| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Acetaminophen Market Size 2024 |

USD 9,591.65 million |

| Acetaminophen Market, CAGR |

4.33% |

| Acetaminophen Market Size 2032 |

USD 13,797.23 million |

Market Overview:

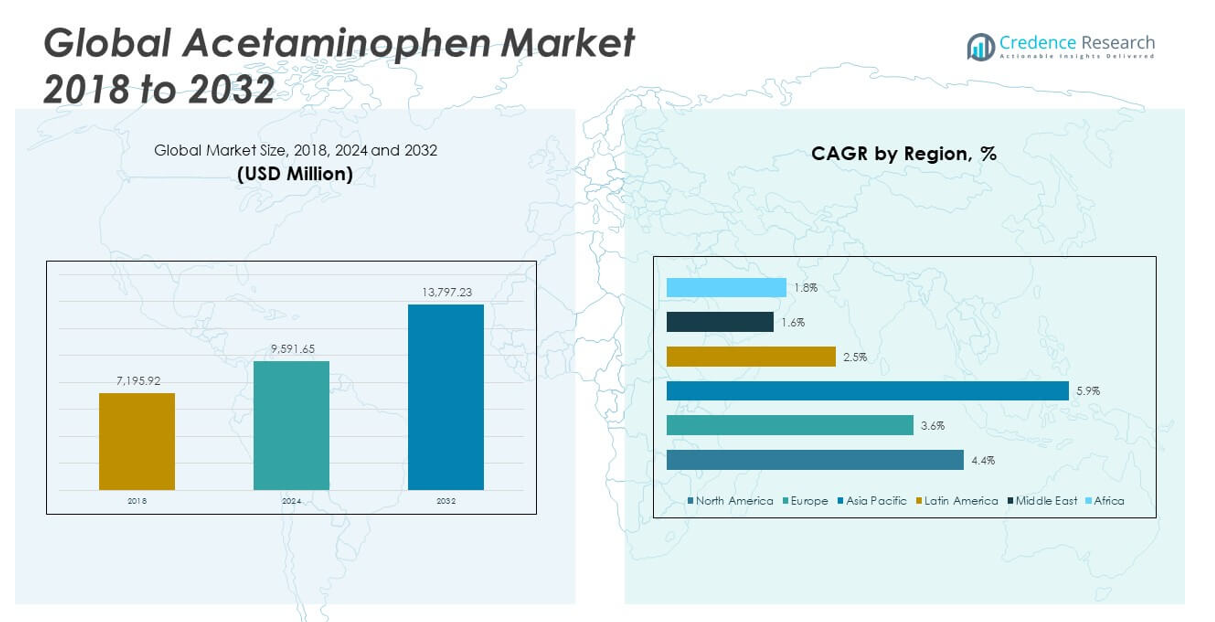

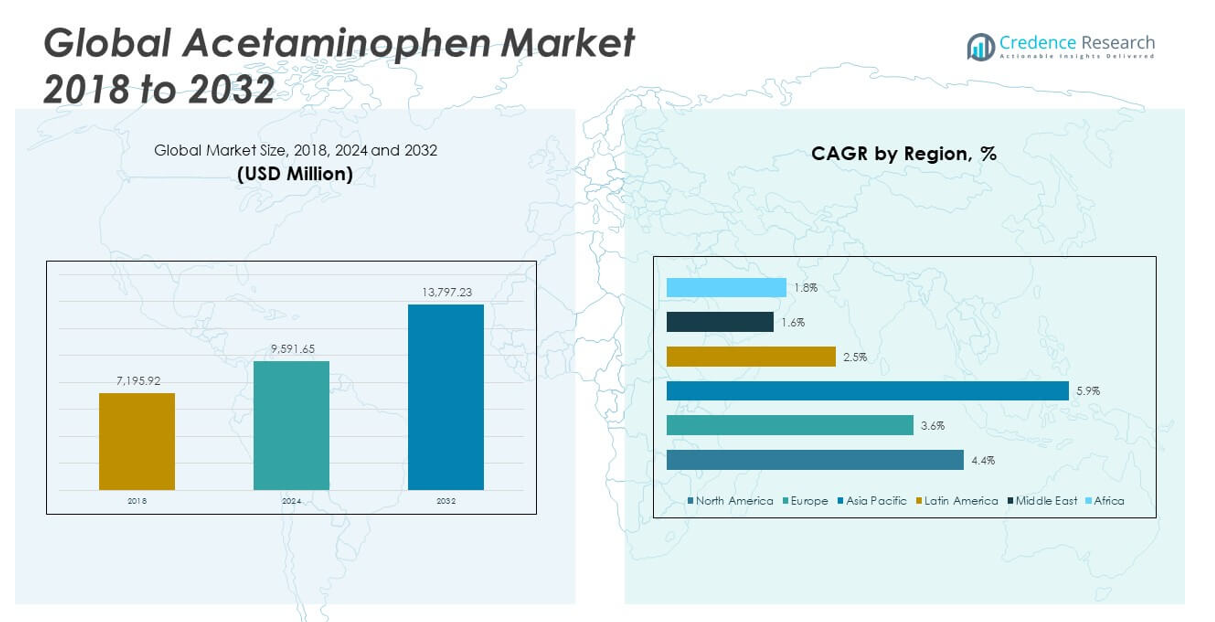

The Global Acetaminophen Market size was valued at USD 7,195.92 million in 2018 to USD 9,591.65 million in 2024 and is anticipated to reach USD 13,797.23 million by 2032, at a CAGR of 4.33% during the forecast period.

The acetaminophen market’s growth is primarily driven by the increasing prevalence of chronic pain conditions, such as osteoarthritis and back pain, which necessitate effective analgesic treatments. Additionally, acetaminophen’s favorable safety profile compared to non-steroidal anti-inflammatory drugs (NSAIDs) and opioids has bolstered its demand, especially amidst global concerns over opioid misuse. The aging global population further contributes to market expansion, as older adults are more susceptible to conditions requiring pain management. Moreover, the rise in self-medication practices, facilitated by the availability of over-the-counter (OTC) acetaminophen products, and the growth of digital healthcare platforms have enhanced accessibility and convenience for consumers, thereby supporting market growth.

Regionally, North America holds the largest market share, driven by a well-established healthcare infrastructure, high healthcare spending, and a significant prevalence of conditions such as headaches, migraines, and musculoskeletal disorders. The Asia-Pacific region is experiencing rapid growth, with countries like India and China witnessing increased demand due to expanding populations, rising healthcare awareness, and greater access to OTC medications. Europe maintains a substantial market presence, supported by a combination of strong healthcare systems and a growing geriatric population. In Latin America and the Middle East & Africa, market growth is more moderate but steady, influenced by improving healthcare access and rising awareness of pain management options

Market Insights:

- The global acetaminophen market is projected to grow from USD 7,195.92 million in 2018 to USD 9,591.65 million in 2024, reaching USD 13,797.23 million by 2032, driven by a 4.33% CAGR during the forecast period.

- Chronic pain conditions, such as osteoarthritis, back pain, and headaches, are major drivers, increasing the demand for safe, effective analgesics like acetaminophen.

- Acetaminophen’s safety profile compared to NSAIDs and opioids has boosted its demand, especially amid concerns over opioid misuse and gastrointestinal side effects associated with NSAIDs.

- The rise of self-medication and greater OTC availability has contributed to increased acetaminophen use, as consumers seek quick and accessible solutions for mild to moderate pain relief.

- An aging population, particularly in North America and Europe, is further propelling the acetaminophen market, as older adults frequently seek pain relief for chronic conditions.

- Regulatory concerns regarding acetaminophen overdose risk, particularly among vulnerable populations like children and the elderly, have led to stricter safety guidelines and labeling requirements.

- The market faces competition from NSAIDs, opioids, and natural remedies, posing challenges in regions where alternative treatments are gaining popularity due to their perceived lower side effects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Increasing Prevalence of Chronic Pain and Pain-Related Disorders

The global rise in chronic pain conditions is one of the primary drivers of the acetaminophen market. Osteoarthritis, back pain, and headaches are becoming increasingly prevalent worldwide, especially among aging populations. These conditions often require consistent pain management, creating a steady demand for over-the-counter (OTC) analgesics like acetaminophen. The global acetaminophen market benefits from its accessibility and efficacy in treating mild to moderate pain. With more individuals seeking effective pain relief solutions, acetaminophen continues to be a preferred choice due to its safety profile and over-the-counter availability. This trend reflects an ongoing shift toward non-invasive pain management options in both developed and emerging economies.

- For example, Panadol Advance® with Optizorb® technology achieves 90% dissolution within three minutes, compared to only 10–15% for more than 50 other marketed acetaminophen formulations, according to in vitro studies.

Growing Preference for Safer Pain Management Alternatives

Consumers and healthcare professionals are turning to acetaminophen due to its relatively mild side effects compared to non-steroidal anti-inflammatory drugs (NSAIDs) and opioids. The rising concerns over the misuse and dependency associated with opioids have led to an increased preference for acetaminophen. It is seen as a safer alternative for treating conditions like headaches, fevers, and muscle pain, with fewer risks of gastrointestinal issues and cardiovascular complications compared to NSAIDs. The market for acetaminophen benefits from the growing awareness of these risks, positioning it as a more reliable and less harmful option for pain management. This demand is particularly strong in regions with rising health consciousness, where the safety of pain relievers is a significant factor in consumer choice.

- For example, Sinew Pharma has recently completed clinical trials for SNP-810 (SafeTynadol), a new acetaminophen pain reliever, demonstrating high liver safety even at daily doses of 4 to 12 grams three times the currently allowable dosage without clinically significant liver toxicity or serious adverse reactions among 48 subjects.

Expansion of the Self-Medication Trend and OTC Accessibility

The trend towards self-medication is gaining momentum globally, fueled by the increasing availability of acetaminophen in pharmacies and online platforms. Many consumers are opting for self-diagnosis and treatment of minor ailments like headaches, fever, and mild muscle pain, which contributes to the demand for OTC medications. The global acetaminophen market benefits from widespread accessibility, with most consumers able to purchase it without a prescription. Its easy availability in pharmacies, supermarkets, and online platforms enhances its convenience. In addition, consumer confidence in acetaminophen’s safety, due to its long-standing reputation as a non-prescription pain reliever, further drives its use in self-care practices.

Rising Geriatric Population and Increasing Healthcare Awareness

The aging population globally is contributing to the growth of the acetaminophen market. Older adults commonly suffer from chronic pain, arthritis, and other age-related conditions that require regular pain relief. Acetaminophen serves as an ideal solution for managing such conditions without the added complications associated with stronger prescription medications. In regions with rapidly aging populations, like North America and Europe, demand for acetaminophen is particularly high. Healthcare awareness has also been increasing globally, and with better education, more individuals are seeking effective, safer options for pain relief. This heightened awareness is encouraging a shift towards acetaminophen for everyday pain management.

Market Trends:

Rising Consumer Preference for OTC Products Over Prescription Medications

The global acetaminophen market is witnessing a trend toward increasing consumer preference for over-the-counter (OTC) products rather than prescription medications. This shift is driven by the growing desire for convenience, accessibility, and affordability. Acetaminophen, widely available in pharmacies and online, is often the first choice for individuals seeking pain relief without the need for a doctor’s visit. As self-medication becomes more common, especially for minor conditions like headaches and fever, the demand for acetaminophen-based OTC solutions continues to rise. Consumers are prioritizing easily accessible, cost-effective, and familiar medications that can be purchased without a prescription, making acetaminophen a favored option in the pain relief segment.

Development of New Formulations and Delivery Methods

Innovation in product formulations and delivery methods is another significant trend impacting the global acetaminophen market. Manufacturers are increasingly focusing on developing new formulations that enhance the drug’s effectiveness and ease of use. These innovations include extended-release formulations, liquid gels, and effervescent tablets, which provide faster relief or longer-lasting effects. Such advancements appeal to consumers seeking more efficient ways to manage pain with minimal disruption to their daily routines. These new delivery methods aim to cater to specific consumer preferences and offer more convenient options, further expanding acetaminophen’s market potential.

- For example, Johnson & Johnson’s Tylenol® Rapid Release Gels, for instance, utilize unique laser-drilled holes in each gelcap to accelerate the release of 500 mg acetaminophen, providing faster onset of pain relief compared to conventional tablets.

Expansion of Global Distribution Networks

The growth of global distribution networks is playing a crucial role in the expansion of the acetaminophen market. Manufacturers are increasingly targeting emerging markets in Asia-Pacific, Latin America, and Africa, where healthcare access is improving and demand for OTC medications is growing. By expanding their reach into these regions, companies are capitalizing on new consumer bases and gaining market share in regions where pain management solutions have historically been underutilized. The globalization of distribution channels, combined with rising income levels and healthcare accessibility in developing regions, has facilitated the wider availability of acetaminophen, thereby supporting its market growth.

Shift Toward Multi-Symptom Relief Products

A growing trend in the global acetaminophen market is the shift toward multi-symptom relief products. Consumers are increasingly drawn to medications that address multiple symptoms simultaneously, such as pain, fever, and congestion. Acetaminophen, often combined with other active ingredients like decongestants or antihistamines, has become a popular choice for these combination products. This trend is particularly prevalent during the cold and flu season, when consumers seek efficient remedies for a range of symptoms. By diversifying their product offerings, manufacturers can cater to broader consumer needs, expanding acetaminophen’s role in the treatment of various health conditions.

- For example, Rite Aid’s Multi-Symptom Cold and Flu Relief Daytime capsules contain 325 mg acetaminophen, 10 mg dextromethorphan HBr, and 5 mg phenylephrine HCl per capsule, specifically targeting pain, cough, and nasal congestion in a single dose.

Market Challenges Analysis:

Regulatory Challenges and Risk of Overdose

One of the significant challenges facing the global acetaminophen market is the growing concern over the risk of overdose and its associated health complications. Acetaminophen, while widely considered safe when used as directed, poses a substantial risk when consumed in excess, leading to liver damage or failure. The increasing availability of acetaminophen in OTC formulations has raised concerns about unintentional overdosing, especially among vulnerable populations like children and the elderly. Regulatory bodies across different regions are imposing stricter guidelines and labeling requirements to mitigate these risks, such as limiting the maximum dosage in a single tablet or enforcing clearer warnings on packaging. These regulations, while essential for consumer safety, can also impact product development and distribution processes, creating challenges for manufacturers in ensuring compliance with varying regional standards.

Competition from Alternative Pain Relief Options

The global acetaminophen market faces stiff competition from alternative pain relief options, including non-steroidal anti-inflammatory drugs (NSAIDs), opioids, and natural remedies. NSAIDs, like ibuprofen and aspirin, offer similar pain-relieving benefits and are often preferred by consumers for conditions involving inflammation. Although acetaminophen is generally considered safer for certain populations, its efficacy in treating inflammatory pain is limited compared to NSAIDs. Furthermore, the rise of alternative pain management options, including natural and herbal remedies, continues to pose a challenge to acetaminophen’s dominance in the market. This increased competition may limit acetaminophen’s growth opportunities, especially in regions where alternative treatments are gaining popularity due to their perceived lower side effects or natural composition.

Market Opportunities:

Expansion in Emerging Markets

The global acetaminophen market presents significant opportunities for growth in emerging markets, where increasing urbanization, rising healthcare awareness, and improving economic conditions are driving the demand for OTC medications. In regions such as Asia-Pacific, Latin America, and Africa, the growing middle class is contributing to a higher consumption of pain relief products like acetaminophen. These markets offer substantial untapped potential, as more consumers seek affordable and accessible solutions for common ailments like headaches, fever, and muscle pain. Manufacturers can capitalize on this trend by expanding their distribution networks, localizing their product offerings, and educating consumers about the benefits and safety of acetaminophen.

Innovation in Product Formulations and Delivery Methods

The global acetaminophen market also has opportunities in product innovation, particularly in developing new formulations and delivery methods. Consumers are increasingly looking for convenience and faster relief, which presents opportunities for manufacturers to create extended-release formulations, effervescent tablets, or liquid gels. These innovations not only cater to evolving consumer preferences but also enhance the product’s effectiveness and appeal. Companies that invest in these advancements can differentiate their brands in a competitive market and attract a broader range of consumers seeking more personalized and efficient pain management solutions.

Market Segmentation Analysis:

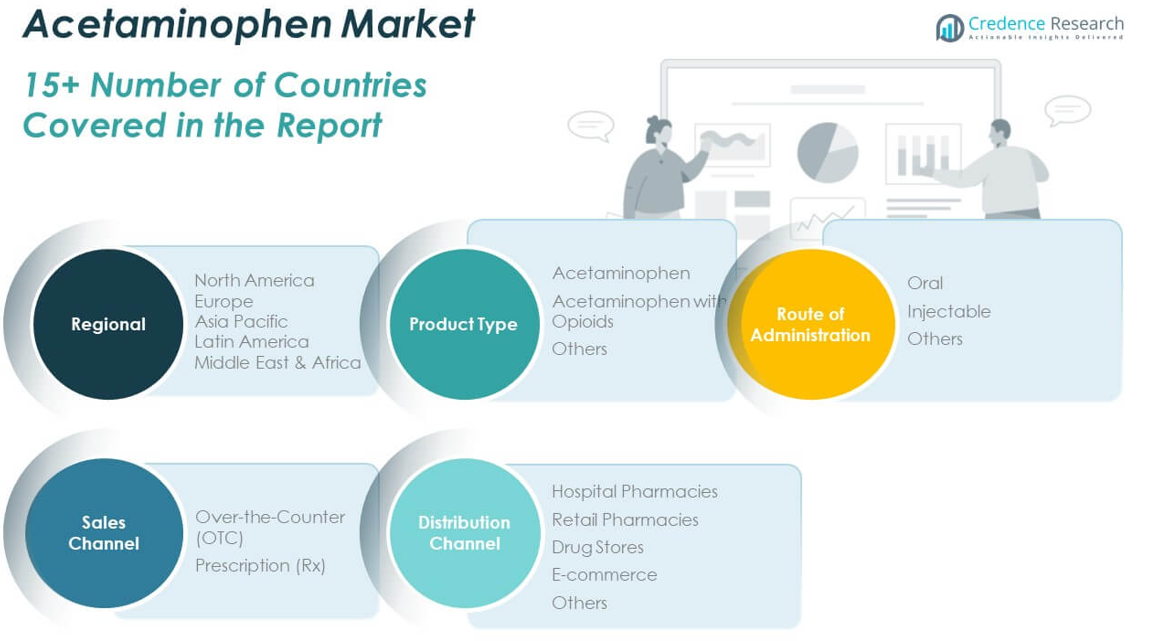

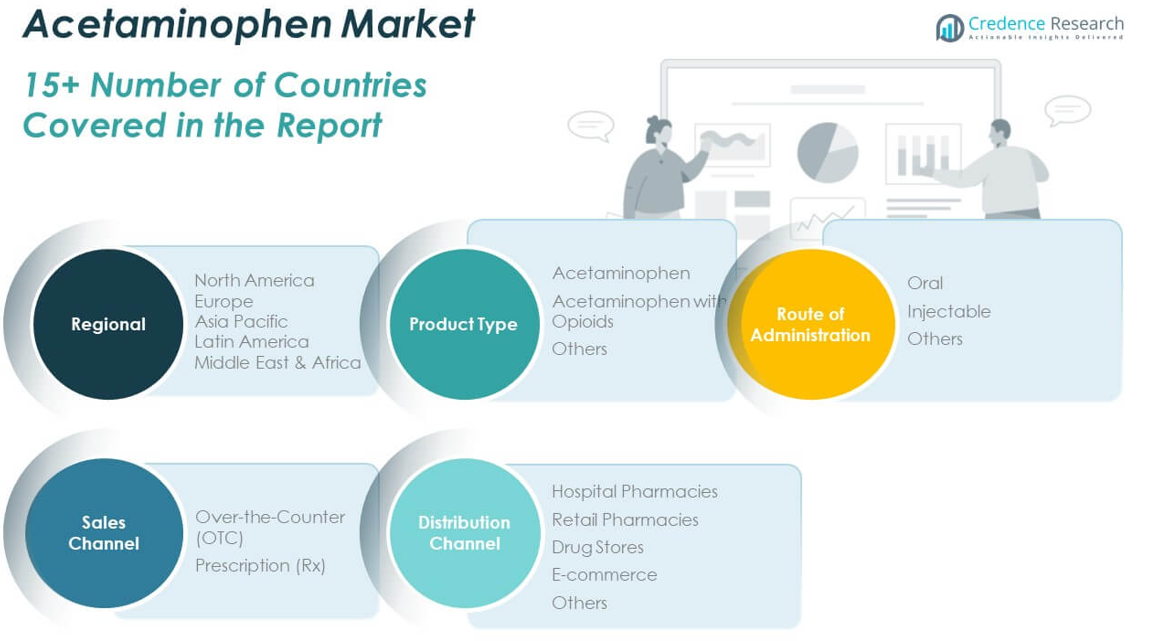

The global acetaminophen market is segmented into various categories based on product type, route of administration, sales channel, and distribution channel, which drive its market dynamics.

By Product Type, the market includes acetaminophen alone, acetaminophen combined with opioids, and others. Acetaminophen is widely preferred for its pain-relieving and fever-reducing properties. The combination with opioids offers enhanced efficacy for severe pain, while other formulations cater to specific consumer needs.

- For example, Maxigesic® by AFT Pharmaceuticals combines 500 mg acetaminophen with 150 mg ibuprofen per tablet, offering dual-action pain relief. According to AFT’s 2024 Annual Report and FDA filings, it is approved in over 50 countries and generates over NZD 40 million in annual sales.

By Route of Administration, the market is categorized into oral, injectable, and others. Oral acetaminophen products dominate the market due to their convenience and ease of use. Injectable acetaminophen is growing in popularity in clinical settings, especially for patients requiring immediate pain relief. Other routes, such as topical or rectal, contribute minimally but offer alternatives for specific medical conditions.

By Sales Channel, the market includes Over-the-Counter (OTC) and Prescription (Rx) options. OTC acetaminophen products hold a significant share due to their accessibility and consumer preference for self-medication. Prescription acetaminophen is generally prescribed for more severe pain conditions.

By Distribution Channel, the market is segmented into hospital pharmacies, retail pharmacies, drug stores, e-commerce, and others. Hospital pharmacies and retail pharmacies dominate, though e-commerce has seen significant growth, particularly with the rise of online pharmaceutical sales. The global acetaminophen market benefits from this multi-channel distribution strategy, expanding its consumer base.

- For instance, Ofirmev® (Mallinckrodt Pharmaceuticals) is an intravenous acetaminophen used for pain management in surgical and acute care settings, and is stocked in over 2,000 U.S. hospitals according to Mallinckrodt’s annual reports and product documentation

Segmentation:

By Product Type

- Acetaminophen

- Acetaminophen with Opioids

- Others

By Route of Administration

By Sales Channel

- Over-the-Counter (OTC)

- Prescription (Rx)

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Drug Stores

- E-commerce

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America global acetaminophen market size was valued at USD 2,896.00 million in 2018, growing to USD 3,816.66 million in 2024, and is anticipated to reach USD 5,506.68 million by 2032, at a CAGR of 4.4% during the forecast period. North America holds a significant market share due to the high demand for OTC medications, driven by an aging population and the prevalence of chronic pain conditions. The region benefits from well-established healthcare infrastructure, widespread consumer awareness, and the availability of a wide range of acetaminophen-based products. The U.S. market dominates, supported by high healthcare spending and a large consumer base seeking efficient pain relief solutions. The demand for multi-symptom relief products also boosts market growth in this region, as consumers prefer convenient, all-in-one solutions for managing pain, fever, and other common ailments.

Europe

The Europe global acetaminophen market size was valued at USD 2,284.34 million in 2018, increasing to USD 2,946.77 million in 2024, and is projected to reach USD 4,018.07 million by 2032, at a CAGR of 3.6%. Europe accounts for a significant portion of the market, driven by an aging population and increasing healthcare awareness. Countries such as Germany, the UK, and France are key contributors to market growth, with acetaminophen widely available in pharmacies and online platforms. Consumers in Europe prefer acetaminophen for mild to moderate pain relief, particularly due to its safety profile compared to NSAIDs. The market is also influenced by growing concerns over the environmental impact of packaging, leading to an increased demand for eco-friendly acetaminophen products in the region.

Asia Pacific

The Asia Pacific global acetaminophen market size was valued at USD 1,420.83 million in 2018, growing to USD 2,048.63 million in 2024, and is projected to reach USD 3,328.24 million by 2032, at a CAGR of 5.9%. The region shows the highest growth potential due to rapid urbanization, improving healthcare access, and rising disposable incomes. Emerging markets like China and India are experiencing increased demand for OTC medications, driven by the prevalence of pain-related disorders and the convenience of acetaminophen. The expanding middle class and rising healthcare awareness further support the market expansion. The availability of acetaminophen through various distribution channels, including e-commerce, has contributed to its growing market penetration in the region.

Latin America

The Latin America global acetaminophen market size was valued at USD 297.48 million in 2018, increasing to USD 390.89 million in 2024, and is projected to reach USD 488.32 million by 2032, at a CAGR of 2.5%. The market in Latin America is experiencing steady growth due to improvements in healthcare access, a growing population, and increasing awareness of pain management solutions. Brazil, Mexico, and Argentina are key contributors to the market, where acetaminophen is commonly used for pain relief and fever reduction. While the market is smaller compared to North America and Europe, it presents opportunities for expansion, especially with the rise of e-commerce platforms and increased access to OTC medications.

Middle East

The Middle East global acetaminophen market size was valued at USD 168.74 million in 2018, increasing to USD 201.84 million in 2024, and is anticipated to reach USD 235.15 million by 2032, at a CAGR of 1.6%. Market growth in the Middle East is slow but steady, driven by increasing urbanization, improving healthcare access, and rising consumer awareness of OTC pain relief products. Saudi Arabia, the UAE, and other Gulf Cooperation Council (GCC) countries play a central role in market growth, with acetaminophen widely available in pharmacies and online. The region also sees a growing preference for pain relief solutions that cater to multiple symptoms, which further supports the demand for acetaminophen-based combination products.

Africa

The Africa global acetaminophen market size was valued at USD 128.52 million in 2018, growing to USD 186.86 million in 2024, and is projected to reach USD 220.77 million by 2032, at a CAGR of 1.8%. Africa’s acetaminophen market remains smaller in comparison to other regions, but it is expected to grow gradually due to increasing healthcare access and rising demand for affordable pain relief solutions. The expansion of distribution networks, particularly in countries like South Africa and Nigeria, is driving market growth. The rising prevalence of common ailments like headaches, fever, and muscle pain, coupled with the growing middle class, offers opportunities for manufacturers to increase market penetration in this region. However, challenges such as economic instability and limited healthcare infrastructure may slow growth in certain countries.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Janssen Pharmaceuticals (Johnson & Johnson)

- Bayer AG

- GlaxoSmithKline plc

- Bristol-Myers Squibb and Company

- Pfizer Inc.

- Sanofi

- Perrigo Company

- Novartis AG

- Sun Pharmaceutical Industries Ltd

- Teva Pharmaceutical Industries Ltd

Competitive Analysis:

The global acetaminophen market is highly competitive, with key players dominating the landscape through both brand recognition and extensive distribution networks. Major pharmaceutical companies like Johnson & Johnson, Pfizer, and GlaxoSmithKline are leading the market, offering well-known acetaminophen brands such as Tylenol and Panadol. These companies leverage strong global distribution channels, including retail pharmacies and e-commerce platforms, to maintain market dominance. Generic brands from regional manufacturers also contribute significantly to market competition, offering cost-effective alternatives to branded products. The competition in the market is further intensified by the growing preference for combination pain relief products and innovative delivery methods such as liquid gels and extended-release formulations. With increasing demand in emerging markets and ongoing product innovation, companies in the global acetaminophen market must continue to focus on regulatory compliance, safety, and sustainability to differentiate themselves from competitors and expand their market share.

Recent Developments:

- In June 2025, Kenvue, the makers of Tylenol®, announced the launch of Tylenol® Proactive Support, a new drug-free supplement designed to support joint comfort and mobility using a proprietary TamaFlex® blend of turmeric and tamarind, expanding the Tylenol® brand into the supplement space for the first time.

- In April 2025, Elite Pharmaceuticals launched its generic version of Percocet® (oxycodone hydrochloride and acetaminophen tablets) in strengths of 5mg/325mg, 7.5mg/325mg, and 10mg/325mg, targeting the moderate to moderately severe pain market, which had 2024 annual U.S. sales of approximately $317 million according to IQVIA.

- In March 2024, Johnson & Johnson’s Janssen Pharmaceuticals announced the U.S. FDA approval of OPSYNVI® (macitentan and tadalafil), the first and only once-daily single-tablet combination therapy for pulmonary arterial hypertension. While not directly an acetaminophen product, this approval demonstrates the company’s continued innovation in combination therapies and its strong regulatory momentum in 2024.

Market Concentration & Characteristics:

The global acetaminophen market is characterized by moderate concentration, with a mix of dominant multinational pharmaceutical companies and regional players. Leading global brands such as Tylenol (Johnson & Johnson) and Panadol (GlaxoSmithKline) maintain a strong market presence due to their established reputations, broad distribution networks, and extensive consumer trust. While large companies hold a significant share, numerous generic manufacturers contribute to the market’s fragmentation by offering lower-priced alternatives. The market is also influenced by increasing demand for OTC products, product innovations, and growing access to online platforms. Companies are focusing on differentiating their offerings through enhanced delivery methods, eco-friendly packaging, and multi-symptom relief products. Despite the dominance of major players, the presence of regional and generic brands creates a competitive environment, with price sensitivity being a key factor influencing consumer choice in many markets.

Report Coverage:

The research report offers an in-depth analysis based on product type, route of administration, sales channel, and distribution channel, It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The global acetaminophen market is expected to continue growing at a steady pace, driven by increasing demand for OTC pain relief products.

- Emerging markets, especially in Asia-Pacific and Latin America, will contribute significantly to market expansion due to rising healthcare access and consumer awareness.

- Innovation in product formulations, such as extended-release tablets and liquid gels, will cater to evolving consumer preferences for faster and longer-lasting pain relief.

- The aging population in developed regions will increase the demand for acetaminophen as a safer pain management solution.

- The rising trend of self-medication will further boost the use of acetaminophen, especially for minor ailments like headaches and fever.

- Manufacturers will focus on eco-friendly packaging solutions to meet growing consumer demand for sustainable products.

- Online pharmacies and e-commerce platforms will expand their reach, making acetaminophen more accessible globally.

- Regulatory pressure regarding safe usage and overdose risks will lead to clearer labeling and stricter guidelines.

- Competition from alternative pain relief options, like NSAIDs and natural remedies, will remain a challenge.

- The growing focus on combination products will drive product diversification and cater to broader consumer needs.