Market Overview:

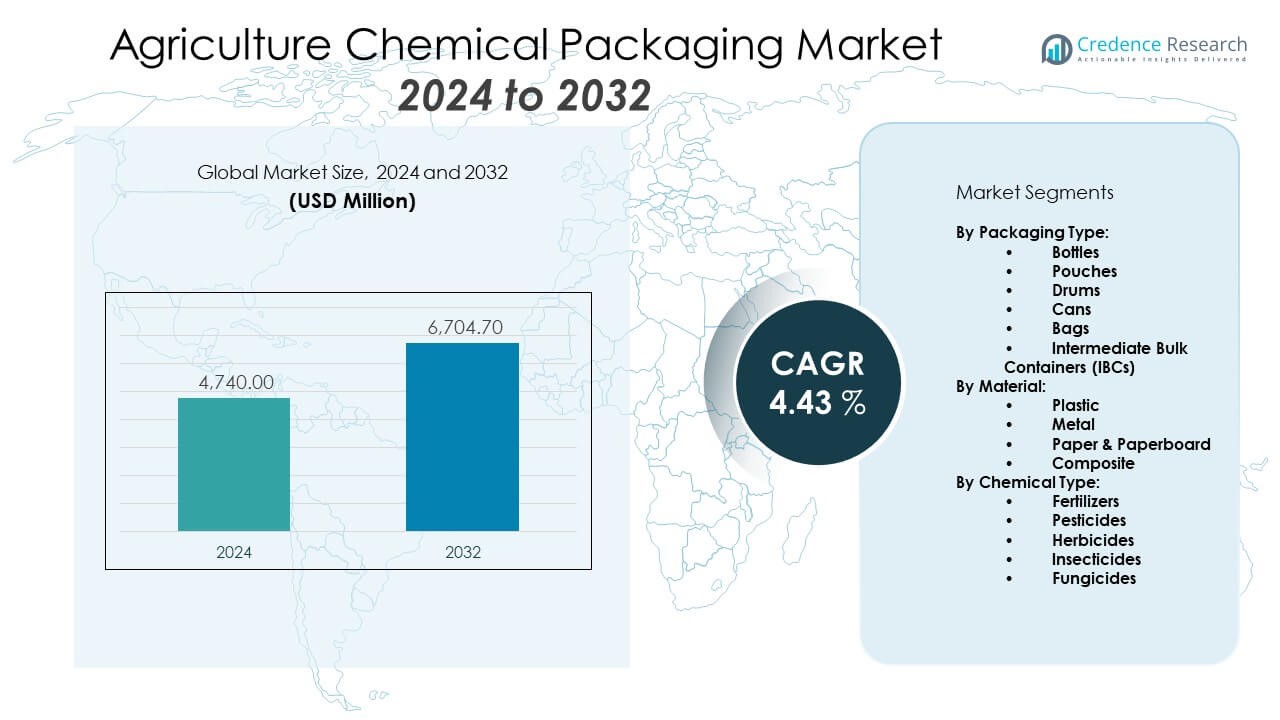

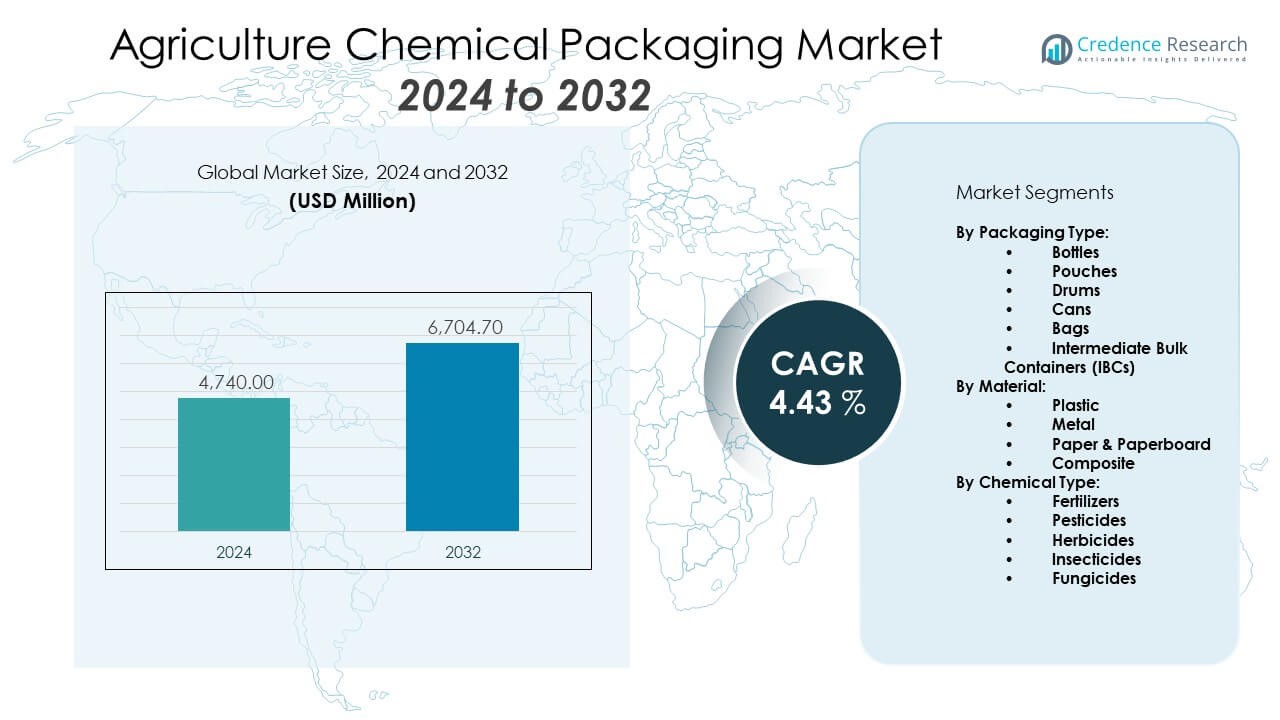

The Agriculture Chemical Packaging Market is expected to expand from USD 4,740 million in 2024 to USD 6,704.7 million by 2032, growing at a CAGR of 4.43% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Agriculture Chemical Packaging Market Size 2024 |

USD 4,740 Million |

| Agriculture Chemical Packaging Market, CAGR |

4.43% |

| Agriculture Chemical Packaging Market Size 2032 |

USD 6,704.7 Million |

This growth is fueled by increasing global food demand, expanding use of agrochemicals, and growing emphasis on sustainable farming practices. As farmers and agricultural businesses strive to enhance crop yields, the need for safe, durable, and environmentally responsible packaging for fertilizers, pesticides, and herbicides has intensified. Manufacturers are adopting recyclable materials, multilayer barrier films, and tamper-evident containers to comply with regulatory norms and improve storage stability. Innovations in packaging design—such as lightweight drums, spill-proof pouches, and user-friendly dosing systems—are improving safety, transport efficiency, and ease of use across distribution chains.

Regionally, North America dominates the Agriculture Chemical Packaging Market, supported by high agrochemical usage, strong R&D activity, and eco-conscious packaging advancements. Europe holds the second-largest share, driven by strict environmental regulations and a shift toward bio-based packaging. Asia-Pacific is projected to register the fastest growth rate, owing to high agricultural output, increasing agrochemical adoption, and improving infrastructure in countries like China, India, and across Southeast Asia.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Agriculture Chemical Packaging Market was valued at USD 4,740 million in 2024 and will reach USD 6,704.7 million by 2032.

- Plastic remains the dominant packaging material due to cost efficiency and compatibility with chemical contents.

- Smart labels, anti-counterfeit technologies, and RFID integration are becoming standard in premium product packaging.

- Asia-Pacific is the fastest-growing regional market, supported by agricultural expansion and increasing agrochemical use.

- Flexible packaging formats like pouches and sachets lead in volume due to ease of handling and storage.

- Sustainability remains a priority, driving demand for biodegradable materials and closed-loop packaging systems.

- Regulatory complexity and raw material supply disruptions pose ongoing risks for packaging manufacturers.

Market Drivers:

Surging Agrochemical Demand:

Growing global population and declining arable land have intensified the demand for agrochemicals to improve crop yield. Agriculture Chemical Packaging Market supports this growth by delivering safe, efficient, and tamper-proof packaging for pesticides, herbicides, and fertilizers. The packaging ensures longevity, transport safety, and compliance with stringent labeling norms. Manufacturers are prioritizing user-friendly designs that reduce spillage and contamination risks. Lightweight packaging formats also improve supply chain economics. As the agriculture sector embraces precision farming and mechanization, the packaging industry is adapting to offer standardized solutions that align with bulk handling and automated dispensing systems.

- For instance, Amcor reported in its 2024 Sustainability Report that 95% of its rigid packaging (by weight) was recyclable at scale, and 94% of its flexible packaging portfolio by area had recycle-ready solutions.

Shift Towards Sustainable Packaging:

Environmental regulations are compelling companies to adopt recyclable and biodegradable packaging for chemical products. Agriculture Chemical Packaging Market sees innovation in compostable films, bio-based polymers, and refillable containers to minimize landfill impact. Regulatory bodies are enforcing restrictions on single-use plastics and VOC emissions. Market players are investing in R&D to develop barrier coatings that maintain chemical stability without harming the environment. Consumer awareness about sustainable practices further fuels this shift, pressuring manufacturers to provide eco-certifications and green labeling. Packaging suppliers are creating closed-loop systems to reclaim used containers and promote circular economy practices.

- For instance, Johnny Appleseed Organic launched ClimateGard fertilizer, which is delivered in certified organic cotton bags with compostable inner liners, offering a reusable and fully biodegradable packaging option for agricultural chemicals.

Rise in Mechanized Farming Practices:

Mechanized farming is gaining traction, increasing the need for large-volume chemical containers compatible with dispensing machinery. Agriculture Chemical Packaging Market is adapting with IBCs, drums, and high-volume pouches designed for mechanized spray systems. These formats enhance application efficiency and reduce downtime. Packaging design now incorporates features such as tamper-evident seals, calibrated spouts, and multi-layer barrier films to ensure dosage accuracy. As precision agriculture and drone-assisted spraying evolve, packaging solutions must integrate usability features that support emerging tech ecosystems. Packaging vendors collaborate with equipment manufacturers to ensure compatibility with automated systems.

Stringent Regulatory Compliance Requirements:

Governments worldwide enforce rigorous safety and environmental standards for agrochemical storage and transport. Agriculture Chemical Packaging Market aligns with these mandates by deploying UN-certified packaging for hazardous materials. Labeling accuracy, resistance to UV, moisture, and temperature fluctuations are critical performance parameters. Companies must validate packaging through stress and compatibility testing. Regulatory trends also emphasize traceability, prompting the use of smart labeling and QR code tracking. Compliance with REACH, EPA, and GHS standards shapes product design and raw material sourcing. Failing to meet these criteria results in product recalls and reputational damage, making regulatory adherence a key market driver.

Market Trends:

Adoption of Smart Packaging Solutions:

Smart packaging technologies are being integrated to enhance traceability, safety, and user interaction. Agriculture Chemical Packaging Market sees the use of QR codes, RFID tags, and NFC-enabled labels for real-time monitoring and authentication. These technologies improve inventory management, prevent counterfeiting, and support regulatory compliance. Brands are leveraging digital packaging to communicate safety guidelines and handling instructions. The growing need for precision and traceability across supply chains drives this trend. Smart packaging also enables better shelf-life tracking and enhances consumer trust. Firms are investing in software and IoT integration for smart-label functionality. This innovation improves operational efficiency for manufacturers and distributors alike.

- For instance, Greif Inc. offers GCUBE Connect Intermediate Bulk Containers (IBCs) featuring integrated real-time tracking technology, developed with IoT specialists. This system provides geolocation, fill-level monitoring, and environmental data via dashboards, enabling customers to optimize logistics, manage inventories, and prevent theft or loss of high-value chemicals.

Growth of Flexible Packaging Formats:

Flexible packaging is witnessing high demand due to its light weight, cost efficiency, and lower environmental footprint. Agriculture Chemical Packaging Market increasingly relies on pouches, sachets, and liners for liquid and powder agrochemicals. These formats are easy to store, reduce transportation costs, and generate less waste. Reclosable spouts and tear notches add convenience and safety. Companies focus on multi-layer laminates that offer chemical resistance and barrier protection. The trend supports both economic and environmental performance. Farmers prefer flexible options for easy handling and field application. Global packaging vendors are scaling flexible solutions to meet rising agrochemical volumes.

- For instance, Flexible packaging (pouches, bags, films) dominates the agricultural chemical packaging market due to superior product protection, reduced shipping weight, lower carbon footprint, and customizability.

Emergence of Bio-Based Materials:

Growing sustainability concerns have led to the development of packaging derived from plant-based sources. Agriculture Chemical Packaging Market supports this shift with bio-polyethylene, PLA, and PHA packaging formats. These materials reduce dependency on fossil fuels and address waste management issues. Biodegradable alternatives maintain chemical compatibility and shelf life. Companies are collaborating with material science firms to develop robust, scalable bio-packaging solutions. Government incentives and consumer demand strengthen this trend. Challenges include achieving required barrier properties and cost parity with conventional plastics. Ongoing R&D aims to overcome these issues and improve adoption across geographies.

Customization for End-User Needs:

Customized packaging solutions are becoming standard to meet diverse agricultural practices and user preferences. Agriculture Chemical Packaging Market accommodates varied volume sizes, dispensing mechanisms, and label requirements. Manufacturers design packaging to suit local climatic conditions, language preferences, and storage logistics. Precision farming, organic farming, and industrial-scale agribusiness all demand specific packaging functionalities. Packaging suppliers collaborate with agrochemical companies to co-develop tailored solutions. This customization enhances safety, compliance, and user convenience. It also supports branding strategies and market differentiation. The trend reflects a shift from generic packaging to performance-optimized formats.

Market Challenges Analysis:

Compliance with Environmental and Safety Regulations Increases Costs and Complexity:

Companies in the Agriculture Chemical Packaging Market face mounting pressure to comply with evolving global and local regulations. Stringent safety and environmental laws require the use of certified materials and hazard-resistant packaging. Compliance often involves additional testing, documentation, and investment in upgraded production lines. This creates barriers for small manufacturers and limits innovation speed. Packaging must now meet standards for leakage resistance, UV protection, chemical compatibility, and labeling clarity. Failure to comply leads to product recalls and brand damage. Navigating diverse regulatory environments adds further complexity to global operations.

Volatile Raw Material Prices Disrupt Profit Margins and Supply Stability:

Agriculture Chemical Packaging Market depends heavily on polymers, resins, and specialty additives, many derived from petrochemicals. Raw material prices are subject to fluctuations due to oil market volatility, supply chain disruptions, and geopolitical issues. These price swings significantly impact production costs and reduce profit margins. Suppliers struggle to maintain consistent pricing and delivery schedules, affecting long-term contracts. Manufacturers are compelled to seek alternative or recycled materials, which may compromise performance or shelf life. This unpredictability undermines forecasting and planning efforts across the value chain. Stability in material supply is critical to support packaging innovation and scalability.

Market Opportunities:

Expansion in Emerging Agricultural Economies:

Rapid agricultural development in countries across Asia, Africa, and Latin America presents significant opportunities for growth. Agriculture Chemical Packaging Market can capitalize on increasing demand for agrochemical products in these regions. Governments are investing in agricultural modernization, improving logistics, and supporting farmer access to crop protection chemicals. Packaging solutions tailored for hot, humid, or rural environments can capture untapped market potential. Local manufacturing partnerships and region-specific designs will enhance competitiveness. Rising food demand and climate-change mitigation strategies also drive agrochemical consumption. Companies entering these markets early can establish strong brand presence and distribution networks. Policy reforms and trade incentives further strengthen the business case for expansion.

Innovation in Sustainable and Functional Packaging Technologies:

Growing consumer awareness and tightening regulations open opportunities for eco-friendly packaging alternatives. Agriculture Chemical Packaging Market players investing in biodegradable films, reusable containers, and smart label systems can gain market share. Packaging innovations such as leak-proof valves, self-measuring dispensers, and anti-counterfeit elements create differentiation. Sustainable design not only meets ESG goals but also enhances brand perception. Collaborations with research institutes and material companies fuel faster development cycles. Digital integration into packaging creates value-added services for tracking and traceability. These innovations provide long-term cost savings and regulatory compliance benefits. Sustainability-focused buyers increasingly prioritize advanced packaging solutions in procurement decisions.

Market Segmentation Analysis:

By Packaging Type

Agriculture Chemical Packaging Market offers a wide variety of formats including bottles, pouches, drums, cans, bags, and intermediate bulk containers (IBCs). Each format caters to different chemical volumes, application methods, and transport needs. Flexible pouches dominate due to lightweight and cost efficiency, while rigid containers offer durability for bulk chemicals.

- For instance, Scholle IPN introduced compostable multilayer pouches using PLA and PBAT; in 2024, over 37% of their European output in this category targeted sustainable organic agricultural applications such as fertilizers.

By Material

The market segments by materials into plastics, metal, paper & paperboard, and composites. Plastic remains the dominant material due to versatility, chemical resistance, and design flexibility. Bioplastics and recyclable materials are gaining traction amid sustainability demands.

- For instance, Greif launched its EcoBalance™ product line with containers made from over 75% recycled HDPE, supporting clients’ CO₂ emissions reduction goals and diverting waste from landfills. This innovation has met industry UN rating standards for liquid containment and ensures safety and regulatory compliance.

By Chemical Type

Key chemical categories include fertilizers, pesticides, herbicides, insecticides, and fungicides. Each chemical type requires specific barrier properties, shelf-life protection, and safety labeling. Packaging solutions are tailored to chemical reactivity and usage environments.

Segmentation:

By Packaging Type:

- Bottles

- Pouches

- Drums

- Cans

- Bags

- Intermediate Bulk Containers (IBCs)

By Material:

- Plastic

- Metal

- Paper & Paperboard

- Composite

By Chemical Type:

- Fertilizers

- Pesticides

- Herbicides

- Insecticides

- Fungicides

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America – 34% Market Share

North America holds the largest share in the Agriculture Chemical Packaging Market, accounting for approximately 34% of the global revenue. The region benefits from advanced farming practices, high agrochemical consumption, and strong regulatory frameworks. Technological innovations in sustainable and smart packaging solutions further strengthen its leadership. The U.S. dominates in both usage and innovation, followed by Canada and Mexico. Growing demand for traceability, environmental compliance, and safe chemical handling drives the adoption of high-performance packaging formats.

Asia-Pacific – 29% Market Share

Asia-Pacific is the fastest-growing region, holding about 29% of the market share. Rapid expansion in agricultural activities, government subsidies, and increasing crop yields in countries like China, India, Vietnam, and Indonesia support demand growth. Packaging manufacturers are investing in joint ventures and local production to cater to rising demand. The region is witnessing adoption of recyclable materials, multilayer packaging, and digital labelling in response to sustainability goals. Infrastructure development and food export requirements continue to drive packaging innovations.

Europe – 23% Market Share

Europe accounts for roughly 23% of the market share, supported by stringent environmental regulations and a strong focus on sustainable farming. Countries such as Germany, France, and the UK lead in agrochemical usage, with packaging solutions aligned to EU compliance standards. Bio-based materials and smart packaging technologies are widely adopted to meet safety and environmental goals.

Latin America and Middle East & Africa – 14% Market Share Combined

Latin America and the Middle East & Africa together hold the remaining 14% of the market. These regions show high growth potential due to increasing agrochemical demand, driven by food security concerns and limited arable land. Packaging formats that offer durability under high temperatures and long transport conditions are gaining preference. International players are expanding their footprint in these emerging markets to diversify revenue streams and tap into underpenetrated agricultural economies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Amcor plc

- Berry Global Inc.

- Greif Inc.

- Mondi Group

- Mauser Packaging Solutions

- Scholle IPN

- Sonoco Products Company

- BASF SE

- CL Smith

- Time Technoplast Ltd.

Competitive Analysis:

Agriculture Chemical Packaging Market is moderately consolidated, with a mix of global and regional players competing on innovation, price, and sustainability. Top companies focus on strategic partnerships, R&D, and eco-friendly solutions to differentiate their offerings. The market features intense competition in flexible packaging formats, especially among contract manufacturers and private label suppliers. Barriers to entry include compliance costs and raw material availability. Firms compete on product performance, regulatory certifications, and supply chain efficiency. Digital traceability and smart labeling provide competitive advantages. Innovation, cost control, and ESG alignment are central to long-term success.

Recent Developments:

• In June 2025, Greif Inc. announced the addition of new sustainable product offerings and closures targeted at the specialty and agrochemical markets ahead of the Specialty & Agro Chemicals America 2025 event. These include new lines such as EcoBalance Samba caps and customizable NexDrums, reflecting Greif’s ongoing investment in product development for agricultural and chemical packaging.

• In April 2025, Berry Global Inc. officially merged with Amcor plc in a transaction that consolidates expertise across global packaging, including solutions relevant to agriculture chemical packaging. The merger aims to boost capabilities in flexible films, closures, and specialized containers for chemical and agriculture applications worldwide.

• In April 2025, Amcor plc completed an all-stock combination with Berry Global Inc., creating one of the world’s largest packaging solutions providers. This strategic move strengthens Amcor’s position in consumer and agriculture chemical packaging, enhancing its material science and innovation capacity for product development and sustainability. Additionally, Amcor will present its latest advancements and offerings tailored for the agricultural sector at major industry events through 2025.

Market Concentration & Characteristics:

Agriculture Chemical Packaging Market is moderately consolidated, with global players dominating high-value segments and regional players catering to localized needs. Innovation is driven by sustainability mandates, digital transformation, and material advancements. Key characteristics include a high level of regulatory scrutiny, supply chain dependencies, and evolving consumer preferences. Barriers to entry include compliance costs, testing requirements, and certification complexity. Companies differentiate through material science, value-added features, and performance customization. The market is dynamic, with shifting trends toward smart packaging and circular economy models.

Report Coverage:

The research report offers an in-depth analysis based on Packaging Type, Material and Chemical Type. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Global demand for agrochemical packaging will rise due to growing food security concerns and higher pesticide use across developing countries.

- Recyclable and biodegradable packaging solutions will gain preference, especially in regulated markets such as the EU and North America.

- Smart packaging technologies such as RFID, QR codes, and tamper-evident labels will see increased adoption for traceability and anti-counterfeit applications.

- Bulk and intermediate packaging formats will grow in industrial farming, driven by efficiency and compatibility with mechanized systems.

- Bio-based materials and compostable plastics will attract investments and partnerships between packaging firms and chemical suppliers.

- Customized and multi-compartment packaging designs will improve chemical dosage accuracy and reduce user handling risks.

- Private label packaging vendors will emerge in Asia and Latin America as agrochemical usage scales up in these markets.

- Digital integration with farm management systems will transform packaging from a container into a data-capturing touchpoint.

- Extended producer responsibility regulations will shape procurement policies and increase demand for closed-loop solutions.

- Smaller players will struggle without sustainability innovations, leading to acquisitions and industry consolidation.