Market Overview

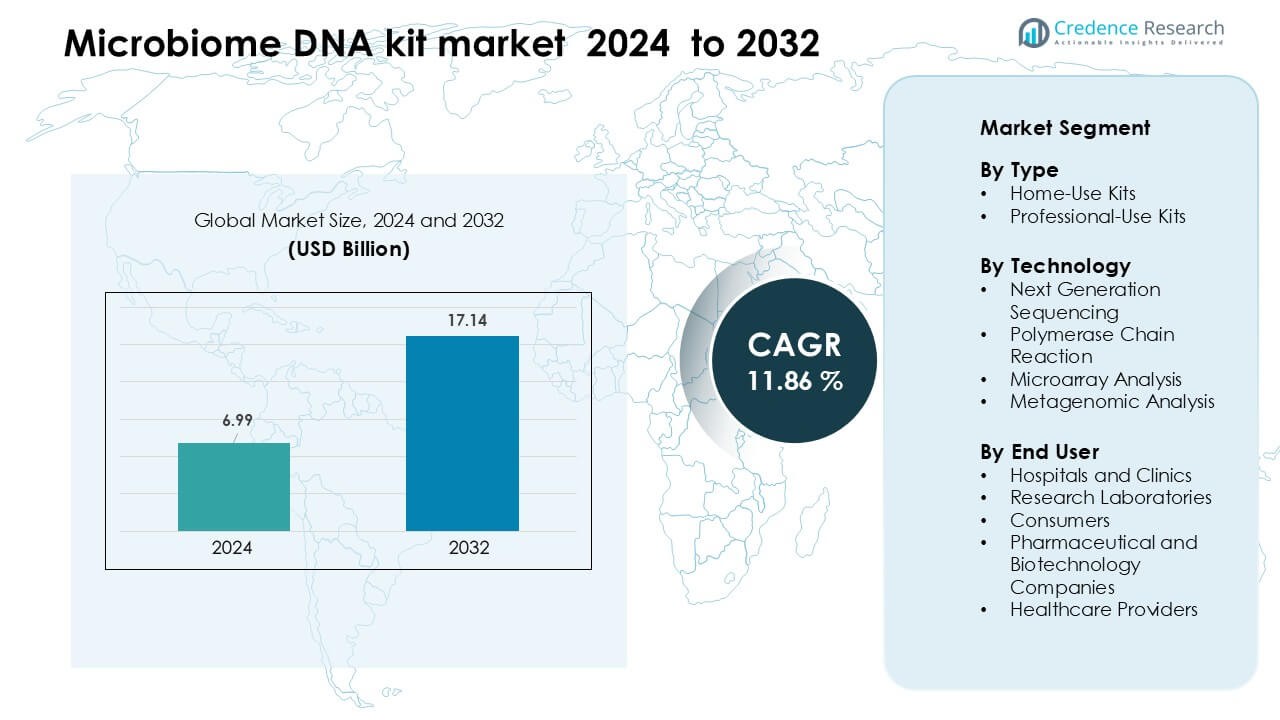

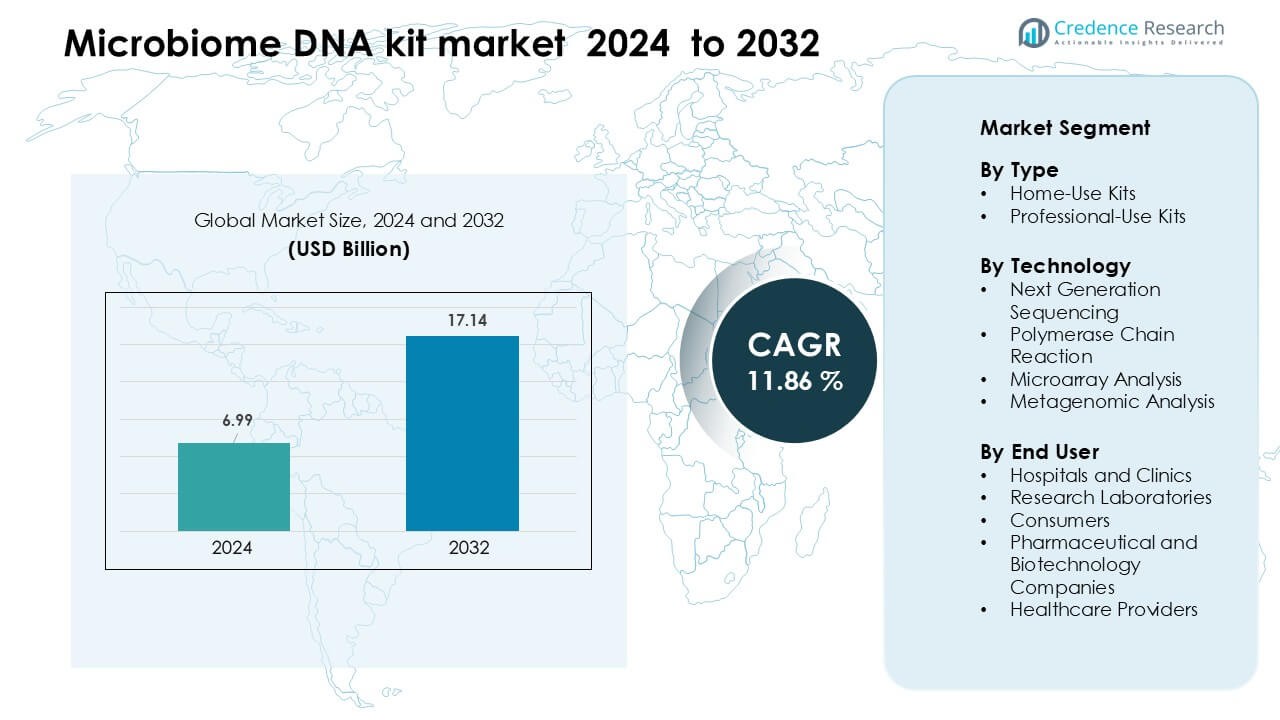

Microbiome DNA kit market was valued at USD 6.99 billion in 2024 and is anticipated to reach USD 17.14 billion by 2032, growing at a CAGR of 11.86 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Microbiome DNA kit Market Size 2024 |

USD 6.99 Billion |

| Microbiome DNA kit Market, CAGR |

11.86 % |

| Microbiome DNA kit Market Size 2032 |

USD 17.14 Billion |

The microbiome DNA kit market is shaped by leading companies such as Microbiome Therapeutics LLC, Enterome Biosciences SA, Seres Therapeutics, Synthetic Biologics, Rebiotix, Metabiomics Corp. (BioSpherex LLC), AOBiome, Second Genome, Yakult Honsha Co., and Osel, Inc. These players compete through advanced sequencing tools, AI-based interpretation platforms, and expanding direct-to-consumer testing services. Many firms focus on stronger clinical validation and broader microbiome databases to improve accuracy and user trust. North America remained the leading region in 2024 with a market share of about 41%, supported by strong adoption of home-use kits, developed research infrastructure, and high preventive health awareness.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The microbiome DNA kit market reached a value of USD 6.99 billion in 2024 and is projected to grow at a CAGR of 11.86% through 2032, supported by rising demand for personalized health insights.

- Strong market drivers include growing adoption of home-use kits, which held about 62% share in 2024, and rising interest in preventive wellness backed by advanced sequencing technologies.

- Key trends include rapid use of NGS platforms, rising integration of AI-based interpretation tools, and expanding partnerships between testing companies and nutrition or wellness brands.

- Competitive activity remains strong as players such as Microbiome Therapeutics, Enterome Biosciences, Seres Therapeutics, AOBiome, and Rebiotix invest in digital platforms, deeper microbial databases, and clinically validated analysis tools.

- North America led the market with 41% share in 2024, followed by Europe at 29% and Asia Pacific at 21%, driven by strong healthcare infrastructure, consumer awareness, and expanding research adoption.

Market Segmentation Analysis:

By Type

Home-use kits held the dominant position in 2024 with about 62% share. Growing interest in personal wellness and rising demand for convenient at-home testing strengthened this lead. Users preferred simple sample-collection methods and fast digital reports that supported diet, gut health, and lifestyle planning. Rising marketing by direct-to-consumer brands also expanded adoption across younger buyers. Professional-use kits grew in hospitals and labs for advanced diagnostic studies, but home-use products maintained wider reach due to lower cost and higher accessibility.

- For instance, 23andMe reported having about 14 million registered personal genome (PGS) customers as of March 31, 2024.

By Technology

Next-generation sequencing (NGS) dominated the market in 2024 with nearly 54% share. NGS gained strong traction because it delivers high-depth microbial analysis and supports detailed profiling of gut, oral, and skin microbiomes. Growing use of NGS platforms in consumer testing and clinical research boosted expansion. PCR kits grew for targeted detection of specific microbes at lower cost, while metagenomic analysis advanced in research settings for broader microbial studies. Microarray tools saw focused use in labs but remained smaller due to limited resolution compared with NGS.

- For instance, Illumina’s MiSeq i100 system—with a 25 M-read flow cell (2×300 bp) and maximum output of about 15 Gb per run—is used extensively for microbial community profiling.

By End User

Consumers led the microbiome DNA kit market in 2024 with roughly 48% share. Strong interest in personalized nutrition, digestive wellness, and preventive care accelerated consumer purchases. Subscription-based insights and app-based guidance further increased repeat usage. Hospitals and clinics used kits for gastrointestinal and metabolic assessments, while research labs applied them in microbial diversity studies. Pharmaceutical and biotechnology companies expanded demand through microbiome drug development, but consumer testing stayed ahead due to broad adoption and growing awareness of microbiome-linked health benefits.

Key Growth Drivers

Rising Demand for Personalized Wellness and Preventive Health

Growing consumer interest in personalized wellness continues to push the microbiome DNA kit market forward. People seek tailored insights to improve digestion, immunity, and overall lifestyle, which drives strong adoption of at-home testing services. Many buyers now prefer data-driven health decisions, and microbiome reports help users adjust diet, supplements, and routines. Rising awareness of gut–brain and gut–metabolism links further increases curiosity about microbial health. Companies expand digital platforms that offer clear guidance, which keeps engagement high. The shift toward preventive care strengthens this driver, as users want early indications of microbiome imbalance. These factors position personalized wellness as a core force behind market growth.

- For instance, Viome has analyzed over 1 million microbiomes, generating more than 100 quadrillion data points to fuel its AI-driven health and nutrition recommendations.

Expanding Use of Next-Generation Sequencing in Consumer and Clinical Testing

Next-generation sequencing (NGS) drives rapid market expansion due to its high accuracy and ability to detect large microbial populations. NGS supports detailed analysis for gut, skin, and oral microbiomes, which improves the value of DNA kits for consumers and healthcare users. Hospitals and clinics use NGS-backed kits to evaluate digestive disorders, metabolic risks, and chronic inflammation indicators. Research laboratories depend on NGS for large microbiome datasets that support scientific studies. As sequencing costs fall, more companies integrate NGS into direct-to-consumer kits, increasing accessibility. The strong shift toward advanced sequencing technologies continues to raise the credibility and adoption of microbiome DNA kits across age groups.

- For instance, Tiny Health uses shotgun metagenomic sequencing in its at-home gut test, enabling strain-level identification and detailed functional insights by sequencing entire microbial genomes.

Growing Integration of Digital Platforms and AI-Based Microbiome Interpretation

AI and digital health tools play a major role in expanding microbiome DNA kit adoption. Modern platforms use machine learning to analyze microbial patterns and convert raw data into clear insights for users. These tools help people understand diet triggers, intolerance patterns, and lifestyle needs with better accuracy. Companies also provide personalized recommendations through mobile apps, which raises trust and encourages repeat testing. Healthcare professionals benefit from AI-supported dashboards that simplify complex datasets for clinical decisions. As digital ecosystems expand, they improve accessibility, user experience, and engagement. This integration of AI and digital services strengthens long-term usage and accelerates overall market growth.

Key Trend & Opportunity

Rising Adoption of At-Home Testing Kits Among Younger and Tech-Savvy Users

At-home microbiome DNA kits continue to gain traction among younger, urban, and tech-centric consumers. This group shows strong interest in digital health tools and values convenience over traditional clinical visits. Companies target this demographic through app-based insights, subscription models, and social media education. Many wellness brands promote microbiome tests as part of broader nutrition or fitness programs, which expands reach. The shift toward self-monitoring through wearables and home diagnostic tools also complements microbiome testing. This trend opens opportunities for bundled services, personalized diet programs, and long-term engagement platforms. As awareness rises, at-home testing becomes a mainstream wellness tool rather than a niche service.

- For instance, Viome’s health insights are delivered via its Vie AI engine, which continuously learns from each of its 1 million microbiome samples to refine its personalized recommendations.

Growing Use of Microbiome Data in Drug Discovery and Therapeutics Development

The increasing role of microbiome science in drug development creates strong opportunities for kit manufacturers. Pharmaceutical and biotechnology companies use microbiome datasets to explore new treatments for metabolic diseases, gastrointestinal disorders, and immune-related conditions. Microbiome DNA kits offer efficient sampling solutions for clinical studies and real-world evidence collection. As interest in live biotherapeutics and microbiome-targeted drugs grows, demand for reliable and scalable testing platforms increases. Companies can partner with research institutions and clinical networks to supply standardized kits. This trend also encourages investment in advanced sequencing and metagenomic tools. The rise of microbiome-based therapeutics opens long-term product and collaboration opportunities.

- For instance, Seres Therapeutics mines its human microbiome datasets (from clinical study subjects) to discover and validate biomarkers, which serve as the basis for its live biotherapeutic products.

Expansion of Personalized Nutrition and Functional Food Ecosystems

The link between gut microbiome health and nutrition drives opportunities in personalized food and supplement markets. Many users rely on microbiome kits to identify food intolerances, optimize digestion, and adjust diet plans. Companies partner with nutrition brands and wellness programs to offer customized diet guidance based on microbial profiles. Functional foods such as probiotics and prebiotics see higher demand when paired with microbiome insights. This creates cross-industry collaboration potential between test kit providers, food manufacturers, and digital health platforms. As consumers shift toward gut-friendly diets, the integration of microbiome testing with nutrition ecosystems strengthens market expansion.

Key Challenge

Limited Clinical Validation and Variation in Test Accuracy

A major challenge for the microbiome DNA kit market is the lack of uniform clinical validation across testing methods. Microbial composition varies widely due to lifestyle, diet, and sample handling, which leads to inconsistent results. Many kits use different databases and analysis tools, creating variations in interpretation. Healthcare professionals often express caution due to limited regulatory guidance and unclear clinical relevance for some findings. This lack of standardization reduces trust among medical users and slows clinical adoption. Ensuring validated datasets, certified labs, and transparent reporting remains essential to improve accuracy. Companies must address these gaps to build stronger confidence across both consumers and healthcare providers.

Rising Data Privacy Concerns and Limited Consumer Understanding of Microbiome Reports

The growth of microbiome testing raises serious concerns about genetic data security and user privacy. Many consumers hesitate to share biological samples due to fears around misuse of personal or microbial information. Weak regulatory frameworks in some regions increase uncertainty about how data is stored, shared, or used by third parties. Another barrier is the complexity of microbiome reports, which many users struggle to interpret without expert help. Confusing scores or scientific terminology reduces engagement and lowers repeat testing rates. Companies must invest in clear communication, strong privacy policies, and transparent data practices to overcome these challenges and sustain long-term adoption.

Regional Analysis

North America

North America dominated the microbiome DNA kit market in 2024 with nearly 41% share. Strong consumer awareness, widespread adoption of at-home health testing, and advanced sequencing infrastructure supported this lead. Companies expanded digital wellness platforms, which boosted repeat testing among health-conscious users. Hospitals and research labs increased use of microbiome profiling for digestive and metabolic studies. High spending on personalized nutrition and preventive care also strengthened growth. Supportive regulatory frameworks for clinical validation and strong biotechnology networks kept North America ahead of other regions.

Europe

Europe captured about 29% share in 2024, driven by strong research capabilities and rising demand for personalized health insights. Consumers across Germany, the UK, and the Nordics adopted home-use kits to monitor gut balance and improve nutrition planning. Clinical institutions expanded microbiome studies related to metabolic diseases and immunity, increasing demand for advanced sequencing tools. Government-funded microbiome research programs supported further adoption. Growing interest in probiotic and functional food integration with microbiome data strengthened market expansion. Europe maintained steady growth supported by well-developed digital health and laboratory ecosystems.

Asia Pacific

Asia Pacific held nearly 21% share in 2024 and recorded the fastest growth rate. Rising urbanization, growing interest in preventive health, and strong smartphone penetration increased adoption of at-home microbiome kits. Consumers in China, Japan, South Korea, and India showed rising awareness of gut health, supporting direct-to-consumer expansion. Regional biotech companies increased investment in sequencing platforms and AI-based interpretation tools. Hospitals also adopted microbiome profiling for digestive disorders, adding to demand. Expanding wellness programs and partnerships with nutrition brands further strengthened the region’s market momentum.

Latin America

Latin America accounted for roughly 6% share in 2024, supported by growing interest in digital health and preventive wellness. Countries such as Brazil and Mexico showed rising adoption of at-home microbiome kits among younger consumers seeking personalized diet guidance. Clinical research groups increased microbiome studies for gastrointestinal and immune-related conditions, boosting use of advanced sequencing tools. Limited healthcare access in some regions encouraged consumers to adopt self-testing solutions. Increasing partnerships with wellness platforms and improved distribution networks supported gradual market expansion across Latin America.

Middle East & Africa

The Middle East & Africa region held about 3% share in 2024, driven by growing awareness of preventive care in major cities. Countries such as the UAE, Saudi Arabia, and South Africa showed early adoption of home-use microbiome kits among higher-income groups. Hospitals expanded diagnostic use for digestive disorders, while research groups explored microbiome links to lifestyle diseases. Limited laboratory infrastructure slowed broader penetration, but rising investment in digital health platforms created new opportunities. Increasing interest in nutrition-focused wellness programs supported gradual demand growth across the region.

Market Segmentations:

By Type

- Home-Use Kits

- Professional-Use Kits

By Technology

- Next Generation Sequencing

- Polymerase Chain Reaction

- Microarray Analysis

- Metagenomic Analysis

By End User

- Hospitals and Clinics

- Research Laboratories

- Consumers

- Pharmaceutical and Biotechnology Companies

- Healthcare Providers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The microbiome DNA kit market features active competition driven by technology innovation, expanding consumer demand, and growing clinical adoption. Key companies such as Seres Therapeutics, Enterome Biosciences SA, Rebiotix, Synthetic Biologics, Microbiome Therapeutics, AOBiome, Second Genome, Metabiomics, Yakult Honsha, and Osel focus on advanced sequencing platforms, AI-supported interpretation tools, and diverse microbial databases to gain advantage. Many brands strengthen reach through direct-to-consumer channels, subscription models, and app-based wellness programs that improve user engagement. Clinical and research-focused firms invest in precision diagnostics and therapeutic pipelines, which enhance credibility and attract strategic partnerships. Product differentiation centers on data accuracy, user-friendly platforms, and secure reporting systems. Companies also invest in global expansion by targeting fast-growing regions with rising preventive health awareness. The competitive environment remains dynamic as players pursue collaborations, digital upgrades, and next-generation testing technologies to capture more market share.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Microbiome Therapeutics LLC

- Enterome Biosciences SA

- Seres Therapeutics

- Synthetic Biologics, Inc.

- Rebiotix, Inc.

- Metabiomics Corp. (BioSpherex LLC)

- AOBiome

- Second Genome

- Yakult Honsha Co.

- Osel, Inc.

Recent Developments

- In September 2025, Seres Therapeutics received constructive feedback from the U.S. Food and Drug Administration (FDA) on the protocol for their SER-155 Phase 2 study and implemented cost-reduction actions.

- In December 2024, Yakult continues to expand its microbiome research infrastructure and public R&D activity (company profile / corporate materials and ongoing scientific programs and symposia), but I did not find a Yakult-branded microbiome DNA kit launch.

- In June 2024, Osel’s recent public activity is focused on live-biotherapeutic product development (LACTIN-V) and associated microbiome clinical studies rather than offering a microbiome DNA kit. Multiple 2023–2025 publications and company updates describe LACTIN-V clinical results, colonization sub-studies and ongoing pivotal trials

Report Coverage

The research report offers an in-depth analysis based on Type, Technology, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as consumers increasingly adopt microbiome testing for personalized wellness.

- Advances in next-generation sequencing will improve accuracy and boost clinical acceptance.

- AI-driven interpretation tools will strengthen report clarity and increase user engagement.

- Partnerships between testing firms and nutrition brands will create new personalized diet solutions.

- Hospitals will integrate microbiome profiling into routine assessments for digestive and metabolic conditions.

- Pharmaceutical companies will use microbiome data to support drug discovery and targeted therapies.

- Home-use kits will gain wider reach due to lower prices and improved digital platforms.

- Growing awareness of gut–brain and gut–immune links will fuel long-term demand.

- Emerging markets in Asia Pacific and Latin America will adopt testing faster with better digital access.

- Regulatory frameworks will evolve, improving quality standards and boosting trust in microbiome testing.