Market Overview

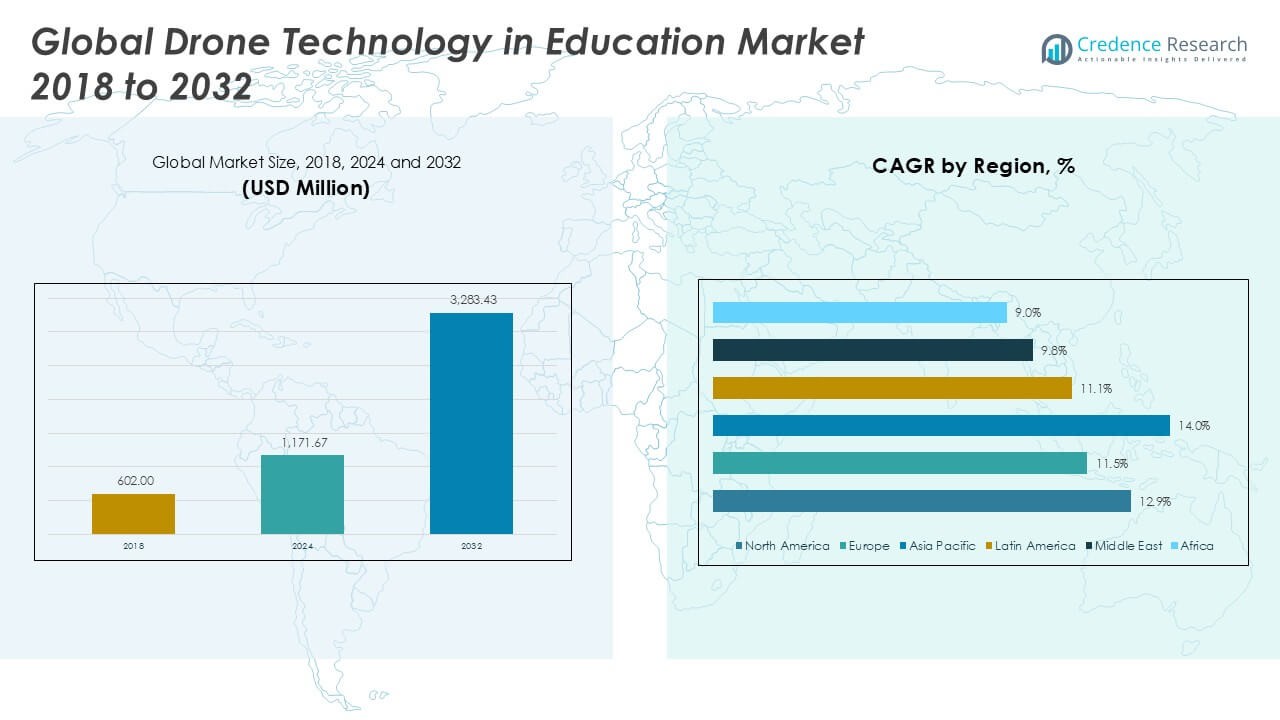

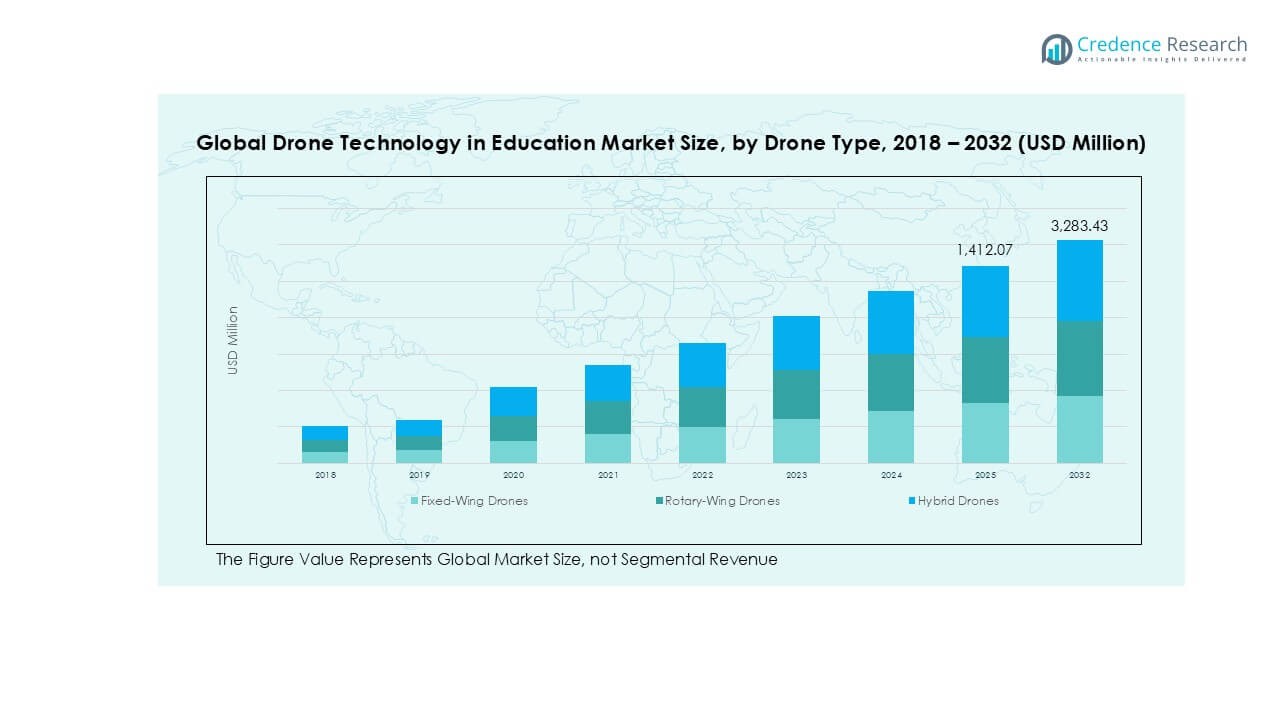

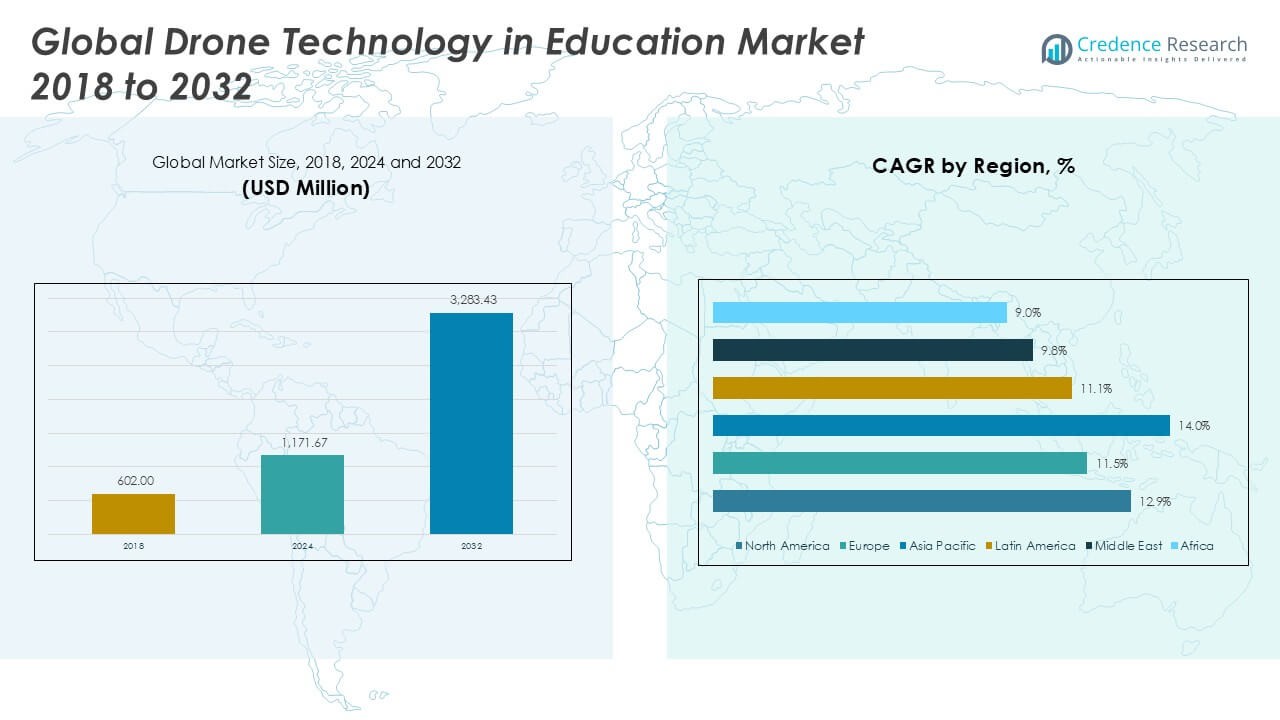

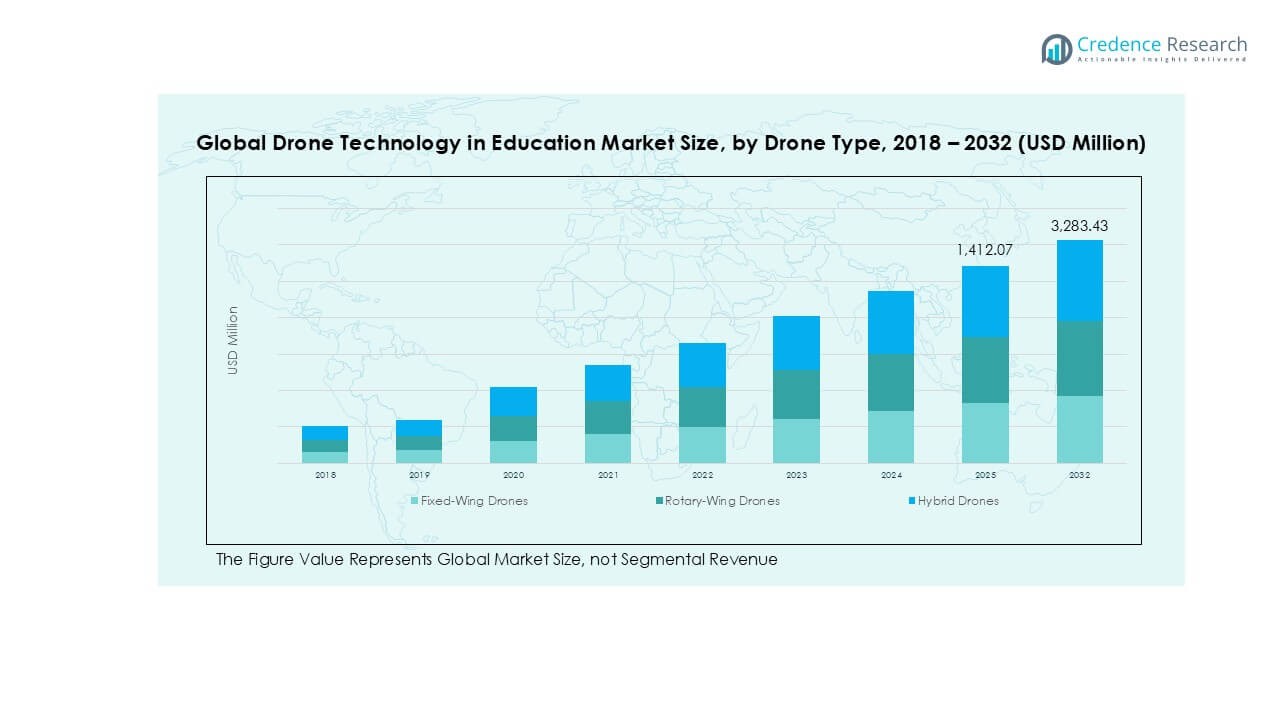

Global Drone Technology in Education Market size was valued at USD 602.00 million in 2018, reaching USD 1,171.67 million in 2024, and is anticipated to reach USD 3,283.43 million by 2032, at a CAGR of 12.81% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Drone Technology in Education Market Size 2024 |

USD 1,171.67 Million |

| Drone Technology in Education Market, CAGR |

12.81% |

| Drone Technology in Education Market Size 2032 |

USD 3,283.43 Million |

The Global Drone Technology in Education market is led by key players including DJI, Parrot, Draganfly, 3DR, Extreme Fliers, Action Drone, and Pix4D, each contributing to market expansion through diverse product portfolios and strategic collaborations with educational institutions. DJI maintains leadership with advanced hardware and integrated software, while Parrot and 3DR focus on cost-effective drones for schools and training programs. Pix4D strengthens the ecosystem with simulation and coding platforms tailored for research and STEM education. Regionally, North America dominates with 43.8% share in 2024, supported by strong institutional adoption and funding programs, while Asia Pacific follows with 30.2%, driven by government-backed STEM initiatives and rapid EdTech integration. Europe holds 18.2%, reflecting steady uptake across universities and vocational training institutes. This competitive and regionally diverse landscape highlights the growing importance of drone technology in enhancing global education systems.

Market Insights

- The Global Drone Technology in Education Market was valued at USD 602.00 million in 2018, reached USD 1,171.67 million in 2024, and is projected to hit USD 3,283.43 million by 2032, growing at a CAGR of 12.81%.

- Rising adoption of drones in STEM education is the primary driver, as schools and universities integrate them into robotics, coding, and physics curricula to enhance interactive and skill-based learning.

- Market trends highlight increasing demand for rotary-wing drones, which dominate with the largest segment share due to affordability, ease of use, and suitability for classroom and outdoor training applications.

- Competition is led by DJI, Parrot, Draganfly, 3DR, Extreme Fliers, Action Drone, and Pix4D, with DJI maintaining leadership through broad hardware portfolios and software integration, while others target niche segments like vocational training and simulation.

- Regionally, North America leads with 43.8% share in 2024, followed by Asia Pacific at 30.2% and Europe at 18.2%, while Latin America, the Middle East, and Africa remain emerging markets with smaller but growing contributions.

Market Segmentation Analysis:

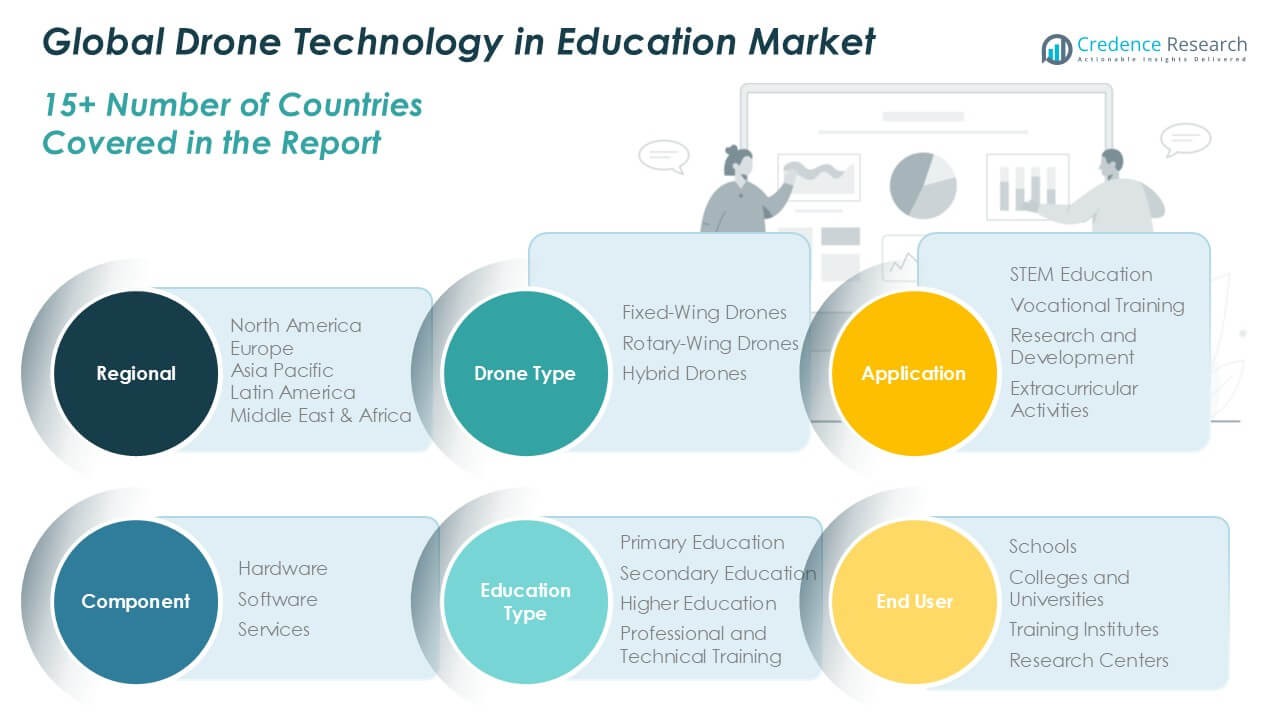

By Drone Type

Rotary-wing drones hold the dominant share in the drone type segment, supported by their ease of use, affordability, and adaptability in confined spaces. Their ability to hover and maneuver precisely makes them highly suitable for classroom demonstrations and outdoor training in education. Fixed-wing drones, while offering longer flight duration, remain more relevant for advanced research activities. Hybrid drones are emerging as a niche sub-segment, combining endurance with maneuverability, and gaining traction in research institutions. The rising demand for practical, hands-on drone applications continues to drive rotary-wing adoption.

- For instance, Ryze Tech’s Tello EDU drones, developed with DJI and Intel, feature programmable flight modes for coding and robotics education using languages like Scratch, Python, and Swift.

By Application

STEM education leads the application segment with the largest revenue share, as drones are increasingly integrated into science, technology, engineering, and mathematics curricula to enhance interactive learning. The adoption is driven by schools and universities incorporating drones into robotics, coding, and physics programs. Vocational training follows, where drones are used for preparing students for careers in surveying, agriculture, and inspection. Research and development utilizes drones for innovative projects, while extracurricular activities such as drone racing clubs further expand market engagement, strengthening STEM-focused growth.

- For instance, the U.S.-based platform DroneBlocks has a comprehensive STEM curriculum that is used by over 500,000 students in thousands of schools globally. While DroneBlocks started with programmable DJI Tello drones, its platform now supports a variety of other hardware.

By Component

Hardware dominates the component segment, accounting for the largest share, as educational institutions primarily invest in physical drone units, sensors, and cameras to support practical training. The demand for cost-effective, durable, and classroom-friendly drone models is a key driver here. Software solutions, including simulation tools and coding platforms, are gaining strong traction as institutions integrate drone programming into curricula. Services such as maintenance, training, and consultancy provide additional growth opportunities. However, hardware continues to command the highest share due to its essential role in enabling hands-on learning experiences.

Key Growth Drivers

Integration of Drones in STEM Education

The increasing integration of drones into STEM education is a major growth driver, as schools and universities adopt drone technology to provide practical, hands-on learning. Drones are widely used in robotics, physics, and computer programming lessons to enhance student engagement. Educators leverage them to foster problem-solving and technical skills, preparing students for technology-driven careers. This push aligns with government and institutional initiatives promoting experiential learning methods. The strong demand for interactive learning solutions makes STEM-focused drone adoption a leading driver of market expansion.

- For instance, the The DroneBlocks platform uses DJI Tello and other drones, along with a curriculum and simulator, to teach STEM and coding in schools. The company has a significant and established presence in the K-12 education market.

Advancements in Affordable Drone Hardware

The rapid availability of low-cost, durable drones with improved safety features has accelerated adoption in education. Manufacturers design models suitable for classroom and outdoor training environments, enabling institutions to integrate them without high budget allocations. Compact drones with protective frames and simple controls allow even younger students to experiment safely. This affordability reduces barriers for schools and training institutes in both developed and emerging economies. The focus on cost efficiency while maintaining performance continues to strengthen hardware-driven demand across global education markets.

- For instance, Ryze Tech’s Tello EDU drone, priced at $129 USD at launch, is used in schools for coding and flight training. It supports programming languages like Scratch, Swift, and Python.

Government and Institutional Support Programs

Supportive initiatives from governments and educational boards have played a critical role in market growth. Funding programs, policy support, and curriculum reforms are encouraging schools and universities to adopt drone-based learning. For example, several national STEM strategies include drone training modules for skill development. Research grants further expand opportunities for higher education and technical institutions to explore drone applications. These incentives enhance accessibility and create long-term sustainability for drone education programs, particularly in regions focusing on digital literacy and workforce readiness.

Key Trends & Opportunities

Expansion of Drone-Based Vocational Training

Vocational training represents a strong trend as drones are increasingly used in skill-based programs for sectors like agriculture, surveying, and infrastructure inspection. Training institutes and technical colleges incorporate drones into certification courses, preparing students for industry-specific roles. This creates opportunities for drone manufacturers and software developers to partner with education providers. The growing link between classroom training and workforce requirements positions vocational education as a promising application area, strengthening the market’s long-term relevance beyond traditional academic settings.

- For instance, eBee drones from AgEagle Aerial Systems (formerly senseFly) are used in vocational and educational programs globally. These platforms support certified training for professionals in geospatial mapping and precision agriculture.

Rising Demand for Drone Software and Simulation Tools

Educational institutions are adopting drone simulation platforms and coding software to complement hardware training. These tools allow safe experimentation, advanced programming practice, and scenario-based learning without risking hardware damage. Software-based curricula also help scale training across larger student groups, lowering operational costs. The demand for cloud-enabled platforms and AI-driven analytics provides opportunities for technology providers to expand their offerings. This trend highlights the increasing balance between hands-on drone use and digital platforms, opening new avenues for market growth.

- For example, the DroneBlocks coding curriculum has enrolled more than 500,000 students in simulation-based training, integrating AI and cloud tools with DJI drones.

Key Challenges

High Maintenance and Operational Costs

Despite affordability improvements, drones still require regular maintenance, battery replacements, and training resources, which raise operational costs for institutions. Schools with limited budgets often struggle to manage recurring expenses associated with repairs and software updates. Safety certifications and insurance add to the financial burden. These costs create disparities in adoption between well-funded institutions and smaller schools. Addressing maintenance challenges through durable designs and bundled service packages remains essential to sustain long-term market penetration.

Regulatory and Safety Concerns

Strict regulations around drone usage in urban or sensitive areas present adoption challenges for educational institutions. Compliance with aviation safety standards requires licenses and permissions, which can limit classroom demonstrations or outdoor activities. Safety concerns related to student handling also deter widespread use, especially in primary and secondary schools. Institutions often need to establish strict supervision protocols to mitigate risks. The regulatory complexity and safety issues could slow growth unless manufacturers and policymakers streamline frameworks for educational applications.

Regional Analysis

North America

North America leads the global drone technology in education market, holding the largest share of 43.8% in 2024. The market grew from USD 263.88 million in 2018 to USD 508.28 million in 2024 and is projected to reach USD 1,428.32 million by 2032, registering a CAGR of 12.9%. Growth is fueled by advanced STEM integration in schools, strong institutional budgets, and federal support for educational technology adoption. High investments from universities and training institutes continue to reinforce North America’s dominant role in the market.

Europe

Europe accounts for a significant 18.2% market share in 2024, driven by widespread adoption of drone technology across STEM programs and research centers. The market expanded from USD 115.86 million in 2018 to USD 213.50 million in 2024 and is expected to reach USD 545.78 million by 2032, at a CAGR of 11.5%. Policy support from EU education initiatives and rising focus on digital skills contribute to demand. Universities and technical training centers actively integrate drones into vocational courses, strengthening Europe’s position in the global market.

Asia Pacific

Asia Pacific represents the fastest-growing region with a CAGR of 14.0% and holds 30.2% of the global share in 2024. Market size increased from USD 172.38 million in 2018 to USD 354.40 million in 2024, and it is forecast to reach USD 1,083.91 million by 2032. Strong growth is supported by government-backed STEM initiatives, high population density, and growing investment in EdTech across China, India, and Japan. Training institutes and universities in the region adopt drones widely for both research and vocational learning, ensuring continued expansion.

Latin America

Latin America accounts for 4.6% of the global market in 2024, reflecting gradual adoption of drone technology in education. The market expanded from USD 27.83 million in 2018 to USD 53.48 million in 2024 and is projected to reach USD 132.28 million by 2032, growing at a CAGR of 11.1%. The region benefits from the rise of vocational training institutes that use drones for agriculture and infrastructure-focused programs. However, limited budgets in public education slow adoption, making private institutions and partnerships critical for growth.

Middle East

The Middle East market shows steady expansion with 2.1% share in 2024, supported by digital literacy initiatives in education. Valued at USD 14.12 million in 2018, it grew to USD 24.66 million in 2024 and is set to reach USD 55.96 million by 2032, at a CAGR of 9.8%. Investments in higher education and research centers drive demand, especially in Gulf countries where technology adoption is rapid. However, overall growth remains moderate compared to Asia Pacific and North America due to budget constraints in smaller economies.

Africa

Africa remains an emerging market with 1.5% share in 2024, reflecting early-stage adoption. The market increased from USD 7.93 million in 2018 to USD 17.34 million in 2024, and it is forecast to reach USD 37.18 million by 2032, growing at a CAGR of 9.0%. Growth is concentrated in vocational and technical training where drones are applied in agriculture and resource management education. Limited infrastructure and funding challenge expansion, but international collaborations and NGO-led initiatives are gradually improving accessibility, supporting the long-term potential of drone-based education across the region.

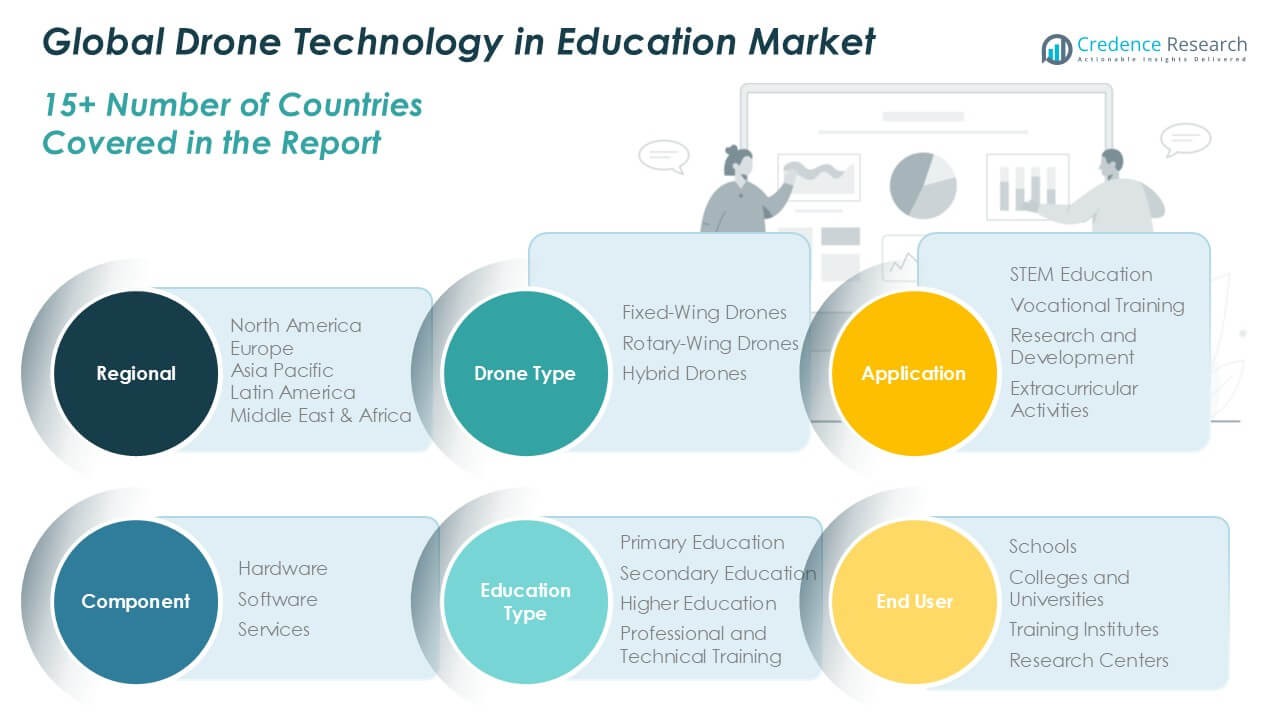

Market Segmentations:

By Drone Type

- Fixed-Wing Drones

- Rotary-Wing Drones

- Hybrid Drones

By Application

- STEM Education

- Vocational Training

- Research and Development

- Extracurricular Activities

By Component

- Hardware

- Software

- Services

By Education Type

- Primary Education

- Secondary Education

- Higher Education

- Professional and Technical Training

By End User

- Schools

- Colleges and Universities

- Training Institutes

- Research Centers

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Competitive Landscape

The global drone technology in education market is moderately consolidated, with key players such as DJI, Draganfly, Extreme Fliers, Parrot, 3DR, Action Drone, and Pix4D shaping industry growth. DJI dominates with a broad product portfolio and strong presence in both hardware and software, offering reliable classroom and training solutions. Companies like Parrot and 3DR focus on affordable, user-friendly drones suited for STEM education and extracurricular learning. Strategic partnerships with schools, universities, and training institutes remain a key growth strategy, alongside continuous innovation in lightweight hardware and AI-integrated software. Recent developments highlight efforts to improve affordability, durability, and safety features tailored to education needs, while collaborations with government programs and EdTech providers strengthen long-term competitiveness in the market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In May, 2025, Pix4D announced a strategic partnership with Vision Aerial to streamline drone mapping workflows. Customers can now access bundled solutions pairing Vision Aerial drones with Pix4D’s photogrammetry software (PIX4Dmatic, PIX4Dsurvey, PIX4Dfields, PIX4Dcloud), including a dedicated public safety bundle.

- In May 2025, Draganfly announced a strategic teaming agreement with Autonome Labs to develop and deploy an integrated UAV-based demining mesh solution (M.A.G.I.C system). Integration and field testing are planned for 2025, with pilot deployments in post-conflict regions later in the year.

Report Coverage

The research report offers an in-depth analysis based on Drone Type, Application, Component, Education Type, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily with strong adoption in STEM-focused curricula worldwide.

- Rotary-wing drones will continue to dominate due to ease of operation and lower costs.

- Hybrid drones will gain traction as institutions seek longer flight times and flexibility.

- Software and simulation platforms will expand, supporting coding and programming education.

- Vocational training institutes will adopt drones to prepare students for industry-specific careers.

- North America will retain leadership, while Asia Pacific will grow fastest with government-backed programs.

- Europe will strengthen its role through research-driven applications and vocational education.

- Partnerships between drone makers and EdTech providers will shape future innovations.

- Safety regulations and compliance frameworks will influence adoption in schools and universities.

- Advancements in AI and automation will make drones more effective for interactive learning.