| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Asia Pacific Construction Aggregates Market Size 2024 |

USD 95,654.89 million |

| Asia Pacific Construction Aggregates Market, CAGR |

6.34% |

| Asia Pacific Construction Aggregates Market Size 2032 |

USD 1,56,471.95 million |

Market Overview

Asia Pacific Construction Aggregates Market size was valued at USD 95,654.89 million in 2024 and is anticipated to reach USD 1,56,471.95 million by 2032, at a CAGR of 6.34% during the forecast period (2024-2032).

The Asia Pacific construction aggregates market is driven by rapid urbanization, infrastructure development, and government investments in smart cities and transportation networks. Rising residential and commercial construction, particularly in emerging economies like India and China, fuels aggregate demand. The growing emphasis on sustainable and recycled aggregates due to environmental concerns and stringent regulations further shapes the market. Technological advancements, such as automated crushing and screening equipment, enhance efficiency and cost-effectiveness. Additionally, increasing foreign direct investments (FDIs) in construction and real estate sectors strengthen market expansion. The region’s booming e-commerce industry also contributes to demand for warehousing and logistics infrastructure. However, fluctuations in raw material prices and environmental restrictions on quarrying activities pose challenges. To mitigate supply chain risks, companies are adopting digital solutions for real-time monitoring and resource optimization. Overall, the Asia Pacific construction aggregates market is poised for steady growth, supported by infrastructure modernization and eco-friendly material innovations.

The Asia Pacific construction aggregates market is geographically diverse, with strong demand across both developed and emerging economies. China, India, Japan, South Korea, Australia, and Southeast Asian nations like Indonesia, Vietnam, and Thailand are key contributors to market growth. Rapid urbanization, large-scale infrastructure projects, and industrial expansion drive demand for aggregates in these regions. Governments are investing heavily in smart cities, transportation networks, and commercial real estate, further boosting the market. Additionally, sustainability concerns are promoting the adoption of recycled aggregates and eco-friendly construction materials. Key players in the Asia Pacific construction aggregates market include CRH plc, China National Building Material Co. Ltd, Colas Group, Siam Cement Group (SCG), CEMEX S.A.B. de C.V., Heidelberg Materials AG, EUROVIA Kamenolomy AS, Sika AG, Vulcan Materials Company, Martin Marietta Materials Inc., Fletcher Building, Buzzi S.p.A., Boral Limited, Tarmac, LSR Group, and Adbri Limited, all of whom are focusing on innovation and expansion strategies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Asia Pacific construction aggregates market was valued at USD 95,654.89 million in 2024 and is expected to reach USD 156,471.95 million by 2032, growing at a CAGR of 6.34% during the forecast period.

- Rapid urbanization and infrastructure development, particularly in China and India, are key drivers boosting aggregate demand.

- The market is witnessing a shift toward sustainable and recycled aggregates due to environmental regulations and resource depletion concerns.

- Major players, including CRH plc, China National Building Material Co. Ltd, and Siam Cement Group (SCG), are expanding their product portfolios and adopting advanced processing technologies.

- Fluctuations in raw material prices, strict mining regulations, and logistical challenges act as market restraints, impacting supply chains and operational costs.

- China dominates the regional market, followed by India, Japan, and Southeast Asian countries, with strong demand from residential, commercial, and industrial sectors.

- Advancements in AI-driven quarrying, automated screening, and digital supply chain solutions are enhancing efficiency and cost-effectiveness.

Report Scope

This report segments the Asia Pacific Construction Aggregates Market as follows:

Market Drivers

Rapid Urbanization and Infrastructure Development

The Asia Pacific construction aggregates market is primarily driven by rapid urbanization and large-scale infrastructure projects. Countries like China, India, and Indonesia are witnessing significant population growth in urban centers, leading to a surge in residential and commercial construction. For instance, the Indian government’s Smart Cities Mission has initiated projects in over 100 cities, focusing on urban renewal and retrofitting. Governments across the region are heavily investing in smart cities, transportation networks, and public infrastructure, which require substantial amounts of aggregates for roadways, bridges, railways, and airports. These developments directly boost the demand for construction aggregates, positioning the industry for long-term growth.

Government Investments and Policy Support

Strategic government initiatives play a crucial role in shaping the construction aggregates market. For instance, India’s National Infrastructure Pipeline (NIP) has allocated significant funding for urban infrastructure, including affordable housing and sustainable urban development. Large-scale public-private partnerships (PPPs) and foreign direct investments (FDIs) in real estate and infrastructure sectors are fostering industry expansion. Many governments in the region are focusing on affordable housing projects and sustainable urban development, further fueling aggregate consumption. Additionally, regulatory policies promoting sustainable mining practices and the use of recycled aggregates are driving innovation in the market.

Technological Advancements in Aggregate Processing

The adoption of advanced technologies in aggregate processing and production is another key driver of market growth. Automated crushing and screening equipment, along with digital monitoring solutions, are improving efficiency and reducing operational costs. The integration of AI and IoT in quarrying and mining operations helps optimize resource utilization and enhance environmental compliance. These advancements enable manufacturers to meet rising demand while adhering to stringent quality and sustainability standards, ensuring long-term market competitiveness.

Sustainability and the Shift Toward Recycled Aggregates

Environmental concerns and regulatory restrictions on quarrying activities are prompting a shift toward sustainable and recycled aggregates. Construction waste recycling is gaining traction, reducing reliance on natural aggregates and minimizing environmental impact. Many companies are investing in eco-friendly production techniques, such as carbon capture in cement manufacturing and the use of industrial by-products in aggregate production. The growing preference for green construction materials among developers and consumers is further accelerating the adoption of sustainable aggregates, ensuring the industry’s alignment with global environmental goals.

Market Trends

Rising Demand for Sustainable and Recycled Aggregates

The Asia Pacific construction aggregates market is witnessing a strong shift toward sustainability, driven by increasing environmental regulations and growing awareness of eco-friendly construction materials. Governments and industry players are emphasizing the use of recycled aggregates sourced from construction and demolition waste to reduce dependence on natural resources. For instance, Japan has implemented policies to encourage the recycling of construction waste, significantly reducing reliance on natural aggregates. The adoption of circular economy practices in the construction sector is further encouraging the development of innovative recycling technologies. This trend not only minimizes environmental impact but also reduces material costs, making sustainable aggregates a preferred choice for infrastructure projects.

Technological Integration in Aggregate Processing

The integration of advanced technologies, such as artificial intelligence (AI), automation, and the Internet of Things (IoT), is transforming aggregate processing and supply chain management. Smart quarrying techniques, including automated crushing, screening, and real-time monitoring systems, are enhancing production efficiency while maintaining quality standards. Additionally, digital tracking solutions are improving logistics, reducing wastage, and optimizing resource utilization. As construction companies seek to enhance operational efficiency and reduce costs, the demand for tech-driven aggregate solutions continues to rise.

Expansion of Infrastructure and Mega Projects

Large-scale infrastructure projects, including highways, rail networks, airports, and smart city developments, are fueling the demand for construction aggregates across Asia Pacific. For instance, China’s Belt and Road Initiative (BRI) has led to extensive infrastructure investments, including high-speed rail networks and urban transit systems. Countries like China, India, and Indonesia are leading the way with extensive government-backed infrastructure investments. The Belt and Road Initiative (BRI) and other regional development programs are further boosting aggregate consumption. This trend is expected to continue as urbanization accelerates and governments prioritize long-term infrastructure modernization.

Increasing Foreign Direct Investment in Construction

Foreign direct investment (FDI) in the Asia Pacific construction sector is playing a crucial role in market expansion. Global investors are actively participating in commercial real estate, industrial zones, and residential developments, leading to increased demand for aggregates. With rapid industrialization and the growth of e-commerce, the need for logistics hubs and warehouses is also rising, further driving aggregate consumption. As favorable investment policies and economic growth attract more foreign players, the construction aggregates market is expected to witness steady expansion in the coming years.

Market Challenges Analysis

Environmental Regulations and Resource Depletion

The Asia Pacific construction aggregates market faces significant challenges due to stringent environmental regulations and the depletion of natural resources. Governments are enforcing stricter policies on quarrying activities to curb deforestation, soil erosion, and air pollution caused by dust emissions. These regulations often lead to delays in obtaining mining permits and higher compliance costs for aggregate producers. Additionally, excessive extraction of natural aggregates is depleting reserves, making it difficult to meet the growing demand. As a result, companies must invest in sustainable alternatives, such as recycled aggregates, which require advanced processing technologies and higher initial capital investment.

Fluctuating Raw Material Prices and Supply Chain Disruptions

Volatility in raw material prices and supply chain disruptions pose major hurdles for the construction aggregates market. Factors such as fuel price fluctuations, labor shortages, and geopolitical uncertainties affect production costs and logistics. For instance, during the COVID-19 pandemic, supply chain vulnerabilities were exposed, leading to material shortages and project delays across countries like India and Indonesia. Additionally, transportation bottlenecks, especially in densely populated or remote areas, further escalate costs and impact timely project execution. To mitigate these risks, companies are increasingly adopting digital supply chain management solutions and diversifying sourcing strategies, but these adjustments require significant investment and operational restructuring.

Market Opportunities

The Asia Pacific construction aggregates market presents significant growth opportunities driven by rapid urbanization and large-scale infrastructure development. Governments across the region are investing heavily in transportation networks, smart cities, and residential housing projects, increasing the demand for high-quality aggregates. Emerging economies such as India, Indonesia, and Vietnam are witnessing a surge in construction activities, fueled by population growth and rising disposable incomes. Additionally, foreign direct investment (FDI) in the real estate and industrial sectors is creating new avenues for market expansion. The ongoing Belt and Road Initiative (BRI) and other cross-border infrastructure projects are further boosting aggregate consumption, offering long-term growth prospects for industry players.

Sustainability and innovation in aggregate production also present lucrative opportunities. The shift toward eco-friendly materials and recycled aggregates is gaining momentum due to stringent environmental regulations and the push for green construction practices. Companies that invest in advanced processing technologies, such as automated crushing and digital monitoring systems, can enhance operational efficiency and meet the rising demand for sustainable aggregates. Additionally, the development of lightweight and high-performance aggregates for specialized construction applications, such as high-rise buildings and earthquake-resistant structures, is opening new market segments. By embracing technological advancements and sustainable practices, businesses can position themselves as leaders in the evolving construction materials industry, ensuring long-term profitability and market relevance.

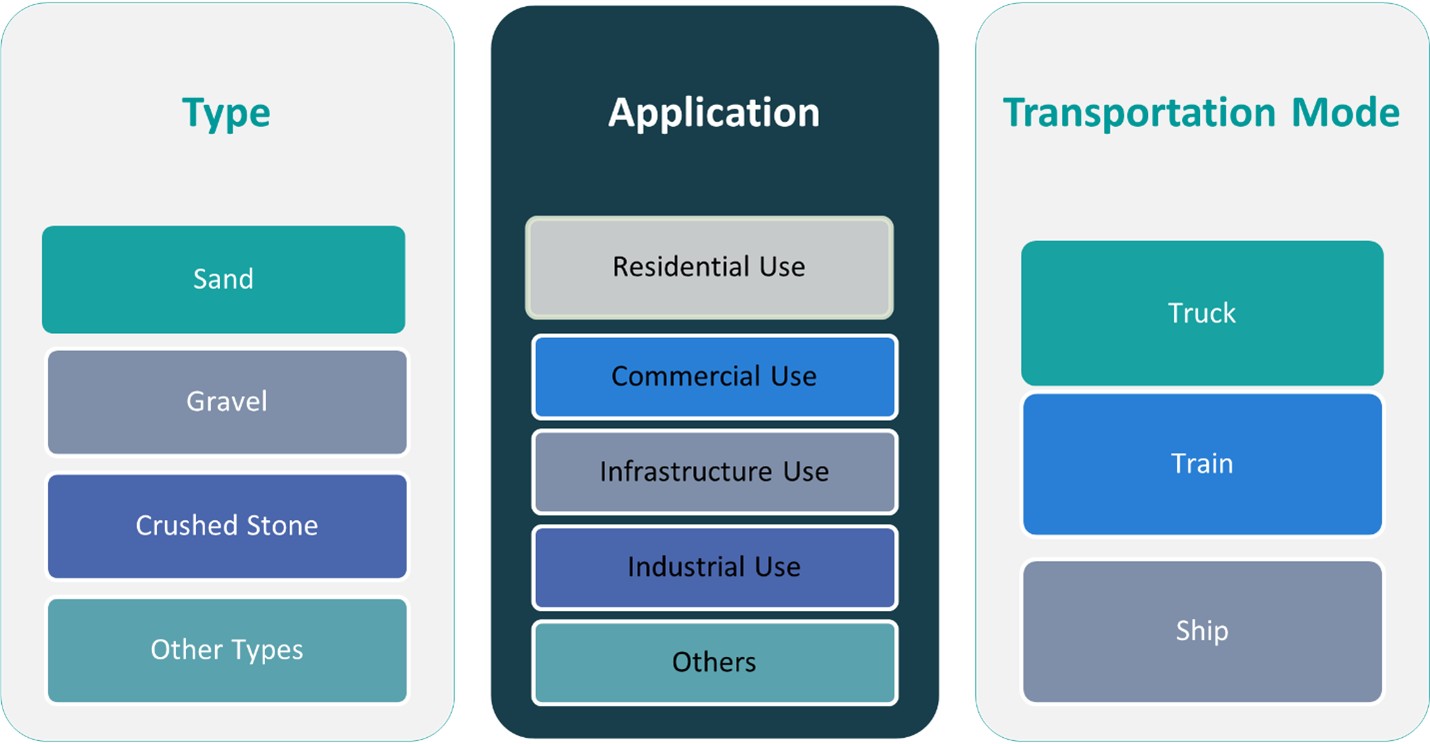

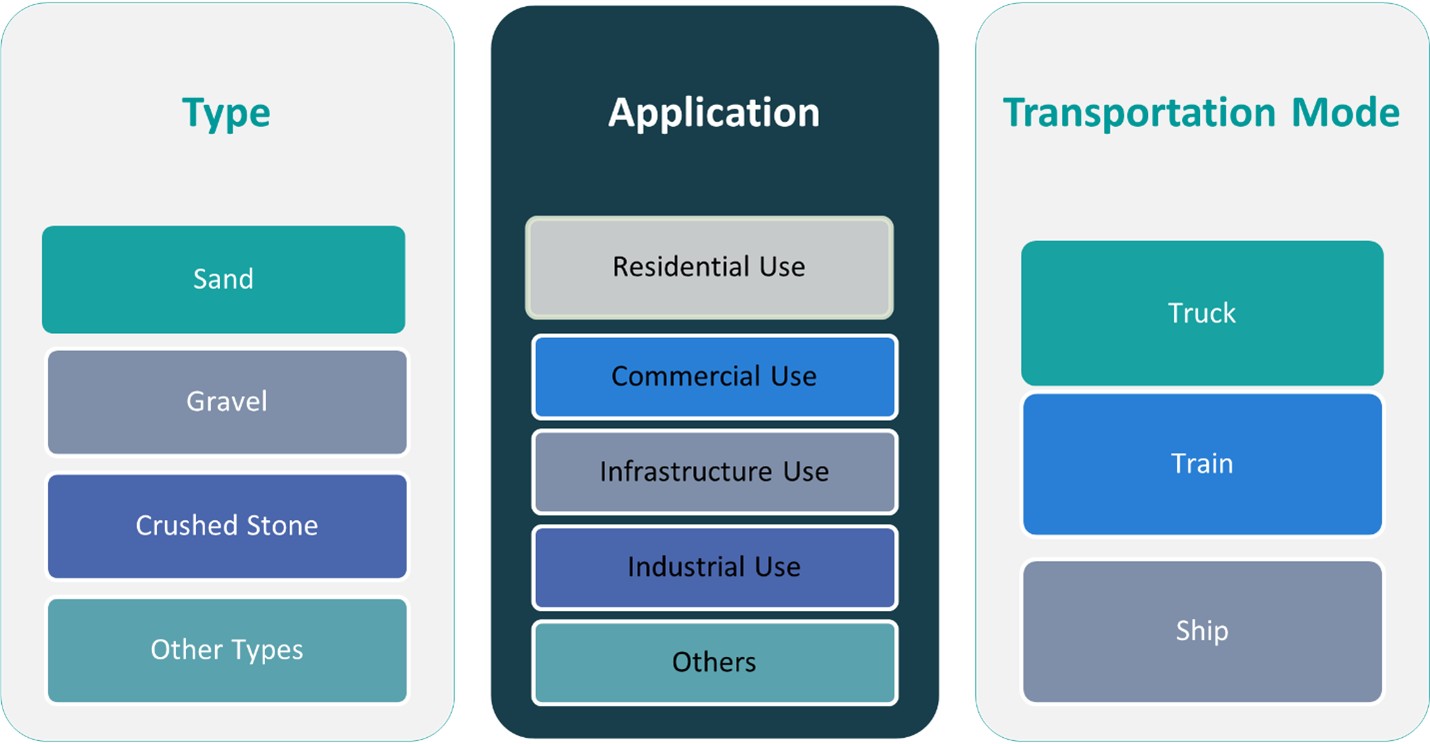

Market Segmentation Analysis:

By Type:

The Asia Pacific construction aggregates market is segmented by type into sand, gravel, crushed stone, and other materials. Sand is the most widely used aggregate, driven by its essential role in concrete production and masonry work. However, increasing environmental restrictions on river sand mining have led to the growing use of manufactured sand (M-sand) as a sustainable alternative. Gravel is another key segment, commonly used in road construction, railway ballast, and drainage systems due to its durability and strength. The demand for crushed stone is also rising, particularly in large-scale infrastructure projects, as it provides superior load-bearing capacity and structural stability. Other aggregates, such as slag and recycled concrete, are gaining traction as sustainable solutions to reduce reliance on natural resources. With advancements in aggregate processing and stricter environmental regulations, the market is shifting toward eco-friendly and high-performance alternatives, ensuring continued growth across all segments.

By Application:

Based on application, the Asia Pacific construction aggregates market is categorized into residential, commercial, infrastructure, and industrial use. The residential sector holds a significant share, fueled by increasing urbanization, government-led affordable housing programs, and rising disposable incomes. Commercial construction, including office spaces, shopping complexes, and hotels, is also a major contributor, driven by economic expansion and foreign direct investment. Infrastructure projects, such as highways, bridges, airports, and rail networks, represent a crucial market segment, with governments across the region prioritizing large-scale development initiatives. Additionally, the industrial sector, which includes manufacturing plants, logistics hubs, and energy projects, is witnessing steady demand for high-quality aggregates. With continued investment in real estate, transportation, and industrial expansion, the application-based demand for construction aggregates is expected to remain strong, providing substantial growth opportunities for market players.

Segments:

Based on Type:

- Sand

- Gravel

- Crushed Stone

- Other Types

Based on Application:

- Residential Use

- Commercial Use

- Infrastructure Use

- Industrial Use

Based on End- User:

Based on the Geography:

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

Regional Analysis

China

China leads the market, holding approximately 45% of the Asia Pacific construction aggregates market share. This dominance is driven by rapid urbanization and extensive infrastructure projects, including the Belt and Road Initiative, which have escalated the demand for construction materials. The country’s commitment to urban development and industrial expansion continues to fuel the need for aggregates.

Japan and South Korea

Japan and South Korea also represent notable portions of the market. Japan accounts for 9% of the region’s market share, while South Korea holds 4%. In Japan, the demand is primarily driven by maintenance projects, reconstruction efforts, and infrastructure upgrades, reflecting a mature construction industry. South Korea’s market benefits from urban development initiatives and technological advancements in construction practices, contributing to its steady growth.

India

India holds a 5% share of the Asia Pacific construction aggregates market. The country’s market is expanding due to rapid urbanization and government initiatives like the Smart Cities Mission, which promote investments in housing and urban infrastructure projects. The increasing population and urban migration further amplify the demand for construction aggregates in India.

Southeast Asian

The Southeast Asian region, including countries like Indonesia, Vietnam, Thailand, and the Philippines, collectively accounts for a significant portion of the market. Indonesia, for instance, holds a 7% share. The growing demand in these nations is attributed to rising disposable incomes, urban population growth, and government-led infrastructure initiatives. However, challenges such as regulatory complexities and logistical limitations can impact market expansion. Emphasis on sustainable practices and environmental regulations is also shaping the demand for recycled aggregates and eco-friendly construction materials in these countries.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- CRH plc

- China National Building Material Co. Ltd

- Colas Group

- Siam Cement Group (SCG)

- CEMEX S.A.B. de C.V.

- Heidelberg Materials AG

- EUROVIA Kamenolomy AS

- Sika AG

- Vulcan Materials Company

- Martin Marietta Materials Inc.

- Fletcher Building

- Buzzi S.p.A.

- Boral Limited

- Tarmac

- LSR Group

- Adbri Limited

Competitive Analysis

The Asia Pacific construction aggregates market is highly competitive, with major players focusing on expansion, technological advancements, and sustainable solutions to strengthen their market positions. Leading companies such as CRH plc, China National Building Material Co. Ltd, Colas Group, Siam Cement Group (SCG), CEMEX S.A.B. de C.V., Heidelberg Materials AG, EUROVIA Kamenolomy AS, Sika AG, Vulcan Materials Company, Martin Marietta Materials Inc., Fletcher Building, Buzzi S.p.A., Boral Limited, Tarmac, LSR Group, and Adbri Limited are actively investing in modernizing production facilities and optimizing supply chains. Many of these companies are adopting eco-friendly practices, such as manufacturing recycled aggregates and implementing sustainable mining techniques, to comply with stringent environmental regulations. Additionally, firms are expanding their geographic presence through mergers, acquisitions, and joint ventures to capitalize on the region’s infrastructure boom. The increasing adoption of AI and automation in aggregate processing is also intensifying competition, as companies strive to enhance operational efficiency and reduce costs. Despite market fragmentation, key players with strong distribution networks and innovative product offerings continue to dominate, making technological adaptation and sustainability essential for maintaining a competitive edge in the evolving construction materials industry.

Recent Developments

- In September 2024, Holcim started the Holcim Sustainable Construction Academy. This is a free online training program that teaches about eco-friendly building methods. It helps people who work in construction learn new skills. The program offers both online classes and face-to-face training.

- In October 2024, CRH Ventures launched the Sustainable Building Materials accelerator to scale up creative climate and build technology firms that specialize in CO2-mineralized materials and sustainable binder solutions.

- In July 2024, Heidelberg Materials launched a recycling plant in Katowice, Poland, using a patented ReConcrete process to recycle demolition concrete and replace virgin material.

- In July 2024, Cemex USA formed a joint venture with Couch Aggregates and Premier Holdings for the production and distribution of aggregates in the Mid-South region. Cemex USA already had a strategic partnership with Couch Aggregates. The company stated that this vertical integration, combined with Premier Holdings’ Gulf Coast marine terminals, would accelerate its regional growth.

- In April 2024, Rogers Group joined The Road Forward initiative to advance sustainable asphalt production and paving practices.

- In January 2024, Heidelberg Materials launched Evo Build, its new global brand for low-carbon and circular products. This initiative aims to provide sustainable solutions for the construction industry, focusing on reducing carbon emissions and promoting circular economy principles.

Market Concentration & Characteristics

The Asia Pacific construction aggregates market exhibits a moderate to high level of concentration, with a mix of global industry leaders and regional players competing for market share. Large multinational corporations such as CRH plc, China National Building Material Co. Ltd, and Siam Cement Group (SCG) dominate the market through extensive production capacities, advanced technologies, and strong distribution networks. Meanwhile, regional and local manufacturers cater to niche markets, benefiting from proximity to raw material sources and lower operational costs. The market is characterized by high demand variability, driven by infrastructure projects, urbanization, and economic growth in key countries like China, India, Japan, and Indonesia. Additionally, environmental concerns and stringent mining regulations are pushing companies to adopt sustainable production methods and invest in recycled aggregates. As technological advancements and government policies continue to shape the industry, market players must focus on innovation and efficiency to maintain competitiveness in this evolving landscape

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Transportation Mode and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Asia Pacific construction aggregates market will continue to grow steadily, driven by increasing urbanization and infrastructure development.

- Governments will invest heavily in smart cities, highways, rail networks, and commercial real estate projects, boosting aggregate demand.

- The adoption of sustainable and recycled aggregates will rise due to strict environmental regulations and resource conservation efforts.

- Technological advancements in AI, automation, and digital monitoring will improve efficiency and reduce operational costs in aggregate production.

- China will remain the dominant market, while India, Indonesia, and Vietnam will experience rapid growth due to industrialization and urban expansion.

- Major players will focus on mergers, acquisitions, and strategic partnerships to strengthen their market positions and expand geographically.

- Supply chain optimization and improved logistics management will play a crucial role in overcoming transportation challenges and cost fluctuations.

- The demand for high-performance aggregates in specialized construction applications like earthquake-resistant structures will increase.

- Government policies promoting green building materials will drive innovation and new product development in the market.

- Rising foreign direct investment in the construction sector will create new growth opportunities for aggregate manufacturers across the region.