Market Overview

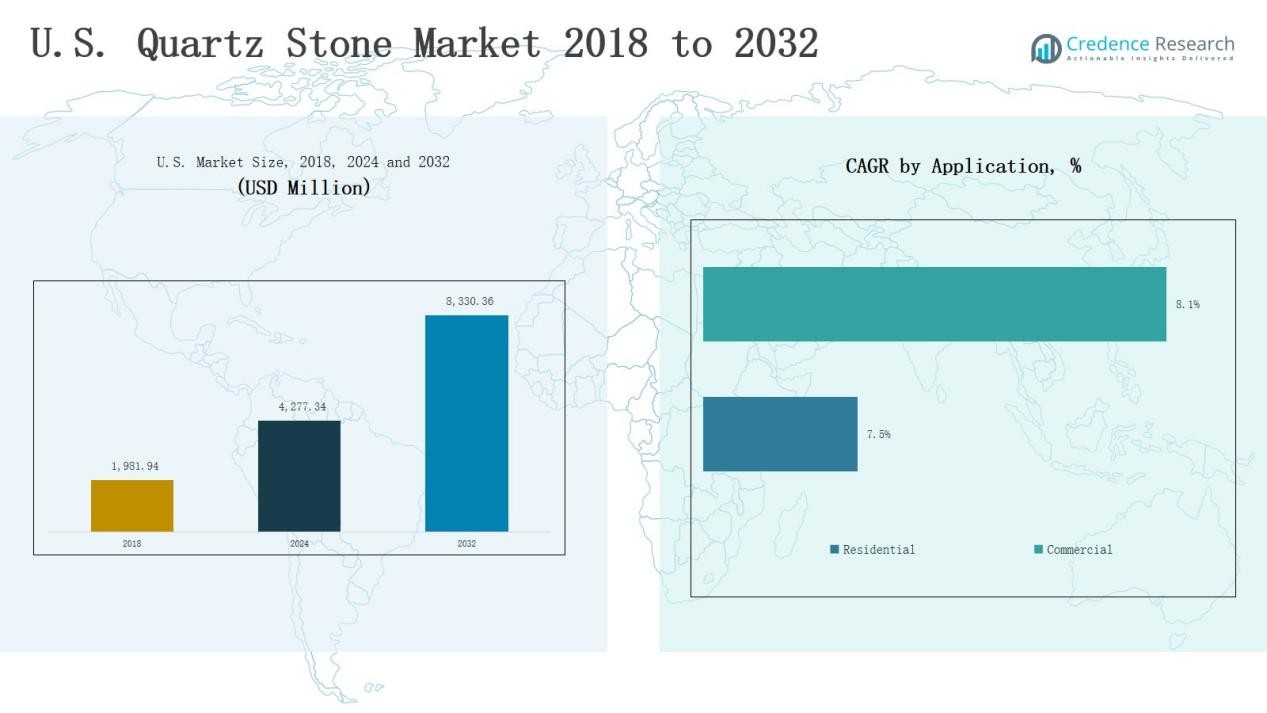

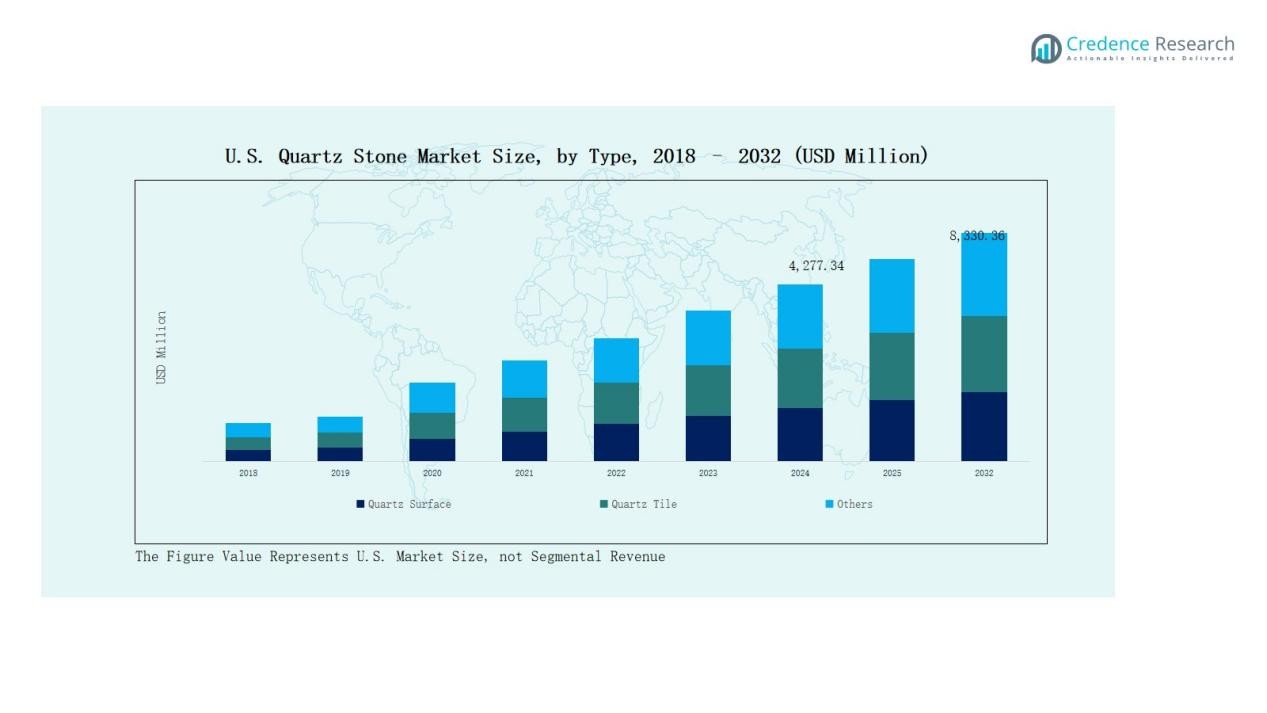

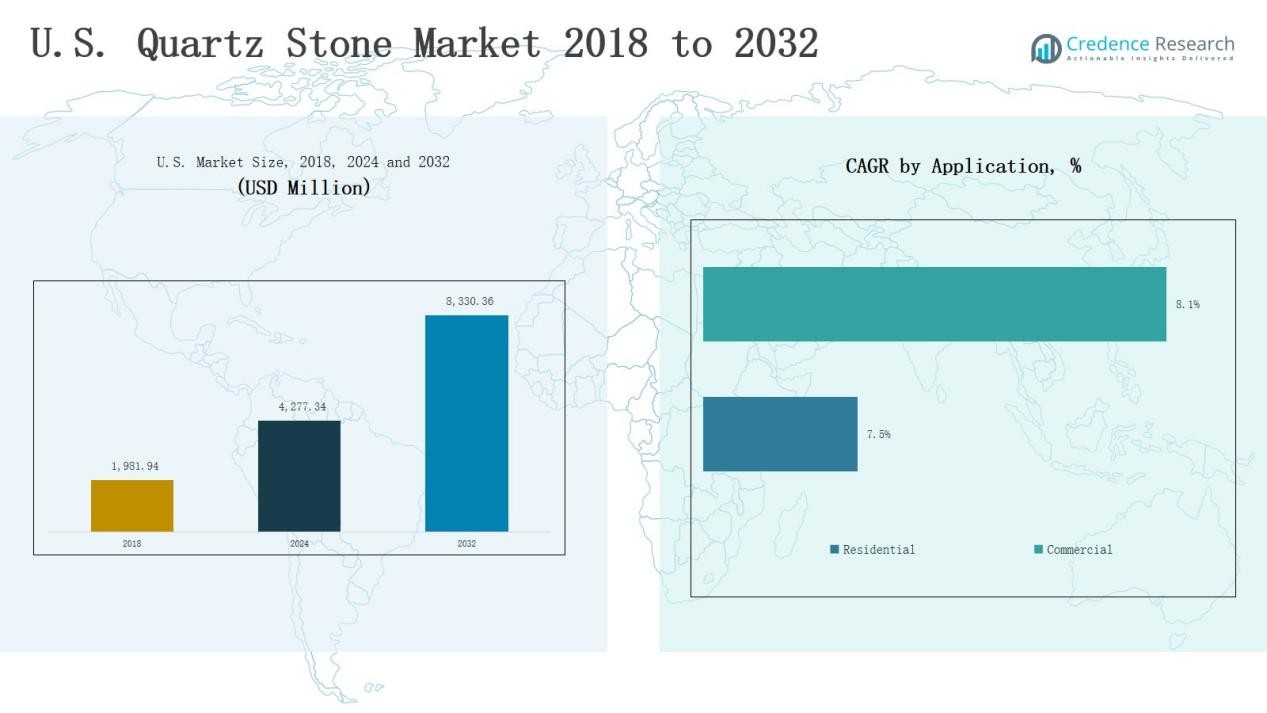

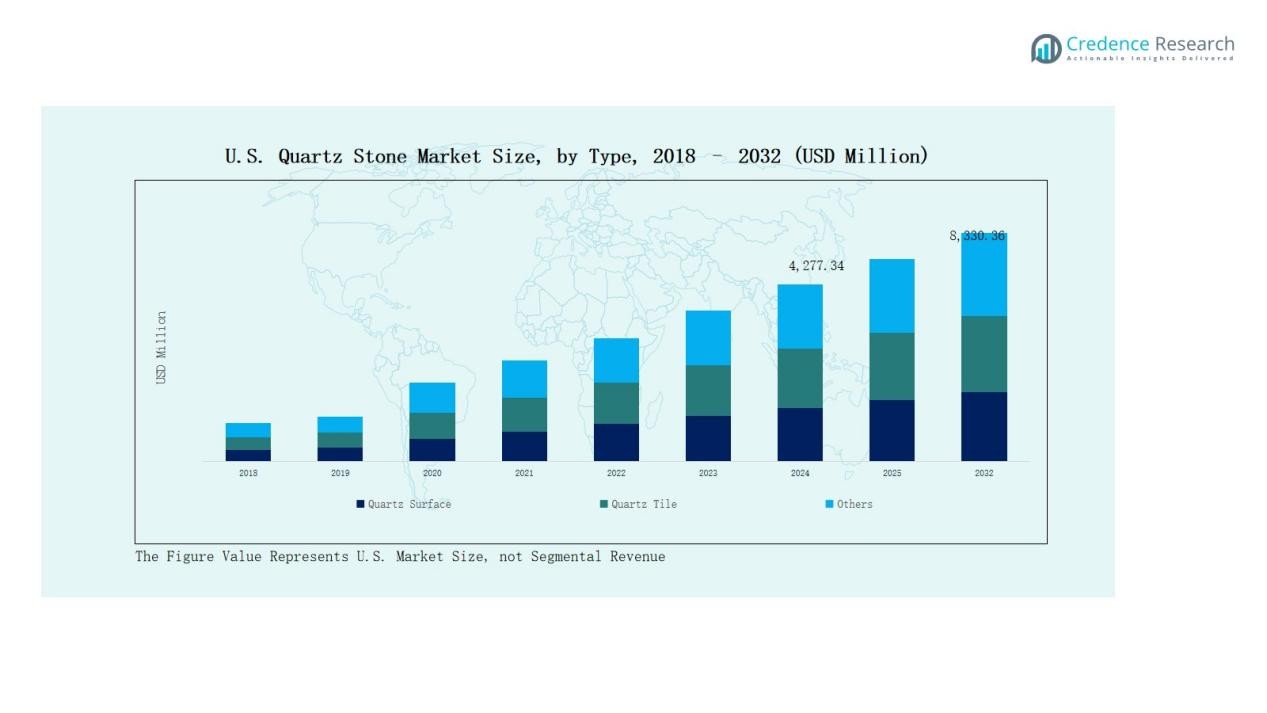

The U.S. Quartz Stone Market size was valued at USD 1,981.94 million in 2018, increased to USD 4,277.34 million in 2024, and is projected to reach USD 8,330.36 million by 2032, growing at a CAGR of 8.69% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Quartz Stone Market Size 2024 |

USD 4,277.34 Million |

| U.S. Quartz Stone Market, CAGR |

8.69% |

| U.S. Quartz Stone Market Size 2032 |

USD 8,330.36 Million |

The U.S. Quartz Stone Market is led by major companies including Caesarstone Ltd., Cambria Company LLC, Hanwha L&C (HanStone Quartz), LG Hausys Ltd., DuPont de Nemours, Inc., Wilsonart LLC, Vicostone JSC, Compac Surfaces, Santa Margherita S.p.A., and Quarella S.p.A. These firms dominate through advanced engineering, design innovation, and strong brand portfolios. They focus on surface durability, aesthetic customization, and sustainable production to meet rising consumer expectations. The South region emerged as the market leader in 2024, holding a 33% share, driven by rapid urbanization, housing expansion, and growing hospitality investments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The U.S. Quartz Stone Market grew from USD 1,981.94 million in 2018 to USD 4,277.34 million in 2024, and is projected to reach USD 8,330.36 million by 2032, growing at 69% CAGR.

- Quartz Surface led with 63% share in 2024 due to its durability and use in countertops, while Quartz Tile held 25% and Other Forms captured 12%.

- The Residential segment dominated with 68% share, driven by rising home renovations and modern kitchen remodeling trends across the United States.

- Engineered Quartz held 72% share in 2024, supported by consistent quality, variety, and growing demand for sustainable and customized designs.

- The South region remained the leader with 33% share, followed by the Northeast and West each at 24%, driven by rapid urbanization and strong construction growth.

Market Segment Insights

By Type:

The Quartz Surface segment dominated the U.S. Quartz Stone Market in 2024, accounting for 63% of the total share. Its popularity stems from superior durability, aesthetic appeal, and wide use in countertops and wall claddings. The Quartz Tile segment captured 25%, driven by cost-effective flooring demand in residential and commercial interiors. Other Forms held the remaining 12%, mainly used in decorative and architectural applications where design flexibility and customized finishing are required.

- For instance, Cambria offers its Inverness Everleigh quartz surface, featuring debossed, intricate veining in both a high-gloss and a Cambria Matte® finish for premium kitchen installations.

By Application:

The Residential segment led the U.S. Quartz Stone Market in 2024 with a 68% share, supported by increasing home renovation and luxury kitchen remodeling activities. Rising consumer preference for durable, stain-resistant surfaces also boosts demand. The Commercial segment held 32%, driven by the growing adoption of premium quartz in hotels, offices, and retail interiors for enhanced durability, visual consistency, and low maintenance requirements.

- For instance, Silestone by Cosentino collaborated with U.S. hotel chains in 2024 to supply its Sunlit Days collection for eco-certified interiors, while HanStone Quartz products were increasingly specified in office fit-outs and retail counters due to their visual uniformity and ease of maintenance.

By Material Composition:

The Engineered Quartz segment dominated the U.S. Quartz Stone Market in 2024, holding 72% of the share. Its strong performance is linked to controlled manufacturing, consistent quality, and wide design variety. Natural Quartz Stone accounted for 18%, favored in traditional applications valuing authentic texture and color depth. Eco-friendly Quartz captured 10%, supported by rising sustainability trends, recycled material use, and increasing consumer preference for environmentally responsible interior products.

Key Growth Driver

Rising Demand for Premium Residential Interiors

The U.S. Quartz Stone Market is driven by growing adoption of premium materials in residential renovations and new housing projects. Homeowners prefer quartz surfaces for their durability, stain resistance, and visual appeal. Expanding home improvement spending and the popularity of modern kitchen and bathroom designs further enhance market growth. The increasing availability of customizable colors and textures supports consumer appeal, positioning quartz stone as a long-term replacement for granite and marble surfaces.

- For instance, Caesarstone Darcrest quartz countertop features unique organic hues and a honed finish that appeals to consumers seeking both aesthetic and practical benefits in bathroom surfaces.

Expanding Commercial Construction Sector

Rising commercial construction across offices, hotels, and retail spaces drives quartz stone demand. Developers favor quartz for its consistency, ease of maintenance, and design flexibility. Growing investment in hospitality and corporate infrastructure supports large-scale adoption. Quartz’s hygienic properties and non-porous surface make it ideal for high-traffic commercial environments, boosting its usage in lobbies, reception areas, and food service facilities throughout the United States.

- For instance, Silestone by Cosentino is a durable, hygienic quartz surface with a wide color range that is often used in hospitality design projects.

Technological Advancements in Manufacturing

Continuous advancements in surface engineering, digital printing, and resin formulation enhance product quality and design realism. U.S. manufacturers invest in automated production lines and sustainable processing technologies to increase efficiency and reduce waste. These innovations enable precise color matching, improved surface hardness, and expanded design options. Technological integration strengthens domestic production capacity and allows local players to compete with international brands offering advanced engineered quartz solutions.

Key Trend & Opportunity

Sustainability and Eco-Friendly Quartz Products

Growing environmental awareness encourages the use of eco-friendly quartz made from recycled materials and low-emission resins. Consumers increasingly prefer sustainable interiors with certified green products. Manufacturers adopt renewable energy, closed-loop water systems, and recycled aggregates to meet U.S. sustainability standards. This shift creates opportunities for brands emphasizing environmental performance, supporting premium positioning within both residential and commercial segments.

- For instance, Cosentino’s HybriQ+ line is produced using 100% renewable electricity and 99% recycled water.

Rise of Digital Customization and Smart Fabrication

Digital design tools and precision fabrication technologies are transforming the quartz industry. Consumers and designers benefit from 3D visualization, computer-aided cutting, and CNC shaping systems for bespoke installations. This trend allows faster project turnaround, reduced material waste, and greater customization flexibility. Integration with digital retail platforms also strengthens direct-to-consumer engagement, expanding brand reach and enabling personalized product experiences.

- For instance, Caesarstone launched its “Caesarstone Visualizer 3.0,” offering real-time 3D kitchen and bathroom layout previews with AI-assisted color matching.

Key Challenge

High Production and Installation Costs

Quartz stone manufacturing requires energy-intensive processes, advanced resins, and imported raw materials, driving up costs. Installation also demands specialized equipment and skilled labor, raising project expenses. Price sensitivity among mid-range consumers limits market expansion. Balancing affordability with premium quality remains a key challenge for manufacturers seeking wider adoption in both residential and commercial segments.

Competition from Alternative Surface Materials

Quartz stone faces strong competition from granite, porcelain, and solid-surface composites. These alternatives offer similar aesthetic and functional benefits at lower price points. Rapid product innovation in ceramics and hybrid surfaces further intensifies competition. To maintain growth, quartz manufacturers must differentiate through sustainability, advanced design, and stronger brand positioning across both online and offline distribution channels.

Supply Chain Volatility and Raw Material Dependence

The U.S. Quartz Stone Market remains vulnerable to fluctuations in resin, silica, and pigment prices. Dependence on imported materials and logistics disruptions can affect production timelines and profit margins. Global trade tensions and rising transportation costs add uncertainty. Companies are adopting localized sourcing and strategic partnerships to secure stable supply chains and ensure consistent market delivery.

Regional Analysis

Northeast

The Northeast region held 24% of the U.S. Quartz Stone Market in 2024. Strong urban infrastructure and high disposable income support residential and commercial remodeling projects. States such as New York, Massachusetts, and Pennsylvania show consistent demand for quartz countertops and flooring in luxury apartments and hospitality spaces. The region’s preference for durable, low-maintenance materials boosts adoption among premium interior designers. Renovation activity in older housing stock and urban redevelopment programs continue to drive steady market growth in this region.

Midwest

The Midwest accounted for 19% of the total market share in 2024. Rising home improvement projects and new housing developments fuel demand for engineered quartz surfaces. Consumers prefer quartz over natural stone due to its cost efficiency and low upkeep. Industrial expansion in Illinois, Ohio, and Michigan also promotes commercial usage in office and retail infrastructure. The region benefits from improved supply chain access and domestic manufacturing facilities, supporting steady distribution across urban and semi-urban centers.

South

The South region led the market with a 33% share in 2024. Rapid urbanization, population growth, and strong housing starts in Texas, Florida, and Georgia drive high consumption of quartz stone. Developers favor quartz for its resistance to humidity and heat, suitable for southern climates. The region’s expanding hospitality sector further strengthens product penetration in hotels and restaurants. Continuous real estate investment and remodeling activities maintain the South’s dominance in overall market revenue.

West

The West region captured 24% of the U.S. Quartz Stone Market in 2024. States like California, Washington, and Arizona lead demand due to their strong design culture and sustainability focus. The popularity of eco-friendly quartz surfaces supports growth among environmentally conscious consumers. Local fabricators benefit from proximity to ports, enabling steady material imports and faster delivery cycles. Expanding high-end residential projects and commercial developments in metropolitan areas sustain long-term regional demand.

Market Segmentations:

By Type

- Quartz Surface

- Quartz Tile

- Other Forms

By Application

By Material Composition

- Engineered Quartz

- Natural Quartz Stone

- Eco-friendly Quartz

By Distribution Channel

- Direct Sales

- Retail Sales

- Online Platforms

- Others

By Region

- Northeast

- Midwest

- South

- West

Competitive Landscape

The U.S. Quartz Stone Market is moderately consolidated, featuring strong competition among global and domestic players. Leading companies such as Caesarstone Ltd., Cambria Company LLC, Hanwha L&C (HanStone Quartz), LG Hausys Ltd., DuPont de Nemours, Inc., and Wilsonart LLC dominate through extensive product portfolios and advanced manufacturing technologies. These firms emphasize innovation, surface durability, and design variety to strengthen market presence. Regional players, including Santa Margherita S.p.A., Vicostone JSC, and Compac Surfaces, expand through partnerships and distribution networks to enhance coverage. The market shows rising investment in automation, digital fabrication, and sustainable quartz production to meet evolving consumer preferences. Product differentiation through texture, finish, and eco-certified materials remains a key strategy for maintaining competitiveness. Companies also focus on capacity expansion, technological integration, and branding efforts to capture growing residential and commercial demand across the United States.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Caesarstone Ltd.

- Hanwha L&C (HanStone Quartz)

- Compac Surfaces

- Vicostone JSC

- Wilsonart LLC

- DuPont de Nemours, Inc.

- LG Hausys Ltd.

- Cambria Company LLC

- Santa Margherita S.p.A.

- Quarella S.p.A.

- Samsung Radianz (Samsung Surface Brand)

- Bitto (Dongguan)

Recent Developments

- In August 2025, Wilsonart introduced ten new quartz designs featuring bold green and blue tones, along with enhanced solid surface patterns to expand its premium design portfolio.

- In April 2025, Vadara Quartz formed a distribution partnership with CRS Marble & Granite to strengthen its U.S. market reach and improve regional supply capabilities.

- In May 2025, LX Hausys launched new quartz colors, including “Taj Duna” in its Viatera Quartzite Collection and an upgraded “Cloud Ridge” in the Suprema line to enhance aesthetic diversity.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Material Composition, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for engineered quartz surfaces will continue to grow across residential and commercial projects.

- Manufacturers will expand production capacity to meet rising domestic construction and renovation needs.

- Sustainable and recycled quartz products will gain strong consumer preference.

- Digital fabrication and automation will improve design precision and reduce production waste.

- Local sourcing of raw materials will increase to reduce supply chain risks.

- Partnerships between manufacturers and interior design firms will strengthen product visibility.

- Retail and online sales channels will expand, offering wider product access to consumers.

- Product innovation will focus on heat resistance, texture variation, and surface strength.

- Rising awareness of eco-friendly building materials will shape future market strategies.

- The competitive landscape will intensify with new entrants introducing advanced design technologies.