| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Asia Pacific Biomaterials Market Size 2024 |

USD 54,534.13 Million |

| Asia Pacific Biomaterials Market, CAGR |

16.37% |

| Asia Pacific Biomaterials Market Size 2032 |

USD 1,83,438.27 Million |

Market Overview

Asia Pacific Biomaterials market size was valued at USD 54,534.13 million in 2024 and is anticipated to reach USD 1,83,438.27 million by 2032, at a CAGR of 16.37% during the forecast period (2024-2032).

The Asia Pacific biomaterials market is driven by rising healthcare demand, technological advancements in biomaterials, and increased adoption of biomaterials in medical applications such as orthopedics, dental implants, and tissue engineering. The growing aging population in the region is fueling the need for advanced medical treatments and implants, further boosting market growth. Additionally, significant investments in research and development are leading to innovations in biomaterial properties, such as enhanced biocompatibility and durability. The trend toward personalized medicine, combined with the rising prevalence of chronic diseases, is also accelerating the use of biomaterials in various therapeutic areas. Moreover, government initiatives supporting healthcare infrastructure and the increasing focus on minimally invasive surgeries are contributing to the expanding market for biomaterials. As a result, the Asia Pacific biomaterials market is poised for substantial growth, driven by these ongoing technological and healthcare trends.

The Asia Pacific biomaterials market is characterized by diverse regional dynamics, with key players spanning several countries. China and Japan dominate the market due to their advanced healthcare systems, significant investments in medical technologies, and growing demand for biomaterials driven by aging populations and chronic disease prevalence. South Korea and India are emerging as strong markets, fueled by increasing healthcare access, medical innovation, and expanding demand for implants, prosthetics, and regenerative therapies. The Rest of Asia Pacific, including Thailand, Indonesia, and Malaysia, also shows promising growth, with rising healthcare infrastructure and greater adoption of advanced medical devices. Leading companies such as Shandong Weigao Group, Mitsubishi Chemical, Teijin Limited, Amgen, and Axogen are instrumental in shaping the market, with their extensive product portfolios and strategic initiatives aimed at addressing the evolving healthcare needs across the region. These players continue to drive innovation and cater to the growing demand for high-quality biomaterials.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Asia Pacific biomaterials market was valued at USD 54,534.13 million in 2024 and is expected to reach USD 1,83,438.27 million by 2032, growing at a CAGR of 16.37% during the forecast period.

- The global biomaterials market was valued at USD 2,03,827.80 million in 2024 and is projected to reach USD 6,19,828.57 million by 2032, growing at a CAGR of 14.91% during the forecast period.

- Growing healthcare demand and an aging population are major drivers of the biomaterials market across the region.

- Technological advancements in biomaterials, such as biodegradable materials and 3D printing, are shaping the future of the market.

- Increasing prevalence of chronic diseases and lifestyle-related conditions is boosting the need for biomaterials in medical treatments.

- The market is competitive, with key players like Shandong Weigao Group, Mitsubishi Chemical, and Teijin Limited focusing on innovation and regional expansion.

- High manufacturing costs and complex regulatory approvals are challenges limiting market growth.

- Regional markets such as China and Japan dominate, while emerging markets in Southeast Asia are experiencing rapid growth.

Report Scope

This report segments the Asia Pacific Biomaterials Market as follows:

Market Drivers

Growing Healthcare Demand and Aging Population

The increasing demand for healthcare services in the Asia Pacific region is a significant driver of the biomaterials market. The region is experiencing a demographic shift, with a rapidly growing aging population. Older adults often require medical treatments, such as joint replacements, dental implants, and cardiovascular interventions, which rely heavily on biomaterials. For instance, the Asia-Pacific report on population ageing 2022 highlights that the proportion of individuals aged 60 and above is expected to exceed 25% of the total population by 2050. As the elderly population rises, the demand for advanced healthcare solutions, including implants and prosthetics, is expected to grow. The need for biomaterials in regenerative medicine, tissue engineering, and orthopedic procedures is further increasing, providing a steady market for advanced biomaterial solutions. This demographic trend is not only creating a demand for existing products but also driving innovation in new biomaterial technologies that can meet the evolving needs of aging patients.

Technological Advancements and R&D Investments

Technological innovations in biomaterial development are another key driver of the market. Ongoing research and development (R&D) efforts are focusing on creating biomaterials with improved performance characteristics, such as enhanced biocompatibility, strength, and biodegradability. Advances in polymer science, nanotechnology, and materials engineering are contributing to the development of next-generation biomaterials used in medical devices, implants, and drug delivery systems. For instance, government-funded research initiatives in biomaterials have been increasing, with institutions such as Drexel University receiving grants from the National Science Foundation to study biomaterial vascularization. These advancements have expanded the potential applications of biomaterials in diverse medical fields, including orthopedics, dentistry, and wound healing. Governments and private companies across the region are increasing their investments in R&D to foster these technological advancements, further accelerating market growth.

Rising Prevalence of Chronic Diseases

The rising prevalence of chronic diseases such as diabetes, cardiovascular diseases, and musculoskeletal disorders in the Asia Pacific region is another important factor driving the biomaterials market. Chronic conditions often require long-term management, which includes the use of implants and prosthetics, further increasing the demand for biomaterials. For instance, diabetes patients may require advanced wound care products, while individuals with cardiovascular diseases may need stents or other implantable devices. With an expanding patient base for these conditions, the demand for biomaterials to treat or manage these diseases is expected to grow. The increase in lifestyle-related diseases, coupled with the higher life expectancy in the region, is expected to further drive the need for medical treatments that rely on biomaterials.

Government Initiatives and Healthcare Infrastructure Development

Government initiatives and investments in healthcare infrastructure are significant drivers of the biomaterials market in the Asia Pacific region. Many countries, including China and India, are making substantial investments to improve healthcare systems and expand access to advanced medical treatments. Policies that encourage healthcare innovation, provide funding for medical research, and support the development of medical technologies are creating favorable market conditions for biomaterials. The increasing emphasis on the adoption of minimally invasive surgeries and advanced medical procedures, supported by government healthcare initiatives, is further boosting the demand for biomaterials. Additionally, the growing number of healthcare institutions and the establishment of specialized centers for biomaterial research and development are contributing to the overall market growth in the region.

Market Trends

Growing Use of 3D Printing in Biomaterial Manufacturing

The integration of 3D printing technology in the production of biomaterials is another important trend. 3D printing allows for the creation of highly intricate and customized biomaterial components with precise specifications, offering new possibilities for personalized treatments. For instance, research institutions in Japan and South Korea have pioneered the development of 3D-printed biomaterials for tissue engineering, supported by government grants. This technology is particularly beneficial in creating patient-specific implants and scaffolds for tissue engineering, allowing for faster production times and reduced costs. As this technology evolves, it is expected to revolutionize the manufacturing process and expand the scope of biomaterial applications, particularly in regenerative medicine and implantable devices.

Increased Focus on Regenerative Medicine and Tissue Engineering

Regenerative medicine and tissue engineering are increasingly becoming central to the Asia Pacific biomaterials market. The demand for biomaterials in regenerative therapies, such as stem cell therapy and wound healing, is rising as advancements in cell-based treatments offer new ways to repair or replace damaged tissues and organs. For instance, government-supported research centers in China have developed extensive stem cell banks to facilitate regenerative medicine applications. Biomaterials play a critical role in creating scaffolds that support cell growth and tissue regeneration. The ongoing trend of using biomaterials in combination with biological agents to promote tissue repair and regeneration is expected to drive market growth. As the focus on regenerative medicine intensifies, biomaterials designed to enhance tissue regeneration, cell growth, and healing processes will see increased demand across the region.

Advancements in Biodegradable and Bioabsorbable Materials

One of the prominent trends in the Asia Pacific biomaterials market is the growing preference for biodegradable and bioabsorbable materials. These materials are gaining popularity due to their ability to degrade naturally within the body, reducing the need for surgical removal after use. Biodegradable biomaterials are increasingly being used in applications such as drug delivery systems, sutures, and tissue engineering. Their ability to minimize the risk of complications associated with permanent implants is driving their adoption in medical procedures. As research continues to enhance the functionality and performance of these materials, their application in various therapeutic areas, including orthopedics and cardiovascular surgery, is expected to expand.

Rise in Personalized Medicine and Custom Implants

The trend toward personalized medicine is significantly influencing the biomaterials market in Asia Pacific. With advancements in medical technology, there is an increasing demand for customized implants and prosthetics tailored to individual patients. Personalized biomaterials are designed based on a patient’s specific anatomical and physiological requirements, offering better fit, comfort, and overall performance. This trend is particularly prevalent in orthopedics, dental implants, and joint replacements. As healthcare providers and manufacturers focus on enhancing the precision of medical treatments, personalized biomaterials are poised to play a key role in improving patient outcomes and satisfaction, driving the market forward.

Market Challenges Analysis

High Manufacturing Costs and Complex Regulatory Approvals

One of the major challenges facing the Asia Pacific biomaterials market is the high cost of manufacturing advanced biomaterials. The development and production of biomaterials often involve complex processes, advanced technologies, and stringent quality control measures, which contribute to increased production costs. These high costs can be a barrier for small and medium-sized enterprises (SMEs) looking to enter the market, as well as for healthcare providers who may face difficulties in adopting the latest biomaterials due to budget constraints. Additionally, the regulatory approval process for biomaterials in many Asia Pacific countries is complex and time-consuming, with strict guidelines for safety and efficacy. This can delay the market introduction of new products and create challenges for manufacturers seeking to meet the growing demand for innovative biomaterials in a timely manner.

Limited Awareness and Adoption of Advanced Biomaterials

Despite significant advancements in biomaterial technologies, there is still limited awareness and adoption of some advanced biomaterials across certain regions in Asia Pacific. For instance, studies suggest that healthcare professionals in emerging markets often lack access to training programs on the latest biomaterial applications, leading to slower adoption rates. In many emerging markets, healthcare professionals may not be fully aware of the latest biomaterial options available, or there may be reluctance to adopt new technologies due to concerns about their long-term performance and cost-effectiveness. This limited adoption is particularly evident in rural areas and less developed healthcare settings, where the infrastructure and resources needed to support advanced biomaterial applications may be lacking. Furthermore, some traditional medical practices may create resistance to the shift toward newer biomaterial technologies. Overcoming these challenges will require increased education, awareness campaigns, and demonstration of the benefits of advanced biomaterials to healthcare professionals and patients alike.

Market Opportunities

The Asia Pacific biomaterials market presents significant opportunities driven by the rapid advancements in medical technology and a growing demand for high-quality healthcare solutions. One of the key opportunities lies in the increasing adoption of biomaterials in emerging medical fields such as regenerative medicine, tissue engineering, and personalized medicine. As the region continues to invest in advanced healthcare infrastructure, the demand for innovative biomaterials, including biocompatible implants, drug delivery systems, and wound healing products, is set to expand. The rise of personalized medicine, where treatments are tailored to individual patients, opens new avenues for the development of custom-made biomaterials. With the region’s large and diverse population, companies have the chance to tap into this growing market by developing biomaterials that cater to the specific needs of different patient demographics.

Another significant opportunity for growth lies in the increasing use of 3D printing technology in biomaterial manufacturing. 3D printing allows for the creation of highly customized and intricate medical devices, offering a faster and more cost-effective alternative to traditional manufacturing methods. As healthcare providers seek more efficient ways to produce personalized implants and prosthetics, 3D printing will likely play a pivotal role in the biomaterials market. Additionally, the growing focus on improving healthcare access and treatment options in developing countries across Asia Pacific presents a vast opportunity for companies to introduce affordable and effective biomaterials to address regional health challenges. With the ongoing push for innovation and a favorable regulatory environment, the Asia Pacific biomaterials market holds immense potential for businesses to expand and cater to the evolving healthcare needs of the region.

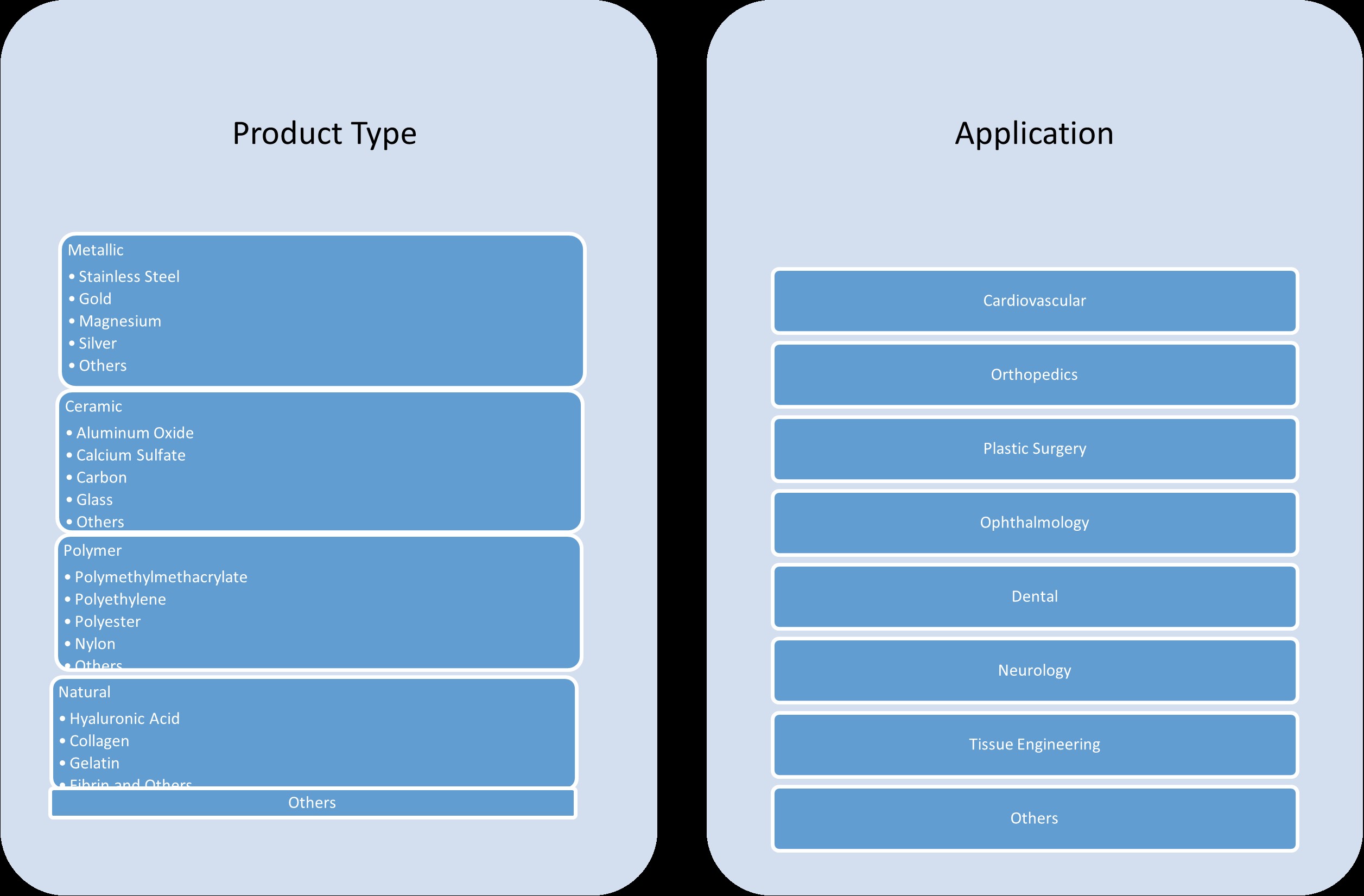

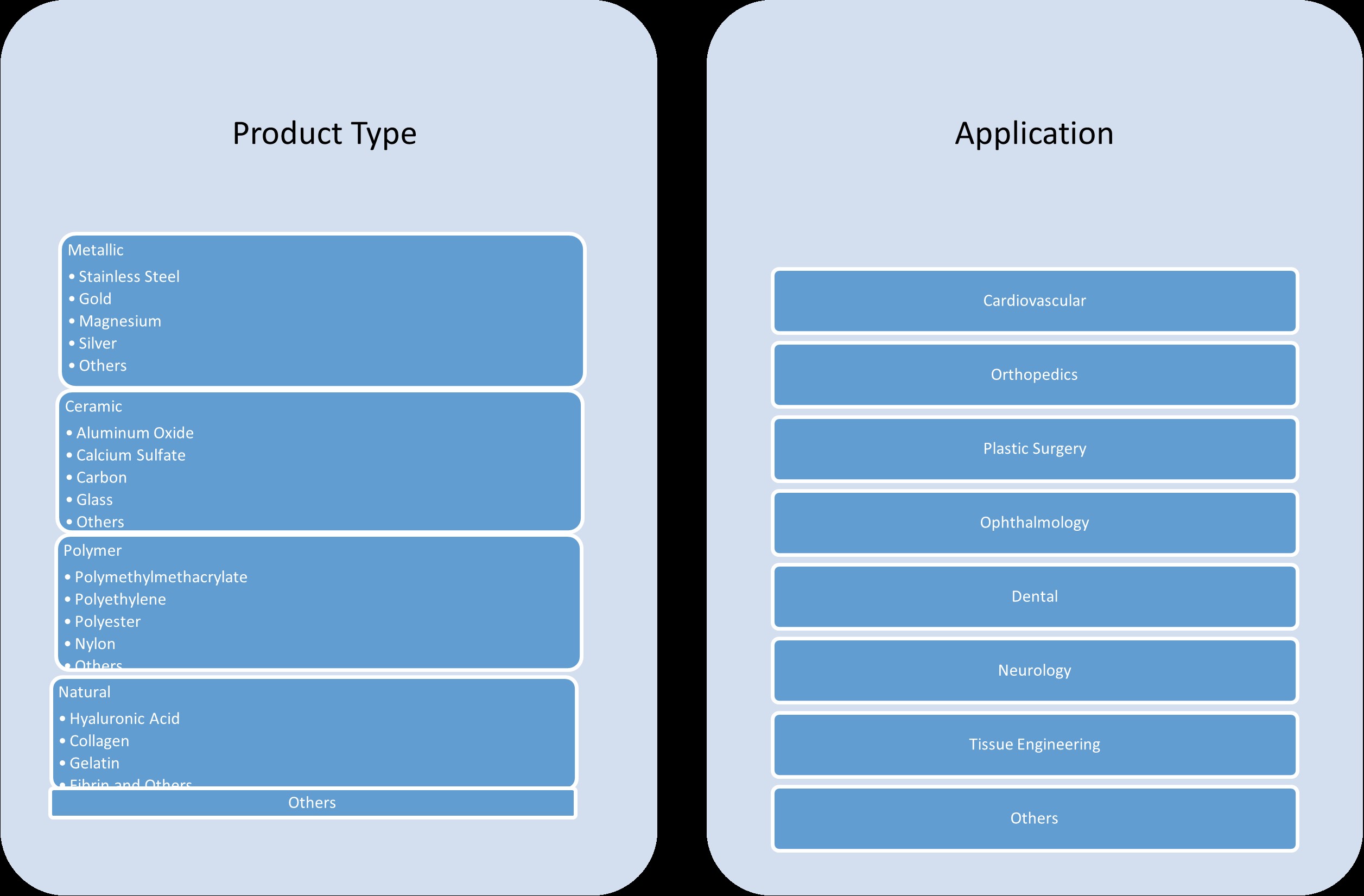

Market Segmentation Analysis:

By Product Type:

The Asia Pacific biomaterials market is diverse, with several key product types driving growth. Metallic biomaterials, including stainless steel, gold, magnesium, and silver, are widely used due to their strength, durability, and biocompatibility. Stainless steel, in particular, is commonly used in orthopedic and dental implants, while magnesium and gold are gaining attention for their unique properties in bioresorbable applications. Ceramic biomaterials such as aluminum oxide, calcium sulfate, and carbon are increasingly favored in applications that require excellent wear resistance and biocompatibility, especially in orthopedic and dental implants. Ceramic materials also support the development of innovative bone repair technologies due to their osteoconductive properties. Polymer biomaterials, including polymethylmethacrylate, polyethylene, polyester, and nylon, are widely used in medical devices and implants due to their versatility, ease of processing, and cost-effectiveness. Natural biomaterials, such as hyaluronic acid, collagen, and gelatin, are gaining traction in tissue engineering and regenerative medicine for their ability to support cell growth and repair.

By Application:

The Asia Pacific biomaterials market is segmented by application, with key areas including cardiovascular, orthopedics, plastic surgery, ophthalmology, dental, neurology, and tissue engineering. In cardiovascular applications, biomaterials are essential for creating stents, heart valves, and pacemakers, with increasing demand driven by the rising prevalence of heart diseases in the region. Orthopedics continues to be a significant segment, with biomaterials used in joint replacements, spinal implants, and bone repair. Plastic surgery applications, including implants for facial reconstruction and aesthetic procedures, also drive demand for specialized biomaterials. Ophthalmology applications, such as intraocular lenses and contact lenses, further expand the market. The dental segment benefits from the increasing use of biomaterials in implants, crowns, and dentures. Neurology applications, including biomaterials used in brain implants and neural regeneration, are emerging as a growing field. Tissue engineering, which focuses on creating scaffolds for cell growth and tissue regeneration, is a rapidly expanding area with enormous potential for biomaterials in regenerative medicine.

Segments:

Based on Product Type:

- Metallic

- Stainless Steel

- Gold

- Magnesium

- Silver

- Others

- Ceramic

- Aluminum Oxide

- Calcium Sulfate

- Carbon

- Glass

- Others

- Polymer

- Polymethylmethacrylate

- Polyethylene

- Polyester

- Nylon

- Others

- Natural

- Hyaluronic Acid

- Collagen

- Gelatin

- Fibrin and others

- Others

Based on Application:

- Cardiovascular

- Orthopedics

- Plastic Surgery

- Ophthalmology

- Dental

- Neurology

- Tissue Engineering

- Others

Based on the Geography:

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

Regional Analysis

China

China is the largest and fastest-growing market for biomaterials in the Asia Pacific region, accounting for approximately 35% of the total market share. This dominance is driven by the country’s large population, growing healthcare infrastructure, and increasing healthcare expenditures. China’s aging population and rising prevalence of chronic diseases, such as cardiovascular diseases and musculoskeletal disorders, contribute to the growing demand for biomaterials, particularly in orthopedics, cardiovascular applications, and tissue engineering. The government’s focus on improving healthcare services and the rapid development of the medical device industry further boosts the biomaterials market. Additionally, China’s growing medical tourism sector and increased adoption of advanced medical treatments are expected to fuel the demand for high-quality biomaterials in the coming years.

Japan

Japan holds a significant portion of the Asia Pacific biomaterials market, with a market share of around 25%. Japan is known for its advanced healthcare system and high adoption of medical technologies, making it a key player in the biomaterials market. The country’s aging population, combined with its increasing focus on regenerative medicine and advanced surgical techniques, drives demand for biomaterials, particularly in orthopedics, ophthalmology, and plastic surgery. Japan’s highly developed medical device industry also contributes to the growing use of biomaterials in medical implants, prosthetics, and drug delivery systems. Despite its mature market, Japan continues to see steady growth, driven by continuous innovation in biomaterials and a focus on providing high-quality healthcare solutions.

South Korea and India

South Korea and India represent emerging markets in the Asia Pacific biomaterials industry, with market shares of approximately 12% and 10%, respectively. South Korea’s rapid adoption of advanced medical technologies and its emphasis on innovation, particularly in the fields of plastic surgery and orthopedics, make it a growing market for biomaterials. The country’s strong focus on aesthetic procedures and medical tourism further supports the demand for high-quality biomaterials. India, on the other hand, is experiencing significant growth due to its large population, rising healthcare awareness, and improving healthcare infrastructure. The demand for biomaterials in India is mainly driven by the orthopedic, dental, and tissue engineering sectors. As healthcare access continues to improve in both countries, they are poised for substantial market growth over the forecast period.

Rest of Asia Pacific

The “Rest of Asia Pacific” region, which includes countries like Thailand, Indonesia, Vietnam, Malaysia, the Philippines, and Taiwan, collectively accounts for about 28% of the biomaterials market. This diverse region is witnessing increased adoption of biomaterials as healthcare infrastructure improves and populations grow. In countries like Thailand and Malaysia, the increasing prevalence of chronic diseases and the rising demand for medical implants and prosthetics are driving growth. Vietnam and Indonesia are emerging as key markets due to their growing healthcare needs and medical device markets. Taiwan’s advanced medical industry, along with rising investments in research and development, further contributes to the region’s growth. As these markets continue to develop, the demand for biomaterials is expected to grow, particularly in orthopedics, dental, and tissue engineering applications.

Key Player Analysis

- Shandong Weigao Group

- Mitsubishi Chemical

- Teijin Limited

- Amgen

- Axogen

Competitive Analysis

The Asia Pacific biomaterials market is highly competitive, with several leading players driving innovation and expanding their market presence. Key players such as Shandong Weigao Group, Mitsubishi Chemical, Teijin Limited, Amgen, and Axogen are at the forefront of the market. These companies are focusing on enhancing their product portfolios, investing in research and development, and forming strategic partnerships to strengthen their positions in the market. Leading players are heavily investing in research and development (R&D) to improve the biocompatibility, durability, and functionality of biomaterials, which are crucial for medical applications such as implants, tissue engineering, and drug delivery systems. Companies are increasingly adopting advanced manufacturing techniques, including 3D printing and biodegradable material technologies, to cater to the growing demand for customized and high-performance biomaterials. Strategic partnerships and collaborations with healthcare institutions and research organizations are also common strategies to enhance product offerings and enter new markets. Additionally, the competitive advantage is often linked to cost-effectiveness, as manufacturers seek to reduce production costs while maintaining high-quality standards. As the market grows, players are focusing on expanding their footprint in emerging markets across Southeast Asia, where improving healthcare infrastructure and rising healthcare demand present significant growth opportunities.

Recent Developments

- In April 2025, BASF expanded its EcoBalanced portfolio for Care Chemicals in North America, introducing the first EcoBalanced personal care products in the region. These include Dehyton® PK 45 and Dehyton® KE UP, both certified as EcoBalanced grades using a biomass balance (BMB) approach to reduce carbon footprint. Additionally, six U.S. Care Chemicals production sites are now powered entirely by renewable electricity, saving approximately 33,000 tons of CO₂ annually.

- In November 2024, Covestro began production of Desmophen® CQ NH, a partially bio-based polyaspartic resin (at least 25% bio-based content), at its Foshan, China site. The facility is powered entirely by renewable energy, and the product is used in wind turbine and flooring coatings, supporting both local supply and sustainability goals.

- In January 2025, BASF’s Performance Materials division transitioned all European sites to 100% renewable electricity, covering engineering plastics, polyurethanes, thermoplastic polyurethanes, and specialty polymers.

- In June 2023, Invibio announced a collaboration with Paragon Medical to scale up manufacturing of PEEK-OPTIMA Ultra-Reinforced composite trauma devices in China, responding to growing global demand for high-performance biomaterials in trauma fixation.

- In February 2023, Celanese introduced ECO-B, more sustainable versions of Acetyl Chain materials, incorporating mass balance bio-content to provide chemically identical, bio-based alternatives for engineered materials.

Market Concentration & Characteristics

The Asia Pacific biomaterials market exhibits moderate to high concentration, with a mix of well-established global players and emerging regional companies. Leading multinational corporations dominate the market, leveraging their extensive research and development (R&D) capabilities, vast distribution networks, and strong brand recognition. However, regional players are also making significant strides by catering to local healthcare needs and developing specialized biomaterials for specific applications such as orthopedics, dental, and tissue engineering. The market is characterized by rapid technological advancements, including the adoption of 3D printing and biodegradable materials, which are reshaping the competitive landscape. Innovation is a key characteristic, with companies focusing on enhancing the performance, biocompatibility, and cost-efficiency of biomaterials. Additionally, increasing investments in R&D, strategic partnerships, and collaborations with healthcare providers are common strategies used by market players to strengthen their positions and drive growth in the highly dynamic and competitive environment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Asia Pacific biomaterials market is expected to witness significant growth driven by increasing healthcare demand and an aging population.

- Technological advancements, including 3D printing and biodegradable materials, will play a key role in shaping the market’s future.

- The growing trend of personalized medicine will drive the demand for custom-made biomaterials tailored to individual patient needs.

- Expansion of healthcare infrastructure in emerging markets, particularly in Southeast Asia, will create new growth opportunities for biomaterials.

- Rising prevalence of chronic diseases, such as cardiovascular and musculoskeletal disorders, will fuel demand for advanced biomaterials in medical treatments.

- Regenerative medicine and tissue engineering will see increased adoption, further boosting the demand for specialized biomaterials.

- Companies will continue to invest heavily in R&D to enhance the biocompatibility and functionality of biomaterials for medical implants and drug delivery systems.

- Increased collaboration between biomaterial manufacturers and healthcare institutions will drive innovation and facilitate the development of new applications.

- The market will see more regional players emerge, focusing on local needs and offering cost-effective solutions to cater to diverse healthcare systems.

- Sustainability and environmental concerns will lead to a greater focus on developing eco-friendly biomaterials to meet regulatory and consumer demands.