Market Overview:

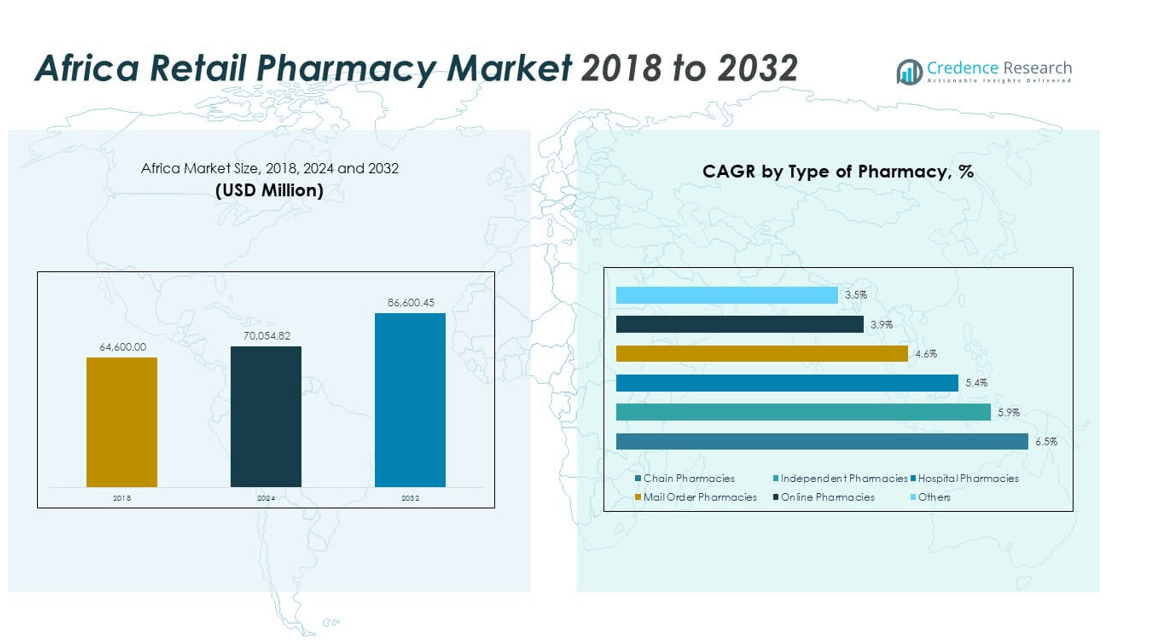

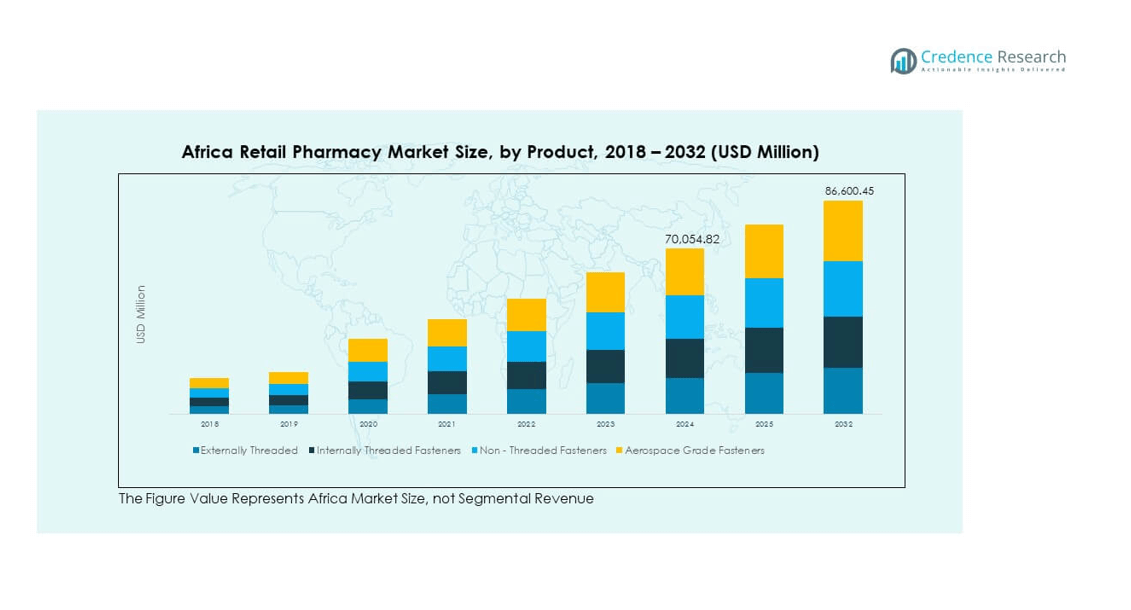

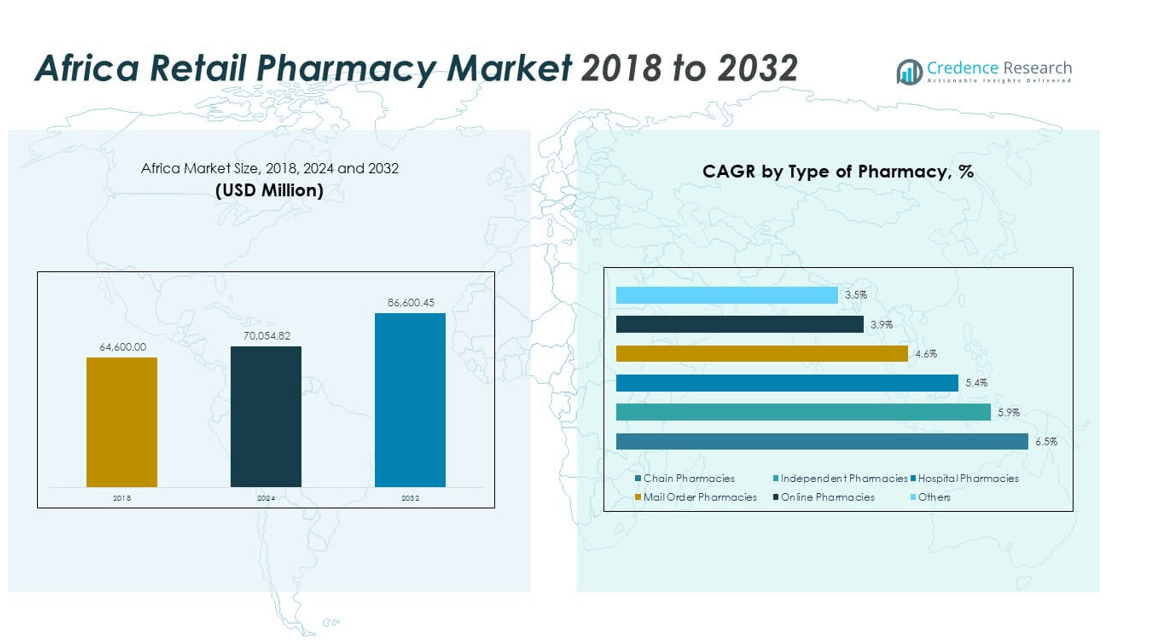

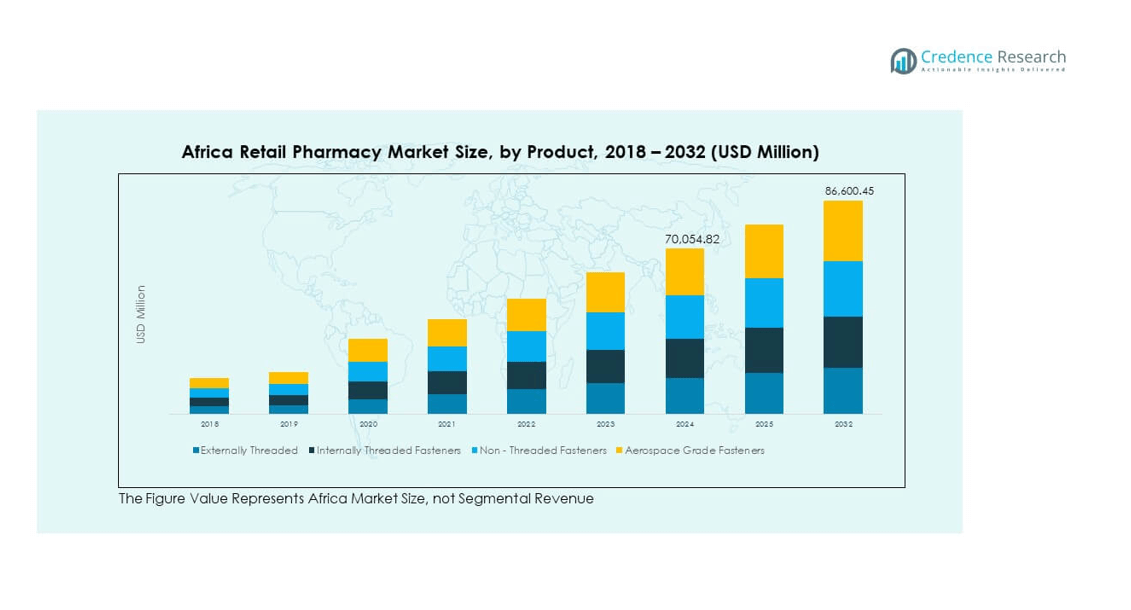

The Africa Retail Pharmacy Market size was valued at USD 68,600.00 million in 2018 to USD 70,054.82 million in 2024 and is anticipated to reach USD 86,600.45 million by 2032, at a CAGR of 2.69% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Africa Retail Pharmacy Market Size 2024 |

USD 70,054.82 million |

| Africa Retail Pharmacy Market, CAGR |

2.69% |

| Africa Retail Pharmacy Market Size 2032 |

USD 86,600.45 million |

Growing healthcare needs, increasing chronic disease cases, and expanding access to medicines are driving the Africa Retail Pharmacy Market. Urbanization and rising disposable incomes encourage more people to seek pharmacy-based healthcare solutions. Expanding health insurance coverage and government support for better drug distribution networks are also boosting retail pharmacy demand. Pharmacies are evolving into one-stop healthcare points offering prescription drugs, over-the-counter medicines, and wellness products. Digital transformation and e-pharmacy platforms further strengthen consumer accessibility, enhancing efficiency in healthcare delivery across the region.

Regionally, South Africa and Nigeria lead the Africa Retail Pharmacy Market due to advanced infrastructure and strong consumer demand. Kenya and Egypt are emerging markets, supported by growing investments in healthcare, rising population, and increasing access to modern retail channels. Francophone Africa is slowly adopting structured pharmacy models, but regulatory and supply chain challenges limit growth. North African nations benefit from stronger pharmaceutical manufacturing bases, while Sub-Saharan regions are seeing rapid growth as healthcare awareness spreads and governments invest in improving accessibility.

Market Insights:

- The Africa Retail Pharmacy Market was valued at USD 68,600.00 million in 2018, reached USD 70,054.82 million in 2024, and is projected to hit USD 86,600.45 million by 2032, growing at a CAGR of 2.69%.

- South Africa leads with around 35% share due to advanced infrastructure and established pharmacy chains, followed by Egypt at 25% driven by strong pharmaceutical manufacturing, and Nigeria at 20% supported by its large population and rising healthcare needs.

- The Rest of Africa, holding 20% share, is the fastest-growing region, driven by expanding e-pharmacy adoption, rising healthcare investments, and growing middle-class populations in markets like Kenya and Ghana.

- Externally threaded products dominate with about 35% share in 2024, supported by widespread application across pharmacy channels.

- Aerospace-grade products, though holding 20% share, show steady growth potential with rising demand for advanced pharmaceutical-grade solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Healthcare Needs and Expanding Chronic Disease Burden:

The Africa Retail Pharmacy Market benefits from growing healthcare demands and an increasing chronic disease burden. Rising cases of diabetes, hypertension, and cardiovascular conditions drive higher prescription and non-prescription drug sales. Urbanization is changing lifestyles, creating a steady need for pharmaceutical support. Expanding middle-class populations are seeking better healthcare access, fueling retail pharmacy visits. The aging population also demands continuous medication access, reinforcing pharmacy relevance. Pharmacies act as critical points for regular drug supply in urban and semi-urban regions. This consistent demand anchors retail pharmacies as integral parts of Africa’s healthcare delivery system. It creates opportunities for both local and multinational players to expand reach.

- For instance, Clicks Group in South Africa reported an 8.9% increase in pharmacy sales in 2024, supported by 11.8 million loyal ClubCard members and a repeat prescription service participation rising to 53%, reflecting the increasing demand for chronic disease medicines.

Government Policies Supporting Accessibility and Healthcare Expansion:

Government initiatives and supportive healthcare regulations are key drivers shaping the Africa Retail Pharmacy Market. National programs encourage medicine affordability and availability in urban and rural locations. Public-private partnerships are promoting stronger pharmacy networks across key African economies. Many governments are investing in health insurance schemes that boost consumer access to pharmacies. Enhanced regulatory frameworks are reducing counterfeit drugs, which strengthens trust in retail pharmacies. Infrastructure development across emerging regions is also helping distribution channels operate efficiently. Rural access programs ensure pharmacies expand beyond urban clusters. It gives pharmacies a central role in improving drug accessibility across the continent.

- For instance, Dis-Chem Pharmacies in South Africa have invested significantly in their distribution center capacity, optimizing supply chain efficiency to service expanded retail footprints and onboard new independent pharmacy customers, aiming to increase national presence beyond urban centers in trading space over three years.

Technological Integration Enhancing Customer Convenience and Efficiency:

The Africa Retail Pharmacy Market is moving toward digital integration, which accelerates accessibility and efficiency. E-pharmacy platforms are gaining popularity, offering doorstep delivery and virtual consultation. Pharmacies are adopting point-of-sale software to streamline inventory management and reduce errors. Mobile applications are increasing consumer engagement with features like refill reminders and promotions. Digital payment solutions encourage more purchases, especially in urban regions with rising smartphone penetration. Technology also helps pharmacies analyze consumer behavior and personalize offerings. Automated dispensing systems are emerging in larger retail chains to improve speed and accuracy. It strengthens consumer trust by offering consistent quality service and reliable product availability.

Expanding Consumer Awareness and Demand for Preventive Healthcare:

Increasing awareness of preventive healthcare and wellness is boosting demand in the Africa Retail Pharmacy Market. Consumers are seeking vitamins, supplements, and over-the-counter products to support healthier lifestyles. Pharmacies have become important touchpoints for preventive care advice, especially in urban centers. Lifestyle diseases encourage people to adopt regular wellness checks and nutritional support. Awareness campaigns by governments and private firms reinforce the importance of proactive healthcare. Pharmacies stock a wide range of products that support immunity and long-term health. Consumers now prefer pharmacies that combine drug supply with wellness services. It is driving pharmacies to diversify into preventive care segments to meet rising expectations.

Market Trends:

Emergence of Chain Pharmacies and Consolidation of Retail Outlets:

The Africa Retail Pharmacy Market is witnessing strong growth in chain pharmacies and retail consolidation. Large pharmacy groups are expanding networks, offering standardized services across multiple locations. Consolidation is improving supply chain efficiencies, reducing product shortages, and ensuring uniform pricing. Customers prefer branded chains due to reliability and consistent service quality. Independent pharmacies are partnering with larger groups to survive competitive pressures. Chain expansion is especially visible in South Africa, Nigeria, and Egypt. Consolidation is helping pharmacies achieve economies of scale and negotiate better supplier contracts. It is setting new benchmarks in professional pharmacy management and customer satisfaction across Africa.

- For instance, Goodlife Pharmacy increased its store presence from 19 to 150 stores under LeapFrog stewardship, reaching 2 million consumers annually across East Africa by 2025, exemplifying rapid network expansion and operational consolidation in the region.

Integration of Telemedicine and Pharmacy Services:

The Africa Retail Pharmacy Market is evolving with the integration of telemedicine services into pharmacy networks. Pharmacies are now offering virtual consultations alongside dispensing medicines. This integration supports rural communities with limited access to healthcare professionals. Telemedicine creates new revenue streams while strengthening pharmacy relevance in digital healthcare ecosystems. Pharmacies collaborate with doctors and diagnostic labs to deliver end-to-end patient support. Consumers benefit from convenience, affordability, and comprehensive care solutions under one roof. This trend aligns with rising smartphone adoption and digital healthcare platforms. It reflects the growing importance of pharmacies in bridging gaps between patients and healthcare providers.

- For instance, mPharma partnered with TytoCare to implement telehealth services across 35 pharmacies in Ghana, Kenya, Uganda, Zambia, and Nigeria, facilitating over 8,000 remote physical examinations since June 2021, enabling rapid virtual consultations often within 10 minutes.

Expansion of Specialty Pharmacies and Niche Healthcare Products:

The Africa Retail Pharmacy Market is witnessing rising demand for specialty pharmacies catering to complex conditions. Specialty outlets focus on oncology, rare diseases, and advanced treatments requiring specific storage. Pharmacies offering such products gain competitive advantages and consumer trust. Growth in biotechnology and specialty drug pipelines is fueling the demand for specialized services. Patients prefer pharmacies with expertise in handling complex prescriptions and counseling. Niche product categories such as dermatology and pediatric care are also expanding. These pharmacies differentiate themselves by offering value-added services beyond basic drug dispensing. It is positioning them as essential partners in delivering advanced and personalized care.

Growing Focus on Health and Wellness Retail Segments:

The Africa Retail Pharmacy Market is broadening into health and wellness segments. Pharmacies are increasingly stocking organic supplements, nutraceuticals, and personal care products. Consumers prefer pharmacies for wellness purchases due to trust and expert guidance. Urban customers are driving demand for fitness-related nutrition, skincare, and preventive health items. Retail outlets are redesigning store layouts to highlight wellness product categories. Pharmacies use loyalty programs to encourage regular purchases across wellness lines. Partnerships with global health and nutrition brands are expanding product ranges. It strengthens the role of pharmacies as holistic healthcare providers beyond traditional medicine dispensing.

Market Challenges Analysis:

Regulatory Variability and Prevalence of Counterfeit Drugs:

The Africa Retail Pharmacy Market faces significant challenges due to diverse regulatory systems across countries. Inconsistent regulations complicate cross-border operations and hinder uniform growth. Counterfeit drugs remain a persistent issue, undermining trust in retail pharmacies. Weak enforcement mechanisms allow unauthorized outlets to flourish, limiting quality assurance. High regulatory compliance costs also burden smaller pharmacies and restrict their expansion. Fragmented policies slow down standardization efforts and affect industry reputation. Consumers often face risks of substandard products due to poor monitoring. It creates a pressing need for stricter governance to safeguard patient safety and industry credibility.

Infrastructure Gaps and Limited Access in Rural Areas:

The Africa Retail Pharmacy Market struggles with infrastructure gaps that restrict its rural penetration. Many remote communities lack access to reliable retail pharmacies. Poor transport and logistics infrastructure delay medicine distribution to underserved areas. Power shortages affect storage of temperature-sensitive products in many regions. Pharmacies face high operating costs when expanding into less-developed markets. Skilled workforce shortages in pharmacy practice further weaken rural service delivery. Urban markets continue to dominate due to better infrastructure and customer density. It reinforces the urban-rural divide and limits equitable access to healthcare across Africa.

Market Opportunities:

Expansion of E-Pharmacy Platforms and Digital Healthcare Integration:

The Africa Retail Pharmacy Market presents strong opportunities through the expansion of e-pharmacy platforms. Growing internet penetration and smartphone use are fueling adoption of digital channels. Consumers increasingly seek doorstep delivery and online consultation for convenience. E-pharmacies can reach rural populations where physical outlets remain scarce. Partnerships with telecom operators and digital payment providers strengthen scalability. It creates a pathway for pharmacies to build hybrid models combining online and offline operations. The rising trend of digital healthcare ensures steady opportunities for innovation.

Rising Demand for Preventive Healthcare and Wellness Products:

The Africa Retail Pharmacy Market shows promising opportunities in preventive healthcare and wellness expansion. Increasing consumer preference for immunity boosters, supplements, and lifestyle products fuels growth. Pharmacies can leverage this demand by diversifying product portfolios into holistic wellness. Collaborations with global nutraceutical and healthcare brands can widen offerings. Health-conscious consumers encourage pharmacies to integrate fitness and nutrition categories. Wellness-focused loyalty programs attract repeat customers and strengthen brand value. It positions retail pharmacies as trusted destinations for comprehensive healthcare and lifestyle solutions.

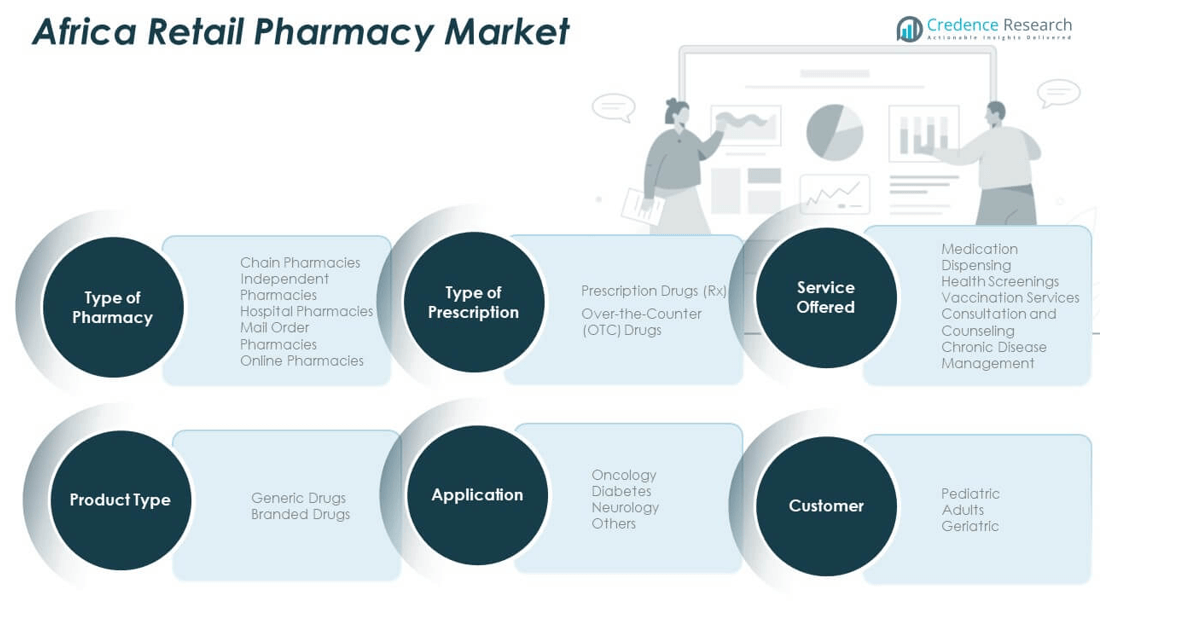

Market Segmentation Analysis:

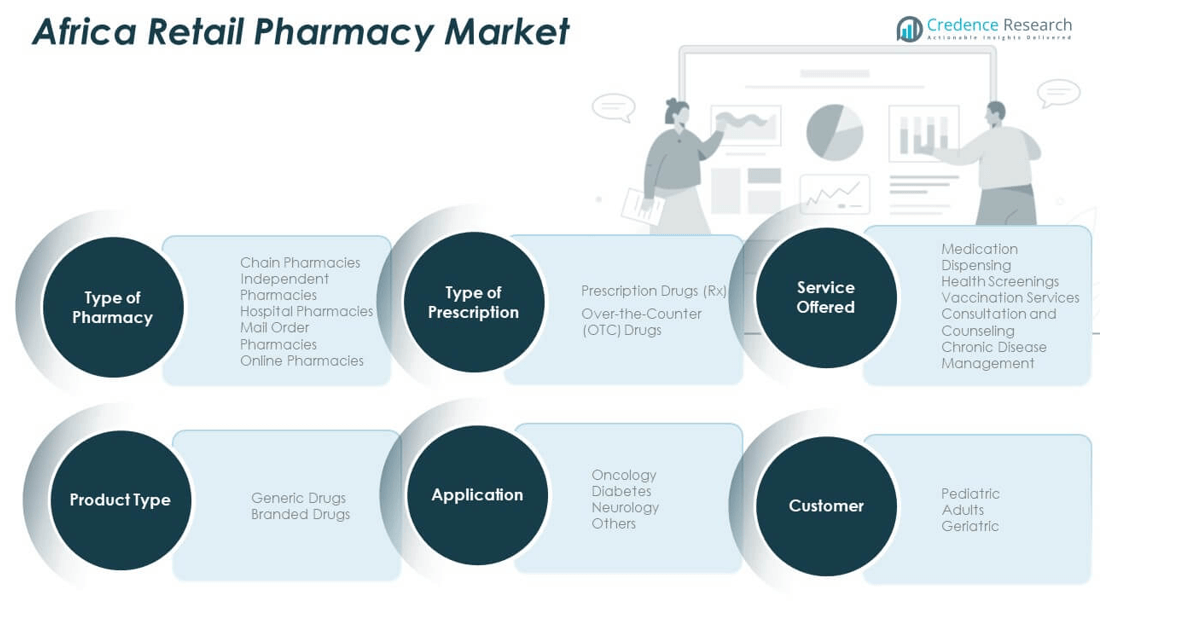

By Type of Pharmacy

The Africa Retail Pharmacy Market includes chain pharmacies, independent outlets, hospital pharmacies, mail order services, and online platforms. Chain pharmacies dominate urban markets due to standardized service and broad product ranges, while independent outlets retain relevance in rural and semi-urban areas. Online pharmacies are emerging as high-growth channels driven by digital adoption.

- For instance, Dis-Chem’s e-commerce operations currently contribute revenue and are expanding through online prescription services and on-demand delivery, integrating physical store presence with digital channels to enhance accessibility and convenience.

By Product Type

Generic drugs hold a substantial share due to affordability and government initiatives supporting access. Branded drugs maintain strong demand in urban centers where consumers seek quality assurance and established brand trust.

By Type of Prescription

Prescription drugs (Rx) represent the majority share, reflecting the growing burden of chronic conditions. Over-the-counter (OTC) drugs expand steadily with rising self-medication trends and consumer awareness of preventive health.

By Application

Oncology and diabetes lead the application segment due to increasing prevalence of lifestyle-related and critical illnesses. Neurology shows steady demand, while the “others” category covers diverse therapeutic needs across regions.

By Services Offered

Medication dispensing remains the primary service, supported by rising demand for vaccination and chronic disease management. Pharmacies increasingly provide health screenings, consultations, and counseling to expand their role in healthcare delivery.

By Customer Segment

Adults form the largest consumer base, followed by a growing geriatric segment requiring long-term medication. Pediatric demand continues in vaccines and child-specific therapies, supporting steady sales across age groups.

Segmentation:

By Type of Pharmacy

- Chain Pharmacies

- Independent Pharmacies

- Hospital Pharmacies

- Mail Order Pharmacies

- Online Pharmacies

By Product Type

- Generic Drugs

- Branded Drugs

By Type of Prescription

- Prescription Drugs (Rx)

- Over-the-Counter (OTC) Drugs

By Application

- Oncology

- Diabetes

- Neurology

- Others

By Services Offered

- Medication Dispensing

- Health Screenings

- Vaccination Services

- Consultation and Counselling

- Chronic Disease Management

By Customer Segment

- Pediatric

- Adults

- Geriatric

By Country

- South Africa

- Egypt

- Rest of Africa

Regional Analysis:

South Africa: Market Leader with Strong Infrastructure

South Africa holds the largest share of the Africa Retail Pharmacy Market, accounting for nearly 35% of total revenue. Its advanced healthcare infrastructure and wide network of chain pharmacies, including Clicks Group and Dis-Chem Pharmacies, strengthen market dominance. High urbanization rates and strong consumer purchasing power support steady demand for both prescription and OTC drugs. The country benefits from favorable insurance coverage and a mature retail distribution model. Online pharmacies are also expanding, supported by high internet penetration. It remains the most developed market in Africa, offering consistent growth and innovation opportunities.

Egypt and Nigeria: Expanding High-Growth Hubs

Egypt contributes around 25% of the Africa Retail Pharmacy Market share, driven by a robust pharmaceutical manufacturing base and government-backed health reforms. Nigeria holds nearly 20%, supported by rapid population growth and increasing healthcare needs. Pharmacies in Egypt focus on branded drugs and hospital-linked services, while Nigeria’s independent outlets dominate due to uneven urban-rural distribution. Both regions are seeing rising investments in chain pharmacies and e-pharmacy models. It reflects strong potential for expansion across urban centers and semi-urban regions.

Rest of Africa: Emerging Frontier with Untapped Potential

The Rest of Africa accounts for about 20% of the Africa Retail Pharmacy Market and represents the fastest-growing region. Kenya and Ghana are key contributors, benefiting from rising middle-class populations and growing healthcare awareness. Limited infrastructure challenges remain, but digital platforms are helping bridge accessibility gaps. Independent pharmacies dominate, though regional players are expanding their presence in urban clusters. Governments in East and West Africa are encouraging local manufacturing and pharmacy regulation to improve trust and availability. It positions the region as an attractive frontier for long-term growth and investment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Africa Retail Pharmacy Market is competitive, with strong participation from regional chains, independent outlets, and online platforms. Large players such as Clicks Group and Dis-Chem Pharmacies dominate in South Africa with extensive networks and standardized services. Companies like mPharma and Goodlife Pharmacy are expanding across multiple African countries through strategic partnerships and digital solutions. Independent pharmacies maintain relevance in rural and semi-urban regions, although they face pressure from expanding chains and online services. The market shows increasing competition driven by consumer demand for affordability, accessibility, and wellness-focused products. It continues to evolve as players strengthen supply chains, expand product portfolios, and leverage technology to enhance customer engagement.

Recent Developments:

- Goodlife Pharmacy, East Africa’s largest retail pharmacy platform, was fully acquired by CFAO Healthcare in July 2025. This acquisition follows an earlier partial sale in 2022 and positions Goodlife for further growth in the East African market, leveraging its digital-first strategy and extensive pharmacy network across Kenya and Uganda.

- In April 2025, Clicks Group announced plans to open 45 to 55 new stores and pharmacies throughout the year as part of its expansion strategy across South Africa. The company has already expanded its national pharmacy footprint to 740 locations, aiming to reach 1,200 stores in the medium term. Additionally, Clicks launched South Africa’s first fleet of zero-emission, pharma-compliant electric delivery vehicles equipped with solar-powered refrigeration, serving customers in Gauteng and the Western Cape.

Report Coverage:

The research report offers an in-depth analysis based on type of pharmacy, product type, prescription type, application, services offered, and customer segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Expansion of chain pharmacies will accelerate consolidation across urban markets.

- Online pharmacies will gain traction with growing smartphone use and digital adoption.

- Preventive healthcare and wellness products will expand their share in pharmacy sales.

- Regulatory reforms will strengthen trust in pharmacy networks across the region.

- Chronic disease management services will drive long-term customer loyalty.

- Regional players will expand through partnerships and acquisitions.

- Independent pharmacies will remain strong in underserved rural regions.

- Telemedicine integration will make pharmacies central to holistic healthcare.

- Local manufacturing of generic drugs will improve affordability and access.

- Consumer loyalty programs will support recurring purchases and higher engagement.