| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Acute Hospital Care Market Size 2024 |

USD 3,207.21 Million |

| Acute Hospital Care Market, CAGR |

5.51% |

| Acute Hospital Care Market Size 2032 |

USD 5,079.73 Million |

Market Overview:

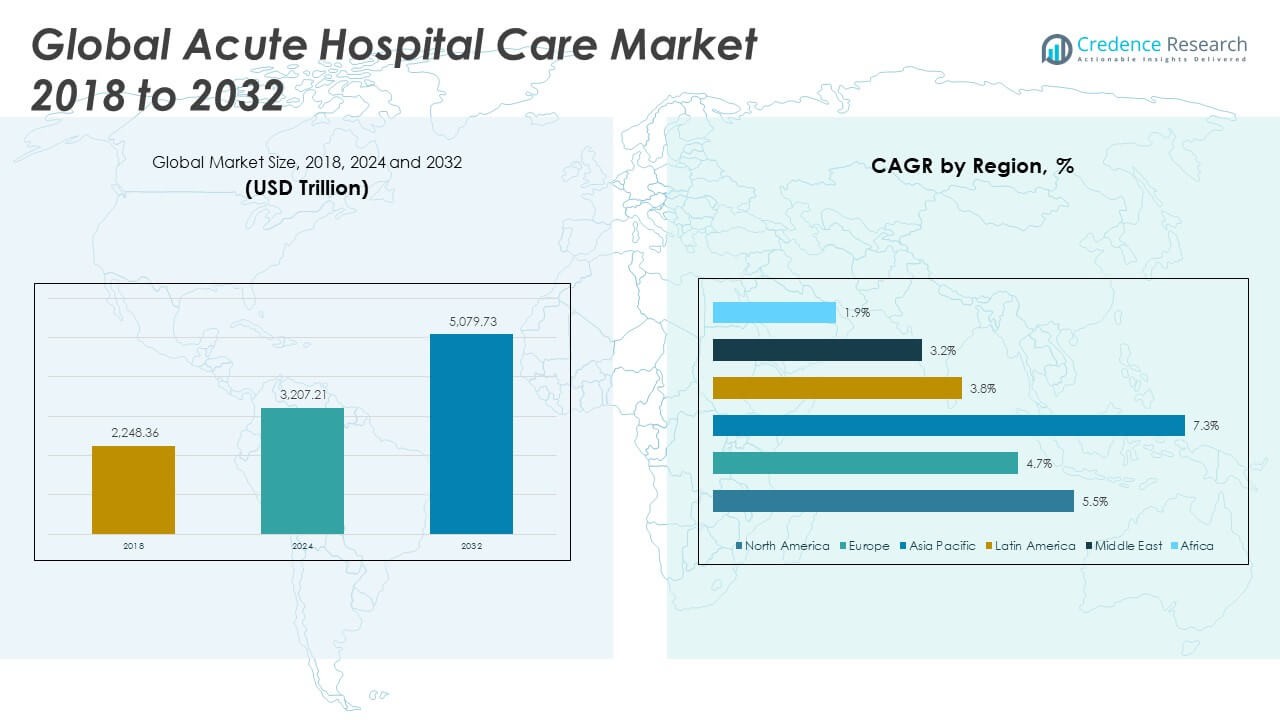

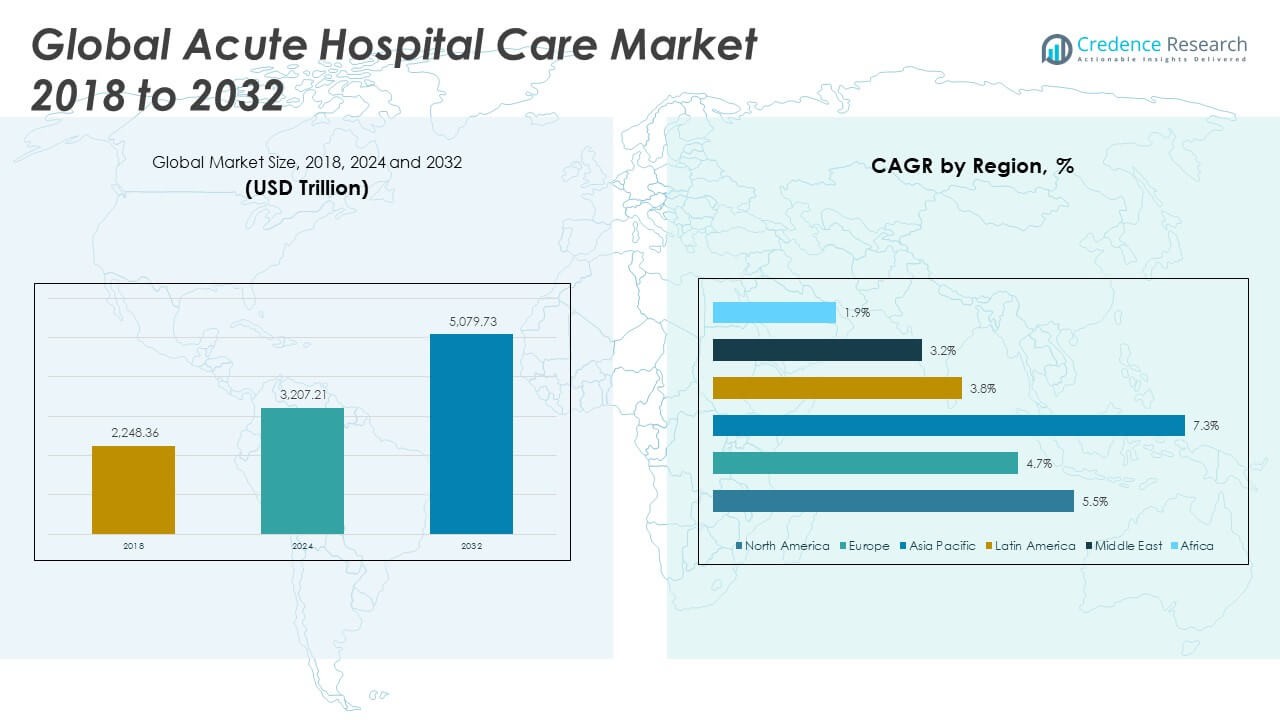

The Global Acute Hospital Care Market size was valued at USD 2,248.36 million in 2018 to USD 3,207.21 million in 2024 and is anticipated to reach USD 5,079.73 million by 2032, at a CAGR of 5.51% during the forecast period.

A key factor driving the growth of the global acute hospital care market is the rising prevalence of chronic diseases and aging populations, which are placing sustained demand on acute care facilities. The growing number of elderly individuals, who are more susceptible to conditions such as cardiovascular disease, diabetes, and respiratory illnesses, has significantly increased the need for immediate and specialized care. In addition, healthcare systems are rapidly evolving with the integration of advanced technologies, including electronic health records (EHRs), telemedicine, robotic surgery, and AI-based diagnostic tools, which are improving operational efficiency and treatment outcomes in acute settings. Governments and private healthcare providers are also investing heavily in the expansion and modernization of hospital infrastructure, emergency departments, and intensive care units to meet the surge in patient admissions and improve care delivery.

Regionally, North America dominates the global acute hospital care market, accounting for the largest share due to its advanced healthcare infrastructure, high healthcare spending, and widespread access to insurance and reimbursement systems. The United States, in particular, has seen continuous investments in high-acuity services, trauma centers, and specialized hospital units, contributing to strong market performance. Europe follows closely, with countries such as Germany, France, and the UK leveraging publicly funded healthcare systems to support acute care expansion, while Eastern Europe is catching up through infrastructure modernization. The Asia-Pacific region is witnessing the fastest growth, driven by increasing healthcare expenditures, government-backed hospital development projects, and the rising burden of chronic diseases across populous nations like China, India, and Indonesia. In Latin America and the Middle East & Africa, growth remains moderate but promising, as national healthcare reforms, public-private partnerships, and international funding are helping to build capacity and improve access to emergency and critical care services.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Acute Hospital Care Market was valued at USD 3,207.21 million in 2024 and is projected to reach USD 5,079.73 million by 2032, growing at a CAGR of 5.51%, reflecting steady global demand for critical and emergency care services.

- Increasing chronic disease prevalence and aging populations are driving higher demand for acute care interventions, with longer hospital stays and specialized treatment units becoming essential across healthcare systems.

- Rising emergency incidents and trauma cases, such as accidents and acute surgical conditions, are accelerating the expansion of emergency departments and trauma centers, particularly in urban and semi-urban regions.

- Integration of technologies like AI, EHRs, telehealth, and robotics is improving care outcomes, operational workflows, and real-time diagnostics, positioning digital innovation as a key market enabler.

- Strong policy support, insurance coverage expansion, and public-private investments are fueling infrastructure development, especially in emerging economies with underserved healthcare access.

- Workforce shortages and clinical staff burnout continue to strain operational capacity, making talent retention, training, and mental wellness programs a strategic priority for hospitals worldwide.

- North America holds the largest market share due to advanced infrastructure and spending, while Asia Pacific is the fastest-growing region, supported by rising healthcare investment and growing demand for specialized acute care.

Market Drivers:

Aging Global Population and Rising Burden of Chronic Illnesses Necessitate Acute Medical Intervention

The Global Acute Hospital Care Market is expanding steadily due to the increasing prevalence of chronic diseases and the aging global population. A higher proportion of elderly individuals require immediate and specialized treatment for age-related conditions such as cardiovascular disease, diabetes, stroke, and respiratory disorders. These medical conditions often result in emergency admissions and longer hospital stays, directly impacting acute care services. Healthcare providers are under growing pressure to expand critical care infrastructure, including ICU beds and specialized treatment units. Governments and private institutions are responding by increasing investments in acute medical facilities to accommodate surging demand. This demographic shift is expected to continuously drive the need for efficient and accessible acute hospital services across all regions.

Growing Demand for Emergency Services and Trauma Centers Boosts Infrastructure Expansion

Rising incidences of trauma, accidents, and emergency health conditions are significantly contributing to the growth of the acute care sector. Road traffic accidents, workplace injuries, and acute surgical cases require immediate attention from fully equipped emergency departments and trauma units. It is prompting hospitals to improve infrastructure and ensure 24/7 operational readiness. Expansion of trauma centers and emergency services across urban and semi-urban locations supports better access to life-saving care. Rapid response capabilities and ambulance integration are becoming critical differentiators for hospitals competing in this space. The increasing reliance on emergency care is reinforcing the strategic role of acute hospital services in national healthcare systems.

- For instance, in Georgia, the Trauma Center Readiness Fund supported 23 trauma centers in FY2023, with $4.1 million allocated to readiness and $1.13 million in trauma-related equipment grants, benefiting 170 agencies with 911-zone ambulances.

Integration of Health Technologies Enhances Efficiency and Improves Patient Outcomes

The integration of digital tools such as electronic health records, AI-powered diagnostics, and telehealth platforms is redefining operational workflows within acute hospital settings. Automation in patient monitoring and diagnostics supports faster and more accurate decision-making, which is essential during emergencies. It allows clinicians to streamline care delivery while reducing medical errors and improving safety. Advanced technologies are also aiding hospitals in managing patient throughput and optimizing resource utilization. Hospitals that adopt data-driven systems gain the ability to monitor clinical performance and reduce unnecessary admissions or delays. Technology is becoming a core enabler for hospitals seeking to enhance service quality in high-pressure environments.

- In May 2025, China’s Tsinghua University launched Agent Hospital, the world’s first fully AI-powered hospital, staffed by 14 AI doctors and 4 AI nurses, capable of handling 3,000 patient interactions daily without human staff or physical wards, marking a significant leap in digital healthcare delivery.

Policy Support and Healthcare Funding Stimulate Market Growth Through Institutional Strengthening

Strong policy frameworks and increased government spending are facilitating the development and modernization of acute hospital facilities. National health agencies are providing grants, subsidies, and infrastructure funding to expand critical care services in underserved areas. In many regions, healthcare reforms and insurance penetration are lowering out-of-pocket expenses, making acute care more accessible. Public-private partnerships are supporting large-scale hospital projects and emergency response systems. Regulatory clarity and health investment priorities are enabling long-term capacity planning and quality improvements. It creates a favorable environment for sustained growth of the acute hospital care industry, especially in emerging economies.

Market Trends:

Rise of Value-Based Care Models Encourages Outcome-Focused Hospital Operations

Hospitals are increasingly shifting from volume-based reimbursement models to value-based frameworks that reward clinical outcomes, efficiency, and patient satisfaction. This trend is influencing care delivery standards and prompting acute care providers to focus on measurable improvements in health outcomes rather than service volume. It is driving hospitals to redesign workflows, adopt outcome tracking systems, and strengthen coordination among medical teams. Payers and regulators are setting performance benchmarks tied to infection rates, readmissions, and length of stay. Hospitals that demonstrate compliance with these benchmarks receive financial incentives, which is accelerating the adoption of evidence-based care models. The Global Acute Hospital Care Market is aligning with these reforms to deliver consistent, high-quality treatment within budgetary constraints.

Emergence of Micro-Hospitals and Specialized Acute Care Units Enhances Accessibility

Healthcare networks are responding to localized demand by establishing micro-hospitals and specialty-specific acute units that operate with fewer beds but provide targeted care. These smaller facilities are gaining popularity in suburban and semi-urban regions, where full-scale hospitals may be unavailable or underutilized. It allows providers to optimize costs while maintaining emergency readiness and essential acute services. Micro-hospitals often include emergency rooms, diagnostic imaging, and short-stay units tailored to community needs. The Global Acute Hospital Care Market is witnessing increased investment in these flexible, scalable models that reduce strain on larger tertiary hospitals. This trend supports greater geographic coverage and quicker response times during medical emergencies.

- For example, Emerus, a leading micro-hospital operator, has treated over 4 million patients across more than 40 facilities since its founding, with rapid growth from 3 million to 4 million patients in just over a year.

Increased Focus on Mental Health Crisis Intervention within Acute Settings

Acute hospital systems are expanding their scope to include crisis stabilization and short-term psychiatric care, reflecting the growing awareness of mental health emergencies. Emergency departments are being equipped with behavioral health specialists and designated mental health zones to handle cases such as severe depression, psychosis, and suicidal ideation. It is driving hospitals to revise protocols, train multidisciplinary teams, and collaborate with mental health agencies. Regulatory bodies are also introducing standards to ensure parity between physical and mental health treatment within acute care facilities. The Global Acute Hospital Care Market is adjusting infrastructure and resources to meet this evolving demand. This shift reflects the broader healthcare industry’s move toward integrated, holistic care delivery.

Sustainability and Green Hospital Initiatives Gain Momentum Across Healthcare Systems

Environmental sustainability has become a strategic priority for hospital systems aiming to reduce their carbon footprint and energy consumption. Hospitals are adopting green building designs, energy-efficient HVAC systems, and sustainable waste management practices. It supports cost savings and regulatory compliance while enhancing the hospital’s public image. Institutions are also investing in clean technologies, including solar energy, smart lighting, and eco-friendly materials in infrastructure development. The Global Acute Hospital Care Market is incorporating sustainability goals into capital planning and operational decision-making. This trend is expected to influence construction, procurement, and facility management practices across new and existing acute care sites.

- For instance, Hitachi India partnered with AIIMS New Delhi under India’s Green & Digital Hospital initiative to modernize the hospital’s power infrastructure and implement ICT-based energy management systems. This project included installing a 693 kWp rooftop solar system, upgrading HVAC systems, replacing 33,000 conventional lights with LEDs, and deploying a real-time ICT-enabled Energy Management System.

Market Challenges Analysis:

Workforce Shortages and Burnout Undermine Operational Capacity and Service Quality

One of the most pressing challenges in the Global Acute Hospital Care Market is the growing shortage of skilled healthcare professionals, including physicians, nurses, and specialized technicians. Many hospitals face difficulty in recruiting and retaining qualified staff, especially in rural and underserved regions. It impacts the ability to deliver timely, high-quality care during peak demand periods or public health emergencies. High workloads, extended shifts, and emotionally taxing environments contribute to burnout, absenteeism, and staff turnover. These workforce constraints strain existing resources and can lead to delayed care, reduced patient satisfaction, and increased risk of medical errors. Efforts to address this issue require long-term investments in medical education, workforce planning, and wellness initiatives for hospital employees.

Financial Pressures and Rising Operational Costs Threaten Sustainability of Acute Care Models

Hospitals worldwide are grappling with mounting financial pressures due to fluctuating reimbursement rates, high capital expenditures, and growing costs for labor, equipment, and pharmaceuticals. It creates challenges in maintaining service continuity while investing in critical infrastructure upgrades and technology adoption. For smaller or independent hospitals, limited funding and cash flow issues may lead to service cutbacks or even closures. The Global Acute Hospital Care Market faces added pressure to balance cost control with quality mandates imposed by regulators and insurance providers. Price transparency regulations, patient cost sensitivity, and increasing competition from outpatient care models further intensify financial strain. Navigating these challenges requires strategic planning, operational efficiency, and diversified revenue models that ensure long-term viability.

Market Opportunities:

Expansion in Emerging Economies Creates New Avenues for Infrastructure Development

Rapid urbanization, population growth, and rising healthcare awareness in emerging markets are opening new opportunities for acute hospital care providers. Governments in Asia-Pacific, Latin America, and Africa are increasing investments in hospital infrastructure to bridge care access gaps. It enables healthcare companies and private investors to participate in public-private partnerships and greenfield hospital projects. Demand for trauma care, emergency services, and surgical interventions is accelerating across tier-2 and tier-3 cities. Medical equipment suppliers, construction firms, and technology vendors can tap into these expanding networks. The Global Acute Hospital Care Market stands to benefit from supportive policy frameworks and international development funding in these regions.

Adoption of Smart Hospital Technologies Enhances Care Delivery and Operational Efficiency

Hospitals are embracing digital innovation to improve patient care, streamline operations, and manage resources more effectively. AI-based triage tools, real-time data analytics, automated supply chains, and predictive maintenance systems are gaining traction. It provides healthcare systems with better control over patient flows, capacity planning, and clinical decision-making. Acute care facilities that integrate smart technologies can achieve faster response times and reduce avoidable complications. The Global Acute Hospital Care Market has strong potential for digital transformation, especially in regions with established IT infrastructure. This trend offers growth opportunities for health tech companies, cloud service providers, and system integrators.

Market Segmentation Analysis:

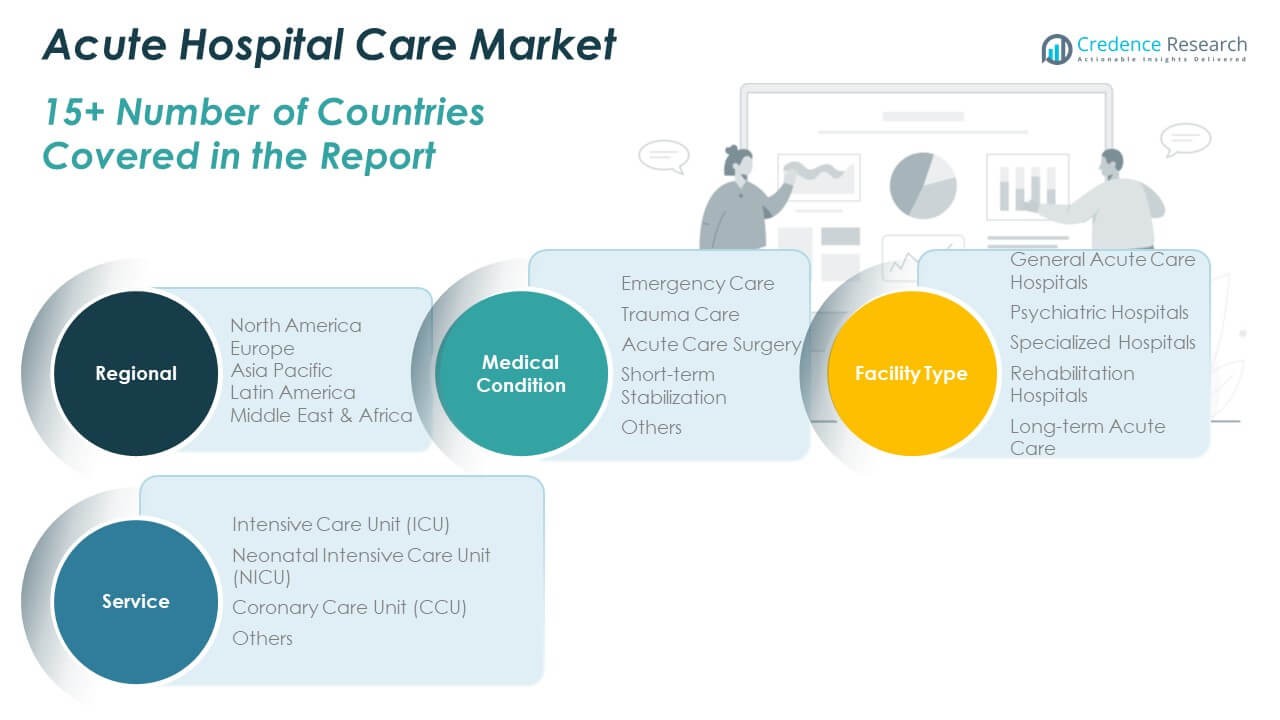

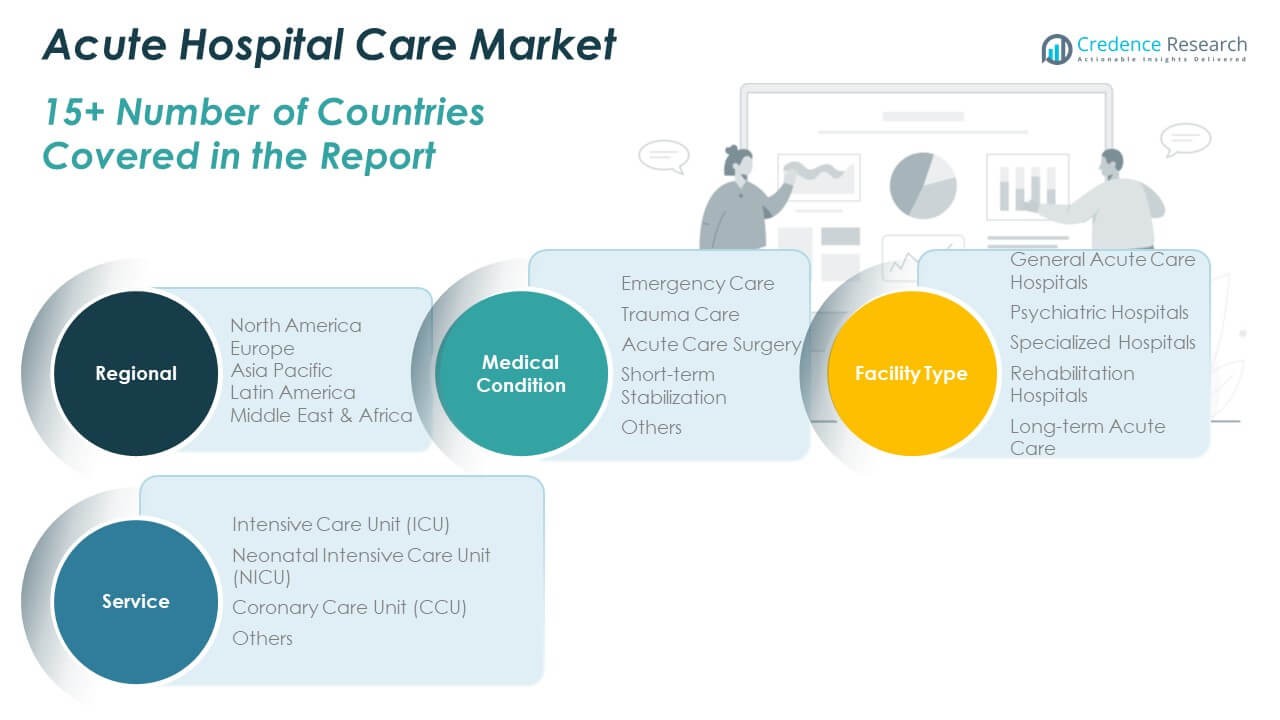

The Global Acute Hospital Care Market is segmented by medical condition, facility type, and service, each contributing uniquely to market dynamics.

By medical condition, emergency care holds a major share due to high patient volumes and the need for immediate intervention. Trauma care and acute care surgery are expanding steadily, driven by increased accident rates and surgical innovations. Short-term stabilization services are critical in managing sudden deteriorations and transitional care, while the others category includes niche acute interventions.

- For example, the Cleveland Clinic’s Emergency Services division reported handling over 190,000 emergency department (ED) visits in 2023, making it one of the busiest EDs in the United States.

By facility type, general acute care hospitals dominate the market with their comprehensive service offerings and wide network presence. Psychiatric hospitals are gaining relevance with the inclusion of mental health in acute care protocols. Specialized hospitals cater to high-acuity cases in cardiology, oncology, and neurology. Rehabilitation hospitals support recovery post-acute treatment, while long-term acute care facilities address complex conditions requiring extended monitoring.

- For example, HCA Healthcare, the largest U.S. hospital operator, managed 186 general acute care hospitals in 2024, delivering over 5.6 million annual emergency visits and 1.2 million inpatient admissions.

By service, intensive care units (ICU) represent the largest segment, followed by neonatal intensive care units (NICU) and coronary care units (CCU). These units are central to life-saving interventions, and their demand rises with disease severity and surgical complexity. Other services include telemetry and intermediate care, which support step-down patients requiring close observation. Each segment plays a vital role in supporting the operational structure and care continuum within the acute hospital ecosystem.

Segmentation:

By Medical Condition

- Emergency Care

- Trauma Care

- Acute Care Surgery

- Short-term Stabilization

- Others

By Facility Type

- General Acute Care Hospitals

- Psychiatric Hospitals

- Specialized Hospitals

- Rehabilitation Hospitals

- Long-term Acute Care

By Service

- Intensive Care Unit (ICU)

- Neonatal Intensive Care Unit (NICU)

- Coronary Care Unit (CCU)

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

The North America Acute Hospital Care Market size was valued at USD 1,028.51 million in 2018 to USD 1,452.59 million in 2024 and is anticipated to reach USD 2,306.78 million by 2032, at a CAGR of 5.5% during the forecast period. North America holds the largest share of the Global Acute Hospital Care Market, accounting for approximately 39% of the total market. The region benefits from highly advanced healthcare infrastructure, extensive insurance coverage, and significant government and private sector investments in acute care services. Hospitals in the United States and Canada continue to lead in the adoption of digital technologies and specialized acute care units. It supports high standards of emergency response, intensive care, and surgical capabilities. Strategic initiatives such as Medicare and Medicaid expansion in the U.S. further increase accessibility to acute care services. The presence of leading healthcare providers and manufacturers reinforces the region’s dominance in the global landscape.

The Europe Acute Hospital Care Market size was valued at USD 626.06 million in 2018 to USD 860.25 million in 2024 and is anticipated to reach USD 1,281.22 million by 2032, at a CAGR of 4.7% during the forecast period. Europe accounts for 23% of the Global Acute Hospital Care Market and shows steady growth driven by strong public health systems and regulatory support. Countries such as Germany, France, and the UK invest consistently in hospital modernization and emergency care expansion. It enables efficient acute care delivery, particularly in urban areas. The region’s universal healthcare models help maintain high utilization rates for emergency and critical care services. Cross-border healthcare cooperation within the EU promotes the standardization of quality care. Europe continues to focus on upgrading digital infrastructure and integrating patient-centric care pathways.

The Asia Pacific Acute Hospital Care Market size was valued at USD 401.22 million in 2018 to USD 624.08 million in 2024 and is anticipated to reach USD 1,128.84 million by 2032, at a CAGR of 7.3% during the forecast period. Asia Pacific holds approximately 22% of the Global Acute Hospital Care Market and represents the fastest-growing regional segment. Rapid urbanization, expanding middle-class populations, and increasing healthcare expenditure are fueling acute care infrastructure development. Governments across China, India, Japan, and Southeast Asia are scaling up emergency departments and trauma centers. It supports higher patient volumes and faster service delivery in densely populated areas. International collaborations and medical tourism further contribute to market expansion. The demand for acute care services continues to rise as chronic diseases become more prevalent.

The Latin America Acute Hospital Care Market size was valued at USD 101.94 million in 2018 to USD 143.53 million in 2024 and is anticipated to reach USD 200.10 million by 2032, at a CAGR of 3.8% during the forecast period. Latin America accounts for approximately 4% of the Global Acute Hospital Care Market, with growth supported by ongoing healthcare reforms and investment in hospital capacity. Countries like Brazil, Mexico, and Argentina are working to enhance public healthcare access through expanded emergency care networks. It helps reduce regional disparities in service availability. Despite challenges related to funding and workforce limitations, progress in infrastructure modernization is evident. Public-private partnerships are emerging as a vital mechanism to bridge gaps in acute care delivery. The market holds potential for improvement through digital integration and international cooperation.

The Middle East Acute Hospital Care Market size was valued at USD 61.72 million in 2018 to USD 80.32 million in 2024 and is anticipated to reach USD 106.90 million by 2032, at a CAGR of 3.2% during the forecast period. The Middle East contributes roughly 2% to the Global Acute Hospital Care Market and shows moderate growth led by initiatives in the Gulf Cooperation Council (GCC) countries. Saudi Arabia, UAE, and Qatar are investing heavily in tertiary care hospitals and emergency preparedness. It allows for improved handling of trauma and non-communicable diseases. Smart hospital projects and medical cities are driving innovation in service delivery. Workforce development and medical training remain strategic priorities to support quality improvement. The region continues to attract private investment and international healthcare providers.

The Africa Acute Hospital Care Market size was valued at USD 28.91 million in 2018 to USD 46.44 million in 2024 and is anticipated to reach USD 55.88 million by 2032, at a CAGR of 1.9% during the forecast period. Africa holds approximately 1% of the Global Acute Hospital Care Market, with limited but gradually improving access to acute care services. The region faces challenges including underdeveloped infrastructure, limited funding, and a shortage of skilled healthcare professionals. It restricts the availability of emergency and critical care facilities in many areas. Governments and international organizations are investing in health system strengthening and rural hospital development. Mobile health units and telemedicine initiatives are beginning to expand access in remote regions. The market presents long-term potential, especially with sustained global support and policy focus.

Key Player Analysis:

- Universal Health Services, Inc.

- Community Health Systems, Inc.

- Ascension

- IHH Healthcare Berhad

- TH Medical (Tenet Healthcare Corporation)

- Fresenius Medical Care AG & Co. KGaA

- Mediclinic International

- Lifepoint Health, Inc.

- Ramsay Health Care

- Asklepios Kliniken GmbH & Co. KGaA

Competitive Analysis:

The Global Acute Hospital Care Market features a competitive landscape driven by a mix of public healthcare systems, private hospital chains, and specialty care providers. Leading players focus on expanding service networks, investing in advanced medical technologies, and enhancing patient care delivery. It includes hospitals, healthcare groups, and academic medical centers operating across multiple regions. Strategic collaborations, acquisitions, and infrastructure upgrades are key growth strategies among top players. Companies also compete on the basis of emergency care capabilities, clinical excellence, and integration of smart healthcare systems. The market sees continuous innovation in trauma management, surgical techniques, and critical care equipment. Leading institutions are leveraging data analytics and AI to improve operational efficiency and clinical outcomes. The Global Acute Hospital Care Market remains dynamic, with competition intensifying in emerging economies where demand for quality acute care is growing rapidly. Players that adapt quickly to changing care models and regulations gain a competitive edge.

Recent Developments:

- In June 2025, Universal Health Services launched Hippocratic AI’s generative AI healthcare agents to assist with post-discharge patient engagement. This move aims to enhance patient outcomes and streamline follow-up care by leveraging advanced AI technology to support patients after they leave the hospital.

- In June 2025, General Catalyst’s Health Assurance Transformation Co. (HATCo) finalized the acquisition of Summa Health, marking the first-ever U.S. hospital acquisition by a venture-capital firm.

- In June 2024, Community Health Systems announced an expanded partnership with Mark Cuban Cost Plus Drugs Company. This expansion allows all 71 CHS-affiliated hospitals to access a broader range of medications at significantly lower costs through the Cost Plus Drugs Marketplace, which offers transparency and potential savings of hundreds of thousands of dollars annually

Market Concentration & Characteristics:

The Global Acute Hospital Care Market is moderately fragmented, with a mix of large-scale healthcare providers, regional hospital networks, and government-operated institutions. It features a high level of service differentiation based on specialty care, emergency readiness, and infrastructure quality. Market concentration is higher in developed regions where a few major hospital chains dominate urban and tertiary care services. In emerging markets, the sector remains more dispersed due to varying levels of investment and infrastructure maturity. The market is characterized by constant demand, regulatory oversight, and the need for rapid response capabilities. It continues to evolve with the integration of digital health technologies, value-based care models, and public-private partnerships. Competitive advantage often depends on geographic reach, clinical expertise, and technological adoption.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on medical condition, facility type, and service. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for acute care services will rise with the increasing prevalence of chronic and lifestyle-related diseases.

- Technological integration such as AI, IoT, and predictive analytics will reshape hospital operations and patient care.

- Public-private partnerships will expand hospital infrastructure in emerging economies.

- Value-based care models will drive efficiency and outcome-focused healthcare delivery.

- Growth in outpatient and short-stay acute care units will optimize hospital resource utilization.

- Mental health emergency response integration will become standard in acute hospital settings.

- Micro-hospitals and satellite emergency centers will enhance accessibility in semi-urban regions.

- Tele-acute care services will expand to support remote monitoring and triage.

- Regulatory frameworks will strengthen quality standards and safety compliance globally.

- Investment in workforce training and retention strategies will address critical staffing shortages.