Market Overview

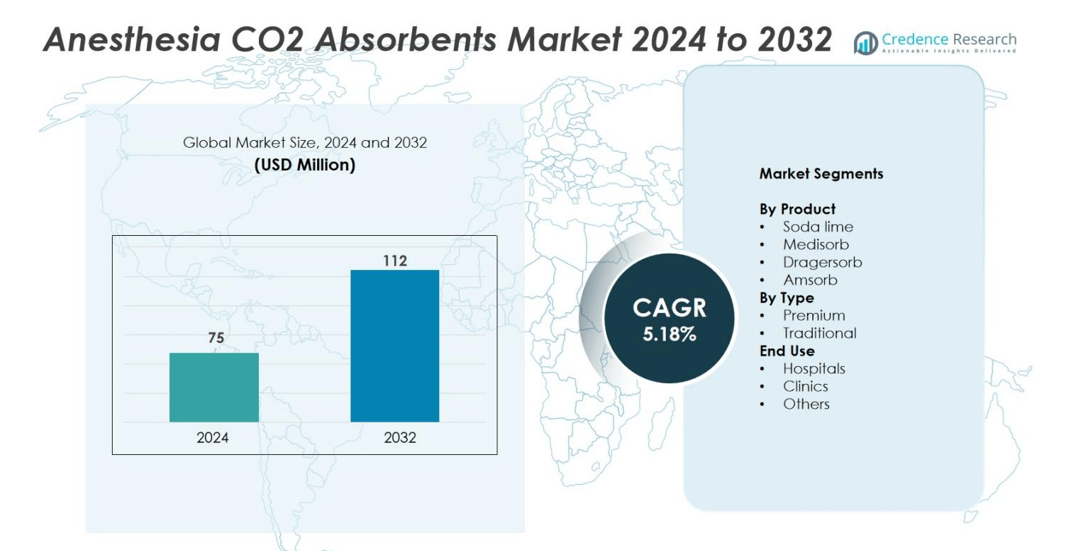

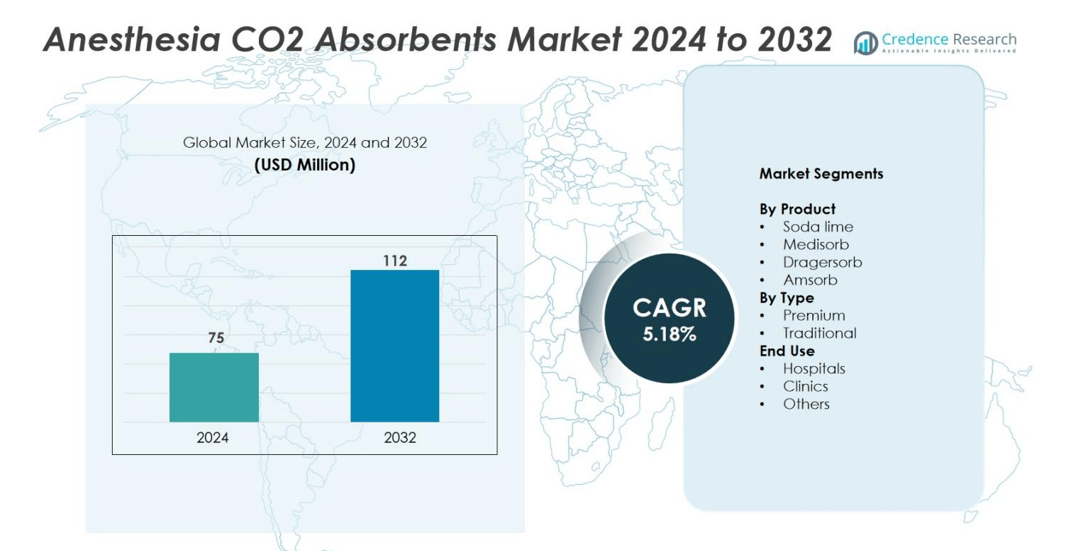

The Anesthesia CO₂ Absorbents Market size was valued at USD 75 million in 2024 and is anticipated to reach USD 112 million by 2032, growing at a CAGR of 5.18% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Anesthesia CO₂ Absorbents Market Size 2024 |

USD 75 million |

| Anesthesia CO₂ Absorbents Market, CAGR |

5.18% |

| Anesthesia CO₂ Absorbents Market Size 2032 |

USD 112 million |

The Anesthesia CO₂ Absorbents market is led by prominent players such as 3M, Baxter, GE HealthCare, Thermo Fisher Scientific Inc., Medline Industries LP, Ecolab, Teleflex Incorporated, Cardinal Health, KCWW, and Koninklijke Philips N.V. These companies focus on advancing absorbent formulations with enhanced moisture retention, low-dust properties, and alkali-free compositions to improve safety and performance. Continuous innovation and partnerships with anesthesia equipment manufacturers strengthen their global presence. North America dominates the market with a 37% share, supported by advanced healthcare infrastructure, high surgical volumes, and strong regulatory emphasis on patient safety and eco-friendly medical consumables.

Market Insights

- The Anesthesia CO₂ Absorbents Market was valued at USD 75 million in 2024 and is projected to reach USD 112 million by 2032, growing at a CAGR of 5.18% during the forecast period.

- Increasing global surgical procedures and growing adoption of closed-circuit anesthesia systems are driving market growth, supported by rising healthcare expenditure and patient safety awareness.

- Key trends include the shift toward eco-friendly, alkali-free absorbents such as Amsorb and Medisorb, and integration with smart anesthesia delivery systems for real-time CO₂ monitoring.

- The competitive landscape is defined by major players including 3M, Baxter, GE HealthCare, Thermo Fisher Scientific, and Cardinal Health, focusing on advanced absorbent technologies and sustainability.

- North America leads with a 37% regional share, while soda lime dominates the product segment with 42% share, driven by its high absorption capacity and cost-effectiveness across hospital settings.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product:

The Anesthesia CO₂ Absorbents market, segmented by product into soda lime, Medisorb, Dragersorb, and Amsorb, is led by soda lime, holding over 42% market share in 2024. Its dominance stems from wide clinical use, cost efficiency, and high CO₂ absorption capacity. Soda lime’s long shelf life and compatibility with standard anesthesia machines further drive its demand. Meanwhile, Amsorb is gaining traction for its safety advantages, as it minimizes the formation of toxic compounds like Compound A and carbon monoxide during desiccation, appealing to advanced healthcare facilities.

- For instance, AMSORB Plus, produced by Armstrong Medical, is gaining adoption in advanced healthcare settings for its safety benefits, as it does not produce toxic compounds like Compound A or carbon monoxide during desiccation, unlike traditional soda lime

By Type

Based on type, the market is divided into premium and traditional absorbents, with the premium segment accounting for around 57% market share in 2024. This segment’s growth is driven by rising adoption of advanced, low-dust formulations and improved moisture retention technologies that extend absorber life. Premium absorbents like Amsorb Plus and Dragersorb 800+ also reduce patient exposure to harmful byproducts, enhancing operational safety. Healthcare providers prefer premium variants for their consistent performance, reduced maintenance costs, and compliance with updated anesthesia safety standards.

- For instance, Drägersorb 800+, produced by Dräger, features a unique pellet form that prevents channel formation, leading to evenly distributed CO2 absorption and longer usage life. This design also minimizes dust emissions, protecting both patients and anesthesia equipment from irritation and damage.

By End Use

In terms of end use, hospitals dominate the market, holding nearly 63% share in 2024. Hospitals remain the key end users due to high surgical volumes, integrated anesthesia systems, and stringent patient safety regulations. Their emphasis on efficient CO₂ management in closed-circuit anesthesia drives consistent demand for reliable absorbents. Clinics represent a growing segment, supported by expanding outpatient surgical centers and cost-effective anesthesia delivery models. Increasing preference for minimally invasive procedures across smaller healthcare facilities also supports broader absorbent utilization.

Key Growth Drivers

Rising Surgical Volume and Anesthesia Demand

The increasing global volume of surgical procedures significantly boosts the demand for anesthesia CO₂ absorbents. Growing prevalence of chronic diseases, trauma cases, and aging populations has led to a surge in elective and emergency surgeries. Hospitals and surgical centers rely on CO₂ absorbents to maintain safe anesthesia delivery in closed or low-flow systems. For instance, the World Health Organization estimates over 230 million major surgical procedures occur annually, driving consistent consumption of absorbents like soda lime and Amsorb. The focus on patient safety and reduced anesthetic gas usage further accelerates adoption across developed and emerging healthcare systems.

- For instance, GE HealthCare sells the Aisys CS2 anesthesia machine, a model that has been on the market since at least December 2013. In April 2022, GE HealthCare launched the FDA-approved End-tidal (Et) Control software for use with the Aisys CS2 system in the U.S. market.

Shift Toward Safe and Eco-Friendly Absorbents

Healthcare providers increasingly favor absorbents that eliminate toxic byproducts and environmental hazards. Traditional soda lime can release carbon monoxide and Compound A under desiccated conditions, posing safety concerns. Advanced formulations like Amsorb Plus and Medisorb reduce these risks by using calcium hydroxide-based compounds and alkali-free compositions. This transition aligns with hospital sustainability initiatives and regulatory standards promoting greener anesthesia practices. The ongoing adoption of low-alkali and non-caustic absorbents enhances operating room safety while reducing waste generation. As awareness grows among anesthesiologists, eco-friendly products continue to capture a larger market share.

- For instance, Amsorb Plus, developed by Armstrong Medical, is a carbon dioxide absorbent that contains no strong base chemicals and does not degrade inhaled anesthetics into carbon monoxide, formaldehyde, or Compound A, making it non-caustic and safe for disposal as non-hazardous waste.

Technological Advancements in Absorbent Efficiency

Continuous R&D efforts have led to absorbents with longer functional life, greater absorption efficiency, and reduced dust formation. Manufacturers such as Dräger and Armstrong Medical have introduced optimized granule designs and improved indicator formulations for real-time color change monitoring. These innovations enhance user confidence, minimize replacement frequency, and reduce overall operational costs. Enhanced moisture retention and uniform granule size distribution also improve reaction kinetics, ensuring steady CO₂ removal during prolonged anesthesia. Such technical progress not only increases product reliability but also supports compliance with modern anesthesia machine designs focused on sustainability and automation.

Key Trends & Opportunities

Integration with Smart Anesthesia Delivery Systems

The adoption of digital and automated anesthesia workstations presents a major opportunity for absorbent manufacturers. Smart anesthesia machines with integrated monitoring systems track CO₂ levels, humidity, and absorbent utilization in real time. Companies are developing absorbents compatible with these systems to ensure optimal performance and reduced waste. For instance, Dräger’s intelligent anesthesia platforms can interface with Dragersorb formulations to maintain stable gas concentrations automatically. This integration allows hospitals to enhance workflow efficiency and patient safety. As digital transformation accelerates in healthcare, absorbents designed for sensor-enabled systems will gain higher adoption rates.

- For instance, Dräger’s Drägersorb 800+ soda lime is specifically designed to integrate seamlessly with Dräger anesthesia systems, ensuring even CO₂ absorption and enhanced safety by eliminating dust generation and unwanted chemical reactions.

Expansion in Emerging Healthcare Markets

Emerging economies in Asia-Pacific, Latin America, and the Middle East are witnessing rapid hospital infrastructure development and growing surgical volumes. Rising healthcare expenditure and government investments in modern anesthesia equipment are creating lucrative opportunities for absorbent suppliers. Local production and strategic partnerships with regional distributors also strengthen market access. Companies expanding in countries like India, Brazil, and Saudi Arabia benefit from favorable import policies and demand for cost-effective, long-lasting absorbents. This regional diversification not only boosts global revenue streams but also reduces dependency on mature Western markets.

- For instance, Medilivescare Manufacturing Pvt. Ltd. (India) manufactures absorbent gauze rolls and related surgical dressings, and exports these products to the Middle East and Africa through distributors.

Key Challenges

Price Sensitivity and Limited Reimbursement Support

High-performance CO₂ absorbents with advanced compositions often carry higher price tags compared to traditional soda lime. In many developing markets, hospitals and clinics operate under tight budget constraints and prefer lower-cost alternatives. The absence of dedicated reimbursement frameworks for consumables like absorbents further limits premium product adoption. Manufacturers face the challenge of balancing performance with affordability while maintaining quality standards. To overcome this, companies must focus on cost-optimized production and bulk-supply contracts with healthcare systems to enhance accessibility without compromising safety or efficacy.

Environmental and Disposal Concerns

Disposal of used absorbents containing chemical residues poses environmental and regulatory challenges. Spent soda lime and other alkali-based materials can generate hazardous waste if not handled properly. Strict guidelines on chemical disposal and occupational safety increase operational complexity for hospitals. Moreover, improper storage can lead to moisture loss, reducing absorbent effectiveness and generating dust that affects staff safety. Addressing these issues requires the development of biodegradable or recyclable absorbent materials. Companies are now investing in sustainable formulations and closed-loop disposal systems to reduce the ecological footprint of anesthesia operations.

Regional Analysis

North America

North America dominates the Anesthesia CO₂ Absorbents market with a 37% share in 2024, driven by advanced healthcare infrastructure and high surgical volumes. The U.S. leads regional adoption due to widespread use of low-flow anesthesia systems and adherence to stringent patient safety regulations. Strong presence of global players like 3M, GE HealthCare, and Cardinal Health enhances supply reliability. Increasing preference for eco-friendly absorbents such as Amsorb and Medisorb further supports regional growth. Continuous technological upgrades in anesthesia machines also promote integration of premium absorbents across hospitals and ambulatory surgical centers.

Europe

Europe holds a 29% market share, supported by well-established healthcare systems and rising adoption of sustainable medical consumables. Countries like Germany, France, and the U.K. prioritize alkali-free absorbents that minimize toxic byproduct formation. Regulatory initiatives from the European Medicines Agency encourage safe anesthesia practices, boosting demand for premium solutions. Manufacturers such as Dräger and Philips drive regional innovation through advanced absorber designs compatible with digital anesthesia systems. The region’s strong focus on green healthcare and waste reduction further accelerates transition toward eco-conscious CO₂ absorbents.

Asia-Pacific

Asia-Pacific accounts for 23% of the global market, fueled by rapid hospital infrastructure expansion and increasing surgical procedures in China, India, and Japan. Rising healthcare expenditure and growing adoption of modern anesthesia equipment are major growth drivers. Governments in emerging economies are investing in affordable yet high-quality absorbents to enhance surgical safety. Local and international players collaborate to strengthen distribution networks, improving product accessibility. Continuous improvements in healthcare awareness and training of anesthesiologists further promote regional market expansion across both public and private healthcare sectors.

Latin America

Latin America represents 7% market share, with Brazil and Mexico emerging as key contributors. The region benefits from increasing private healthcare investment and gradual modernization of surgical facilities. Growing emphasis on infection control and patient safety in anesthesia procedures supports steady demand for high-efficiency absorbents. However, limited local manufacturing capacity and import dependency restrain faster adoption of premium products. Partnerships between international brands and regional distributors are helping overcome cost barriers and improving access to sustainable and longer-lasting absorbent formulations in hospitals and outpatient surgical centers.

Middle East & Africa

The Middle East & Africa collectively hold a 4% share of the Anesthesia CO₂ Absorbents market. Growth is led by Gulf countries such as Saudi Arabia and the UAE, where healthcare infrastructure modernization and government funding drive surgical advancements. Rising numbers of specialized hospitals and expansion of critical care services further support market penetration. However, adoption remains slower across parts of Africa due to limited access to advanced anesthesia systems. Increasing training initiatives and imports of reliable absorbents are gradually improving the availability of high-performance CO₂ absorbents in the region.

Market Segmentations:

By Product

- Soda lime

- Medisorb

- Dragersorb

By Type

By End Use

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Anesthesia CO₂ Absorbents market features strong competition among global and regional players focusing on safety, performance, and sustainability. Leading companies such as 3M, Baxter, GE HealthCare, Thermo Fisher Scientific, and Medline Industries dominate through broad product portfolios and strong hospital partnerships. Firms like Ecolab, Teleflex Incorporated, and Cardinal Health emphasize eco-friendly absorbent formulations and efficient distribution channels. Koninklijke Philips N.V. and KCWW contribute with advanced medical technology integration and material innovation. Continuous R&D investments target alkali-free, low-dust absorbents that enhance safety and reduce toxic byproducts. Strategic mergers, product launches, and collaborations with anesthesia equipment manufacturers strengthen market presence. The focus on meeting stringent clinical and environmental standards positions premium absorbents such as Amsorb and Dragersorb as preferred choices across developed markets, while cost-effective formulations gain traction in emerging economies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In May 2024, Bell Medical Inc. promoted its sodium hydroxide-free Amsorb Plus CO₂ absorbent, which is an eco-friendly product that prevents harmful byproducts and supports low fresh gas flow techniques, enhancing sustainability in anesthesia practices.

- In March 2024, Tata Elxsi and Drägerwerk AG & Co. KGaA announced a partnership to establish an offshore development centre in India, focusing on critical-care and anesthesia devices.

- In May 2023, SunMED Medical acquired Vyaire Medical’s respiratory and anesthesia consumables business. This merger is expected to create a leading manufacturer of operative care and airway management, offering high quality anesthesia and consumable respiratory medical products, thereby supporting best patients’ outcomes.

Report Coverage

The research report offers an in-depth analysis based on Product, Type, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for anesthesia CO₂ absorbents will grow with the rising global volume of surgical procedures.

- Eco-friendly and alkali-free absorbents will gain higher adoption due to safety and sustainability concerns.

- Hospitals will continue to dominate usage owing to advanced anesthesia equipment and strict patient safety standards.

- Integration with smart anesthesia systems will improve real-time monitoring and absorbent efficiency.

- Emerging economies in Asia-Pacific and Latin America will create strong expansion opportunities for manufacturers.

- Continuous R&D will focus on enhancing absorbent longevity and reducing replacement frequency.

- Partnerships between absorbent manufacturers and anesthesia machine producers will strengthen supply chain efficiency.

- Premium absorbents will gain market share as hospitals shift toward high-performance medical consumables.

- Regulatory standards promoting low-toxicity materials will accelerate innovation in absorbent formulations.

- Adoption of sustainable production and waste management practices will shape the market’s long-term direction.