| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Computer Aided Design (CAD) Software MarketSize 2024 |

USD 10,692.67 million |

| Computer Aided Design (CAD) Software Market, CAGR |

7.37% |

| Computer Aided Design (CAD) Software Market Size 2032 |

USD 19,668.83 million |

Market Overview

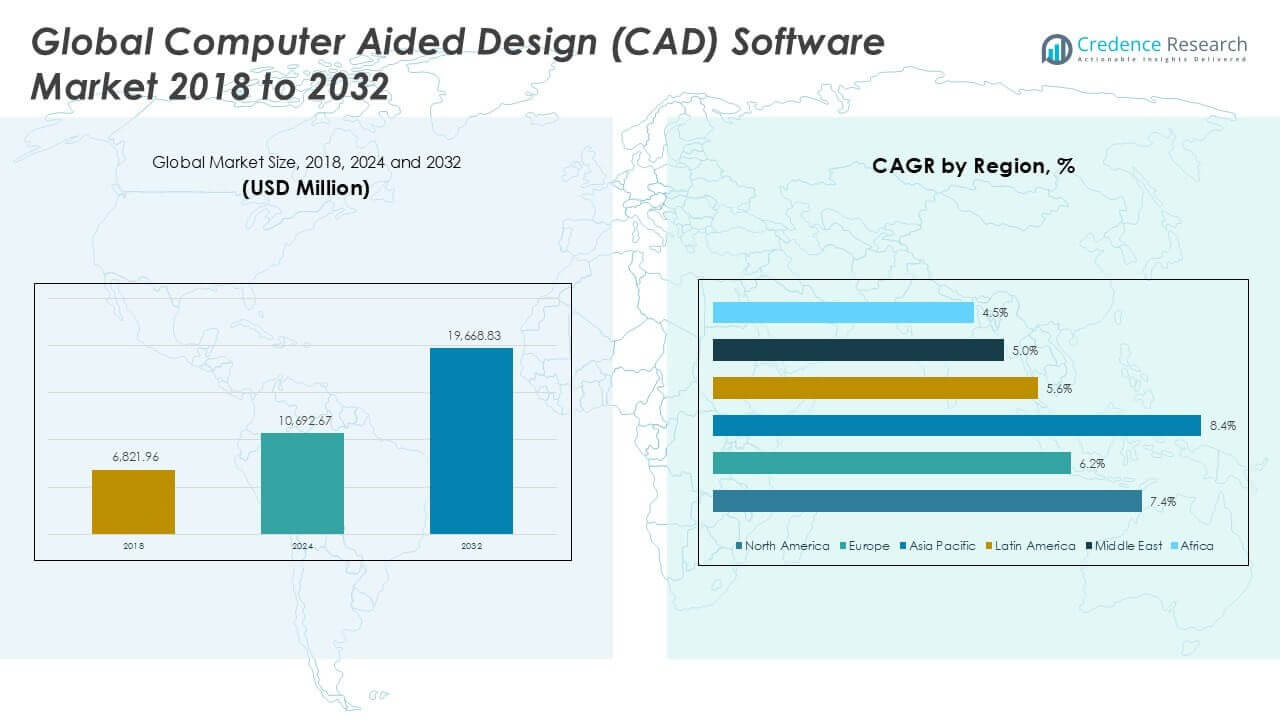

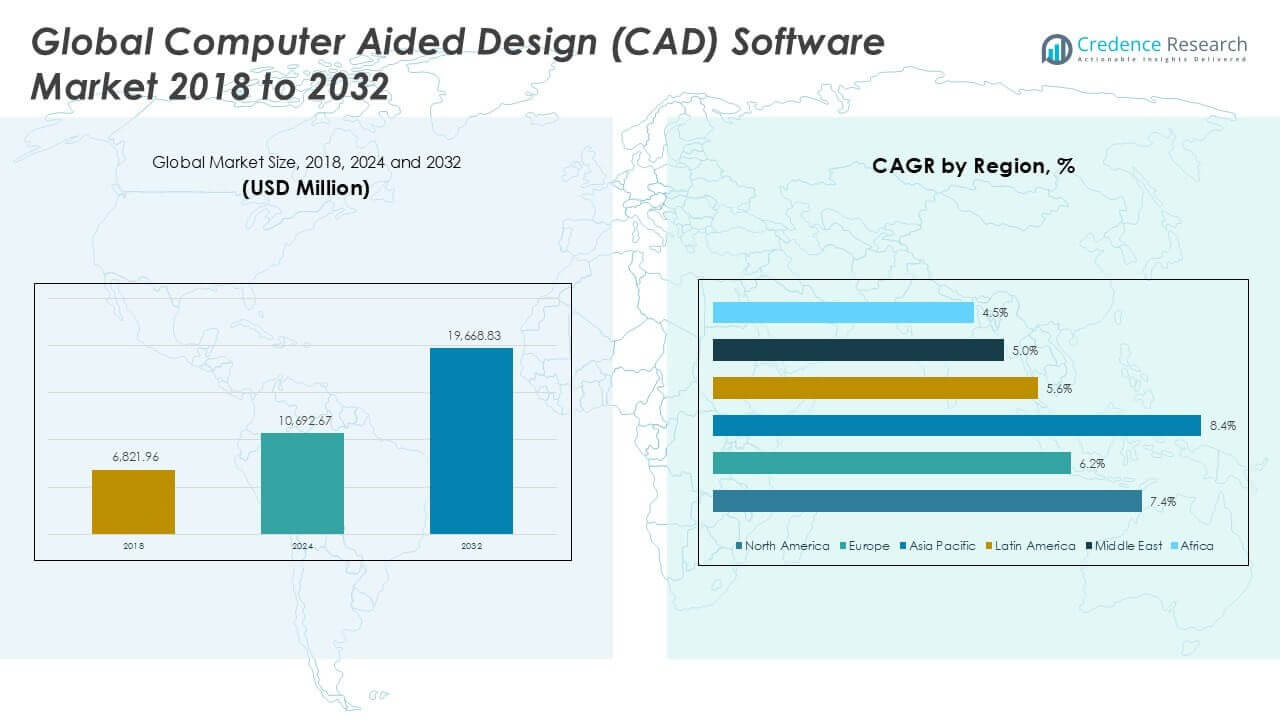

Computer Aided Design (CAD) Software Market size was valued at USD 6,821.96 million in 2018 to USD 10,692.67 million in 2024 and is anticipated to reach USD 19,668.83 million by 2032, at a CAGR of 7.37% during the forecast period.

The Computer Aided Design (CAD) Software market is driven by the accelerating adoption of digital transformation strategies across manufacturing, automotive, aerospace, and construction sectors, where precise and efficient design processes are critical. The demand for enhanced product visualization, rapid prototyping, and seamless design-to-manufacturing integration fuels market growth. Organizations seek to reduce time-to-market and minimize errors, leveraging CAD software for greater productivity and collaboration. Key trends include the shift toward cloud-based platforms and subscription-based licensing models, enabling remote access and scalable deployment. Ongoing advancements in artificial intelligence, generative design, and simulation capabilities are further expanding the scope and functionality of CAD tools. The integration of CAD solutions with IoT and other digital technologies supports real-time collaboration, data-driven insights, and automation of complex workflows. As industries pursue innovation and operational efficiency, the CAD software market continues to evolve, reinforcing its role as a foundational technology in modern product development.

The Computer Aided Design (CAD) Software Market demonstrates strong geographical presence across North America, Europe, and Asia Pacific, with rapid adoption fueled by industrial innovation and digital transformation. North America and Europe lead in advanced manufacturing and engineering applications, while Asia Pacific shows accelerated growth driven by expanding infrastructure and electronics sectors, particularly in China, Japan, and India. Latin America, the Middle East, and Africa also show increasing uptake, supported by ongoing modernization and investment in digital technologies. Major players shaping the global CAD software landscape include Autodesk, known for its robust design solutions and innovation leadership; Dassault Systèmes, offering comprehensive 3D and PLM platforms; and Siemens Digital Industries Software, which excels in industrial automation and engineering software integration. Other notable companies such as Bentley Systems and PTC further enhance market competition and technological advancement, ensuring a dynamic and evolving industry environment.

Market Insights

- The Computer Aided Design (CAD) Software Market was valued at USD 10,692.67 million in 2024 and is projected to reach USD 19,668.83 million by 2032, reflecting a CAGR of 7.37%.

- Increasing demand for efficient product development, digital transformation, and rapid prototyping is driving adoption across manufacturing, automotive, aerospace, and construction sectors.

- The market is shifting toward cloud-based platforms and subscription licensing, enabling flexible deployment, remote collaboration, and scalable solutions for businesses of all sizes.

- Integration of artificial intelligence, generative design, and IoT capabilities is expanding the scope of CAD software, supporting automation and more intelligent workflows.

- Autodesk, Dassault Systems, Siemens Digital Industries Software, and PTC are recognized as leading players, offering robust product portfolios and continuous technological innovation to maintain their competitive edge.

- High implementation costs, complex software integration, and data security concerns present significant restraints, particularly for small and medium-sized enterprises.

- North America and Europe hold strong market positions due to advanced industrial bases, while Asia Pacific is witnessing the fastest growth, driven by investment in infrastructure, manufacturing, and technology in countries such as China, Japan, and India.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Efficient Product Development and Time-to-Market Reduction

The Computer Aided Design (CAD) Software Market is experiencing significant growth due to the need for efficient product development and faster time-to-market. Organizations across manufacturing, automotive, aerospace, and construction are adopting CAD tools to streamline design processes and improve accuracy. Companies rely on CAD software to accelerate design cycles, reduce manual errors, and optimize resource allocation. Faster product launches enable firms to maintain a competitive edge and respond quickly to evolving market requirements. The ability to visualize, simulate, and iterate designs digitally drives adoption among businesses focused on innovation. CAD solutions support collaboration among distributed teams, ensuring alignment and efficiency throughout the design-to-manufacturing workflow. These factors collectively drive the market forward.

- For instance, CAD software adoption has increased across manufacturing and automotive industries, enabling companies to accelerate design cycles and reduce manual errors

Growing Adoption of Digital Transformation and Industry 4.0 Initiatives

Digital transformation and Industry 4.0 initiatives are reshaping how enterprises approach design and engineering. The CAD Software Market benefits from the integration of digital technologies, including automation, cloud computing, and smart manufacturing. Companies pursue digitalization to enhance operational efficiency and ensure data-driven decision-making. CAD software plays a crucial role in facilitating digital workflows, enabling seamless integration with other enterprise systems such as Product Lifecycle Management (PLM) and Enterprise Resource Planning (ERP). Industry 4.0 emphasizes connected processes and real-time data exchange, which elevates the value of CAD solutions in the industrial landscape. The drive for continuous process improvement increases reliance on advanced design tools.

- For instance, Industry 4.0 emphasizes connected processes and real-time data exchange, increasing reliance on CAD solutions for digital workflows.

Advancements in Cloud-Based Platforms and Subscription Licensing Models

Innovations in cloud technology and the transition to subscription-based licensing have transformed how organizations deploy and use CAD software. Cloud-based CAD solutions offer flexibility, scalability, and remote access, aligning with the needs of modern, distributed workforces. Companies favor cloud platforms for their lower upfront costs, simplified maintenance, and ability to support real-time collaboration. Subscription models make advanced design tools accessible to a broader range of businesses by reducing capital expenditure. The ongoing development of cloud-native features, including enhanced security and integration with other cloud applications, strengthens market adoption. These advancements ensure that organizations can efficiently adapt to changing business environments.

Integration with Emerging Technologies to Enable Intelligent Design

The Computer Aided Design (CAD) Software Market benefits from rapid advancements in artificial intelligence, generative design, and Internet of Things (IoT) integration. CAD platforms now deliver intelligent design assistance, automate repetitive tasks, and optimize design outputs based on simulation and real-world data. IoT integration enables real-time feedback and performance monitoring, allowing designers to create more resilient and efficient products. Companies leverage these capabilities to enhance product functionality, minimize development costs, and increase sustainability. The convergence of CAD with emerging digital technologies drives innovation and opens new opportunities for value creation. The market continues to evolve as vendors invest in advanced features and intelligent automation.

Market Trends

Shift Toward Cloud-Based Solutions and Subscription Models Accelerates Market Evolution

The Computer Aided Design (CAD) Software Market is witnessing a strong shift toward cloud-based platforms and subscription models. Organizations value the flexibility, scalability, and cost efficiency that cloud solutions provide, allowing remote teams to collaborate in real time from different locations. Subscription-based models reduce upfront investment, making advanced CAD capabilities accessible to a wider range of businesses, including small and medium enterprises. Vendors focus on enhancing security, interoperability, and integration with other cloud applications, which increases user confidence and adoption. The trend reflects the growing need for agile design processes and seamless data management. Companies also benefit from automatic updates and continuous access to the latest features.

- For instance, cloud-based CAD solutions are improving workflow efficiency by enabling real-time collaboration and secure access to design environments.

Integration of Artificial Intelligence and Generative Design Enhances Capabilities

Artificial intelligence and generative design are reshaping the functionality of CAD software, creating significant trends in the market. The CAD Software Market is leveraging AI to automate routine tasks, provide design recommendations, and enable more complex simulations. Generative design tools use algorithms to explore numerous design options, optimizing for parameters like weight, strength, and cost. These intelligent systems allow engineers to focus on higher-value tasks and drive innovation in product development. It offers designers the ability to respond to rapid changes in customer requirements and industry standards. AI-driven features continue to attract investment and development from leading software providers.

- For instance, machine learning algorithms are being used to analyze historical design data and improve simulation outcomes.

Increasing Demand for Real-Time Collaboration and Remote Work Capabilities

Real-time collaboration and remote accessibility have become essential in today’s distributed work environment. The CAD Software Market addresses these needs by introducing features that enable seamless teamwork and centralized data management. Engineers and designers can now work together across geographies, share updates instantly, and reduce project timelines. It supports version control and secure file sharing, minimizing the risk of data loss or miscommunication. Organizations gain efficiency by breaking down silos and ensuring all stakeholders remain aligned throughout the project lifecycle. The focus on improving remote work capabilities will remain prominent.

Expanding Adoption Across Diverse Industries and New Applications

The Computer Aided Design (CAD) Software Market is expanding its reach beyond traditional sectors such as automotive and manufacturing to include industries like healthcare, electronics, and consumer goods. New applications emerge in areas like medical device design, architecture, and smart infrastructure development. The market benefits from the growing need for customized and complex product designs, which require advanced modeling and simulation tools. It enables companies to accelerate innovation and maintain competitive advantages across a broader spectrum of industries. Vendors respond by developing specialized features tailored to diverse application requirements. The continued expansion of use cases is expected to shape the market’s future trajectory.

Market Challenges Analysis

Complexity of Software Implementation and User Training Limits Adoption

The Computer Aided Design (CAD) Software Market faces significant challenges due to the complexity involved in software implementation and user training. Organizations often encounter hurdles integrating CAD solutions with legacy systems and existing workflows, leading to longer deployment cycles. It demands substantial investment in user education to ensure efficient use and maximize return on investment. Skilled professionals must adapt to frequent updates and new functionalities, which can disrupt established processes. Companies with limited technical resources may struggle to keep pace with rapid technological advancements. These factors can delay adoption and hinder the full realization of software benefits across industries.

- For instance, businesses struggle with aligning digital twin technologies with outdated infrastructure, leading to operational disruptions and increased transition times.

High Costs and Data Security Concerns Impact Market Growth

High acquisition and maintenance costs present another barrier for the CAD Software Market, particularly for small and medium enterprises with limited budgets. The expense of software licenses, hardware upgrades, and ongoing support can restrict access to advanced tools. Data security and intellectual property protection remain top concerns, especially with the increasing use of cloud-based platforms. Organizations must invest in robust cybersecurity measures to safeguard sensitive design files and proprietary information. It can deter adoption for companies operating in industries with strict compliance requirements. Balancing cost efficiency with security and performance remains a persistent challenge for market participants.

Market Opportunities

Emerging Demand from New Industry Verticals Fuels Expansion

The Computer Aided Design (CAD) Software Market holds substantial opportunities in new and rapidly evolving industry verticals such as healthcare, electronics, and renewable energy. These sectors increasingly require precise modeling, simulation, and customization to meet complex product requirements and regulatory standards. The rise of medical device design, wearable technology, and smart infrastructure creates demand for specialized CAD features and interoperability with other engineering software. Companies can address unique challenges in these fields by developing tailored solutions that enhance efficiency and innovation. Expanding market reach into these high-growth industries supports diversification and long-term sustainability. Vendors can secure competitive advantages by aligning product development with industry-specific needs.

Integration with Advanced Technologies Unlocks Value Creation

Integration of CAD software with advanced technologies such as artificial intelligence, Internet of Things, and augmented reality presents significant growth opportunities. It enables organizations to optimize design processes, automate repetitive tasks, and leverage real-time data for more informed decision-making. AI-powered tools deliver intelligent design recommendations and simulation capabilities, improving speed and accuracy in product development. IoT connectivity allows for real-time monitoring and iterative improvements throughout the product lifecycle. Augmented and virtual reality expand the possibilities for immersive design reviews and remote collaboration. The ongoing convergence of CAD with these technologies creates new avenues for innovation and value creation across diverse industries.

Market Segmentation Analysis:

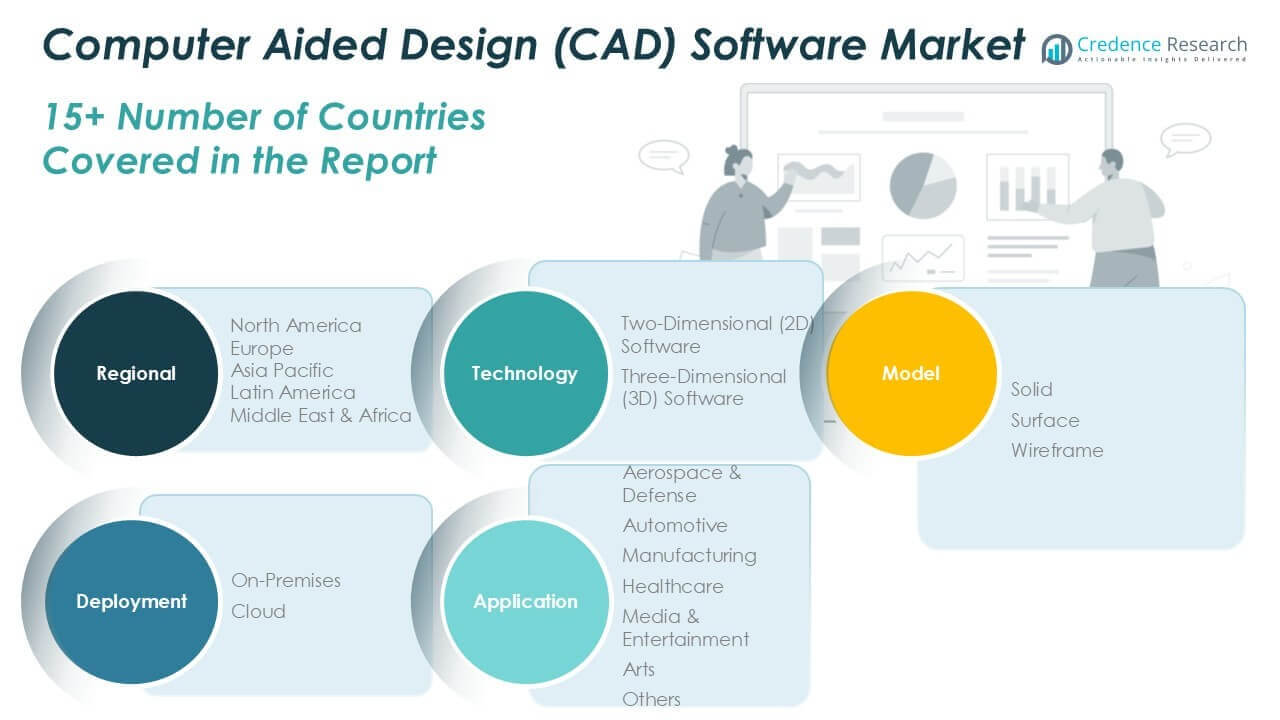

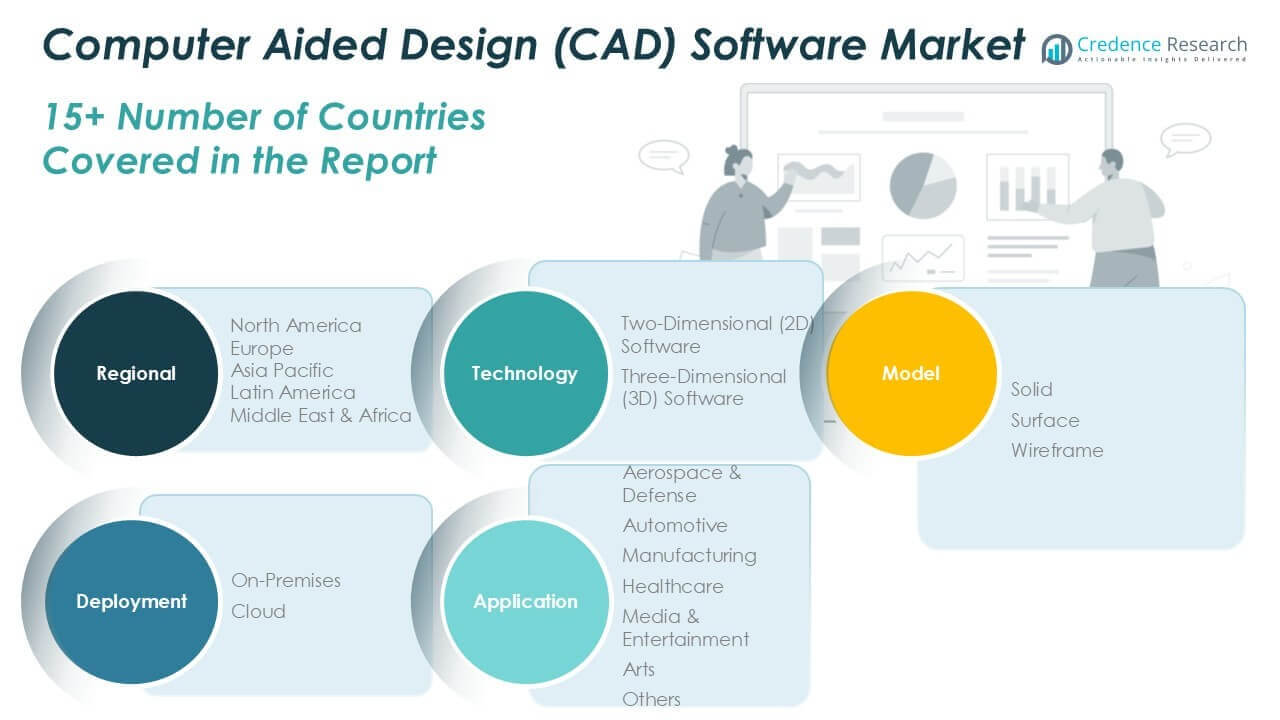

By Technology:

The Computer Aided Design (CAD) Software Market is divided into Two-Dimensional (2D) Software and Three-Dimensional (3D) Software. Two-Dimensional (2D) Software remains widely used for basic drafting, architectural layouts, and technical schematics, providing essential tools for users seeking simplicity and speed in design documentation. However, Three-Dimensional (3D) Software has gained significant traction, supported by advancements in visualization, simulation, and product modeling capabilities. It enables engineers and designers to create, analyze, and iterate complex geometries, making it the preferred choice in industries demanding precision and innovation. The shift toward 3D solutions aligns with the need for digital prototyping and integration with emerging technologies like additive manufacturing.

By Model:

The model segment comprises Solid, Surface, and Wireframe models, each offering distinct benefits tailored to specific design requirements. Solid modeling dominates the market because it provides complete volumetric information, critical for manufacturing, assembly, and engineering analysis. Surface modeling appeals to industries like automotive and aerospace, where high-quality surface finishes and aerodynamic properties are essential. Wireframe modeling, though less prevalent today, still finds applications in conceptual design and legacy system integration due to its straightforward approach. The Computer Aided Design (CAD) Software Market caters to diverse industry needs by offering robust modeling capabilities that enhance design flexibility and product accuracy.

By Deployment:

Deployment models include On-Premises and Cloud-based solutions. On-Premises deployment offers organizations control over data security, customization, and compliance, making it suitable for sectors handling sensitive intellectual property. Many large enterprises continue to prefer this model for its reliability and integration with existing IT infrastructure. Cloud-based deployment, on the other hand, has emerged as a transformative trend, driven by the need for scalability, remote collaboration, and cost efficiency. It supports real-time data access, software updates, and distributed workflows, making it highly attractive to small and medium-sized enterprises and geographically dispersed teams. The growing shift toward cloud platforms underlines the market’s responsiveness to digital transformation and changing workforce dynamics.

Segments:

Based on Technology:

- Two-Dimensional (2D) Software

- Three-Dimensional (3D) Software

Based on Model:

Based on Deployment:

Based on Application:

- Aerospace & Defense

- Automotive

- Manufacturing

- Healthcare

- Media & Entertainment

- Arts

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Computer Aided Design (CAD) Software Market

North America Computer Aided Design (CAD) Software Market grew from USD 2,711.43 million in 2018 to USD 4,201.37 million in 2024 and is projected to reach USD 7,751.90 million by 2032, reflecting a compound annual growth rate (CAGR) of 7.4%. North America is holding a 36% market share. The United States and Canada dominate regional demand, driven by early technology adoption, a strong industrial base, and continued investment in R&D. The market benefits from a high concentration of leading software vendors and robust demand from automotive, aerospace, and manufacturing sectors. Cloud-based CAD deployment is rising rapidly, supporting remote engineering teams and digital transformation strategies. Regulatory standards and intellectual property protection further reinforce market growth and technology advancement in the region.

Europe Computer Aided Design (CAD) Software Market

Europe Computer Aided Design (CAD) Software Market grew from USD 1,361.39 million in 2018 to USD 2,024.47 million in 2024 and is projected to reach USD 3,409.25 million by 2032, reflecting a CAGR of 6.2%. Europe is holding a 17% market share. Germany, the United Kingdom, and France lead regional adoption, fueled by the region’s advanced manufacturing and automotive industries. The emphasis on smart factories, precision engineering, and compliance with strict industry standards accelerates software integration. European companies focus on sustainability and product innovation, leveraging CAD tools for simulation and design optimization. The region’s diverse industrial landscape fosters ongoing investment in engineering solutions.

Asia Pacific Computer Aided Design (CAD) Software Market

Asia Pacific Computer Aided Design (CAD) Software Market grew from USD 2,145.92 million in 2018 to USD 3,536.01 million in 2024 and is projected to reach USD 7,048.03 million by 2032, reflecting a CAGR of 8.4%. Asia Pacific is holding a 36% market share. China, Japan, South Korea, and India drive rapid adoption, supported by booming manufacturing, infrastructure, and electronics sectors. The growing focus on automation and digital manufacturing underpins rising demand for advanced CAD solutions. Expanding government initiatives and increasing foreign investment in technology contribute to regional market expansion. Companies invest in cloud-based and mobile-accessible platforms to meet workforce needs.

Latin America Computer Aided Design (CAD) Software Market

Latin America Computer Aided Design (CAD) Software Market grew from USD 303.99 million in 2018 to USD 470.19 million in 2024 and is projected to reach USD 759.47 million by 2032, reflecting a CAGR of 5.6%. Latin America is holding a 4% market share. Brazil and Mexico are key countries driving adoption, with manufacturing, automotive, and construction industries investing in digital design tools. Modernization efforts and infrastructure projects support gradual market penetration. The rise of small and medium-sized enterprises encourages adoption of flexible, cloud-based solutions. Regional challenges include budget constraints and limited access to skilled professionals.

Middle East Computer Aided Design (CAD) Software Market

Middle East Computer Aided Design (CAD) Software Market grew from USD 186.51 million in 2018 to USD 266.61 million in 2024 and is projected to reach USD 411.74 million by 2032, reflecting a CAGR of 5.0%. The Middle East is holding a 2% market share. The United Arab Emirates and Saudi Arabia lead growth, supported by ambitious infrastructure development and diversification away from oil-dependent economies. The region invests in smart city projects, advanced engineering, and construction technologies, driving demand for CAD software. Government initiatives and partnerships with international technology firms play a pivotal role in expanding the regional market.

Africa Computer Aided Design (CAD) Software Market

Africa Computer Aided Design (CAD) Software Market grew from USD 112.73 million in 2018 to USD 194.02 million in 2024 and is projected to reach USD 288.44 million by 2032, reflecting a CAGR of 4.5%. Africa is holding a 2% market share. South Africa and Egypt represent the largest markets, with growth centered on construction, infrastructure, and manufacturing sectors. The adoption of CAD software is increasing as governments invest in modernization and education initiatives. Access to affordable cloud-based solutions is encouraging wider market participation. Localized training and technical support remain important for sustained growth across the continent.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Autodesk

- Dassault Systèmes

- PTC

- Siemens Digital Industries Software

- Bentley Systems

- Hexagon AB

- ZWSOFT

- Graphisoft

- Trimble

- Altium

- ANSYS

- Altair Engineering

- Bricsys

- Zuken

Competitive Analysis

The Computer Aided Design (CAD) Software Market is defined by intense competition among leading players, each leveraging robust technological capabilities and diversified portfolios to capture market share. Autodesk, Dassault Systèmes, Siemens Digital Industries Software, and PTC stand out as the most influential companies, recognized for their ongoing investments in research and development, user-friendly solutions, and strong customer support networks. Market leaders prioritize research and development to introduce advanced functionalities such as artificial intelligence, generative design, and cloud-based collaboration tools. Companies compete on the basis of software usability, integration with enterprise systems, and robust technical support. The shift toward subscription models and flexible deployment options intensifies competition, making advanced CAD solutions accessible to a broader range of customers. Strategic partnerships, regional expansions, and targeted solutions for specific industries further distinguish leading vendors in the market. Continuous investment in security, interoperability, and mobile accessibility reflects a commitment to meeting evolving client requirements. The market’s dynamic nature ensures that vendors must remain agile and responsive to technological shifts and emerging design trends to maintain their competitive advantage.

Recent Developments

- In September 2022, PTC launched a new product coined ‘Onshape-Arena Connection’, which connects Arena Solutions Product Lifecycle Management (PLM) and Onshape Product Development. This accelerates data sharing, which aids organizations to improve product development processes and maintain partnerships with supply chain partners.

- In August 2022, Autodesk launched Fusion 360 Manage with Upchain, which is an integration of acquired PLM software with the CAD solution. This enables organizations to purchase all-in-one products at a single price.

Market Concentration & Characteristics

The Computer Aided Design (CAD) Software Market demonstrates a moderate to high degree of market concentration, with a few large, established vendors dominating global revenues through broad product portfolios and continuous innovation. It features strong brand recognition and customer loyalty, supported by significant investments in research, development, and technical support. The market is characterized by high entry barriers, driven by the complexity of software development and integration requirements across multiple industries. It values interoperability, security, and seamless integration with other engineering and enterprise platforms, appealing to organizations seeking efficient digital transformation. Ongoing advances in cloud computing, artificial intelligence, and generative design further shape the competitive dynamics and product evolution in the market. Its customer base spans large enterprises, small and medium businesses, and specialized industry sectors, reinforcing its diverse application and long-term growth potential

Report Coverage

The research report offers an in-depth analysis based on Technology, Model, Deployment, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is projected to grow steadily, driven by increasing demand for advanced design solutions across various industries.

- Integration of artificial intelligence and machine learning is enhancing design automation and predictive modeling capabilities.

- Cloud-based CAD solutions are gaining traction, offering improved collaboration and accessibility for remote teams.

- The adoption of 3D CAD software is expanding, particularly in sectors like automotive, aerospace, and construction.

- Emerging technologies such as augmented reality and virtual reality are being incorporated to provide immersive design experiences.

- The Asia Pacific region is expected to witness significant growth due to rapid industrialization and infrastructure development.

- Small and medium-sized enterprises are increasingly adopting CAD tools to enhance productivity and reduce time-to-market.

- Sustainability considerations are influencing CAD software development, focusing on energy-efficient and eco-friendly design processes.

- The market is experiencing a shift towards subscription-based models, providing cost-effective solutions for users.

- Continuous innovation and strategic partnerships among key players are shaping the competitive landscape of the CAD software market.