Market Overview

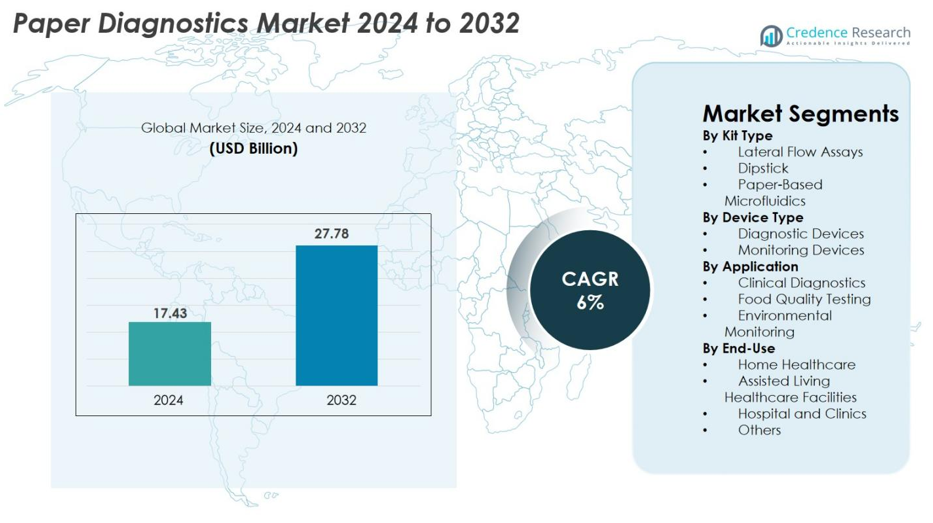

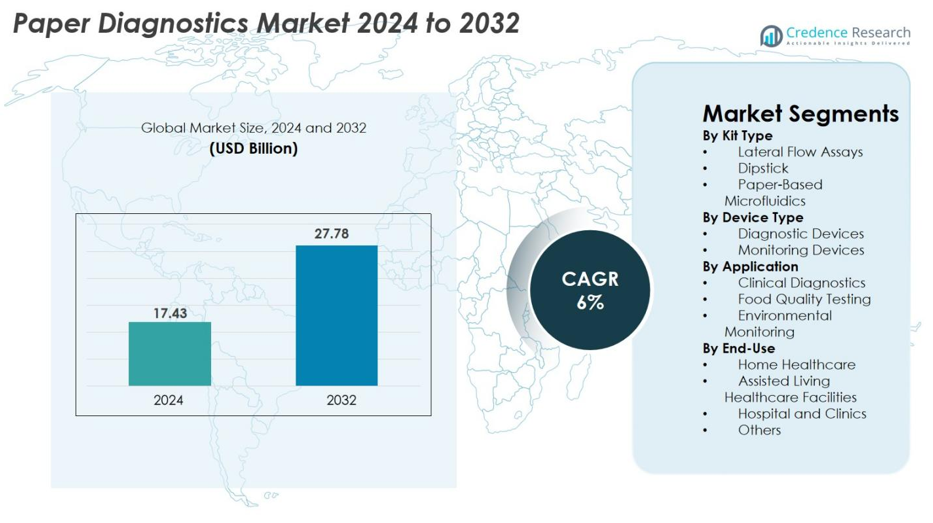

The Paper Diagnostics Market size was valued at USD 17.43 billion in 2024 and is anticipated to reach USD 27.78 billion by 2032, at a CAGR of 6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Paper Diagnostics Market Size 2024 |

USD 17.43 billion |

| Paper Diagnostics Market, CAGR |

6% |

| Paper Diagnostics Market Size 2032 |

USD 27.78 billion |

The Paper Diagnostics Market is led by key players such as Abbott (formerly Alere), Siemens Healthcare GmbH, Bio-Rad Laboratories Inc., Arkray Inc., and GVS S.p.A. These companies dominate the market by leveraging strong brand recognition, broad distribution networks, and continuous investments in R&D. Abbott, for instance, is a significant contributor to the lateral flow assay segment, while Siemens Healthcare and Bio-Rad are pioneers in diagnostic and monitoring devices. North America holds the largest market share at 38.5% in 2024, driven by a robust healthcare infrastructure, strong regulatory support, and advanced diagnostic technologies. Europe follows with 32.4%, supported by stringent healthcare regulations and high adoption of eco-friendly solutions. Asia Pacific, with a 24.5% share, is experiencing rapid growth due to increasing healthcare access in emerging markets and government initiatives to provide low-cost diagnostic solutions.

Market Insights

- The Paper Diagnostics Market was valued at USD 17.43 billion in 2024 and is projected to reach USD 27.78 billion by 2032, growing at a CAGR of 6%.

- Lateral flow assays captured 52% of the kit‑type segment in 2024, driven by demand for rapid, cost‑effective diagnostics in clinical settings.

- Digital health integration and eco‑friendly materials are emerging trends, enabling remote monitoring via smartphone‑linked paper tests and biodegradable diagnostic kits gaining traction.

- Market restraints include inconsistent regulatory frameworks and technical limitations in sensitivity and multiplexing for complex diagnostics, which slow adoption in advanced clinical applications.

- Regionally, North America led with a 38.5% share in 2024, Europe followed at 32.4%, and Asia Pacific held 24.5%, with Latin America and Middle East & Africa accounting for the remaining share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Kit Type

The Paper Diagnostics Market is primarily segmented by kit type, with lateral flow assays being the dominant sub-segment, holding a market share of 52% in 2024. This growth is driven by the increasing demand for rapid, on-site diagnostics across various healthcare applications. Lateral flow assays offer ease of use, quick results, and cost-effectiveness, making them ideal for clinical diagnostics and monitoring infectious diseases. Other kit types, such as dipsticks and paper-based microfluidics, contribute to the market but hold smaller shares, driven by niche applications in research and diagnostics.

- For instance, Abbott’s BinaxNOW COVID-19 lateral flow antigen test can deliver results in 15 minutes and reached a production capacity of 100 million tests per month during peak global demand, demonstrating the scalability of LFA technology.

By Device Type

In the Paper Diagnostics Market, diagnostic devices lead the segment with a market share of 65% in 2024. This dominance is attributed to the rising demand for quick diagnostic solutions in point-of-care settings, particularly in resource-limited regions. Diagnostic devices include those used for detecting diseases like malaria, COVID-19, and pregnancy tests. Monitoring devices follow with a 35% share, driven by increasing health monitoring needs, particularly in chronic conditions. The market for monitoring devices is expected to grow due to the increasing focus on continuous health tracking and home-based testing solutions.

- For instance, Quidel’s QuickVue rapid test line surpassed 300 million units produced globally, highlighting the expanding use of paper-based diagnostic kits for infectious disease detection.

By Application

Clinical diagnostics dominates the Paper Diagnostics Market, holding a market share of 70% in 2024. This sub-segment’s growth is driven by the increasing prevalence of chronic diseases and the need for affordable, rapid diagnostic solutions. Paper diagnostic kits are extensively used in hospitals and clinics for a range of conditions, including infections and metabolic disorders. Food quality testing and environmental monitoring follow with shares of 15% and 15%, respectively, as both sectors increasingly adopt paper diagnostics for their cost-effectiveness and ease of use in quality control and environmental assessments.

Key Growth Drivers

Rising Demand for Point-of-Care Diagnostics

The increasing demand for point-of-care (POC) diagnostics is one of the major growth drivers in the paper diagnostics market. As healthcare shifts towards more accessible and convenient diagnostic solutions, paper-based tests provide a low-cost, portable alternative to traditional laboratory-based methods. The ability to deliver quick, on-site results, especially in remote and resource-limited regions, is fueling market growth. This demand is particularly evident in sectors such as infectious disease detection, pregnancy testing, and glucose monitoring, where rapid diagnostics are critical.

- For instance, Abbott’s Panbio COVID-19 Ag Rapid Test provides results in 15 minutes and has been deployed in more than 120 countries, supporting large-scale POC testing in low-infrastructure regions

Advancements in Microfluidics Technology

Advancements in microfluidics technology are propelling the growth of the paper diagnostics market. The integration of paper-based microfluidics with diagnostic kits enhances the precision and efficiency of testing while maintaining the low-cost, user-friendly advantages of traditional paper-based methods. This innovation allows for more complex tests to be conducted with the same simplicity and speed that paper diagnostics offer. These advancements are opening new opportunities in clinical diagnostics, environmental monitoring, and food safety testing, as they enable more comprehensive diagnostic applications.

- For instance, Diagnostics for All developed a microfluidic paper-based liver function test capable of processing whole blood samples using channels less than 500 microns wide, enabling accurate enzyme analysis without instruments.

Increased Focus on Preventive Healthcare

Preventive healthcare is driving the demand for diagnostic tools that can monitor health status regularly and cost-effectively. With the growing emphasis on early detection of diseases and health conditions, paper diagnostics are becoming an essential tool in routine screenings and health monitoring. Their affordability, ease of use, and quick results make them ideal for preventive health programs in both developed and emerging markets. This shift towards preventive care is expected to further propel the market, as individuals and healthcare providers prioritize regular health assessments.

Key Trends & Opportunities

Integration with Digital Health Solutions

A key trend in the paper diagnostics market is the increasing integration with digital health solutions, including mobile apps and telemedicine platforms. By combining paper-based diagnostic devices with smartphones and other digital tools, users can track, record, and share results in real time. This integration enhances patient engagement, enables remote monitoring, and improves the efficiency of healthcare delivery. The rise of telehealth and remote patient monitoring presents significant opportunities for paper diagnostics, particularly in chronic disease management and rural healthcare access.

- For instance, BD’s Veritor Plus analyzer connects with the BD Synapsys informatics platform, enabling over 100,000 digital test results to be transmitted securely to clinicians for remote review.

Sustainability and Eco-Friendly Solutions

Sustainability is becoming a prominent trend within the paper diagnostics market. With growing concerns over environmental impacts, there is an increasing demand for eco-friendly and biodegradable diagnostic tools. Paper-based diagnostics align well with these sustainability goals, as they are typically low-cost and use materials that can be sourced responsibly. The market has an opportunity to innovate further by creating fully biodegradable or recyclable diagnostic kits, responding to consumer demand for greener alternatives, and adhering to environmental regulations.

Key Challenges

Regulatory and Standardization Issues

One of the key challenges facing the paper diagnostics market is the lack of consistent regulatory standards across regions. While paper diagnostics offer significant benefits in terms of cost and convenience, ensuring their reliability, accuracy, and safety remains critical. In many regions, regulatory bodies have not yet fully developed standardized guidelines for approval, which can lead to delays in market entry and adoption. The lack of universal regulatory frameworks can also hinder manufacturers from scaling operations globally, limiting market growth potential.

Technological Limitations for Complex Diagnostics

Another challenge facing the paper diagnostics market is the technological limitations for conducting more complex diagnostic tests. While paper-based methods are effective for simple tests, such as glucose monitoring and pregnancy tests, they may not be suitable for more complex diagnostics that require higher sensitivity and specificity. As medical diagnostics evolve and demand for more advanced tests increases, paper diagnostics may struggle to meet these requirements. Overcoming these technological barriers will be essential for expanding the market’s application in more intricate diagnostic fields.

Regional Analysis

North America

North America holds a market share of 38.5 % in 2024 in the paper diagnostics market. The region’s dominance stems from its advanced healthcare infrastructure, high R&D investments, and strong adoption of innovative diagnostic technologies. Institutional support and early regulatory approvals enable swift commercialization of paper‑based diagnostic tools. Key players leverage robust domestic production and distribution networks, facilitating widespread uptake in clinical, home‑healthcare and point‑of‑care settings. Sustained demand for rapid, cost‑effective diagnostics and well‑established reimbursement frameworks further reinforce North America’s leadership.

Europe

Europe accounts for 32.4 % of the global paper diagnostics market in 2024. The region benefits from stringent healthcare regulations, growing emphasis on preventive diagnostics and environmental monitoring, and a strong base of medical‑device manufacturers investing in paper‑based technologies. Countries such as Germany, the U.K. and France are advancing national initiatives for decentralized testing and eco‑friendly diagnostic solutions. The well‑developed public health infrastructure accelerates adoption of paper diagnostic kits in both hospital and home‑care settings. However, varying reimbursement regimes across countries present a challenge to uniform uptake.

Asia Pacific

The Asia Pacific region holds a market share of 24.5 % in 2024 and is anticipated to record the fastest compound annual growth rate through the forecast period. Growth is propelled by rising prevalence of infectious diseases, expanding healthcare access in rural areas, and increasing governmental support for low‑cost diagnostics. Countries such as India and China are key drivers, with domestic manufacturing and large patient populations enabling rapid scale‑up of paper‑based solutions. The region’s cost‑sensitivity and demand for point‑of‑care diagnostics create a large opportunity for manufacturers entering the market.

Latin America

Latin America contributes 4.8 % of the global paper diagnostics market in 2024. The region’s growth is supported by increasing adoption of affordable diagnostics across emerging healthcare markets, awareness campaigns for infectious disease screening, and expanding private‑sector diagnostic chains. Although infrastructure and reimbursement limitations persist, paper diagnostics’ portability and ease of use suit remote and underserved communities. Rising collaborations between global diagnostics firms and local distributors are improving access. Still, political instability and supply‑chain constraints remain hurdles to faster expansion.

Middle East & Africa

The Middle East & Africa region represents 0.8 % of the global paper diagnostics market in 2024. Market uptake is gaining momentum via humanitarian and public‑health initiatives focused on infectious‑disease detection, refugee‑health programs and basic diagnostic screening in remote locations. The inherent advantages of paper diagnostics portability, ease of disposal and low‑cost manufacture make them particularly suitable for resource‑limited settings. Nevertheless, limited regulatory frameworks, fragmented healthcare systems and low per‑capita healthcare expenditure constrain broader commercialization and require tailored regional strategies for growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations

By Kit Type

- Lateral Flow Assays

- Dipstick

- Paper-Based Microfluidics

By Device Type

- Diagnostic Devices

- Monitoring Devices

By Application

- Clinical Diagnostics

- Food Quality Testing

- Environmental Monitoring

By End-Use

- Home Healthcare

- Assisted Living Healthcare Facilities

- Hospital and Clinics

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape in the paper diagnostics market features key players such as Arkray Inc., Acon Laboratories Inc., Abbott (formerly Alere), Bio‑Rad Laboratories Inc., GVS S.p.A., Siemens Healthcare GmbH, Diagnostics for All Inc., FFEI Life Science (Biognostix), Navigene, and Micro Essential Laboratory Inc. The market shows a moderate concentration, with these established firms leveraging strong brand recognition, broad distribution networks and ongoing R&D to maintain leadership. They pursue growth through strategic collaborations, acquisitions and geographic expansion, addressing both developed and emerging markets. Meanwhile, smaller agile firms and start‑ups are driving innovation—particularly in paper‑based microfluidics and home‑based diagnostics—intensifying competitive pressure and accelerating product differentiation. As a result, margins are increasingly tied to speed of innovation, cost‑efficiency of manufacturing and ability to offer integrated, end‑to‑end solutions rather than stand‑alone tests.

Key Player Analysis

- Abbott (Alere Inc.)

- GVS S.p.A.

- Micro Essential Laboratory Inc.

- Arkray Inc.

- Diagnostics For All Inc.

- FFEI Life Science (Biognostix)

- Siemens Healthcare GmbH

- Acon Laboratories Inc.

- Navigene

- Bio‑Rad Laboratories Inc.

Recent Developments

- In November 2025, Sapphiros announced a strategic agreement with Roche Holding AG to supply up to one billion lateral flow (paper-based) tests and collaborate on future molecular point-of-care diagnostics.

- In 2025, Global Access Diagnostics (GADx) and BBI Solutions announced a strategic collaboration to accelerate development and manufacturing of rapid lateral-flow/ paper-based diagnostics.

- In June 2025, Abingdon Health plc announced a partnership with Okos Diagnostics to develop an H5N1 (avian flu) lateral flow test.

Report Coverage

The research report offers an in-depth analysis based on Kit Type, Device Type, Application, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will increasingly shift toward decentralised and point‑of‑care testing, enabling diagnostics outside traditional laboratories and expanding access in remote or low‑resource settings.

- Growth in the paper‑based microfluidics sub‑segment will accelerate as manufacturers develop more complex assays on paper substrates, unlocking new clinical and non‑clinical applications.

- Integration of digital and mobile health technologies—such as smartphone‑linked readers and cloud‑based data systems—will enhance user‑experience, ease of result interpretation and connectivity.

- Sustainable and eco‑friendly materials in paper diagnostics will become more prominent, driven by regulatory and consumer pressure for biodegradable or recyclable device components.

- Strong demand will emerge in emerging markets, where cost‑sensitive healthcare systems and large underserved populations will adopt affordable paper diagnostics at a faster pace.

- The environmental monitoring and food quality testing applications of paper diagnostics will gain traction alongside clinical use, as regulatory and consumer awareness around safety rises.

- Strategic partnerships and M&A among diagnostics firms will intensify, enabling smaller innovators to scale production and larger firms to broaden their portfolios in paper‑based test formats.

- Regulatory frameworks will evolve to standardise quality and performance criteria for paper diagnostics globally, reducing barriers to adoption and enabling wider commercialisation.

- Innovative business models including subscription services, home‑testing kits and outcome‑based pricing will reshape how paper diagnostics are offered and paid for in both clinical and consumer domains.

10. Technical challenges such as sensitivity, multiplexing capability, and integration with downstream analytics will gradually be addressed, enabling paper diagnostics to move beyond simple tests into more advanced diagnostic territory.