Market Overview:

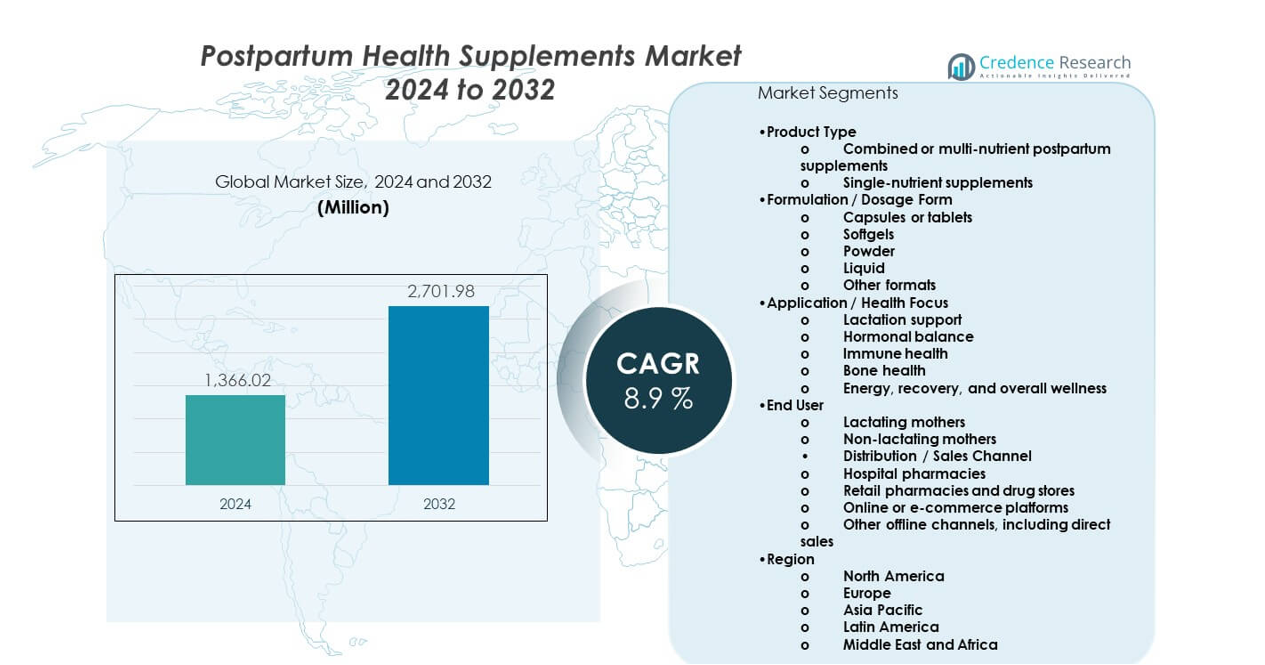

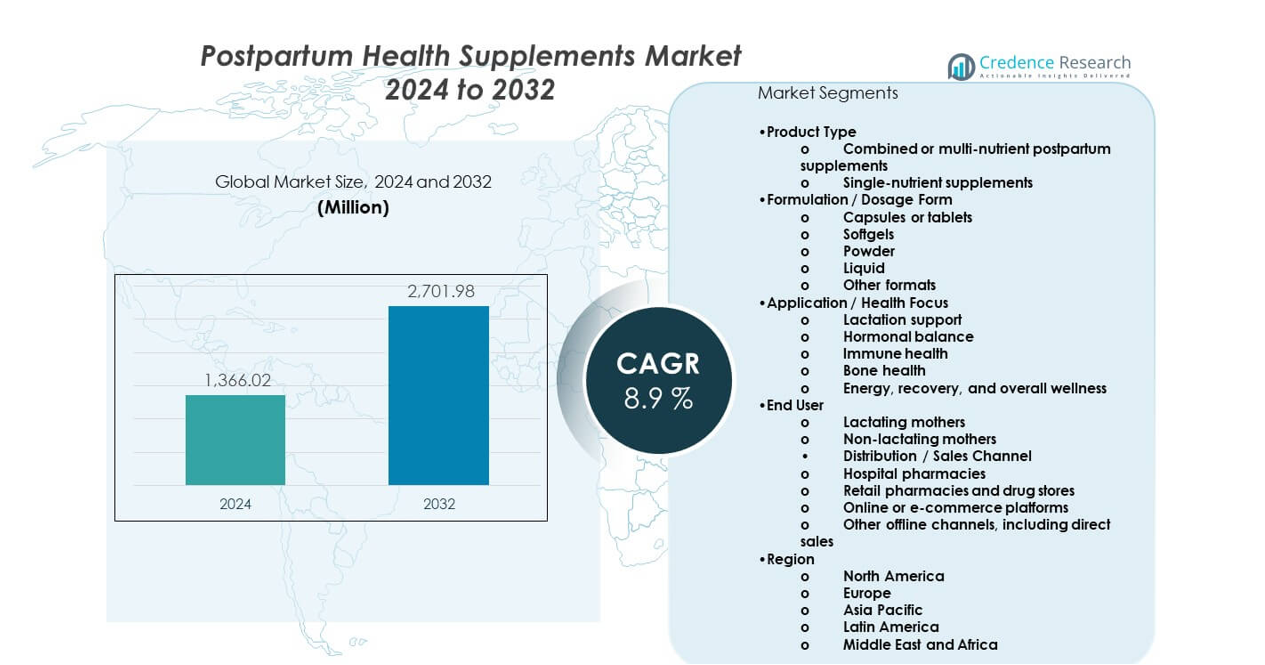

The Postpartum Health Supplements Market is projected to grow from USD 1,366.02 million in 2024 to an estimated USD 2,701.98 million by 2032, at a CAGR of 8.9% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Postpartum Health Supplements Market Size 2024 |

USD 1,366.02 million |

| Postpartum Health Supplements Market, CAGR |

8.9% |

| Postpartum Health Supplements Market Size 2032 |

USD 2,701.98 million |

Market growth is driven by higher focus on postnatal recovery and nutrition. Mothers seek support for energy, immunity, and lactation. Doctors recommend supplements to address nutrient gaps. Urban lifestyles increase reliance on convenient nutrition formats. Clean-label products gain trust among new parents. E-commerce improves access and product education. Social media shapes awareness and peer guidance. Rising birth rates in select regions support demand. Innovation improves taste, absorption, and dosage compliance.

North America leads due to strong awareness and clinical guidance. The United States shows high adoption through retail and online sales. Europe follows with demand for regulated, clean products. Asia-Pacific is emerging fast due to urbanization and maternal education. India and China see rising acceptance through digital health platforms. Latin America grows steadily with improving healthcare access. Middle East and Africa remain early-stage due to access gaps. Policy support and education will shape regional growth.

Market Insights:

- The market reached USD 1,366.02 million in 2024 and is projected to hit USD 2,701.98 million by 2032, registering an 8.9% CAGR due to rising postnatal nutrition awareness.

- North America leads with ~36% share, followed by Europe at ~29% and Asia Pacific at ~24%, driven by healthcare access, clinical guidance, and consumer awareness.

- Asia Pacific is the fastest-growing region with ~24% share, supported by high birth rates, urbanization, and expanding e-commerce access.

- By product type, combined or multi-nutrient supplements hold ~62% share, while single-nutrient supplements account for ~38% due to targeted clinical use.

- By distribution channel, retail pharmacies contribute ~34% share, while online platforms account for ~31%, reflecting trust-based purchases and rising digital adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Focus On Maternal Recovery And Postnatal Nutrition Needs

Mothers place stronger focus on recovery after childbirth. Nutrient gaps remain common during postnatal stages. Doctors advise supplements to restore strength and immunity. Fatigue control supports daily childcare needs. Breastfeeding increases vitamin and mineral demand. Awareness programs stress postnatal nutrition value. The Postpartum Health Supplements Market benefits from this shift. It supports structured recovery routines.

- For instance, Ritual Postnatal includes 350 mg DHA per serving, aligned with breastfeeding needs.

Higher Clinical Guidance And Professional Recommendations After Delivery

Healthcare teams guide postnatal nutrition plans. Hospitals include supplements in discharge advice. Diet gaps receive formal medical attention. Physicians stress iron, calcium, and vitamin intake. Counseling improves trust in supplement use. The Postpartum Health Supplements Market gains from professional support. It builds confidence among new mothers. Clinical advice improves usage consistency.

- For instance, Nature Made Iron provides 65 mg elemental iron per tablet, often advised for deficiency.

Lifestyle Shifts And Need For Convenient Nutritional Support Products

Urban lifestyles reduce time for balanced meals. New mothers manage family and work roles. Ready supplements offer daily nutrition support. Capsules and powders simplify intake routines. Busy homes prefer easy health solutions. The Postpartum Health Supplements Market fits this demand. It aligns with modern care habits. Convenience supports repeat purchases.

Growing Awareness Through Digital Health Education And Parenting Platforms

Digital platforms spread postnatal health knowledge. Parenting forums discuss supplement benefits. Influencers share recovery experiences responsibly. Educational content improves product understanding. Reviews shape buying confidence. The Postpartum Health Supplements Market benefits from digital reach. It gains visibility among first-time mothers. Awareness supports early adoption.

Market Trends:

Shift Toward Clean Label And Naturally Sourced Supplement Formulations

Consumers prefer simple ingredient lists. Natural sources replace synthetic blends. Transparency builds trust with new parents. Brands highlight plant-based inputs clearly. Safety perception improves with clean labels. The Postpartum Health Supplements Market reflects this trend. It supports premium positioning. Clean labels strengthen loyalty.

- For instance, Garden of Life Postnatal uses organic plant-based vitamins with non-GMO certification.

Growth Of Personalized And Condition-Specific Postnatal Nutrition Products

Brands launch targeted nutrient blends. Products address lactation, immunity, or energy needs. Custom packs suit recovery stages. Personal focus improves perceived value. Digital tools guide product choice. The Postpartum Health Supplements Market adopts tailored solutions. It improves user satisfaction. Targeted formulas raise differentiation.

- For instance, Perelel Postpartum Packs separate daily doses into five capsules matched to recovery needs.

Expansion Of Online And Direct-To-Consumer Distribution Channels

Online sales gain strong traction. Mothers value home delivery convenience. Digital stores offer education and reviews. Subscription models support routine intake. Mobile access eases ordering. The Postpartum Health Supplements Market expands online. It reaches wider regions. Digital trust improves conversion.

Integration Of Supplements With Holistic Postnatal Wellness Programs

Brands link supplements with wellness plans. Programs include diet and recovery advice. Holistic care improves outcomes. Mothers seek complete postnatal solutions. Wellness bundles raise perceived value. The Postpartum Health Supplements Market aligns with this approach. It deepens brand engagement. Integrated care supports retention.

Market Challenges Analysis:

Regulatory Compliance And Product Safety Assurance Across Regions

Regulations vary across countries and regions. Brands face complex approval processes. Safety claims require strong clinical backing. Label rules differ by market. Compliance raises development costs. The Postpartum Health Supplements Market faces entry barriers. It slows new product launches. Trust depends on strict quality control.

Consumer Skepticism And Uneven Awareness In Emerging Markets

Some mothers question supplement need. Cultural beliefs influence postnatal care choices. Limited education restricts product acceptance. Misinformation affects buying decisions. Healthcare access remains uneven. The Postpartum Health Supplements Market faces awareness gaps. It limits growth in early-stage regions. Education efforts remain essential.

Market Opportunities:

Product Innovation Focused On Specific Postnatal Health Conditions

Brands can address unmet recovery needs. Formulas may target anemia or bone health. Research-backed blends improve outcomes. Innovation builds medical trust. Condition focus supports premium pricing. The Postpartum Health Supplements Market can expand scope. It supports differentiated portfolios. Innovation drives long-term growth.

Rising Demand Across Emerging Economies With Improving Maternal Care

Emerging markets improve maternal health focus. Urbanization raises nutrition awareness. Healthcare access continues to expand. Digital education supports product discovery. Local brands adapt global formats. The Postpartum Health Supplements Market finds new demand pockets. It gains volume growth potential. Regional expansion supports scale.

Market Segmentation Analysis:

Product Type

Combined or multi-nutrient postpartum supplements hold strong demand due to convenience. These products address multiple nutrient gaps in one dose. Single-nutrient supplements serve targeted needs like iron deficiency or omega-3 intake. Doctors recommend single nutrients for specific clinical gaps. Consumer choice depends on recovery stage and medical advice. The Postpartum Health Supplements Market reflects balanced demand across both product types. It supports both preventive and corrective nutrition use.

- For instance, One A Day Postnatal delivers over 20 vitamins and minerals in one daily serving.

Formulation / Dosage Form

Capsules and tablets remain widely preferred due to familiarity and storage ease. Softgels attract users seeking better absorption and comfort. Powders support flexible dosing and mixing with foods. Liquid formats suit mothers with swallowing difficulty. Gummies and sachets appeal to taste and portability needs. Format choice links closely with lifestyle and tolerance levels.

- For instance, SmartyPants Postnatal Gummies supply 60 mg omega-3 DHA per daily serving. The total Omega-3 Fatty Acid content is 113 mg, which also includes 30 mg of EPA.

Application / Health Focus

Lactation support remains a primary focus due to breastfeeding needs. Hormonal balance products support mood and cycle regulation. Immune health supplements gain relevance during recovery periods. Bone health products address calcium depletion concerns. Energy and overall wellness segments serve fatigue management and daily functioning. Demand varies by postpartum phase.

End User

Lactating mothers represent the core consumer base due to higher nutrition demand. Non-lactating mothers seek recovery and wellness support. Product positioning differs based on feeding status. Clinical guidance influences segment penetration. Both groups drive sustained market volume.

Distribution / Sales Channel

Hospital pharmacies benefit from physician trust and early-stage adoption. Retail pharmacies offer accessibility and brand variety. Online platforms grow through convenience and education tools. Direct sales support personalized guidance and repeat purchases. Channel mix shapes brand visibility and reach.

Segmentation:

- By Product Type

- Combined or multi-nutrient postpartum supplements

- Single-nutrient supplements, including vitamins, minerals, omega-3, iron, calcium, and probiotics

- By Formulation / Dosage Form

- Capsules or tablets

- Softgels

- Powder

- Liquid

- Other formats, including gummies and sachets

- By Application / Health Focus

- Lactation support

- Hormonal balance

- Immune health

- Bone health

- Energy, recovery, and overall wellness

- By End User

- Lactating mothers

- Non-lactating mothers

- By Distribution / Sales Channel

- Hospital pharmacies

- Retail pharmacies and drug stores

- Online or e-commerce platforms

- Other offline channels, including direct sales

- By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America And Europe

North America holds the largest share of the Postpartum Health Supplements Market, accounting for about 38% of global demand. Strong clinical guidance and high health awareness support supplement use after childbirth. The United States leads due to wide retail access and online adoption. Europe follows with nearly 28–30% market share. Countries such as Germany, the United Kingdom, and France drive demand through regulated maternal care systems. Clean-label preference shapes product selection across the region. Pharmacy-led distribution strengthens consumer trust.

Asia Pacific

Asia Pacific represents around 22% of the Postpartum Health Supplements Market and shows the fastest growth pace. China and India lead due to high birth volumes and rising maternal awareness. Urbanization improves access to supplements and digital health content. Japan and South Korea support demand through preventive healthcare culture. Traditional postnatal practices blend with modern supplements. E-commerce plays a key role in regional expansion. Local brands adapt formulations to cultural needs.

Latin America And Middle East & Africa

Latin America accounts for nearly 6% market share, led by Brazil and Mexico. Improving maternal care access supports gradual adoption. Retail pharmacies remain the main sales channel in the region. Middle East & Africa hold about 4–5% share with early-stage development. Gulf countries show higher uptake due to premium healthcare services. Awareness gaps limit faster growth in parts of Africa. Public health education will influence long-term regional demand.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

-

- Nestlé S.A.

- Abbott Laboratories

- Bayer AG / Bayer HealthCare

- Pfizer Inc.

- Wyeth

- DSM-Firmenich

- Glanbia plc

- Herbalife Nutrition Ltd.

- Amway Corp.

- Church & Dwight Co., Inc.

- New Chapter, Inc.

- Mama’s Select

- ACTIF USA

- Anya (Anya Healthcare)

- Pink Stork

- Mommy’s Bliss, Inc.

- The Honest Company, Inc.

- Nordic Naturals

Competitive Analysis:

The Postpartum Health Supplements Market shows moderate competition with global nutrition firms and specialist maternal brands. Large players leverage strong R&D, clinical backing, and wide distribution networks. Specialist brands compete through clean labels and postpartum-focused formulations. Brand trust and medical endorsement shape competitive strength. Product differentiation relies on formulation quality and safety claims. E-commerce presence improves competitive reach. Strategic pricing supports penetration across income groups. Innovation pace defines long-term positioning. It remains driven by brand credibility and portfolio breadth.

Recent Developments:

- In December 2025, Church & Dwight announced a definitive agreement to sell its Vitafusion and L’il Critters gummy vitamin brands to Piping Rock Health Products, effectively exiting the gummy supplement business to focus on its core “power brands”. Despite this divestiture, the company retains its First Response brand, which continues to offer reproductive health products, though the sale marks a significant shift away from its direct manufacturing of general gummy supplements.

- In July 2025, Herbalife Nutrition launched MultiBurn™, a new multi-action dietary supplement formulated with clinically studied botanicals like Morosil™ and Metabolaid to support metabolic health and weight management. This launch complements the February 2024 introduction of the Herbalife GLP-1 Nutrition Companion, a range of food and supplement product combos designed to support the nutritional needs of individuals on weight-loss medications, addressing a growing area of interest for postpartum weight management.

- In January 2025, Amway launched the Nutrilite Begin 30 Holistic Wellness Program, a 30-day regimen focused on gut health and healthy habits. The program features a suite of products including Nutrilite Begin Daily GI Primer, Balance Within Probiotic, and Organics Plant Protein Powder, supported by a digital app for tracking wellness goals. This initiative targets overall holistic health, including the nutritional needs of women seeking to reset their health.

Report Coverage:

The research report offers an in-depth analysis based on product type and formulation type. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand will rise with higher focus on structured postnatal recovery care.

- Clean-label and natural formulations will gain wider acceptance.

- Personalized nutrition solutions will see stronger adoption.

- E-commerce channels will expand product reach globally.

- Medical guidance will continue to shape purchase behavior.

- Emerging markets will offer new volume growth opportunities.

- Product innovation will focus on absorption and tolerance.

- Brand education will influence consumer trust levels.

- Partnerships with health platforms will increase visibility.

- Regulatory clarity will support product standardization.