Market Overview:

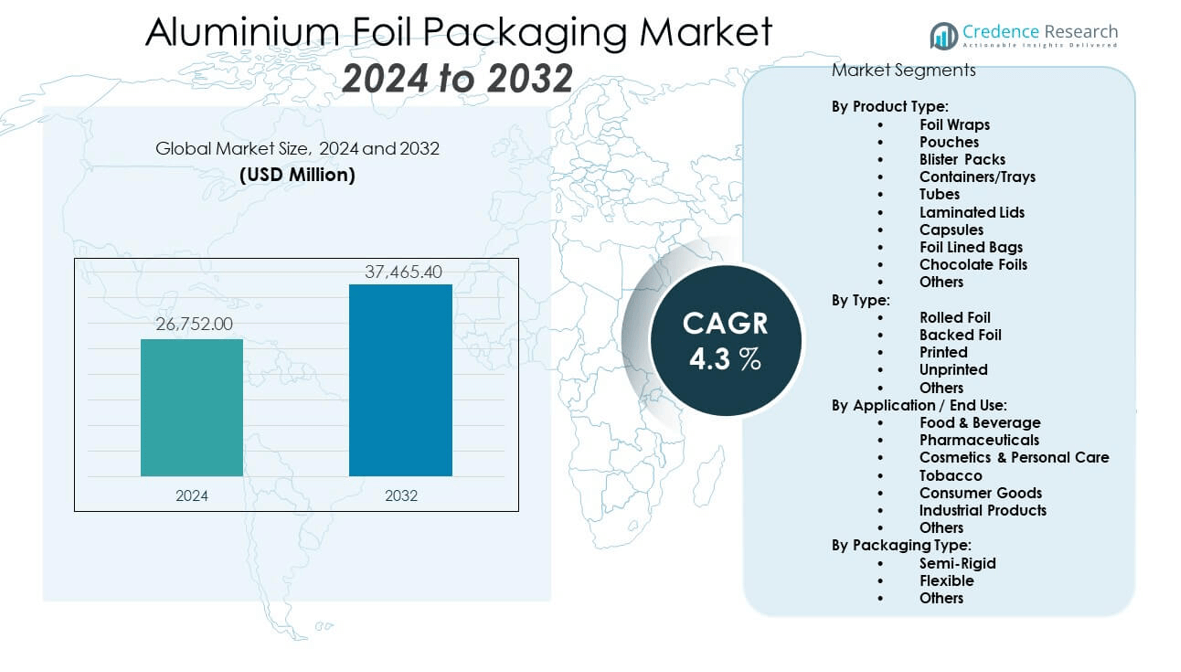

The Aluminium Foil Packaging Market is projected to grow from USD 26,752 million in 2024 to an estimated USD 37,465.4 million by 2032, with a compound annual growth rate (CAGR) of 4.3% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Aluminium Foil Packaging Market Size 2024 |

USD 26,752 million |

| Aluminium Foil Packaging Market, CAGR |

4.3% |

| Aluminium Foil Packaging Market Size 2032 |

USD 37,465.4 million |

The market is experiencing significant growth due to rising demand for lightweight, durable, and recyclable packaging solutions across various industries including food and beverage, pharmaceuticals, and cosmetics. Aluminium foil’s barrier properties against light, oxygen, moisture, and bacteria make it an ideal choice for extending shelf life and maintaining product integrity. Growing consumer preference for convenient, on-the-go packaging and increasing awareness of environmental sustainability are also driving manufacturers to adopt aluminium foil as a reliable and eco-friendly alternative.

Regionally, Asia Pacific dominates the aluminium foil packaging market, led by China and India, owing to strong manufacturing capabilities, expanding middle-class populations, and increasing consumption of packaged goods. North America and Europe also hold significant shares due to advanced food processing industries and stringent regulations encouraging recyclable packaging. Meanwhile, Latin America and the Middle East & Africa are emerging markets, supported by improving economic conditions and growing urbanization, which drive the demand for flexible and sustainable packaging formats.

Market Insights:

- The Aluminium Foil Packaging Market was valued at USD 26,752 million in 2024 and is projected to reach USD 37,465.4 million by 2032, growing at a CAGR of 4.3%.

- Rising demand for moisture-resistant, lightweight, and recyclable packaging in food, pharmaceutical, and personal care sectors is driving market growth.

- The shift toward sustainable and eco-friendly packaging solutions supports widespread adoption of aluminium foil across industries.

- Volatility in raw material prices and supply chain disruptions hinder consistent production and pricing stability.

- Limited recycling infrastructure and low consumer awareness restrict the effective recovery of post-consumer aluminium foil waste.

- Asia Pacific dominates the market, led by strong manufacturing in China and India and high consumption of packaged products.

- Latin America and the Middle East & Africa show growth potential due to urbanization, retail expansion, and rising demand for hygienic packaging.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Surging Demand from Food and Beverage Sector Fuels Aluminium Foil Packaging Adoption:

The Aluminium Foil Packaging Market gains momentum from robust demand in the food and beverage industry. Consumers seek packaging that ensures freshness, extends shelf life, and offers convenience. Aluminium foil’s superior barrier properties protect against moisture, oxygen, and light, making it suitable for ready-to-eat meals, dairy, confectionery, and beverages. It supports portability and reduces product spoilage, aligning with changing consumption patterns and busy lifestyles. Manufacturers integrate foil in multi-layered packaging to enhance durability. It plays a key role in ensuring food safety and hygiene, driving its adoption globally. Growing urbanization and rapid retail expansion create sustained need for secure food packaging. The Aluminium Foil Packaging Market remains firmly anchored in food safety standards.

- For instance, Amcor has documented that its advanced high-barrier aluminium foils can keep ready-to-eat foods fresh for up to 24 months, as certified in its technical product disclosures.

Rising Preference for Recyclable and Eco-Friendly Packaging Materials:

Sustainability influences consumer and corporate preferences, prompting a shift toward recyclable materials. Aluminium foil is 100% recyclable without quality loss, making it a preferred packaging solution. Regulatory pressures worldwide to reduce plastic usage intensify the demand for eco-conscious alternatives. The Aluminium Foil Packaging Market benefits from initiatives encouraging sustainable manufacturing and waste reduction. Companies replace traditional plastic with aluminium foil in multiple packaging formats to align with circular economy goals. It supports lower carbon footprints and energy-efficient production cycles. Environmental certifications further drive its use across industries. Stakeholders prioritize materials that ensure performance without compromising sustainability goals.

- For instance, According to industry-verified data, recycling aluminium requires only 5% of the energy used to produce virgin aluminium, enabling up to 95% less CO₂ emissions.

Growing Pharmaceutical Applications Enhance Packaging Versatility:

The pharmaceutical industry relies on aluminium foil for blister packs, sachets, and strip packaging due to its non-reactive, sterile, and protective nature. It prevents contamination and safeguards sensitive drugs from moisture and light. The Aluminium Foil Packaging Market capitalizes on stringent packaging regulations in the healthcare sector. Foil’s flexibility supports various dosage forms and tamper-evident formats, promoting patient safety. Rising chronic illnesses and ageing populations raise the volume of drug production globally. It provides compliance with FDA and EMA requirements, strengthening its role in the pharma supply chain. Manufacturers value its adaptability and ease of use in automated systems. Healthcare infrastructure expansion in emerging regions creates additional market pull.

Rapid Expansion of E-Commerce Sector Demands Secure Packaging:

The e-commerce boom drives demand for protective and lightweight packaging materials. Aluminium foil offers secure, tamper-proof features ideal for online retail, particularly for food, cosmetics, and health products. The Aluminium Foil Packaging Market aligns with evolving logistics systems that require reliable insulation and damage prevention. Foil laminates provide thermal resistance for temperature-sensitive goods. Companies use foil-based pouches and wraps to reduce shipment damage and preserve content quality. Consumers expect premium unboxing experiences, which foil’s sheen and texture help deliver. It facilitates compact, high-performance formats ideal for last-mile delivery. Global growth in direct-to-consumer shipments reinforces the importance of foil in smart packaging strategies.

Market Trends:

Technological Integration in Foil Packaging Manufacturing Processes:

Manufacturers implement automation and advanced machinery to improve output quality and operational efficiency. Digital printing technologies enhance branding and allow short-run customizations. The Aluminium Foil Packaging Market sees rising investments in high-speed laminators, embossers, and coating systems. Smart packaging technologies, such as temperature indicators and QR-code-enabled foil wraps, begin to influence premium packaging. It helps streamline production and reduce waste through precision engineering. Technological improvements support the shift toward thinner, stronger foils that reduce material use. These systems improve traceability and enable compliance tracking in regulated sectors. Industry 4.0 integration brings real-time control and predictive maintenance to packaging lines.

- For instance, Vision-based defect detection systems at pharmaceutical suppliers like GSK and Pfizer support first-pass yield rates compliant with regulatory standards, as disclosed in certification filings.

Premiumization in Packaging Influences Design and Material Choices:

Consumer brands adopt premium aluminium foil packaging for visual appeal, tactile quality, and functionality. Foil offers a glossy finish, smooth texture, and customizable embossing that enhance product perception. The Aluminium Foil Packaging Market caters to sectors seeking packaging that communicates quality and exclusivity. Luxury cosmetics, artisanal foods, and specialty beverages use foil wraps and liners to elevate their shelf presence. It enables unique shapes and branding flexibility. High-end packaging reinforces product identity and customer loyalty. Retailers use foil sachets for product sampling and promotional items. This trend supports low-volume, high-value production across niche product lines.

- For instance, NFC-enabled foil sachets for product sampling, with traceability for authenticity, are documented in case studies by packaging solution providers.

Shift Toward Lightweight and Compact Packaging Formats:

Manufacturers pursue material reduction strategies to cut shipping costs and environmental impacts. Aluminium foil allows for ultra-thin gauges without compromising performance. The Aluminium Foil Packaging Market reflects demand for compact formats like stick packs, sachets, and foil lids. Consumers prefer lightweight packaging for portability and ease of use. It supports flexible pouches that reduce bulk and material waste. Packaging innovation focuses on maximizing internal volume while minimizing external footprint. Lightweight foil formats help meet air freight and postal service criteria. Brand owners embrace these changes to improve supply chain economics and sustainability metrics.

Increased Use of Foil in Ready-to-Cook and Ready-to-Serve Meals:

Changing eating habits drive growth in the convenience food category. Aluminium foil trays and wraps support microwave and oven-ready formats. The Aluminium Foil Packaging Market responds to rising demand for pre-packaged meals that require minimal preparation. Foil maintains food integrity during heating and storage. Consumers seek single-serve, portion-controlled formats that fit their lifestyles. Retailers expand frozen food aisles, boosting demand for heat-stable foil packs. It supports high-speed sealing and tamper-evident features. Manufacturers develop dual-purpose packaging that serves both storage and cooking functions. Meal kit services also rely on foil for insulation and safety during transit.

Market Challenges Analysis:

Volatility in Aluminium Prices and Raw Material Supply Constraints:

Frequent fluctuations in aluminium prices create uncertainty for packaging manufacturers. The Aluminium Foil Packaging Market faces cost pressures that impact pricing strategies and profit margins. It relies heavily on aluminium ingots and coils, which are sensitive to global trade dynamics, energy costs, and geopolitical factors. Supply chain disruptions and export restrictions can limit material availability. Small- and mid-sized converters struggle to absorb price hikes, leading to reduced competitiveness. Contract-based pricing models offer limited flexibility in volatile markets. Companies must optimize production to manage input costs effectively. Long-term planning becomes difficult under unstable raw material conditions.

Recycling Infrastructure Gaps and Contamination Issues in Waste Streams:

Despite its recyclability, aluminium foil often ends up in landfills due to contamination with food residue. The Aluminium Foil Packaging Market suffers from low post-consumer recycling rates in many regions. Municipal recycling systems may lack the technology to separate lightweight foils from other materials. Consumers remain unaware of proper disposal practices, reducing recycling effectiveness. Foil-laminated materials further complicate separation and processing. Regulatory pushback in some countries discourages multilayered packaging formats. Brands must invest in consumer education and clearer labelling. Infrastructure upgrades and extended producer responsibility schemes are needed to improve recycling performance.

Market Opportunities:

Expansion into Emerging Markets with Growing Packaged Goods Demand:

Rapid urbanization and rising disposable incomes in emerging economies create opportunities for aluminium foil packaging. The Aluminium Foil Packaging Market can grow through localized production and regional partnerships. Consumers in developing countries increasingly buy packaged food, personal care, and pharmaceutical products. Brands can introduce foil-based options as a step up from basic packaging. Government food safety campaigns promote the use of hygienic materials, driving adoption. Growth in modern retail channels increases product visibility and shelf competition, benefiting foil packaging formats.

Product Innovation and Customization Drive Competitive Differentiation:

Customization helps brands tailor foil packaging to specific consumer needs and product characteristics. The Aluminium Foil Packaging Market benefits from innovations such as heat-sealable foils, printed laminates, and multi-compartment formats. Packaging that enables resealability or dual-purpose use enhances consumer experience. Brands can differentiate through design, functionality, and sustainability claims. Foil’s compatibility with digital printing supports localized and seasonal promotions. These innovations enable agile marketing and product positioning in fast-moving consumer segments.

Market Segmentation Analysis:

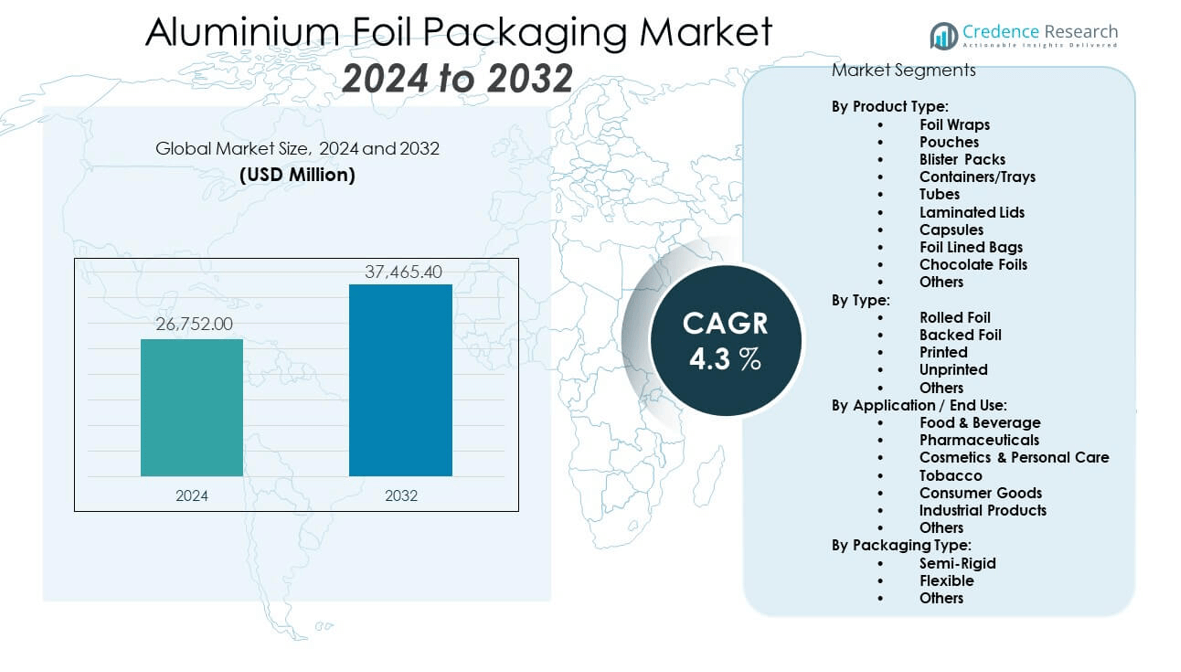

By Product Type: Foil Wraps, Pouches, and Blister Packs Lead Usage

The Aluminium Foil Packaging Market includes various product types, with foil wraps, pouches, and blister packs widely adopted in food, pharmaceutical, and personal care applications. Containers/trays and tubes serve heat-and-eat meals and creams, while laminated lids, capsules, and foil-lined bags are used in beverages, dairy, and industrial sectors. Chocolate foils meet aesthetic and protective needs in confectionery packaging.

- For instance, Retailers and CPG brands leverage short-run digital printing and embossing systems supporting batch runs as small as 1,000 units, enabling real-time campaign changes and limited-edition releases without compromising throughput or quality.

By Type: Rolled and Printed Foils Capture Most Demand

Among types, rolled foil holds a dominant share due to high demand in bulk and industrial packaging. Printed foils are popular for branding and retail appeal in consumer goods. Unprinted and backed foils offer economical and insulation-focused solutions. It accommodates varied end-user requirements across product categories through this segmentation.

- For instance, Printed foils employing digital presses achieve print resolutions up to 1,200 dpi, supporting security and custom branding for multinational customers such as Procter & Gamble and Unilever, as disclosed in commercial case studies.

By Application/End Use: Food & Beverage and Pharmaceuticals Dominate

The food & beverage segment drives the largest volume in the Aluminium Foil Packaging Market, supported by the need for freshness and safety. Pharmaceuticals follow, where foil ensures product protection and regulatory compliance. Cosmetics & personal care, tobacco, and industrial products also utilize foil for its barrier and shelf-life properties.

By Packaging Type: Flexible Format Drives Market Expansion

Flexible packaging leads due to its lightweight, cost efficiency, and convenience. Semi-rigid solutions serve niche formats like trays and ready meals. The market offers solutions suited for high-speed filling lines and diverse product needs through both flexible and rigid formats.

By Thickness: 0.2mm Foil Offers Optimal Strength and Versatility

By thickness, 0.2mm foil maintains a leading share due to its performance in food and pharma packaging. 0.07mm and 0.09mm suit lightweight wrapping applications, while 0.4mm is used in industrial and specialty use cases. It ensures optimal performance based on barrier, formability, and cost-efficiency needs.

Segmentation:

By Product Type:

- Foil Wraps

- Pouches

- Blister Packs

- Containers/Trays

- Tubes

- Laminated Lids

- Capsules

- Foil Lined Bags

- Chocolate Foils

- Others

By Type:

- Rolled Foil

- Backed Foil

- Printed

- Unprinted

- Others

By Application / End Use:

- Food & Beverage

- Pharmaceuticals

- Cosmetics & Personal Care

- Tobacco

- Consumer Goods

- Industrial Products

- Others

By Packaging Type:

- Semi-Rigid

- Flexible

- Others

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia Pacific Holds Dominant Market Position with Expanding Consumer Base

Asia Pacific accounts for the largest share of the Aluminium Foil Packaging Market at approximately 45.1%. The region benefits from high consumption of packaged food, strong pharmaceutical production, and expanding retail infrastructure. China and India lead due to low production costs, large-scale manufacturing, and increasing demand for flexible and hygienic packaging. Government initiatives promoting sustainable packaging practices support the shift from plastic to recyclable materials like aluminium foil. It continues to witness growth due to urbanization and rising middle-class income. The market’s expansion is also supported by significant investments in food processing and healthcare sectors.

North America Maintains Strong Presence Through Innovation and Compliance

North America represents around 23.8% of the Aluminium Foil Packaging Market. The region’s growth is supported by high demand in the food and pharmaceutical sectors, where regulatory compliance and consumer expectations favor aluminium-based packaging. The United States drives much of the demand with innovations in product safety, tamper-proof formats, and eco-friendly packaging technologies. Aluminium foil use is rising in convenience and ready-to-eat meals, aligning with fast-paced consumer lifestyles. It remains a key region due to advanced packaging technologies and strong emphasis on recycling. Canada also contributes with regulatory frameworks supporting sustainable packaging adoption.

Europe Focuses on Sustainability and Regulatory Alignment

Europe holds a market share of approximately 18.6% in the Aluminium Foil Packaging Market. The region emphasizes recyclability, environmental impact reduction, and sustainable sourcing of materials. Countries like Germany, France, and the UK lead in adopting aluminium foil for food safety and pharmaceutical compliance. Strict EU regulations on single-use plastics push industries toward aluminium alternatives. It benefits from established recycling systems, which improve post-consumer recovery rates. Consumer preference for eco-conscious packaging continues to influence growth across multiple sectors. The European market favors innovation in laminated foil structures and lightweight formats.

Other Regions Contribute Emerging Demand and New Growth Avenues

Latin America and the Middle East & Africa collectively account for around 12.5% of the Aluminium Foil Packaging Market. These regions show rising demand driven by population growth, economic development, and expanding food retail networks. Brazil, Mexico, and South Africa are key contributors due to rising packaged goods consumption. While infrastructure gaps limit recycling efficiency, awareness campaigns and regulatory reforms are beginning to shape sustainable packaging preferences. It has opportunities to grow through investments in local manufacturing and distribution. These markets represent long-term growth potential as urbanization and healthcare needs accelerate.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Amcor plc

- Constantia Flexibles

- Hindalco Industries Ltd. (Aditya Birla Group)

- China Hongqiao Group Limited

- Novelis Inc.

- Ardagh Group S.A.

- RUSAL

- Pactiv Evergreen Inc.

- Reynolds Group Holdings Ltd.

- Tetra Laval Group

Competitive Analysis:

The Aluminium Foil Packaging Market features a mix of global giants and regional manufacturers competing on product quality, innovation, and sustainability. Companies such as Amcor plc, Constantia Flexibles, Hindalco Industries, and Novelis dominate with integrated operations, broad portfolios, and strong distribution networks. It sees intense competition in flexible and high-barrier packaging formats, where players invest in lightweight, printed, and recyclable foil innovations. Strategic mergers, capacity expansions, and sustainable material development drive market positioning. Companies focus on vertical integration and automation to reduce costs and enhance supply reliability. Smaller firms emphasize niche applications and custom solutions to remain competitive.

Recent Developments:

- In May 2025, Hindalco Industries announced it will commence local production of aluminium battery foils for lithium-ion cells by October 2025 at a new 25,000-tonne capacity facility in Orissa, India. This INR 800 crore investment is designed to reduce import reliance and support the electric vehicle sector, leveraging Hindalco’s integrated value chain from bauxite mining to finished aluminium foil products.

- In May 2025, RUSAL invested in expanding the production capacity for thin gauge aluminium foils used in food packaging. The upgrade at the SAYANAL foil plant is projected to increase thin gauge output by 10–12% and introduces advanced automation controls to the mill, with a total project investment of 500 million roubles. The thinnest foil now produced at the plant is 6 microns, bringing improved barrier properties for light, air, and odor protection in food packaging applications.

- In April 2025, Ardagh Group S.A., through its subsidiary AGP-North America, entered a new long-term partnership with CAP Glass to invest in establishing glass recycling infrastructure. While not a direct product launch, the collaboration is significant for sustainability efforts in the packaging sector, complementing Ardagh’s metal and foil packaging businesses through enhanced raw material recycling capabilities.

- In March 2025, Novelis unveiled the industry’s first aluminium coil made entirely from 100% recycled end-of-life automotive scrap. This landmark achievement in circular economy practices was closely followed in April 2025 by the opening of the Ulsan Aluminum Recycling Center in South Korea, a $65 million facility with an annual production capacity of 100,000 tons of low-carbon aluminium. The new center is expected to reduce carbon emissions by 420,000 tons annually by expanding the use of recycled content in packaging and specialty aluminium products.

Market Concentration & Characteristics:

The Aluminium Foil Packaging Market remains moderately concentrated, with a few large players controlling significant global share. It features high entry barriers due to capital-intensive production, technological requirements, and supply chain complexities. Large firms dominate due to scale advantages and integrated aluminium processing capabilities. Product differentiation lies in thickness, printability, sustainability, and performance across end-use sectors. The market shows strong innovation cycles, driven by sustainability regulations and consumer demand for safe and hygienic packaging.

Report Coverage:

The research report offers an in-depth analysis based on product type, type, application, packaging type, thickness, and region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising sustainability mandates will increase demand for recyclable aluminium foil formats.

- Food and beverage applications will remain the dominant revenue source due to changing consumption habits.

- Pharmaceutical packaging will grow steadily, driven by stricter safety standards and rising medicine demand.

- Flexible foil packaging will outpace semi-rigid formats in growth due to cost-efficiency and convenience.

- Asia Pacific will continue to lead, supported by industrial capacity and rising packaged goods demand.

- North America and Europe will focus on innovation in sustainable and printed foil technologies.

- Product development will target lightweight, multilayer foils with improved barrier performance.

- Technological advances in manufacturing will reduce energy use and enhance recyclability.

- Emerging economies will offer new opportunities due to rising urbanization and retail expansion.

- Strategic partnerships and acquisitions will shape competitive positioning across global markets.