| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Italy Water Pump Market Size 2023 |

USD 1,534.99 Million |

| Italy Water Pump Market, CAGR |

2.91% |

| Italy Water Pump Market Size 2032 |

USD 1,987.56 Million |

Market Overview:

Italy Water Pump Market size was valued at USD 1,534.99 million in 2023 and is anticipated to reach USD 1,987.56 million by 2032, at a CAGR of 2.91% during the forecast period (2023-2032).

Several factors are propelling the growth of Italy’s water pump market. Foremost among these is the rising demand from industries such as manufacturing, water and wastewater management, oil and gas, construction, and agriculture (Bonafide Research). The agricultural sector, in particular, is witnessing increased mechanization, necessitating advanced irrigation systems that rely heavily on efficient water pumps. Additionally, the construction industry’s expansion, driven by urbanization and infrastructure development, is contributing to the heightened demand for water pumps. Furthermore, Italy’s emphasis on sustainable water and wastewater practices is fostering the adoption of energy-efficient and technologically advanced pumping solutions (GII Research). The government’s supportive regulatory framework and subsidies for water-efficient technologies further accelerate the adoption of modern pump systems across sectors.

Regionally, the demand for water pumps in Italy is widespread, reflecting the country’s diverse economic activities. Industrialized northern regions, such as Lombardy and Veneto, exhibit high demand due to their concentration of manufacturing and industrial operations. In contrast, southern regions, including Sicily and Calabria, are experiencing growth driven by agricultural activities and infrastructure development. The emphasis on sustainable water management practices is evident across the country, with investments in modernizing water infrastructure and adopting advanced technologies to enhance efficiency and reduce environmental impact. Increasing climate variability and drought concerns in southern regions are also prompting greater investments in efficient water pumping and irrigation systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Italy Water Pump Market was valued at USD 1,534.99 million in 2023 and is expected to reach USD 1,987.56 million by 2032, registering a CAGR of 2.91% during the forecast period.

- The global water pump market was valued at USD 55,454.00 million in 2023 and is projected to reach USD 80,304.96 million by 2032, growing at a CAGR of 4.2% during the forecast period.

- Demand is rising across sectors such as manufacturing, construction, oil & gas, and wastewater management, supported by ongoing infrastructure development and industrial growth.

- The agriculture sector in southern regions like Sicily and Calabria is witnessing increased pump adoption due to mechanized irrigation practices and drought mitigation needs.

- The market is transitioning toward energy-efficient, smart, and sustainable pumping systems, driven by regulatory mandates and EU climate goals.

- Adoption of IoT, automation, and AI-powered diagnostics is expanding, especially in public infrastructure, to reduce water loss and improve operational efficiency.

- Despite growth, challenges such as aging infrastructure, high modernization costs, and competition from global manufacturers pose restraints.

- Northern regions, including Lombardy and Veneto, lead the market with a 45% share, while southern Italy shows strong growth potential due to agricultural expansion and water management investments.

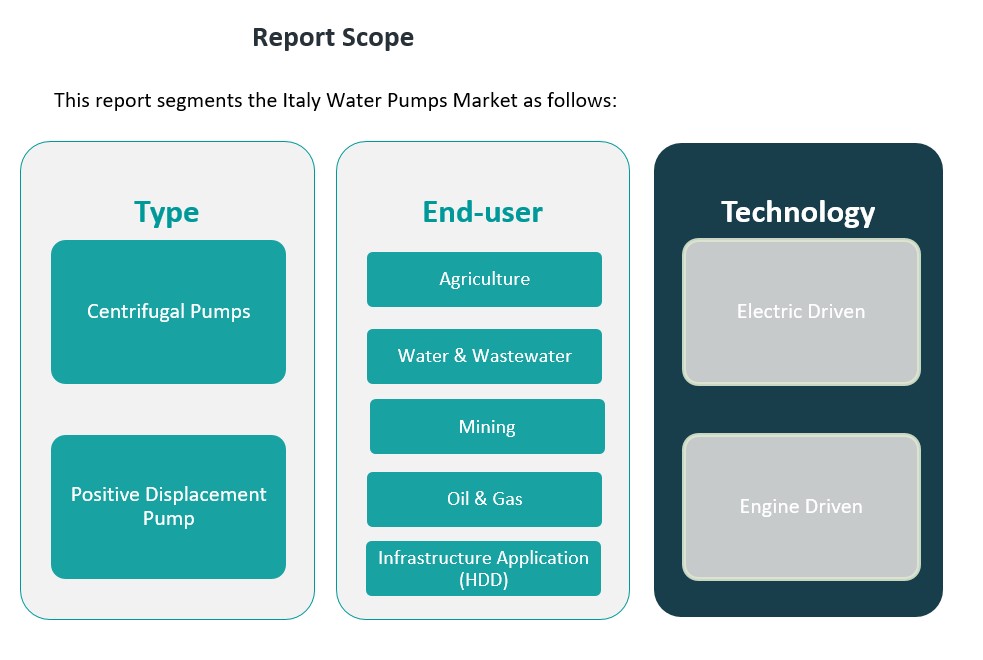

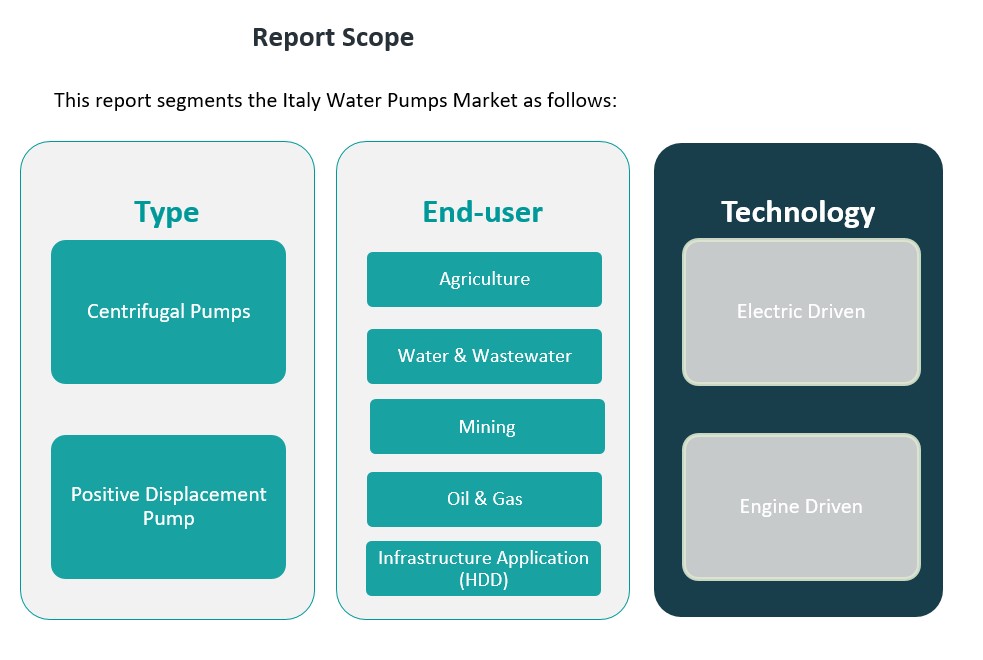

Report Scope

This report segments the Indonesia Writing Instruments Market as follows:

Market Drivers:

Industrial Expansion and Urbanization

Italy’s robust industrial base plays a central role in driving demand for water pumps across the country. Manufacturing sectors such as automotive, textiles, and chemicals require high-performance pumping systems to support processes including cooling, fluid handling, and wastewater disposal. As industries scale up operations to meet global export demands, the need for reliable and efficient water pump systems has risen accordingly. Urbanization is also contributing to this growth, particularly through the development of residential, commercial, and municipal infrastructure. New construction projects require pumping systems for water distribution, sewage management, and HVAC systems, further boosting the demand for technologically advanced water pump solutions.

Agricultural Mechanization and Irrigation Demand

Italy’s agriculture sector, especially in regions such as Sicily, Calabria, and Apulia, is increasingly reliant on water pumps to support irrigation-intensive crop cultivation. With a growing focus on maximizing crop yields and reducing dependency on unpredictable rainfall, farmers are turning to automated and efficient water pumping systems. This mechanization trend is being supported by regional development programs and agricultural subsidies that promote sustainable water use. The rising adoption of drip and sprinkler irrigation methods also necessitates pumps that can operate under specific pressure and flow requirements, which is pushing manufacturers to offer tailored solutions for agricultural applications.

Sustainable Water Management Initiatives

Environmental sustainability has become a strategic priority across Italy, with increasing emphasis on efficient water use and waste reduction. Water pumps designed for wastewater treatment plants, desalination facilities, and water recycling systems are in high demand due to the need to comply with European Union regulations on water quality and sustainability. For instance, in 2024, the city of Milan upgraded its Nosedo wastewater treatment plant with high-efficiency submersible pumps and smart monitoring systems. The market is witnessing a transition toward energy-efficient pumps that reduce power consumption and minimize environmental impact. Technological innovations such as variable frequency drives (VFDs), smart monitoring systems, and solar-powered pumping units are gaining traction, aligning with Italy’s commitment to climate change mitigation and sustainable development goals.

Technological Advancements and Government Support

The integration of advanced technologies into water pumping systems has significantly influenced market growth. Manufacturers are incorporating automation, AI-driven diagnostics, and IoT-enabled sensors to enhance system performance, reduce downtime, and enable predictive maintenance. These innovations not only improve efficiency but also help operators meet regulatory compliance requirements with ease. For example, in 2023, the Italian utility Acea Ato 2 deployed IoT-enabled leak detection pumps across Rome’s water distribution network. Moreover, government incentives promoting digitalization and green infrastructure have accelerated the adoption of smart water pump solutions. The Italian government’s initiatives to modernize public water infrastructure and reduce water loss further support market expansion, ensuring long-term demand for high-efficiency pumping equipment across sectors.

Market Trends:

Adoption of Smart Pumping Technologies

A prominent trend shaping the Italy water pump market is the increasing adoption of smart pumping technologies. For instance, Waltero, a company specializing in smart water infrastructure, has deployed W-Sensors equipped with IoT and edge AI in European water utilities, enabling real-time monitoring of pressure, flow, and water quality. These technologies allow operators to remotely track performance metrics such as pressure, flow rate, and energy consumption, enabling timely maintenance and minimizing operational disruptions. Italian municipalities and utility providers are particularly investing in these smart systems to improve the efficiency of water distribution networks, reduce losses, and enhance resource planning in response to aging infrastructure and growing urban demands.

Growth of Solar-Powered Pump Solutions

Another emerging trend is the rise in the deployment of solar-powered water pumps, especially in rural and off-grid regions of Italy. As part of the country’s broader commitment to renewable energy and carbon neutrality, solar pumping systems are increasingly being implemented in agriculture, remote water supply, and small-scale irrigation projects. These pumps offer a cost-effective and sustainable alternative to conventional electric or diesel-powered models, particularly in areas with high solar radiation and limited grid connectivity. Government-backed initiatives and funding under the EU Green Deal and Italy’s National Recovery and Resilience Plan (PNRR) have accelerated the transition to solar-integrated water infrastructure.

Rising Demand for Custom-Engineered Pumps

The market is also witnessing a growing demand for custom-engineered water pumps tailored to specific industrial needs. For example, in the manufacturing sector, pumps with corrosion-resistant materials or specialized impeller designs are being developed to handle corrosive chemicals and high-viscosity fluids. Industries such as pharmaceuticals, food and beverage, and energy production require highly specialized fluid handling systems with precise specifications. This trend has encouraged pump manufacturers to offer customized solutions that address unique operating conditions, regulatory standards, and energy efficiency requirements. As industrial applications become more complex and diversified, the shift toward application-specific pump designs is expected to expand, creating opportunities for niche suppliers and engineering firms operating in the Italian market.

Emphasis on Lifecycle Efficiency and Retrofit Solutions

An increasing number of end-users in Italy are prioritizing lifecycle efficiency in pump procurement decisions. Rather than focusing solely on upfront costs, organizations are evaluating total cost of ownership, which includes energy usage, maintenance requirements, and operational lifespan. This shift has led to growing interest in retrofitting and upgrading existing pump systems with high-efficiency motors, variable speed drives, and smart controllers. Retrofit solutions are particularly appealing in industrial facilities and municipal plants where infrastructure modernization is necessary but full system replacements are cost-prohibitive. This trend aligns with Italy’s focus on sustainable infrastructure investment, promoting long-term cost savings and environmental benefits.

Market Challenges Analysis:

Market Saturation and Economic Sensitivity

The Italy water pump market faces constraints due to its mature and saturated nature.With widespread adoption across industrial, agricultural, and municipal sectors, opportunities for rapid expansion are limited.Economic fluctuations further exacerbate this issue, as downturns can lead to reduced investments in infrastructure and industrial projects, particularly in sectors like agriculture and construction.Such economic sensitivity hampers the consistent growth of the water pump market in Italy.

Intensifying Global Competition

Italian water pump manufacturers are increasingly challenged by competition from international players offering advanced technologies at competitive prices.Global manufacturers have been making inroads into the Italian market, intensifying pressure on domestic companies to innovate and differentiate their products.This heightened competition necessitates significant investment in research and development for Italian firms to maintain their market position.

Aging Infrastructure and Investment Requirements

Many regions in Italy are burdened with aging water management infrastructure, necessitating substantial investments for modernization. Upgrading these systems is essential to improve efficiency and comply with environmental standards. However, the high costs associated with such overhauls can be prohibitive, especially for smaller municipalities and private entities, posing a significant challenge to the adoption of new water pump technologies.

Regulatory Compliance and Environmental Standards

The stringent environmental regulations in Italy and the broader European Union demand high energy efficiency and low emissions from water pump systems. For instance, the implementation of the EU’s Ecodesign Regulation (EC 547/2012) mandates minimum energy efficiency standards for water pumps, requiring manufacturers to meet specific efficiency levels at various operating points.Compliance with these standards requires manufacturers to invest in advanced technologies and materials, increasing production costs.Smaller manufacturers may struggle to meet these requirements, potentially limiting their competitiveness in the market.

Market Opportunities:

Italy’s transition toward sustainable water infrastructure presents a significant opportunity for the water pump market. The increasing emphasis on energy efficiency, climate resilience, and environmental compliance is driving demand for advanced pump technologies across multiple sectors. Public investments under the National Recovery and Resilience Plan (PNRR), aligned with EU Green Deal objectives, are expected to support the modernization of water supply and wastewater treatment systems. This government-backed funding creates a favorable environment for manufacturers and service providers offering smart, eco-friendly, and low-maintenance pump systems. The growing need for digitalization in municipal water utilities also opens avenues for smart pumps integrated with IoT, automation, and remote monitoring solutions.

Additionally, the agricultural and industrial sectors are creating emerging opportunities for tailored and high-performance water pump solutions. As agriculture shifts toward precision farming and sustainable irrigation, the demand for pumps that support efficient water usage is likely to expand, particularly in water-scarce southern regions. In parallel, Italy’s industrial sector is undergoing technological upgrades that call for application-specific pumping systems with better energy management and operational control. The rising focus on retrofitting existing infrastructure with energy-efficient and cost-effective pump systems further enhances the growth potential. Market players that can offer customized solutions with value-added services, such as maintenance, monitoring, and performance optimization, are well-positioned to capture a larger share of this evolving market landscape.

Market Segmentation Analysis:

The Italy water pump market is segmented by type, end-user, and technology, each playing a critical role in shaping the industry’s dynamics.

By type segment, centrifugal pumps hold a dominant share due to their widespread application in water circulation, supply systems, and irrigation. Their efficiency, low maintenance, and suitability for continuous operation make them ideal for municipal and industrial uses. Positive displacement pumps, though comparatively smaller in market share, are witnessing increased adoption in niche applications such as oil & gas and chemical processing, where precise fluid handling under varying pressures is essential.

By end-user segmentation, the agriculture sector remains a key contributor, especially in southern Italy, where irrigation is vital for crop production. Water and wastewater management also accounts for a significant share, driven by ongoing investments in treatment facilities and municipal infrastructure modernization. The oil & gas and mining sectors, although smaller, provide steady demand for robust pump systems suited to harsh operating conditions. Additionally, infrastructure applications, particularly horizontal directional drilling (HDD), are generating interest in high-capacity and durable pumps for construction and utility installation projects.

By technology perspective, electric-driven pumps lead the market due to their operational efficiency, lower emissions, and compatibility with smart monitoring systems. Their usage is prevalent in both urban and rural applications. Engine-driven pumps, while less dominant, remain critical in remote or off-grid regions where electricity access is limited, especially for emergency services, agriculture, and temporary construction sites. This segmentation reflects a balanced market with opportunities across multiple sectors and technologies.

Segmentation:

By Type Segment:

- Centrifugal Pumps

- Positive Displacement Pumps

By End-User Segment:

- Agriculture

- Water & Wastewater

- Mining

- Oil & Gas

- Infrastructure Application (HDD)

By Technology Segment:

- Electric Driven

- Engine Driven

Regional Analysis:

The Italy water pump market exhibits distinct regional dynamics, influenced by varying industrial activities, agricultural practices, and infrastructure development across the country. The northern regions, notably Lombardy, Veneto, and Emilia-Romagna, dominate the market, accounting for approximately 45% of the national demand. This dominance is attributed to the concentration of manufacturing industries, advanced infrastructure, and proactive adoption of energy-efficient technologies in these areas. The presence of major industrial hubs and a focus on sustainable practices further bolster the demand for advanced water pumping solutions in the north.

Central Italy, encompassing regions such as Tuscany and Lazio, contributes around 25% to the market share. This region benefits from a mix of industrial activities and agricultural operations, driving the need for versatile water pump applications. The emphasis on modernizing water infrastructure and implementing efficient irrigation systems supports market growth in central Italy. Meanwhile, southern regions, including Sicily, Calabria, and Apulia, represent approximately 30% of the market. The demand here is primarily driven by agricultural needs, especially for irrigation in arid zones, and ongoing infrastructure development projects. Government initiatives aimed at enhancing water management and promoting sustainable agricultural practices are expected to further stimulate demand in the southern regions.

Key Player Analysis:

- SLB

- Ingersoll Rand

- The Weir Group PLC

- Vaughan Company

- KSB SE & Co. KGaA

- Pentair

- Grundfos Holding A/S

- Xylem

- Flowserve Corporation

- ITT Inc.

- Ebara Corporation

- CS Waterpumps

Competitive Analysis:

The Italy water pump market is characterized by the presence of both international and domestic manufacturers competing across various segments. Leading global players such as Grundfos, Xylem, and KSB maintain strong market positions through advanced technological offerings, extensive distribution networks, and a focus on energy efficiency and smart pumping solutions. Italian firms, including Pedrollo and Calpeda, leverage local market knowledge and long-standing customer relationships to maintain competitiveness. The market is witnessing increased competition due to the entry of low-cost manufacturers from Asia, prompting established companies to invest in innovation and product customization. Companies are also focusing on digitalization, predictive maintenance features, and value-added services to differentiate their offerings. Strategic partnerships with municipal authorities and industrial clients further strengthen competitive positioning. Overall, innovation, regulatory compliance, and responsiveness to sector-specific demands remain key competitive factors in the evolving Italian water pump market landscape.

Recent Developments:

- Servotech Power Systems Ltd.launched solar pump controllers on October 28, 2024, designed for 2HP to 10HP water pumps. This aligns with initiatives like PM-KUSUM to promote sustainable farming practices through water-efficient solutions.

- Roto Pumps Ltd.announced the launch of its subsidiary, Roto Energy Systems Ltd., in Feb 2024. This new division focuses on solar-powered water pumping solutions, including submersible and surface pumps, catering to eco-friendly water management needs.

- Grundfos’ commitment to the Water Resilience Coalition in March 2025 aligns with the water pump market’s focus on sustainability and efficient water management. The coalition’s goals include measurable improvements in global water sustainability by 2030.

- On February 28, 2025, KSB launched the MultiTec Plus pump series, specifically optimized for drinking water transport. This product integrates energy-saving technologies and real-time monitoring capabilities, emphasizing advancements in smart and sustainable water pumping solutions.

Market Concentration & Characteristics:

The Italy water pump market exhibits a moderately concentrated structure, featuring a blend of established global manufacturers and specialized domestic firms. Leading international companies such as Grundfos, Xylem, and KSB maintain a significant presence, leveraging their extensive product portfolios and advanced technological capabilities to cater to diverse industrial and municipal needs. Simultaneously, Italian companies like Pedrollo, Calpeda, and Interpump Group hold substantial market shares, capitalizing on their deep-rooted local expertise, strong distribution networks, and tailored solutions that address specific regional requirements. The market is characterized by a strong emphasis on energy efficiency, technological innovation, and compliance with stringent environmental regulations. The growing demand for smart pumping solutions, integration of Internet of Things (IoT) technologies, and the shift towards sustainable water management practices are driving product development and differentiation among competitors. Additionally, the prevalence of aging infrastructure in certain regions necessitates the replacement and upgrading of existing systems, further influencing market dynamics. These factors collectively shape a competitive landscape where companies must continuously innovate and adapt to evolving market demands to maintain and enhance their market positions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type Segment, End-User Segment and Technology Segment. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Italy water pump market is projected to experience steady growth driven by rising investments in infrastructure modernization.

- Demand for smart pumps integrated with IoT and automation will expand across industrial and municipal applications.

- Agricultural sectors in southern Italy will increasingly adopt efficient irrigation pumps to combat water scarcity.

- Renewable energy integration, especially solar-powered pumps, will gain traction in off-grid and rural applications.

- Retrofitting of aging water systems with energy-efficient technologies will boost replacement pump sales.

- Environmental regulations will accelerate the shift toward low-emission and high-efficiency pump systems.

- Custom-engineered pump solutions will find growing demand in pharmaceuticals, food processing, and energy sectors.

- Domestic manufacturers are expected to strengthen market presence through regional partnerships and innovation.

- Digital maintenance services and predictive analytics will become standard offerings among key players.

- Public-private collaborations will support sustainable water resource management, expanding long-term market opportunities.