Market Overview

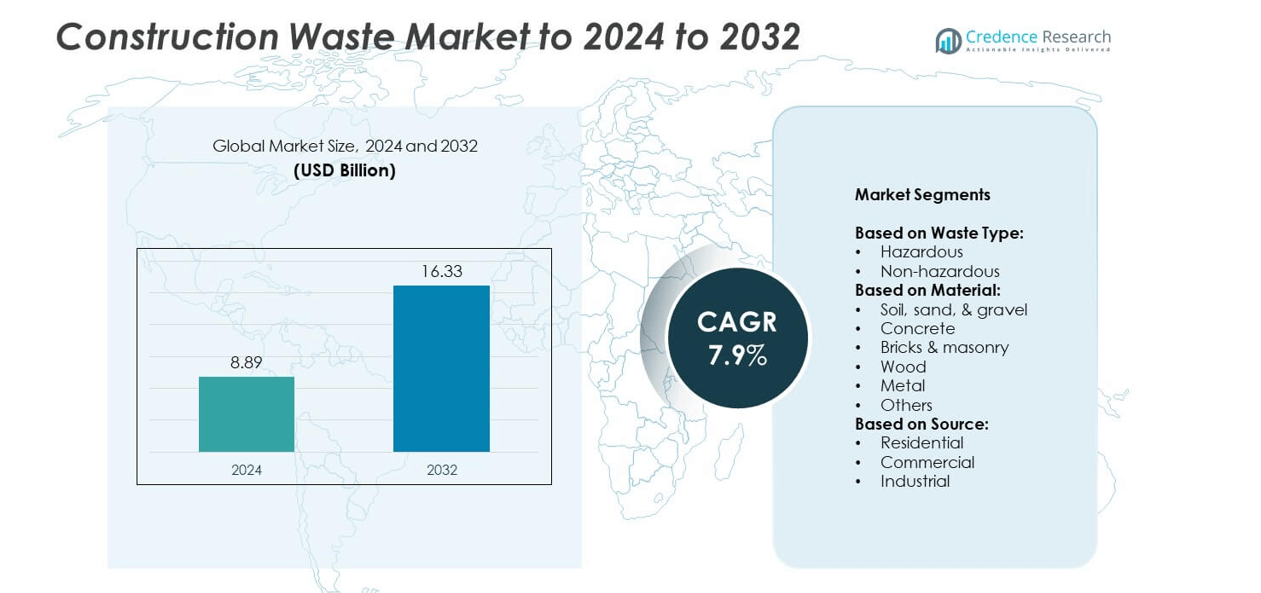

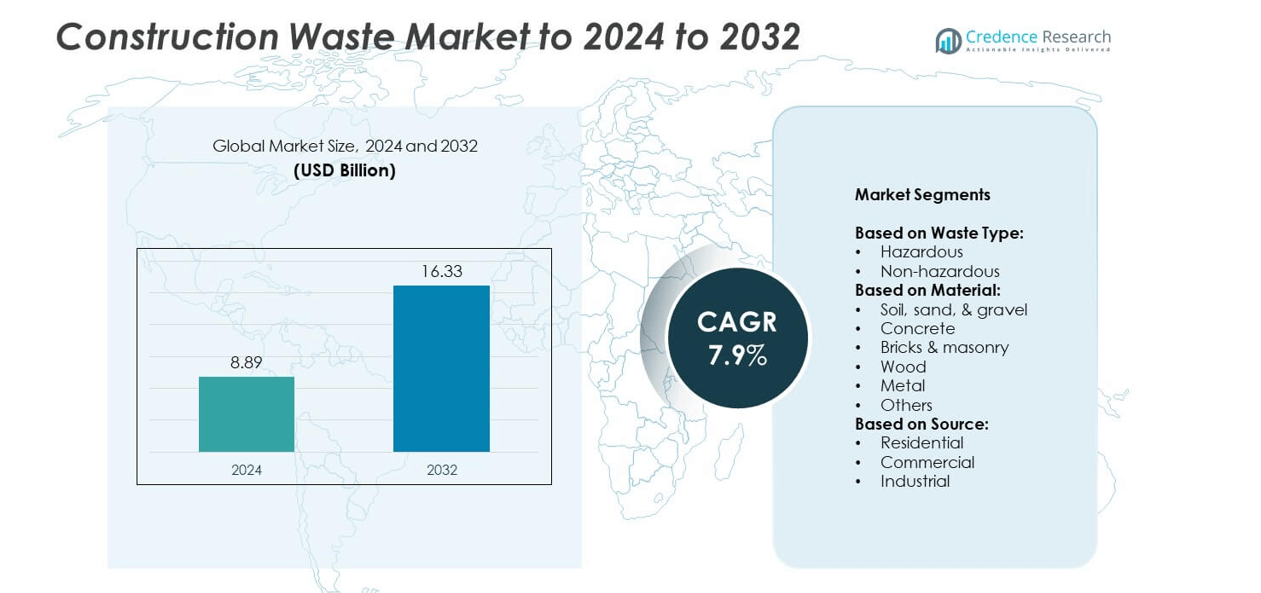

Construction Waste Market size was valued at USD 8.89 billion in 2024 and is anticipated to reach USD 16.33 billion by 2032, at a CAGR of 7.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Construction Waste Market Size 2024 |

USD 8.89 billion |

| Construction Waste Market, CAGR |

7.9% |

| Construction Waste Market Size 2032 |

USD 16.33 billion |

The construction waste market is dominated by major players such as Veolia Environment S.A., WM Intellectual Property Holdings, LLC, Holcim, Republic Services, Cleanaway Waste Management Limited, and GFL Environmental Inc. These companies focus on recycling technologies, waste-to-resource solutions, and sustainable material recovery to strengthen their global presence. Strategic partnerships and investments in circular economy infrastructure have enhanced their competitiveness. Asia-Pacific led the market in 2024 with a 34% share, driven by rapid urbanization and large-scale infrastructure projects, followed by North America with 32% and Europe with 28%, supported by stringent waste management regulations and green building initiatives.

Market Insights

- The Construction Waste Market was valued at USD 8.89 billion in 2024 and is projected to reach USD 16.33 billion by 2032, growing at a CAGR of 7.9%.

- Rising construction, demolition, and infrastructure projects are driving waste generation, boosting demand for recycling and reuse practices across industrial, commercial, and residential sectors.

- Increasing adoption of circular economy principles and digital waste tracking systems is transforming collection, sorting, and material recovery efficiency.

- The market remains competitive with leading players investing in advanced recycling technologies, smart waste management platforms, and sustainable processing solutions to strengthen global presence.

- Asia-Pacific held a 34% market share in 2024, followed by North America with 32% and Europe with 28%; among waste types, the non-hazardous segment dominated with an 88% share, supported by rising urban redevelopment and strict environmental regulations across developed and emerging economies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Waste Type

The non-hazardous segment dominated the construction waste market in 2024, accounting for around 88% of the total share. This dominance is driven by the large-scale generation of inert materials such as concrete, wood, and metals from demolition and renovation projects. Non-hazardous waste management practices, including recycling and reuse, are gaining traction as governments enforce stricter landfill diversion policies. Rising construction activity in urban areas and the growing adoption of circular economy models are further propelling non-hazardous waste processing demand across residential and commercial projects.

- For instance, Holcim recycled 8.4 million tons of construction-demolition materials in 2023 through ECOCycle.

By Material

Concrete held the largest market share in 2024, capturing about 42% of total construction waste generated. The segment’s dominance stems from its widespread use in infrastructure, commercial, and residential projects. Increasing demolition and redevelopment activities contribute significantly to concrete debris generation. The growing focus on recycled aggregates and cement substitutes, coupled with regulatory encouragement for green construction, supports this segment’s expansion. Recycling technologies that convert concrete waste into usable materials for road base and new structures are further driving sustainability in this category.

- For instance, according to its 2024 Sustainability Report, Tarmac utilized over 980,000 tonnes of recycled asphalt planings (RAP) in 2023. The company later reported reusing over one million tonnes of RAP in 2024, as noted in a July 2025 news release.

By Source

The residential segment led the construction waste market in 2024, accounting for nearly 46% of the total volume. Rapid urbanization, rising disposable income, and housing renovation trends are major contributors to this segment’s growth. The increasing number of small-scale home improvement and redevelopment projects has amplified the generation of non-hazardous waste materials such as concrete, bricks, and wood. Government-backed affordable housing initiatives and the adoption of sustainable construction practices are accelerating waste recycling and reuse within the residential construction sector.

Key Growth Drivers

Expansion of Urban Infrastructure Projects

Rapid urbanization and large-scale infrastructure development are significantly increasing construction waste generation. Growing investments in transport networks, residential complexes, and commercial buildings are creating high volumes of demolition and renovation debris. Countries in Asia-Pacific and the Middle East are prioritizing sustainable infrastructure, driving the need for efficient waste management systems. This expansion promotes recycling and circular construction models, making infrastructure growth a major driver of the construction waste market.

- For instance, Ramky Enviro Engineers (now Re Sustainability) commissioned a Hyderabad C&D plant with 500 TPD capacity, adding to the city’s network.

Rising Focus on Recycling and Circular Economy

Environmental regulations and sustainability goals are boosting recycling and reuse practices in the construction sector. Governments are enforcing landfill restrictions and encouraging circular economy models that convert waste materials like metal, concrete, and wood into reusable resources. This shift reduces environmental impact and lowers project costs while promoting material efficiency. Recycling adoption not only supports resource conservation but also strengthens the market’s long-term sustainability outlook.

- For instance, Skanska’s Collin College–Wylie Campus recycled 5,257 tons of C&D debris, achieving 96% diversion on the project.

Government Regulations and Green Building Policies

Tightening government regulations and the rise of green building certifications are fostering structured waste management practices. Programs such as LEED and BREEAM encourage the recycling of construction debris and the use of eco-friendly materials. Many regions are mandating waste segregation and recovery targets, improving compliance among contractors. These initiatives are propelling the adoption of sustainable materials and efficient recycling infrastructure, reinforcing regulatory frameworks as a key market growth factor.

Key Trends & Opportunities

Integration of Digital Waste Tracking Systems

Digital technologies are transforming construction waste management through improved tracking and data accuracy. IoT sensors, AI-based analytics, and blockchain systems help monitor material flow and optimize waste collection. These technologies enhance transparency, reduce illegal dumping, and streamline logistics for recycling. Construction firms adopting digital waste management platforms gain real-time insights and regulatory compliance, creating opportunities for efficiency and sustainability improvements across large projects.

- For instance, Sensoneo deployed over 11,000 smart sensors in Madrid, which is the largest smart waste installation in Europe. The installation, which began in 2023, uses sensors in bins for light packaging, textiles, glass, organic, and general waste to provide data for optimizing collection routes.

Growing Adoption of Modular and Prefabricated Construction

The rise of modular and prefabricated construction methods is reducing material waste on-site. Off-site manufacturing ensures precise material use, cutting waste generation by nearly half compared to traditional methods. This trend aligns with sustainable construction goals and helps meet green building standards. By investing in prefabrication and recyclable materials, builders enhance project efficiency while minimizing environmental impact, opening new growth avenues for eco-friendly construction practices.

- For instance, Laing O’Rourke’s DfMA approach for Crossrail used 460 precast platform elements at Liverpool Street, replacing in-situ methods.

Key Challenges

Limited Recycling Infrastructure and High Processing Costs

Insufficient recycling facilities and high operational expenses remain major obstacles in the market. Developing nations face limited access to modern waste segregation and processing plants, leading to higher landfill dependency. Transportation and sorting costs further discourage contractors from recycling. Expanding recycling capacity and developing low-cost waste recovery technologies are essential to address this challenge and improve construction waste management efficiency.

Inconsistent Regulatory Enforcement and Lack of Awareness

Uneven policy enforcement and limited industry awareness hinder effective waste handling. Many small construction firms lack knowledge of recycling protocols or fail to comply with disposal guidelines. The absence of standardized classification systems complicates material recovery processes. Stronger regulatory oversight, better education programs, and nationwide waste tracking initiatives are necessary to ensure consistent implementation of sustainable construction waste management practices.

Regional Analysis

North America

North America held a 32% share of the construction waste market in 2024, driven by strong infrastructure development and renovation activities. The United States leads the region due to large-scale urban redevelopment and government mandates promoting waste recycling. The growing adoption of sustainable construction practices and green building certifications has encouraged recycling of concrete, metal, and wood materials. Technological advancements in waste sorting and digital monitoring systems are further improving operational efficiency. Canada’s focus on zero-waste construction initiatives also supports regional growth, with both nations prioritizing circular economy goals and landfill reduction.

Europe

Europe accounted for 28% of the global construction waste market in 2024, supported by strict environmental policies and advanced recycling infrastructure. The European Union’s Waste Framework Directive and Green Deal initiatives are driving waste reduction and reuse practices. Countries such as Germany, the UK, and France lead with robust circular economy programs and high recycling rates. Growing demand for eco-friendly materials and resource-efficient building designs strengthens the market. Ongoing investments in digital waste management systems and smart demolition technologies are expected to further boost Europe’s leadership in sustainable construction waste processing.

Asia-Pacific

Asia-Pacific dominated the construction waste market in 2024, holding a 34% share. Rapid industrialization, urban expansion, and infrastructure megaprojects in China, India, and Japan are key growth factors. The rising number of residential and commercial projects has significantly increased waste generation. Governments are implementing policies to improve recycling and reduce landfill dependency. Emerging smart city projects and investments in waste sorting and recycling technologies are accelerating sustainable waste management practices. The region’s growing focus on resource recovery and public-private partnerships is driving long-term market growth potential.

Latin America

Latin America captured about 4% of the construction waste market in 2024. The region’s market growth is supported by expanding urban housing projects and modernization of aging infrastructure. Brazil and Mexico lead due to increasing awareness of sustainable waste disposal and recycling initiatives. However, limited infrastructure for large-scale waste processing remains a key challenge. Governments are gradually introducing policies to regulate construction waste segregation and recycling. Ongoing infrastructure investments, coupled with international partnerships promoting environmental compliance, are expected to enhance market efficiency across the region.

Middle East & Africa

The Middle East & Africa accounted for nearly 2% of the construction waste market in 2024. Rapid urbanization and large-scale construction projects in the UAE, Saudi Arabia, and South Africa are key contributors. The growing focus on sustainable development and circular economy principles is encouraging investment in recycling facilities. Government programs under initiatives like Saudi Vision 2030 and Dubai Clean Energy Strategy are driving eco-friendly construction practices. Despite infrastructure limitations, increasing private sector participation and adoption of modern waste management technologies are improving efficiency in handling construction debris across the region.

Market Segmentations:

By Waste Type:

By Material:

- Soil, sand, & gravel

- Concrete

- Bricks & masonry

- Wood

- Metal

- Others

By Source:

- Residential

- Commercial

- Industrial

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The construction waste market is led by key players such as Veolia Environment S.A., WM Intellectual Property Holdings, LLC, Cleanaway Waste Management Limited, Holcim, Republic Services, FCC Environment Limited, Casella Waste Systems, Inc., Daiseki Co., Ltd., GFL Environmental Inc., Waste Connections, Renewi plc, Metso Corporation, Kiverco, Eqiom, Remondis, Windsor Waste, and Clean Harbors, Inc. These companies compete through strategic investments in recycling technologies, sustainable processing solutions, and waste-to-resource innovations. They focus on expanding service portfolios across demolition, sorting, and material recovery to enhance operational efficiency. Partnerships with construction firms and government agencies are strengthening their regional presence and compliance with environmental regulations. The increasing adoption of digital waste tracking, automated segregation systems, and green building collaborations is also shaping market competition. Continuous mergers, acquisitions, and infrastructure upgrades highlight a shift toward integrated circular economy solutions, ensuring competitive advantages and long-term sustainability in the global construction waste management industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Veolia Environment S.A.

- WM Intellectual Property Holdings, LLC

- Cleanaway Waste Management Limited

- Holcim

- Republic Services

- FCC Environment Limited

- Casella Waste Systems, Inc.

- Daiseki Co., Ltd.

- GFL Environmental Inc.

- Waste Connections

- Renewi plc

- Metso Corporation

- Kiverco

- Eqiom

- Remondis

- Windsor Waste

- Clean Harbors, Inc.

Recent Developments

- In 2023, Swiss company Holcim launched ECOCycle, a proprietary circular technology platform for recycling construction and demolition (C&D) waste.

- In 2023, WM completed the acquisition of Specialized Environmental Technologies, Inc., expanding its specialized waste services to include hazardous waste capabilities.

- In 2022, Eqiom, which is a branch of CRH, has reported the commissioning of a pilot plant that has been designed to recycle construction waste in Gennevilliers, France.

Report Coverage

The research report offers an in-depth analysis based on Waste Type, Material, Source and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily as global construction and demolition activities increase.

- Recycling and reuse of concrete, metal, and wood will become standard practice across major regions.

- Governments will strengthen regulations promoting circular economy adoption in construction.

- Digital waste tracking and AI-based monitoring systems will improve operational efficiency.

- Green building certifications will drive demand for sustainable waste management solutions.

- Public-private partnerships will support the development of advanced recycling infrastructure.

- Prefabrication and modular construction will reduce material waste generation significantly.

- Investments in waste-to-resource technologies will enhance profitability for recycling companies.

- Asia-Pacific will remain the leading region due to strong infrastructure expansion.

- Growing awareness of environmental impact will push construction firms toward zero-waste strategies.