| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Asia Pacific Gasket And Seals Market Size 2024 |

USD 27,765.84 Million |

| Asia Pacific Gasket And Seals Market, CAGR |

6.61% |

| Asia Pacific Gasket And Seals Market Size 2032 |

USD 46,323.26 Million |

Market Overview

The Asia Pacific Gasket And Seals Market is projected to grow from USD 27,765.84 million in 2024 to an estimated USD 46,323.26 million by 2032, with a compound annual growth rate (CAGR) of 6.61% from 2025 to 2032. The growing demand for gaskets and seals in industries such as automotive, manufacturing, and energy, driven by rising production activities and infrastructure development, is fueling market expansion.

Key market drivers include the rising demand for gaskets and seals in the automotive industry, where they are critical for ensuring leak prevention and improving system performance. Additionally, the demand from the energy and oil & gas sectors, where high-temperature and high-pressure environments require advanced sealing solutions, is increasing. Moreover, innovations in materials such as elastomers, PTFE, and metals are expected to bolster the market by offering better durability and resistance in extreme conditions.

Geographically, the Asia Pacific region holds significant market potential, driven by rapid industrialization in countries like China, India, and Japan. The growing automotive production and increasing energy demands in these countries are key contributors to market growth. Leading players in the region include companies like Trelleborg AB, Freudenberg Sealing Technologies, and Parker Hannifin Corporation, which dominate the market with their advanced sealing solutions and strong regional presence.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Asia Pacific Gasket and Seals Market is projected to grow from USD 27,765.84 million in 2024 to USD 46,323.26 million by 2032, at a CAGR of 6.61% from 2025 to 2032.

- Key drivers include rising demand for sealing solutions in the automotive, energy, and oil & gas sectors, as well as technological advancements in material science, such as elastomers and PTFE.

- The adoption of industrial automation and improved manufacturing technologies is boosting the demand for high-performance gaskets and seals in machinery and production lines.

- Fluctuating raw material prices and the challenge of meeting stringent environmental and regulatory standards can impact the profitability and growth of gasket and seal manufacturers.

- The automotive industry’s growth, driven by increased production and the shift to electric vehicles (EVs), is driving the demand for advanced sealing solutions in engine and battery systems.

- China, India, and Japan dominate the market due to rapid industrialization, large automotive production, and increasing energy demands, making Asia Pacific the leading region for gasket and seal solutions.

- Innovations in materials, such as high-performance composites and smart seals, are enhancing the durability, efficiency, and functionality of gaskets and seals, driving demand across sectors.

Market Drivers

Technological Advancements and Innovations in Sealing Materials

Another key driver for the Asia Pacific Gasket and Seals Market is the continuous development of advanced sealing materials. Innovations in materials science, such as the introduction of more durable elastomers, expanded PTFE (polytetrafluoroethylene), and specialized metals, have enhanced the performance and longevity of gaskets and seals. These advancements have expanded their application range, allowing them to be used in increasingly demanding environments such as high-temperature machinery, chemical processing plants, and power generation facilities. New material technologies not only improve the sealing capabilities but also reduce maintenance costs, which is a significant benefit for industries where downtime can be costly. Additionally, the development of seals that offer improved resistance to wear, fatigue, and extreme chemicals makes them an essential component in high-performance machinery. The demand for customized and specialized sealing solutions is rising as industries increasingly require seals designed for specific applications. As manufacturers invest in research and development to create more efficient, cost-effective, and sustainable sealing solutions, the market is expected to grow further.

Rising Industrialization and Infrastructure Development

Rapid industrialization and infrastructure development across the Asia Pacific region are key factors contributing to the market’s expansion. As countries like China, India, and Southeast Asian nations continue to industrialize, the need for robust and reliable sealing solutions increases. Industries such as construction, manufacturing, chemical processing, and food & beverage production are highly dependent on the performance of gaskets and seals to ensure the integrity and efficiency of machinery, pipelines, and industrial systems. Furthermore, the growing trend of urbanization, particularly in emerging economies, is driving investments in infrastructure projects, including transportation networks, power plants, and water treatment facilities. These large-scale infrastructure projects require a wide range of sealing products to maintain their operational reliability. The need to meet environmental regulations and enhance operational efficiency in these sectors also spurs the demand for advanced sealing solutions that offer superior durability, performance, and resistance to challenging environmental factors. As governments continue to prioritize infrastructure development and economic growth in the region, the gasket and seals market will see continued expansion.

Increasing Demand from the Automotive Industry

The automotive sector is a key driver for the growth of the Asia Pacific Gasket and Seals Market. Gaskets and seals are essential components in automotive manufacturing, used to prevent leaks, reduce friction, and ensure optimal performance of various engine and transmission parts. For instance, companies like Kokusan Parts Industry have been providing critical components such as cylinder head gaskets to major automotive brands like Mazda, highlighting the importance of these parts in vehicle production. As automotive production continues to rise in the Asia Pacific region, driven by rapid industrialization and economic growth, the demand for high-performance gaskets and seals has increased. This trend is particularly evident in countries like China, India, and Japan, where automotive manufacturing plays a vital role in the economy. The shift toward electric vehicles (EVs) and more energy-efficient vehicles also requires specialized sealing solutions to meet stringent environmental standards.

Growth in the Oil & Gas and Energy Sectors

The oil & gas and energy sectors significantly contribute to the increasing demand for gaskets and seals in the Asia Pacific region. These industries operate in extreme conditions, including high temperatures and pressures, where maintaining a proper seal is critical to prevent hazardous situations. For instance, China National Petroleum Corporation (CNPC) is involved in major oil and gas pipeline projects, which require high-performance sealing solutions to ensure system integrity. The expansion of offshore drilling activities, especially in countries like China, India, and Australia, has increased the need for gaskets and seals that can provide superior resistance to corrosion, chemicals, and high pressures. Furthermore, the push toward renewable energy sources, including geothermal and hydropower, has created additional demand for sealing solutions that can withstand harsh environmental conditions. The rising energy consumption across Asia Pacific, driven by population growth and industrialization, has significantly boosted the gasket and seals market.

Market Trends

Sustainability and Eco-friendly Sealing Solutions

With increasing environmental awareness and stricter regulations, there is a growing trend toward the development and use of eco-friendly gasket and seal materials in the Asia Pacific region. Sustainability has become a key focus for many industries, especially those in manufacturing, automotive, and energy, as they strive to reduce their carbon footprint and meet environmental standards. This has led to a surge in demand for biodegradable, recyclable, and non-toxic sealing materials. Companies are investing in research and development to produce gaskets and seals from sustainable materials such as biodegradable elastomers, recycled metals, and plant-based polymers. These eco-friendly materials not only help companies comply with environmental regulations but also appeal to environmentally-conscious consumers and businesses seeking to improve their sustainability practices. Additionally, the development of seals with a longer life cycle and the ability to withstand more cycles of use without degradation reduces the need for frequent replacements, thereby contributing to waste reduction and lower environmental impact. As sustainability becomes increasingly important in the Asia Pacific region, the demand for environmentally friendly gasket and seal solutions is expected to grow, shaping the market dynamics.

Integration of Smart Seals and IoT-Enabled Solutions

The rise of the Industrial Internet of Things (IIoT) and smart technologies is another significant trend shaping the Asia Pacific Gasket and Seals Market. The integration of sensors and smart technology into gaskets and seals has led to the development of intelligent sealing solutions that can monitor their own performance in real-time. Smart seals equipped with embedded sensors can provide data on pressure, temperature, and wear, allowing for predictive maintenance and early detection of potential failures. This technology significantly enhances operational efficiency by enabling businesses to detect issues before they escalate into costly downtime or equipment damage. The ability to monitor the health of sealing systems in real-time also helps companies optimize the maintenance schedules of critical machinery, reducing maintenance costs and increasing overall system reliability. The automotive and manufacturing industries, in particular, are adopting these smart sealing solutions to improve safety and operational performance. The growing demand for automation and connected devices across industries in the Asia Pacific region is expected to drive further development and integration of smart seals, making this a major trend in the gasket and seals market.

Adoption of Advanced Materials for Improved Performance

The Asia Pacific gasket and seals market is witnessing a significant shift toward advanced materials to enhance the performance and durability of sealing solutions. Traditional materials like rubber and metal are increasingly being replaced or supplemented by innovative options such as expanded PTFE, elastomers, and composites. These materials are gaining traction due to their superior resistance to extreme temperatures, chemical exposure, and wear. For instance, the oil and gas industry in the region has adopted gaskets and seals made from advanced PTFE and elastomer compounds to ensure leak-proof performance in high-pressure environments. Similarly, automotive manufacturers are leveraging lightweight composite materials to reduce vehicle weight while maintaining sealing efficiency. The rise of electric vehicles (EVs) in countries like China and South Korea has further driven demand for specialized sealing solutions tailored for EV powertrains. Additionally, emerging technologies, such as graphene-based composites and self-healing materials, are enabling longer lifespans and reduced maintenance needs. These innovations are particularly relevant in high-tech sectors like aerospace and electronics, where reliability under extreme conditions is critical. Overall, the adoption of advanced materials is poised to play a pivotal role in improving system reliability, reducing operational costs, and driving market growth across diverse industries.

Customization and Tailored Solutions for Specific Applications

The growing complexity of industrial processes has led to an increased demand for customized gasket and seal solutions across various sectors in Asia Pacific. Industries such as automotive, aerospace, pharmaceuticals, and food processing are seeking tailored sealing solutions that meet specific operational challenges. For example, in the aerospace sector, precision-engineered seals are designed to perform under extreme pressure and temperature conditions, ensuring safety and efficiency. Similarly, the food processing and pharmaceutical industries require seals that comply with strict hygiene standards while maintaining high-performance levels. The automotive sector has also embraced customization to address the unique requirements of EVs and fuel-efficient vehicles. Companies in the region are leveraging advancements in additive manufacturing (3D printing) to produce highly specialized gaskets that cater to niche applications. Furthermore, partnerships between global manufacturers and local players have enabled the development of innovative solutions tailored to regional needs. For instance, collaborations between leading companies have resulted in sealing products optimized for harsh environmental conditions prevalent in infrastructure projects across Asia Pacific. As industries continue to demand precision-engineered solutions that enhance performance while adhering to regulatory standards, customization is expected to remain a key driver of innovation in the gasket and seals market.

Market Challenges

Stringent Regulatory Standards and Compliance

Another significant challenge in the Asia Pacific Gasket and Seals Market is the increasingly stringent regulatory standards and compliance requirements imposed on industries that rely heavily on sealing solutions. In sectors such as automotive, food processing, and oil & gas, regulatory bodies are setting stricter environmental, safety, and performance standards for sealing products. These regulations often require manufacturers to develop gaskets and seals that meet higher durability, performance, and safety standards. Ensuring compliance with these regulations can increase the cost of development and manufacturing, as well as extend the time required for product testing and certification. Furthermore, the need to comply with diverse regulatory requirements across different countries within the Asia Pacific region adds complexity for manufacturers looking to expand their operations. The challenge lies in balancing regulatory compliance with the need for innovation and cost efficiency. Manufacturers must invest in research and development to ensure their sealing solutions are compliant, without compromising on performance and competitiveness in the market.

Price Volatility of Raw Materials

One of the significant challenges in the Asia Pacific Gasket and Seals Market is the price volatility of raw materials used in manufacturing these products. The costs of essential materials like rubber, metals, and elastomers are subject to frequent fluctuations due to various factors, including global supply chain disruptions, geopolitical tensions, and economic conditions. For instance, geopolitical events such as trade wars or sanctions can disrupt the supply of critical materials like stainless steel and aluminum, which are widely used in gasket manufacturing. Similarly, the prices of petrochemical-based materials, such as elastomers and polymers, are influenced by crude oil price volatility. Natural disasters and production capacity shifts also contribute to unpredictable cost variations. These fluctuations often increase production expenses for manufacturers, squeezing profit margins and complicating pricing strategies. To address these challenges, companies must adopt proactive measures such as diversifying their supplier base, utilizing long-term contracts to stabilize costs, and exploring alternative materials that offer greater price stability. Additionally, implementing advanced technologies like CAD software can help optimize material usage and minimize waste during production. By developing resilient procurement strategies and fostering strong supplier relationships, manufacturers can better navigate the uncertainties of raw material markets while maintaining competitiveness in the Asia Pacific region.

Market Opportunities

Expansion of the Automotive and Electric Vehicle (EV) Market

The growing automotive industry in the Asia Pacific region presents a significant opportunity for the gasket and seals market. As automotive production continues to rise, particularly in countries like China, India, and Japan, the demand for high-performance sealing solutions has increased. This is driven by the need for gaskets and seals in critical automotive components, such as engines, transmissions, and exhaust systems, to ensure leak prevention, durability, and efficiency. Moreover, the shift toward electric vehicles (EVs) opens up new opportunities for sealing manufacturers. EVs require specialized sealing solutions to optimize energy efficiency and ensure the protection of electrical components. As the demand for EVs continues to rise in the region, particularly in markets with stringent emission standards, gasket and seal manufacturers can capitalize on the growing need for lightweight, durable, and efficient sealing solutions tailored to EV applications.

Growth in Renewable Energy and Infrastructure Development

The increasing focus on renewable energy sources and large-scale infrastructure development in the Asia Pacific region presents another promising opportunity for the gasket and seals market. As countries invest in renewable energy projects, including wind, solar, and geothermal energy, the demand for sealing solutions capable of withstanding harsh environmental conditions and extreme pressures is expected to grow. Similarly, the region’s rapid infrastructure development, including new power plants, water treatment facilities, and transportation networks, will require reliable sealing solutions to ensure operational efficiency and safety. Gasket and seal manufacturers can tap into these expanding sectors by providing high-quality, specialized products that meet the unique demands of renewable energy and infrastructure projects, driving market growth in the coming years.

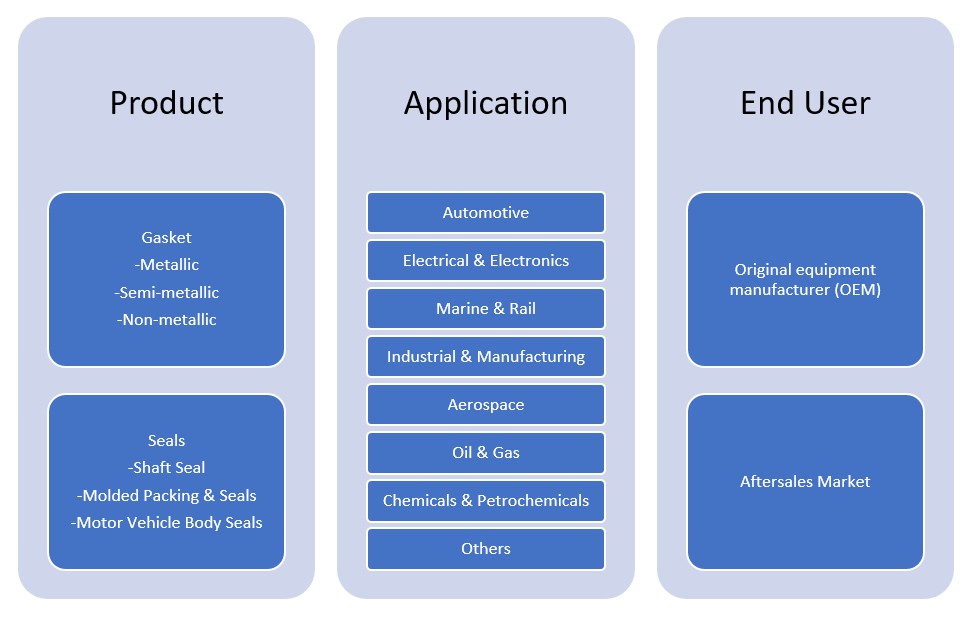

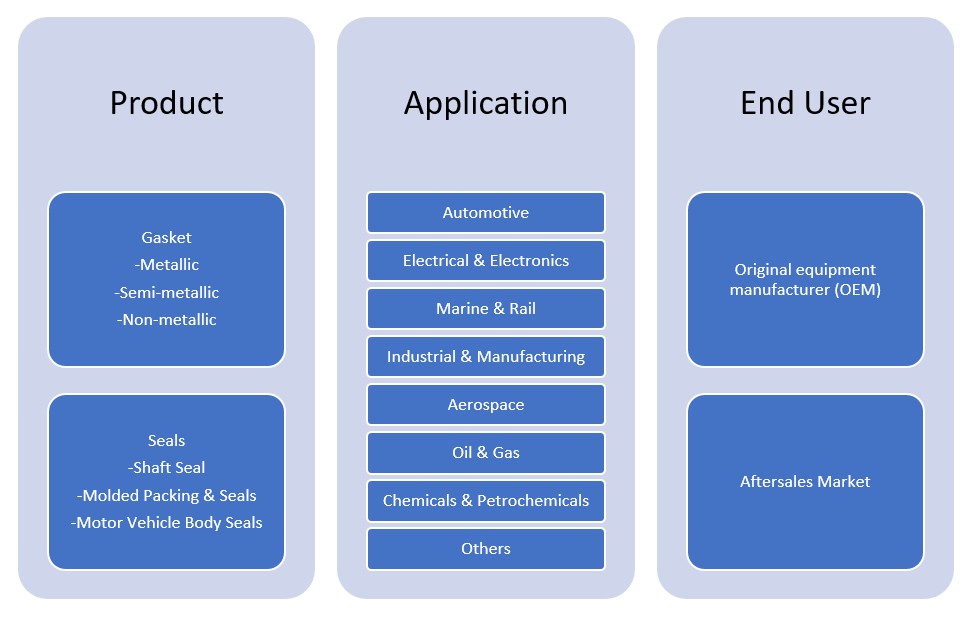

Market Segmentation Analysis

By Product:

The market is divided into gaskets and seals. Gaskets are further categorized into metallic, semi-metallic, and non-metallic types. Metallic gaskets are widely used for high-temperature and high-pressure applications, such as in the oil & gas and automotive industries, due to their excellent strength and durability. Semi-metallic gaskets, often used in applications requiring flexibility and resilience, are ideal for industries like automotive and chemical processing. Non-metallic gaskets, including those made from rubber or PTFE, are commonly used in low-pressure and low-temperature environments, offering cost-effective sealing solutions for industries such as food and beverage and pharmaceuticals.Seals are also segmented into shaft seals, molded packing & seals, and motor vehicle body seals. Shaft seals play a vital role in preventing fluid or gas leakage in rotating machinery and are particularly important in automotive, manufacturing, and industrial applications. Molded packing & seals are critical for sealing moving parts in machinery and ensuring system efficiency. Motor vehicle body seals are essential for preventing noise, vibration, and harshness (NVH) in automotive designs, and their demand is growing as the automotive industry shifts toward electric vehicles (EVs) and more energy-efficient designs.

By Application:

The Asia Pacific market for gaskets and seals sees substantial demand across various applications, including automotive, electrical & electronics, marine & rail, industrial & manufacturing, aerospace, oil & gas, chemicals & petrochemicals, and others. The automotive sector holds a dominant share, driven by the need for high-performance seals in engines, transmissions, and electrical components, especially with the rise of electric vehicles. In the industrial & manufacturing sector, gaskets and seals are crucial for maintaining operational efficiency in machinery, while the oil & gas industry demands sealing solutions capable of handling high pressures and corrosive environments. Additionally, the aerospace and chemicals & petrochemicals sectors require gaskets and seals that can withstand extreme temperatures and pressures.

Segments

Based on Product

- Metallic

- Semi-metallic

- Non-metallic

- Seals

- Shaft Seal

- Molded Packing & Seals

- Motor Vehicle Body Seals

Based on Application

- Automotive

- Electrical & Electronics

- Marine & Rail

- Industrial & Manufacturing

- Aerospace

- Oil & Gas

- Chemicals & Petrochemicals

- Others

Based on End User

- Original equipment manufacturer (OEM)

- Aftersales Market

Based on Region

- China

- India

- Japan

- Southeast Asia

Regional Analysis

India (20%)

India holds a substantial market share of around 20% in the Asia Pacific Gasket and Seals Market. India’s automotive industry is one of the fastest-growing in the world, with significant demand for sealing solutions in vehicles and manufacturing systems. Furthermore, India’s expanding infrastructure, including industrial parks, power generation facilities, and renewable energy projects, provides growth opportunities for gasket and seal manufacturers. The government’s push for “Make in India” and increased industrial output are expected to contribute to further market expansion in the coming years.

Japan (15%)

Japan is a major player in the Asia Pacific Gasket and Seals Market, accounting for approximately 15% of the market share. Known for its advanced manufacturing capabilities and automotive sector, Japan demands high-performance sealing solutions, particularly for automotive, aerospace, and electronics industries. The country’s commitment to high-quality, durable sealing products, along with the rising demand for electric vehicles (EVs), drives significant market activity. Japan’s mature industrial base ensures steady growth in the gasket and seals market, particularly in the automotive and industrial sectors.

Key players

- Garlock Sealing Technologies

- Trelleborg Sealing Solutions

- SKF

- Freudenberg Sealing Technologies

- Yokohama Rubber Co., Ltd.

Competitive Analysis

The Asia Pacific Gasket and Seals Market is characterized by the presence of several prominent players, each offering diverse product portfolios and solutions tailored to different industries. Garlock Sealing Technologies stands out with its advanced sealing products, particularly in the oil & gas and chemical industries, where high-performance seals are essential. Trelleborg Sealing Solutions focuses on providing innovative, custom-designed sealing solutions for a variety of sectors, including automotive and industrial applications, leveraging its global manufacturing footprint. SKF, known for its engineering expertise, delivers high-quality seals designed for heavy-duty applications across automotive and industrial machinery. Freudenberg Sealing Technologies focuses on research-driven innovations, offering high-performance materials for automotive, aerospace, and industrial markets. Yokohama Rubber Co., Ltd., with its robust presence in automotive and industrial sectors, emphasizes the development of advanced rubber-based sealing technologies. These companies are focused on expanding their market share by enhancing their product offerings, improving performance, and catering to industry-specific requirements.

Recent Developments

- On February 12, 2025, SKF India Limited’s Board of Directors approved the appointment of Ms. Surbhi Srivastava, Head of People Experience, to the Senior Management Team. Ms. Srivastava holds a Bachelor of Science from Fergusson College and an MBA from Symbiosis Institute of Business Management, Pune, with over 20 years of experience across various industries.

- In May 2024, Trelleborg announced plans to invest in a new production facility in Casablanca, Morocco, dedicated to aerospace sealing solutions. Construction commenced prior to January 2025, with operations expected to begin by the end of 2025.

- In November 2023, Freudenberg Sealing Technologies reported that sales of its Simriz perfluoroelastomeric (FFKM) compounds had more than doubled in North America over the preceding 24 months. This surge was attributed to the compounds’ quality, performance, and availability during supply chain disruptions.

- On May 2, 2023, The Yokohama Rubber Co., Ltd. completed the acquisition of all outstanding shares of Trelleborg Wheel Systems Holding AB, expanding its presence in the off-highway tire sector.

Market Concentration and Characteristics

The Asia Pacific Gasket and Seals Market is moderately concentrated, with several leading players holding significant market shares while a large number of smaller and regional manufacturers also contribute to the market’s diversity. Key players such as Garlock Sealing Technologies, Trelleborg Sealing Solutions, SKF, Freudenberg Sealing Technologies, and Yokohama Rubber Co., Ltd. dominate the market, focusing on innovation, high-quality products, and regional expansions to maintain a competitive edge. The market characteristics are driven by technological advancements, such as the development of specialized sealing materials and smart sealing solutions, along with increasing demand from various industries like automotive, oil & gas, and manufacturing. Additionally, the market is characterized by a strong emphasis on product customization, as companies cater to industry-specific requirements for durability, temperature resistance, and chemical compatibility. Competitive strategies often involve mergers, acquisitions, and partnerships to enhance market presence and drive product innovations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Asia Pacific Gasket and Seals Market is expected to witness steady growth through 2032, supported by rising industrialization and infrastructure development across emerging economies.

- With the growing shift toward electric mobility, manufacturers will see increased demand for specialized sealing solutions to ensure thermal management and battery safety in EVs.

- The market will benefit from the expansion of renewable energy projects, especially in wind, solar, and geothermal energy, where advanced gaskets and seals are essential for operational reliability.

- Innovation in materials such as high-performance elastomers, PTFE, and composites will enhance the durability and functionality of seals in high-pressure and high-temperature applications.

- The demand for application-specific, custom-designed gaskets and seals will increase, particularly in industries requiring high precision and performance, such as aerospace and pharmaceuticals.

- Environmental regulations will push manufacturers to develop eco-friendly and recyclable sealing products, creating opportunities for innovation in green materials and processes.

- Smart seals integrated with sensors for real-time monitoring and predictive maintenance will become more prevalent, improving operational efficiency and reducing downtime.

- As factories and plants across Asia Pacific continue to automate, the demand for robust and long-lasting sealing solutions in automated equipment will rise significantly.

- The aftersales segment is expected to grow, driven by the need for regular maintenance and replacement of gaskets and seals in aging machinery and vehicles.

- Key players are likely to engage in mergers, acquisitions, and partnerships to expand their market reach, enhance product offerings, and strengthen their competitive positioning in the region.