Market Overview

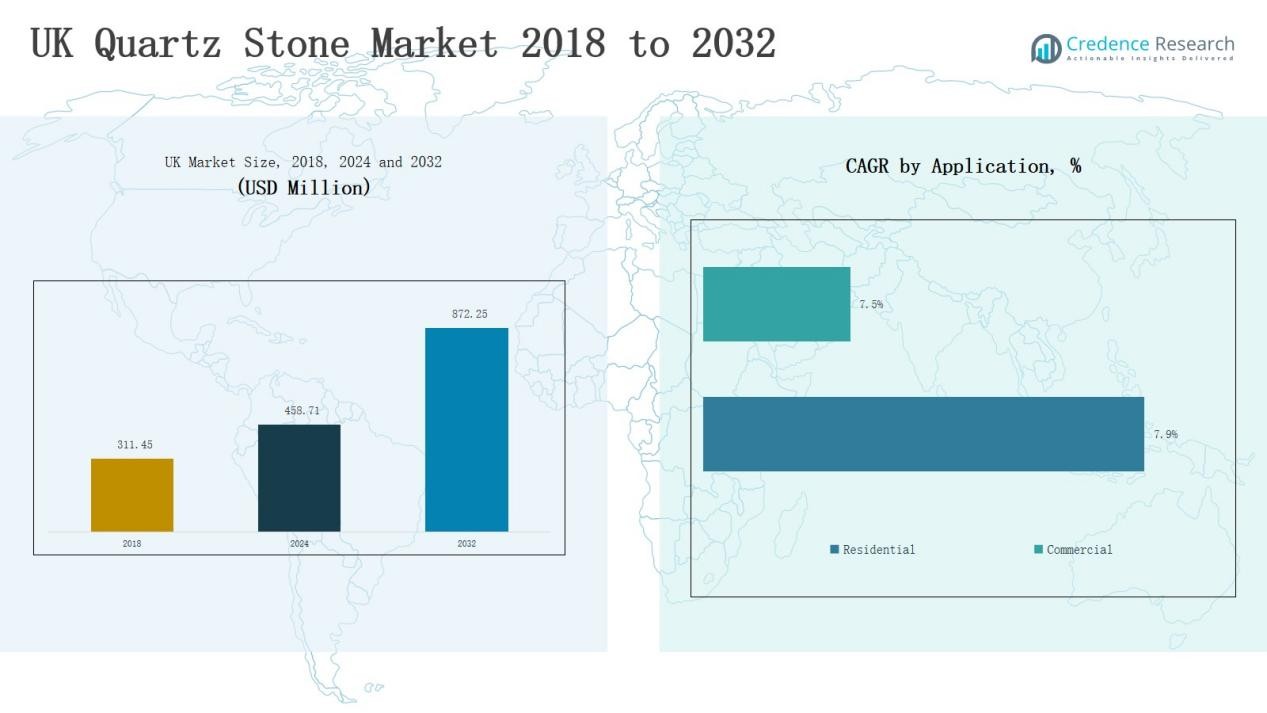

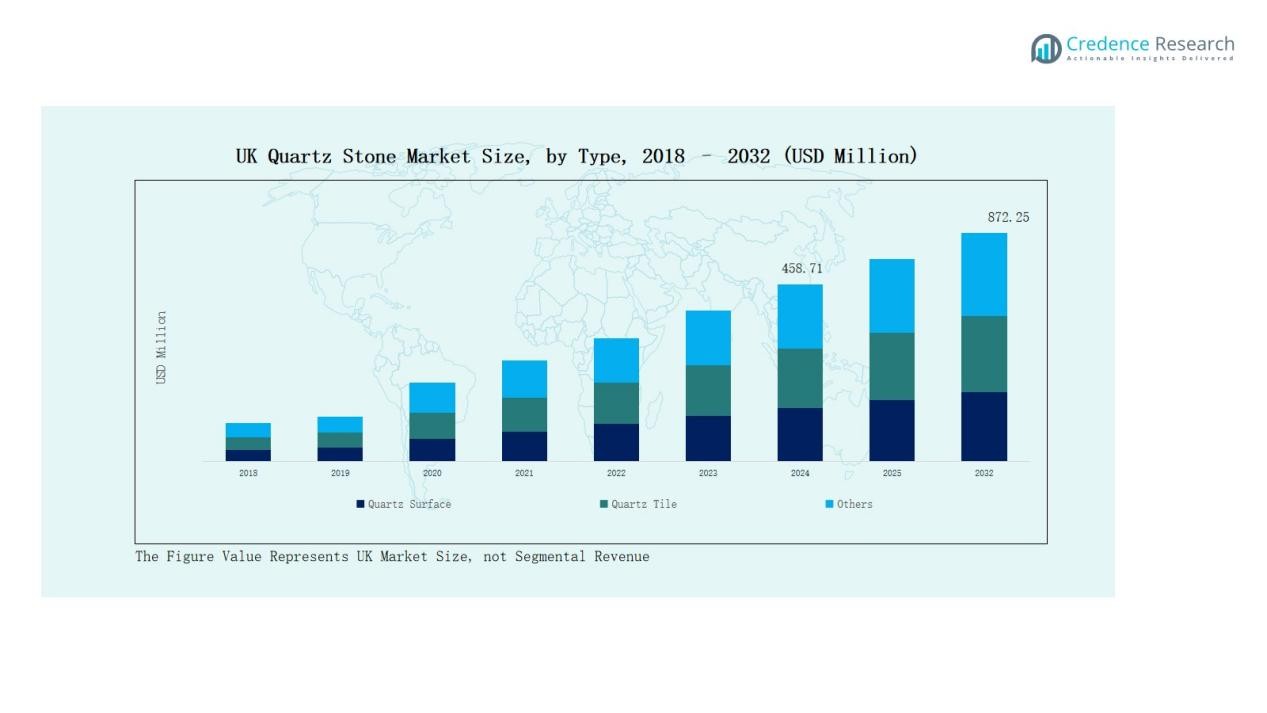

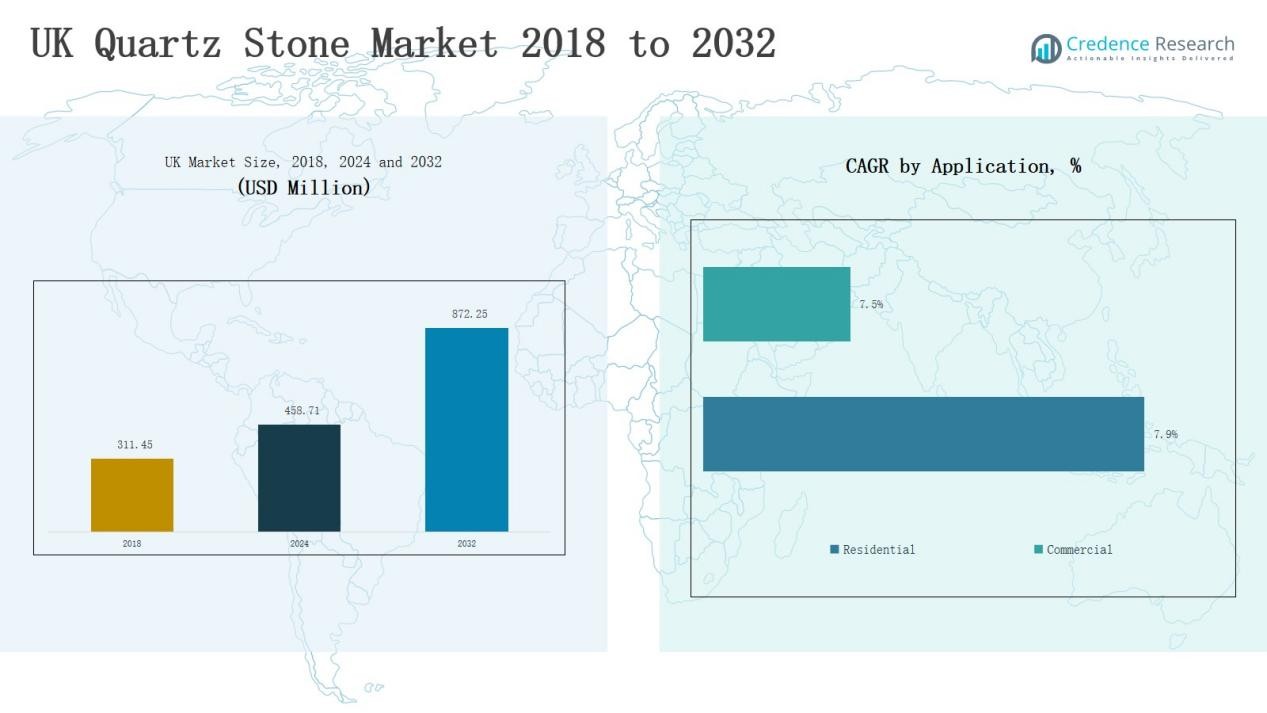

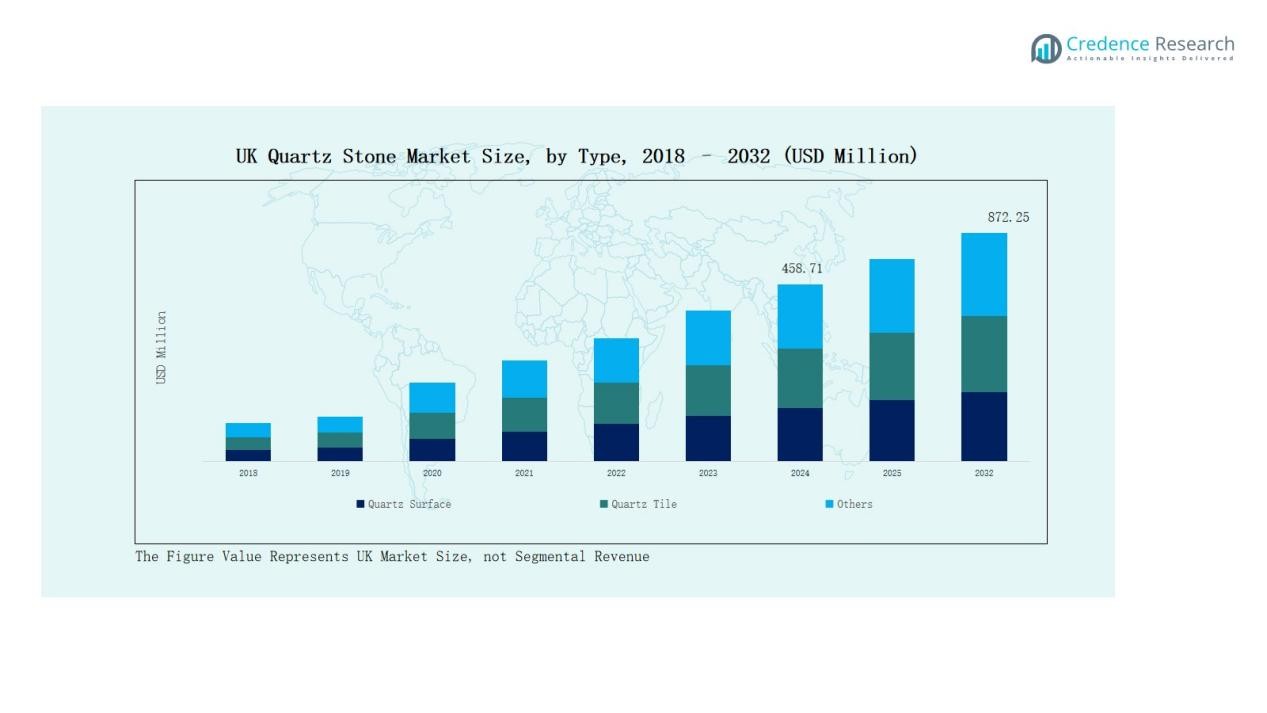

The UK Quartz Stone Market size was valued at USD 311.45 million in 2018, increased to USD 458.71 million in 2024, and is anticipated to reach USD 872.25 million by 2032, growing at a CAGR of 8.36% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Quartz Stone Market Size 2024 |

USD 458.71 Million |

| UK Quartz Stone Market, CAGR |

8.36% |

| UK Quartz Stone Market Size 2032 |

USD 872.25 Million |

The UK Quartz Stone Market is led by prominent companies such as Caesarstone Ltd., Cambria Company LLC, Silestone (Cosentino S.A.), Compac Quartz, International Stone, HanStone Quartz (Hanwha L&C), LG Hausys Ltd., and Stone Italiana S.p.A. These players maintain strong positions through advanced production technologies, design innovation, and sustainable manufacturing practices. They focus on developing eco-friendly surfaces, expanding product customization, and strengthening partnerships with builders and retailers. England emerged as the leading regional market in 2024, accounting for 64% of the total share, driven by rising residential renovations, commercial construction, and growing preference for premium interior materials.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The UK Quartz Stone Market was valued at USD 311.45 million in 2018, increased to USD 458.71 million in 2024, and is projected to reach USD 872.25 million by 2032, growing at a CAGR of 8.36%.

- Caesarstone Ltd., Cambria Company LLC, Silestone (Cosentino S.A.), Compac Quartz, and International Stone lead the market through innovation, eco-friendly manufacturing, and strong distribution networks.

- The Quartz Surface segment dominated with a 63% share in 2024, driven by durability, design variety, and rising installation in residential and commercial interiors.

- The Residential application led with a 68% share, supported by increased remodeling activities and preference for non-porous, easy-to-maintain surfaces in modern homes.

- England remained the top regional market, holding 64% of total share in 2024, driven by luxury construction, renovation projects, and widespread use of engineered quartz across major urban areas.

Market Segment Insights

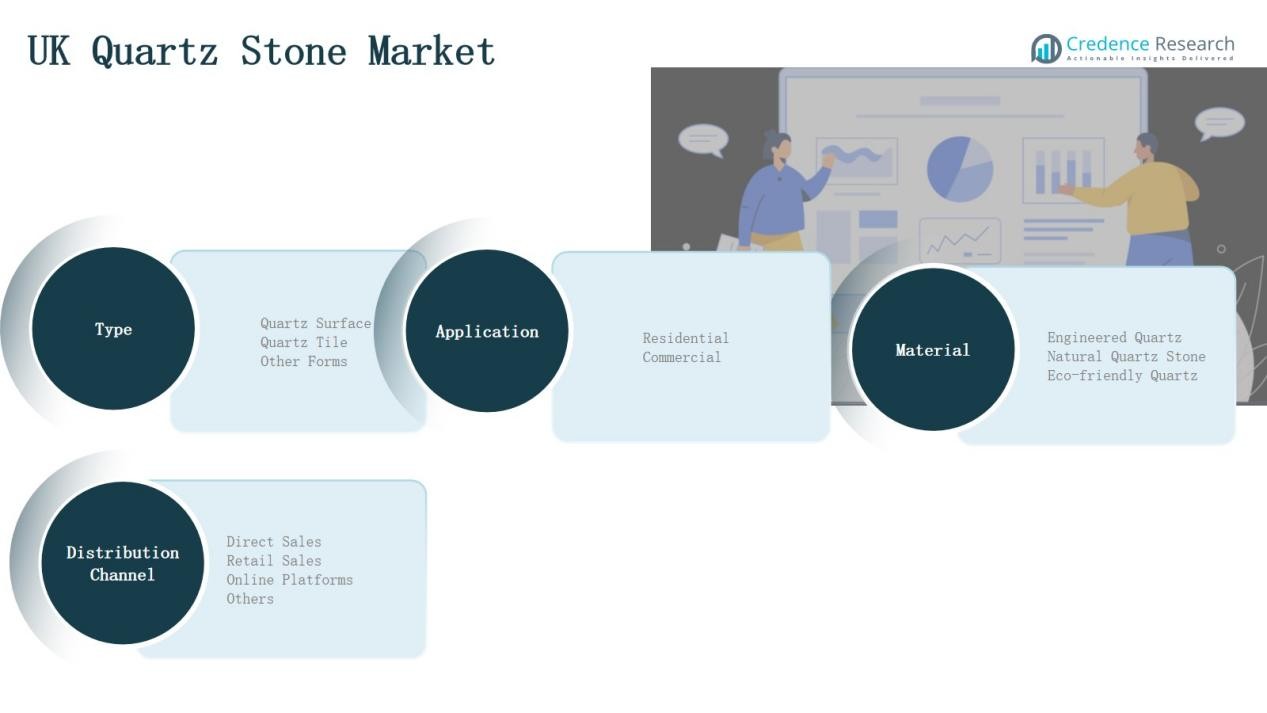

By Type:

The Quartz Surface segment dominated the UK Quartz Stone Market in 2024, accounting for 63% of the total share. Its popularity stems from superior durability, low maintenance, and aesthetic versatility in countertops and wall claddings. Demand is strong in modern kitchen and bathroom installations. Quartz Tile captured 25% due to growing use in flooring, while Other Forms held 12%, supported by decorative and custom architectural applications emphasizing luxury and design flexibility.

- For instance, Caesarstone launched its Porcelain and expanded Quartz Surface collection in the UK with designs like Arabetto and Adamina, tailored for premium residential countertops.

By Application:

The Residential segment led the UK Quartz Stone Market in 2024 with a 68% market share, driven by rising home renovation and remodeling activities. The preference for non-porous, easy-to-clean surfaces enhances its adoption in kitchens and bathrooms. The Commercial segment, holding 32%, grows steadily as hospitality and office projects adopt engineered quartz for its durability, stain resistance, and premium finish suitable for high-traffic interior environments.

By Material Composition:

The Engineered Quartz segment held the largest share of 71% in 2024, supported by its uniform texture, strength, and availability in diverse designs. Builders and designers favor it for consistent quality and wide color options. Natural Quartz Stone captured 19%, appealing to luxury projects seeking unique patterns. Eco-friendly Quartz, at 10%, is gaining momentum with the shift toward recycled materials, green certifications, and sustainable building practices across the UK construction sector.

- For instance, Cosentino’s Silestone Hybriq+ uses at least 20% recycled materials. Production uses 99% reused water and limits silica to 10–40%.

Key Growth Drivers

Rising Demand from Residential Renovation Projects

The UK Quartz Stone Market benefits from expanding home renovation and remodeling activities. Homeowners increasingly prefer quartz for its durability, aesthetic flexibility, and stain resistance compared to natural stones. Growth in kitchen and bathroom remodeling, supported by higher disposable incomes and modern design trends, boosts sales. The popularity of quartz countertops as a luxury yet low-maintenance option continues to strengthen residential adoption across major cities including London, Manchester, and Birmingham.

- For instance, PACIFIC introduced a state-of-the-art manufacturing plant with high automation and Breton Stone Technology in India in late 2024, elevating production precision and meeting rising global demand for high-quality quartz surfaces.

Technological Advancements in Engineered Quartz Production

Manufacturers in the UK Quartz Stone Market leverage advanced production methods such as vacuum vibro-compression and digital surface finishing. These technologies enhance strength, color uniformity, and design precision. Automated fabrication and cutting systems reduce waste and improve customization capabilities. Continuous innovation in surface textures and finishes has made engineered quartz a preferred choice for architects and interior designers seeking premium quality materials for modern interiors and commercial infrastructure.

- For instance, Compac Surfaces has introduced new quartz collections, such as the “Unique” series, featuring through-body veining to replicate natural stone aesthetics. Created with a proprietary technological process, the material offers enhanced durability and non-porous properties suitable for high-traffic commercial projects.

Growing Focus on Sustainable and Eco-Friendly Materials

The increasing environmental awareness among UK consumers drives the adoption of eco-friendly quartz products. Manufacturers integrate recycled glass and industrial by-products into production to reduce carbon footprints. Sustainable certifications and government initiatives promoting green construction enhance this shift. Eco-friendly quartz surfaces are now gaining preference among architects and developers aiming for LEED-certified projects, positioning sustainability as a significant driver in the country’s quartz stone market growth.

Key Trends & Opportunities

Expansion of Online Sales and Customization Platforms

The rapid growth of digital retail platforms enables customers to explore and customize quartz stone designs online. Virtual design tools and augmented reality visualization improve the buying experience. Distributors and manufacturers use e-commerce to reach broader markets, offering made-to-order options and quick delivery. This trend supports greater consumer engagement and accessibility, making online platforms a key opportunity for market expansion among retail and small-scale renovation customers.

- For instance, Paradigm Surfaces provides an online platform where homeowners and contractors can directly purchase premium quartz slabs at factory prices, ensuring affordable customization and timely delivery.

Rising Use of Quartz in Commercial and Luxury Applications

The demand for premium interior materials in hotels, offices, and retail spaces boosts quartz stone adoption. Its visual appeal, durability, and hygienic surface make it ideal for high-traffic environments. Developers favor quartz for reception areas, wall claddings, and high-end furniture applications. Luxury interior designers are incorporating customized quartz designs to meet upscale client preferences, opening new growth avenues across commercial and hospitality sectors in the UK market.

- For instance, Saint-Gobain Quartz introduced a range of customizable quartz slabs specifically designed for upscale office interiors, combining aesthetics with durability.

Key Challenges

High Production and Installation Costs

Quartz stone production involves advanced machinery, energy-intensive processes, and quality control systems, increasing costs. Installation also requires skilled labor and specialized adhesives, further raising total expenses. This cost barrier limits adoption among price-sensitive consumers and small contractors. Market players face pressure to balance quality and affordability, prompting investments in cost-efficient production and optimized distribution channels to remain competitive in the UK market.

Supply Chain Disruptions and Raw Material Dependence

The UK Quartz Stone Market depends heavily on imported raw materials such as quartz sand and resins. Global supply fluctuations, logistics constraints, and tariff changes often affect material availability and pricing. The recent geopolitical and transportation challenges across Europe have heightened sourcing risks. Companies are increasingly focusing on building local supply chains and strategic partnerships to mitigate these vulnerabilities and ensure production stability.

Competition from Natural and Substitute Materials

Quartz stone faces competition from alternatives such as granite, marble, and solid-surface materials. These substitutes often appeal to consumers seeking natural aesthetics or lower costs. Traditional materials continue to hold strong cultural and design relevance in certain UK markets. To counter this, quartz manufacturers must emphasize product differentiation through innovation, branding, and awareness campaigns highlighting performance benefits, sustainability, and design versatility over natural stone options.

Regional Analysis

England

England held the largest share of 64% in the UK Quartz Stone Market in 2024. Strong residential renovation activity and large-scale commercial projects continue to drive demand. It benefits from high consumer awareness of engineered surfaces and an established network of distributors and retailers. London, Manchester, and Birmingham lead in installations across luxury homes and premium offices. The market in England also benefits from advanced fabrication facilities and design innovation centers. Sustainable quartz demand continues to rise due to growing environmental consciousness among consumers.

Scotland

Scotland accounted for 17% of the total market share in 2024. The growth is supported by urban development and rising home improvement spending in cities such as Glasgow and Edinburgh. It experiences steady adoption of quartz countertops and flooring in both residential and hospitality sectors. Government efforts to promote energy-efficient housing further enhance product acceptance. The local construction sector favors quartz for its durability and aesthetic appeal. Increased investment in retail and tourism infrastructure contributes to steady demand growth.

Wales

Wales represented 11% of the market share in 2024, supported by expanding construction and interior design activities. It is witnessing growing adoption of engineered quartz in modern housing and small commercial spaces. The rising popularity of low-maintenance materials drives quartz use in kitchen and bathroom remodeling. Local distributors have expanded product availability through retail partnerships and online channels. Government housing initiatives also support material adoption in affordable housing projects. Rising consumer preference for sustainable, high-quality interiors continues to shape market growth.

Northern Ireland

Northern Ireland captured 8% of the UK Quartz Stone Market share in 2024. Demand is primarily driven by ongoing urban housing developments and modern refurbishment projects. It benefits from increasing imports of engineered quartz slabs and improving local distribution networks. The hospitality and retail construction sectors show consistent use of quartz for durability and design flexibility. Collaboration between regional builders and international suppliers supports product accessibility. Rising consumer preference for premium interiors further enhances quartz demand across residential and commercial spaces.

Market Segmentations:

By Type

- Quartz Surface

- Quartz Tile

- Other Forms

By Application

By Material Composition

- Engineered Quartz

- Natural Quartz Stone

- Eco-friendly Quartz

By Distribution Channel

- Direct Sales

- Retail Sales

- Online Platforms

- Others

By Region

- England

- Scotland

- Wales

- Northern Ireland

Competitive Landscape

The UK Quartz Stone Market features a moderately concentrated competitive landscape led by global and regional manufacturers focusing on innovation, quality, and sustainability. Key players such as Caesarstone Ltd., Cambria Company LLC, Silestone (Cosentino S.A.), Compac Quartz, and International Stone dominate through strong brand recognition, diverse product portfolios, and extensive distribution networks. These companies emphasize advanced surface technologies, color customization, and eco-friendly manufacturing practices to meet rising demand from residential and commercial sectors. Strategic partnerships with builders, designers, and retailers enhance market reach. New entrants target niche segments with cost-effective and design-oriented offerings. Continuous investment in automation, digital fabrication, and recycled material integration strengthens competitiveness. The market’s growth is further influenced by ongoing mergers, product launches, and marketing campaigns promoting durability, aesthetics, and sustainability, reinforcing quartz’s position as a preferred surface material across the United Kingdom.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- International Stone

- Cambria Company LLC

- Compac Quartz

- Caesarstone Ltd.

- Silestone (Cosentino S.A.)

- Radianz (Samsung Surface Brand)

- Stone Italiana S.p.A.

- HanStone Quartz (Hanwha L&C)

- LG Hausys Ltd.

- Vicostone JSC

- Technistone a.s.

- DuPont de Nemours, Inc.

- Santa Margherita S.p.A.

- Quarella S.p.A.

- Sia Stones

Recent Developments

- In August 2025, CRL Stone introduced its 2025 Collection brochure in the UK, featuring new quartz surface designs such as Verona Gold and Arabescato Vagli, expanding its premium product range.

- In February 2024, Natural Stone Surfaces acquired Precision Stone in Wolverhampton to strengthen its presence in the UK quartz and stone surface manufacturing sector.

- In June 2024, Stonegate Precision Tooling completed the acquisition of National Masonry Ltd, a major supplier and UK agent for Marmo Meccanica, enhancing its distribution and tooling capabilities in the engineered stone industry.

- In December 2024, Asissssan Granito India Ltd. entered the UK market through a joint venture named Klyn AGL Ltd, focusing on the trade of quartz slabs and tiles to expand its European footprint.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Material Composition, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for engineered quartz surfaces will continue to rise in residential renovation projects.

- Manufacturers will expand eco-friendly product lines using recycled and low-emission materials.

- Digital fabrication and design customization will enhance product precision and visual appeal.

- Growth in commercial construction will drive adoption across hotels, offices, and retail interiors.

- Online retail platforms will play a larger role in quartz stone distribution and marketing.

- Technological upgrades in production will reduce costs and improve surface durability.

- Consumer preference will shift toward matte and textured finishes over high-gloss options.

- Strategic partnerships with builders and designers will strengthen market positioning.

- Sustainable building regulations will encourage greater use of certified green quartz materials.

- Increased competition will push brands to innovate through design differentiation and value-added services.