Market Overview

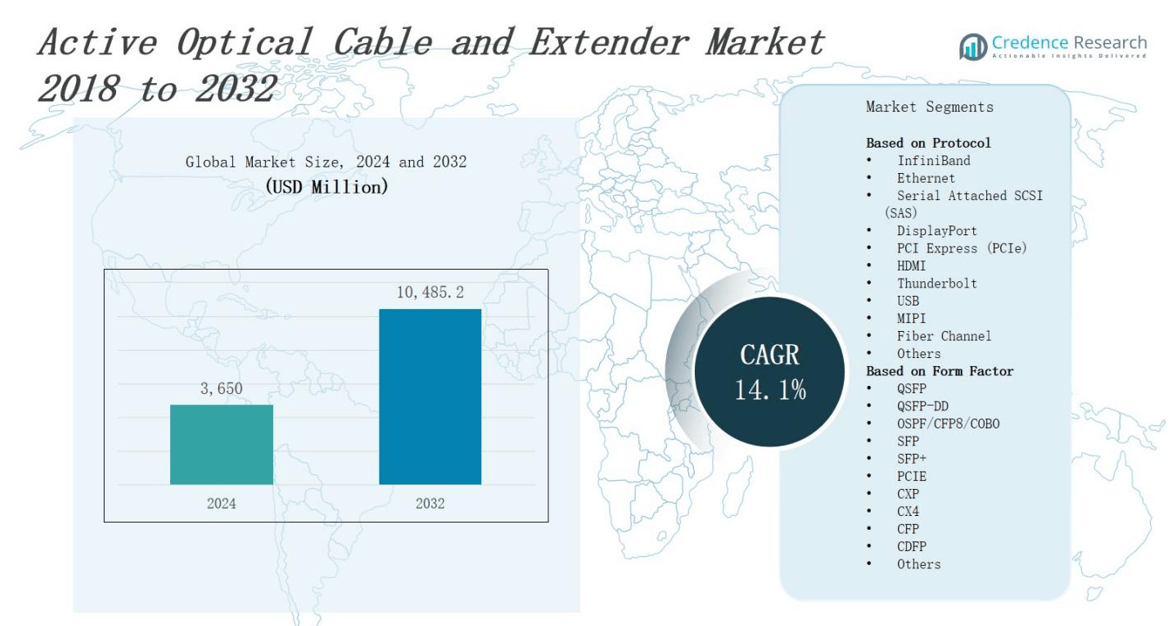

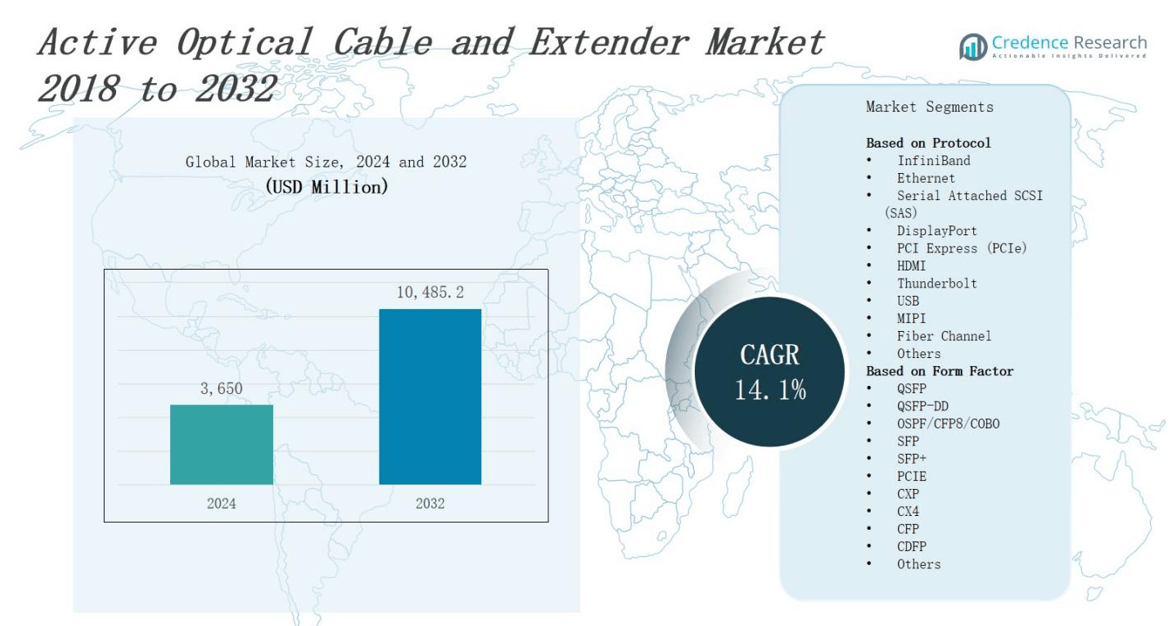

The active optical cable and extender market is projected to grow from USD 3,650 million in 2024 to USD 10,485.2 million by 2032, expanding at a CAGR of 14.1%.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Active Optical Cable and Extender Market Size 2024 |

USD 3,650 million |

| Active Optical Cable and Extender Market, CAGR |

14.1% |

| Active Optical Cable and Extender Market Size 2032 |

USD 10,485.2 million |

The active optical cable and extender market grows driven by increasing demand for high-speed data transmission in data centers, telecommunications, and enterprise networks. The shift toward cloud computing and 5G infrastructure fuels the need for efficient, low-latency connectivity solutions. Advancements in optical technology enhance signal quality and extend transmission distances, reducing reliance on traditional copper cables. Rising adoption of AI, IoT, and big data analytics further propels market growth. Manufacturers focus on developing compact, energy-efficient cables to meet evolving industry standards. These factors collectively stimulate innovation and expand the application scope of active optical cables and extenders across multiple sectors.

The active optical cable and extender market spans key regions including North America, Europe, Asia Pacific, and the Rest of the World, with North America leading at 34%, followed by Europe at 28%, Asia Pacific at 25%, and the Rest of the World at 13%. Major players driving this market include Coherent Corp., Broadcom, Amphenol Communications Solutions, Corning Incorporated, TE Connectivity, 3M, Molex, Sumitomo Electric Industries, Dell Inc., Eaton, EverPro Technology, and Alysium-Tech GmbH. These companies focus on innovation and expanding their regional presence to capture growing demand globally.

Market Insights

- The active optical cable and extender market is projected to grow from USD 3,650 million in 2024 to USD 10,485.2 million by 2032, at a CAGR of 14.1%.

- Increasing demand for high-speed data transmission in data centers, telecommunications, and enterprise networks drives market growth.

- The global rollout of 5G and expanding cloud computing services boost the need for low-latency, high-bandwidth connectivity solutions.

- Technological advancements improve cable performance, energy efficiency, and integration, enhancing appeal across multiple sectors.

- Rising adoption of AI, IoT, and big data analytics increases network traffic and connectivity requirements, expanding market applications.

- North America leads the market with 34% share, followed by Europe (28%), Asia Pacific (25%), and the Rest of the World (13%).

- Major players include Coherent Corp., Broadcom, Amphenol Communications Solutions, Corning Incorporated, TE Connectivity, 3M, Molex, Sumitomo Electric Industries, Dell Inc., Eaton, EverPro Technology, and Alysium-Tech GmbH.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for High-Speed Data Transmission in Data Centers and Telecommunications

The active optical cable and extender market benefits significantly from the growing need for high-speed data transmission in data centers and telecommunications networks. Data centers require efficient, low-latency connections to handle vast volumes of information and support cloud computing services. Telecommunications providers invest heavily in upgrading their infrastructure to meet consumer demands for faster internet and reliable connectivity. It delivers extended reach and enhanced signal integrity compared to copper cables, making it a preferred choice for critical communication links.

- For instance, Sumitomo Electric Industries develops cutting-edge fiber optic AOCs used extensively in high-performance computing environments, providing high-speed data transmission with extended reach and lower power consumption.

Expansion of 5G Infrastructure and Cloud Computing Adoption

The global rollout of 5G networks drives demand for advanced connectivity solutions, bolstering the active optical cable and extender market. 5G technology requires high-bandwidth, low-latency transmission, which active optical cables support effectively over long distances. The rapid adoption of cloud computing services also increases the volume of data that must be transmitted between servers and end-users. It enables network operators to maintain high performance and reliability, meeting stringent service level agreements and operational requirements.

Technological Advancements Enhancing Performance and Energy Efficiency

Technological innovations in optical components improve the performance and energy efficiency of active optical cables and extenders. Manufacturers develop compact, lightweight cables that reduce power consumption while maintaining signal strength over extended distances. It supports seamless integration into existing network infrastructure and simplifies installation processes. Enhanced durability and electromagnetic interference resistance further increase its appeal across demanding applications in enterprise and industrial sectors.

- For instance, Amphenol’s 100G QSFP28 Active Optical Cables provide high-performance, cost-efficient, plug-and-play solutions with compact, low-power designs manufactured in Mexico, enabling seamless integration and durability in demanding data center environments.

Growing Adoption of AI, IoT, and Big Data Analytics Applications

The expansion of artificial intelligence, IoT, and big data analytics increases data traffic and connectivity requirements, benefiting the active optical cable and extender market. These applications demand real-time data processing and transmission with minimal delay, necessitating high-speed optical solutions. It offers scalability and flexibility, accommodating growing network complexity without compromising performance. Enterprises and service providers adopt it to support emerging digital transformation initiatives and enhance overall operational efficiency.

Market Trends

Increasing Integration of Advanced Materials and Miniaturized Designs

The active optical cable and extender market trends toward the adoption of advanced materials and miniaturized designs that enhance performance while reducing size and weight. Manufacturers focus on developing cables with improved flexibility and durability to support complex network architectures. It incorporates materials that offer better thermal management and resistance to physical stress. These innovations enable seamless deployment in data centers and telecom infrastructures where space optimization and reliability are critical factors.

- For instance, Panasonic’s Active Optical Connector V series achieves an 85% reduction in mounting area compared to traditional optical transceivers, enabling two-channel transmission within a 0.6 mm diameter cable that supports greater flexibility and space saving in equipment design.

Rising Adoption of AI-Powered Network Management and Automation

AI-powered network management and automation drive new trends within the active optical cable and extender market. Operators increasingly implement intelligent systems to monitor network health, predict failures, and optimize performance. It supports integration with AI tools that analyze real-time data to adjust signal transmission dynamically. This capability improves network uptime and reduces maintenance costs. The trend accelerates the deployment of smart, self-healing networks that can adapt to evolving traffic demands efficiently.

- For instance, CommScope emphasizes that high-speed cabling systems with AI-driven AI tools often use parallel optics with advanced connectors (MPO-16, MMC-16) to handle speeds up to 1.6Tbps efficiently in AI data centers.

Expansion into Emerging Markets and Industry Verticals

The active optical cable and extender market witnesses growth from expansion into emerging geographic markets and diverse industry verticals. Regions in Asia Pacific, Latin America, and the Middle East show increasing infrastructure investments and digital transformation initiatives. It finds applications beyond traditional telecom and data centers, including healthcare, automotive, and manufacturing sectors. These industries require high-speed, reliable connectivity for automation and IoT deployments, broadening the market’s scope and driving innovation tailored to specific use cases.

Focus on Energy Efficiency and Environmental Sustainability

Energy efficiency and environmental sustainability become key trends influencing the active optical cable and extender market. Manufacturers prioritize reducing power consumption through innovative designs and materials that lower heat generation. It promotes the development of eco-friendly production processes and recyclable components to align with global sustainability goals. These efforts appeal to environmentally conscious customers and regulatory bodies, encouraging wider adoption in data centers and enterprises committed to reducing their carbon footprint.

Market Challenges Analysis

High Initial Investment and Integration Complexity in Network Infrastructure

The active optical cable and extender market faces challenges due to the high initial investment required for deployment in existing network infrastructures. The cost of advanced optical components and installation remains significantly higher than traditional copper cabling. It complicates budget allocations, especially for small and medium-sized enterprises. Integration with legacy systems requires careful planning and technical expertise to avoid compatibility issues. These factors slow down widespread adoption despite the clear performance advantages offered by active optical solutions.

Technical Limitations and Supply Chain Constraints Impacting Market Growth

Technical limitations, such as signal attenuation over extremely long distances and sensitivity to physical damage, pose challenges for the active optical cable and extender market. It requires continuous innovation to improve durability and extend operational ranges. Supply chain constraints, including shortages of specialized semiconductor components and raw materials, disrupt manufacturing schedules and increase lead times. These issues limit the market’s ability to meet rapid demand growth, affecting customer confidence and delaying project timelines.

Market Opportunities

Expanding Applications in Emerging Technologies and Vertical Markets

The active optical cable and extender market presents significant opportunities through expanding applications in emerging technologies such as 5G, AI, and IoT. Growing demand for high-speed, low-latency data transmission in smart cities, autonomous vehicles, and industrial automation drives adoption across various sectors. It enables reliable connectivity in complex environments where traditional cabling falls short. Penetration into healthcare, automotive, and manufacturing verticals offers new revenue streams. Tailoring solutions to meet specific industry requirements can strengthen market position and foster long-term partnerships.

Growth Potential in Developing Regions with Infrastructure Investments

Developing regions in Asia Pacific, Latin America, and the Middle East offer promising opportunities for the active optical cable and extender market due to increased investments in digital infrastructure and network modernization. Governments and private enterprises prioritize upgrading telecom and data center facilities to support rapid urbanization and digital transformation. It benefits from rising internet penetration and cloud adoption in these regions. Expanding presence through local partnerships and targeted marketing can accelerate growth. These markets represent untapped potential for customized, cost-effective optical connectivity solutions.

Market Segmentation Analysis:

By Protocol

The active optical cable and extender market segments by protocol include InfiniBand, Ethernet, Serial Attached SCSI (SAS), DisplayPort, PCI Express (PCIe), HDMI, Thunderbolt, USB, MIPI, Fiber Channel, and others. Ethernet dominates due to its widespread adoption in data communication and enterprise networks, offering high-speed, scalable connectivity. PCIe and Thunderbolt protocols gain traction for their low latency and high bandwidth, supporting advanced computing applications. It serves diverse communication needs by providing protocol-specific solutions that optimize performance and compatibility across various systems.

- For instance, Finisar Corporation offers active optical cables compliant with 10G and 40G Ethernet standards, supporting data rates up to 10.3125 Gb/s per lane in QSFP+ modules suitable for data center applications.

By Form Factor

Form factor segmentation in the active optical cable and extender market includes QSFP, QSFP-DD, OSPF/CFP8/COBO, SFP, SFP+, PCIE, CXP, CX4, CFP, CDFP, and others. QSFP and SFP+ lead the market due to their compact size and ability to support high data rates, making them suitable for data center and telecom applications. It focuses on developing form factors that balance speed, power efficiency, and ease of integration. The emergence of newer form factors like QSFP-DD addresses growing demand for higher bandwidth and density in modern network infrastructures.

- For instance, the QSFP-DD module supports up to 400 Gbps using an eight-lane (8x50G) PAM4 electrical interface and is backward compatible with QSFP+ and QSFP28, making it versatile for gradual upgrades in data centers.

By Application

The active optical cable and extender market serves various applications, including data centers, high-performance computing (HPC), consumer electronics, telecommunications, industrial, energy, oil & gas, medical, military/aerospace, and others. Data centers and HPC remain the primary drivers due to their intense need for fast, reliable data transmission. It also expands into industrial and medical sectors requiring robust, low-latency connectivity. Growth in telecommunications and military/aerospace applications reflects increasing demand for secure, high-capacity optical communication in critical environments.

Segments:

Based on Protocol

- InfiniBand

- Ethernet

- Serial Attached SCSI (SAS)

- DisplayPort

- PCI Express (PCIe)

- HDMI

- Thunderbolt

- USB

- MIPI

- Fiber Channel

- Others

Based on Form Factor

- QSFP

- QSFP-DD

- OSPF/CFP8/COBO

- SFP

- SFP+

- PCIE

- CXP

- CX4

- CFP

- CDFP

- Others

Based on Application

- Data Centers

- High-performance Computing (HPC)

- Consumer Electronics

- Telecommunications

- Industrial

- Energy

- Oil & Gas

- Medical

- Military/Aerospace

- Others

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds a dominant position in the active optical cable and extender market with a market share of 34%. The region benefits from advanced telecommunications infrastructure, widespread adoption of cloud computing, and substantial investments in 5G deployment. It hosts key technology companies driving innovation in optical connectivity solutions. Growing demand from data centers and high-performance computing centers supports market expansion. Regulatory support for digital infrastructure development further strengthens its leadership. The region’s mature ecosystem and focus on energy-efficient technologies encourage continuous product enhancements. It remains a critical hub for research, development, and early adoption of advanced optical cables.

Europe

Europe accounts for 28% of the active optical cable and extender market, driven by strong telecom networks and rapid digital transformation initiatives across industries. Countries such as Germany, the UK, and France lead infrastructure upgrades to support high-speed data transmission and cloud services. It experiences rising demand from industrial automation, healthcare, and aerospace sectors that require reliable optical solutions. Europe’s emphasis on sustainability encourages manufacturers to develop energy-efficient and recyclable products. Collaborative government and private sector efforts propel network modernization. The region balances innovation with stringent regulatory compliance, sustaining steady market growth.

Asia Pacific

Asia Pacific commands 25% of the active optical cable and extender market due to rapid urbanization, expanding internet penetration, and significant investments in telecom infrastructure. China, India, Japan, and South Korea contribute heavily to market growth through large-scale 5G rollouts and data center expansions. It experiences rising adoption across emerging verticals such as automotive, healthcare, and smart cities. The region offers high growth potential due to increasing digitalization in developing countries. Local manufacturing capabilities and cost-effective solutions enhance competitiveness. Asia Pacific attracts substantial foreign direct investment, fostering market development and technological advancements.

Rest of the World

The Rest of the World, including Latin America, the Middle East, and Africa, holds a 13% market share in the active optical cable and extender market. Investments in digital infrastructure and telecom modernization in countries like Brazil, UAE, and South Africa drive demand. It supports growing network capacity requirements amid expanding internet user bases and cloud adoption. Challenges such as infrastructure gaps and regulatory complexities persist but present opportunities for tailored optical solutions. Regional governments encourage technology upgrades to boost economic development. The market grows steadily due to rising awareness of advanced connectivity benefits in these regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Sumitomo Electric Industries Ltd. (Japan)

- Broadcom (US)

- Eaton (Ireland)

- Corning Incorporated (US)

- EverPro Technology Co., Ltd. (China)

- Amphenol Communications Solutions (US)

- TE Connectivity (Switzerland)

- Molex (US)

- Alysium-Tech GmbH (US)

- Coherent Corp. (US)

- Dell Inc. (US)

- 3M (US)

Competitive Analysis

The active optical cable and extender market features intense competition among key global players focusing on innovation, product quality, and strategic partnerships. Leading companies invest heavily in research and development to enhance cable performance, increase transmission speeds, and improve energy efficiency. It witnesses ongoing mergers and collaborations aimed at expanding product portfolios and geographic reach. Companies emphasize customization to meet specific customer requirements across industries such as data centers, telecommunications, and healthcare. Market leaders leverage advanced manufacturing capabilities and strong distribution networks to maintain competitive advantages. It faces challenges from emerging regional players offering cost-effective alternatives. Continuous technological advancements and evolving customer demands drive competitive dynamics, compelling companies to adopt aggressive pricing and marketing strategies. The market’s competitive landscape fosters rapid innovation, supporting the deployment of cutting-edge optical connectivity solutions worldwide.

Recent Developments

- In September 2024, TE Connectivity completed a merger with its wholly owned subsidiary, changing its jurisdiction of incorporation from Switzerland to Ireland.

- In August 2024, Chord Company launched the Clearway HDMI Active Optical Cable (AOC), supporting 8K at 60Hz and 4K at 120Hz, tailored for home cinema and gaming applications.

- In September 2023, LESSENGERS Inc. announced volume production of its new 800G transceiver product (800G OSFP SR8) designed for AI and ML clusters, utilizing direct optical wiring technology.

- In March 2023, Jabil Inc. introduced an 800G active optical cable family, expanding its photonics offerings for AI, cloud, HPC, and ML applications.

Market Concentration & Characteristics

The active optical cable and extender market demonstrates a moderately concentrated competitive landscape dominated by key multinational corporations with strong technological capabilities and extensive distribution networks. It features a mix of established industry leaders and emerging players focusing on innovation to address evolving connectivity demands. Market leaders invest heavily in research and development to enhance product performance, energy efficiency, and form factor miniaturization. It faces pressure from regional manufacturers offering cost-effective solutions, particularly in emerging markets. The market’s competitive dynamics emphasize customization, quality, and integration with existing infrastructure to meet diverse customer needs across data centers, telecommunications, and industrial sectors. Strong partnerships and strategic collaborations enable companies to expand their global footprint and access new applications. It balances rapid technological advancements with high entry barriers, including substantial capital investment and technical expertise, which shape its characteristic competitive structure and growth trajectory.

Report Coverage

The research report offers an in-depth analysis based on Protocol, Form Factor, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The active optical cable and extender market will expand due to growing demand for high-speed data transmission.

- Increasing deployment of 5G networks will boost the need for advanced optical connectivity solutions.

- Cloud computing growth will drive adoption in data centers and enterprise networks.

- Manufacturers will focus on developing more compact and energy-efficient cables.

- Integration of AI, IoT, and big data analytics will increase network complexity and demand.

- Emerging markets will offer significant growth opportunities for tailored optical solutions.

- Technological advancements will enhance cable durability and transmission distances.

- Demand from industrial, healthcare, and military sectors will diversify market applications.

- Strategic partnerships and collaborations will accelerate innovation and regional expansion.

- Sustainability and environmental concerns will encourage development of eco-friendly materials and processes.