| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Asia Pacific Cyber Physical Systems Market Size 2024 |

USD 37,261.95 Million |

| Asia Pacific Cyber Physical Systems Market, CAGR |

11.42% |

| Asia Pacific Cyber Physical Systems Market Size 2032 |

USD 88,523.21 Million |

Market Overview:

The Asia Pacific Cyber Physical Systems Market is projected to grow from USD 37,261.95 million in 2024 to an estimated USD 88,523.21 million by 2032, with a compound annual growth rate (CAGR) of 11.42% from 2024 to 2032.

The growth of the Asia Pacific Cyber-Physical Systems (CPS) market is fueled by several factors, including rapid industrialization, advancements in smart infrastructure, and the proliferation of new technologies. Countries such as China, Japan, and India are embracing Industry 4.0, which drives the automation of manufacturing processes, enhancing operational efficiency and increasing the adoption of CPS solutions. Additionally, the push for smart cities and infrastructure investments in urban planning, traffic management, and public services is creating significant opportunities for CPS applications. Technological advancements, particularly in the Internet of Things (IoT) and artificial intelligence (AI), further enhance CPS capabilities, enabling real-time data processing and decision-making across multiple sectors. Government initiatives, such as India’s National Smart Grid Mission, are also promoting CPS integration in energy management, contributing to sustainability and efficiency.

Regionally, the Asia Pacific market is poised to dominate the global CPS market due to rapid industrialization, urbanization, and government support for digital transformation. With major economies like China and India leading the way, the demand for CPS in manufacturing, energy, healthcare, and transportation is growing at an accelerated pace. The region is also heavily investing in smart city projects that require CPS to enhance urban living, optimize energy use, and improve public services. The widespread adoption of IoT and AI across industries further propels CPS applications, particularly in sectors like healthcare, automotive, and energy. Government policies supporting innovation and the implementation of smart technologies are creating a favorable environment for the continued expansion of CPS in the region.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Asia Pacific Cyber-Physical Systems market is projected to grow from USD 37,261.95 million in 2024 to USD 88,523.21 million by 2032, with a CAGR of 11.42%.

- The Global Cyber Physical Systems is projected to grow from USD 1,25,271.30 million in 2024 to an estimated USD 2,71,668.59 million by 2032, with a compound annual growth rate (CAGR) of 10.16% from 2024 to 2032.

- The region is driving CPS adoption through rapid industrialization, with countries like China, Japan, and India embracing Industry 4.0 technologies to enhance operational efficiency.

- Smart city initiatives are contributing to CPS growth as urban areas invest in infrastructure projects for traffic, energy, and waste management, enhancing sustainability.

- Technological advancements in IoT and AI are key enablers of CPS, enabling real-time data processing and decision-making across multiple industries.

- Government policies and initiatives, such as India’s National Smart Grid Mission and China’s “Made in China 2025,” are promoting CPS integration in energy and industrial sectors.

- High implementation costs, including hardware and workforce training, remain a significant barrier, particularly for small and medium-sized enterprises.

- Data security concerns and the integration of CPS with legacy systems continue to pose challenges, requiring robust cybersecurity measures and system updates for seamless adoption.

Market Drivers:

Industrial Automation and Industry 4.0 Adoption

The increasing adoption of Industry 4.0 principles across the Asia Pacific region is one of the primary drivers for the growth of Cyber-Physical Systems (CPS). Countries such as China, Japan, and South Korea are heavily investing in industrial automation to streamline manufacturing processes, enhance productivity, and reduce operational costs. For instance, China’s “Made in China 2025” initiative emphasizes integrating advanced automation technologies to maintain competitiveness in manufacturing. Industry 4.0 is centered on the integration of advanced technologies like IoT, AI, and robotics, which are essential components of CPS. This technological evolution allows manufacturers to create highly efficient, interconnected systems that optimize resource usage, improve product quality, and enable predictive maintenance, driving demand for CPS solutions in industrial environments.

Smart City Initiatives and Infrastructure Development

Urbanization and the rise of smart city initiatives across Asia Pacific are accelerating the need for CPS to manage critical infrastructure. As cities grow, they require innovative solutions for transportation, energy management, water supply, and waste management. For example, India’s National Smart Grid Mission integrates CPS into energy management systems to modernize the power sector. CPS technologies play a pivotal role in the development of smart cities by enabling real-time monitoring and optimization of these systems. Governments in the region are actively investing in building smart infrastructure that integrates sensors, networks, and data analytics. These developments create significant opportunities for CPS solutions to drive efficiency, sustainability, and improved quality of life in urban environments, fueling market growth.

Technological Advancements in IoT and Artificial Intelligence

Technological advancements, particularly in the Internet of Things (IoT) and artificial intelligence (AI), are key enablers of the CPS market. The increasing proliferation of IoT devices and sensors allows for the seamless collection of real-time data from physical systems. Coupled with AI, this data is analyzed to provide valuable insights, automate decision-making, and improve system performance. In sectors such as healthcare, automotive, and energy, CPS solutions are transforming operations by providing autonomous control, predictive capabilities, and enhanced system reliability. The continuous advancements in both IoT and AI technologies are expanding the potential applications of CPS, further driving its adoption in the region.

Government Policies and Digital Transformation Support

Government policies and initiatives across Asia Pacific are another significant driver of CPS market growth. Governments in countries such as India, China, and Japan are promoting digital transformation through favorable policies, investments in technology infrastructure, and the development of smart grids, digital healthcare systems, and automation in industries. For example, India’s National Smart Grid Mission aims to modernize the power sector by integrating CPS into energy management systems. Similarly, China’s “Made in China 2025” initiative emphasizes the need for automation and technological innovation, encouraging the adoption of CPS across various sectors. These supportive policies create an environment conducive to the growth of CPS technologies, enabling businesses and governments to leverage the benefits of cyber-physical integration.

Market Trends:

Increasing Integration of Artificial Intelligence and Machine Learning

One of the prominent market trends in the Asia Pacific Cyber-Physical Systems (CPS) market is the growing integration of Artificial Intelligence (AI) and Machine Learning (ML) technologies. As AI and ML become more advanced, they are increasingly being incorporated into CPS to enhance automation and decision-making processes. By leveraging AI algorithms, CPS can analyze large volumes of real-time data generated by IoT devices, providing predictive analytics and improving system performance. For instance, in manufacturing, AI-powered CPS can predict machine failures before they occur, reducing downtime and improving operational efficiency. This trend is expected to continue, with AI and ML playing a central role in the evolution of smart systems across multiple industries in the region.

Rise of Edge Computing for Real-Time Processing

Another key trend reshaping the Asia Pacific CPS market is the rise of edge computing. With the proliferation of IoT devices and the increasing volume of data being generated, there is a growing demand for real-time data processing. Edge computing brings computation closer to the data source, enabling faster decision-making by processing data at the edge of the network rather than relying solely on centralized cloud infrastructure. This is particularly important in sectors like autonomous vehicles, healthcare, and industrial automation, where timely data analysis is critical. The adoption of edge computing is accelerating as it enhances the efficiency, reliability, and scalability of CPS applications, helping to meet the demands of real-time operations across industries.

Expansion of Smart Manufacturing and Industry 4.0 Applications

The Asia Pacific region is seeing significant growth in smart manufacturing, driven by the widespread adoption of Industry 4.0 technologies. Manufacturers are increasingly relying on CPS to optimize production lines, enhance product quality, and reduce costs. The integration of cyber-physical systems with advanced robotics, IoT devices, and real-time monitoring systems allows for more efficient and flexible manufacturing processes. In countries like Japan and South Korea, CPS is becoming a critical part of factory automation, enabling real-time insights into machine performance, inventory management, and supply chain optimization. For example, Japan has invested heavily in CPS for its manufacturing sector, leveraging real-time data processing to optimize production lines and supply chains. As smart manufacturing continues to expand, the demand for CPS solutions in this sector is expected to increase, further contributing to the market’s growth.

Growth of CPS in Healthcare and Remote Monitoring Systems

Healthcare is another sector where CPS is making significant strides. The trend of adopting connected medical devices and remote monitoring systems is gaining traction in the Asia Pacific region, particularly as the demand for telemedicine and digital health solutions increases. CPS technologies enable healthcare providers to remotely monitor patients, collect data from medical devices, and deliver more personalized care. In countries like China and India, where there are challenges related to healthcare accessibility and infrastructure, CPS offers a viable solution to improve patient outcomes. The integration of CPS into healthcare systems is also supporting advancements in areas like robotic surgery, patient tracking, and wearable health devices. As healthcare systems in the region continue to modernize, the adoption of CPS technologies is expected to grow significantly, improving overall healthcare delivery and efficiency.

Market Challenges Analysis:

High Implementation Costs

One of the primary restraints hindering the growth of the Cyber-Physical Systems (CPS) market in Asia Pacific is the high cost of implementation. The integration of CPS into existing infrastructure requires significant investments in advanced hardware, software, and specialized workforce training. Many organizations, particularly small and medium-sized enterprises (SMEs), face financial challenges in adopting these complex systems. The upfront costs involved in CPS deployment, including purchasing IoT devices, sensors, and ensuring the necessary connectivity, may deter businesses from transitioning to smarter, more efficient operations. These high costs can limit the widespread adoption of CPS in certain industries, particularly in developing economies within the region.

Data Security and Privacy Concerns

Data security and privacy concerns pose another significant challenge to the growth of CPS in Asia Pacific. As CPS relies heavily on interconnected devices and the collection of vast amounts of real-time data, there is an increased risk of cyber threats and data breaches. In sectors such as healthcare, finance, and manufacturing, where sensitive data is involved, ensuring the security of information is paramount. The lack of robust cybersecurity measures can result in vulnerabilities, leading to potential data theft or system manipulation. Furthermore, differing regulatory standards across countries in the region complicate the enforcement of consistent data protection protocols, creating challenges for organizations looking to deploy CPS solutions securely.

Integration with Legacy Systems

Many industries in Asia Pacific continue to rely on legacy systems that may not be compatible with modern CPS technologies. The integration of advanced cyber-physical systems with older infrastructure can be complex and time-consuming, requiring considerable customization. This challenge is particularly pronounced in industries like manufacturing and energy, where legacy equipment is still widely used. For example, HSBC faced significant hurdles when modernizing its core banking systems due to data incompatibility and technological obsolescence. The reluctance or inability to replace these older systems creates a barrier to the seamless deployment of CPS, limiting the full potential of these systems and increasing the time required for system upgrades.

Lack of Skilled Workforce

The shortage of skilled professionals in fields like AI, machine learning, and IoT is another challenge facing the CPS market in Asia Pacific. Effective deployment and management of CPS require a high level of technical expertise, and there is a growing demand for engineers, data scientists, and cybersecurity professionals. However, the talent pool in the region is not yet sufficiently large to meet this demand. This skills gap can delay the implementation of CPS solutions and hinder the overall growth of the market.

Market Opportunities:

The Asia Pacific Cyber-Physical Systems (CPS) market presents significant opportunities driven by rapid technological advancements and the region’s increasing focus on digital transformation. One of the key opportunities lies in the burgeoning smart manufacturing sector, particularly as industries across countries like China, Japan, and South Korea adopt Industry 4.0 practices. The integration of CPS into production lines offers manufacturers the potential to optimize processes, reduce costs, and improve quality control through real-time data collection and analysis. With an expanding industrial base and rising demand for automation, businesses in the region can capitalize on CPS to gain competitive advantages in the global market.

Additionally, the growing adoption of smart city initiatives in Asia Pacific presents a substantial opportunity for CPS solutions. Governments across the region are investing heavily in infrastructure development, including energy management systems, traffic control, and waste management, all of which require robust cyber-physical integration. As urbanization continues to accelerate, CPS will play a pivotal role in managing these complex systems more efficiently. Furthermore, the increasing need for remote monitoring and digital health solutions in the healthcare sector offers another promising avenue for CPS growth. With advancements in IoT, AI, and machine learning, CPS can improve patient care, streamline medical operations, and enhance service delivery, creating a wealth of opportunities for healthcare providers and technology companies alike.

Market Segmentation Analysis:

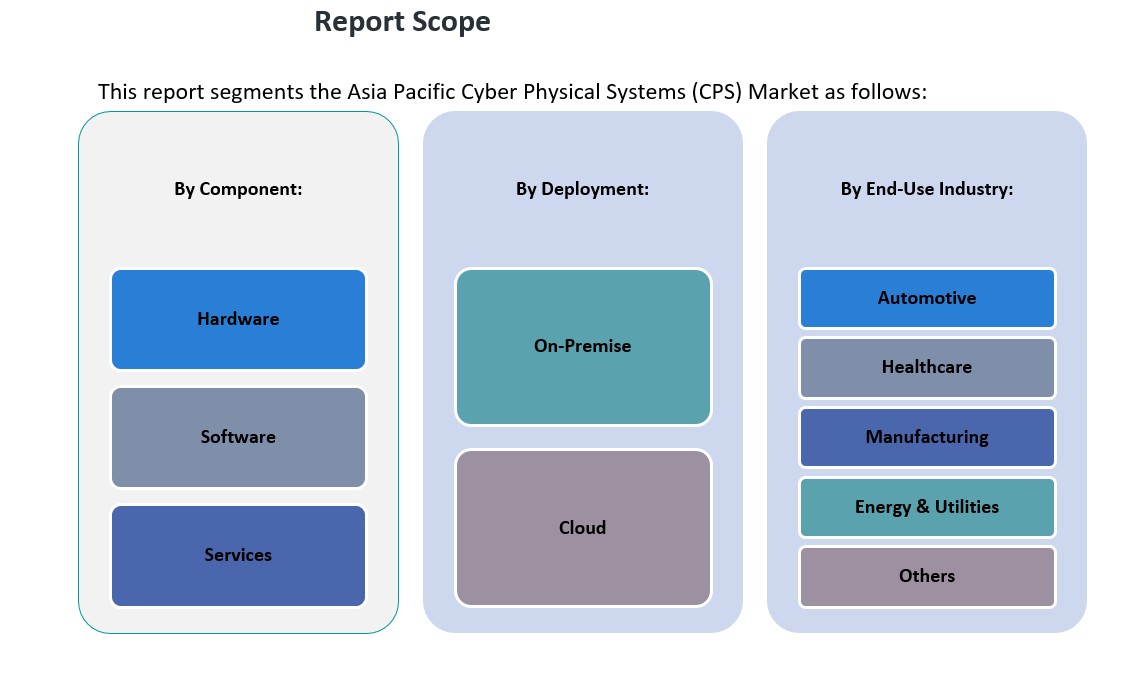

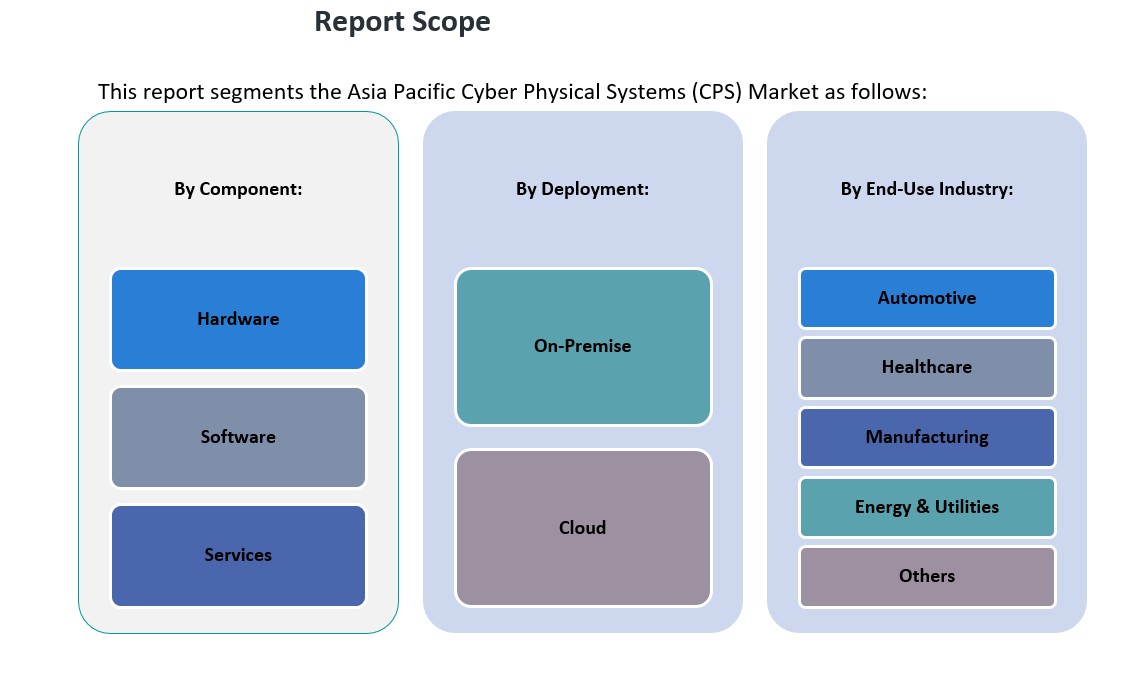

The Asia Pacific Cyber-Physical Systems (CPS) market is segmented into components, deployment methods, and end-use industries, each presenting unique growth opportunities.

By Component: The CPS market is primarily driven by three key components: hardware, software, and services. The hardware segment holds the largest share, driven by the increasing demand for IoT devices, sensors, and connected systems used to collect real-time data. The software segment, which includes analytics tools and system integration platforms, is experiencing rapid growth as businesses seek to derive actionable insights from the data generated by CPS. The services segment, including installation, maintenance, and consulting, is expanding as companies look for expert support in deploying and optimizing CPS technologies.

By Deployment: CPS can be deployed on-premise or via the cloud, with each deployment method offering distinct benefits. On-premise deployments remain popular in sectors like manufacturing, where data privacy and control are critical. However, cloud deployments are gaining momentum due to their scalability, cost-effectiveness, and ease of integration, especially in industries like healthcare and automotive. The flexibility of cloud solutions is increasingly attractive to companies looking to streamline operations and enhance collaboration.

By End-Use Industry: CPS is widely adopted across several industries, including automotive, healthcare, manufacturing, and energy & utilities. In the automotive sector, CPS enables advanced driver-assistance systems (ADAS) and autonomous vehicles. The healthcare sector leverages CPS for remote patient monitoring and personalized healthcare. In manufacturing, CPS facilitates smart factories and industrial automation, while in energy & utilities, CPS optimizes power grid management and resource distribution. Other industries, such as logistics and agriculture, are also emerging as significant adopters of CPS solutions.

Segmentation:

By Component:

- Hardware

- Software

- Services

By Deployment:

By End-Use Industry:

- Automotive

- Healthcare

- Manufacturing

- Energy & Utilities

- Others

Regional Analysis:

The Asia Pacific region holds a dominant position in the global Cyber-Physical Systems (CPS) market, driven by rapid industrialization, technological advancements, and government support for digital transformation. This market is poised for substantial growth, with key players across various countries contributing to its expansion. The region is witnessing increasing investments in smart infrastructure, manufacturing automation, and digital healthcare, driving demand for CPS solutions in multiple sectors.

China holds the largest market share in the Asia Pacific CPS market, accounting for approximately 40% of the total regional market. This can be attributed to the country’s aggressive push toward Industry 4.0, smart city development, and large-scale manufacturing operations. China’s extensive industrial base, coupled with government-backed initiatives such as “Made in China 2025,” supports the widespread adoption of CPS across various sectors, including manufacturing, energy, and transportation.

Japan ranks second in terms of market share, with a share of about 25%. The country’s strong focus on robotics, automation, and advanced manufacturing technologies has made CPS a crucial element in enhancing industrial processes. Japan’s well-established infrastructure for smart cities and technological innovation further contributes to the market’s growth, particularly in automotive, healthcare, and manufacturing applications. Additionally, Japan’s leadership in IoT and AI technologies positions it as a key player in the CPS market within Asia Pacific.

India is emerging as a significant market for CPS, holding around 15% of the regional market share. The country’s rapid urbanization, expanding industrial base, and growing adoption of digital technologies in healthcare, manufacturing, and energy sectors are accelerating the demand for CPS solutions. Government initiatives such as the National Smart Grid Mission and Digital India are fostering the integration of CPS in critical infrastructure, creating opportunities for market expansion.

South Korea holds approximately 10% of the Asia Pacific CPS market share, driven by its advanced industrial landscape and robust technological ecosystem. The country’s focus on smart manufacturing, automotive, and energy sectors is propelling the adoption of CPS solutions. Additionally, South Korea’s investments in smart city projects are contributing to the growing demand for CPS technologies.

Southeast Asia collectively represents the remaining 10% market share, with countries such as Singapore, Malaysia, and Thailand seeing an increase in CPS adoption. These nations are leveraging CPS for smart city initiatives, industrial automation, and energy management systems. With continued investments in digital infrastructure, the market share in Southeast Asia is expected to grow steadily in the coming years.

Key Player Analysis:

- Mitsubishi Electric Corporation

- Toshiba Corporation

- Hitachi, Ltd.

- Fujitsu Limited

- Panasonic Corporation

- NEC Corporation

- Huawei Technologies Co., Ltd.

- Samsung Electronics Co., Ltd.

- Infosys Limited

- Wipro Limited

Competitive Analysis:

The Asia Pacific Cyber-Physical Systems (CPS) market is highly competitive, with numerous global and regional players vying for market share. Key players such as Siemens AG, Schneider Electric, Honeywell International, and Rockwell Automation lead the market with their advanced CPS solutions, focusing on industrial automation, smart infrastructure, and energy management. These companies have established strong presences across the region, particularly in China, Japan, and South Korea, by offering integrated CPS solutions that enhance operational efficiency and support digital transformation initiatives. Regional players are also making significant strides in the CPS space, particularly in manufacturing and automotive sectors. Mitsubishi Electric and Hitachi are leveraging their deep industrial expertise to provide tailored CPS solutions to the Asia Pacific market. Additionally, startups and local firms in countries like India and Southeast Asia are emerging as innovative players, offering cost-effective solutions tailored to the region’s growing infrastructure needs.

Recent Developments:

- In Oct 2024, Phosphorus Cybersecurity Inc., a leader in unified security management for xIoT devices, announced its strategic expansion into the Asia Pacific and Japan (APJ) region. This move is driven by the region’s rapid growth in cyber-physical systems and increasing cybersecurity challenges.

- On March 6, 2025, Armis, a prominent cyber exposure management company, acquired OTORIO, a leading provider of operational technology (OT) and cyber-physical system (CPS) security. OTORIO’s Titan platform will now be integrated into Armis’ Centrix™ cloud-based platform, expanding its capabilities to include on-premises CPS solutions for air-gapped environments.

- In February 2025, Nozomi Networks was recognized as a Leader in the 2025 Gartner Magic Quadrant for CPS Protection Platforms. This accolade highlights Nozomi’s expertise in OT, IoT, and CPS security, particularly its AI-powered platform for asset discovery, threat detection, and vulnerability management. The recognition underscores Nozomi’s commitment to securing critical infrastructure and enhancing resilience against evolving cyber threats.

Market Concentration & Characteristics:

The Asia Pacific Cyber-Physical Systems (CPS) market exhibits moderate concentration, with several global leaders and regional players holding significant market shares. Major multinational corporations such as Siemens, Schneider Electric, and Honeywell International dominate the market, particularly in industrial automation, smart manufacturing, and energy management sectors. These companies benefit from extensive resources, technological expertise, and established networks across the region. However, the market also sees increasing participation from regional players, especially in emerging economies like India and Southeast Asia. Local firms offer cost-effective, region-specific solutions, catering to the growing demand for CPS in infrastructure development, healthcare, and automotive sectors. The CPS market in Asia Pacific is characterized by rapid technological advancements, with a strong emphasis on the integration of IoT, AI, and automation. Companies are focused on offering scalable and flexible solutions to address diverse industry needs, driving competition and innovation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Component, Deployment and End-Use Industry. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Asia Pacific CPS market is projected to grow significantly, driven by increased adoption of Industry 4.0 and automation technologies.

- Strong government initiatives supporting digital transformation and smart city projects will accelerate CPS adoption.

- IoT and AI integration will enhance the capabilities of CPS, leading to more advanced data analytics and decision-making.

- Manufacturing sectors will see widespread implementation of CPS to improve efficiency, reduce costs, and optimize supply chains.

- The healthcare industry will increasingly rely on CPS for remote monitoring and personalized care solutions.

- Edge computing adoption will rise, enabling faster, real-time data processing for CPS applications.

- Expanding urbanization in emerging markets will drive the demand for CPS in smart city infrastructure.

- Cybersecurity challenges will push companies to develop more secure, resilient CPS technologies.

- The automotive sector will benefit from CPS advancements in autonomous vehicles and advanced driver-assistance systems.

- Southeast Asia will emerge as a key growth market for CPS, fueled by increasing industrial automation and infrastructure development.