages new consumers and makes it difficult for reputable brands to maintain credibility. Addressing these regulatory gaps and ensuring strict compliance with safety standards are essential steps toward fostering a trustworthy and sustainable market environment for protein-based sports supplements in India.

Market Opportunities

The India protein-based sports supplement market presents substantial growth opportunities driven by the country’s evolving health and wellness landscape. As more individuals, particularly in urban and semi-urban areas, adopt active lifestyles, the demand for protein supplements is expected to rise significantly. The expanding fitness industry, characterized by the growing number of gyms, health clubs, and wellness centers, is fostering a favorable environment for protein supplement adoption. In addition, the rising participation of women in fitness and sports activities opens new consumer segments for market players. Brands that offer tailored products catering to gender-specific nutritional needs, such as weight management or muscle toning for women, stand to gain a competitive advantage. Furthermore, the increasing influence of digital media and fitness influencers is creating awareness about the benefits of protein consumption, leading to greater acceptance and market penetration across various age groups.

Another promising opportunity lies in product diversification and innovation, particularly in plant-based and functional protein supplements. As dietary preferences shift toward veganism and lactose-free diets, demand for alternatives like soy, pea, and rice protein is growing steadily. Companies that invest in clean-label, organic, and allergen-free formulations are likely to attract a broader consumer base. Additionally, incorporating functional ingredients such as vitamins, minerals, probiotics, and adaptogens into protein products can enhance their appeal by offering added health benefits beyond muscle support. Regional expansion into Tier II and Tier III cities, supported by improved distribution networks and e-commerce platforms, also offers immense potential. As awareness improves and purchasing power increases in these regions, brands that localize their marketing strategies and offer affordable, high-quality products can capitalize on untapped demand. Overall, aligning product development with consumer preferences and leveraging digital outreach can unlock significant growth opportunities in India’s protein-based sports supplement market.

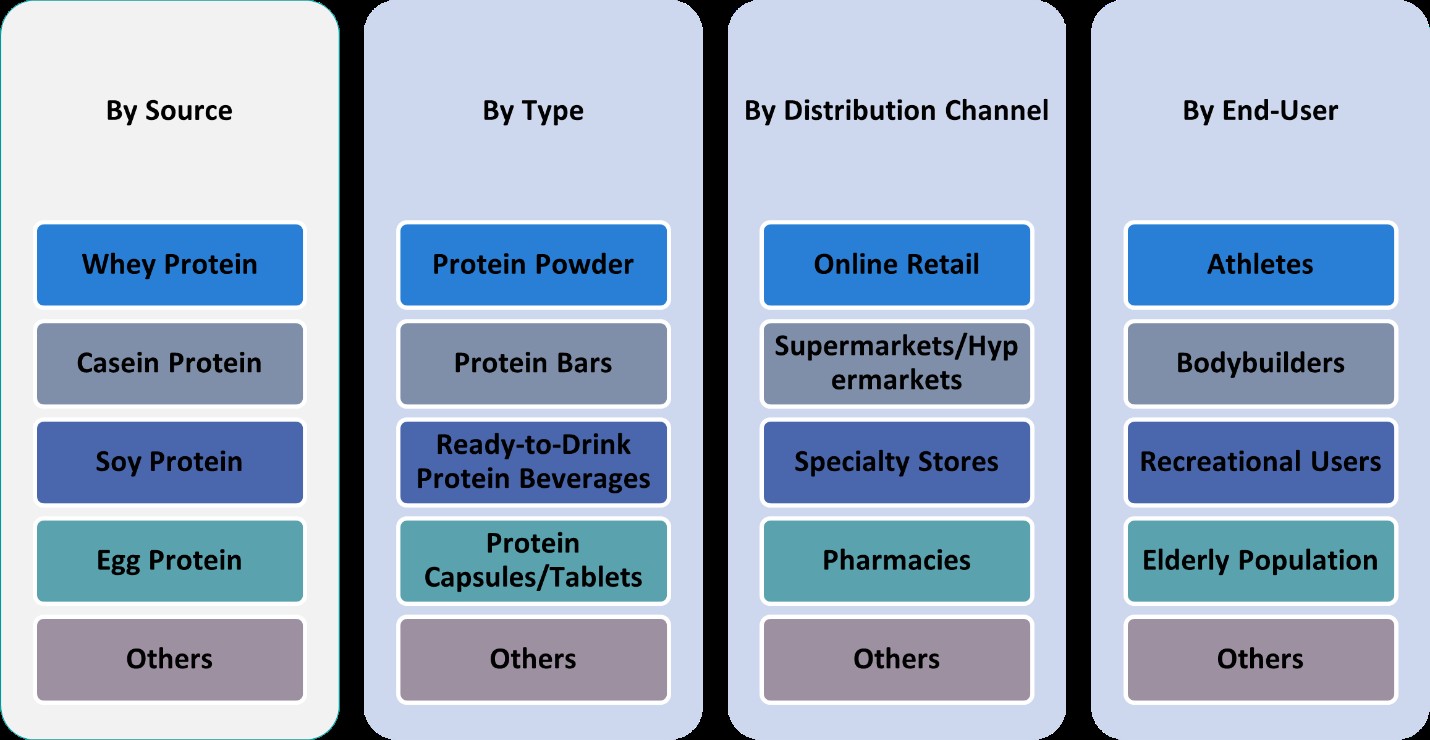

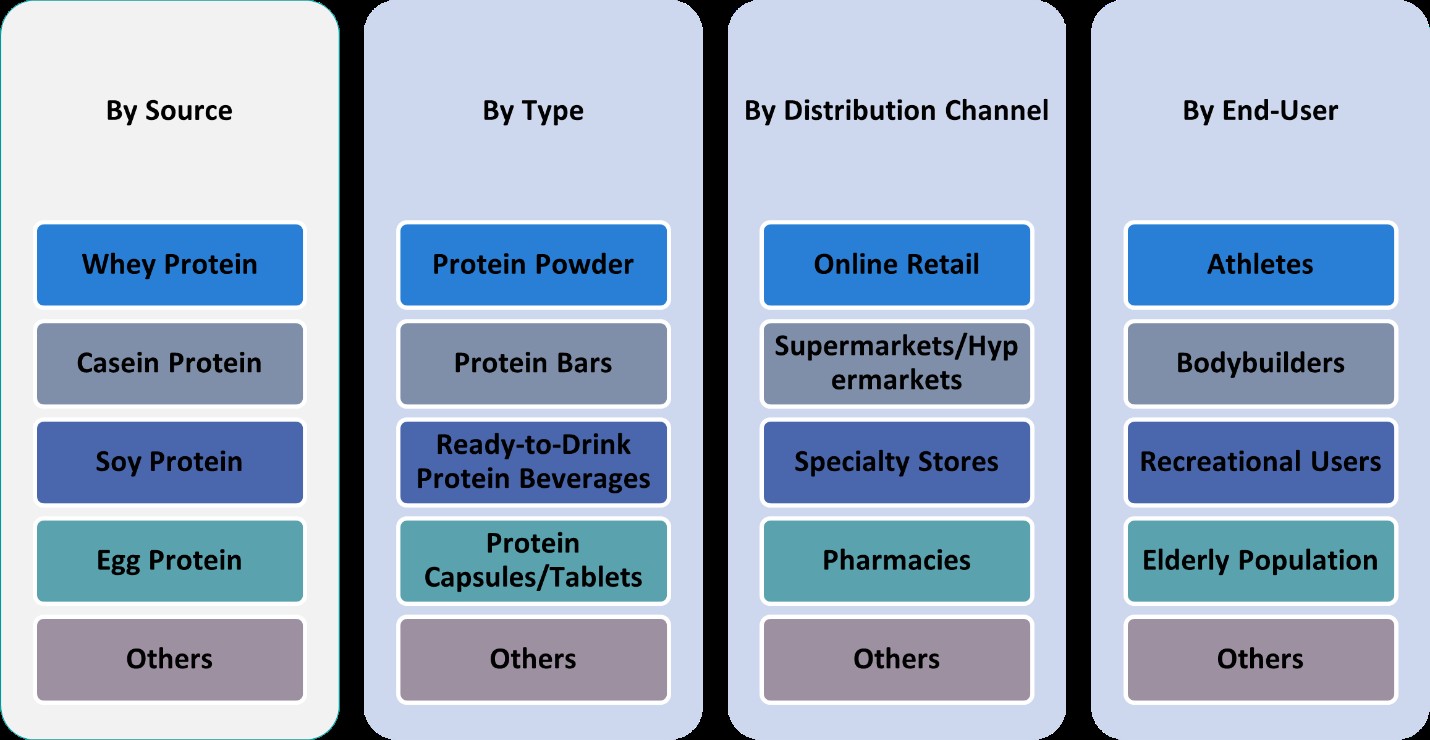

Market Segmentation Analysis:

By Type:

The India protein-based sports supplement market is segmented into protein powder, protein bars, ready-to-drink (RTD) protein beverages, protein capsules/tablets, and others. Among these, protein powder holds the largest market share due to its high protein content, cost-effectiveness, and widespread consumer familiarity. Fitness enthusiasts and athletes commonly use protein powders as a daily dietary supplement for muscle recovery and performance enhancement. Meanwhile, protein bars and RTD protein beverages are witnessing rapid growth owing to their convenience and appeal to time-conscious urban consumers. These formats offer on-the-go nutrition and are gaining popularity among working professionals and casual gym-goers who seek portable and tasty protein options. Protein capsules and tablets represent a niche yet growing segment, primarily targeting individuals focused on specific health benefits or those looking for easy-to-consume alternatives. As consumer preferences diversify and lifestyles become increasingly fast-paced, the demand for innovative and functional product formats across these segments is expected to drive further growth in the Indian market.

By Source:

Based on protein source, the market is segmented into whey protein, casein protein, soy protein, egg protein, and others. Whey protein dominates the market due to its high bioavailability, rapid absorption, and proven effectiveness in muscle building and recovery. It remains the preferred choice for most gym-goers and athletes. Casein protein follows, valued for its slow-digesting nature, making it suitable for nighttime supplementation. Plant-based options like soy protein are gaining significant traction, driven by the increasing number of vegan and lactose-intolerant consumers. Soy protein’s complete amino acid profile and health benefits make it a strong alternative to dairy-based proteins. Egg protein also holds a notable share due to its high-quality protein content and digestibility. The “others” category, including rice, hemp, and pea proteins, is emerging as a promising segment, particularly among health-conscious consumers seeking clean-label and allergen-free options. This diversification in protein sources reflects the evolving dietary preferences and expanding consumer base within the Indian protein supplement market.

Segments:

Based on Type:

- Protein Powder

- Protein Bars

- Ready-to-Drink Protein Beverages

- Protein Capsules/Tablets

- Others

Based on Source:

- Whey Protein

- Casein Protein

- Soy Protein

- Egg Protein

- Others

Based on End- User:

- Athletes

- Bodybuilders

- Recreational Users

- Elderly Population

- Others

Based on Distribution Channel:

- Online Retail

- Supermarkets/Hypermarkets

- Specialty Stores

- Pharmacies

- Others

Based on the Geography:

- Northern

- Western

- Southern

- Eastern

Regional Analysis

Northern region

The Northern region holds the largest share of the India protein-based sports supplement market, accounting for approximately 35% of the total market in 2024. This dominance can be attributed to the high concentration of urban centers, fitness clubs, and gyms in cities like Delhi, Chandigarh, and Lucknow. Consumers in this region exhibit a strong inclination toward fitness and bodybuilding, which drives demand for protein powders and ready-to-drink beverages. Additionally, the presence of several premium supplement retail outlets and a rising number of wellness-focused consumers contribute to the region’s strong market performance. Increased awareness campaigns, social media influence, and accessibility to international and domestic brands have further boosted the adoption of sports nutrition products in Northern India. Moreover, Northern states have shown early receptiveness to global health trends, making them a key target market for established players and new entrants alike.

Western region

The Western region contributes to around 28% of the Indian protein-based sports supplement market. Maharashtra, Gujarat, and Rajasthan lead this segment, with cities like Mumbai and Pune acting as prominent hubs for fitness and sports culture. The western market is characterized by a growing middle-class population with increasing disposable incomes and health awareness. A strong distribution network, combined with the popularity of e-commerce platforms, has enabled consumers to access a wide range of protein supplements, from international whey protein brands to emerging Indian startups. The increasing participation in marathons, cycling events, and gym memberships has created a favorable environment for protein product consumption. Additionally, Western India is witnessing an increased focus on plant-based protein options, which are gaining momentum among the health-conscious and vegan population.

Southern region

The Southern region accounts for approximately 22% of the market share. States such as Tamil Nadu, Karnataka, and Kerala have emerged as important markets due to the rising fitness culture in cities like Bangalore, Chennai, and Hyderabad. This region shows a strong preference for innovative and flavored protein products, including bars and ready-to-drink options that suit fast-paced lifestyles. With a highly educated and health-conscious population, South India has shown rapid adoption of both whey and plant-based proteins. The growing presence of local fitness influencers and regional health brands has helped raise awareness and improve consumer trust in protein supplements. As urbanization continues and gym culture spreads across Tier II cities in the South, the demand for convenient, affordable, and high-quality protein-based products is expected to accelerate.

Eastern region

The Eastern region currently holds the smallest market share, at around 15%, but it shows strong potential for growth. Cities such as Kolkata, Bhubaneswar, and Patna are gradually embracing health and wellness trends, with rising interest in fitness activities and nutritional supplements. Limited awareness and lower penetration of organized fitness centers have historically restrained growth in this region. However, increasing digital access, social media influence, and government health campaigns are improving consumer education and creating opportunities for market expansion. As e-commerce platforms and regional retail chains improve their outreach in Eastern India, the availability of diverse protein products is increasing. The region’s growing youth population and changing dietary habits signal a positive outlook for future growth in the protein-based sports supplement market.

Key Player Analysis

- Herbalife Nutrition Ltd.

- Yakult Honsha Co., Ltd.

- Shandong Minqiang Biotechnology Co., Ltd.

- Bright LifeCare Pvt. Ltd. (MuscleBlaze)

- Wipro Consumer Care and Lighting (Nutrition Business)

- Nongfu Spring Co., Ltd.

- Dymatize

- Oziva (Zywie Ventures Pvt. Ltd.)

- Nestlé Health Science

Competitive Analysis

The India protein-based sports supplement market is witnessing intense competition, with several domestic and international players striving to strengthen their presence through innovation, branding, and strategic distribution. Leading companies such as Herbalife Nutrition Ltd., Nestlé Health Science, Bright LifeCare Pvt. Ltd. (MuscleBlaze), Yakult Honsha Co., Ltd., Oziva (Zywie Ventures Pvt. Ltd.), Dymatize, Wipro Consumer Care and Lighting (Nutrition Business), Nongfu Spring Co., Ltd., and Shandong Minqiang Biotechnology Co., Ltd. are actively contributing to market growth. These players are focusing on product diversification, offering a wide range of protein sources including whey, soy, and plant-based variants to cater to varied dietary preferences. E-commerce expansion plays a crucial role in boosting product availability across Tier I and Tier II cities, while retail presence is being strengthened through partnerships with gyms, pharmacies, and health stores. Competitive pricing, localization of flavors, and transparent labelling are also being adopted to build consumer trust and differentiate offerings. The overall landscape remains highly dynamic, with players striving to capture market share through customer engagement and innovation.

Recent Developments

- In March 2025, Quest Nutrition introduced Quest Protein Milkshakes, ready-to-drink beverages with a category-leading 45 grams of protein per bottle. Available in chocolate, vanilla, and strawberry flavors, these shakes cater to high-protein diets with minimal sugar and carbs.

- In December 2024, Dymatize launched Performance Protein Shakes and Energyze Pre-Workout Powder. The ready-to-drink shakes contain 30 grams of high-quality proteins along with BCAAs for muscle recovery and growth.

- In November 2024, Myprotein expanded operations in India by manufacturing locally to meet growing demand. The brand introduced localized flavors such as Kesar Badam and Nimbu Pani and launched Clear Whey Isolate as a refreshing alternative to traditional protein shakes.

- In January 2024, Abbott launched Protality, a high-protein weight-loss shake designed for individuals on weight-loss medications. Each serving contains 30 grams of protein and is tailored to preserve muscle mass while supporting weight loss.

Market Concentration & Characteristics

The India protein-based sports supplement market exhibits moderate to high market concentration, with a mix of established global brands and rapidly emerging domestic players competing for consumer attention. While a few key players dominate in terms of brand recognition, distribution networks, and product variety, the market continues to attract new entrants, especially startups focused on plant-based and clean-label formulations. The industry is characterized by innovation, evolving consumer preferences, and increasing health consciousness across urban and semi-urban regions. Digital transformation plays a pivotal role in reshaping consumer access, with e-commerce platforms and direct-to-consumer models expanding reach beyond metropolitan cities. The market also reflects a strong inclination toward functional ingredients, convenient formats, and transparent labelling. Although traditional whey protein continues to lead, alternative protein sources are gaining traction due to dietary shifts and lifestyle changes. Overall, the market’s competitive dynamics, coupled with a growing awareness of fitness and wellness, make it increasingly vibrant and opportunity-rich.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Source, End-User, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The India protein-based sports supplement market is projected to grow significantly, driven by increasing health consciousness and fitness trends among the population.

- Rising disposable incomes and urbanization are leading to greater expenditure on health and wellness products, including protein supplements.

- There is a growing preference for plant-based protein supplements, reflecting a shift towards vegetarian and vegan diets in India.

- E-commerce platforms are expanding the reach of protein supplements, making them more accessible to consumers in both urban and rural areas.

- Innovations in product formulations, such as ready-to-drink protein beverages and protein bars, are catering to the demand for convenient nutrition options.

- Collaborations between international and domestic brands are enhancing product availability and diversity in the Indian market.

- Regulatory developments are expected to standardize product quality and labeling, boosting consumer confidence in protein supplements.

- The increasing number of fitness centers and health clubs across the country is promoting the adoption of protein-based sports supplements.

- Marketing strategies leveraging social media influencers and fitness enthusiasts are effectively engaging younger demographics.

- Overall, the market is poised for robust growth, with companies focusing on innovation, quality, and strategic partnerships to meet evolving consumer needs.