| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Canada Industrial Fasteners Market Size 2024 |

USD 3327.76 Million |

| Canada Industrial Fasteners Market, CAGR |

5.45% |

| Canada Industrial Fasteners Market Size 2032 |

USD 5087.94 Million |

Market Overview:

The Canada Industrial Fasteners Market is projected to grow from USD 3327.76 million in 2024 to an estimated USD 5087.94 million by 2032, with a compound annual growth rate (CAGR) of 5.45% from 2024 to 2032.

Several factors are propelling the growth of Canada’s industrial fasteners market. Foremost is the expansion of the construction and infrastructure sectors, which necessitate a wide array of fasteners for structural integrity and safety. Urbanization and population growth are fueling residential and commercial construction projects, thereby increasing the demand for reliable fastening solutions. The automotive industry also plays a significant role, with the rise of electric vehicle (EV) manufacturing creating new opportunities for fastener suppliers. EV production requires specialized fasteners that can withstand unique stresses and contribute to overall vehicle efficiency. Additionally, advancements in fastener manufacturing technologies are enabling the production of high-performance, lightweight fasteners that meet the stringent requirements of modern automotive and aerospace applications. Furthermore, the emphasis on maintenance, repair, and operations (MRO) across industries ensures a consistent demand for fasteners, as equipment and structures require regular upkeep to maintain safety and functionality.

Within North America, Canada is emerging as a significant player in the industrial fasteners market. While the United States continues to lead in terms of market size, Canada’s market is experiencing robust growth, particularly in sectors like construction and automotive manufacturing. The establishment of new EV manufacturing facilities by global automotive giants is a testament to Canada’s growing importance in the automotive sector. However, the market faces challenges, including the impact of tariffs on steel and aluminum imports, which have led to increased costs for fastener manufacturers and end-users. Despite these hurdles, Canada’s industrial fasteners market remains resilient, supported by technological advancements and a diversified industrial base

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Canada Industrial Fasteners Market is projected to grow from USD 3327.76 million in 2024 to an estimated USD 5087.94 million by 2032, with a compound annual growth rate (CAGR) of 5.45% from 2024 to 2032.

- The Global Industrial Fasteners Market is projected to grow from USD 98,826 million in 2024 to USD 158,987.23 million by 2032, registering a robust CAGR of 6.12%.

- Strong growth in automotive manufacturing, particularly electric vehicle (EV) production, is creating significant opportunities for suppliers of lightweight and high-performance fasteners.

- Technological advancements, including the development of smart fasteners and enhanced material compositions, are reshaping the competitive landscape and driving innovation in product offerings.

- Expansion of maintenance, repair, and operations (MRO) activities across sectors such as manufacturing, oil and gas, and aerospace ensures a consistent, recurring demand for durable fastening solutions.

- Market growth faces challenges from volatile raw material prices, especially for steel and aluminum, which create pricing and production uncertainties for manufacturers.

- Stringent regulatory standards and increasing global competition, particularly from low-cost imports, are pushing Canadian manufacturers to focus on quality, specialization, and technological upgrades.

- Ontario leads the regional market, followed by Quebec, British Columbia, and Alberta, with infrastructure projects and automotive hubs supporting the strongest demand for industrial fasteners.

Market Drivers:

Growing Demand from Construction and Infrastructure Development

The expansion of construction and infrastructure activities is a key driver of the Canada industrial fasteners market. Investments in commercial, residential, and public infrastructure projects continue to rise, supported by government initiatives to modernize transport networks, energy facilities, and urban areas. Fasteners are critical components in building frameworks, bridges, rail systems, and renewable energy installations. The increasing adoption of advanced construction techniques that emphasize strength, durability, and safety further amplifies the demand for specialized and high-performance fastening solutions. As Canada continues to prioritize infrastructure resilience and sustainability, the consumption of industrial fasteners is expected to grow steadily.

Rising Automotive Manufacturing and Electric Vehicle Initiatives

Canada’s strong presence in automotive manufacturing, coupled with a growing focus on electric vehicles (EVs), significantly boosts the demand for industrial fasteners. For instance, companies like PEM® have developed fastener portfolios specifically for EV and charging applications, including high-voltage battery connections, battery management systems, and thermal management systems, reflecting the sector’s shift toward advanced, application-specific fasteners. The unique requirements of EV assembly, such as battery integration and chassis weight optimization, demand innovative fastening technologies. As Canada solidifies its position as a North American hub for EV production, the industrial fasteners market will increasingly benefit from collaborations between automotive manufacturers and specialized fastener producers seeking to meet evolving industry standards.

Technological Advancements in Fastener Design and Materials

Innovation in materials and manufacturing processes is reshaping the landscape of the industrial fasteners market in Canada. Advances in cold forming, heat treatment, and coating technologies are enabling the production of fasteners that offer enhanced tensile strength, superior corrosion resistance, and longer service life. The introduction of composite and plastic fasteners is gaining traction, particularly in industries aiming to reduce overall product weight without compromising durability. For example, advanced coatings such as zinc flake and PTFE (polytetrafluoroethylene) are increasingly applied to fasteners to improve corrosion resistance and reduce friction during assembly, extending product lifespan in harsh environments. Additionally, smart fasteners equipped with sensors for predictive maintenance and monitoring are gradually entering industrial applications, offering new dimensions of efficiency and operational reliability. These technological improvements are helping manufacturers cater to the growing demand for specialized solutions across various sectors.

Expansion of Maintenance, Repair, and Operations (MRO) Activities

The increasing emphasis on maintenance, repair, and operations (MRO) across industrial sectors serves as a consistent demand driver for fasteners in Canada. Industries such as manufacturing, oil and gas, mining, and aerospace require regular upkeep of machinery, infrastructure, and equipment to ensure operational efficiency and safety compliance. MRO activities necessitate a steady supply of high-quality fasteners capable of withstanding harsh environments and mechanical stresses. As companies invest in predictive maintenance strategies and extend the operational life of their assets, the need for durable and reliable fastening solutions will continue to strengthen the market’s growth trajectory.

Market Trends:

Growing Emphasis on Lightweight and High-Strength Materials

The Canada industrial fasteners market is witnessing a steady shift toward lightweight and high-strength materials, reflecting broader trends in manufacturing and automotive sectors. For instance, construction equipment OEMs are increasingly utilizing industrial fasteners made from high-strength alloys to reduce equipment weight, which in turn improves both performance and battery efficiency for electrified machinery. This trend is particularly noticeable in the aerospace and automotive sectors, where reducing weight directly contributes to improved energy efficiency and performance. Companies are investing heavily in R&D to develop fasteners that meet stringent performance specifications while offering superior corrosion resistance, thus broadening their applications across diverse end-use industries.

Expansion of Custom and Application-Specific Fasteners

There is a rising demand for customized and application-specific fasteners in Canada, driven by the evolving needs of sectors such as renewable energy, infrastructure, and heavy machinery. Industries are increasingly seeking tailor-made fastening solutions that align with specific performance requirements like vibration resistance, thermal stability, and precision installation. As projects grow more complex, particularly in energy and construction, the need for specialized fastening systems has surged. Canadian manufacturers and suppliers are responding by expanding their product portfolios to include fasteners with specialized coatings, geometries, and material compositions designed to extend operational lifespan and enhance safety.

Integration of Digital Technologies in Manufacturing

Another significant trend shaping the Canada industrial fasteners market is the integration of digital technologies such as smart manufacturing, IoT-enabled production systems, and automated quality control. Manufacturers are leveraging Industry 4.0 technologies to improve production efficiency, minimize defects, and enhance traceability throughout the supply chain. For example, smart fasteners equipped with sensors are now being used to monitor the condition of connections and provide real-time feedback, supporting predictive maintenance and reducing downtime in manufacturing facilities. Advanced data analytics and real-time monitoring systems are enabling companies to optimize processes and maintain consistent product quality. Additionally, predictive maintenance technologies are gaining traction in fastener production facilities, helping companies reduce downtime and operational costs while ensuring higher standards of precision and reliability.

Increased Focus on Sustainability and Eco-Friendly Practices

Sustainability has emerged as a key focus area in the Canadian industrial fasteners sector. Companies are adopting eco-friendly manufacturing practices, such as using recyclable materials, minimizing waste generation, and implementing energy-efficient production techniques. The push toward green building standards and sustainable infrastructure development is encouraging the adoption of fasteners that are compliant with environmental regulations and certifications. Furthermore, end-users are increasingly favoring suppliers that demonstrate strong environmental stewardship, prompting fastener manufacturers to highlight sustainable practices as a competitive differentiator in the market.

Market Challenges Analysis:

Fluctuating Raw Material Costs

The Canada industrial fasteners market faces significant challenges due to the volatility of raw material prices, particularly steel, aluminum, and specialty alloys. Frequent fluctuations in global metal prices directly impact production costs, making it difficult for manufacturers to maintain consistent pricing strategies. This unpredictability often compresses profit margins and creates budgeting uncertainties for both manufacturers and end-users, hindering long-term project planning and investment decisions across various industries.

Stringent Quality and Compliance Requirements

Stringent regulatory standards and quality certifications present another restraint for the market. Industries such as aerospace, automotive, and construction demand fasteners that meet rigorous safety and performance benchmarks. For example, manufacturers and importers are required to retain records of conformance for fasteners for five years, and testing must be performed by accredited laboratories to verify compliance with grade identification markings. Compliance with these standards often requires extensive testing, documentation, and certification processes, which add considerable costs and lengthen product development cycles. Smaller manufacturers, in particular, struggle to meet these requirements without substantial investments in quality control and advanced manufacturing technologies.

Intense Market Competition

The Canadian industrial fasteners market is characterized by intense competition, both from domestic players and international suppliers. The influx of low-cost fasteners from global markets, especially from Asia, has increased pricing pressures on local manufacturers. To remain competitive, Canadian companies must invest in product innovation, customization, and after-sales support, which can strain resources and impact profitability, particularly for small and medium-sized enterprises.

Supply Chain Disruptions and Logistics Challenges

Persistent supply chain disruptions, driven by global uncertainties, transportation bottlenecks, and labor shortages, have created challenges in maintaining steady inventory levels and meeting delivery timelines. These issues not only impact the operational efficiency of fastener manufacturers but also affect end-users who rely on timely availability for critical infrastructure and manufacturing projects. Overcoming these disruptions requires resilient supply chain strategies and stronger collaborations with logistics partners.

Market Opportunities:

The Canada industrial fasteners market presents substantial opportunities driven by the country’s ongoing infrastructure development initiatives and investments in advanced manufacturing. Major infrastructure projects, such as transportation networks, renewable energy installations, and commercial construction, are fueling the demand for high-performance and durable fastening solutions. Additionally, the government’s focus on building resilient and sustainable infrastructure under national programs is opening new avenues for fastener manufacturers to supply innovative, high-strength products tailored for demanding applications. Growth in the automotive, aerospace, and heavy machinery sectors, which require specialized fastening systems for performance and safety, further strengthens the potential for product diversification and technological advancements within the market.

Moreover, the rising adoption of Industry 4.0 technologies across Canadian manufacturing industries offers a significant opportunity for fastener producers to integrate smart technologies into their offerings. The demand for fasteners with embedded sensors for monitoring load, stress, and environmental conditions is steadily growing, particularly in critical applications. Sustainability trends also create prospects for manufacturers that focus on eco-friendly production methods and recyclable materials. Expanding collaboration between Canadian firms and international players for technology exchange, innovation, and export development can further enhance the global competitiveness of domestic fastener producers. Companies that strategically invest in product innovation, digital transformation, and green manufacturing practices are well-positioned to capitalize on emerging demand across a wide range of industries in Canada.

Market Segmentation Analysis:

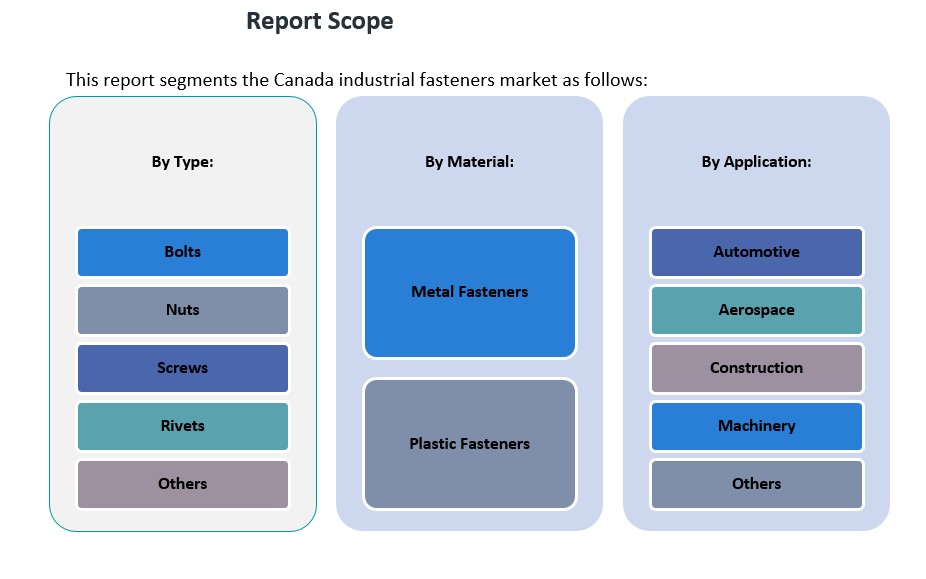

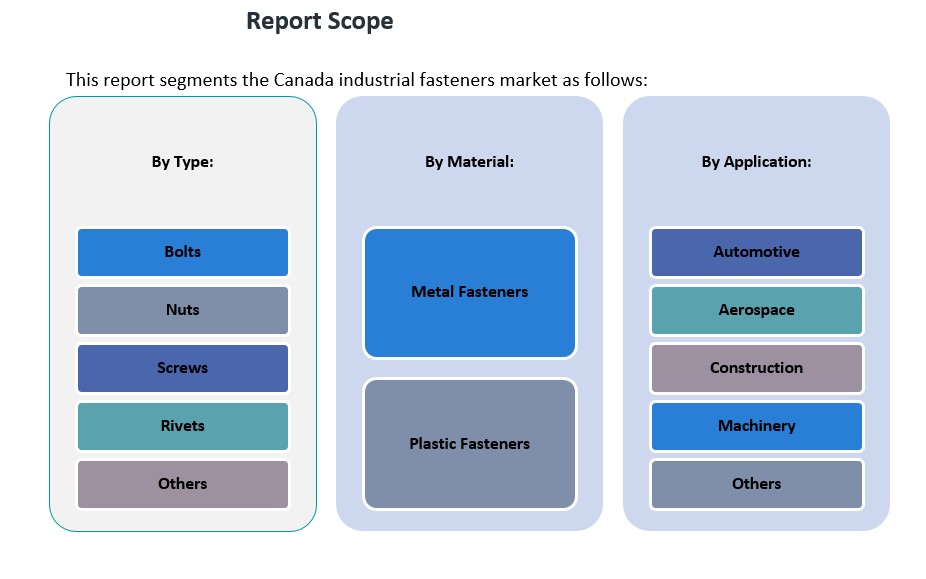

The Canada industrial fasteners market is segmented by type, application, and material, each playing a critical role in shaping industry demand.

By type, bolts hold the largest market share due to their widespread use across automotive, construction, and heavy machinery sectors, where high-strength fastening is crucial. Nuts and screws also command significant portions of the market, driven by their versatility in a variety of applications ranging from infrastructure development to manufacturing equipment assembly. Rivets are witnessing steady demand, particularly in aerospace and specialized construction projects that require permanent fastening solutions. The “Others” segment, including washers and pins, supports diverse niche applications across multiple industries.

By application, the automotive sector remains the dominant consumer of industrial fasteners, fueled by rising production volumes and the shift toward lightweight, high-performance vehicles. The aerospace sector is expanding its fastener usage, emphasizing high-strength and corrosion-resistant products for aircraft assembly and maintenance. Construction activities, spurred by government investments in infrastructure renewal, continue to generate significant demand for a wide range of fastening solutions. The machinery sector further supports market growth, requiring durable and reliable fasteners for industrial equipment manufacturing and maintenance. Other applications, such as electronics and renewable energy, also contribute to the evolving market landscape.

By material, metal fasteners account for the majority of the market share due to their superior strength, durability, and load-bearing capacity. However, plastic fasteners are gaining popularity in specialized applications where lightweight, corrosion resistance, and electrical insulation properties are prioritized, particularly in automotive and electronics sectors.

Segmentation:

By Type Segment:

- Bolts

- Nuts

- Screws

- Rivets

- Others

By Application Segment:

- Automotive

- Aerospace

- Construction

- Machinery

- Others

By Material Segment:

- Metal Fasteners

- Plastic Fasteners

Regional Analysis:

The Canada industrial fasteners market is geographically segmented into Ontario, Quebec, British Columbia, Alberta, and the Rest of Canada, with each region contributing differently to overall market dynamics. Ontario dominates the market with a share of 38%, primarily due to its strong industrial base, robust automotive manufacturing presence, and extensive infrastructure projects. The province’s highly developed construction sector and concentration of aerospace activities further drive the demand for a wide range of fastening solutions. Major automotive production hubs, alongside large-scale urban development initiatives in cities like Toronto and Ottawa, continue to create steady growth opportunities for fastener manufacturers and distributors.

Quebec follows with a market share of 26%, supported by its well-established aerospace and transportation industries. The province is home to leading aircraft manufacturers and suppliers, boosting the need for advanced, high-strength fasteners that meet strict quality and performance standards. Quebec’s active construction sector and investments in public infrastructure, such as bridges, transportation corridors, and energy projects, also contribute significantly to market expansion. Additionally, government-backed initiatives to promote sustainable building practices are encouraging the use of innovative fastening solutions that align with environmental standards.

British Columbia accounts for 18% of the market, driven largely by investments in residential and commercial construction, as well as expansion projects in the renewable energy and transportation sectors. The province’s focus on green building initiatives and infrastructure modernization supports the growing demand for durable and eco-friendly fastening systems. Vancouver and other urban centers are witnessing rapid growth, further strengthening the need for high-performance fasteners across construction and industrial projects.

Alberta captures 12% of the market, mainly fueled by oil and gas infrastructure, industrial equipment manufacturing, and pipeline construction activities. The province’s energy sector continues to require highly durable and corrosion-resistant fasteners capable of withstanding extreme environmental conditions. Ongoing investment in petrochemical facilities and energy diversification projects provides additional avenues for market growth.

The Rest of Canada, comprising smaller provinces and territories, holds the remaining 6% market share. Although smaller in volume, these regions present niche opportunities, particularly in mining operations, maritime industries, and localized construction projects. Efforts to improve transportation networks and expand remote infrastructure are gradually enhancing demand for industrial fasteners in these areas, offering growth potential for manufacturers willing to cater to regional specifications and needs.

Key Player Analysis:

- Arconic Inc.

- Illinois Tool Works Inc.

- STANLEY Engineered Fastening

- Hilti Corporation

- Acument Global Technologies

- Fastenal Company

- Nucor Corporation

- PennEngineering

- TriMas Corporation

- Parker Fasteners

Competitive Analysis:

The Canada industrial fasteners market is characterized by a mix of established domestic manufacturers and strong international players competing on product quality, customization, and pricing strategies. Leading companies focus on expanding their product portfolios with advanced materials and application-specific solutions to meet evolving industry demands. Innovation in corrosion resistance, lightweight design, and precision manufacturing serves as a key differentiator in this highly competitive landscape. Strategic partnerships with end-use industries such as automotive, aerospace, and construction are common as companies aim to secure long-term supply agreements. Additionally, market participants are investing in automation and smart manufacturing technologies to enhance production efficiency and ensure compliance with stringent quality standards. Competitive pressure is further intensified by imports from Asia, pushing domestic firms to emphasize value-added services, such as technical support and customized fastening solutions, to maintain and grow their market share in a challenging business environment.

Recent Developments:

- In April 2022, LindFast, a US-based distributor of specialty fasteners, made a significant move in the Canadian industrial fasteners market by acquiring Fasteners and Fittings Inc., a Canadian manufacturer specializing in specialty fasteners. This strategic acquisition is expected to strengthen LindFast’s presence and capabilities across North America, particularly enhancing its market position in Canada. By integrating Fasteners and Fittings Inc.’s robust market standing and expertise, LindFast aims to better serve and exceed customer expectations in the Canadian fastener sector, reflecting a broader trend of consolidation and partnership within the industry.

- In April 2024, TR Fastenings, a prominent provider of industrial fasteners, launched its new Plas-Tech 30-20 screws. These innovative fasteners are specifically designed for high-temperature environments up to 120°C and are manufactured from modified polyphthalamide. The new product targets demanding applications in the automotive, electronics, and industrial sectors, offering increased strength, reduced weight, and exceptional resistance to chemicals and moisture. This launch underscores TR Fastenings’ commitment to expanding its portfolio with advanced solutions tailored to the evolving needs of industrial clients, including those in the Canadian market.

Market Concentration & Characteristics:

The Canada industrial fasteners market demonstrates a moderate level of concentration, with a few established players maintaining a strong presence alongside numerous small and medium-sized enterprises. Leading manufacturers focus on delivering a wide range of fastening solutions, catering to sectors such as automotive, construction, aerospace, and heavy machinery. Competitive dynamics are shaped by product quality, innovation, and the ability to provide customized solutions tailored to specific industrial needs. The market is characterized by a combination of standardized and specialized fasteners. Standardized products, such as generic bolts, screws, and nuts, face stiff competition from lower-cost imports, particularly from global suppliers. In contrast, specialized fasteners, designed for high-performance and application-specific use, offer better profit margins and a competitive edge for domestic manufacturers. Companies are increasingly investing in advanced manufacturing technologies and sustainable production practices to differentiate themselves and meet evolving customer demands across various end-use industries.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type, Application and Material. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing infrastructure investments will continue to drive demand for high-strength fasteners across transportation and energy sectors.

- Expansion of electric vehicle manufacturing is expected to boost the need for lightweight and corrosion-resistant fastening solutions.

- Increasing adoption of automation and smart manufacturing will enhance production efficiency and quality control among fastener manufacturers.

- Rising focus on renewable energy projects will create new opportunities for specialized fastening products.

- Demand for customized, application-specific fasteners is likely to grow across aerospace, automotive, and machinery industries.

- Sustainability initiatives will encourage the development of recyclable and eco-friendly fastener materials.

- Technological advancements such as IoT-enabled fasteners are expected to gain traction in critical infrastructure applications.

- Supply chain optimization and localized manufacturing strategies will become crucial to mitigating global disruptions.

- Increased competition from low-cost imports will push domestic players to focus on innovation and value-added services.

- Strategic mergers and partnerships are anticipated to strengthen market positioning and expand product portfolios.