| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| AI in Digital Dentistry Market Size 2024 |

USD 5,477.84 Million |

| AI in Digital Dentistry Market, CAGR |

12.31% |

| AI in Digital Dentistry Market Size 2032 |

USD 14,776.67 Million |

Market Overview

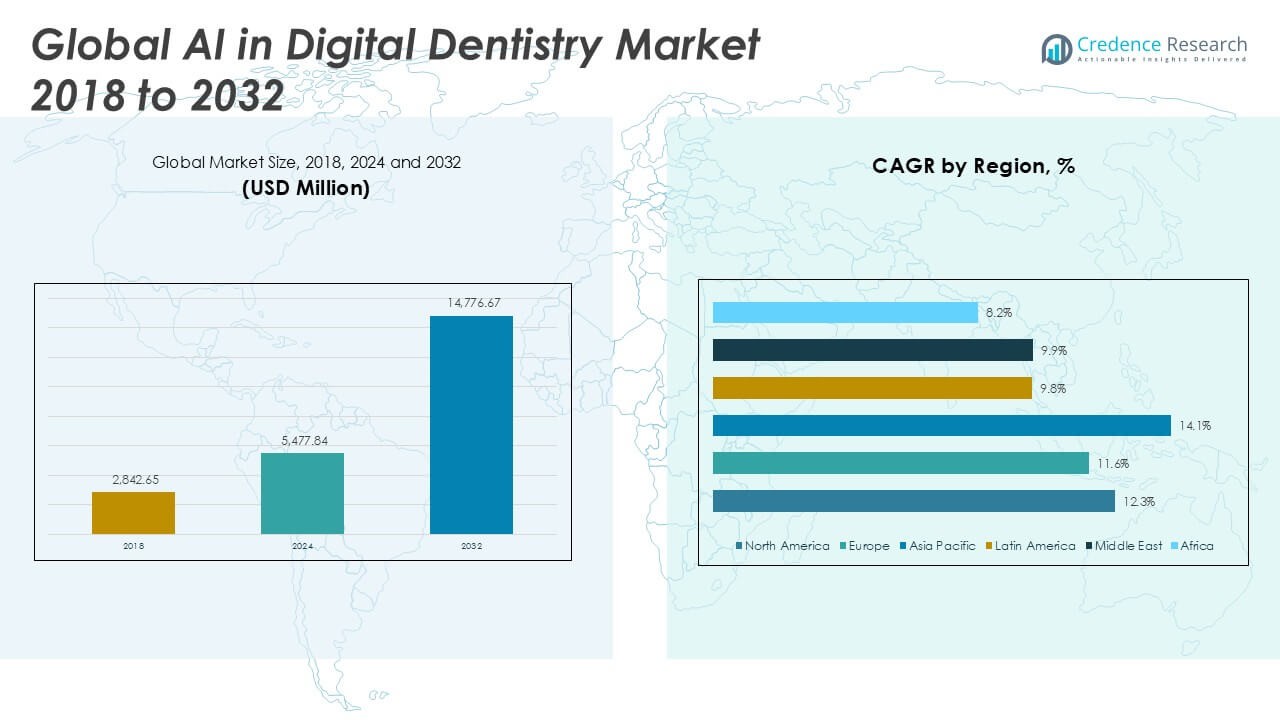

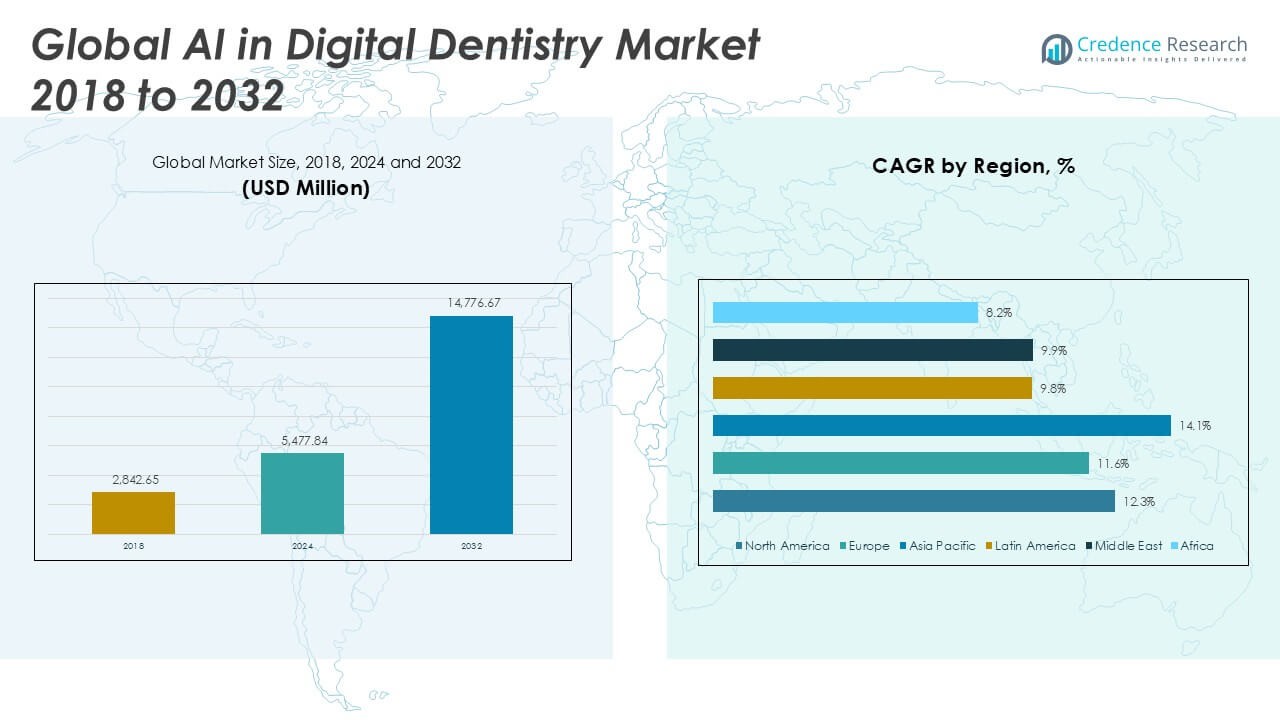

The AI in Digital Dentistry Market size was valued at USD 2,842.65 million in 2018, increased to USD 5,477.84 million in 2024, and is anticipated to reach USD 14,776.67 million by 2032, at a CAGR of 12.31% during the forecast period.

The AI in Digital Dentistry Market is driven by the increasing adoption of artificial intelligence to enhance diagnostic accuracy, streamline treatment planning, and improve patient outcomes. AI-powered tools such as intraoral scanners, image recognition software, and predictive analytics enable dentists to detect oral diseases at earlier stages and customize treatment protocols more effectively. Growing demand for minimally invasive procedures and digital workflow integration across dental clinics fuels the adoption of AI-based solutions. Cloud computing and machine learning algorithms further support real-time data sharing and intelligent decision-making. Additionally, the expansion of teledentistry platforms and rising investment in healthcare AI startups contribute to market growth. The trend toward personalized and data-driven dental care, supported by innovations in 3D printing and computer-aided design/manufacturing (CAD/CAM) systems, continues to shape the industry landscape. Dental professionals increasingly rely on AI to optimize chair time, reduce human error, and deliver cost-efficient, high-quality care to a wider patient base.

The AI in Digital Dentistry Market demonstrates strong growth across North America, Europe, and Asia Pacific due to rising demand for advanced diagnostic and treatment technologies. North America leads in adoption due to established healthcare infrastructure and early integration of AI tools in clinical workflows. Europe follows with widespread use of CAD/CAM systems and regulatory support for digital innovation in dentistry. Asia Pacific shows the fastest growth, driven by large patient volumes, expanding dental tourism, and increased investment in healthcare digitization across countries like China, Japan, and India. Latin America, the Middle East, and Africa are emerging markets with increasing potential through mobile health applications and public-private partnerships. Key players in the AI in Digital Dentistry Market include Align Technology, Inc., known for its AI-enabled clear aligner systems; Dentsply Sirona, offering integrated digital workflows; and 3Shape A/S, recognized for its advanced intraoral scanners and software. Ivoclar Vivadent AG also contributes with AI-supported restorative and prosthetic solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The AI in Digital Dentistry Market was valued at USD 2,842.65 million in 2018, reached USD 5,477.84 million in 2024, and is projected to grow to USD 14,776.67 million by 2032 at a CAGR of 12.31%.

- The market is expanding rapidly due to increasing adoption of AI for diagnostic accuracy, personalized treatment planning, and workflow automation in dental clinics and laboratories.

- Integration of AI in CAD/CAM systems, intraoral scanners, and 3D printing technologies is a leading trend, enhancing precision and reducing manual intervention in restorative and cosmetic dentistry.

- Major players such as Align Technology, Dentsply Sirona, 3Shape A/S, and Straumann Group are focusing on AI-powered digital solutions, mergers, and clinical innovations to strengthen their global footprint.

- High implementation costs, lack of interoperability between legacy systems and AI platforms, and data security concerns are key restraints limiting adoption, especially among smaller clinics.

- North America holds the largest market share at 40%, followed by Europe at 30%, driven by strong healthcare infrastructure, early AI adoption, and presence of leading companies.

- Asia Pacific is the fastest-growing region with a CAGR of 14.1%, fueled by rising dental tourism, government investments in digital healthcare, and expanding urban patient populations in China, India, and Japan.

Market Drivers

Integration of AI for Enhanced Diagnostic Precision and Early Detection

The AI in Digital Dentistry Market benefits significantly from the ability of artificial intelligence to detect dental issues with higher accuracy and speed. AI-based diagnostic tools help identify conditions like caries, periodontal disease, and oral cancer at earlier stages through pattern recognition in digital radiographs and 3D imaging. This diagnostic precision supports dentists in delivering timely interventions, which improves clinical outcomes. It enhances patient trust and promotes the adoption of advanced digital solutions across clinics. The demand for early and accurate diagnosis continues to push the integration of AI into standard dental workflows. It plays a crucial role in raising clinical efficiency and reducing misdiagnosis in busy practices.

- For instance, Pearl’s “Second Opinion” platform received FDA clearance for detecting over 30 dental conditions and has analyzed more than 100 million radiographs globally with an accuracy rate exceeding 90%.

Growing Demand for Personalized Treatment Planning and Workflow Optimization

Dentists increasingly seek personalized treatment solutions, driving the AI in Digital Dentistry Market toward customized care models. AI helps automate treatment planning by analyzing patient data and suggesting optimal procedures tailored to individual needs. It simplifies complex cases by recommending prosthetic designs or orthodontic adjustments through machine learning algorithms. Workflow efficiency improves as AI reduces manual planning time, streamlines record-keeping, and supports digital impressions. Clinics adopting AI report better utilization of resources and reduced chair time. These improvements create operational advantages, especially in high-volume practices looking to maximize throughput without compromising care quality.

- For instance, Align Technology’s ClinCheck software supports over 1.8 million active Invisalign users annually and processes approximately 920,000 digital treatment plans per week.

Adoption of CAD/CAM Systems and 3D Imaging in AI Workflows

The rise in CAD/CAM systems and 3D imaging has strengthened the role of AI in dental practices, expanding the AI in Digital Dentistry Market. AI supports design and manufacturing of crowns, bridges, and aligners by processing 3D scans and optimizing prosthetic fit. It improves digital impression accuracy and minimizes patient discomfort associated with traditional methods. Dental labs and clinics use AI-driven software to reduce human error in modeling and fabrication. Faster turnaround times and high-quality outputs increase patient satisfaction and clinic profitability. It facilitates a shift toward full digital integration in restorative and cosmetic dentistry.

Investment in Teledentistry and AI-Based Patient Engagement Tools

Rising investment in teledentistry and AI-powered virtual consultation tools contributes to the expansion of the AI in Digital Dentistry Market. AI supports patient triage, remote diagnosis, and post-treatment follow-ups through automated platforms. It helps dental professionals manage patient relationships more effectively by predicting treatment adherence and sending reminders. This digital engagement enhances patient experience and drives higher retention rates. Clinics deploying AI-based tools can operate with greater agility and reach underserved regions. It creates opportunities for scalable and sustainable dental care delivery models.

Market Trends

Emergence of AI-Powered Imaging and Diagnostic Platforms in Clinical Settings

The AI in Digital Dentistry Market is witnessing strong momentum with the rise of AI-powered imaging solutions that enhance diagnostic reliability. Clinicians are adopting computer vision tools to analyze radiographs, cone-beam CT scans, and intraoral images more accurately. These platforms improve detection of hard-to-identify pathologies and reduce clinician fatigue. It enables faster decision-making and supports second-opinion capabilities, which boost patient confidence. AI-based imaging software is also being integrated into existing dental equipment, making adoption more seamless. This trend is strengthening demand for intelligent diagnostic ecosystems within clinics and labs.

- For instance, Vatech’s AI View platform identifies root canals and impacted teeth with 95% precision and has been installed in over 40,000 dental clinics worldwide.

Proliferation of Chairside AI Tools to Automate Routine Dental Procedures

Chairside automation using AI is redefining how routine dental care is delivered across clinics, positively impacting the AI in Digital Dentistry Market. AI assists in real-time interpretation of patient data, guiding dentists during procedures such as cavity preparation, crown placement, or orthodontic adjustment. It reduces manual variability and helps standardize treatment quality. Tools that offer predictive insights based on patient history improve accuracy and minimize unnecessary interventions. Dentists increasingly depend on AI to reduce chair time and enhance procedural outcomes. It continues to evolve into an essential tool for operational consistency and patient satisfaction.

- For instance, Planmeca’s Romexis software with AI caries detection reduces average chairside diagnostic time by 30% and is used in over 120 countries with more than 65,000 installations.

Integration of AI into CAD/CAM Systems for Precision-Driven Dental Fabrication

The growing integration of AI into CAD/CAM workflows is driving a major shift in the AI in Digital Dentistry Market. It allows dental technicians and clinicians to automate prosthetic design, margin detection, and milling processes with minimal manual input. AI accelerates fabrication timelines and ensures reproducibility across multiple cases. It enhances the precision of fit and aesthetics, which elevates the standard of restorative and cosmetic dentistry. The use of AI in CAD/CAM systems also supports digital archiving and centralized design libraries. It transforms traditional dental labs into advanced digital production hubs.

Rising Use of Virtual Assistants and Predictive Analytics in Dental Practice Management

Virtual assistants and predictive analytics tools are gaining traction within the AI in Digital Dentistry Market for streamlining administrative and clinical operations. AI-based systems handle appointment scheduling, billing, patient follow-ups, and resource planning with high efficiency. It predicts appointment cancellations, estimates chair utilization, and supports staff allocation. Dentists use AI tools to track treatment progress and identify patients needing re-engagement. These solutions reduce administrative burdens and enhance overall practice productivity. It enables clinics to scale operations while maintaining service quality and profitability.

Market Challenges Analysis

High Implementation Costs and Technical Integration Barriers Across Dental Practices

The AI in Digital Dentistry Market faces a major challenge in the form of high implementation costs and complex integration requirements. Small and mid-sized dental clinics often hesitate to adopt AI systems due to expensive hardware, software licenses, and ongoing maintenance. Many legacy systems lack compatibility with new AI platforms, making upgrades financially and technically demanding. It becomes difficult for independent practitioners to justify return on investment within a short period. Staff training and workflow adaptation further add to the cost and time burdens, slowing technology adoption. Vendors must address these issues by offering scalable, interoperable, and cost-effective solutions.

Concerns Around Data Privacy, Accuracy, and Regulatory Compliance

Data privacy concerns and lack of clear regulatory standards hinder the expansion of the AI in Digital Dentistry Market. AI systems rely on large volumes of patient data, making them susceptible to breaches if not managed under strict cybersecurity protocols. It raises liability issues for clinics and software providers, especially in regions with stringent health data laws. Dentists also question the clinical reliability of AI predictions in the absence of consistent validation frameworks. Varying regulations across countries create uncertainty for global AI solution providers. Overcoming these trust and compliance barriers is essential to increase adoption and gain professional acceptance.

Market Opportunities

Expansion of AI Applications in Orthodontics, Prosthodontics, and Implantology

The AI in Digital Dentistry Market presents strong opportunities through the diversification of applications across specialized dental fields. AI can support orthodontic planning by predicting tooth movement and simulating treatment outcomes with high accuracy. In prosthodontics, it enhances digital impressions and automates crown and denture design workflows. Implantology benefits from AI through bone density analysis and surgical guide optimization, improving placement precision. These specialized uses increase clinical efficiency and improve patient-specific care. It allows practices to differentiate their service offerings and attract high-value procedures.

Growing Adoption in Emerging Markets and Integration with Mobile Health Platforms

Emerging markets offer untapped growth potential for the AI in Digital Dentistry Market due to rising investments in healthcare infrastructure and digital transformation. Countries in Asia-Pacific, Latin America, and the Middle East are increasing funding for advanced diagnostic and treatment tools. AI-driven mobile health applications offer further opportunity by extending dental services to remote or underserved populations. It enables virtual consultations, image-based diagnostics, and remote monitoring through smartphones and tablets. Government initiatives supporting digital health create a favorable environment for AI adoption. Expanding access to these technologies will help bridge service gaps and drive long-term market penetration.

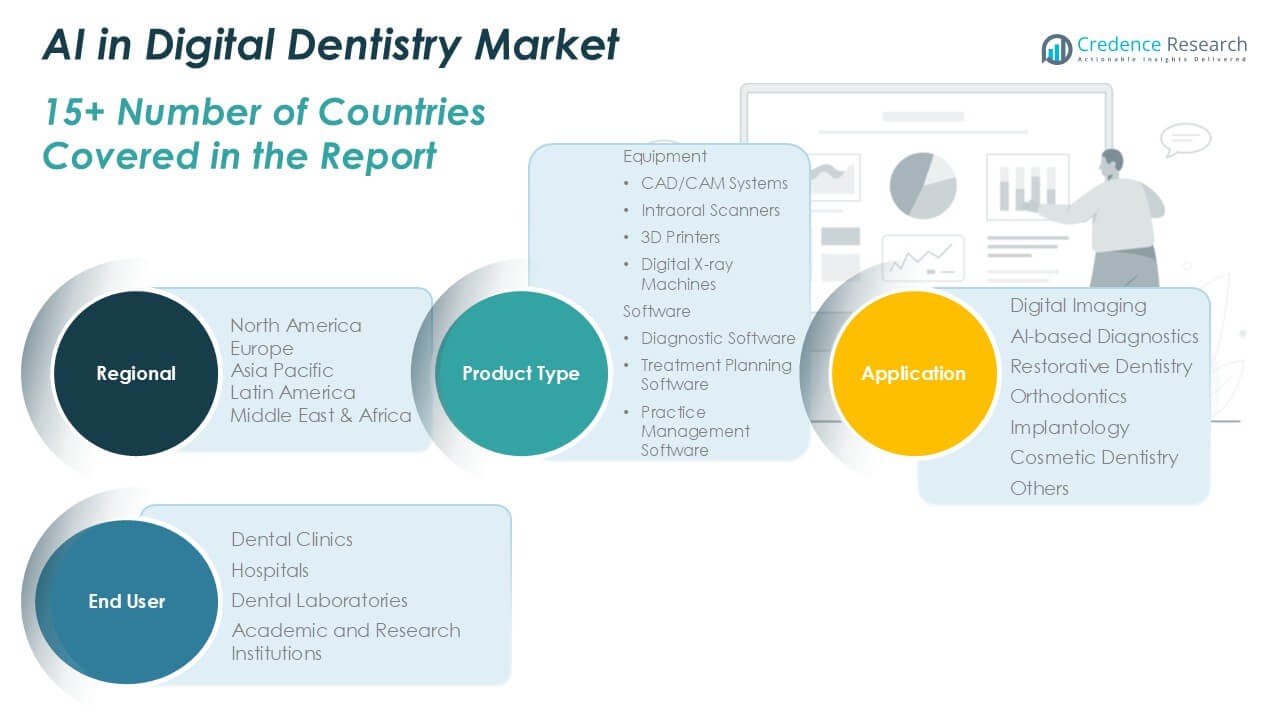

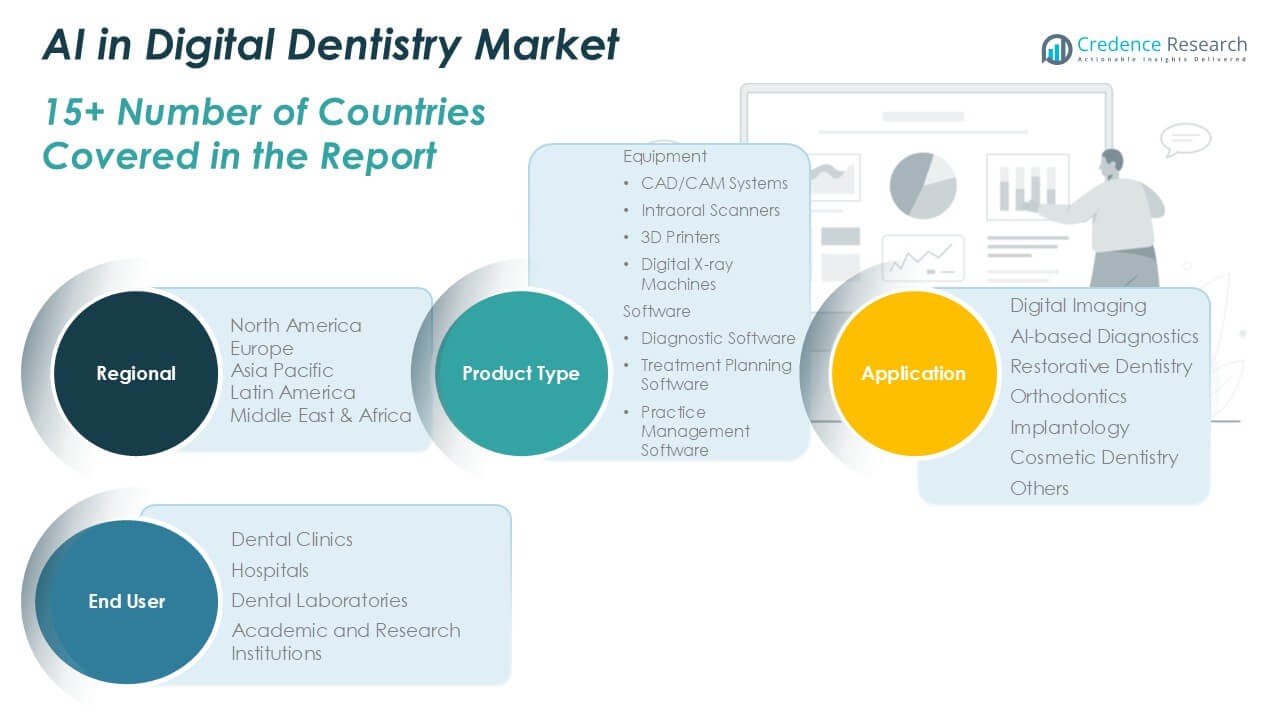

Market Segmentation Analysis:

By Product Type:

The AI in Digital Dentistry Market is segmented into equipment and software. Equipment dominates due to widespread use of CAD/CAM systems, intraoral scanners, 3D printers, and digital X-ray machines. CAD/CAM systems improve precision in prosthetic fabrication and streamline chairside workflows. Intraoral scanners replace traditional impressions with faster and more comfortable procedures. 3D printers offer cost-efficient production of crowns, bridges, and aligners. Digital X-ray machines, integrated with AI, enhance imaging quality and diagnostic confidence. Software solutions such as diagnostic software, treatment planning tools, and practice management platforms are growing steadily due to their role in improving clinical decision-making, automating workflows, and optimizing patient communication.

- For instance, Formlabs has more than 100,000 dental 3D printers in operation, producing over 15 million dental appliances annually. Digital X-ray machines, integrated with AI, enhance imaging quality and diagnostic confidence.

By Application:

The AI in Digital Dentistry Market covers digital imaging, AI-based diagnostics, restorative dentistry, orthodontics, implantology, cosmetic dentistry, and others. Digital imaging holds the leading share due to its foundational role in diagnosis and treatment planning. AI-based diagnostics enable early detection of caries, lesions, and bone loss with high accuracy. Restorative dentistry benefits from AI through automated design of restorations and digital impressions. Orthodontics uses AI to simulate tooth movement and personalize aligner therapy. In implantology, AI improves surgical planning and placement accuracy. Cosmetic dentistry applies AI to enhance aesthetic evaluations and treatment outcomes. The “others” segment includes general diagnostics and preventive care supported by AI integration.

- For instance, Align Technology’s ClinCheck software handles over 920,000 digital orthodontic treatment plans per week across its 1.8 million annual Invisalign cases. In implantology, AI improves surgical planning and placement accuracy.

By End-User:

The AI in Digital Dentistry Market is segmented into dental clinics, hospitals, dental laboratories, and academic and research institutions. Dental clinics lead in adoption due to demand for workflow efficiency, personalized care, and patient volume management. Hospitals invest in AI systems to improve multidisciplinary care and integrate dental diagnostics with broader healthcare IT systems. Dental laboratories apply AI to streamline prosthetic design and fabrication, enhancing output quality and reducing turnaround time. Academic and research institutions focus on innovation and training, using AI to develop new diagnostic models and conduct clinical validation studies. It creates a foundation for future market development and adoption across other end-user segments.

Segments:

Based on Product Type:

- Equipment

- CAD/CAM Systems

- Intraoral Scanners

- 3D Printers

- Digital X-ray Machines

- Software

- Diagnostic Software

- Treatment Planning Software

- Practice Management Software

Based on Application:

- Digital Imaging

- AI-based Diagnostics

- Restorative Dentistry

- Orthodontics

- Implantology

- Cosmetic Dentistry

- Others

Based on End-User:

- Dental Clinics

- Hospitals

- Dental Laboratories

- Academic and Research Institutions

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America AI in Digital Dentistry Market

North America AI in Digital Dentistry Market grew from USD 1,206.26 million in 2018 to USD 2,299.66 million in 2024 and is projected to reach USD 6,221.13 million by 2032, reflecting a compound annual growth rate (CAGR) of 12.3%. North America is holding a 40% market share. The United States leads the region due to early adoption of AI technologies, high healthcare spending, and a well-established digital dental infrastructure. Canada is expanding investments in AI-based diagnostics and teledentistry platforms. Strong presence of key market players and supportive regulatory frameworks also enhance growth. It benefits from advanced research institutions that support continuous innovation in dental AI applications.

Europe AI in Digital Dentistry Market

Europe AI in Digital Dentistry Market grew from USD 896.40 million in 2018 to USD 1,671.36 million in 2024 and is projected to reach USD 4,272.12 million by 2032, reflecting a CAGR of 11.6%. Europe holds a 30% market share. Germany, France, and the UK are the primary contributors, with increasing demand for AI-supported orthodontics and prosthodontics. The European market emphasizes data privacy compliance and AI ethics, influencing adoption strategies. Growing geriatric population and digital transformation in dental practices drive regional demand. It sees expanded usage of AI in dental laboratories and public health systems across the region.

Asia Pacific AI in Digital Dentistry Market

Asia Pacific AI in Digital Dentistry Market grew from USD 532.87 million in 2018 to USD 1,115.24 million in 2024 and is projected to reach USD 3,416.82 million by 2032, reflecting a CAGR of 14.1%. Asia Pacific holds a 24% market share. China, Japan, South Korea, and India are rapidly digitizing their dental ecosystems, supported by national health initiatives and private investment. AI is being deployed in high-volume practices to address care gaps and optimize resource use. The region benefits from cost-effective AI integration and a rising number of trained dental professionals. It is emerging as a hub for AI-driven dental innovation and manufacturing.

Latin America AI in Digital Dentistry Market

Latin America AI in Digital Dentistry Market grew from USD 95.40 million in 2018 to USD 180.62 million in 2024 and is projected to reach USD 408.03 million by 2032, reflecting a CAGR of 9.8%. Latin America holds a 3% market share. Brazil and Mexico are leading regional markets due to expanding private dental services and increasing focus on digital diagnostics. Government partnerships with tech firms support digital health infrastructure growth. It faces challenges related to cost barriers and training, but growing dental tourism supports AI-based service upgrades. Urban centers show faster adoption compared to rural areas.

Middle East AI in Digital Dentistry Market

Middle East AI in Digital Dentistry Market grew from USD 77.73 million in 2018 to USD 136.61 million in 2024 and is projected to reach USD 309.40 million by 2032, reflecting a CAGR of 9.9%. The Middle East holds a 2% market share. The United Arab Emirates and Saudi Arabia lead with investments in AI healthcare systems and high-end dental clinics. National AI strategies and smart city initiatives include dental innovation programs. It is expanding AI use in cosmetic dentistry and implantology, especially in premium service segments. Regional governments support AI integration through public-private collaborations.

Africa AI in Digital Dentistry Market

Africa AI in Digital Dentistry Market grew from USD 33.98 million in 2018 to USD 74.36 million in 2024 and is projected to reach USD 149.16 million by 2032, reflecting a CAGR of 8.2%. Africa holds a 1% market share. South Africa, Nigeria, and Egypt are key countries exploring digital dental tools to improve access and care quality. Challenges include limited infrastructure and high equipment costs. It shows potential for mobile AI tools and teledentistry in underserved regions. Partnerships with global health organizations could support future AI expansion.

Key Player Analysis

- Align Technology, Inc.

- Ivoclar Vivadent AG

- Straumann Group

- Dentsply Sirona

- Carestream Dental LLC

- 3Shape A/S

- Planmeca Oy

- Morita Corporation

- GC Corporation

- Shofu Dental Corporation

- Zimmer Biomet Holdings, Inc.

- Henry Schein, Inc.

Competitive Analysis

The AI in Digital Dentistry Market is highly competitive, with leading players focusing on innovation, product integration, and strategic partnerships to gain market share. Key players include Align Technology, Inc., Ivoclar Vivadent AG, Straumann Group, Dentsply Sirona, Carestream Dental LLC, 3Shape A/S, Planmeca Oy, J. Morita Corporation, GC Corporation, Shofu Dental Corporation, Zimmer Biomet Holdings, Inc., and Henry Schein, Inc. These companies offer advanced AI-powered tools that support diagnostics, treatment planning, and workflow optimization. Competitive strategies include expanding AI functionality within CAD/CAM systems, integrating AI into imaging equipment, and offering cloud-based software for practice management. Many vendors are also forming strategic alliances with dental clinics, academic institutions, and healthcare networks to accelerate product adoption. These collaborations help validate AI solutions clinically and promote wider use across multiple geographies. Digital transformation across dental practices drives competition, with companies offering scalable platforms compatible with existing systems. Emphasis on user-friendly interfaces, workflow efficiency, and technical support helps strengthen customer loyalty. Players compete on product quality, turnaround time, data security, and regulatory compliance. The rising demand for AI solutions in emerging markets further intensifies competition, prompting firms to localize offerings and optimize cost structures. The competitive landscape continues to evolve as AI capabilities become central to value-driven dental care delivery.

Recent Developments

- In January 2025, VideaHealth was pleased to announce the release of the Caries 3.0 model, the most sophisticated dental caries detection model, which will help dental professionals identify caries more accurately and consistently. Their goal of providing physicians with tools that improve patient care and diagnostic confidence is being carried out with the Caries 3.0 model.

- In June 2024, Overjet revealed Overjet for Educators, AI designed to educate the leaders of oral health of the future. The same technology that thousands of dentists now use to evaluate X-rays, instruct patients, and run their practices is now available to students. The only FDA-approved AI technology is used by Overjet for Educators to identify, describe, and measure oral disorders in X-rays. To attain previously unheard-of precision, a special team of leading dentists and cutting-edge machine learning models was trained on millions of X-rays.

Market Concentration & Characteristics

The AI in Digital Dentistry Market exhibits a moderately concentrated structure, with a mix of established global players and emerging innovators competing across equipment, software, and service segments. It is characterized by high entry barriers due to the need for advanced technical expertise, regulatory compliance, and integration with existing clinical workflows. Leading firms hold strong brand credibility and maintain long-term relationships with dental clinics and laboratories, supported by extensive distribution networks. The market is innovation-driven, with consistent investments in AI research, machine learning algorithms, and cloud-based platforms. It demonstrates strong growth potential due to rising demand for diagnostic precision, digital workflow efficiency, and patient-specific treatment planning. Product differentiation, ease of integration, and clinical reliability define competitive advantage. It is also shaped by regulatory dynamics, data privacy standards, and increasing awareness of AI’s role in improving patient outcomes. Companies continue to expand regionally by offering scalable and cost-effective digital solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue expanding due to increased demand for AI-driven diagnostic and treatment solutions in dental practices.

- AI integration in CAD/CAM systems and 3D imaging will improve precision and reduce turnaround time in restorative procedures.

- More dental clinics will adopt AI to streamline workflows, reduce manual errors, and improve patient experience.

- Cloud-based AI platforms will support real-time data sharing, virtual consultations, and remote diagnostics.

- AI-powered mobile applications will extend access to dental care in remote and underserved regions.

- Regulatory frameworks will evolve to address data privacy, AI validation, and ethical concerns in dental applications.

- AI will become more accessible to small and mid-sized clinics through scalable and affordable solutions.

- Strategic collaborations between dental institutions and technology firms will accelerate clinical validation and adoption.

- Continuous advancements in machine learning algorithms will enhance accuracy and personalization in treatment planning.

- The role of AI in dental education and training will increase, supporting future-ready digital professionals.