Table of Content

Chapter No. 1 :….. Introduction.. 21

1.1. Report Description. 21

Purpose of the Report 21

USP & Key Offerings 21

1.2. Key Benefits for Stakeholders 22

1.3. Target Audience. 22

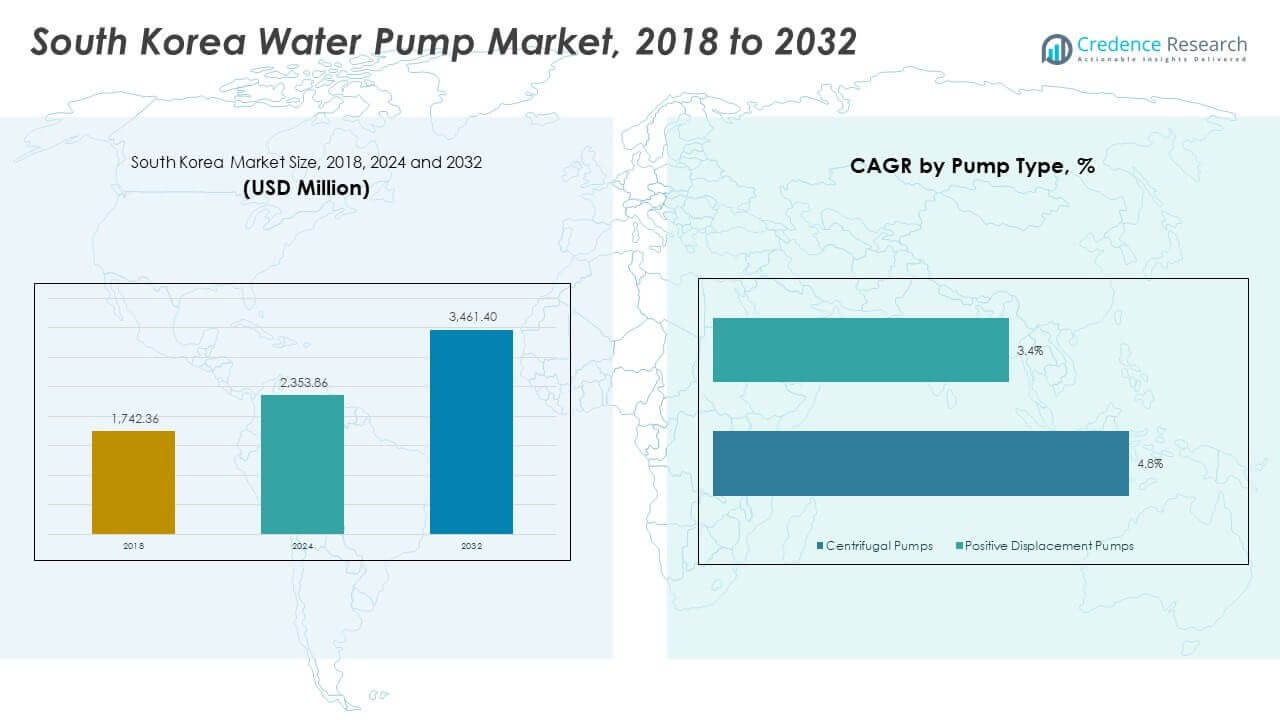

Chapter No. 2 :….. Executive Summary.. 23

Chapter No. 3 :….. WATER PUMP MARKET FORCES & INDUSTRY PULSE.. 25

3.1. Foundations of Change – Market Overview.. 25

3.2. Catalysts of Expansion – Key Market Drivers 27

3.2.1. Momentum Boosters – Growth Triggers 28

3.2.2. Innovation Fuel – Disruptive Technologies 28

3.3. Headwinds & Crosswinds – Market Restraints 29

3.3.1. Regulatory Tides – Compliance Challenges 30

3.3.2. Economic Frictions – Inflationary Pressures 30

3.4. Untapped Horizons – Growth Potential & Opportunities and Strategic Navigation – Industry Frameworks 31

3.5. Market Equilibrium – Porter’s Five Forces 32

3.6. Ecosystem Dynamics – Value Chain Analysis 34

3.7. Macro Forces – PESTEL Breakdown. 36

3.8. Price Trend Analysis 38

3.8.1. Regional Price Trend. 39

3.8.2. Price Trend by Type. 39

3.9. Buying Criteria. 40

Chapter No. 4 :….. COMPETITION ANALYSIS. 41

4.1. Company Market Share Analysis 41

4.1.1. South Korea Water Pump Market Company Volume Market Share. 41

4.1.2. South Korea Water Pump Market Company Revenue Market Share. 43

4.2. Strategic Developments 45

4.2.1. Acquisitions & Mergers 45

4.2.2. New Pump Type Launch. 46

4.2.3. Agreements & Collaborations 47

4.3. Competitive Dashboard. 48

4.4. Company Assessment Metrics, 2024. 49

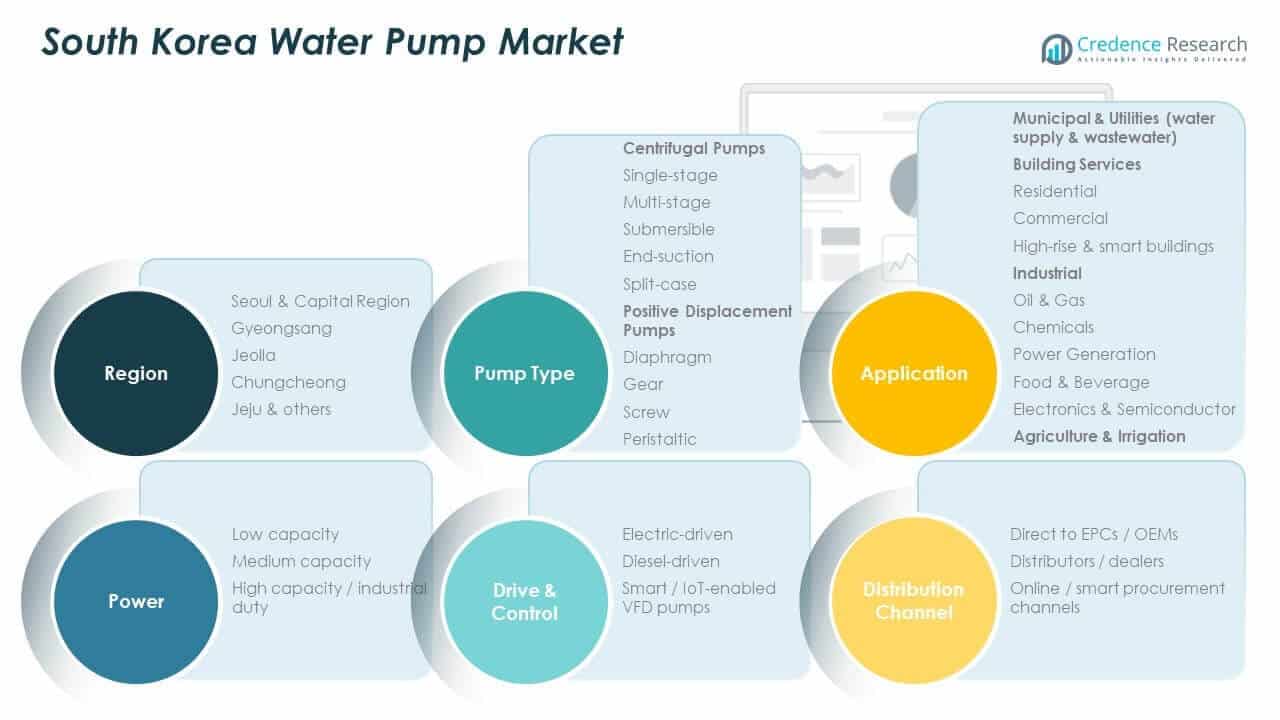

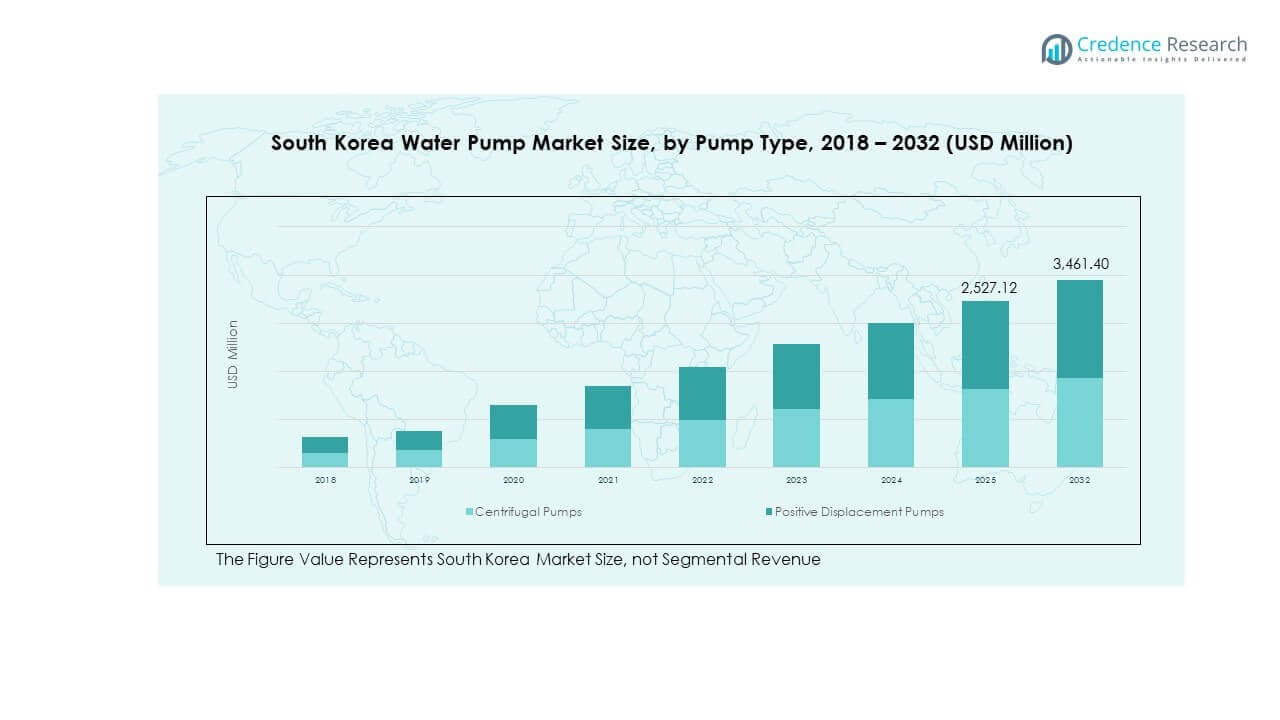

Chapter No. 5 :….. South Korea Market Analysis, Insights & Forecast, by Pump Type.. 50

Chapter No. 6 :….. South Korea Market Analysis, Insights & Forecast, by Application.. 55

Chapter No. 7 :….. South Korea Market Analysis, Insights & Forecast, by Power.. 60

Chapter No. 8 :….. South Korea Market Analysis, Insights & Forecast, by Drive & Control.. 65

Chapter No. 9 :….. South Korea Market Analysis, Insights & Forecast, by Distribution Channel.. 70

Chapter No. 10 :… South Korea Market Analysis, Insights & Forecast, by Region.. 75

Chapter No. 11 :… Company Profile.. 80

11.1. Grundfos 80

11.2. Wilo 83

11.3. Xylem 83

11.4. KSB 83

11.5. Ebara 83

List of Figures

FIG NO. 1……… Water Pump Market Revenue Share, By Pump Type, 2024 & 2032. 50

FIG NO. 2……… Market Attractiveness Analysis, By Pump Type. 51

FIG NO. 3……… Incremental Revenue Growth Opportunity by Pump Type, 2024 – 2032. 52

FIG NO. 4……… Water Pump Market Revenue Share, By Application, 2024 & 2032. 55

FIG NO. 5……… Market Attractiveness Analysis, Application. 56

FIG NO. 6……… Incremental Revenue Growth Opportunity by Application, 2024 – 2032. 57

FIG NO. 7……… Water Pump Market Revenue Share, By Power, 2024 & 2032. 60

FIG NO. 8……… Market Attractiveness Analysis, By Power. 61

FIG NO. 9……… Incremental Revenue Growth Opportunity by Power, 2024 – 2032. 62

FIG NO. 10……. Water Pump Market Revenue Share, By Drive & Control, 2024 & 2032. 65

FIG NO. 11……. Market Attractiveness Analysis, By Drive & Control 66

FIG NO. 12……. Incremental Revenue Growth Opportunity by Drive & Control, 2024 – 2032. 67

FIG NO. 13……. Water Pump Market Revenue Share, By Distribution Channel, 2024 & 2032. 70

FIG NO. 14……. Market Attractiveness Analysis, By Distribution Channel 71

FIG NO. 15……. Incremental Revenue Growth Opportunity by Distribution Channel, 2024 – 2032. 72

FIG NO. 16……. Water Pump Market Revenue Share, By Region, 2024 & 2032. 75

FIG NO. 17……. Market Attractiveness Analysis, By Region. 76

FIG NO. 18……. Incremental Revenue Growth Opportunity by Region, 2024 – 2032. 77

List of Tables

TABLE NO. 1. :. South Korea Water Pump Market Revenue, By Pump Type, 2018 – 2024 (USD Million). 53

TABLE NO. 2. :. South Korea Water Pump Market Revenue, By Pump Type, 2025 – 2032 (USD Million). 53

TABLE NO. 3. :. South Korea Water Pump Market Revenue, By Pump Type, 2018 – 2024 (Units). 54

TABLE NO. 4. :. South Korea Water Pump Market Revenue, By Pump Type, 2025 – 2032 (Units). 54

TABLE NO. 5. :. South Korea Water Pump Market Revenue, By Application, 2018 – 2024 (USD Million). 58

TABLE NO. 6. :. South Korea Water Pump Market Revenue, By Application, 2025 – 2032 (USD Million). 58

TABLE NO. 7. :. South Korea Water Pump Market Revenue, By Application, 2018 – 2024 (Units). 59

TABLE NO. 8. :. South Korea Water Pump Market Revenue, By Application, 2025 – 2032 (Units). 59

TABLE NO. 9. :. South Korea Water Pump Market Revenue, By Power, 2018 – 2024 (USD Million). 63

TABLE NO. 10. :…….. South Korea Water Pump Market Revenue, By Power, 2025 – 2032 (USD Million). 63

TABLE NO. 11. :…… South Korea Water Pump Market Revenue, By Power, 2018 – 2024 (Units). 64

TABLE NO. 12. :…… South Korea Water Pump Market Revenue, By Power, 2025 – 2032 (Units). 64

TABLE NO. 13. :… South Korea Water Pump Market Revenue, By Drive & Control, 2018 – 2024 (USD Million). 68

TABLE NO. 14. :… South Korea Water Pump Market Revenue, By Drive & Control, 2025 – 2032 (USD Million). 68

TABLE NO. 15. :… South Korea Water Pump Market Revenue, By Drive & Control, 2018 – 2024 (Units). 69

TABLE NO. 16. :… South Korea Water Pump Market Revenue, By Drive & Control, 2025 – 2032 (Units). 69

TABLE NO. 17. :…. South Korea Water Pump Market Revenue, By Distribution Channel, 2018 – 2024 (USD Million). 73

TABLE NO. 18. :…. South Korea Water Pump Market Revenue, By Distribution Channel, 2025 – 2032 (USD Million). 73

TABLE NO. 19. :…. South Korea Water Pump Market Revenue, By Distribution Channel, 2018 – 2024 (Units). 74

TABLE NO. 20. :…. South Korea Water Pump Market Revenue, By Distribution Channel, 2025 – 2032 (Units). 74

TABLE NO. 21. :……. South Korea Water Pump Market Revenue, By Region, 2018 – 2024 (USD Million). 78

TABLE NO. 22. :……. South Korea Water Pump Market Revenue, By Region, 2025 – 2032 (USD Million). 78

TABLE NO. 23. :…. South Korea Water Pump Market Revenue, By Region , 2018 – 2024 (Units). 79

TABLE NO. 24. :….. South Korea Water Pump Market Revenue, By Region, 2025 – 2032 (Units). 79