Market Overview

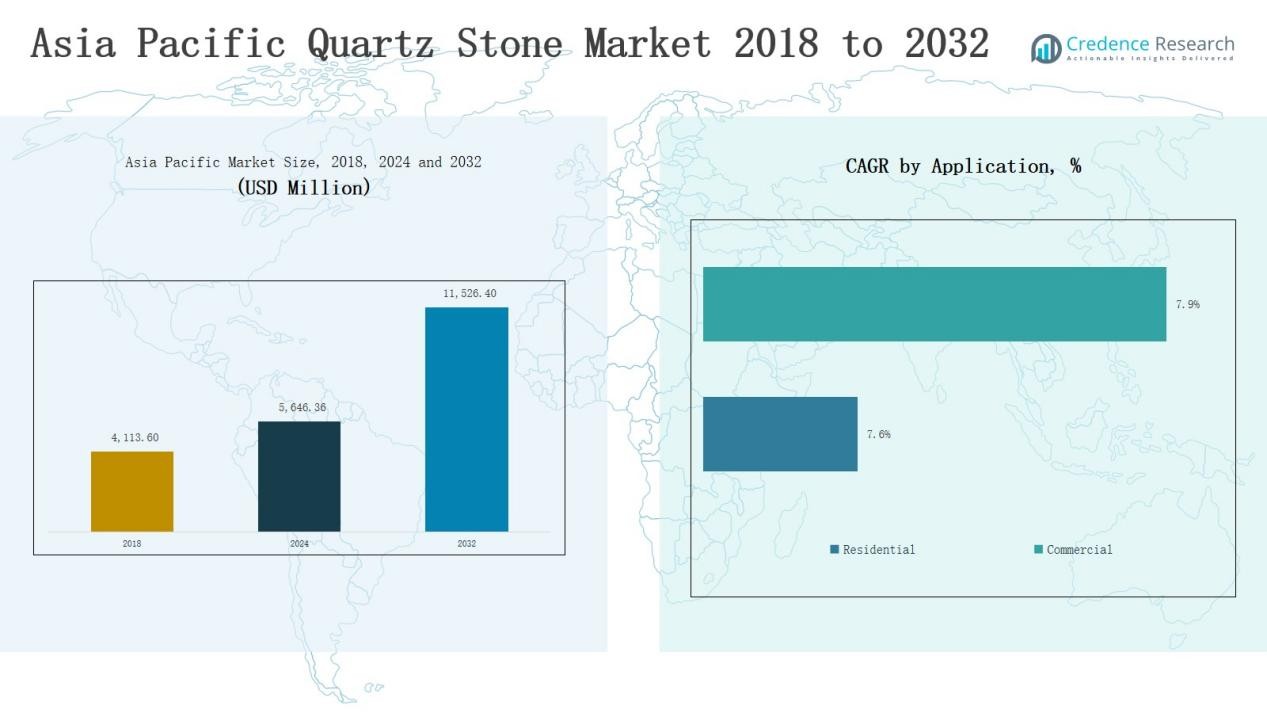

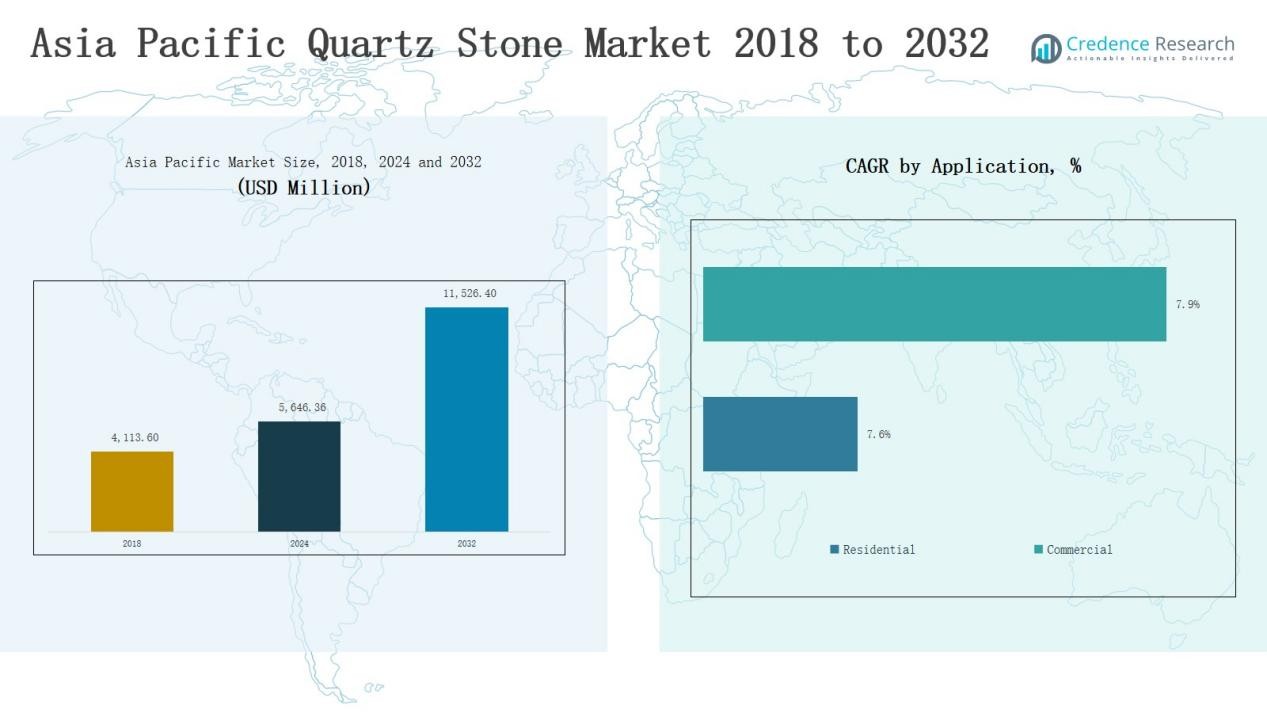

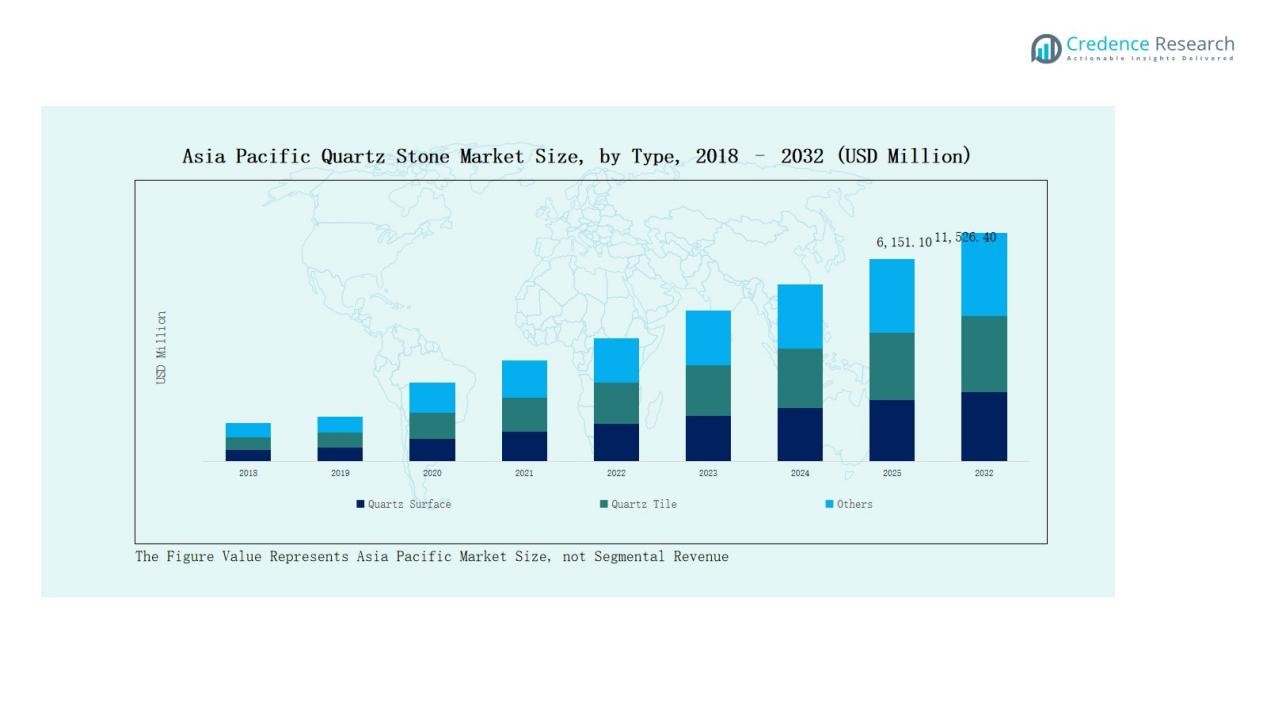

The Asia Pacific Quartz Stone Market was valued at USD 4,113.60 million in 2018, increased to USD 5,646.36 million in 2024, and is projected to reach USD 11,526.40 million by 2032, growing at a CAGR of 9.36% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Asia Pacific Quartz Stone Market Size 2024 |

USD 5,646.36 Million |

| Asia Pacific Quartz Stone Market, CAGR |

9.36% |

| Asia Pacific Quartz Stone Market Size 2032 |

USD 11,526.40 Million |

The Asia Pacific Quartz Stone Market is dominated by key players such as Sinostone, Bitto Quartz Stone, Pokarna Limited, LG Hausys, Quantra Quartz, Alicante Surfaces, and Bao Phat Vietnam New Material Co. Ltd. These companies lead through advanced manufacturing technologies, extensive product portfolios, and strong regional distribution networks. They focus on engineered quartz production, emphasizing durability, sustainability, and design innovation to meet rising interior and architectural demand. Among all regions, China emerged as the leading market in 2024, holding a 41% share, driven by its robust industrial base, high domestic consumption, and expanding export capacity.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Asia Pacific Quartz Stone Market grew from USD 4,113.60 million in 2018 to USD 5,646.36 million in 2024 and is expected to reach USD 11,526.40 million by 2032, expanding at a CAGR of 9.36%.

- China led the market in 2024 with a 41% share, driven by strong manufacturing capacity, abundant raw materials, and rising domestic demand for engineered quartz products.

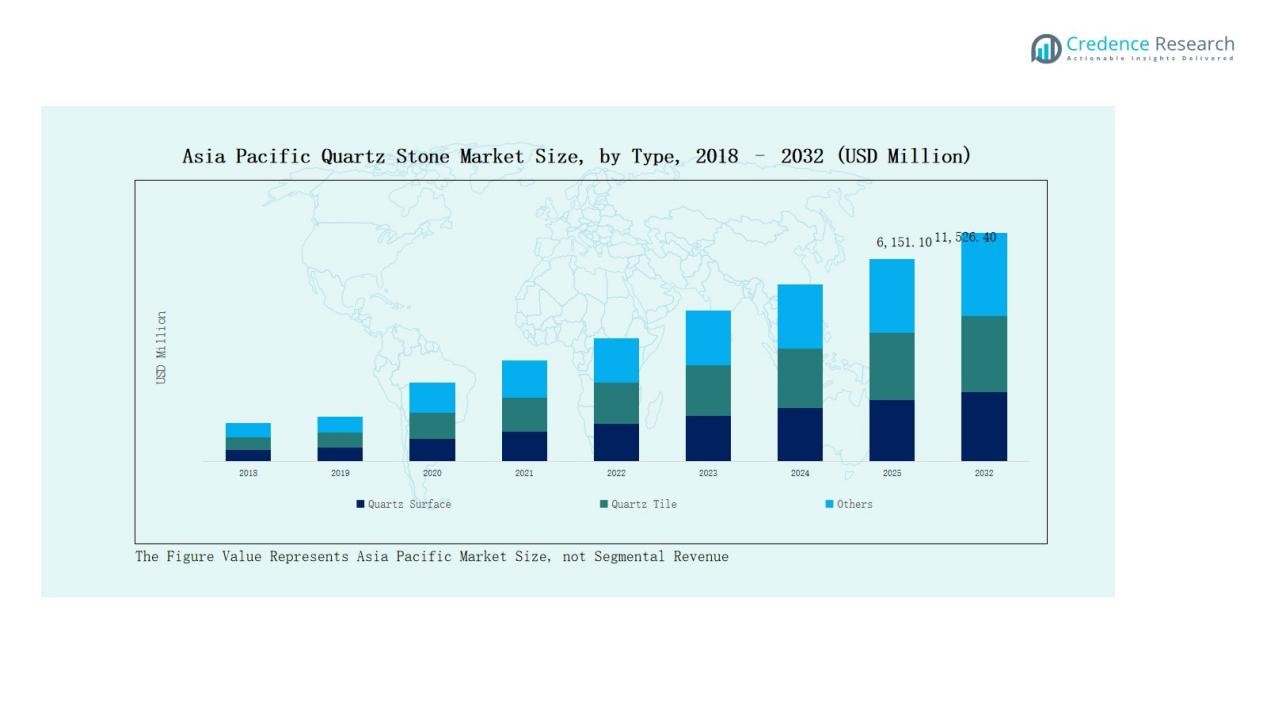

- The Quartz Surface segment dominated by type with a 58% share in 2024, supported by high use in countertops, flooring, and wall cladding applications across residential and commercial projects.

- The Residential application segment held a 63% share, fueled by urban housing projects, renovation trends, and increasing preference for durable, low-maintenance surfaces.

- Engineered Quartz accounted for 71% of material composition share due to its superior strength, design flexibility, and growing adoption in modular kitchens across China and India.

Market Segment Insights

By Type:

The Quartz Surface segment dominated the Asia Pacific Quartz Stone Market in 2024, accounting for 58% of the total share. Its leadership stems from high demand in kitchen countertops, flooring, and wall cladding. The segment benefits from the material’s durability, non-porous nature, and premium finish. Growing adoption in residential and commercial construction, particularly across China and India, further supports its dominance. Rising design flexibility and improved manufacturing technologies continue to drive segment growth.

- For instance, PACIFIC launched commercial operations at a new Indian quartz manufacturing plant using Breton Stone Technology and advanced automation, setting a production benchmark of 1.1 million square meters annually and supplying super jumbo slabs for residential and commercial projects.

By Application:

The Residential segment held a 63% share of the Asia Pacific Quartz Stone Market in 2024. Demand is driven by rising urban housing projects, premium interior design preferences, and renovation activities. Quartz stones’ stain resistance and longevity make them ideal for kitchen and bathroom installations. Rapid urbanization in emerging economies like China, India, and Vietnam strengthens this segment’s outlook. Increasing consumer spending on home aesthetics and sustainable surfaces boosts residential usage.

- For instance, Johnson Marble & Quartz offers the Cristal quartz series, which includes Cristal Grey and Cristal White. The company has a manufacturing plant in Gujarat, near Rajkot, and supplies its engineered marble and quartz products across India for a range of residential and commercial projects.

By Material Composition:

The Engineered Quartz segment led the Asia Pacific Quartz Stone Market in 2024, representing 71% of the total share. Its dominance arises from superior uniformity, color consistency, and enhanced strength over natural alternatives. Manufacturers favor engineered quartz for its design versatility and resistance to scratches, heat, and chemicals. Rapid growth in modular kitchen adoption and expanding production capacity across China and India sustain this lead. Eco-friendly innovations further increase consumer preference for engineered quartz solutions.

Key Growth Drivers

Expanding Construction and Remodeling Activities

Rising residential and commercial construction across China, India, and Southeast Asia drives quartz stone demand. The region’s focus on infrastructure modernization, luxury housing, and urban redevelopment projects boosts installations of quartz surfaces and tiles. Increasing consumer preference for durable, low-maintenance materials in kitchens and bathrooms further supports market expansion. Rapid urbanization and government-led housing programs enhance consumption of engineered quartz products across major Asia Pacific economies.

- For instance, Sinostone, a Chinese quartz manufacturer, offers engineered quartz products with NSF and GREENGUARD certifications, catering to residential and commercial applications.

Growing Adoption of Engineered Quartz

Engineered quartz leads due to superior strength, uniform texture, and wide design variety. The segment’s non-porous and low-maintenance properties make it ideal for modern interiors. Increased production capabilities in China and India and advancements in resin bonding technologies strengthen its market position. Rising awareness of sustainable and recyclable quartz composites encourages greater adoption across residential and commercial projects. Manufacturers are expanding product lines to meet rising aesthetic and performance standards.

- For instance, Cambria Company LLC released its Inverness Frost design in February 2022, as an addition to its existing Inverness quartz surface line. The company has a longstanding commitment to sustainable manufacturing practices, and this design, like others, reflects that dedication.

Technological Advancements in Manufacturing

Advanced fabrication technologies like CNC machining, automated polishing, and resin infusion improve precision and efficiency. These developments enable consistent surface quality, enhanced customization, and reduced material waste. Automation integration lowers production costs and boosts scalability for large infrastructure projects. Manufacturers also invest in digital design tools and surface treatments that enhance aesthetics and functionality, meeting the diverse preferences of Asia Pacific’s growing middle-class population.

Key Trends & Opportunities

Rising Demand for Sustainable and Eco-friendly Materials

Eco-friendly quartz, incorporating recycled content and low-emission resins, is gaining traction across Asia Pacific. Consumers are increasingly focused on green interiors and sustainable building practices. Governments promoting environmental certifications like LEED further encourage adoption. Manufacturers are developing energy-efficient processes and offering recyclable quartz surfaces, aligning with regional sustainability goals. This trend creates strong opportunities for innovative product lines with minimal ecological impact and longer life cycles.

- For instance, Granite & TREND Transformations and Eco Surfaces Australia also use significant amounts of recycled glass in their engineered stone products, diverting substantial landfill waste while maintaining durability and design versatility.

Increasing Penetration in Emerging Markets

Emerging economies such as Vietnam, Indonesia, and the Philippines are experiencing rapid urbanization and income growth, fueling quartz stone demand. Expanding construction of hotels, offices, and retail spaces increases commercial application potential. Local manufacturing capacity expansion and affordable quartz alternatives enhance accessibility. Market players are focusing on localized distribution networks and tailored designs to capture this demand surge. This expansion offers a significant opportunity for long-term regional growth.

- For instance, HanStone Quartz, a brand of Hyundai L&C, is manufactured in a state-of-the-art facility in London, Ontario, Canada, primarily serving the North American market. The company also has production facilities in South Korea.

Key Challenges

High Manufacturing and Installation Costs

Quartz stone production involves costly raw materials and energy-intensive processes, increasing overall expenses. Transportation and installation also require specialized handling, further raising costs. These factors limit adoption among price-sensitive customers in developing economies. Fluctuating resin and silica prices affect profitability margins. Despite technological advancements, maintaining competitive pricing while ensuring quality remains a key challenge for regional manufacturers.

Environmental and Regulatory Constraints

Quartz manufacturing emits silica dust and other particulates, leading to occupational health and environmental concerns. Stricter environmental regulations across countries like China and Australia demand cleaner production technologies. Compliance with emission standards and waste management adds operational costs. Manufacturers must adopt sustainable practices to meet government norms while maintaining production efficiency. Delays in regulatory adaptation can slow expansion in some regions.

Intense Market Competition and Price Pressure

The Asia Pacific Quartz Stone Market faces stiff competition from regional and international players. Local manufacturers offer low-cost alternatives, creating pricing pressure on established brands. High product similarity limits differentiation, leading to narrow profit margins. Continuous innovation and branding are needed to sustain market presence. Companies must balance quality, design, and affordability to maintain competitiveness in this rapidly evolving market.

Regional Analysis

China

China dominated the Asia Pacific Quartz Stone Market in 2024, holding a 41% share. It benefits from large-scale manufacturing capabilities, abundant raw material availability, and strong domestic demand. Rapid urbanization and government infrastructure programs drive product usage in residential and commercial spaces. The country’s extensive export network further enhances regional growth. Manufacturers such as Sinostone and Bitto Quartz Stone lead innovation and capacity expansion. Rising adoption of engineered quartz for kitchen and bathroom applications supports sustained market growth.

India

India accounted for a 22% share of the regional market in 2024. It experiences robust growth driven by expanding construction, rising disposable income, and growing preference for premium interiors. Increasing investments in housing and commercial projects strengthen local consumption. Key producers like Pokarna Limited and Maestro Surfaces enhance the country’s position in engineered quartz exports. Government initiatives promoting affordable housing and smart city development create strong market opportunities. Domestic processing capacity expansion improves supply reliability and cost competitiveness.

Japan

Japan captured a 10% share in 2024, supported by advanced technological infrastructure and demand for high-quality materials. The market focuses on precision-engineered quartz surfaces tailored for architectural and industrial applications. Strong emphasis on sustainability and energy-efficient buildings drives quartz adoption. Japanese consumers value durability and aesthetics, favoring premium engineered quartz variants. It benefits from the presence of advanced processing technologies and research-based material innovation. Urban redevelopment and renovation projects continue to create steady demand.

South Korea

South Korea represented a 9% share of the regional market in 2024. It shows strong demand for engineered quartz surfaces in modern residential and commercial interiors. Manufacturers such as LG Hausys focus on product diversification and aesthetic enhancements. The country’s innovation-driven manufacturing ecosystem supports quality and sustainability. Expanding export opportunities to neighboring countries also boost production efficiency. Rising renovation activities in urban housing further fuel market expansion.

Australia and Southeast Asia

Australia and Southeast Asia together accounted for a 18% share of the Asia Pacific Quartz Stone Market in 2024. Australia’s strong residential remodeling activities and sustainable material trends promote quartz adoption. Southeast Asia, led by Vietnam, Thailand, and Indonesia, experiences rising demand from rapid urbanization and hospitality projects. Local manufacturing advancements and competitive pricing attract new buyers. It continues to emerge as a key growth hub supported by government-led infrastructure programs and foreign investment inflows.

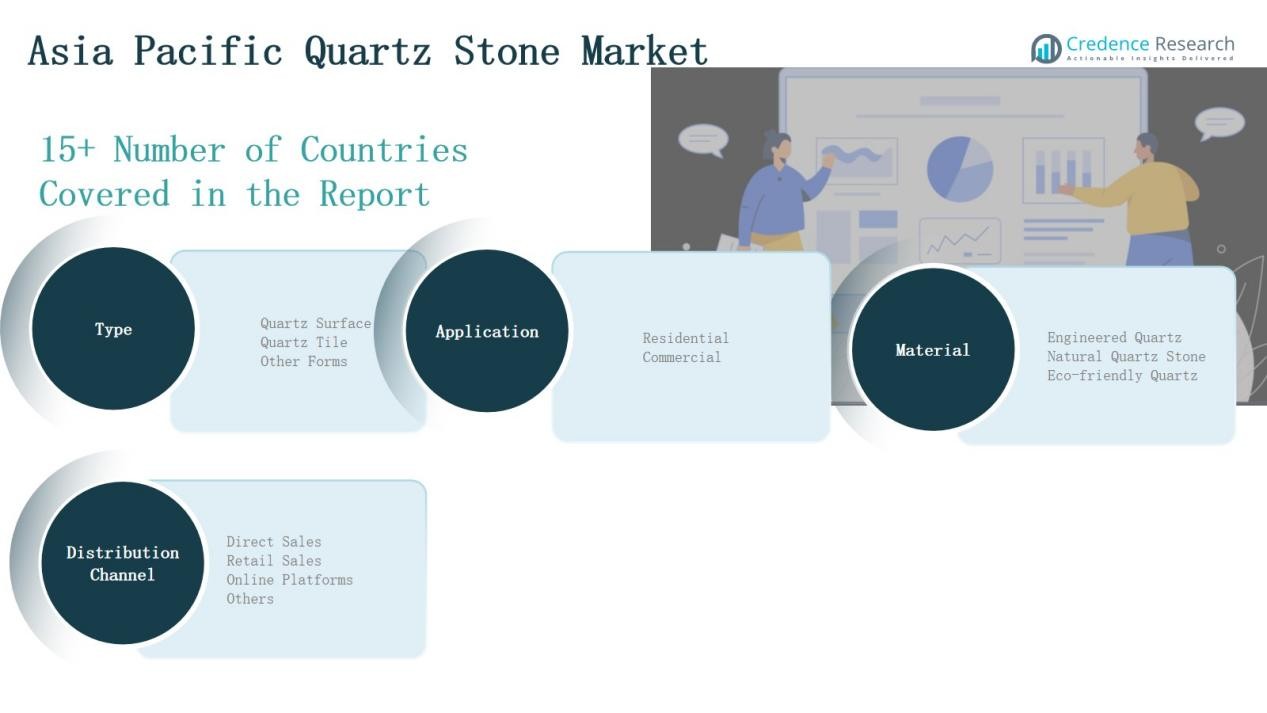

Market Segmentations:

By Type

- Quartz Surface

- Quartz Tile

- Other Forms

By Application

By Material Composition

- Engineered Quartz

- Natural Quartz Stone

- Eco-friendly Quartz

By Distribution Channel

- Direct Sales

- Retail Sales

- Online Platforms

- Others

By Region

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

Competitive Landscape

The Asia Pacific Quartz Stone Market features strong competition among regional and global manufacturers focused on innovation, cost efficiency, and design diversity. Leading players such as Sinostone, Bitto Quartz Stone, Pokarna Limited, LG Hausys, and Quantra Quartz dominate through advanced production facilities and extensive distribution networks. Companies emphasize engineered quartz development using precision fabrication and eco-friendly materials to meet evolving consumer preferences. Expanding infrastructure and housing projects in China and India drive capacity upgrades and product differentiation. Strategic initiatives, including partnerships, product launches, and regional expansions, strengthen brand presence and market reach. Mid-tier companies like Alicante Surfaces, UMGG Stone, and Bao Phat Vietnam New Material Co. Ltd. focus on affordability and design customization to capture emerging markets. The competitive landscape remains fragmented, with intense pricing pressure and a growing shift toward sustainable quartz solutions enhancing innovation and long-term market consolidation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Sinostone

- Bitto Quartz Stone (China)

- Pengxiang Quartz (China)

- UMGG Stone (China)

- Bao Phat Vietnam New Material Co. Ltd. (Vietnam)

- RenShou Industries (China)

- Pokarna Limited (India)

- Alicante Surfaces (India)

- Quantra Quartz (Pokarna Engineered Stone Ltd.) (India)

- LG Hausys (South Korea)

- Lung Shing Quartz Stone (China)

- Maestro Surfaces (India)

Recent Developments

- In December 2024, SCHOTT AG announced the acquisition of QSIL GmbH Quarzschmelze Ilmenau to strengthen its quartz glass and semiconductor materials portfolio. The transaction was completed in January 2025, expanding SCHOTT’s footprint across the Asia Pacific quartz value chain.

- In October 2025, Cosentino introduced its new mineral surface brand Éclos®, developed using Inlayr® technology, which eliminates crystalline silica. The launch highlights the company’s focus on sustainable and advanced quartz alternatives in the Asia Pacific market.

- In 2025, Vicostone launched ten new quartz surface colors in Japan to enhance its product range for residential and commercial interiors. The new collection reflects the company’s strategy to expand its presence and design offerings across Asia Pacific markets.

- In May 2025, Caesarstone launched its ICON line, featuring higher recycled content and enhanced durability for commercial and residential uses.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Material Composition, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for engineered quartz will rise due to growing residential and commercial construction.

- Manufacturers will focus on expanding production capacity across China and India.

- Eco-friendly and recyclable quartz surfaces will gain higher adoption among consumers.

- Technological advancements in surface finishing will enhance product durability and appeal.

- Increasing renovation and remodeling activities will support sustained market demand.

- Local players will strengthen export potential through improved manufacturing efficiency.

- Smart city and infrastructure projects will drive large-scale quartz installations.

- Rising consumer preference for premium interiors will boost high-end quartz designs.

- Strategic collaborations between suppliers and builders will improve product accessibility.

- Continued investment in sustainable manufacturing will shape long-term regional competitiveness.