Market Overview:

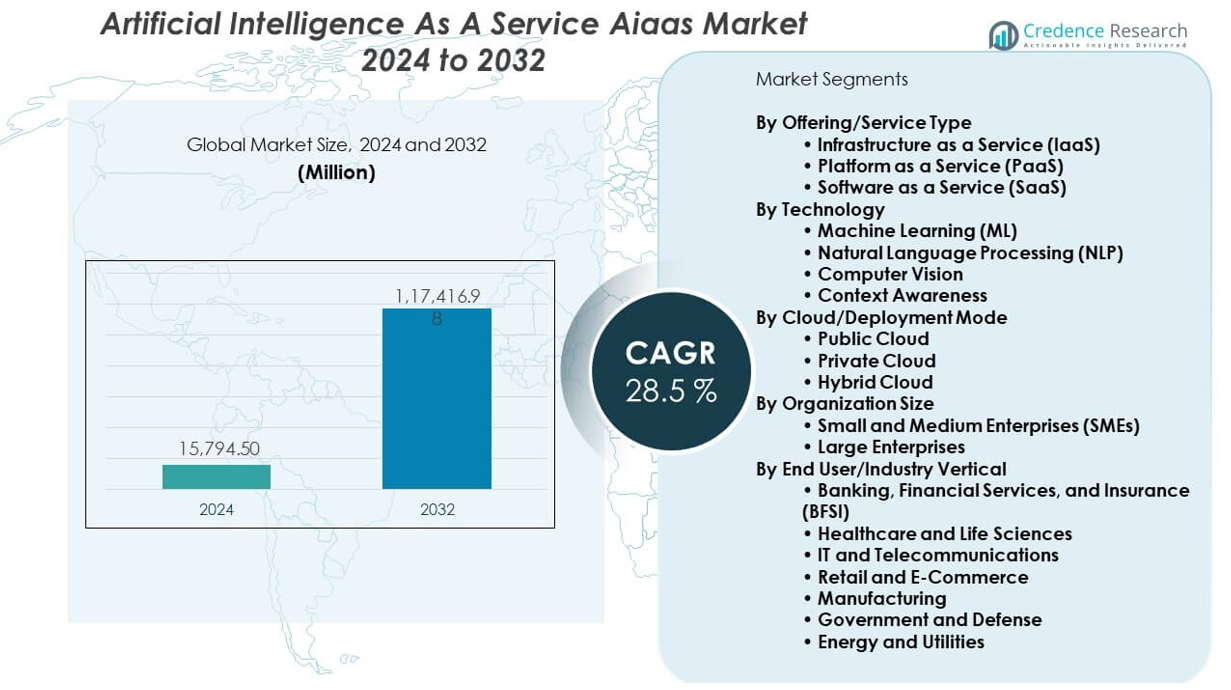

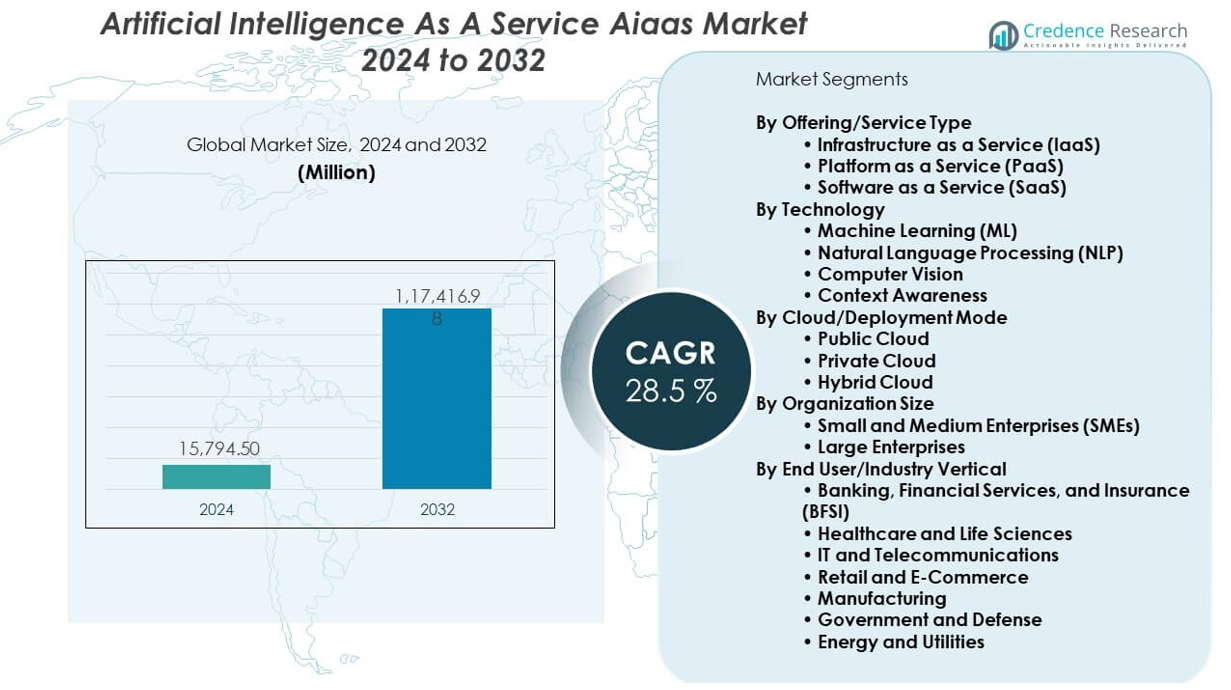

The Artificial Intelligence as a Service (AIaaS) Market is projected to grow from USD 15,794.5 million in 2024 to USD 117,416.98 million by 2032, with a CAGR of 28.5% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Artificial Intelligence as a Service (AIaaS) Market Size 2024 |

USD 15,794.5 million |

| Artificial Intelligence as a Service (AIaaS) Market, CAGR |

28.5% |

| Artificial Intelligence as a Service (AIaaS) Market Size 2032 |

USD 117,416.98 million |

Strong demand for low-cost AI deployment drives steady growth across sectors. Cloud vendors offer flexible subscription options that help small firms adopt AI without heavy capital use. Enterprises use these tools to improve forecasting, automate workflows, and enhance customer engagement. Vendors integrate easy APIs to support faster adoption. Companies shift from traditional software to service models for better speed. AIaaS helps teams scale models quickly. This benefit increases adoption in BFSI, retail, and healthcare.

North America leads due to strong cloud ecosystems and high enterprise spending. Europe follows with steady use of AI services in manufacturing and public sectors. Asia Pacific emerges as the fastest-growing region due to rising digital investments and a large SME base. Firms in Japan, India, and China adopt AIaaS to support automation and analytics. Latin America shows moderate growth driven by cloud expansion. The Middle East and Africa gain pace through smart city and telecom projects.

Market Insights:

- The Artificial intelligence as a service aiaas market is valued at USD 15,794.5 million in 2024 and is projected to reach USD 117,416.98 million by 2032, growing at a 28.5% CAGR through the forecast period.

- North America (38.5%), Europe (27.4%), and Asia Pacific (24.8%) hold the top regional shares due to strong cloud ecosystems, enterprise digitalization, and structured AI adoption programs.

- Asia Pacific, with 24.8%, stands as the fastest-growing region driven by SME expansion, high digital investments, and rapid cloud deployment.

- The Public Cloud segment accounts for 52% of the market share, driven by wider accessibility and flexibility for AI workloads across enterprises.

- Machine Learning holds 41% of the technology share due to its dominant use in prediction, automation, and enterprise decision intelligence.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Enterprise Demand for Scalable AI Deployment

The Artificial intelligence as a service aiaas market gains strong momentum due to higher demand for scalable AI tools. Companies adopt flexible service models to reduce upfront infrastructure needs. Cloud vendors provide modular architectures that support faster deployment cycles. Firms use AIaaS to improve decision workflows and automate routine tasks. This shift helps enterprises control operating costs. It supports teams that rely on predictive analytics for customer engagement. Adoption rates rise in BFSI, healthcare, and retail sectors. It accelerates transformation programs across multiple industry groups.

- For instance, AWS operates clusters exceeding 500,000 chips and provides customers with compute comprising hundreds of thousands of state-of-the-art NVIDIA GPUs. Cloud vendors provide modular architectures that support faster deployment cycles. Firms use AIaaS to improve decision workflows and automate routine tasks.

Expanding Use of Cloud-Based Intelligence Platforms

Cloud ecosystems strengthen the growth path for the Artificial intelligence as a service aiaas market. Service providers integrate easy APIs that help firms build custom AI functions. This approach reduces the burden on in-house technical teams. Vendors offer training models that support quick customization. Enterprises use these tools to improve fraud detection and forecast accuracy. Many firms prefer subscription plans for better control over spending. Adoption rises in small and mid-size firms due to lower risk. It broadens the use of AI in core and support operations.

- For instance, enterprises are increasingly leveraging AI tools from vendors like Google Cloud to reduce the burden on in-house technical teams. Vendors, such as Google Cloud with its Vertex AI platform, offer training models that support quick customization. Enterprises are using these tools to improve fraud detection by analyzing transaction patterns and to increase forecast accuracy by analyzing large datasets.

Growing Adoption Across Data-Driven Business Functions

The Artificial intelligence as a service aiaas market benefits from rising use across marketing, supply chains, and HR functions. Teams deploy AIaaS to segment customers with higher precision. Firms use automated insights to refine product planning. Service platforms help teams optimize social sentiment analysis. It boosts operational clarity for strategic teams. Companies use ready frameworks to cut model development time. Demand strengthens due to the need for faster insights. More sectors incorporate AIaaS into routine activities.

Increasing Integration of Automation and Cognitive Tools

Automation platforms shape adoption patterns in the Artificial intelligence as a service aiaas market. Vendors integrate NLP, machine vision, and speech intelligence into core modules. These tools support service tasks in telecom and financial firms. It brings higher efficiency to customer support centers. Automation improves accuracy in document workflows. Firms rely on these capabilities to reduce error rates. Growth rises due to expanding use of digital assistants. Cognitive tools help firms scale intelligence across multiple business units.

Market Trends:

Shift Toward Industry-Specific AIaaS Solutions

The Artificial intelligence as a service aiaas market observes a shift toward tailored AI services. Vendors build sector-focused modules for healthcare insights and risk scoring. Firms prefer platforms that address unique compliance needs. It encourages deeper integration within regulated sectors. Providers deliver solutions with tuned models for faster deployment. Industry templates gain traction among mid-size firms. Businesses reduce resource needs for model training. Adoption expands across logistics, utilities, and public enterprises.

- For instance, Oracle Cloud Infrastructure delivers over 200 AI and cloud services deployable in as few as three racks, with more than 60 OCI Dedicated Regions live or planned globally. Providers deliver solutions with tuned models for faster deployment. Industry templates gain traction among mid-size firms.

Rapid Growth in Multimodal AI Services

The Artificial intelligence as a service aiaas market evolves with the rise of multimodal intelligence. Platforms combine text, image, and audio processing in unified tools. This trend improves the accuracy of decision engines. Service providers update models to support broad content types. Enterprises use multimodal tools to analyze customer interactions. It helps marketing teams refine targeted strategies. Vendors strengthen pipelines that handle varied datasets. Growth increases due to wider use of advanced inference capabilities.

Higher Use of Explainable and Transparent AI Models

The Artificial intelligence as a service aiaas market embraces explainable AI methods. Firms demand transparent outputs for higher trust levels. Vendors integrate dashboards that show reasoning paths. It supports teams that manage risk in financial and legal sectors. Clear insights help end users interpret outcomes. Businesses prefer solutions that meet internal audit criteria. Transparent models boost responsible AI adoption. This trend grows due to stronger regulatory pressure.

Rise of Edge-Enabled AIaaS for Low-Latency Workloads

The Artificial intelligence as a service aiaas market expands toward edge intelligence. Vendors build distributed models that run closer to devices. This architecture supports real-time tasks in retail and manufacturing. It reduces dependence on central cloud nodes. Firms use edge systems for process control in industrial units. It helps improve response times in critical operations. Providers enhance support for IoT integration. Growth picks up across sectors with high data velocity.

Market Challenges Analysis:

High Data Privacy Risks and Complex Regulatory Compliance

The Artificial intelligence as a service aiaas market faces strong compliance pressure. Firms must handle sensitive data under strict rules. Vendors need secure pipelines that protect user privacy. It increases the cost of deployment for many sectors. Regulatory gaps between countries create operational complexity. Companies struggle to align AI use with internal controls. Privacy risks limit adoption in heavily regulated fields. Firms require continuous oversight to maintain compliance.

Skill Gaps, Integration Barriers, and Limited Interoperability

The Artificial intelligence as a service aiaas market encounters challenges linked to skill shortages. Many teams lack expertise to manage AI workflows. Integration issues appear when legacy systems conflict with AIaaS models. It slows deployment across older enterprise stacks. Limited interoperability raises the need for custom connectors. Firms spend extra time on configuration tasks. Vendors face pressure to simplify toolkits. Adoption slows when firms cannot align systems with new intelligence services.

Market Opportunities:

Expansion of AIaaS in SME Ecosystems Across Global Markets

The Artificial intelligence as a service aiaas market gains strong opportunities from rising SME use. Smaller firms adopt service platforms to reduce capital spending. Vendors offer lightweight models that support fast onboarding. It helps SMEs compete with larger enterprises. Emerging markets show higher interest in cloud intelligence. Providers can gain scale by targeting regional clusters. New use cases appear across retail and education. Demand grows as SMEs shift toward digital-first operations.

Growth Potential in Hybrid AI, Autonomous Workflows, and Industry 4.0

The Artificial intelligence as a service aiaas market creates openings through hybrid deployment models. Firms combine cloud and local engines for more control. It supports sectors that need faster insights. Autonomous workflow systems open new demand pockets. Industry 4.0 programs accelerate the use of predictive tools. Providers can introduce specialized models for manufacturing intelligence. Growth improves when firms automate production and quality tasks. Opportunities expand with deeper automation adoption.

Market Segmentation Analysis:

By Offering/Service Type

The Artificial intelligence as a service aiaas market expands across IaaS, PaaS, and SaaS due to rising demand for cloud-based intelligence. IaaS supports scalable compute needs for model training. PaaS offers ready frameworks that reduce development time for teams. SaaS gains strong traction due to easy deployment and low maintenance. Firms prefer SaaS for quick integration across workflows. PaaS suits enterprises that build custom AI pipelines. IaaS helps firms manage large datasets. Each layer supports distinct adoption needs across industries.

- For instance, in early 2025, AWS announced plans to invest approximately $100 billion in capital expenditures throughout the year to boost capacity for its cloud and AI infrastructure. This was announced after AWS reported around $28.8 billion in cloud revenues for the fourth quarter of 2024 and $29.3 billion for the first quarter of 2025. During this same period, the AI-specific portion of AWS’s multi-billion dollar revenue base was reported to be experiencing triple-digit percentage growth, a detail sometimes presented misleadingly as overall AI revenue growth.

By Technology

Machine Learning leads due to its broad use in predictions and classification tasks. NLP supports customer service and content analytics. Computer Vision grows due to strong use in automation and surveillance. Context Awareness enhances personalization across digital platforms. Enterprises rely on ML to support core decision goals. NLP tools help firms manage chat interactions. Computer Vision assists in manufacturing quality checks. Context systems refine targeted customer actions.

- For instance, Netflix uses predictive analytics for personalized content recommendations resulting in significant user engagement increases, while Starbucks leverages predictive analytics for personalized promotions enhancing customer satisfaction. Enterprises rely on ML to support core decision goals.

By Cloud/Deployment Mode

Public Cloud dominates due to flexibility and wide service availability. Private Cloud gains pace in sectors with strict compliance rules. Hybrid Cloud grows due to balanced control across environments. Firms choose models based on sensitivity of workloads. Public Cloud supports fast scaling across regions. Private Cloud allows tight control of data. Hybrid Cloud suits firms with mixed infrastructure. Each mode offers clear operational benefits.

By Organization Size

Large Enterprises adopt AIaaS to support heavy workloads and complex analytics. SMEs prefer subscription models with lower cost. It helps small firms deploy intelligence without high investments. Large firms use AI to automate core functions. SMEs gain value from ready tools. Adoption grows across both groups. Market demand strengthens within digital-first firms. Uptake increases across regions.

By End User/Industry Vertical

BFSI leads due to strong use in risk scoring and fraud control. Healthcare uses AIaaS to support clinical analysis and workflow automation. IT and Telecom deploy AI for network optimization. Retail uses AI to refine demand forecasting. Manufacturing integrates AI into quality and maintenance tasks. Government and Defense adopt AI for security workloads. Energy and Utilities improve asset monitoring with AI. Other sectors expand adoption across service functions.

Segmentation:

By Offering/Service Type

- Infrastructure as a Service (IaaS)

- Platform as a Service (PaaS)

- Software as a Service (SaaS)

By Technology

- Machine Learning (ML)

- Natural Language Processing (NLP)

- Computer Vision

- Context Awareness

By Cloud/Deployment Mode

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Organization Size

- Small and Medium Enterprises (SMEs)

- Large Enterprises

By End User/Industry Vertical

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare and Life Sciences

- IT and Telecommunications

- Retail and E-Commerce

- Manufacturing

- Government and Defense

- Energy and Utilities

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The Artificial intelligence as a service aiaas market holds strong presence in North America, which captures 38.5% of global share due to high cloud maturity and early AI adoption. The region benefits from strong investments by hyperscale cloud providers. Enterprises in the United States adopt AIaaS to accelerate automation across finance, healthcare, and telecom. It gains traction through rapid platform integration within large organizations. Canada supports uptake through digital-first enterprise programs. Growth remains steady due to strong demand for scalable intelligence tools. Innovation clusters strengthen the regional leadership position.

Europe

Europe accounts for 27.4% of the global share due to strong enterprise digitalization and regulatory-driven AI adoption. The Artificial intelligence as a service aiaas market grows in Germany, France, and the U.K. due to rising use in manufacturing, retail, and public administration. Firms deploy AIaaS to support risk monitoring and operational visibility. It gains wider use through structured initiatives tied to Industry 4.0. Cloud expansion improves access to scalable AI platforms. Southern and Western Europe show consistent adoption across diverse sectors. Strong regulation encourages demand for transparent and trusted AI models.

Asia Pacific

Asia Pacific holds 24.8% share and ranks as the fastest-growing region due to rising cloud investments in China, India, and Japan. The Artificial intelligence as a service aiaas market expands here due to a large SME base that adopts subscription-based AI tools. Firms deploy AIaaS for process automation and customer analytics. It benefits from rapid growth of digital commerce and telecom networks. Strong support from public initiatives accelerates enterprise adoption. Southeast Asian economies adopt AI to strengthen productivity and service quality. The region continues to widen demand due to fast innovation cycles and expanding digital ecosystems.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Artificial intelligence as a service aiaas market shows strong competition driven by hyperscale cloud vendors and specialized AI platform providers. Major players focus on broad service portfolios that integrate machine learning, NLP, and computer vision into cloud-native environments. It gains strength from heavy investments in platform scalability, security, and multimodal intelligence. Vendors compete through advanced APIs, pre-trained models, and industry-specific toolkits. Partnerships with enterprises accelerate adoption across BFSI, healthcare, and retail. Market leaders expand global cloud regions to improve latency and service reach. Smaller providers position themselves through niche AI capabilities and domain-focused models. Competitive intensity stays high due to fast innovation cycles and continuous updates in cloud architectures.

Recent Developments:

- In November 2025, AWS and HUMAIN expanded their partnership with NVIDIA AI Infrastructure, including the deployment of up to 150,000 AI accelerators featuring the latest NVIDIA GB300s AI infrastructure and AWS’s Trainium AI chips. The expanded partnership establishes AWS as HUMAIN’s preferred AI partner globally, with both companies collaborating to bring AI compute and services from Saudi Arabia to customers worldwide. This first-of-a-kind AI Zone in Saudi Arabia will support cutting-edge AI training and inference workloads with access to the latest NVIDIA GB300 AI infrastructure and AWS’s Trainium AI chips, enabling customers to rapidly move from concept to production.

- In November 2025, AWS and OpenAI announced a multi-year, strategic partnership worth $38 billion that provides OpenAI with immediate access to AWS’s world-class infrastructure for their advanced AI workloads. The partnership enables OpenAI to run its core artificial intelligence workloads starting immediately, with AWS providing OpenAI with Amazon EC2 UltraServers featuring hundreds of thousands of chips and the ability to scale to tens of millions of CPUs for advanced generative AI workloads. Under this agreement, which will have continued growth over the next seven years, OpenAI is accessing AWS compute comprising hundreds of thousands of state-of-the-art NVIDIA GPUs, with the ability to expand to tens of millions of CPUs to rapidly scale agentic workloads.

- In November 2025, at re:Invent 2025, AWS launched three Well-Architected Lenses specifically focused on AI workloads, including the Responsible AI Lens, the Machine Learning Lens, and the Generative AI Lens. These lenses provide comprehensive guidance for organizations at different stages of their AI journey, whether they are just starting to experiment with machine learning or already deploying complex AI applications at scale. The launch also included Amazon Transform, a revolutionary service that uses agentic AI to accelerate and simplify the migration and modernization of infrastructure, applications, and code, achieving previously impossible results such as modernizing Windows-based .NET applications to Linux four times faster.

- In November 2025, Microsoft, NVIDIA, and Anthropic announced new strategic partnerships where Anthropic is scaling its rapidly-growing Claude AI model on Microsoft Azure, powered by NVIDIA. Anthropic has committed to purchase $30 billion of Azure compute capacity and to contract additional compute capacity up to one gigawatt. As part of the partnership, NVIDIA and Microsoft are committing to invest up to $10 billion and up to $5 billion respectively in Anthropic. Microsoft has also committed to continuing access for Claude across Microsoft’s Copilot family, including GitHub Copilot, Microsoft 365 Copilot, and Copilot Studio.

Report Coverage:

The research report offers an in-depth analysis based on Offering/Service Type, Technology, Cloud/Deployment Mode, Organization Size, End User/Industry Vertical, and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- AIaaS adoption will rise due to higher demand for scalable intelligence platforms.

- Enterprises will integrate multimodal AI for deeper workflow automation.

- Hybrid and private cloud deployments will grow across regulated industries.

- SMEs will drive uptake through cost-effective subscription models.

- Industry-specific AIaaS solutions will expand across BFSI, healthcare, and retail.

- Need for explainable AI will influence platform design and compliance strategies.

- Edge-based AIaaS models will gain traction in low-latency environments.

- Partnerships between cloud providers and software vendors will increase.

- Generative AI services will support new productivity and development use cases.

- Global cloud region expansion will improve availability and performance.