Market Overview

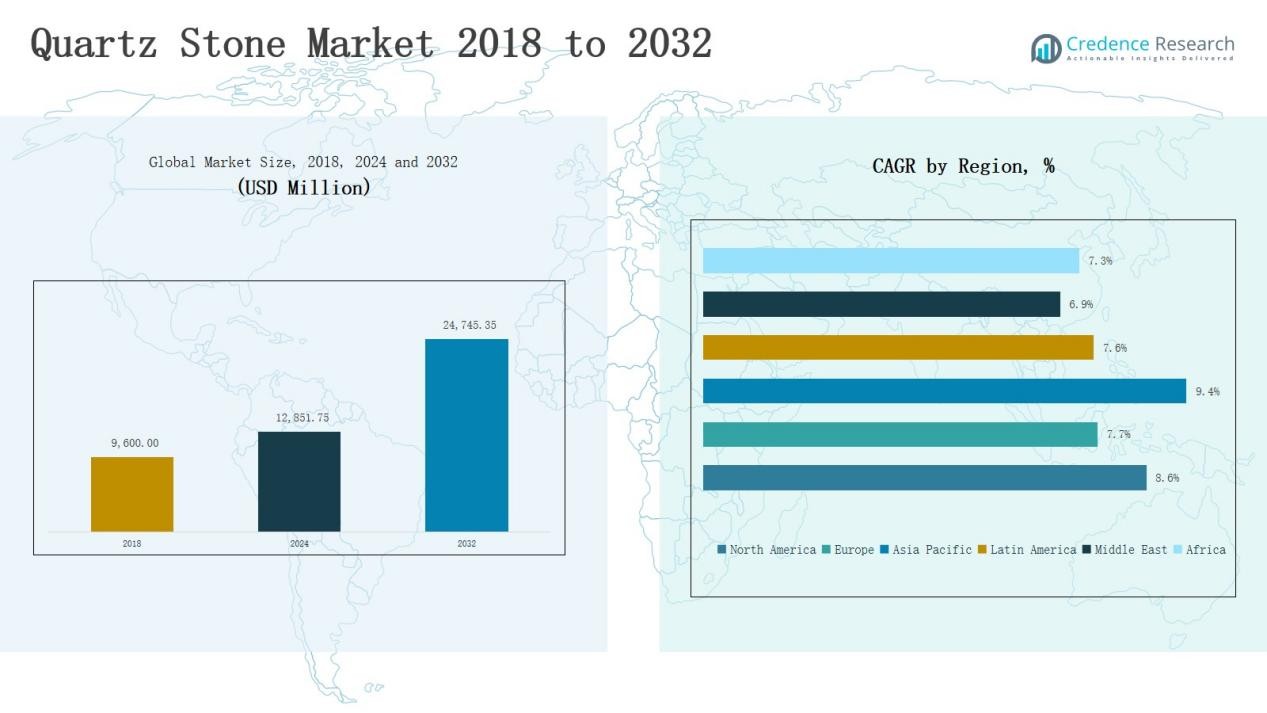

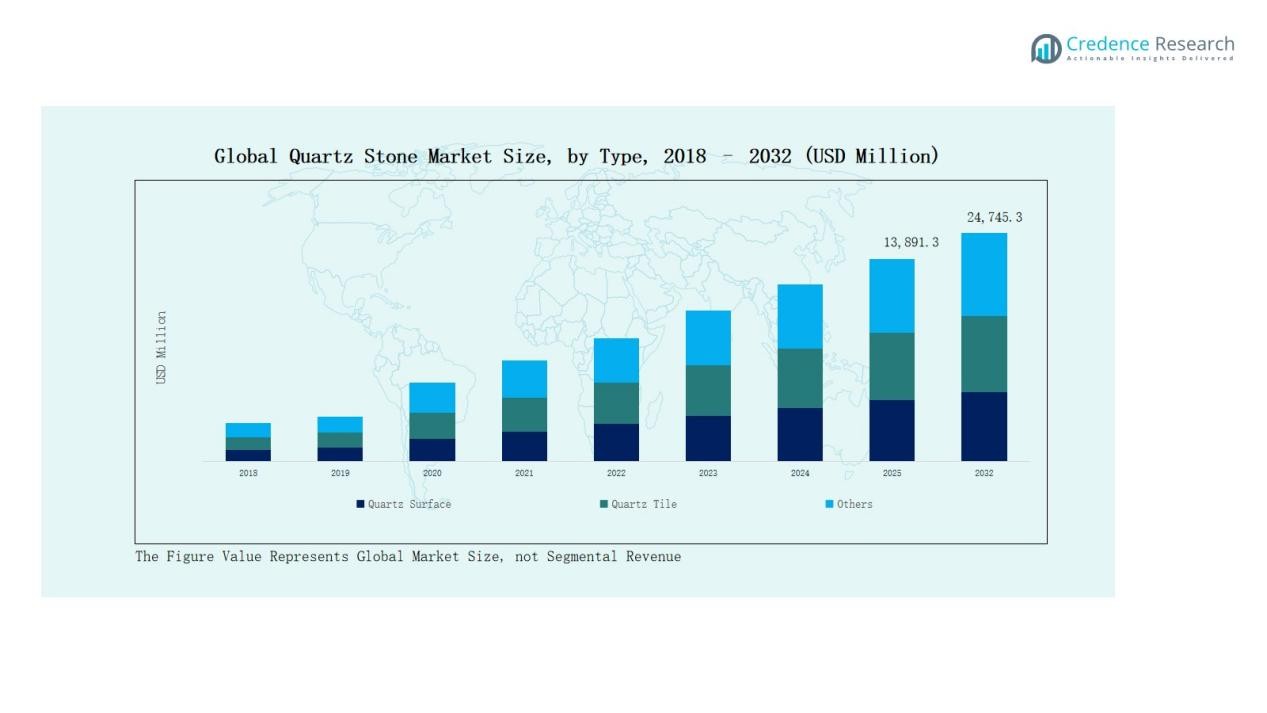

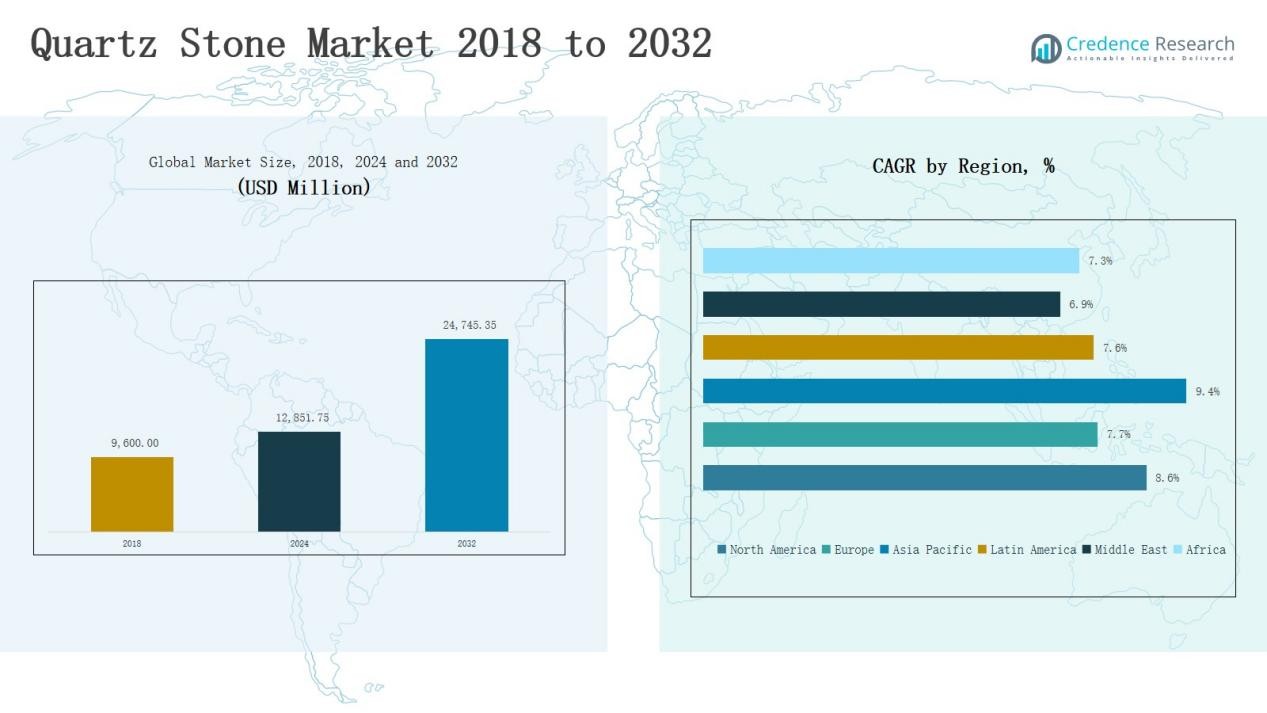

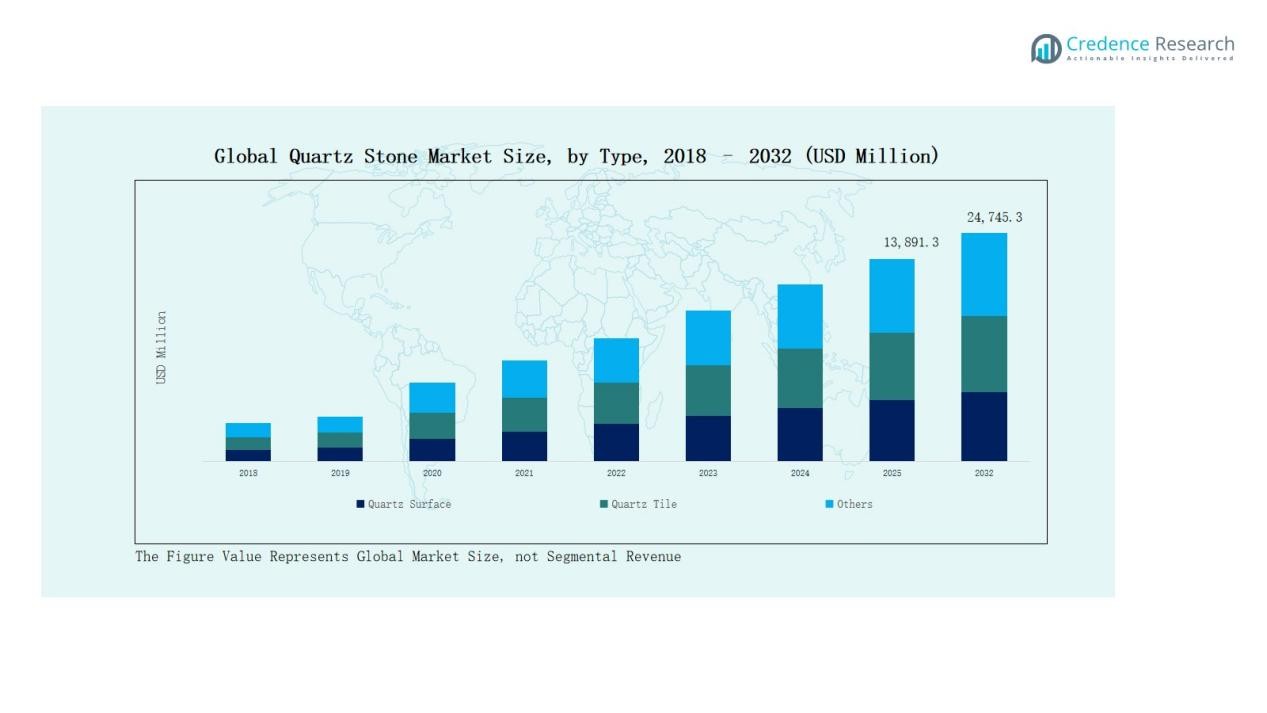

The Quartz Stone Market was valued at USD 9,600.00 million in 2018, increased to USD 12,851.75 million in 2024, and is projected to reach USD 24,745.35 million by 2032, growing at a CAGR of 8.60% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Quartz Stone Market Size 2024 |

USD 12,851.75 Million |

| Quartz Stone Market, CAGR |

8.60% |

| Quartz Stone Market Size 2032 |

USD 24,745.35 Million |

The Quartz Stone Market is led by key players such as Caesarstone, Cambria, Hanwha L&C, LG Hausys, Vicostone, and DuPont, recognized for their innovation, product diversity, and advanced manufacturing capabilities. These companies focus on engineered quartz production featuring superior durability, aesthetic precision, and sustainable composition. Strategic initiatives such as product launches, capacity expansions, and partnerships strengthen their global footprint across residential and commercial segments. The Asia Pacific region emerged as the leading market in 2024, commanding a 44% share, driven by rapid urbanization, infrastructure expansion, and rising adoption of high-quality interior materials.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Quartz Stone Market grew from USD 9,600.00 million in 2018 to USD 12,851.75 million in 2024, projected to reach USD 24,745.35 million by 2032, at a CAGR of 8.60%.

- Asia Pacific led the market with a 44% share in 2024, driven by rapid urbanization, infrastructure growth, and rising use of premium interior materials.

- The Quartz Surface segment dominated by 58% share, fueled by strong demand for countertops, vanities, and wall claddings in residential projects.

- The Residential application segment held 64% share, supported by renovation trends and consumer preference for durable, low-maintenance surfaces.

- Engineered Quartz accounted for the largest 72% share, benefiting from its superior strength, design flexibility, and technological advancements in resin and pigment composition.

Market Segment Insights

By Type:

- For instance, LX Hausys expanded its Viatera Quartz range in South Korea, offering new marble-look designs tailored for premium interior remodeling projects.

By Application:

The Residential segment led the Quartz Stone Market with a 64% share in 2024. Rising home renovation activities and increased adoption of premium interior materials boost segment growth. Consumers prefer quartz for its stain resistance, longevity, and low maintenance, making it ideal for countertops and flooring. The Commercial segment, holding 36%, gains traction from hospitality and corporate construction projects emphasizing durable and aesthetic materials suitable for heavy-use environments and consistent visual appeal.

- For instance, Caesarstone launched its “Metropolitan Collection” in North America, showcasing industrial-inspired quartz slabs designed for modern residential kitchens.

By Material Composition:

The Engineered Quartz segment held a commanding 72% market share in 2024, driven by superior strength, consistent texture, and wide design range. Advancements in resin and pigment technology enhance its appeal across residential and commercial installations. Natural Quartz Stone accounted for 20%, valued for its authenticity and natural grain patterns, while Eco-friendly Quartz represented 8%, witnessing rising adoption due to growing sustainability awareness and increased use of recycled materials in construction and interior design.

Key Growth Drivers

Rising Demand for Premium Interior Applications

The Quartz Stone Market is driven by growing demand for premium interior solutions across residential and commercial spaces. Consumers increasingly prefer quartz for its aesthetic appeal, durability, and low maintenance compared to marble or granite. Expanding real estate construction and remodeling projects, especially in kitchens and bathrooms, fuel consumption. The availability of diverse textures, patterns, and finishes further enhances adoption, positioning quartz as a leading surface material for modern architecture and luxury interior design.

- For instance, Cosentino introduced its Silestone XM Series, which features sustainable, low-silica surfaces with enhanced scratch resistance.

Advancements in Engineered Quartz Technology

Continuous innovation in engineered quartz manufacturing strengthens market growth. Producers integrate advanced resin systems, automated fabrication, and color blending techniques to enhance quality and design flexibility. Improved resistance to stains, impact, and microbial growth increases its suitability for high-traffic and hygiene-sensitive environments. These advancements enable manufacturers to meet evolving consumer demands while maintaining sustainable production standards, resulting in higher efficiency, lower waste generation, and expanding applications in residential and commercial interior design projects globally.

- For instance, Santa Margherita S.p.A., a Verona-based manufacturer of engineered stone, produces and exports marble and quartz agglomerates using a blend of natural materials and resins, with a focus on sustainable manufacturing processes.

Sustainability and Green Building Initiatives

Growing focus on sustainability significantly drives quartz stone adoption. Eco-friendly quartz, incorporating recycled glass and waste materials, aligns with global green building certifications such as LEED and BREEAM. Manufacturers prioritize cleaner production processes and lower carbon footprints to meet environmental regulations. Rising consumer awareness about eco-conscious construction materials further supports segment expansion. This shift toward sustainable materials strengthens quartz stone’s market presence, appealing to environmentally responsible builders, designers, and consumers seeking performance with ecological compliance.

Key Trends & Opportunities

Growing Customization and Design Innovation

A key trend in the Quartz Stone Market is the increasing demand for customized textures, colors, and finishes. Manufacturers leverage digital printing and precision cutting technologies to offer personalized surface designs. The trend toward matte, concrete, and metallic finishes creates new aesthetic possibilities in modern architecture. This innovation-driven customization expands the market’s appeal among interior designers and builders, supporting greater product differentiation and premium pricing strategies in both residential and commercial applications.

- For instance, Cambria Company LLC unveiled Harlow™ Quartz, a premium matte-finish surface developed using precision laser texturing to achieve bespoke tone variations favored by contemporary designers.

Expansion Across Emerging Construction Markets

Rapid urbanization and infrastructure investments in Asia Pacific, Latin America, and the Middle East present major opportunities for market growth. Rising disposable income and lifestyle upgrades drive demand for durable, luxury materials in housing and commercial projects. Expanding retail chains, hotels, and office spaces in developing economies further boost quartz installation. Local production capacity expansion and improved distribution networks also enhance affordability, strengthening the regional foothold of global quartz manufacturers.

- For instance, Compac Surfaces has launched sustainable quartz collections, and The Big 5 is a relevant event in the Middle East, with the next Dubai event in November 2025.

Key Challenges

High Manufacturing and Installation Costs

Quartz stone production involves advanced machinery, precision fabrication, and imported raw materials, resulting in elevated manufacturing costs. Installation also requires skilled labor and specialized tools, increasing overall project expenses. These high costs restrict adoption in price-sensitive markets, particularly in developing regions. Small-scale players struggle to compete with established brands, creating market entry barriers and limiting widespread accessibility of premium quartz products among mid-range consumers.

Environmental Concerns During Production

Despite the shift toward sustainable quartz, environmental concerns persist due to energy-intensive manufacturing and resin emissions. Quartz production generates silica dust, posing occupational health risks when inadequately managed. Regulations on chemical resins and carbon emissions increase compliance costs for manufacturers. Companies must invest in cleaner technologies, filtration systems, and waste recycling to address these challenges, which can affect profitability and slow expansion in markets with strict environmental standards.

Competition from Alternative Surface Materials

The growing availability of alternative materials like porcelain slabs, sintered stone, and solid surfaces poses strong competition. These substitutes often offer comparable aesthetics, lower prices, or enhanced performance in specific applications. Consumer preference diversification challenges quartz producers to sustain market share. To remain competitive, manufacturers must innovate in design, durability, and sustainability while maintaining cost efficiency. The increasing adoption of hybrid and composite materials adds further pressure on quartz stone market penetration.

Regional Analysis

North America

The North America Quartz Stone Market was valued at USD 2,328.96 million in 2018, increased to USD 2,719.48 million in 2024, and is projected to reach USD 5,224.04 million by 2032, growing at a CAGR of 7.98%. The region accounted for 21% of the global market share in 2024. Growth is driven by strong demand for premium interior materials, rising home renovations, and advancements in engineered quartz technology. The United States leads regional adoption, supported by high consumer spending, sustainable building practices, and increasing residential and commercial construction activities.

Europe

The Europe Quartz Stone Market stood at USD 2,073.60 million in 2018, expanded to USD 2,644.54 million in 2024, and is forecast to reach USD 4,744.99 million by 2032, registering a CAGR of 7.09%. The region captured 21% of the global market share in 2024. Market growth is supported by the rising popularity of sustainable construction, aesthetic architecture, and increasing remodeling projects. Countries such as Germany, Italy, and the UK lead due to advanced manufacturing capabilities, high disposable income, and strong demand for energy-efficient, durable interior materials.

Asia Pacific

The Asia Pacific Quartz Stone Market dominated globally, valued at USD 4,113.60 million in 2018, rising to USD 5,646.36 million in 2024, and projected to reach USD 11,526.40 million by 2032, growing at a CAGR of 9.18%. The region held the largest 44% market share in 2024. Rapid urbanization, expanding residential and commercial construction, and the rise of local quartz manufacturing clusters drive growth. China, India, and Japan lead demand due to large-scale infrastructure projects and strong export capabilities. Increasing adoption of eco-friendly quartz surfaces further supports market expansion across Asia Pacific.

Market Segmentations:

By Type

- Quartz Surface

- Quartz Tile

- Other Forms

By Application

By Material Composition

- Engineered Quartz

- Natural Quartz Stone

- Eco-friendly Quartz

By Distribution Channel

- Direct Sales

- Retail Sales

- Online Platforms

- Others

By Region

- North America:S., Canada, Mexico

- Europe:UK, France, Germany, Italy, Spain, Russia, Rest of Europe

- Asia Pacific:China, Japan, South Korea, India, Australia, Southeast Asia, Rest of Asia Pacific

- Latin America:Brazil, Argentina, Rest of Latin America

- Middle East:GCC Countries, Israel, Turkey, Rest of Middle East

- Africa:South Africa, Egypt, Rest of Africa

Competitive Landscape

The Quartz Stone Market is highly competitive, characterized by the presence of global and regional manufacturers focusing on product quality, innovation, and design diversity. Key players such as Caesarstone, Cambria, Hanwha L&C, LG Hausys, Vicostone, and DuPont dominate through extensive distribution networks and advanced production technologies. These companies emphasize engineered quartz products that offer superior durability, aesthetic appeal, and sustainability. Strategic partnerships, capacity expansions, and product innovations enhance their market reach and brand positioning. Emerging players from Asia, particularly China and India, strengthen price competitiveness and expand export volumes. Sustainability-focused production using recycled materials and low-emission resins is gaining prominence, reflecting industry adaptation to green building standards. The competitive environment remains dynamic, with technological advancements, regional capacity growth, and rising brand consolidation shaping market behavior across residential, commercial, and architectural applications globally.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Caesarstone

- Hanwha L&C

- Compac

- Vicostone

- Wilsonart

- DuPont

- LG Hausys

- Cambria

- Santa Margherita

- Quarella

- Samsung Radianz

- Bitto (Dongguan)

- OVERLAND

- UVIISTONE

- Polystone

- Ordan

- Blue Sea Quartz

- Falat Sang Asia Co.

- Belenco Quartz Surfaces

- Prestige Group

Recent Developments

- In August 2025, Cambria announced an $80 million investment to reshore quartz processing and build a new manufacturing facility in Dakota County.

- In August 2025, CRL Stone launched its 2025 Quartz Collection brochure, featuring new designs such as Verona Gold and Arabescato Vagli.

- In April 2025, Stone Plus (India) expanded into quartz manufacturing with the opening of its QRocks facility in Udaipur, Rajasthan.

- In July 2025, Vicostone launched 10 new quartz colors for its Fall 2025 collection.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Material Composition, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for engineered quartz surfaces will continue increasing across residential and commercial sectors.

- Sustainability-focused production and recycling practices will gain stronger industry adoption.

- Advancements in digital design and surface finishing will enhance customization options.

- Growing investments in smart manufacturing will improve quality and production efficiency.

- Asia Pacific will remain the primary growth hub due to rapid urbanization and infrastructure expansion.

- The use of quartz in luxury interiors and modern architecture will strengthen market penetration.

- Strategic collaborations between builders and quartz manufacturers will expand distribution networks.

- Eco-friendly quartz products will gain traction among environmentally conscious consumers.

- Innovations in color, texture, and pattern replication will drive design diversification.

- Expansion of online retail platforms will boost accessibility and global brand visibility.