| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Asia Pacific Loitering Munition Market Size 2023 |

USD 578.36 Million |

| Asia Pacific Loitering Munition Market, CAGR |

12.1% |

| Asia Pacific Loitering Munition Market Size 2032 |

USD 1,613.90 Million |

Market Overview:

Asia Pacific Loitering Munition Market size was valued at USD 578.36 million in 2023 and is anticipated to reach USD 1,613.90 million by 2032, at a CAGR of 12.1% during the forecast period (2023-2032).

Several factors are propelling the expansion of the loitering munition market in Asia Pacific. The rising demand for precision strike capabilities, particularly in counterterrorism and border security operations, is a primary driver. Loitering munitions offer real-time surveillance and the ability to engage high-value or time-sensitive targets with pinpoint accuracy. Additionally, the integration of artificial intelligence (AI) and autonomous systems into loitering munitions enhances their operational efficiency, enabling them to function effectively in complex and dynamic combat environments. The increasing military expenditure in countries like China and India further supports the growth of this market, as these nations seek to modernize their defense capabilities and maintain strategic advantages. Moreover, the growing threat from asymmetric warfare, especially in the context of regional conflicts, is pushing nations to invest in cost-effective and high-impact military technologies.

China leads the Asia Pacific loitering munition market, owing to its substantial defense budget and ongoing efforts to modernize its military forces. India follows closely, with significant investments in defense technology and collaborations with international defense contractors to bolster its indigenous manufacturing capabilities. Other countries such as Japan, South Korea, and Australia are also contributing to the market’s growth, driven by regional security concerns and the need for advanced defense solutions. The strategic importance of loitering munitions in enhancing surveillance and strike capabilities is recognized across the region, leading to increased procurement and development of these systems. Additionally, the growing geopolitical tensions in the South China Sea, Taiwan Strait, and Korean Peninsula are driving nations in the region to prioritize cutting-edge military technologies to strengthen their defense readiness.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Asia Pacific loitering munition market was valued at USD 578.36 million in 2023 and is expected to grow to USD 1,613.90 million by 2032, with a CAGR of 12.1% during the forecast period.

- The global loitering munition market is valued at USD 1,967.89 million in 2023 and is expected to grow significantly, reaching USD 4,952.89 million at a CAGR of 10.8% by 2032, driven by increasing demand for precision strike systems.

- Increasing demand for precision strike capabilities is a major driver, particularly in counterterrorism and border security operations, as loitering munitions enable real-time surveillance and precise targeting.

- Technological advancements in AI and autonomous systems are enhancing the operational efficiency of loitering munitions, allowing them to function effectively in dynamic and complex combat environments.

- Rising military expenditures in countries like China, India, and Japan are fueling investments in loitering munition technologies as part of defense modernization programs to maintain strategic military advantages.

- Geopolitical tensions in regions such as the South China Sea, Taiwan Strait, and Korean Peninsula are driving countries to prioritize advanced defense solutions like loitering munitions for surveillance and rapid strike capabilities.

- High development and operational costs are a significant restraint, as the manufacturing, maintenance, and training associated with loitering munitions require substantial investments, particularly in countries with limited defense budgets.

- Vulnerability to countermeasures, such as electronic warfare systems and jamming technologies, is a challenge that loitering munition manufacturers must address to ensure the resilience and effectiveness of these systems in evolving combat environments.

Market Drivers:

Increasing Demand for Precision Strike Capabilities

One of the foremost drivers of the Asia Pacific loitering munition market is the growing demand for precision strike capabilities. For instance, in April 2025, India-based IndoWings unveiled the LM-250 loitering munition system, specifically designed to integrate with the Indian Army’s Pinaka Multiple Barrel Rocket Launcher (MBRL). This adaptation enables a single Pinaka canister to launch up to 50 LM-250 units simultaneously, significantly enhancing the armed forces’ ability to conduct targeted operations with minimal collateral damage. The ability to conduct targeted operations with minimal collateral damage is essential, especially in regions where military operations involve high-value or time-sensitive targets. Loitering munitions offer a unique solution by providing real-time surveillance and autonomous strike capabilities. This technology allows armed forces to engage enemies with greater accuracy, reducing the risk of civilian casualties and enhancing the effectiveness of military operations. As countries in the region face an increasing number of asymmetrical threats, loitering munitions are seen as an essential tool for counterterrorism, border security, and regional defense strategies.

Technological Advancements in Autonomous Systems and Artificial Intelligence

Technological advancements are rapidly shaping the future of loitering munitions in the Asia Pacific region. The integration of artificial intelligence (AI) and autonomous systems is a major catalyst for the growth of the market. For instance, in March 2025, China completed development of the Feilong-60A (Flying Dragon-60), its first modular rocket-based loitering munition. This system, paired with the SR-5 multiple-launch rocket system, features two six-tube canisters per unit, enabling simultaneous deployment and enhancing precision strike capabilities. These technologies enhance the decision-making capabilities of loitering munitions, enabling them to operate independently in complex environments. AI algorithms are being used to optimize flight paths, target recognition, and real-time decision-making, improving the overall performance and effectiveness of these systems. As military forces in the region increasingly focus on automation and reducing human intervention in combat scenarios, loitering munitions equipped with autonomous capabilities are becoming a critical component of modern defense strategies.

Rising Military Expenditures in Asia Pacific

The increasing military expenditures of key nations in the Asia Pacific region is another significant driver behind the growth of the loitering munition market. Countries such as China, India, and Japan have been heavily investing in defense modernization programs, recognizing the importance of technological innovation in maintaining a competitive military edge. These nations are prioritizing the development and procurement of advanced weaponry, including loitering munitions, to enhance their defense capabilities. China’s large defense budget, in particular, is driving investments in cutting-edge military technology, including precision-guided systems like loitering munitions. As military budgets continue to grow, the demand for cost-effective, efficient, and high-impact defense solutions will further propel the loitering munition market in the region.

Geopolitical Tensions and Regional Security Concerns

Geopolitical tensions and security concerns in the Asia Pacific region are also playing a significant role in driving the demand for loitering munitions. The region is marked by several long-standing territorial disputes, particularly in the South China Sea, the Taiwan Strait, and the Korean Peninsula. These areas are fraught with the potential for conflict, pushing nations to enhance their military capabilities. Loitering munitions offer a strategic advantage in these sensitive regions by providing real-time intelligence, surveillance, and reconnaissance (ISR) while also enabling quick, precise strikes. As countries like India, Japan, and South Korea face growing security challenges, the need for sophisticated defense technologies, such as loitering munitions, becomes more pressing. The ability to deploy loitering munitions in regions with high tensions helps maintain strategic advantages and ensures readiness in the face of potential threats.

Market Trends:

Increasing Focus on Integration with Unmanned Systems

A significant trend in the Asia Pacific loitering munition market is the increasing integration of loitering munitions with unmanned systems, including drones and other autonomous platforms. This trend is driven by the desire to enhance the capabilities of these munitions in complex combat environments. By combining loitering munitions with unmanned aerial systems (UAS), military forces can achieve enhanced surveillance, target acquisition, and strike precision. These integrated systems allow for real-time data sharing, improved operational efficiency, and greater flexibility in deployment. As unmanned systems continue to evolve, the integration of loitering munitions with these platforms is expected to drive increased demand in the market, offering new tactical advantages for forces across the region.

Shift Towards Modular and Multi-role Systems

Another emerging trend in the loitering munition market is the shift towards modular and multi-role systems. For example, Elbit Systems’ Harop and the upcoming Hammer loitering munitions are designed for both surveillance and precision strike missions, allowing users to reconfigure payloads and operational roles as needed. Traditionally, loitering munitions were designed for specific missions, but there is a growing emphasis on developing systems that can perform multiple roles. These systems can be configured for a variety of operational needs, including intelligence gathering, surveillance, electronic warfare, and precision strike. This versatility increases their utility across different types of military operations, making them attractive to a broader range of defense forces. As the demand for flexible and adaptable defense technologies grows, manufacturers are focusing on designing loitering munitions that can be easily reconfigured to meet different mission requirements, which in turn drives market expansion.

Adoption of Swarming Technology

The adoption of swarming technology is another key trend shaping the loitering munition market in the Asia Pacific region. For instance, HALCON, an EDGE Group subsidiary, signed a contract in February 2023 to provide the UAE Armed Forces with HUNTER 2-S swarming loitering munitions, which can coordinate multiple units for simultaneous attacks. Swarming involves the simultaneous deployment of multiple loitering munitions to overwhelm enemy defenses and increase the likelihood of mission success. This trend is being driven by the advances in communication technologies, AI, and autonomous flight systems, which enable the coordination of multiple munitions in real-time. Swarming loitering munitions are particularly valuable in electronic warfare and anti-aircraft defense, where saturation attacks can provide a significant strategic advantage. As military forces in the region seek to enhance their offensive capabilities, the integration of swarming technology into loitering munition systems is expected to increase, further bolstering the market’s growth.

Focus on Cost-effective, High-impact Solutions

As defense budgets across the Asia Pacific region grow, there is a noticeable shift towards the procurement of cost-effective, high-impact solutions. Loitering munitions offer a more affordable alternative to traditional guided missile systems, providing significant savings while still delivering precision strike capabilities. This trend is particularly important for countries with constrained defense budgets but still looking to modernize their military forces. Loitering munitions, with their lower operational costs and high effectiveness, present an attractive option for nations looking to maximize their defense spending. As the focus on cost-efficiency grows in tandem with the desire for high-performance systems, loitering munitions will continue to see increased adoption, particularly in emerging defense markets within the region.

Market Challenges Analysis:

High Development and Operational Costs

One of the primary restraints affecting the Asia Pacific loitering munition market is the high development and operational costs associated with these advanced systems. While loitering munitions offer precision and efficiency, the research, development, and manufacturing of these systems require significant investment in technology and resources. Additionally, the ongoing operational costs, including maintenance, training, and logistics, can be prohibitive for some countries, especially those with limited defense budgets. Despite the growing demand for loitering munitions, the financial barriers to entry for smaller or less economically advanced nations may hinder widespread adoption in the region.

Regulatory and Political Challenges

Another key challenge is the regulatory and political environment surrounding the use of loitering munitions. The proliferation of autonomous weapon systems and precision strike capabilities raises concerns related to international arms control agreements and the potential for misuse. Several countries in the Asia Pacific region have complex regulatory frameworks that govern the development, export, and use of military technology. The ambiguity surrounding the classification and control of loitering munitions can delay their deployment and adoption, particularly in regions with strict defense regulations. Moreover, political tensions between countries may affect cross-border collaborations and the transfer of technology, creating an additional layer of uncertainty for market players.

Vulnerability to Countermeasures

The vulnerability of loitering munitions to countermeasures is another challenge facing the market. As the technology continues to evolve, adversaries are developing counter-strategies to neutralize the effectiveness of loitering munitions. For instance, during the Russia-Ukraine conflict, several KUB loitering munitions built by Kalashnikov were either downed by Ukrainian military forces or crashed due to internal malfunctions, suggesting the effectiveness of electronic warfare (EW) countermeasures and air defense systems. Advanced electronic warfare (EW) systems and jamming technologies can disrupt the communication and control systems of loitering munitions, rendering them ineffective in certain scenarios. This technological arms race creates pressure on manufacturers to continuously innovate and improve the resilience of these systems against evolving threats, adding complexity to the development process.

Limited Operational Range and Endurance

While loitering munitions offer several advantages, they are often limited by their operational range and endurance. The duration for which these systems can remain airborne, combined with the range over which they can effectively operate, may limit their use in certain strategic scenarios. These limitations are particularly relevant for large-scale, prolonged operations that require persistent surveillance or long-range strike capabilities. As the market demands more versatile solutions, overcoming these range and endurance limitations will be critical to the future growth and widespread adoption of loitering munitions in the Asia Pacific region.

Market Opportunities:

The Asia Pacific loitering munition market presents significant opportunities driven by the increasing need for precision strike capabilities and advanced defense technologies across the region. As nations in the region, particularly China, India, and Japan, modernize their defense strategies, there is a growing demand for cost-effective, high-impact military solutions. Loitering munitions offer a unique advantage by providing real-time surveillance and the ability to engage high-value targets with precision, making them an attractive option for defense forces seeking to enhance their operational effectiveness. The integration of artificial intelligence (AI) and autonomous systems into these munitions further enhances their capabilities, creating new opportunities for adoption in a variety of military applications, including border security, counterterrorism, and asymmetric warfare.

Additionally, the rise of geopolitical tensions and regional conflicts presents a compelling opportunity for the loitering munition market. With increasing concerns over security in areas such as the South China Sea, Taiwan Strait, and the Korean Peninsula, nations are investing heavily in advanced defense technologies to strengthen their military readiness. Loitering munitions, with their versatility, precision, and ability to perform multi-role functions, align well with the evolving defense needs of these nations. The increasing focus on unmanned systems, swarming technologies, and modular designs further enhances the potential for growth in this market. As the demand for innovative, scalable, and efficient defense solutions rises, loitering munitions are well-positioned to play a critical role in shaping the future of military strategies in the Asia Pacific region.

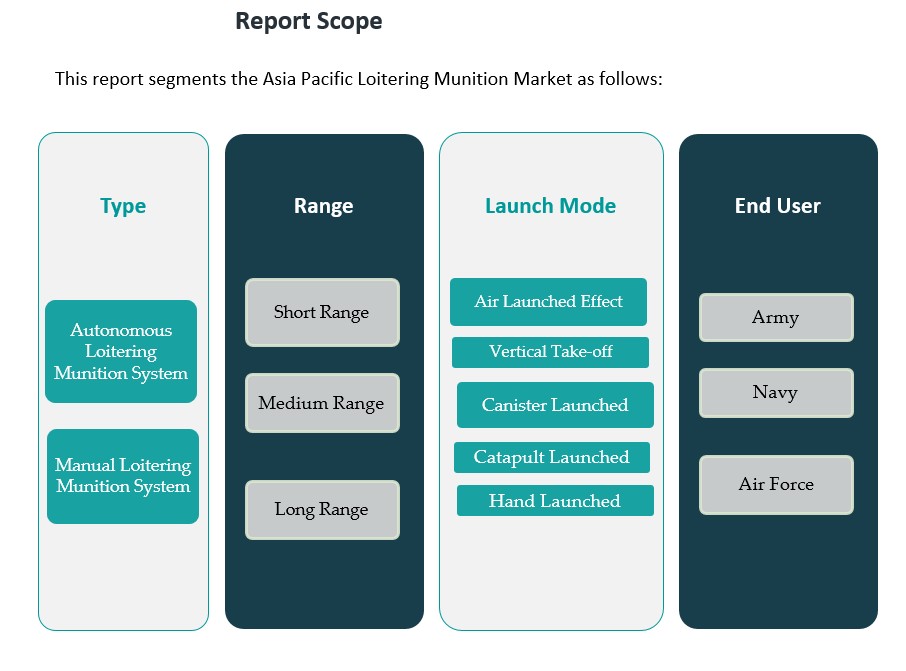

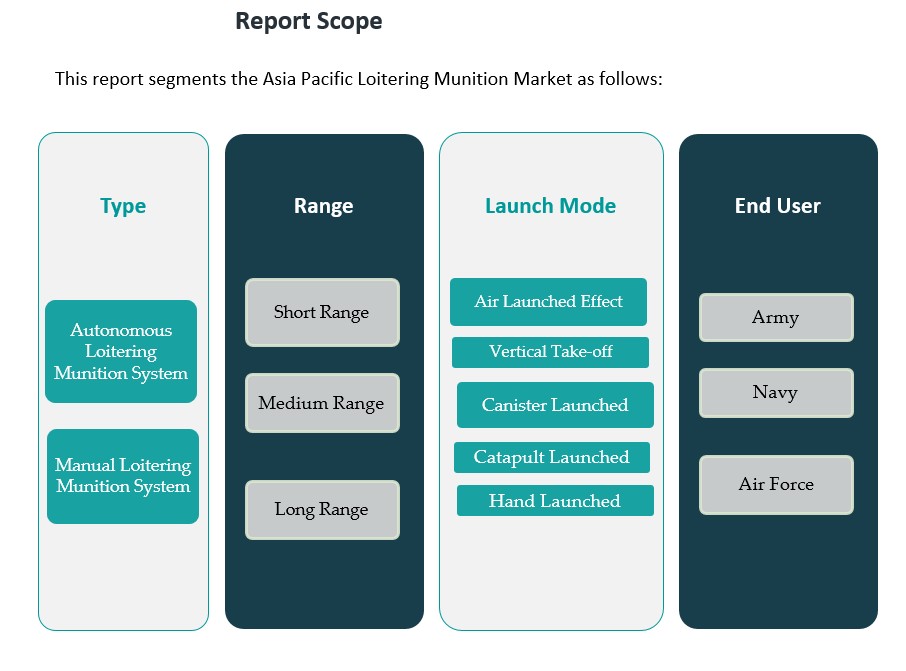

Market Segmentation Analysis:

The Asia Pacific loitering munition market can be segmented based on type, range, launch mode, and end user, each contributing to the market’s growth in unique ways.

By Type, the market is divided into Autonomous Loitering Munition Systems and Manual Loitering Munition Systems. Autonomous systems dominate the market due to their advanced capabilities, such as AI-driven decision-making and minimal human intervention. These systems provide enhanced operational efficiency and flexibility, which is highly valued in modern military strategies. Manual loitering munitions, while still relevant, are typically used in specific scenarios where human control is necessary for greater precision.

By Range, the market is segmented into Short Range, Medium Range, and Long Range loitering munitions. Short Range systems are used for tactical operations and close-range engagements, while Medium Range munitions cater to more extended surveillance and precision strike roles. Long Range loitering munitions are increasingly in demand for strategic operations, offering extended flight durations and capabilities suited for large-scale missions.

By Launch Mode, the market includes Air Launched, Vertical Take-off, Canister Launched, Catapult Launched, and Hand Launched systems. Air Launched systems are prevalent due to their flexibility and ability to be deployed from various platforms. Vertical Take-off systems are gaining traction for their versatility in confined spaces, while Canister and Catapult Launched systems offer high reliability for quick deployment in various operational scenarios.

By End User, the market is divided into Land, Air, and Navy. The Land segment is the largest, driven by the increasing adoption of loitering munitions for ground-based operations. The Air and Navy segments are also growing as defense forces seek advanced solutions for aerial and maritime engagements.

Segmentation:

By Type:

- Autonomous Loitering Munition System

- Manual Loitering Munition System

By Range:

- Short Range

- Medium Range

- Long Range

By Launch Mode:

- Air Launched Effect

- Vertical Take-off

- Canister Launched

- Catapult Launched

- Hand Launched

By End User:

Regional Analysis:

The Asia Pacific loitering munition market is experiencing dynamic growth, driven by strategic defense investments and increasing security concerns across the region. The market is primarily influenced by key players such as China, India, Japan, and South Korea, each contributing to the overall growth trajectory in unique ways. The region is expected to witness continued expansion in the coming years, with varying levels of adoption and market share across different countries.

China holds the largest share of the Asia Pacific loitering munition market, accounting for approximately 35-40% of the overall market. The country’s substantial defense budget, along with its ongoing modernization initiatives, positions it as a leader in military technology adoption. China’s focus on strengthening its defense capabilities in response to regional tensions, such as those in the South China Sea and the Taiwan Strait, further accelerates the demand for advanced defense solutions, including loitering munitions. China’s investment in autonomous and precision-guided munitions aligns with its broader strategy of modernizing its military to counter emerging threats.

India follows closely, with a market share of around 20-25%. The country’s increasing military expenditure, particularly under its defense modernization programs, is driving demand for innovative defense systems like loitering munitions. India’s focus on counterterrorism operations, border security, and strategic defense in regions such as Kashmir contributes to the growing adoption of loitering munitions. Collaborative efforts with international defense contractors also enable India to enhance its indigenous production capabilities, further supporting market growth.

Japan and South Korea are also key players in the market, with each country holding a combined market share of 15-20%. Japan’s defense policy, focused on regional security and countering threats from North Korea, drives demand for loitering munitions, especially for surveillance and precision strikes. South Korea, dealing with ongoing tensions with North Korea, invests heavily in advanced military technologies to enhance its defense capabilities. Both countries are increasingly incorporating loitering munitions into their defense strategies to ensure tactical superiority in regional security challenges.

Other emerging markets in the region, including Southeast Asia and Oceania, are also contributing to the growth of the loitering munition market. Countries like Australia and Indonesia are progressively investing in advanced defense systems, with Australia focusing on defense innovation and Indonesia expanding its military modernization initiatives. These regions hold a smaller market share, but their increasing defense budgets and strategic focus on military technology are expected to drive further demand for loitering munitions in the coming years.

Key Player Analysis:

- Northrop Grumman

- Solar Industries

- Israel Aerospace Industries

- UVision Air

- Elbit Systems Ltd

- Thales

- Zhongce Beifang Science and Technology

- Paramount Group

- AVIC (Aviation Industry Corporation of China)

- Norinco (China North Industries Group Corporation)

- CASC (China Aerospace Corporation)

Competitive Analysis:

The Asia Pacific loitering munition market is highly competitive, with several key players vying for dominance through technological innovation and strategic collaborations. Leading manufacturers such as Israel Aerospace Industries (IAI), Elbit Systems, and Northrop Grumman are at the forefront, providing advanced loitering munition systems with cutting-edge features like autonomous capabilities, precision targeting, and extended endurance. In addition to established players, emerging regional companies in China, India, and Japan are contributing to market growth by developing indigenous systems tailored to local defense needs. These companies are increasingly focusing on cost-effective, modular solutions to enhance their market presence. Collaborations between defense contractors and government agencies play a critical role in shaping the competitive landscape, as countries in the region seek to modernize their military capabilities. The increasing focus on R&D and the incorporation of artificial intelligence and autonomous systems will drive competition, further intensifying the race for advanced loitering munition technologies.

Recent Developments:

- In October 2024, UVision, a leading Israeli defense company, launched its Autonomous Multi-Launch Loitering Munition System. This system is capable of deploying multiple HERO 120 munitions at once and features advanced mission planning capabilities. The integration of artificial intelligence enables autonomous mission management, from target identification to neutralization, and allows seamless operation with tactical UAS, drones, and command-and-control systems, further enhancing operational flexibility and precision for military users in the Asia Pacific region and beyond.

- In April 2025, India-based IndoWings unveiled the LM-250 loitering munition system, specifically designed for integration with India’s Pinaka Multiple Barrel Rocket Launcher (MBRL). This innovation allows a single Pinaka canister to launch up to 50 LM-250 units simultaneously, greatly boosting India’s capacity for rapid and precise strikes in modern battlefield scenarios.

- In March 2025, China completed the development of the Feilong-60A (Flying Dragon-60), its first modular rocket-based loitering munition. This new system is paired with the SR-5 multiple-launch rocket system, and each unit is equipped with two six-tube canisters, significantly enhancing China’s precision strike capabilities and marking a notable advancement in the country’s indigenous loitering munition technology.

Market Concentration & Characteristics:

The Asia Pacific loitering munition market is moderately concentrated, with a few large, established players dominating the competitive landscape. Key international defense contractors such as Israel Aerospace Industries (IAI), Elbit Systems, and Northrop Grumman hold significant market shares due to their advanced technologies and extensive defense contracts with governments across the region. These companies are leading the development of autonomous loitering munitions, incorporating cutting-edge capabilities such as AI, real-time surveillance, and precision strike systems. However, the market is also witnessing increasing participation from regional players in China, India, and Japan, where defense modernization efforts are driving local innovation. These companies focus on providing cost-effective solutions, often tailored to the specific needs of regional military forces. The market’s characteristics are defined by rapid technological advancements, a high degree of defense collaboration, and a focus on enhancing operational efficiency while reducing costs, which fuels competition and market dynamics.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type. Range, Launch Mode and End User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Asia Pacific loitering munition market is expected to grow steadily, driven by increasing military expenditure across the region.

- The demand for autonomous systems will surge as nations prioritize AI and machine learning integration in defense technologies.

- Precision strike capabilities will remain a key growth factor, with loitering munitions providing cost-effective alternatives to traditional missiles.

- The rise of geopolitical tensions, particularly in the South China Sea and Taiwan Strait, will push countries to invest in advanced weaponry.

- Regional manufacturers will focus on developing indigenous loitering munition systems tailored to local defense needs.

- Collaboration between defense contractors and governments will intensify, promoting the development of cutting-edge technologies.

- The shift towards modular and multi-role loitering munitions will open up new market opportunities.

- Increased adoption of swarming technologies will enhance operational flexibility and effectiveness in various military operations.

- Smaller nations with limited defense budgets will seek affordable loitering munition systems to modernize their forces.

- The integration of loitering munitions with unmanned aerial systems (UAS) will gain traction, driving innovation and market growth.