Market Overview:

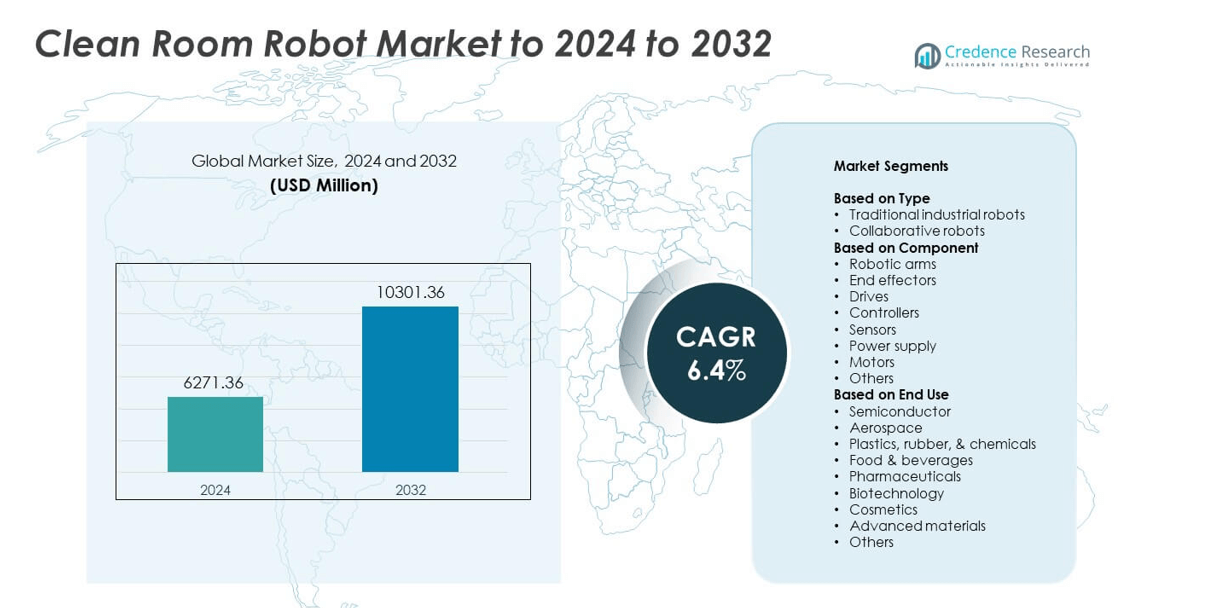

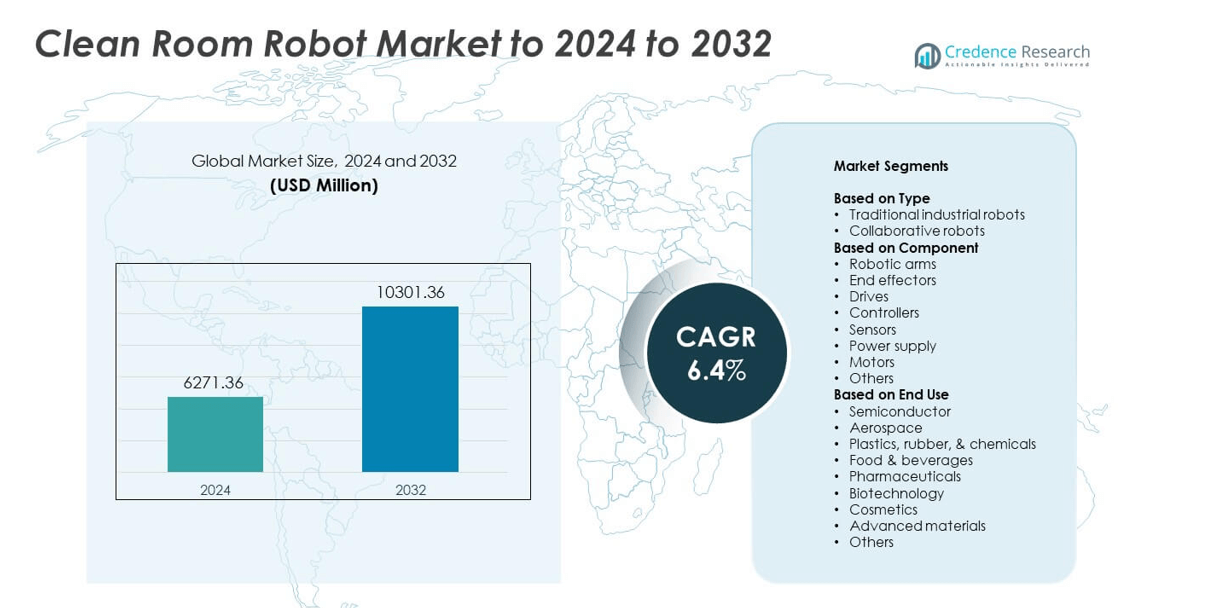

The Clean Room Robot Market size was valued at USD 6271.36 million in 2024 and is anticipated to reach USD 10301.36 million by 2032, at a CAGR of 6.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Clean Room Robot Market Size 2024 |

USD 6271.36 million |

| Clean Room Robot Market, CAGR |

6.4% |

| Clean Room Robot Market Size 2032 |

USD 10301.36 million |

The clean room robot market is led by major players such as ABB Ltd, FANUC Corporation, KUKA AG, Yaskawa Electric Corporation, Mitsubishi Electric Corporation, and Universal Robots. These companies dominate through advanced automation technologies, precision control systems, and AI-enabled robotic platforms designed for contamination-free environments. Their strong presence across semiconductor, pharmaceutical, and biotechnology sectors drives consistent innovation and product expansion. Regionally, Asia Pacific held the largest share of 29.8% in 2024, supported by rapid industrial automation in China, Japan, and South Korea. North America followed with 35.6%, while Europe accounted for 27.4%, reflecting steady growth in high-precision manufacturing.

Market Insights

- The clean room robot market was valued at USD 6271.36 million in 2024 and is projected to reach USD 10301.36 million by 2032, growing at a CAGR of 6.4%.

- Rising automation in semiconductor, pharmaceutical, and biotechnology industries is driving market growth, as companies seek higher precision and contamination-free production.

- Key trends include the integration of AI, vision systems, and collaborative robots designed for hybrid cleanroom environments to improve operational efficiency.

- The market is competitive, with leading players focusing on R&D and partnerships to enhance robotic performance, safety, and compliance with ISO cleanroom standards.

- North America held 35.6% of the market in 2024, followed by Asia Pacific at 29.8% and Europe at 27.4%, while the semiconductor segment dominated with a 42.3% share due to high automation demand in chip manufacturing.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Traditional industrial robots dominated the clean room robot market with a 64.5% share in 2024. Their strong presence is due to high precision, repeatability, and long operational life suited for controlled environments. These robots are widely used in semiconductor, pharmaceutical, and biotechnology facilities to handle delicate tasks and reduce contamination risks. The demand for traditional robots is increasing as manufacturers prioritize accuracy and automation in sterile production processes. However, collaborative robots are gaining traction for their flexibility and safety features in hybrid production settings.

- For instance, ABB’s IRB 120 Cleanroom was certified to ISO 5 (Class 100) by Fraunhofer-IPA, confirming low particle emission for cleanroom use.

By Component

Robotic arms held the largest share of 37.8% in the clean room robot market in 2024. Their dominance stems from their essential role in handling wafers, drug vials, and precision components with minimal contamination. Advanced robotic arms equipped with torque sensors and vision systems ensure higher accuracy and cleanroom compatibility. The adoption of sensor-driven and AI-enabled arms is growing, especially in semiconductor and pharmaceutical cleanrooms. The continuous development of lightweight, contamination-free materials further strengthens the growth of this segment.

- For instance, DENSO cleanroom models list ISO Class 3/5 options and repeatability down to ±0.02–0.03 mm, enabling precise vial and wafer handling.

By End Use

The semiconductor segment accounted for the largest share of 42.3% in the clean room robot market in 2024. This dominance results from the need for precise handling of wafers, microchips, and optical components in particle-free environments. Semiconductor fabs rely heavily on robotic automation to maintain production yield and reduce human interference. Increasing wafer size and the adoption of advanced lithography technologies further drive robotic demand. Meanwhile, sectors such as pharmaceuticals and biotechnology are rapidly integrating robots to improve sterility and production efficiency.

Key Growth Drivers

Rising Automation in Semiconductor Manufacturing

The expansion of semiconductor fabrication facilities is fueling the adoption of clean room robots. These robots handle fragile wafers and components with precision while maintaining contamination-free environments. Automation enhances yield, reduces downtime, and supports advanced node manufacturing. Growing global chip demand and government investments in semiconductor production are driving robotic integration, particularly in Asia-Pacific and North America. This automation trend remains a major catalyst for market expansion.

- For instance, Kawasaki’s NT wafer transfer robots are specified to meet ISO Class 1 cleanliness, supporting ultra-low particle handling in fab EFEMs.

Growing Demand from Pharmaceutical and Biotechnology Sectors

Pharmaceutical and biotech companies are increasingly using clean room robots to ensure sterility and product consistency. Robots reduce human intervention in aseptic manufacturing, minimizing contamination risks. Their use in drug formulation, filling, and packaging improves accuracy and regulatory compliance. With rising biologics and vaccine production, robotic deployment in GMP-certified facilities continues to accelerate, supporting higher throughput and precision in sterile processes.

- or instance, FANUC’s LR Mate 200iD/7C cleanroom robot offers a 7 kg payload, 717 mm reach, and a repeatability of ±0.02 mm (the common figure based on ISO 9283 standard, though some official marketing sources list an even tighter 0.01 mm) for aseptic tasks.

Advancements in Robotic Sensing and AI Integration

echnological progress in sensors, AI, and machine vision is improving robot performance in cleanroom environments. Enhanced sensing allows precise motion control and contamination detection during handling operations. AI algorithms support adaptive learning and real-time decision-making, increasing operational flexibility. These innovations are enabling smart, self-optimizing robots suited for complex cleanroom applications, driving long-term adoption across semiconductor and life sciences industries.

Key Trends & Opportunities

Adoption of Collaborative Robots in Controlled Environments

Collaborative robots, or cobots, are emerging as a promising trend in cleanroom operations. Their flexibility, safety, and compact design make them ideal for handling small-batch or variable tasks in sterile environments. Cobots allow human-robot collaboration while meeting ISO cleanroom standards. Industries are leveraging cobots to improve productivity and reduce floor space usage, creating new opportunities in modular cleanroom setups and microelectronics production.

- For instance, OMRON’s TM-Series collaborative robots offer cleanroom certification up to ISO Class 3, with various models available. All standard models in the series, including those with payloads up to 20 kg (e.g., TM20), have a standard repeatability of ±0.1 mm.

Shift Toward Fully Automated and Modular Cleanrooms

Manufacturers are transitioning to modular cleanrooms with integrated robotic systems to enhance scalability and cost-efficiency. Automation minimizes human entry, improving contamination control and production reliability. Modular layouts allow faster upgrades and integration of multi-axis robotic systems for complex assembly and inspection. This shift aligns with growing demand for flexible, high-purity manufacturing in semiconductors, pharmaceuticals, and advanced materials.

- For instance, Stäubli cleanroom robots meet ISO 14644-1 Class 2 (SCR) and Class 4 (CR), supporting high-purity modular cell designs.

Key Challenges

High Initial Investment and Maintenance Costs

The high capital requirement for installing and maintaining clean room robots limits adoption among small and medium enterprises. Robots designed for sterile environments require specialized materials, sealing, and cleaning systems, increasing cost. Additionally, maintenance and recalibration to comply with cleanroom standards add recurring expenses. This financial barrier often delays adoption despite long-term efficiency benefits.

Integration Complexity with Legacy Systems

Integrating advanced robotic systems with existing cleanroom infrastructure poses technical challenges. Older facilities may lack compatible interfaces or environmental controls needed for robotic automation. Achieving seamless coordination between sensors, control units, and existing production systems demands customization. This complexity extends project timelines and raises integration costs, discouraging rapid deployment across traditional manufacturing plants.

Regional Analysis

North America

North America held a 35.6% share of the clean room robot market in 2024, driven by advanced semiconductor and pharmaceutical manufacturing. The region’s strong presence of major chipmakers and life sciences companies fuels automation adoption. The United States leads due to high investment in robotics R&D and cleanroom modernization. Increased demand for sterile manufacturing in biotechnology and vaccine production further strengthens regional growth. Supportive government funding for semiconductor fabs and Industry 4.0 initiatives continues to expand robot deployment in controlled environments.

Europe

Europe accounted for 27.4% of the clean room robot market in 2024, supported by robust pharmaceutical, aerospace, and advanced materials sectors. Countries such as Germany, France, and the Netherlands are integrating automation to meet stringent ISO cleanroom standards. Growing adoption in biopharmaceutical production and nanotechnology labs drives regional growth. The EU’s focus on digital transformation and green manufacturing enhances robotics adoption. Increasing demand for flexible cleanroom setups across medical device production also contributes to the market’s expansion in Europe.

Asia Pacific

Asia Pacific dominated the clean room robot market with a 29.8% share in 2024, emerging as the fastest-growing region. High investments in semiconductor fabrication across China, Japan, South Korea, and Taiwan boost regional leadership. The expansion of electronics, pharmaceuticals, and biotechnology industries drives large-scale automation adoption. Rapid industrialization and government-backed manufacturing programs promote cleanroom infrastructure upgrades. The rise of contract manufacturing in life sciences and electronics also supports continuous demand for advanced cleanroom robotics across the region.

Latin America

Latin America held a 4.2% share of the clean room robot market in 2024, with gradual growth driven by expanding pharmaceutical and food industries. Brazil and Mexico are leading adopters, focusing on contamination control and automation in production facilities. Increasing foreign investments in healthcare manufacturing are improving cleanroom standards. Although adoption is slower compared to other regions, regional modernization initiatives and technology transfer from global firms are fostering steady progress in robotic cleanroom integration.

Middle East & Africa

The Middle East & Africa region captured a 3.0% share of the clean room robot market in 2024. Growth is supported by rising pharmaceutical production and cleanroom investments in countries such as Saudi Arabia, the UAE, and South Africa. Government initiatives to enhance healthcare and industrial automation are encouraging adoption. The region’s growing focus on local drug manufacturing and advanced material research is driving demand for robotic precision and contamination control. Expanding infrastructure and economic diversification efforts further support gradual market development.

Market Segmentations:

By Type

- Traditional industrial robots

- Collaborative robots

By Component

- Robotic arms

- End effectors

- Drives

- Controllers

- Sensors

- Power supply

- Motors

- Others

By End Use

- Semiconductor

- Aerospace

- Plastics, rubber, & chemicals

- Food & beverages

- Pharmaceuticals

- Biotechnology

- Cosmetics

- Advanced materials

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

ABB Ltd, Universal Robots, FANUC Corporation, Rockwell Automation, Yaskawa Electric Corporation, Denso Corporation, KUKA AG, Omron Corporation, Mitsubishi Electric Corporation, Epson Robotics, Staubli International AG, Kawasaki Heavy Industries, and Teradyne are prominent players in the clean room robot market. The market is characterized by intense competition focused on precision performance, contamination control, and compliance with ISO cleanroom standards. Leading manufacturers are expanding their portfolios with AI-integrated robots, advanced vision systems, and compact designs for cleanroom compatibility. Strategic partnerships with semiconductor, pharmaceutical, and biotech industries are strengthening global presence. Companies are investing heavily in automation solutions optimized for micro-level handling and sterile operations. The introduction of collaborative and modular robotic platforms is enhancing productivity across controlled manufacturing environments. Continuous R&D efforts, coupled with emphasis on energy efficiency and adaptive software integration, are expected to further shape the competitive dynamics of this rapidly evolving market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- ABB Ltd

- Universal Robots

- FANUC Corporation

- Rockwell Automation

- Yaskawa Electric Corporation

- Denso Corporation

- KUKA AG

- Omron Corporation

- Mitsubishi Electric Corporation

- Epson Robotics

- Staubli International AG

- Kawasaki Heavy Industries

- Teradyne

Recent Developments

- In 2025, KUKA launched the KMR iisy CR, a cleanroom-certified autonomous mobile robot (AMR) designed for sensitive environments such as semiconductor and electronics manufacturing.

- In 2023, Yaskawa launched the MOTOMAN NEXT series, an autonomous robot aimed at opening up new automation fields through the integration of AI and software functions based on a new control platform.

- In 2022, FANUC launched new ultra-hygienic SCARA robots (SR-3iA/C and SR-6iA/C) designed to meet ISO Class 5 cleanroom requirements, featuring anti-contamination features and white epoxy coating

Report Coverage

The research report offers an in-depth analysis based on Type, Component, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness steady growth driven by automation in semiconductor and biotech manufacturing.

- Demand for precision-driven robots will rise with advancements in microelectronics and nanofabrication.

- Pharmaceutical and vaccine production facilities will continue adopting robots for sterile operations.

- Collaborative robots will gain traction in hybrid cleanrooms for flexible and safe human interaction.

- AI-enabled sensing and vision technologies will improve accuracy and contamination detection.

- Modular cleanroom setups will integrate more robotic systems for scalable manufacturing.

- Asia Pacific will remain the key growth hub due to strong industrial expansion.

- Increased investment in R&D will lead to more compact and energy-efficient robotic systems.

- The adoption of digital twins and predictive maintenance tools will enhance operational efficiency.

- Strategic collaborations between robotics manufacturers and cleanroom solution providers will drive market innovation.