Market Overview

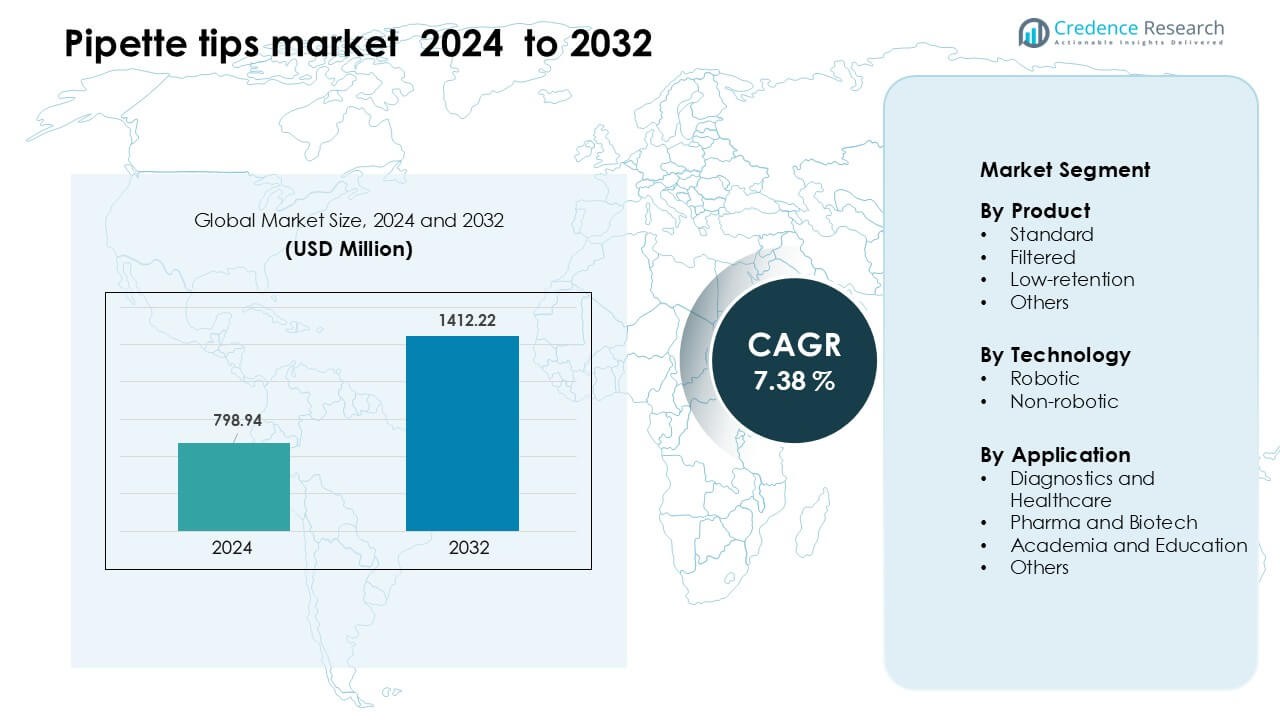

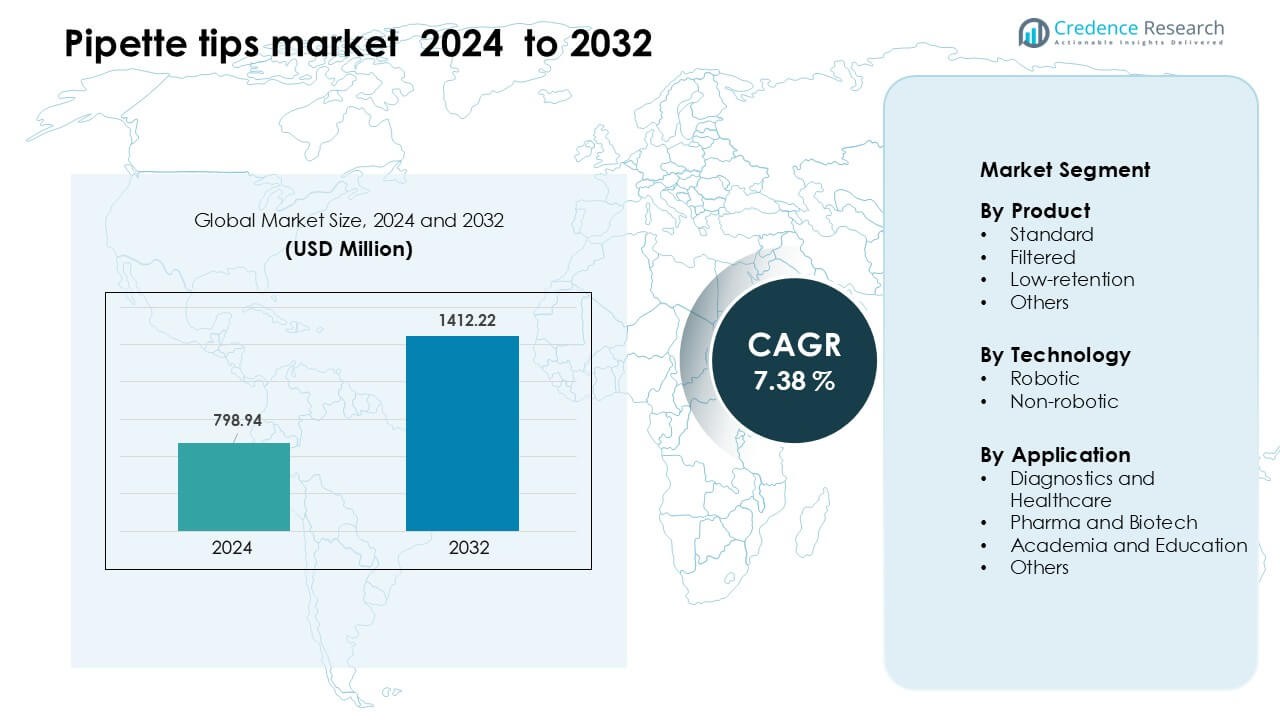

Pipette tips market was valued at USD 798.94 million in 2024 and is anticipated to reach USD 1412.22 million by 2032, growing at a CAGR of 7.38 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Pipette Tips Market Size 2024 |

USD 798.94 Million |

| Pipette Tips Market, CAGR |

7.38 % |

| Pipette Tips Market Size 2032 |

USD 1412.22 Million |

The pipette tips market is shaped by key players such as Biotix, Greiner Group AG, Sartorius, Capp, Brand GmbH, Thermo Fisher Scientific, Corning, Sarstedt, Eppendorf, and Mettler Toledo, all competing through high-precision designs, contamination-control features, and strong global supply networks. These companies support major diagnostic, biopharma, and academic workflows with standard, filtered, low-retention, and robotic-compatible tips. North America remained the leading region in 2024, capturing 37% of global market share due to its advanced laboratory infrastructure, strong automation adoption, and high testing volumes across clinical and research facilities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The pipette tips market reached USD 798.94 million in 2024 and is anticipated to reach USD 1412.22 million by 2032, growing at a CAGR of 7.38 % during the forecast period.

- Demand increased as diagnostics and biopharma R&D expanded, with standard tips holding the largest share at 46% due to high-volume lab workflows and broad compatibility.

- Low-retention and robotic-compatible tips gained traction as labs adopted automation, precision workflows, and advanced molecular testing platforms.

- Competition intensified among Biotix, Greiner Group AG, Sartorius, Capp, Brand GmbH, Thermo Fisher Scientific, Corning, Sarstedt, Eppendorf, and Mettler Toledo as firms focused on contamination control, precision molding, and supply-chain expansion.

- North America led the market with 37% share in 2024, followed by Europe at 29%, driven by strong testing capacity and well-established research infrastructure.

Market Segmentation Analysis:

By Product

Standard pipette tips held the largest share in 2024 with about 46% of the pipette tips market. Labs favored standard tips due to broad compatibility, stable supply, and lower cost for high-volume workflows. Filtered tips also grew as hospitals and biotech labs focused on contamination control during PCR and sequencing tasks. Low-retention tips expanded in advanced research labs that needed accurate handling of viscous samples. Demand across all products rose as global testing volumes increased and automation platforms required consistent tip quality.

- For instance, Thermo Fisher Scientific ClipTip standard tips use a three‑interlocking‑clip design that achieves a secure seal with minimal ejection force.

By Technology

Non-robotic pipette tips dominated the market in 2024 with nearly 63% share. These tips remained essential in routine diagnostics, academic labs, and manual research workflows where flexibility and low operating cost were priorities. Robotic tips gained traction as automated liquid-handling systems became more common in genomics and drug discovery. Growth in robotic platforms was driven by higher test throughput, reduced manual error, and stronger adoption of high-content screening. Labs invested in hybrid setups that used both manual and automated systems to manage rising sample loads.

- For instance, Thermo Fisher’s automation tips for the Eppendorf epMotion system undergo a 15‑point quality control program per lot to ensure straightness and low coefficient of variation their 300 µL automation tips are certified on the epMotion platform.

By Application

Diagnostics and healthcare led the pipette tips market in 2024 with about 41% share. Hospitals and clinical labs consumed large volumes of tips due to high daily testing activity in areas like infectious disease screening and molecular diagnostics. Pharma and biotech followed through strong R&D spending on biologics, vaccines, and cell-based studies. Academia and education contributed steady demand from teaching labs and small-scale research. Market expansion was supported by higher testing capacities, stronger biopharma pipelines, and continuous upgrades in lab infrastructure worldwide.

Key Growth Drivers

Rising Diagnostic Testing Volumes

Diagnostic testing volumes increased worldwide as hospitals and labs expanded molecular and immunology testing. This shift drove higher use of pipette tips due to their role in liquid handling during PCR, ELISA, and sequencing tasks. Growing demand for respiratory pathogen tests, oncology panels, and metabolic assays boosted consumable needs, especially in high-throughput labs. Many public health systems also strengthened surveillance programs, which raised routine testing rates. These developments pushed laboratories to maintain larger inventories of pipette tips to avoid supply gaps and support uninterrupted workflows during peak testing cycles.

- For instance, Roche reported that more than 29 billion diagnostic tests were completed with its in‑vitro diagnostic systems in 2023.

Expansion of Pharma and Biotech R&D

Pharma and biotech companies increased R&D spending as pipelines shifted toward biologics, cell therapies, and gene-based treatments. These fields require precise sample handling, which raised the use of high-quality pipette tips in research and early-stage development. Growth in screening programs, assay miniaturization, and protein engineering also expanded liquid-handling steps that rely heavily on consumables. Contract research organizations boosted procurement as outsourcing gained pace across formulation and bioassay testing. This broader industry expansion increased the need for reliable pipette tips that support accuracy, contamination control, and repeatability in sensitive experiments.

- For instance, AbCellera, a biotech company focused on antibody discovery, uses a microfluidic single‑cell screening platform that can screen more than four million individual cells per day. Their pipetting systems must handle ultra‑small volumes with high precision to support this throughput, driving demand for high‑quality, low-contamination tips.

Adoption of Lab Automation and Robotics

Automation platforms gained wider use in genomics, drug discovery, and molecular diagnostics, creating strong demand for robotic pipette tips. Automated liquid-handling systems need consistent tip dimensions, low contamination risk, and high batch uniformity, which increased consumption rates. Labs adopted automation to reduce manual error, speed sample throughput, and support large research programs with limited staff. High-throughput screening units and next-generation sequencing workflows integrated robotic tips as standard components. As automation becomes central to lab operations, recurring demand for compatible pipette tips continues to rise across research, clinical, and commercial settings.

Key Trend & Opportunity

Shift Toward Sustainable and Recyclable Consumables

Growing environmental awareness encouraged labs to explore sustainable pipette tip options made from recycled or bio-based plastics. Manufacturers responded by developing recyclable racks, energy-efficient molding processes, and reusable tip systems for select applications. Many institutions adopted green procurement policies, creating opportunities for suppliers offering low-waste designs. The trend also aligned with global efforts to reduce laboratory plastic waste, which contributes significantly to institutional material disposal volumes. This shift opened pathways for innovation in material science and drove companies to differentiate products through sustainability-focused certifications and eco-friendly manufacturing credentials.

- For instance, Eppendorf’s epT.I.P.S. BioBased pipette tips are made from 100% biobased polypropylene, derived via a mass‑balance approach from renewable sources (such as waste cooking oil).

Rising Use of High-Performance and Low-Retention Tips

Advanced research workflows increased demand for low-retention and high-precision pipette tips designed for viscous, sensitive, or low-volume samples. These tips helped labs improve accuracy in proteomics, genomics, and drug discovery tasks where minor deviations affect experimental outcomes. Growth in single-cell analysis, CRISPR research, and high-content screening created new opportunities for specialized consumables. Many companies introduced surface-treated or ultra-smooth interior designs to reduce sample loss. As labs prioritize reproducibility and high-quality outputs, premium tip categories continue to expand and offer attractive revenue potential for manufacturers.

- For instance, Eppendorf’s epTIPS Low‑Retention pipette tips feature an ultrahomogeneous and ultrahydrophobic inner surface, which helps minimize sample loss and foam formation particularly useful when handling detergents or media in single-cell or protein assays.

Integration with Smart Lab Systems and IoT Platforms

Smart laboratories adopted digital tracking systems and IoT platforms to manage consumable usage, including pipette tips. Automation software now tracks tip consumption, batch performance, and inventory levels, reducing manual oversight and preventing shortages. This shift favored suppliers capable of offering barcoded racks, RFID-enabled tracking, and compatibility with digital lab management tools. The trend also supported quality assurance initiatives by improving traceability across workflows. As more labs integrate connected systems, opportunities grow for suppliers that align consumables with smart lab infrastructure and data-driven procurement models.

Key Challenge

Volatile Raw Material Costs and Supply Chain Disruptions

Pipette tips depend heavily on high-grade plastics, and price fluctuations in polymer markets created instability for manufacturers. Supply chain disruptions, shipping delays, and sudden demand surges also affected production schedules and delivery times. Many labs experienced shortages during peak global testing periods, which exposed vulnerabilities in existing manufacturing and distribution networks. Producers invested in regional facilities to reduce import reliance, but uneven raw material availability still created issues. These factors continued to challenge pricing, inventory planning, and long-term supply reliability for both suppliers and end users.

Increasing Competition and Pressure on Pricing

The pipette tips market includes many global and regional players, which intensified competition and reduced pricing flexibility. Labs often prioritize cost efficiency for high-volume consumables, leading to frequent supplier switches and competitive bidding. Large distributors negotiated bulk contracts that pressured margins for smaller manufacturers. Counterfeit and low-quality products in some regions added further challenges by disrupting pricing and raising quality concerns. As users expect higher performance without major cost increases, manufacturers face constant pressure to balance innovation, quality assurance, and competitive pricing in a crowded marketplace.

Regional Analysis

North America

North America held the largest share of the pipette tips market in 2024, accounting for about 37% of global demand. The region benefited from strong diagnostic testing volumes, extensive biopharma R&D, and early adoption of automated liquid-handling systems. Hospitals, research institutes, and biotech companies maintained high consumable usage across genomics, clinical testing, and drug development workflows. Strong supply networks and steady investment in laboratory modernization also supported growth. Regulatory focus on quality and contamination control encouraged wider use of filtered and high-precision tips, reinforcing the region’s dominant position.

Europe

Europe accounted for nearly 29% of the pipette tips market in 2024, driven by robust laboratory infrastructure and strong clinical research activity. Genomics programs, biopharmaceutical development, and academic research centers continued to generate consistent demand for high-quality consumables. Countries such as Germany, the U.K., and France invested in expanded diagnostic capabilities, fueling higher use of both manual and robotic pipette tips. Emphasis on quality standards and contamination-free workflows supported adoption of filtered and low-retention tips. Sustainability initiatives also encouraged demand for recyclable racks and eco-friendly consumable designs across research institutions.

Asia Pacific

Asia Pacific held around 24% of the pipette tips market in 2024 and recorded the fastest growth due to expanding healthcare systems and strong biopharma investments. China, India, South Korea, and Japan increased diagnostic testing and research capacity across molecular biology and clinical labs. Contract research organizations and vaccine developers contributed to rising consumable demand. Rapid growth in academic research, automation adoption, and public health testing programs strengthened regional consumption. Competitive manufacturing capabilities also boosted local supply, lowering costs and improving availability of standard, filtered, and robotic pipette tips.

Latin America

Latin America represented nearly 6% of the pipette tips market in 2024, supported by expanding diagnostic networks and improving research infrastructure. Brazil, Mexico, and Argentina increased laboratory capacity to handle infectious disease testing, driving higher use of standard and filtered pipette tips. Growth in pharmaceutical manufacturing and university-level research further contributed to demand. However, supply chain delays and uneven access to automated systems limited broader adoption of robotic tips. Continued investment in healthcare modernization and regional manufacturing is expected to improve availability and support steady market expansion.

Middle East & Africa

Middle East & Africa captured about 4% of the pipette tips market in 2024, driven by gradual improvements in healthcare and diagnostic testing capabilities. Countries such as the UAE, Saudi Arabia, and South Africa expanded clinical laboratories and molecular diagnostics, increasing reliance on consumables. Public health programs supported steady demand for standard and filtered tips, while automation adoption remained limited to larger hospitals and research centers. Market expansion was moderated by budget constraints and import dependence, though ongoing investments in laboratory modernization and disease surveillance continue to support regional growth.

Market Segmentations:

By Product

- Standard

- Filtered

- Low-retention

- Others

By Technology

By Application

- Diagnostics and Healthcare

- Pharma and Biotech

- Academia and Education

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the pipette tips market features major companies such as Biotix, Greiner Group AG, Sartorius, Capp, Brand GmbH, Thermo Fisher Scientific, Corning, Sarstedt, Eppendorf, and Mettler Toledo leading global supply. These firms compete through high-quality consumables, broad compatibility with manual and automated systems, and strong distribution networks. Many manufacturers focus on contamination-free designs, low-retention surfaces, and robotic-ready formats to support advanced workflows in diagnostics, biopharma, and academic research. Strategic moves include expanding production capacity, streamlining global supply chains, and introducing eco-friendly materials. Continuous investment in precision molding and surface-treatment technologies strengthens product performance and helps companies defend share in a high-volume, price-sensitive consumables market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Biotix

- Greiner Group AG

- Sartorius

- Capp

- Brand GmbH

- Thermo Fisher Scientific

- Corning

- Sarstedt

- Eppendorf

- Mettler Toledo

Recent Developments

- In September 2025, Eppendorf: Announced the Research® 3 neo pipette family (next-generation mechanical pipettes) whose feature set (fast/easy volume change, low tip forces, compatibility with epT.I.P.S.) is positioned to drive renewed tip-consumption patterns and accessory demand across labs.

- In 2025, Thermo Fisher Scientific Inc. opened a new carbon-neutral, 375,000-sq-ft manufacturing facility in Mebane, North Carolina, specialising in pipette-tip production to bolster domestic supply chains.

- In 2024, Eppendorf launched epT.I.P.S.® BioBased pipette tips in bags (eco-friendly material option and new packaging format) to help labs lower environmental impact while keeping epT.I.P.S. performance and purity grades.

Report Coverage

The research report offers an in-depth analysis based on Product, Technology, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-precision and contamination-free tips will keep rising across diagnostics and genomics.

- Automation-ready robotic tips will gain wider adoption as labs expand high-throughput workflows.

- Sustainable and recyclable pipette tip materials will become a major focus for manufacturers.

- Digital tracking and smart lab systems will increase demand for barcoded and RFID-enabled consumables.

- Low-retention tips will see strong growth in proteomics, cell therapy, and advanced research workflows.

- Regional manufacturing expansion will strengthen supply stability and reduce import dependence.

- Biopharma R&D growth will drive higher consumption in screening, formulation, and assay development.

- Academic and government labs will increase adoption of premium tips for improved reproducibility.

- Competitive pricing pressure will push manufacturers to optimize production and expand automation.

- Emerging markets will see faster adoption as healthcare and research infrastructure continue to grow.