Market Overview

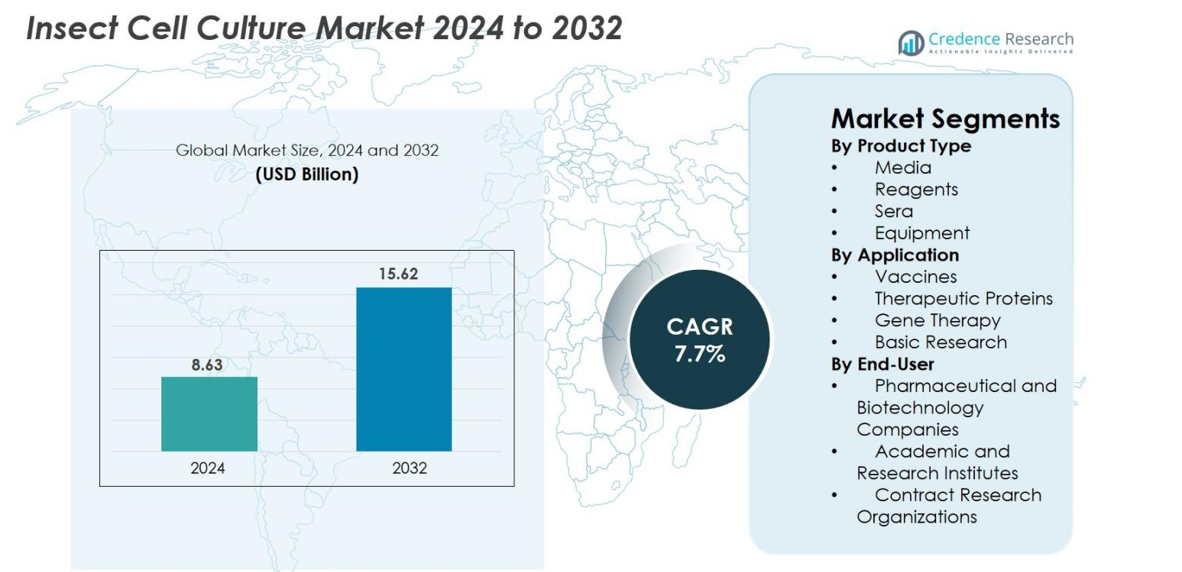

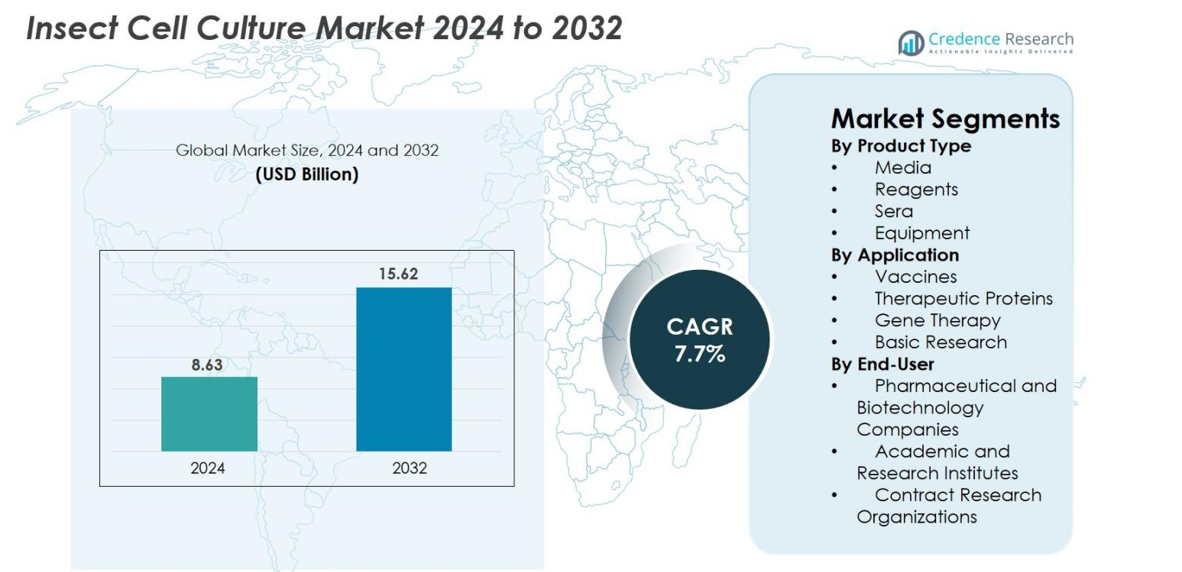

Insect Cell Culture Market size was valued at USD 8.63 Billion in 2024 and is anticipated to reach USD 15.62 Billion by 2032, at a CAGR of 7.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Insect Cell Culture Market Size 2024 |

USD 8.63 Billion |

| Insect Cell Culture Market, CAGR |

7.7% |

| Insect Cell Culture Market Size 2032 |

USD 15.62 Billion |

The Insect Cell Culture market is driven by strong participation from leading life science companies, including Thermo Fisher Scientific, Merck Millipore, Lonza, GE Healthcare, Corning (Cellgro), Sigma-Aldrich, BD, Life Technologies, Takara, and HiMedia, all of which offer advanced media, reagents, equipment, and baculovirus expression systems. These players focus on enhancing yield, scalability, and regulatory compliance to meet growing demand in vaccines, recombinant proteins, and gene therapy. North America leads the global market with 40.5% share, supported by robust biopharmaceutical infrastructure and high R&D investment, followed by Europe at 28.3% and the rapidly expanding Asia-Pacific region at 22.7%.

Market Insights

- The Insect Cell Culture market was valued at USD 8.63 billion in 2024 and is projected to reach USD 15.62 billion by 2032, registering a CAGR of 7.7% during the forecast period.

- Market growth is driven by rising demand for recombinant protein production, expanding vaccine development pipelines, and increasing adoption of baculovirus expression systems across pharmaceutical and biotechnology companies.

- Key trends include the rapid shift toward serum-free and chemically defined media, along with growing integration of automation and single-use bioreactors to enhance scalability and process efficiency.

- The market features active participation from players such as Thermo Fisher Scientific, Merck Millipore, Lonza, GE Healthcare, Corning, Sigma-Aldrich, BD, Life Technologies, Takara, and HiMedia, strengthening innovation and expanding product portfolios.

- Regionally, North America leads with 40.5% share, followed by Europe with 28.3% and Asia-Pacific with 22.7%, while product-wise, media holds the dominant segment share at 41.6% due to its critical role in high-yield insect cell culture workflows.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Product Type

The Insect Cell Culture market by product type is driven by expanding biopharmaceutical production and rising adoption of high-performance cell expression systems. Media dominates the segment, capturing 41.6% market share, supported by increasing demand for optimized serum-free and protein-free formulations that enhance cell viability and recombinant protein yields. Reagents and sera continue to gain traction due to advancements in transient expression workflows, while equipment benefits from automation trends. Growing emphasis on scalable, contamination-free culture processes and continuous improvements in media formulations significantly contribute to this segment’s strong growth trajectory.

- For instance, Thermo Fisher Scientific’s ExpiSf™ Expression System reported recombinant protein yields of up to 90 milligrams per liter in Sf9 insect cells, demonstrating a substantial improvement over traditional baculovirus systems.

By Application

Within the application segment, vaccines lead the market with a 38.4% share, driven by the growing use of insect cell lines such as Sf9 and High Five for producing safe, high-yield viral vector and recombinant protein-based vaccines. Therapeutic proteins and gene therapy applications are also expanding rapidly due to the efficiency of baculovirus expression systems in delivering complex molecular structures. Basic research continues to support market growth as academic institutes increasingly adopt insect cell platforms for molecular biology and protein interaction studies, reinforcing the broad applicability of these systems.

- For instance, The FDA-approved Flublok® influenza vaccine, developed using Sf9 insect cells by Protein Sciences (now part of Sanofi), has been manufactured at scales exceeding 2 million commercial doses per production campaign, demonstrating industrial-level vaccine output.

By End-User

Among end-users, pharmaceutical and biotechnology companies command the largest share at 52.7%, fueled by rising investments in biologics manufacturing, vaccine development, and gene therapy programs. These companies increasingly rely on insect cell culture for its scalability, speed, and cost-effective production capabilities. Academic and research institutes contribute notably through ongoing innovation in genetic engineering and fundamental cell biology studies. Contract research organizations also show strong momentum as outsourcing of recombinant protein and viral vector production rises, driven by the need for specialized expertise and accelerated development timelines.

Key Growth Drivers

Rising Demand for Recombinant Protein and Vaccine Production

The increasing global demand for recombinant proteins and modern vaccines stands as a major growth driver for the Insect Cell Culture market. Insect cell systems such as Sf9 and High Five offer high expression efficiency, rapid scalability, and the ability to generate complex post-translational modifications, making them ideal for recombinant vaccine and therapeutic protein development. The surge in viral vector-based vaccines, including those used for influenza, HPV, and emerging infectious diseases, further accelerates the adoption of insect cell culture technologies. Biopharmaceutical companies prefer these systems due to their robustness, lower contamination risks, and faster development cycles compared to mammalian cultures. Additionally, the scalability of baculovirus expression vector systems (BEVS) supports large-scale production without requiring costly infrastructure upgrades. As global immunization programs expand and demand rises for next-generation biologics, insect cell culture continues to play a critical role in enabling cost-effective and high-yield bioproduction solutions across industrial and research settings.

- For instance, Novavax’s manufacturing network, leveraging Sf9 insect cell culture, was configured to support annual production capacity of up to 2 billion vaccine doses, enabled through large-scale BEVS-based facilities including the Praha site.

Expansion of Gene Therapy and Viral Vector Manufacturing

The rapid growth of gene therapy pipelines worldwide significantly boosts demand for insect cell culture platforms, which are widely used to generate adeno-associated virus (AAV), lentiviral vectors, and baculovirus-based delivery systems. Insect cells provide cost-effective, scalable production with high vector titers, making them ideal for both clinical and commercial manufacturing of gene therapies. As more genetic disorders gain regulatory approval for vector-based treatment approaches, manufacturers seek production systems with predictable yields and minimal contamination risk key strengths of insect cell lines. Furthermore, the rising usage of viral vectors in oncology, rare diseases, and regenerative medicine fuels accelerated investment in BEVS-based production technologies. The capability of insect cells to support flexible, modular bioprocessing appeals to biotech companies aiming to shorten development timelines. With global gene therapy trials increasing and regulatory agencies encouraging efficient vector production strategies, insect cell culture continues to emerge as a cornerstone for next-generation therapeutic solutions.

- For instance, Oxford Biomedica reported productivity levels of bioreactor titers above viral genomes per liter (vg/L) using its HEK293 suspension cell-based production system for AAV manufacturing, which supports vector supply for global therapy developers

Increasing R&D Activities in Biopharmaceutical and Academic Institutions

Growing research activity across academic institutes, biotechnology firms, and CROs provides strong momentum for the Insect Cell Culture market. Researchers increasingly rely on insect cell systems for structural biology, molecular interaction studies, and high-throughput protein expression due to their reliability and ease of genetic manipulation. Continuous funding for life sciences research, expansion of university-industry collaborations, and the rise of translational medicine programs amplify the use of insect-based platforms. Additionally, the need for cost-effective, rapid protein screening and validation accelerates the adoption of serum-free insect cell media and innovative reagents. These systems enable researchers to express proteins that are difficult to produce in bacterial or mammalian cells, thus broadening the range of scientific applications. As global research investments expand and demand grows for efficient experimental models, insect cell culture remains an essential tool driving discovery, innovation, and early-stage biopharmaceutical development.

Key Trends & Opportunities

Advancements in Serum-Free and Chemically Defined Media

A major opportunity in the Insect Cell Culture market arises from the rapid innovation in serum-free and chemically defined media, which significantly enhances culture consistency, productivity, and regulatory compliance. These advanced media formulations minimize batch variability, reduce contamination risks, and support high-density culture systems, enabling more efficient downstream processing. Biopharmaceutical companies increasingly prefer chemically defined media as they streamline manufacturing workflows and simplify regulatory validation for vaccines, viral vectors, and recombinant proteins. Innovations in nutrient delivery, optimized growth supplements, and metabolic control further improve protein yield and quality. As demand increases for scalable and contamination-resistant platforms, manufacturers invest heavily in next-generation media tailored for Sf9, Sf21, and High Five cells. The shift toward animal-component-free production not only supports global quality standards but also aligns with sustainability goals, creating new opportunities for technology providers to introduce high-performance, regulatory-ready insect cell culture solutions.

- For instance, Xell AG validated its High Five–optimized chemically defined medium to sustain peak cell densities of up to 9.4 million cells per milliliter in a controlled bioreactor environment, enabling enhanced protein expression without the use of animal-derived components.

Automation, Single-Use Bioreactors, and Scalable Bioprocessing

The growing adoption of automation and single-use bioreactor systems presents significant opportunities for scaling insect cell culture processes. Automated systems enhance reproducibility, reduce manual labor, and enable precise monitoring of parameters such as oxygenation, pH, nutrient flow, and cell density, leading to superior culture outcomes. Single-use bioreactors appeal to biopharmaceutical developers due to their flexibility, lower contamination risks, and suitability for both small-batch research and large-volume commercial production. These systems help accelerate time-to-market for vaccines and gene therapies by simplifying cleaning validation and reducing turnaround times. Additionally, technological innovations in perfusion bioreactors, modular bioprocessing, and integrated upstream-downstream workflows allow efficient scale-ups without compromising product quality. As companies increasingly adopt flexible manufacturing models and decentralized production facilities, automation and single-use systems open new avenues for cost-effective, high-yield insect cell culture expansion worldwide.

- For instance, Sartorius’ ambr® 250 high-throughput automated mini-bioreactor platform supports 24 independent parallel reactors with working volumes of 100 to 250 milliliters, enabling rapid process optimization for insect cell cultures while minimizing manual handling and improving run-to-run consistency.

Key Challenges

High Production Costs and Limited Infrastructure Adoption

Despite strong demand, high production costs remain a key challenge in the widespread adoption of insect cell culture systems. The need for specialized bioreactors, optimized media, controlled environments, and trained personnel increases the overall operational expenditure for companies transitioning from traditional expression systems. Many emerging biotech firms and academic institutions face budget constraints that limit their ability to invest in advanced insect cell platforms or scale-up infrastructure. Additionally, the cost of high-quality, chemically defined media and downstream purification processes can be substantially higher compared to bacterial or yeast systems. In regions with limited biopharmaceutical infrastructure, the absence of standardized facilities and limited access to advanced equipment slows market penetration. As manufacturers seek cost-efficient bioprocessing models, overcoming the economic barriers associated with initial setup and ongoing production remains a critical challenge in enabling broader adoption of insect cell culture technologies.

Technical Complexity and Regulatory Constraints in Bioproduction

The technical complexity of insect cell culture and evolving regulatory expectations pose significant challenges for biopharmaceutical developers. Maintaining optimal culture conditions, controlling baculovirus infection kinetics, and ensuring consistent protein quality require extensive expertise and robust process control. Variability in viral infection efficiency, post-translational modifications, and expression stability can hinder batch consistency, complicating large-scale production. Regulatory agencies also require comprehensive validation of insect cell-based systems, including critical assessments of viral safety, purity, and process reproducibility. Meeting these stringent requirements demands significant investment in documentation, quality control, and process standardization. Moreover, companies must navigate evolving global guidelines governing viral vector manufacturing and recombinant vaccine production. These regulatory and technical complexities can delay commercialization timelines and increase operational risks, making compliance and skilled bioprocess management essential for sustainable adoption.

Regional Analysis

North America

North America holds the largest share of the Insect Cell Culture market at 40.5%, driven by its strong biopharmaceutical base, advanced research infrastructure, and high adoption of recombinant protein and vaccine production platforms. The region benefits from significant R&D spending, large-scale gene therapy programs, and widespread use of baculovirus expression systems by leading biotechnology companies. Supportive regulatory frameworks and consistent government funding for biologics and infectious disease research further strengthen its position. Expanding investments in viral vector manufacturing and next-generation vaccines continue to reinforce North America’s leadership in this market.

Europe

Europe accounts for 28.3% of the global Insect Cell Culture market, supported by its well-established pharmaceutical sector, strong academic research networks, and rapid advancements in gene therapy and recombinant protein development. The region’s strict regulatory environment encourages high-quality biologics manufacturing, increasing demand for robust insect cell platforms such as Sf9 and High Five. Growing funding for life sciences innovation, expansion of biotechnology clusters, and rising interest in scalable viral vector production contribute to market growth. Europe’s mature infrastructure and expanding research collaborations help sustain steady adoption across both commercial and academic settings.

Asia-Pacific

Asia-Pacific holds 22.7% of the Insect Cell Culture market and is the fastest-growing region, propelled by expanding biotechnology investments, rising vaccine production capacity, and government-backed initiatives to strengthen biologics manufacturing. Countries including China, India, South Korea, and Japan are accelerating adoption of insect cell platforms due to cost advantages and increasing demand for recombinant proteins and gene therapies. Rapid upgrades in research laboratories, growth in CRO activities, and expanding clinical research pipelines further improve regional penetration. As local biopharma companies scale up viral vector manufacturing, Asia-Pacific continues to gain momentum as a major growth engine.

Latin America

Latin America represents 5.1% of the global market, with growth supported by increasing investments in public health, vaccine development, and early-stage biotechnology research. Countries such as Brazil and Mexico are gradually adopting insect cell systems as part of their expanding biologics manufacturing capabilities. Although infrastructure and funding remain more limited than in developed regions, growing interest in cost-efficient vaccine production and partnerships with global biotech firms enhance adoption rates. Ongoing government efforts to strengthen domestic pharmaceutical production and improve research capacity provide additional opportunities for regional market expansion.

Middle East & Africa

The Middle East & Africa region holds 3.4% of the Insect Cell Culture market, characterized by emerging demand supported by rising investments in healthcare modernization, academic research, and infectious disease control programs. Adoption remains at an early stage due to limited specialized infrastructure; however, countries such as the UAE, Saudi Arabia, and South Africa are gradually increasing their focus on advanced biologics production. Collaborations with international biotech companies, growing funding for vaccine research, and development of regional biotechnology hubs contribute to incremental growth. Continued expansion of research facilities is expected to drive steady, long-term adoption.

Market Segmentations

By Product Type

- Media

- Reagents

- Sera

- Equipment

By Application

- Vaccines

- Therapeutic Proteins

- Gene Therapy

- Basic Research

By End-User

- Pharmaceutical and Biotechnology Companies

- Academic and Research Institutes

- Contract Research Organizations

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Insect Cell Culture market features a diverse mix of global life science leaders and specialized suppliers that focus on high-performance media, reagents, and expression platforms. Key players include Thermo Fisher Scientific, Merck Millipore, Lonza, GE Healthcare, Corning (Cellgro), Sigma-Aldrich, BD, Life Technologies, Takara, and HiMedia. These companies actively expand their portfolios of serum-free and chemically defined media, optimized baculovirus expression systems, and single-use bioprocessing solutions to support vaccine, recombinant protein, and gene therapy production. Strategic priorities center on R&D investment, technical support services, and collaborations with biopharmaceutical firms, CROs, and academic institutes. Many suppliers also strengthen their presence in high-growth regions through distribution partnerships, regional manufacturing, and tailored solutions for local regulatory and cost requirements.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Takara

- Merck Millipore

- BD

- HiMedia

- Lonza

- Corning (Cellgro)

- Life Technologies

- GE Healthcare

- Sigma-Aldrich

- Thermo Fisher

Recent Developments

- In July 2024, Merck KGaA (Life Science business) signed a non-binding MoU with Gene Therapy Research Institution Co., Ltd. (Japan) to deploy its Sf-RVN® insect cell line platform for clinical-stage AAV viral vector manufacturing.

- In October 2023, Expression Systems (an Advancion company) introduced ESF AdvanCD™, a 100% chemically defined, animal-origin-free, serum-free insect cell culture medium designed for scalable baculovirus infection and high-yield protein expression.

- In April 2024, Expression Systems partnered with another company to demonstrate combined use of its ESF AdvanCD medium and a flasks platform for scale-up of insect cell protein production.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Insect Cell Culture market will expand steadily as demand rises for recombinant proteins, vaccines, and gene therapy vectors.

- Adoption of insect cell systems will continue to increase due to their faster production cycles and high expression efficiency.

- Advances in baculovirus expression technologies will improve yield, scalability, and overall product quality.

- Serum-free and chemically defined media will gain wider adoption to meet regulatory and consistency requirements.

- Automation and single-use bioreactors will become essential for enhancing operational efficiency and reducing contamination risks.

- Emerging markets will strengthen biopharma infrastructure, driving greater regional adoption of insect cell platforms.

- Collaboration between industry, CROs, and academic institutions will accelerate innovation in insect cell–based technologies.

- Enhanced cell lines with improved stability and productivity will achieve broader commercial utilization.

- Growing emphasis on precision medicine and advanced therapeutics will increase demand for high-quality viral vector production.

- Evolving global regulatory guidelines will support wider acceptance and scale-up of insect cell culture in biologics manufacturing.