Market Overview

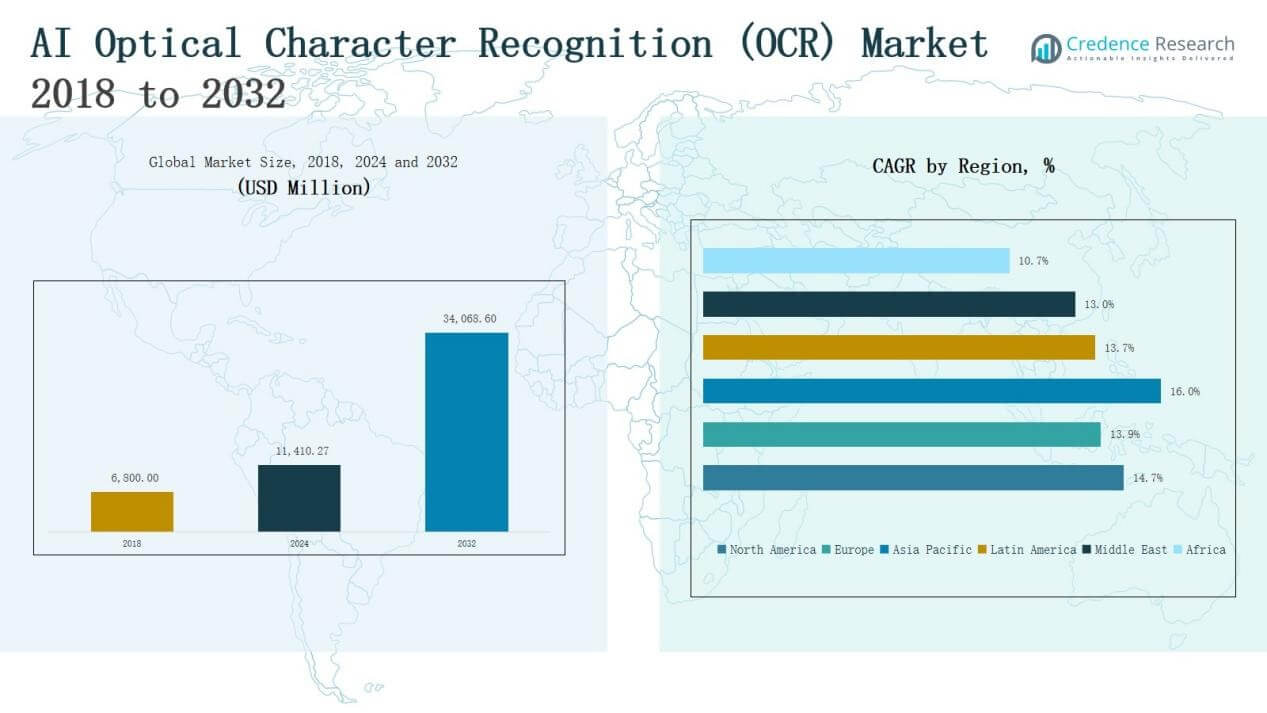

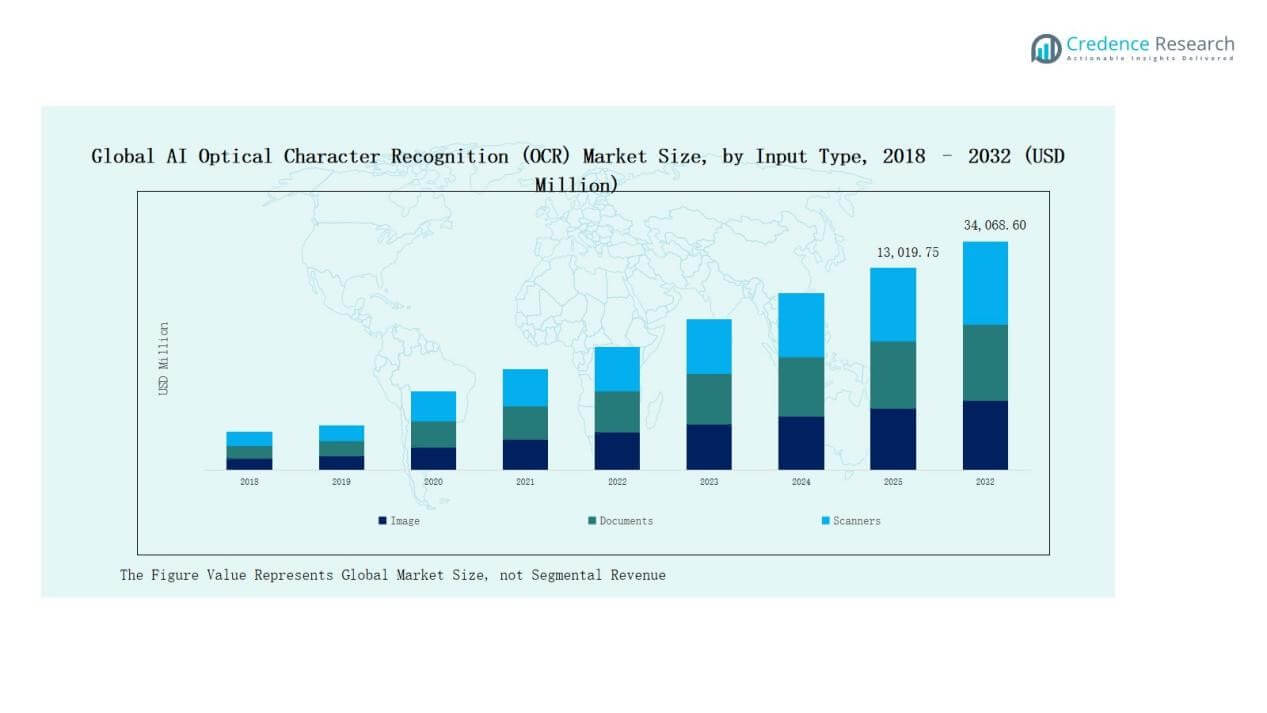

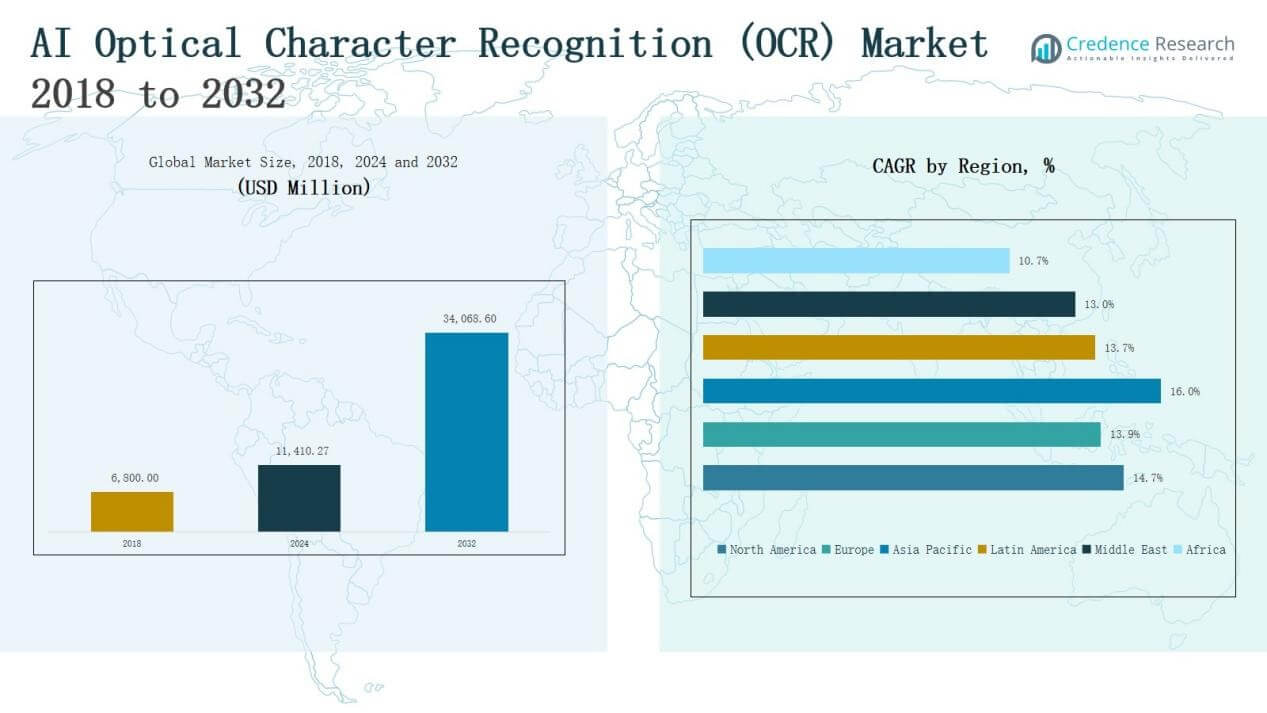

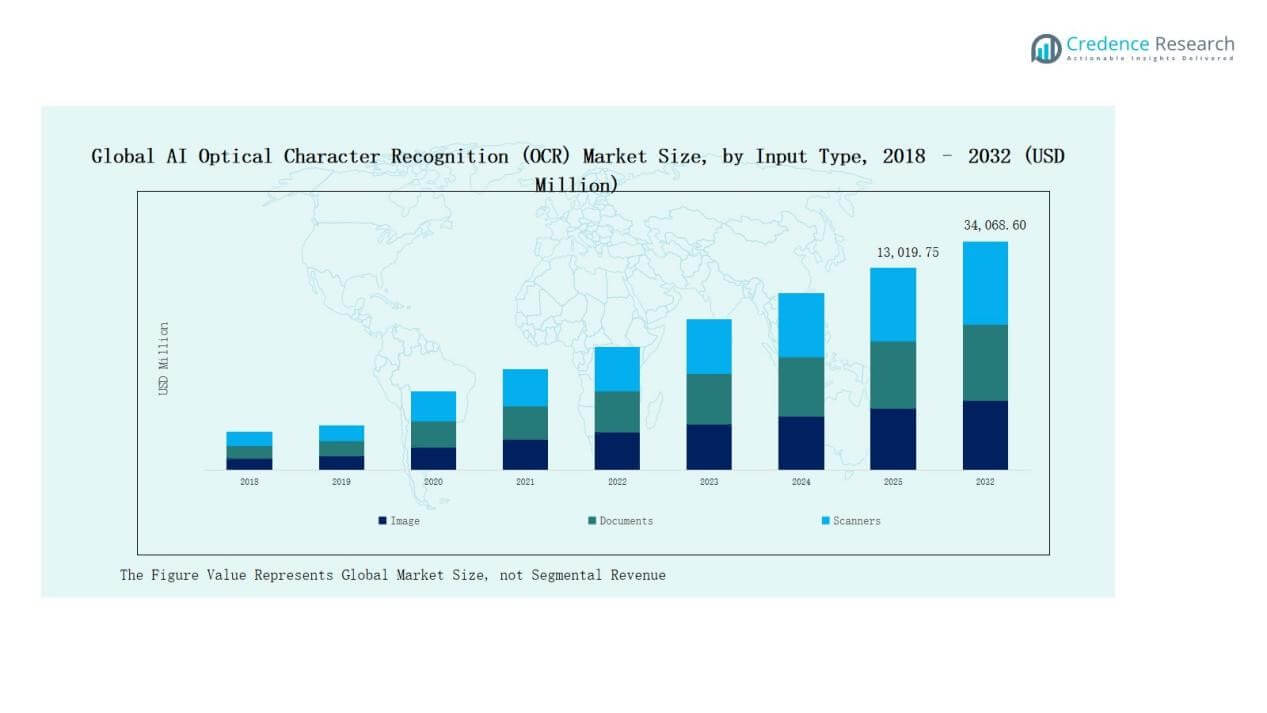

AI Optical Character Recognition (OCR) Market size was valued at USD 6,800.00 million in 2018, reached USD 11,410.27 million in 2024, and is anticipated to reach USD 34,068.60 million by 2032, at a CAGR of 14.73% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| AI Optical Character Recognition (OCR) Market Size 2024 |

USD 11,410.27 Million |

| AI Optical Character Recognition (OCR) Market, CAGR |

14.73% |

| AI Optical Character Recognition (OCR) Market Size 2032 |

USD 34,068.60 Million |

The AI Optical Character Recognition (OCR) Market is shaped by global technology leaders and specialized solution providers competing through innovation, scalability, and sector-focused offerings. Key players include Google, Microsoft, IBM, Adobe, ABBYY, Nuance Communications, Kofax, Docsumo, Anyline, Nano Net Technologies, Cognex Corporation, and NAVER Cloud Corporation. These companies dominate by leveraging AI, cloud ecosystems, and advanced language recognition capabilities, while emerging firms target mobile-first and niche applications. Regionally, North America led the market with a 36% share in 2024, driven by strong AI adoption, advanced digital infrastructure, and high demand across BFSI, healthcare, and government sectors.

Market Insights

Market Insights

- The AI Optical Character Recognition (OCR) Market grew from USD 6,800.00 million in 2018 to USD 11,410.27 million in 2024 and is expected to reach USD 34,068.60 million by 2032, advancing at a CAGR of 14.73%.

- Leading players such as Google, Microsoft, IBM, Adobe, ABBYY, Nuance Communications, Kofax, Docsumo, Anyline, Nano Net Technologies, Cognex Corporation, and NAVER Cloud Corporation drive market growth through innovation, scalability, and AI-based solutions.

- By input type, documents led with 48% share in 2024, followed by images at 34% and scanners at 18%, reflecting strong enterprise digitization trends and rising mobile usage.

- Cloud-based deployment dominated with 56% share in 2024, while on-premises held 30% and hybrid 14%, highlighting the industry’s shift toward cost-efficient, scalable, and SaaS-based OCR solutions.

- North America led with 36% share in 2024, Europe followed with 24%, and Asia Pacific held 29% while emerging markets in Latin America, the Middle East, and Africa showed steady adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Input Type

The documents segment held the largest share of 48% in 2024, driven by its widespread use in digitizing banking records, invoices, contracts, and government files. Growing adoption of digital workflows across industries has reinforced demand for OCR solutions that streamline compliance and reduce manual errors. Image-based OCR followed with 34% share, fueled by rising smartphone usage and mobile scanning apps. Scanners accounted for the remaining 18%, supported by enterprises modernizing archival systems in financial, healthcare, and legal domains.

For instance, Adobe enhanced its Acrobat mobile scanner with AI-powered OCR, enabling seamless digital archiving of receipts for enterprise expense tracking.

By Deployment

Cloud-based OCR dominated the market with 56% share in 2024, propelled by scalability, remote accessibility, and integration with enterprise applications. Organizations prefer cloud platforms for cost savings and real-time processing of high data volumes. On-premises solutions maintained a 30% share, appealing to industries with strict data security needs, including government and BFSI. Hybrid deployment accounted for 14%, as enterprises increasingly balance flexibility with control. The shift toward SaaS-based OCR continues to strengthen the growth of the cloud segment.

By End-User

The BFSI sector led the market with 32% share in 2024, supported by automation of KYC, loan documents, and fraud detection processes. Healthcare and life sciences followed with 22% share, leveraging OCR to digitize patient records, prescriptions, and diagnostic reports. Government applications contributed 18%, focusing on e-governance and public record management. Retail and e-commerce secured 15%, driven by demand for digital receipts and inventory scanning. Airports, transportation, and other industries, including education and manufacturing, collectively accounted for the remaining 13%.

For instance, State Bank of India implemented an OCR-powered system to automate loan document verification, significantly accelerating approval workflows.

Key Growth Drivers

Rising Digital Transformation Across Industries

The growing need for digitization in BFSI, government, and healthcare sectors is a primary driver for AI OCR adoption. Organizations are increasingly shifting from manual document processing to automated recognition systems to enhance efficiency and reduce operational errors. Cloud integration and enterprise-level automation further expand OCR adoption. Digital transformation initiatives globally are pushing businesses to modernize workflows, driving steady demand for OCR solutions. This trend positions OCR as a critical tool for productivity, compliance, and cost savings in the digital era.

For instance, ArcelorMittal Nippon Steel leveraged OCR combined with robotic process automation to handle 300,000 invoices annually from over 10,500 suppliers, improving payment speeds and operational efficiency across its supply chain.

Expansion of Mobile and Cloud-Based Applications

Cloud-based OCR platforms dominate due to their scalability, affordability, and ease of deployment across industries. The rapid increase in smartphone penetration and mobile apps for scanning receipts, ID cards, and invoices further accelerates market growth. Businesses prefer cloud OCR for real-time accessibility and seamless integration with enterprise software. Enhanced AI capabilities, including machine learning and natural language processing, improve recognition accuracy. Combined, these factors strengthen the market for mobile-enabled OCR services, making them the preferred choice for enterprises and individuals alike.

For instance, ABBYY launched its Vantage Mobile solution, a cloud-native OCR platform designed to integrate with enterprise workflows, providing real-time document capture and processing for remote employees.

Growing Demand in Healthcare and BFSI Sectors

Healthcare and BFSI sectors represent strong demand centers due to their heavy reliance on document-intensive processes. OCR enables hospitals to digitize patient records, prescriptions, and diagnostic reports, improving clinical efficiency and compliance. In banking and insurance, OCR automates customer onboarding, loan documentation, and fraud detection processes. Both industries prioritize data accuracy and speed, making AI-powered OCR indispensable. Regulatory requirements for record-keeping and secure data management further push adoption. This vertical-driven growth underscores the role of OCR in mission-critical, high-volume document environments.

Key Trends & Opportunities

Key Trends & Opportunities

Integration of AI and Machine Learning for Accuracy

AI-powered OCR solutions increasingly integrate advanced machine learning and natural language processing to deliver higher accuracy in complex use cases. These include handwritten text recognition, multi-language support, and contextual interpretation. Businesses are adopting intelligent OCR for improved data extraction and reduced manual correction efforts. This trend opens opportunities for providers to differentiate through precision and adaptability. Enhanced AI models also allow OCR platforms to evolve with new data inputs, making them more valuable in dynamic industries such as healthcare and e-commerce.

For instance, Adobe introduced AI-driven OCR upgrades in its Acrobat platform, enhancing accuracy for handwritten notes and scanned multilingual documents, improving workflows for enterprise clients.

Expansion in Emerging Markets and SMEs

Adoption of OCR is expanding rapidly in emerging economies, driven by government digitization programs, rising internet penetration, and cost-effective cloud services. Small and medium enterprises (SMEs) are also embracing OCR for affordability and efficiency in handling invoices, receipts, and customer documents. The shift toward subscription-based OCR services makes it easier for smaller firms to access advanced solutions. This opportunity highlights the untapped potential in regions such as Asia-Pacific, Latin America, and Africa, where digitalization is accelerating, and OCR adoption is still in its early stages.

For instance, MeitY utilized the BHASHINI platform to enhance multilingual OCR accessibility across 11 Indian languages, supporting SMEs nationwide.

Key Challenges

Data Privacy and Security Concerns

Data protection remains a significant challenge for OCR adoption, especially in industries dealing with sensitive information such as healthcare and banking. Cloud-based OCR raises concerns over storage and transmission of confidential data. Stringent regulations, including GDPR and HIPAA, require vendors to ensure compliance, which increases implementation complexity and costs. Businesses remain cautious, balancing efficiency gains with potential security risks. Addressing these concerns with robust encryption, secure APIs, and compliance certifications is essential for sustained adoption of AI OCR solutions globally.

High Implementation and Integration Costs

Despite its benefits, AI OCR adoption is limited by high deployment and integration expenses. Enterprises often require customization, system integration, and ongoing training of AI models, which add to costs. Smaller organizations and SMEs may struggle to justify these expenses compared to their budgets. Complex IT infrastructure further delays deployment in large organizations. Vendors face the challenge of offering affordable, scalable solutions that deliver measurable ROI. Without cost optimization, OCR adoption may remain skewed toward large enterprises with stronger technology budgets.

Accuracy Limitations in Complex Inputs

Although AI OCR has advanced, challenges persist in recognizing low-quality scans, handwritten text, and documents with diverse fonts or layouts. Errors in extraction reduce trust in automated systems and increase reliance on manual verification. Industries like healthcare and legal, where accuracy is critical, are particularly affected by these shortcomings. The inability to handle multi-language scripts or contextual nuances further limits usability. Vendors must continue to enhance AI models and incorporate contextual learning to overcome these barriers and improve widespread acceptance.

Regional Analysis

North America

North America dominated the AI OCR market with a 36% share in 2024, supported by strong digital infrastructure and adoption across BFSI, government, and healthcare sectors. The market was valued at USD 2,482.00 million in 2018, reached USD 4,114.48 million in 2024, and is projected to hit USD 12,268.16 million by 2032, growing at a CAGR of 14.7%. Widespread use of AI and cloud platforms, alongside regulatory digitization mandates, continues to drive growth in the U.S. and Canada.

Europe

Europe held a 24% share in 2024, driven by strong adoption in banking, retail, and government digitization projects. The market stood at USD 1,720.40 million in 2018, grew to USD 2,770.10 million in 2024, and is anticipated to reach USD 7,793.28 million by 2032, at a CAGR of 13.9%. Key markets such as Germany, the UK, and France prioritize automation for compliance and operational efficiency. Investments in AI-powered OCR tools for multilingual applications strengthen Europe’s position in the global market.

Asia Pacific

Asia Pacific emerged as the fastest-growing region, holding a 29% share in 2024. The market was valued at USD 1,876.80 million in 2018, rose to USD 3,272.99 million in 2024, and is forecasted to reach USD 10,673.72 million by 2032, at a CAGR of 16.0%. Rapid urbanization, government-led digitization programs, and widespread mobile adoption fuel demand across China, India, and Southeast Asia. Expanding e-commerce, fintech, and healthcare digitization further accelerate growth, positioning Asia Pacific as a key hub for OCR innovation and adoption.

Latin America

Latin America accounted for a 6% share in 2024, reflecting steady adoption in BFSI, retail, and government sectors. The market stood at USD 421.60 million in 2018, increased to USD 700.48 million in 2024, and is projected to reach USD 1,937.48 million by 2032, at a CAGR of 13.7%. Brazil and Mexico lead demand with growing investments in digital banking and automation. Expanding e-commerce penetration and government initiatives for digital record-keeping continue to create opportunities for OCR adoption across the region.

Middle East

The Middle East represented a 4% share in 2024, with adoption primarily in government, BFSI, and transportation sectors. The market was valued at USD 217.60 million in 2018, grew to USD 337.67 million in 2024, and is expected to reach USD 889.38 million by 2032, at a CAGR of 13.0%. GCC countries are at the forefront of digitization initiatives, particularly in smart city development and e-governance. Rising investments in AI and cloud services strengthen demand for OCR solutions in the region.

Africa

Africa held a 1% share in 2024, reflecting early-stage adoption compared to other regions. The market was valued at USD 81.60 million in 2018, increased to USD 214.56 million in 2024, and is anticipated to reach USD 506.57 million by 2032, at a CAGR of 10.7%. South Africa and Egypt lead adoption, driven by digital banking and education sector initiatives. Limited infrastructure remains a barrier, yet rising mobile penetration and gradual government-led digitization projects present long-term opportunities for AI OCR solutions in Africa.

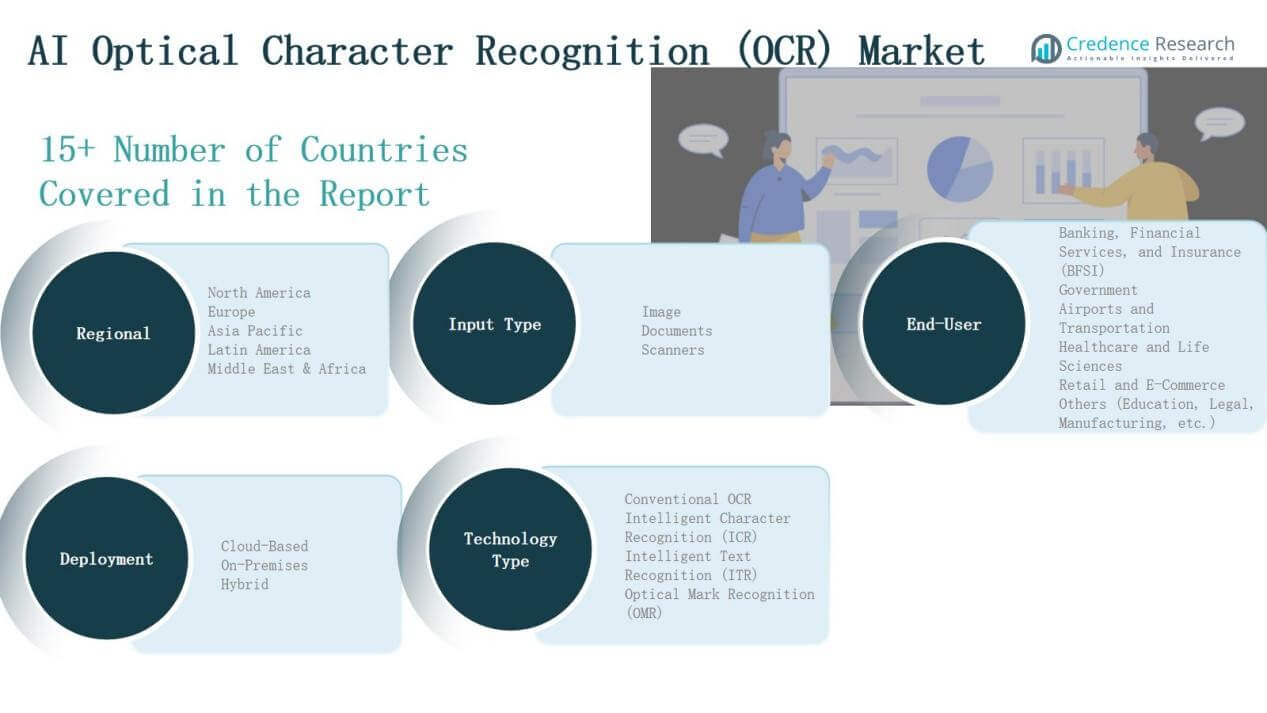

Market Segmentations:

Market Segmentations:

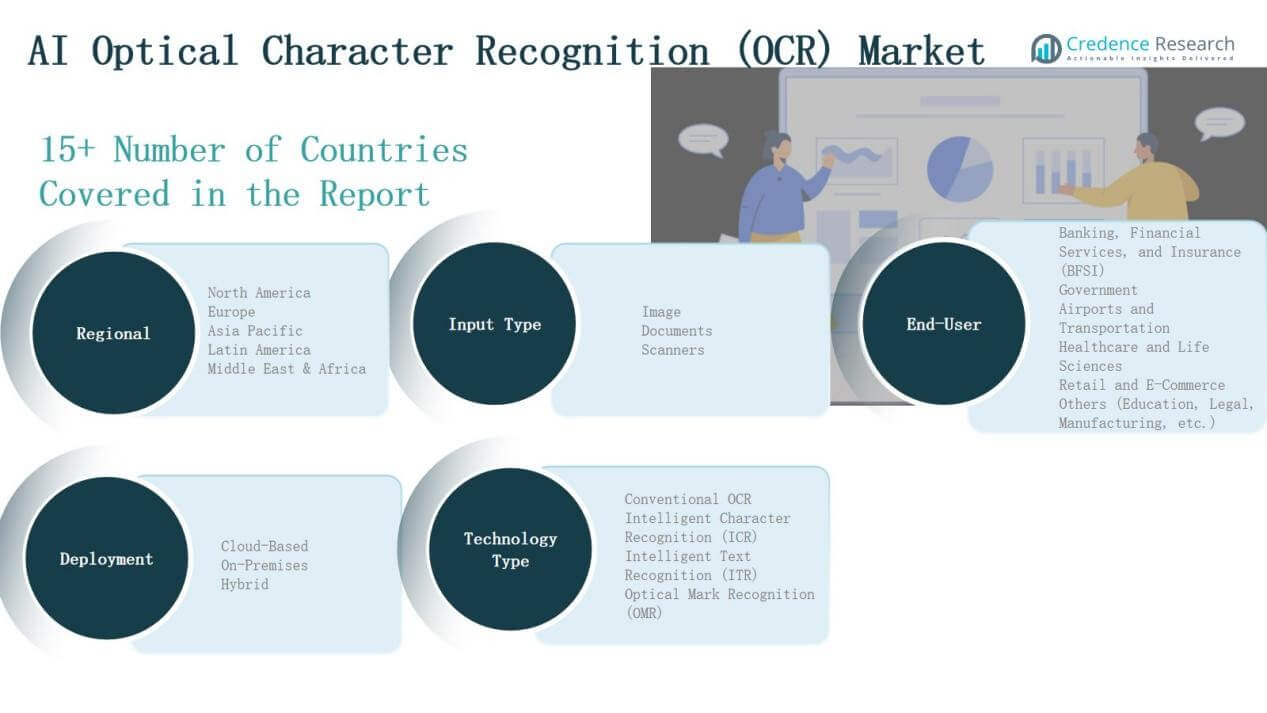

By Input Type

By Deployment

- Cloud-Based

- On-Premises

- Hybrid

By End-User

- Banking, Financial Services, and Insurance (BFSI)

- Government

- Airports and Transportation

- Healthcare and Life Sciences

- Retail and E-Commerce

- Others (Education, Legal, Manufacturing, etc.)

By Technology Type

- Conventional OCR

- Intelligent Character Recognition (ICR)

- Intelligent Text Recognition (ITR)

- Optical Mark Recognition (OMR)

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The AI Optical Character Recognition (OCR) market is highly competitive, shaped by global technology leaders, established enterprise solution providers, and innovative startups. Major players such as Google, Microsoft, IBM, and Adobe dominate with broad AI capabilities, robust R&D, and integrated cloud ecosystems. ABBYY, Nuance Communications, and Kofax hold strong positions through specialized OCR software and enterprise automation platforms, while emerging firms like Docsumo, Anyline, and Nano Net Technologies differentiate through lightweight, mobile-first, and niche applications. Strategic initiatives, including product innovations, partnerships, and acquisitions, remain central to competitive positioning, as vendors seek to improve accuracy, scalability, and industry-specific offerings. With increasing demand across BFSI, healthcare, retail, and government, competition intensifies around delivering secure, compliant, and cost-effective solutions. Regional players also contribute by targeting localized language recognition and compliance needs. Overall, the competitive landscape reflects a balance between large enterprises driving consolidation and agile innovators addressing evolving customer demands.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Google Inc.

- Microsoft Corporation

- IBM Corporation

- Adobe Systems Incorporated

- ABBYY

- Nuance Communications

- Kofax Inc.

- NAVER Cloud Corp

- IDCentral

- Cognex Corporation

- Klippa App BV

- Qualitas Technologies

- Nano Net Technologies Inc.

- Docsumo

- Anyline GmbH

- IRIS S.A.

- LEAD Technologies Inc.

Recent Developments

- In April 2025, ABBYY launched an OCR API designed to boost accuracy in intelligent-automation workflows, reinforcing its leadership in the Everest Group rankings.

- In March 2025, Mistral AI introduced an OCR API capable of processing 2,000 pages per minute with 97-99.54% accuracy across 11 languages, targeting high-speed, multi-language document processing needs.

- In September 2025, Affinda launched a new agentic AI document-processing platform achieving over 99% accuracy across diverse document types.

- In June 2025, OCR Studio partnered with ZeusTech I.T. Services to integrate MRZ scanning into its OCR solutions.

Report Coverage

The research report offers an in-depth analysis based on Input Type, Deployment, End user, Technology Type and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption will rise as industries accelerate digital transformation initiatives worldwide.

- Cloud-based OCR platforms will expand due to scalability and integration benefits.

- Mobile-enabled OCR applications will gain traction with increasing smartphone penetration.

- Healthcare and BFSI sectors will continue to drive significant demand for automation.

- Advances in AI and machine learning will improve recognition accuracy and language support.

- SMEs in emerging economies will adopt OCR through affordable subscription-based models.

- Government-led digitization projects will strengthen adoption in public sector services.

- Hybrid deployment models will grow as enterprises balance flexibility with data security.

- Partnerships between OCR vendors and enterprise software providers will shape market expansion.

- Focus on data privacy and compliance will influence product development and adoption strategies.

Market Insights

Market Insights Key Trends & Opportunities

Key Trends & Opportunities Market Segmentations:

Market Segmentations: