Market Overview

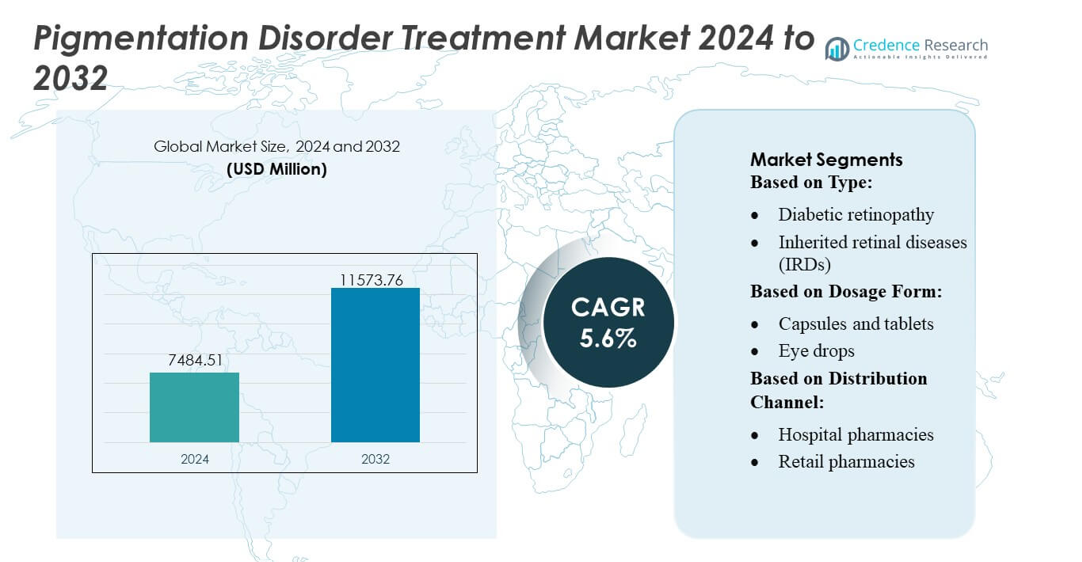

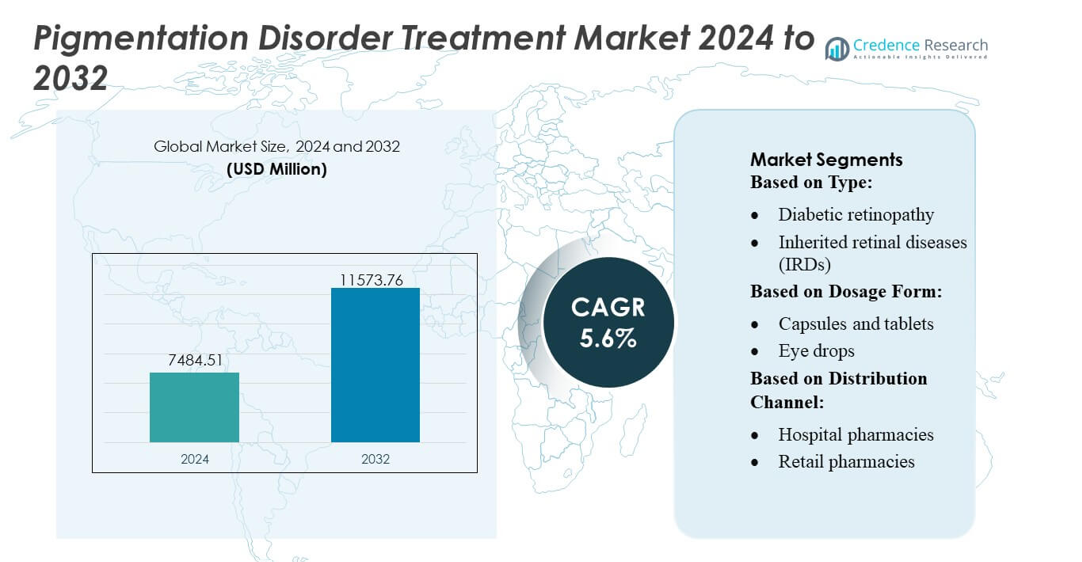

Pigmentation Disorder Treatment Market size was valued USD 7484.51 million in 2024 and is anticipated to reach USD 11573.76 million by 2032, at a CAGR of 5.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Pigmentation Disorder Treatment Market Size 2024 |

USD 7484.51 million |

| Pigmentation Disorder Treatment Market, CAGR |

5.6% |

| Pigmentation Disorder Treatment Market Size 2032 |

USD 11573.76 million |

The Pigmentation Disorder Treatment Market is shaped by a mix of global pharmaceutical manufacturers, dermatology-focused innovators, and aesthetic device companies that continue to expand advanced topical formulations, laser platforms, and combination therapy protocols. Industry leaders strengthen competitiveness through investments in melanogenesis-inhibiting actives, biologic-based approaches, and digital skin-analysis technologies that enhance diagnostic precision and treatment personalization. The market benefits from strong innovation pipelines, expanding dermatology networks, and rising consumer preference for minimally invasive solutions. North America remains the leading region with an exact 40% market share, supported by high treatment adoption, robust clinical infrastructure, and early integration of advanced pigmentation management technologies.

Market Insights

- The Pigmentation Disorder Treatment Market was valued at USD 7,484.51 million in 2024 and is projected to reach USD 11,573.76 million by 2032, registering a CAGR of 5.6% during the forecast period.

- Market growth is driven by rising cases of melasma, vitiligo, and post-inflammatory hyperpigmentation, alongside strong adoption of advanced lasers, energy-based devices, and prescription-strength topical depigmenting agents.

- Key trends include growing demand for personalized treatment protocols, expanding use of AI-enabled skin analysis tools, and increasing adoption of combination therapies integrating topical agents with laser and phototherapy modalities.

- The competitive landscape intensifies as pharmaceutical innovators and aesthetic device manufacturers invest in melanogenesis inhibitors, biologic candidates, and nanotechnology-based formulations to improve safety and long-term results.

- North America holds an exact 40% market share, while Asia-Pacific emerges as the fastest-growing region; topical depigmenting agents remain the dominant segment supported by high consumer preference and broad OTC availability.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The Pigmentation Disorder Treatment Market is dominated by wet macular degeneration, accounting for the largest share due to its rapid progression and the strong clinical adoption of anti-VEGF therapies that significantly reduce vision loss risk. High patient volumes, frequent dosing requirements, and continuous advancements in intravitreal biologics strengthen its lead. Dry macular degeneration follows as the second major segment, driven by rising geriatric prevalence and expanding use of antioxidant-based regimens. Growth across diabetic retinopathy and diabetic macular edema accelerates as early screening improves, while inherited retinal diseases and retinal vein occlusion represent emerging therapeutic areas supported by gene therapy innovations.

- For instance, Pfizer’s marketed anti‑VEGF aptamer Macugen (pegaptanib sodium) demonstrated in a Phase 3 study for diabetic macular edema (DME) that 37% of patients gained two lines (10 letters) of vision on the ETDRS chart at 54 weeks compared with 20% in the sham group.

By Dosage Form

Injections hold the dominant share in the Pigmentation Disorder Treatment Market, supported by their critical role in anti-VEGF delivery for wet age-related macular degeneration and diabetic retinal diseases. Their superior therapeutic precision, sustained efficacy, and physician preference for intravitreal administration reinforce market leadership. Eye drops represent a growing segment, driven by increased adoption for early-stage dry macular degeneration and supportive symptom management. Capsules, gels, ointments, and eye solutions contribute steady demand across mild-to-moderate conditions, while ongoing R&D in sustained-release injectables and implantable devices advances long-term treatment adherence.

- For instance, JNJ-81201887 (formerly “AAVCAGsCD59”), a one‑time intravitreal injection for patients with advanced dry age‑related macular degeneration (AMD) with geographic atrophy (GA), completed a Phase 1 open‑label dose‑escalation study (n = 17) in which all three doses met safety endpoints over a two‑year follow-up.

By Distribution Channel

Hospital pharmacies lead the market with the highest share, underpinned by the concentration of intravitreal injection procedures and specialist-led treatments performed in hospital settings. Their access to advanced biologics, controlled storage environments, and reimbursement alignment strengthens dominance. Retail pharmacies show consistent growth due to rising prescriptions for maintenance therapies and supportive care products. Online pharmacies gain momentum as digital fulfillment expands and chronic retinal disease patients increasingly prefer home-delivery models. Collectively, these channels support broad accessibility, but hospital pharmacies remain the primary hub for high-value ophthalmic therapeutics.

Key Growth Drivers

Rising Global Burden of Melasma, Vitiligo, and Post-Inflammatory Hyperpigmentation

The market expands as the prevalence of melasma, vitiligo, and post-inflammatory hyperpigmentation rises across diverse demographics. High UV exposure, hormonal fluctuations, pollution, and increased incidence of inflammatory skin disorders drive expanding patient volumes. Growing awareness of dermatological care and earlier diagnosis supports higher treatment adoption. Increased spending on cosmetic dermatology and the availability of advanced formulations, including targeted depigmenting agents and melanocyte-stimulating inhibitors, accelerates therapy uptake. The expanding pool of dermatology clinics and medical spas further strengthens global demand.

- For instance, AbbVie’s oral JAK inhibitor Upadacitinib (RINVOQ®) achieved T‑VASI 50 (≥ 50% reduction in total-body depigmented area) and F‑VASI 75 (≥ 75% reduction in facial depigmented area) at week 48 versus placebo in non‑segmental vitiligo (NSV) patients.

Advancements in Laser and Energy-Based Treatment Technologies

Rapid innovation in energy-based systems strengthens market growth as dermatologists increasingly adopt Q-switched lasers, picosecond lasers, fractional lasers, and IPL platforms for precise melanin targeting. These systems improve pigment clearance, minimize downtime, and reduce recurrence risk, enhancing treatment satisfaction. Manufacturers continue refining wavelength combinations, pulse-duration control, and cooling mechanisms to deliver safer outcomes for different skin types. Broader availability of portable laser devices and hybrid systems also expands procedural accessibility across developed and emerging markets, accelerating procedural volumes.

- For instance, Lundbeck is actively presenting pipeline data from mid-stage programs including the Phase II AMULET trial and a 12-month open-label extension of the Phase 1b/2a PACIFIC tria.

Growing Adoption of Combination Therapy Protocols

Demand rises as dermatologists shift toward multimodal treatment strategies integrating topical agents, chemical peels, energy-based devices, and phototherapy to achieve superior clinical outcomes. Combination protocols enhance pigment reduction, improve treatment durability, and reduce relapse rates, especially for stubborn conditions. Expanding clinical evidence supporting synergistic effects of ingredients such as hydroquinone, retinoids, azelaic acid, kojic acid, and tranexamic acid fuels adoption. The increasing development of dermatologist-supervised regimens, personalized treatment plans, and long-term maintenance therapies further boosts overall market expansion.

Key Trends & Opportunities

Shift Toward Personalized and Skin-Type-Specific Treatments

Manufacturers and dermatologists increasingly prioritize personalized therapies tailored to Fitzpatrick skin types, genetic markers, and pigment distribution patterns. The trend accelerates as AI-enabled skin analysis tools, digital imaging platforms, and mobile-based diagnostic applications support precise evaluation of pigmentation severity and treatment response. These personalized insights enable optimized dosing, targeted modality selection, and reduced side-effect profiles. Expanding R&D in genomic-based pigmentation pathways and melanin biosynthesis inhibitors presents significant long-term opportunities for individualized care models.

- For instance, Glenmark Pharmaceuticals manufactures and markets a Luliconazole 1% cream under the brand name Lulican. While clinical studies have demonstrated the efficacy of Luliconazole 1% cream for treating dermatophytosis.

Expansion of Cosmeceutical and Prescription-Strength Topical Innovations

The surge in premium cosmeceuticals and dermatologist-approved formulations creates strong growth opportunities. Companies invest heavily in stabilized actives, nano-delivery systems, peptide-based ingredients, and antioxidant complexes to improve skin penetration and efficacy. Hybrid products that blend cosmetic appeal with therapeutic performance gain traction among consumers seeking non-invasive solutions. Growing demand for clean-label, clinically tested, and multifunctional pigmentation-correcting products across retail and online channels further enlarges the addressable market for topical treatment innovations.

- For instance, Bayer AG refined its OTC antifungal offering by relaunching the Canesten range in India in May 2022. The relaunch introduced the cream in a 30 g tube and a dusting-powder in 50 g and 100 g SKUs.

Rising Demand for Non-Invasive and At-Home Treatment Devices

The market witnesses increasing popularity of at-home LED therapy tools, microcurrent devices, and handheld pigment-correcting gadgets that offer convenience and affordability. Advancements in light-based wearable patches, blue-light and red-light platforms, and photobiomodulation solutions open new revenue opportunities. Demand strengthens as consumers seek long-term maintenance solutions after clinical treatments. Manufacturers explore smartphone-connected devices and AI-guided home protocols, creating a new segment within consumer dermatology and expanding access to pigmentation management.

Key Challenges

High Relapse Rates and Limited Long-Term Treatment Durability

A major challenge involves high recurrence rates associated with melasma and post-inflammatory hyperpigmentation, even after successful treatment. Environmental triggers, UV exposure, hormonal factors, and chronic inflammation lead to inconsistent long-term outcomes. Many therapies require extended maintenance regimens, which increases patient burden and reduces compliance. Limited availability of curative treatments and variability in therapeutic response across skin types further complicate disease management. These factors constrain overall clinical success and impact patient satisfaction levels.

Risk of Adverse Effects and Treatment-Induced Complications

Safety concerns remain a critical barrier as certain topical agents and laser modalities may cause irritation, rebound hyperpigmentation, or hypopigmentation, especially in darker skin tones. Hydroquinone-associated sensitivity, procedural downtime, and potential post-treatment inflammation deter some patients from long-term use. Inadequate practitioner expertise or inappropriate device settings can exacerbate pigmentation issues. Regulatory scrutiny on depigmenting agents and uneven global access to dermatology specialists further limit the widespread adoption of advanced therapies.

Regional Analysis

North America

North America leads the Pigmentation Disorder Treatment Market with an estimated 38–40% share, driven by high awareness of dermatological health, strong adoption of advanced laser systems, and widespread availability of specialized dermatology clinics. The region benefits from robust healthcare spending, early use of innovative topical formulations, and growing patient preference for cosmetic dermatology procedures. Extensive insurance coverage for select medical treatments, coupled with expanding medical spa networks, strengthens accessibility. The rising prevalence of melasma and post-inflammatory hyperpigmentation, especially among diverse ethnic groups, continues to accelerate treatment demand across clinical and consumer channels.

Europe

Europe holds approximately 27–29% of the global market, supported by a mature dermatology infrastructure and strong demand for non-invasive treatment options. The region benefits from a high concentration of dermatologists, strict regulatory standards for topical depigmenting agents, and increasing adoption of combination therapy protocols. Growing consumer interest in premium cosmeceuticals and aesthetic procedures boosts uptake in Germany, France, Italy, and the U.K. Increased UV exposure due to climatic shifts and rising pigmentation concerns among aging populations further expand treatment volumes. Government-backed skin health initiatives also enhance early diagnosis and long-term management.

Asia-Pacific

Asia-Pacific accounts for roughly 23–25% of the market, emerging as the fastest-growing region due to high melasma prevalence and strong cultural preference for skin-brightening solutions. Expanding urbanization, pollution exposure, and higher UV index levels contribute to rising pigmentation disorders. The region experiences rapid uptake of advanced lasers, Korean aesthetic innovations, and prescription-strength depigmenting topicals. Growing middle-class spending and the proliferation of dermatology chains in China, India, Japan, and South Korea strengthen market penetration. Increasing digital skin-diagnosis tools and e-commerce-driven sales of cosmeceuticals further accelerate market growth.

Latin America

Latin America captures about 7–8% of global share, driven by rising cases of melasma stemming from high UV exposure and hormonal influences. Brazil and Mexico lead market demand due to strong aesthetic procedure adoption and growing availability of dermatology clinics specializing in pigment correction. The region benefits from expanding medical tourism and increasing consumer interest in affordable laser treatments and combination protocols. However, uneven access to advanced dermatology technologies and limited reimbursement frameworks affect penetration rates. Growing awareness of skin health and rising adoption of dermatologist-supervised regimens support steady regional expansion.

Middle East & Africa

The Middle East & Africa region holds approximately 5–6% market share, supported by high pigmentation concerns associated with intense sun exposure and higher Fitzpatrick skin types. Demand grows as consumers increasingly adopt laser-based procedures, topical depigmenting agents, and maintenance therapies tailored for darker skin tones. The UAE, Saudi Arabia, and South Africa represent key growth centers due to expanding aesthetic clinics and rising medical tourism. However, limited dermatologist availability in several African countries and high treatment costs constrain broader adoption. Growing investments in skincare retail and advanced dermatology services gradually strengthen market presence.

Market Segmentations:

By Type:

- Diabetic retinopathy

- Inherited retinal diseases (IRDs)

By Dosage Form:

- Capsules and tablets

- Eye drops

By Distribution Channel:

- Hospital pharmacies

- Retail pharmacies

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Pigmentation Disorder Treatment Market features an increasingly competitive environment shaped by leading pharmaceutical and dermatology-focused innovators such as Sanofi, Pfizer Inc., AstraZeneca, GSK plc, Johnson & Johnson Services, Inc., AbbVie Inc., Merck & Co., Inc., Bristol-Myers Squibb Company, Eli Lilly and Company, and H. Lundbeck A/S. the Pigmentation Disorder Treatment Market continues to evolve as pharmaceutical innovators, dermatology specialists, and aesthetic technology manufacturers intensify efforts to deliver more effective and longer-lasting solutions. Companies focus on expanding portfolios across topical depigmenting agents, biologics, laser platforms, and combination therapy protocols that target multiple pigmentation pathways. Advancements in picosecond lasers, nanotechnology-based delivery systems, and clinically validated cosmeceuticals strengthen differentiation in a crowded market. Strategic collaborations with dermatology clinics, medical spas, and digital skin-analysis platforms enhance patient access and treatment personalization. Growing emphasis on safety, relapse prevention, and skin-type-specific formulations continues to shape competitive strategies and accelerate product innovation across global markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Sanofi

- Pfizer Inc.

- AstraZeneca

- GSK plc

- Johnson & Johnson Services, Inc.

- AbbVie Inc.

- Merck & Co., Inc.

- Bristol-Myers Squibb Company

- Eli Lilly and Company

- Lundbeck A/S

Recent Developments

- In February 2025, Bayer announced that Health Canada has approved Eylea HD (aflibercept injection, 8mg), a pre-filled syringe with OcuClick integrated dosing system for the treatment of nAMD and diabetic macular oedema (DME) in Canada.

- In January 2025, Johnson & Johnson announced the U.S. Food and Drug Administration (FDA) approval of a supplemental New Drug Application (sNDA) for SPRAVATO® (esketamine), making it the first and only monotherapy (standalone treatment) for adults with treatment-resistant depression in the U.S.

- In December 2024, the FDA approved Eli Lilly’s Zepbound (tirzepatide) for moderate to severe obstructive sleep apnea in adults with obesity, marking a significant advancement in treatment options in the U.S.

- In July 2024, Genentech, a part of the Roche Group, gained FDA clearance for the Vabysmo (faricimab-svoa) 6.0 mg single dose prefilled syringe (PFS) for wet AMD, DME and RVO associated macular edema. This action enhanced convenience in treatment and broadened access, reaffirming Roche’s dedication towards innovation in ocular disease therapeutic development

Report Coverage

The research report offers an in-depth analysis based on Type, Dosage Form, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see rising adoption of personalized pigmentation therapies designed around skin-type classification and digital diagnostic insights.

- Demand for advanced laser and energy-based systems will grow as clinics prioritize faster recovery and more predictable outcomes.

- Topical innovations will expand with nano-formulations, stabilized actives, and multifunctional ingredients offering stronger efficacy.

- Combination therapy protocols will become standard as clinicians integrate topical agents, devices, and maintenance regimens.

- AI-driven skin imaging and remote monitoring tools will enhance treatment planning and progress tracking.

- Consumer interest in premium cosmeceuticals and medically backed skincare will strengthen retail and online sales channels.

- Growth in aesthetic clinics and medical spas across emerging markets will accelerate global penetration.

- Development of biologics targeting inflammatory and autoimmune pigmentation pathways will broaden therapeutic options.

- At-home light therapy and device-based maintenance solutions will gain traction among long-term users.

- Regulatory focus on ingredient safety and clinical validation will push manufacturers toward higher-quality, evidence-based formulations.