Market overview

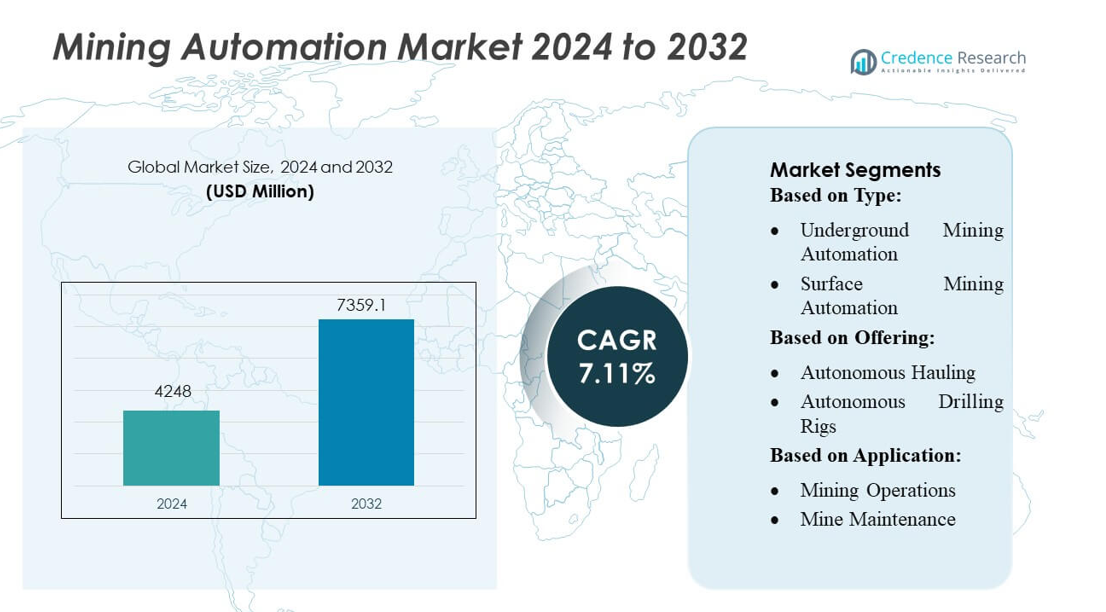

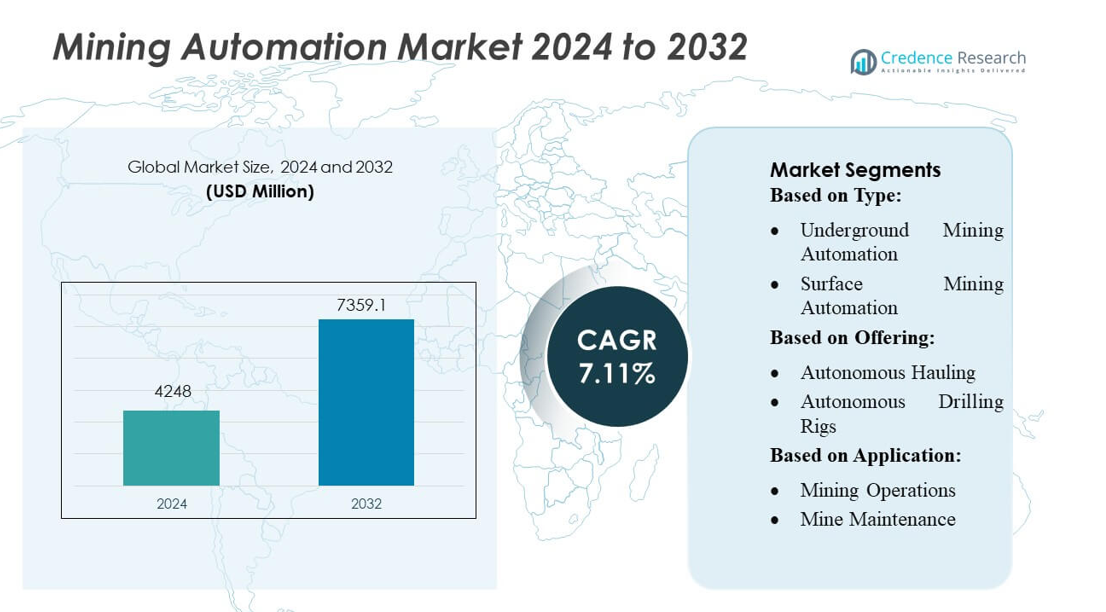

Mining Automation Market size was valued USD 4248 million in 2024 and is anticipated to reach USD 7359.1 million by 2032, at a CAGR of 7.11% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Mining Automation Market Size 2024 |

USD 4248 million |

| Mining Automation Market, CAGR |

7.11% |

| Mining Automation Market Size 2032 |

USD 7359.1 million |

The mining automation market is shaped by major global OEMs and digital technology providers that compete through advancements in autonomous haulage, automated drilling, fleet optimization, and integrated mine-management platforms. These companies focus on delivering interoperable systems, AI-driven analytics, and high-reliability sensors that enhance productivity, workforce safety, and real-time operational visibility. Asia-Pacific leads the market with an estimated 30–33% share, driven by large-scale deployments of autonomous fleets, remote operations centers, and advanced communication networks across Australia, China, and emerging Asian mining hubs. The region’s strong investment momentum positions it as the center of long-term automation growth.

Market Insights

- The mining automation market reached USD 4,248 million in 2024 and is projected to hit USD 7,359.1 million by 2032 at a 7.11% CAGR, driven by accelerating adoption of autonomous equipment, digital optimization tools, and real-time operational intelligence across major mining regions.

- Growing demand for productivity enhancement, worker safety, and precise ore extraction fuels strong uptake of autonomous haulage, automated drilling systems, and AI-enabled fleet optimization solutions across both surface and underground mining operations.

- Advancements in IoT connectivity, remote operations, 5G networks, and integrated mine-management platforms shape key market trends, enabling continuous, low-latency control of equipment and improved data-driven decision-making.

- High capital investment, integration complexity, and cybersecurity vulnerabilities restrain adoption, especially for mid-sized mines with limited digital infrastructure and legacy equipment systems requiring costly upgrades.

- Asia-Pacific leads with a 30–33% regional share, while equipment dominates offerings with around 60% segment share, supported by large autonomous fleet deployments in Australia, China, and emerging Asian markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Underground mining automation dominates the segment with an estimated 65–70% market share, driven by the higher complexity, safety risks, and demand for remote-operated systems in deep mining environments. Companies increasingly deploy autonomous drilling, ventilation-on-demand, and real-time geotechnical monitoring solutions to reduce workforce exposure and improve productivity. Surface mining automation grows steadily as mine operators adopt autonomous haulage and fleet management tools, yet underground operations lead due to stronger regulatory pressure, rising accident prevention initiatives, and higher operational cost-saving potential achievable through full-cycle automation.

- For instance, MST (Mine Site Technologies) has deployed its HELIX platform to integrate real-time 3D mapping, automation, and personnel tracking: its HELIX 3DConnect module visualizes all mobile assets and personnel underground, while the Sentinel module uses integrated tracking to monitor every worker’s location.

By Offering

Equipment-based solutions hold the dominant position with roughly 60% market share, supported by the rapid adoption of autonomous hauling systems, autonomous drilling rigs, and underground LHD equipment. Autonomous hauling drives the highest demand due to its proven ability to reduce fuel use by 10–15% and increase haul cycle consistency. Software solutions expand quickly—particularly fleet management and data management systems—as mines integrate predictive analytics and sensor-driven optimization. Communication tools such as wireless mining mesh networks and navigation systems also gain traction as connectivity becomes essential for real-time interoperability across automated assets.

- For instance, HxGN Underground Mining solution supports collision-avoidance and real-time fleet situational awareness, leveraging safety modules that have already been deployed in more than 40,000 vehicles worldwide.

By Application

Mining operations account for the largest share at approximately 55–60%, primarily because automation delivers immediate value in haulage optimization, drilling accuracy, and hazard reduction. Operators deploy intelligent equipment, environmental monitoring, and advanced control systems to improve ore recovery and reduce unplanned downtime. Mine maintenance follows as predictive maintenance platforms and condition monitoring tools help extend machinery lifespan and prevent failures. Mine development applications grow steadily as automation supports precision tunneling, geological mapping, and digital mine planning, driven by increasing adoption of simulation-based design and autonomous exploration technologies.

Key Growth Drivers

Rising Focus on Worker Safety and Risk Reduction

The mining automation market grows significantly as companies prioritize worker safety in high-risk mining environments. Automated drilling, hauling, and monitoring systems reduce human exposure to hazardous conditions and help operators comply with stringent safety regulations. The shift toward remote and autonomous operations lowers accident rates, enhances precision, and ensures operational continuity. Adoption accelerates further as mines in deep and ultra-deep zones increasingly rely on sensor-based hazard detection, ventilation-on-demand, and real-time environmental monitoring to maintain safer and more predictable working conditions.

- For instance, Liebherr Group drives automation with concrete technical innovations: for instance, its open-architecture autonomy kit supports an 8-layer safety concept, combining long-range, 360° perception sensors onboard its haul trucks.

Demand for Higher Productivity and Operational Efficiency

Automation technologies enable mining companies to improve productivity by optimizing drilling accuracy, reducing haul cycle variability, and minimizing unplanned downtime. Autonomous haulage systems, fleet management software, and predictive maintenance platforms streamline asset utilization and lower fuel consumption. The growing need to extract deeper ore reserves with consistent output quality drives the adoption of advanced automation systems. Productivity pressures from fluctuating commodity prices also push operators to leverage autonomous systems that deliver higher throughput and sustained 24/7 operation without human fatigue or performance inconsistencies.

- For instance, SmartROC D65 drill rig uses the powerful COP M7 DTH hammer as one of its options. This rig leverages automated drilling sequences and optimized compressor (Vaportec) control to enhance efficiency.

Growing Integration of Digital Technologies and IoT

The expansion of digital mining ecosystems accelerates investment in automation as operators adopt IoT-enabled sensors, cloud analytics, and connected control systems. These tools provide real-time insight into equipment performance, geological variations, and environmental metrics, enabling faster decision-making and automated responses. The rise of digital twins, AI-driven modeling, and automated data processing strengthens the value of interoperable automation platforms. Mining companies increasingly rely on these technologies to optimize resource allocation, improve predictive maintenance accuracy, and enhance mine planning, supporting long-term efficiency and cost reductions.

Key Trends & Opportunities

Expansion of Autonomous Haulage and Drilling Technologies

Autonomous haulage systems (AHS) and automated drilling rigs represent major growth opportunities as large mining operators scale pilot deployments into full-site rollouts. These systems improve fuel efficiency, reduce tire wear, and deliver consistent performance across long operational cycles. Advances in LiDAR navigation, collision-avoidance algorithms, and high-precision GPS accelerate adoption. Growing interest in fully autonomous truck fleets and drill rigs creates opportunities for equipment manufacturers and software developers offering interoperable autonomy stacks and retrofitting solutions for existing fleet assets.

- For instance, Epiroc AB has demonstrated tangible progress: for instance, its LinkOA system has converted 78 haul trucks at the Roy Hill mine to fully driverless operation, and those trucks have traveled over 5 million km, completing more than 846,000 autonomous haul cycles.

Increasing Adoption of Integrated Mine Management Platforms

A strong trend emerges toward centralized platforms that integrate fleet management, workforce coordination, environmental monitoring, and production analytics. Mining companies seek unified dashboards that consolidate operational data for real-time optimization and automated decision-making. This shift creates opportunities for software vendors offering modular platforms with predictive analytics, digital twins, and AI-based optimization. As mines modernize, demand rises for scalable software capable of supporting end-to-end automation—from planning and scheduling to execution and performance tracking—driving long-term digital transformation across the sector.

- For instance, Wenco Mine Performance Suite, jointly developed through Hitachi’s mining solutions business, manages more than 8,000 mining assets globally, consolidating fleet productivity, operator performance, and machine health into a single operational dashboard.

Growth in Advanced Communication and Connectivity Solutions

Robust wireless infrastructure, including private LTE and mining mesh networks, becomes critical as automated systems require low-latency, high-reliability connectivity. Investments in 5G-enabled networks and underground communication solutions open opportunities for vendors providing secure, high-bandwidth systems capable of supporting real-time remote operations. Enhanced connectivity enables seamless integration of sensors, autonomous equipment, and analytics platforms, facilitating the expansion of fully automated mine sites. This trend also accelerates the adoption of remote operations centers, reducing the need for onsite personnel and improving operational resilience.

Key Challenges

High Capital Cost and Implementation Complexity

Mining automation requires substantial upfront investment in advanced machinery, communication systems, and integration software, making adoption difficult for mid-tier and small mining firms. Implementation complexity rises due to the need for tailored solutions that match each mine’s geological, operational, and safety requirements. Integrating legacy equipment with new autonomous systems further increases cost and time. These challenges slow the pace of adoption, especially in regions with limited financial resources or inadequate digital infrastructure to support automated operations.

Cybersecurity Risks and Data Vulnerabilities

As mines become more connected, cybersecurity concerns intensify due to the reliance on cloud-based platforms, wireless networks, and IoT devices. Automated systems are vulnerable to cyberattacks that can disrupt operations, compromise safety, or expose sensitive data. The increasing use of remote operations centers and autonomous fleets requires robust security frameworks, yet many mining sites lack mature cybersecurity strategies. Ensuring secure communication, protecting real-time operational data, and preventing system breaches remain significant challenges that mining companies must address to fully trust and scale automation technologies.

Regional Analysis

North America

North America leads the global mining automation market with an estimated 32–35% share, supported by strong investments in autonomous haulage systems, fleet management platforms, and advanced connectivity infrastructure. The U.S. and Canada deploy large-scale autonomous truck fleets across major iron ore, coal, and metal mines, driven by strict worker safety standards and a mature digital ecosystem. The region benefits from early adoption of IoT, AI-driven analytics, and remote operations centers, enabling continuous productivity improvements. Ongoing advancements in 5G networks and predictive maintenance technologies further reinforce North America’s position as the dominant automation hub.

Europe

Europe holds approximately 20–22% market share, driven by stringent environmental and safety regulations that encourage the adoption of fully automated mining equipment and sustainable digital solutions. Countries such as Sweden, Germany, and Finland lead underground automation, supported by strong OEM presence and advanced robotics research. The region accelerates adoption of electric autonomous vehicles, hybrid drilling systems, and ventilation-on-demand platforms to meet decarbonization goals. Investments in AI-enabled mine planning and cyber-secure digital twins further strengthen Europe’s position as a technology-intensive market with a focus on low-impact, high-efficiency mining operations.

Asia-Pacific

Asia-Pacific captures the largest growth momentum with an estimated 30–33% market share, supported by rapid automation deployment across Australia, China, and India. Australia remains a global benchmark for autonomous haulage and large-scale remote operations centers, while China expands automation to boost ore productivity and reduce labor dependency. The region sees rising adoption of AI-driven fleet control, autonomous drilling rigs, and advanced communication networks, including private LTE and 5G. Increasing mineral demand, large production volumes, and a strong shift toward digitalized mining operations position Asia-Pacific as the fastest-growing market with significant long-term potential.

Latin America

Latin America accounts for around 8–10% market share, with growth driven by major mining economies such as Chile, Brazil, and Peru adopting automation to enhance efficiency and address labor shortages. The region increasingly deploys autonomous haul trucks, remote-controlled loaders, and real-time monitoring systems across copper, lithium, and iron ore mines. Harsh terrains and deep open-pit operations accelerate the need for precision and safety-focused technologies. Although adoption is gradual due to capital constraints, rising foreign investments and modernization initiatives are expanding demand for fleet optimization tools, predictive maintenance software, and advanced connectivity systems.

Middle East & Africa (MEA)

The Middle East & Africa region holds roughly 7–8% market share, driven by growing automation adoption in South Africa, Botswana, and GCC countries. Mining companies pursue autonomous drilling, environmental monitoring, and digital fleet management to improve productivity in deep, complex mineral reserves. The region benefits from increasing partnerships with global technology providers to upgrade legacy operations. However, limited digital infrastructure and high operational costs remain adoption barriers. Ongoing investments in remote operation centers, wireless communication networks, and AI-based ore analysis are gradually positioning MEA as an emerging market with strong long-term automation opportunities.

Market Segmentations:

By Type:

- Underground Mining Automation

- Surface Mining Automation

By Offering:

- Autonomous Hauling

- Autonomous Drilling Rigs

By Application:

- Mining Operations

- Mine Maintenance

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the mining automation market features leading players such as Komatsu Ltd., MST (Mine Site Technologies), Hexagon AB, Liebherr Group, Atlas Copco AB, Epiroc AB, Hitachi Construction Machinery Co. Ltd., The Weir Group PLC, Autonomous Solution Inc., and Caterpillar Inc. The mining automation market remains highly competitive, with companies focusing on technological differentiation, system interoperability, and strong service capabilities to secure market presence. Vendors increasingly invest in AI-enabled fleet management, autonomous haulage, and smart drilling solutions that enhance precision, reduce operational variability, and support continuous 24/7 mining activity. The competitive environment is shaped by rising demand for integrated digital platforms that unify planning, equipment control, and real-time performance analytics. Companies also expand collaborations with communication providers to strengthen connectivity through private LTE and 5G networks. As automation adoption accelerates globally, firms emphasize scalable solutions, retrofitting options, and predictive maintenance services to capture long-term value across both surface and underground mining operations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Komatsu Ltd.

- MST (Mine Site Technologies)

- Hexagon AB

- Liebherr Group

- Atlas Copco AB

- Epiroc AB

- Hitachi, Construction Machinery Co. Ltd.

- The Weir Group PLC

- Autonomous Solution Inc.

- Caterpillar, Inc.

Recent Developments

- In March 2025, Caterpillar, Inc. announced a partnership with Luminar to integrate lidar technology into its Cat Command autonomy platform. This collaboration aims to enhance the safety and efficiency of autonomous construction and mining equipment by improving object detection capabilities in challenging environments.

- In January 2025, Hexagon AB announced a significant investment in Saudi Arabia’s mining sector by providing technology and training to King Saud University. This initiative is part of Hexagon’s strategy to develop the next generation of mining professionals and promote the adoption of advanced mining technologies in the region.

- In February 2024, Epiroc’s VC 3000 drum cutter, unveiled features an innovative V-shaped design that enables a flat base cut without leaving material untouched between the drums. This design allows the cutter to move straight through material like a bucket, eliminating the need for side-to-side movements and resulting in up to 40% energy savings

Report Coverage

The research report offers an in-depth analysis based on Type, Offering, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Automation adoption will accelerate as mining companies prioritize safety, productivity, and remote operating capabilities.

- Autonomous haulage systems will expand across large open-pit mines, driven by improved navigation and fleet coordination technologies.

- Underground mining automation will grow rapidly as deeper operations require advanced robotics, real-time sensing, and autonomous drilling.

- Integrated digital platforms will become standard as operators demand unified control over planning, equipment, and data analytics.

- AI-based predictive maintenance systems will see wider deployment to reduce equipment failures and operational downtime.

- Private LTE and 5G networks will strengthen connectivity, enabling reliable real-time communication for automated assets.

- Demand for retrofitting solutions will increase as mines automate existing fleets to minimize capital expenditure.

- Environmental monitoring and ventilation-on-demand systems will gain traction to support sustainability goals.

- Remote operation centers will become more common as companies shift toward centralized and off-site control models.

- Collaboration between OEMs, software providers, and telecom companies will intensify to deliver fully interoperable automation ecosystems.