| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| 3D Animation Software Market Size 2024 |

USD 26,942.73 million |

| 3D Animation Software Market, CAGR |

12.30% |

| 3D Animation Software Market Size 2032 |

USD 68,015.16 million |

Market Overview:

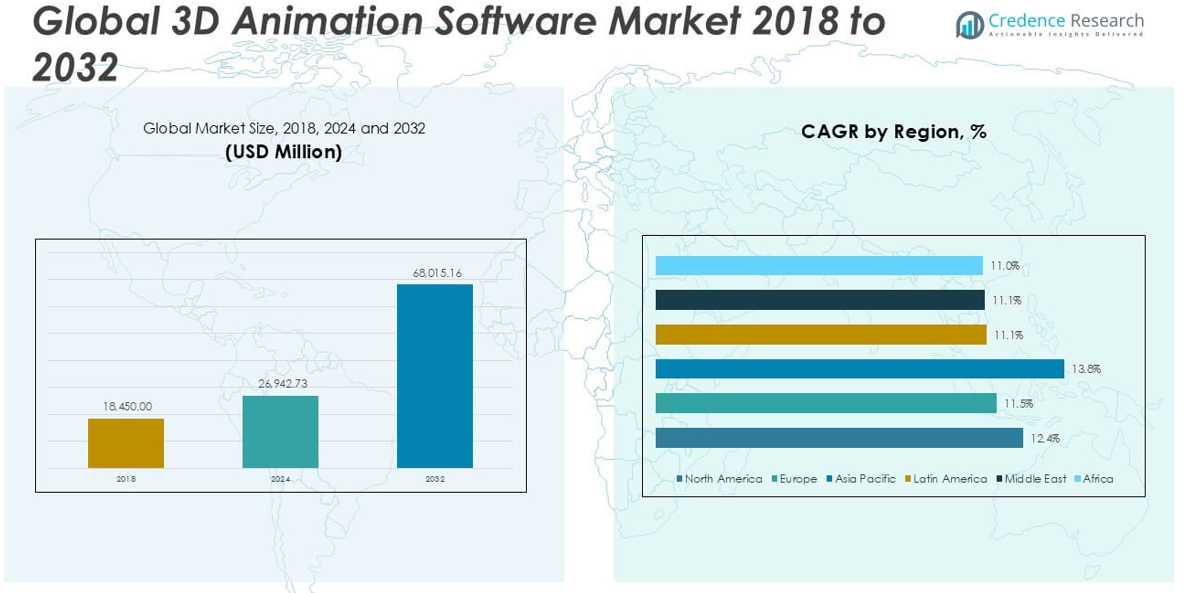

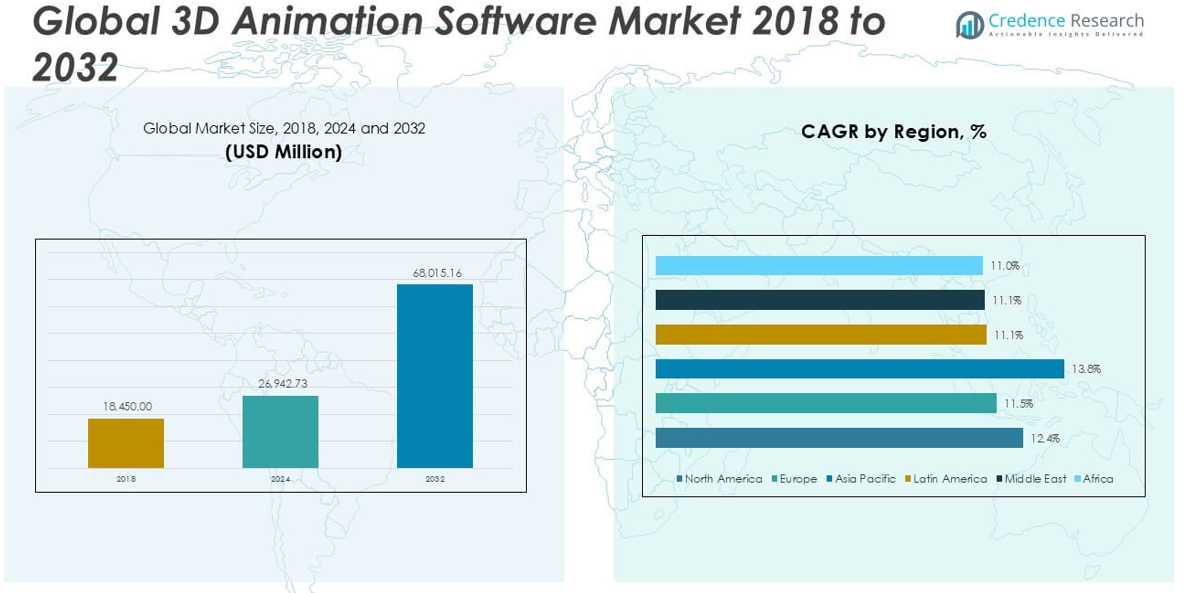

The 3D Animation Software market size was valued at USD 18,450.00 million in 2018, reached USD 26,942.73 million in 2024, and is anticipated to reach USD 68,015.16 million by 2032, at a CAGR of 12.30% during the forecast period.

The 3D Animation Software market is led by prominent players such as Adobe Systems, Autodesk Inc., Corel Corp., Toon Boom Animation Inc., Electric Image, Maxon, Corastar, Magix, NewTek, and Smith Micro Software. These companies dominate through continuous product development, cloud-based offerings, and advanced AI-driven features that cater to diverse industries including media, gaming, and education. North America holds the leading regional position, accounting for approximately 39.5% of the global market share in 2024, driven by the presence of major studios and rapid adoption of cutting-edge technologies. Europe follows, supported by strong demand for 3D content across entertainment and architecture sectors. The Asia Pacific region is emerging as the fastest-growing market due to increasing investment in gaming and digital content creation. Together, these key players and regions shape the highly competitive and technology-driven landscape of the 3D Animation Software market.

Market Insights

- The 3D Animation Software market was valued at USD 26,942.73 million in 2024 and is expected to reach USD 68,015.16 million by 2032, growing at a CAGR of 12.30% during the forecast period.

- Increasing demand for high-quality animated content in the media, entertainment, and gaming industries is a key driver boosting the adoption of advanced 3D animation tools globally.

- A notable market trend is the growing shift toward cloud-based deployment and the integration of AI and machine learning to streamline animation processes and improve creative output.

- North America leads the market with a 39.5% share in 2024, followed by Europe at 27.5% and Asia Pacific at 21.5%; the professional version segment holds the largest product type share.

- High software and hardware costs, along with a steep learning curve and limited access for small studios, continue to restrain broader adoption, particularly in developing regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

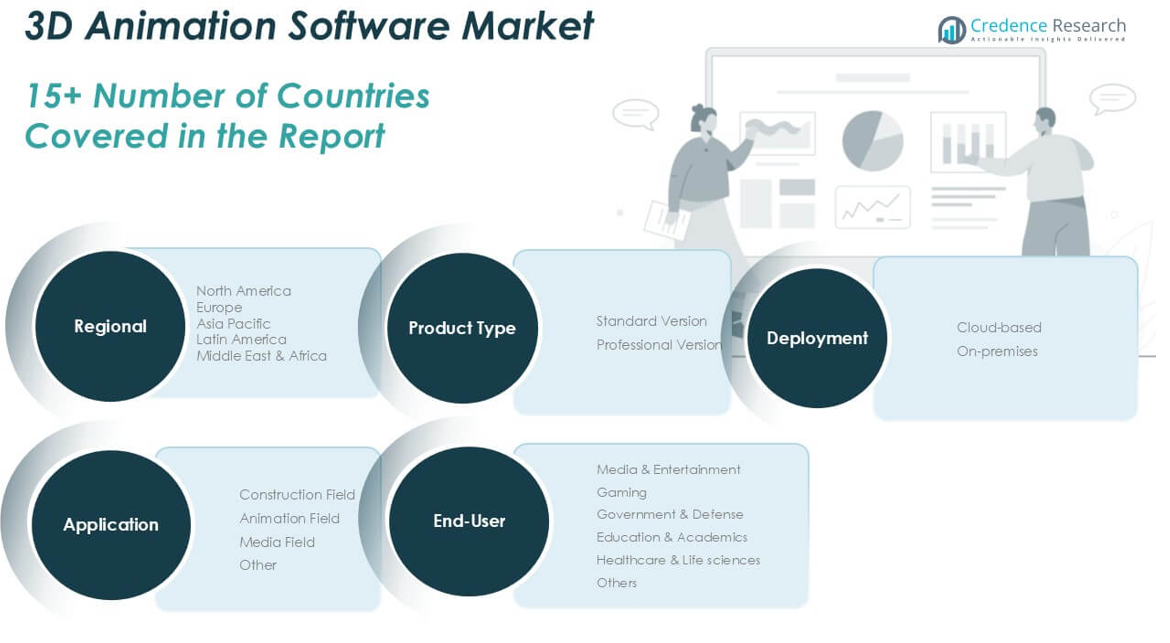

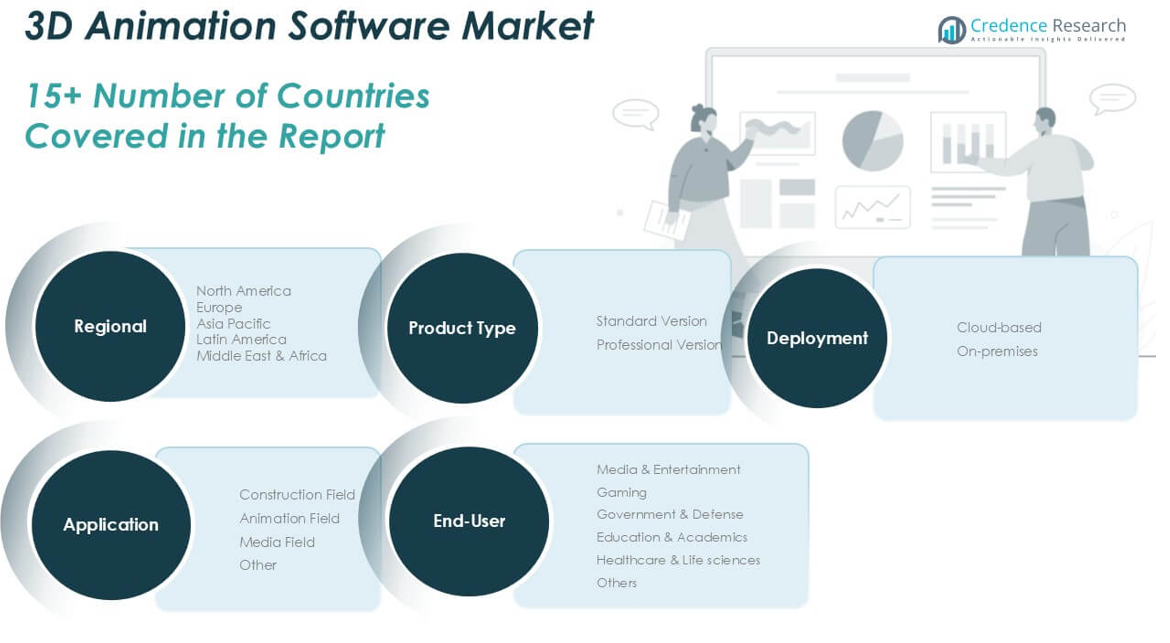

By Product Type:

In the 3D Animation Software market, the professional version segment holds the dominant market share due to its advanced capabilities, comprehensive toolsets, and high-end performance preferred by large studios and enterprises. This segment benefits from increasing demand in complex animation projects across media, entertainment, and gaming industries. The standard version, while gaining traction among small businesses and independent creators, continues to serve as an entry-level solution with limited functionalities. The growing need for photorealistic animations, enhanced visual effects, and immersive content creation drives the expansion of the professional version segment.

- For instance, Autodesk’s Maya, a leading professional software, was used in the production of over 800 feature films and television projects in the past five years, demonstrating its dominance and wide-scale adoption in complex animation environments.

By Deployment:

Cloud-based deployment leads the 3D Animation Software market, holding a significant market share driven by scalability, remote accessibility, and cost-efficiency. The flexibility to collaborate in real-time across global teams further accelerates the adoption of cloud solutions among large animation studios and creative professionals. On-premises deployment still finds relevance in organizations prioritizing data security and system control, particularly in government and defense sectors. However, the cloud-based segment is expected to witness sustained growth due to the increasing shift toward subscription-based models and the continuous advancement of cloud infrastructure.

- For instance, Adobe Creative Cloud has surpassed over 30 million paid subscribers globally by 2024, with its cloud-based 3D animation tools like Adobe Substance 3D increasingly used for real-time, cross-team collaboration.

By End-user:

The media and entertainment segment dominates the 3D Animation Software market, capturing the largest revenue share supported by the rising demand for high-quality animated films, advertisements, and television content. The gaming industry follows closely, driven by the surge in 3D game development and virtual reality integration. Government and defense, education, public sector, and healthcare segments are progressively adopting 3D animation for simulations, training, and educational purposes. The increasing use of animated visuals to enhance user engagement and communication across diverse industries continues to fuel the growth of this market.

Market Overview

Surging Demand from Media and Entertainment Industry

The growing consumption of animated content across movies, television, OTT platforms, and digital advertising significantly drives the 3D animation software market. Production studios are investing heavily in advanced tools to deliver high-quality visuals and immersive experiences. The rising popularity of VFX and 3D-rendered characters has prompted a shift toward sophisticated software solutions. Additionally, streaming platforms are commissioning animated originals at a faster pace, further fueling demand. This trend positions the media and entertainment sector as a critical catalyst in expanding the global adoption of 3D animation tools.

- For instance, Pixar used proprietary 3D animation software to produce 1,500 unique character rigs and over 18,000 individual assets for the movie Lightyear in 2022, showcasing the scale of software usage in high-end animation production.

Increased Adoption in Gaming and Virtual Reality

The gaming industry’s exponential growth, supported by evolving technologies such as AR and VR, plays a pivotal role in propelling the 3D animation software market. Developers are increasingly integrating 3D animated characters, lifelike environments, and real-time rendering to enhance player immersion. Virtual and augmented reality applications rely on accurate 3D modeling and animation, necessitating robust software tools. The demand for mobile and console-based interactive gaming content continues to rise, creating a steady need for innovative animation solutions tailored for diverse platforms and high-performance graphics.

- For instance, Unity Technologies reported that over 230,000 games were built using its real-time 3D platform in 2023 alone, with many incorporating advanced animation pipelines for AR and VR applications.

Expansion of Cloud-Based Deployment Models

The shift toward cloud-based deployment offers scalability, collaboration, and reduced IT overheads, making 3D animation tools more accessible to small and mid-sized studios. Cloud platforms support real-time rendering, multi-user collaboration, and data security, enabling global teams to work seamlessly. With the rise of remote work and freelancing in creative fields, cloud-based animation tools are becoming a preferred choice. Subscription models also make high-end features affordable, opening opportunities for startups and independent artists. This transition significantly broadens the user base and fosters continuous software adoption across industries.

Key Trends & Opportunities

Integration of AI and Machine Learning Capabilities

The integration of artificial intelligence and machine learning in 3D animation software is transforming production efficiency and creativity. AI-driven features such as automated rigging, facial animation, and predictive modeling streamline workflows and reduce time-to-market. These innovations empower animators to focus on storytelling and visual design rather than repetitive tasks. Additionally, generative AI tools are being incorporated to create lifelike textures and movements. This technological trend not only enhances animation quality but also creates opportunities for cost savings and broader adoption in non-traditional sectors like education and healthcare.

- For instance, NVIDIA’s Omniverse platform achieved the ability to simulate tens of thousands of AI-driven autonomous agents in real-time 3D environments, illustrating the scale and power of AI-integrated animation tools.

Growing Use of Animation in Non-Entertainment Sectors

Beyond entertainment, sectors such as healthcare, education, architecture, and defense are adopting 3D animation for training, simulation, and visualization. Medical professionals use animated visuals for surgical planning and patient education, while educators employ interactive content to simplify complex concepts. Architects and engineers utilize 3D visualization to present project blueprints and construction plans effectively. This cross-industry demand expands the application scope of animation software, opening new markets and revenue streams. The versatility of 3D animation creates long-term opportunities for developers to tailor solutions for specialized use cases.

- For instance, Dassault Systèmes’ 3DEXPERIENCE platform has been implemented in over 4,000 healthcare institutions globally for surgical simulation and planning, reflecting the growing reliance on 3D animation outside the entertainment sector.

Key Challenges

High Software and Hardware Costs

The initial investment required for premium 3D animation software and compatible high-performance hardware poses a major barrier for small studios and independent creators. Licensing fees, ongoing subscription costs, and the need for frequent system upgrades add to operational expenses. Advanced rendering capabilities and real-time simulation demand powerful GPUs and storage solutions, limiting affordability. These financial constraints hinder broader adoption, especially in developing markets where budget limitations restrict access to cutting-edge tools and services.

Steep Learning Curve and Skill Shortage

3D animation software often involves complex functionalities that require significant training and expertise. The steep learning curve can discourage new users and delay project timelines. Moreover, there is a global shortage of skilled animators and technical artists proficient in the latest tools and techniques. Educational institutions struggle to keep pace with industry demands, widening the talent gap. Companies must invest in training and development programs to overcome this barrier, which continues to affect production efficiency and quality output.

Software Compatibility and Integration Issues

Ensuring seamless compatibility between different animation tools, rendering engines, and production pipelines remains a persistent challenge. Studios often use a mix of software solutions, and integration issues can lead to workflow disruptions, data loss, and inefficiencies. Version mismatches, proprietary file formats, and lack of standardization hinder interoperability. These technical difficulties require ongoing investment in middleware and customized solutions, increasing complexity and costs. Addressing compatibility concerns is crucial to enable collaborative workflows and streamlined production processes across teams and platforms.

Regional Analysis

North America

North America held the largest share of the 3D Animation Software market in 2024, accounting for approximately 39.5% of the global market. The market in this region was valued at USD 7,356.02 million in 2018 and reached USD 10,640.36 million in 2024. It is projected to grow significantly, reaching USD 26,985.35 million by 2032 at a CAGR of 12.4%. The strong presence of major animation studios, increasing investment in advanced technologies, and the rapid adoption of virtual reality and gaming solutions continue to drive the North American market’s leadership position.

Europe

Europe accounted for about 27.5% of the global 3D Animation Software market share in 2024. Starting from USD 5,258.25 million in 2018, the regional market expanded to USD 7,403.12 million in 2024 and is expected to reach USD 17,600.46 million by 2032, registering a CAGR of 11.5%. The region’s growth is fueled by rising demand for 3D content in media, advertising, and architectural visualization. Strong government support for creative industries, coupled with growing investments in educational applications and simulation technologies, further contribute to the steady market expansion across Europe.

Asia Pacific

The Asia Pacific region captured approximately 21.5% of the global market share in 2024 and is poised for the fastest growth with a CAGR of 13.8%. The regional market was valued at USD 3,773.03 million in 2018, grew to USD 5,802.00 million in 2024, and is projected to reach USD 16,284.11 million by 2032. Increasing investments in gaming, rapid digital transformation, and the expansion of animation studios in countries like China, Japan, and India are major growth drivers. The region’s growing consumer base for mobile and console gaming further enhances market opportunities.

Latin America

Latin America represented around 4.4% of the 3D Animation Software market share in 2024. Valued at USD 826.56 million in 2018, the market reached USD 1,190.60 million in 2024 and is expected to grow to USD 2,732.17 million by 2032, at a CAGR of 11.0%. The region’s growth is supported by increasing adoption of 3D animation in the entertainment, education, and advertising sectors. Brazil and Mexico are emerging as key contributors, driven by growing creative industries and technological advancements that support affordable access to animation tools.

Middle East

The Middle East accounted for approximately 3.5% of the global 3D Animation Software market share in 2024. The market size increased from USD 682.65 million in 2018 to USD 932.04 million in 2024 and is forecasted to reach USD 2,148.84 million by 2032, growing at a CAGR of 11.1%. Regional growth is driven by rising investments in digital transformation, government initiatives to expand the creative economy, and the increasing popularity of 3D content in media and advertising. The growing demand for cloud-based animation solutions also supports market expansion in the Middle East.

Africa

Africa held a 3.6% market share in the global 3D Animation Software market in 2024. The market value increased from USD 553.50 million in 2018 to USD 974.60 million in 2024 and is projected to reach USD 2,264.23 million by 2032, registering a CAGR of 11.2%. The African market is gradually expanding, supported by increasing use of 3D animation in education, mobile gaming, and digital advertising. South Africa leads the regional growth, driven by government support for digital innovation and rising consumer interest in immersive content across various entertainment platforms.

Market Segmentations:

By Product Type

- Standard Version

- Professional Version

By Deployment

By End-user

- Media & Entertainment

- Gaming

- Government & Defense

- Education & Academics

- Public Sector & Utilities

- Healthcare & Life Sciences

- Others

By Application

- Construction Field

- Animation Field

- Media Field

- Others

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the 3D Animation Software market is characterized by the presence of several well-established players actively focusing on product innovation, strategic partnerships, and technological advancements to strengthen their market positions. Key companies such as Adobe Systems, Autodesk Inc., Corel Corp., and Toon Boom Animation Inc. consistently invest in enhancing software capabilities, integrating AI features, and expanding cloud-based solutions to meet evolving customer demands. Market participants are also focusing on user-friendly interfaces and real-time rendering to attract a broader customer base, including independent creators and small studios. Additionally, competitive pricing strategies and subscription-based models are becoming essential to gain market share. Mergers, acquisitions, and collaborations with gaming, film, and educational sectors are further shaping the industry dynamics. The market remains moderately fragmented, with both global and regional players competing on the basis of technological expertise, product differentiation, and customer service, creating a dynamic and rapidly evolving competitive environment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Adobe Systems

- Corel Corp.

- Autodesk Inc.

- Toon Boom Animation Inc.

- Electric Image

- Maxon

- Corastar

- Magix

- NewTek

- Smith Micro Software

Recent Developments

- In December 2023, Spaceblock introduced an innovative series of 3D animation packs based on motion capture technology, on the Unreal Engine Marketplace. This collection is poised to transform virtual gaming and live performances by delivering unmatched realism and creativity to users.

- In November 2023, DeepMotion launched MotionGPT, an innovative tool leveraging Generative AI to convert text prompts into detailed 3D animations. MotionGPT streamlines animation creation, making 3D animation accessible to a broader range of creators and industries.

- In September 2023, Adobe launched AI and 3D features in both Adobe Premiere Pro and Adobe After Effects, accompanied by enhanced storage capacities within Frame.io. These AI-driven features automate laborious tasks, enabling video editors and motion designers to realize their creative vision swiftly.

- In August 2023, NVIDIA introduced a major upgrade to its NVIDIA Omniverse platform, introducing new foundational applications and services. These additions are designed to empower developers and industrial enterprises in optimizing and improving their 3D pipelines with generative AI, and OpenUSD framework.

- In August 2023, Pixar (The Walt Disney Company), Adobe, Apple Inc., Autodesk, Inc., and NVIDIA Corporation, in collaboration with the Joint Development Foundation (JDF), a member of the Linux Foundation, jointly announced the establishment of the Alliance for OpenUSD (AOUSD). This initiative aims to standardize the 3D ecosystem and enhance the capabilities of Open Universal Scene Description (OpenUSD).

Market Concentration & Characteristics

The 3D Animation Software Market shows moderate to high market concentration, with several key players holding significant shares. It is dominated by a few global companies that consistently invest in product development, technology upgrades, and strategic partnerships to maintain their competitive edge. The market demonstrates rapid adoption of cloud-based platforms and AI-driven features, which are shaping software functionality and user preferences. Demand for real-time rendering, user-friendly interfaces, and scalable solutions continues to influence product innovation. It offers both standard and professional versions, with the professional segment commanding the largest share due to its advanced capabilities and high user demand across major industries. North America leads with the highest regional share, driven by strong technology infrastructure and the presence of leading animation studios. Europe and Asia Pacific follow, showing steady growth supported by rising digital content consumption. The market features a balanced mix of subscription and perpetual licensing models, catering to diverse user requirements.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Deployment, End-user, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The 3D Animation Software market is expected to grow steadily driven by increasing demand for high-quality visual content.

- Adoption of cloud-based animation platforms will continue to rise due to their flexibility and collaborative features.

- Integration of artificial intelligence and machine learning will streamline animation processes and improve production efficiency.

- The gaming industry will remain a major growth contributor with increasing demand for immersive 3D experiences.

- The professional version segment will continue to dominate the market due to its advanced features and industry preference.

- Asia Pacific is projected to witness the fastest growth supported by expanding gaming, media, and entertainment sectors.

- Small and mid-sized studios will increasingly adopt subscription-based software due to affordability and scalability.

- Non-entertainment sectors like healthcare, education, and construction will create new growth opportunities for 3D animation software.

- Companies will focus on enhancing real-time rendering and user-friendly interfaces to capture wider user segments.

- High initial costs and the shortage of skilled professionals will remain key challenges for market expansion.