| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| ASIC Verification & Validation Services Market Size 2024 |

USD 5,024.77 Million |

| ASIC Verification & Validation Services Market, CAGR |

8.80% |

| ASIC Verification & Validation Services Market Size 2032 |

USD 9,866.14 Million |

Market Overview:

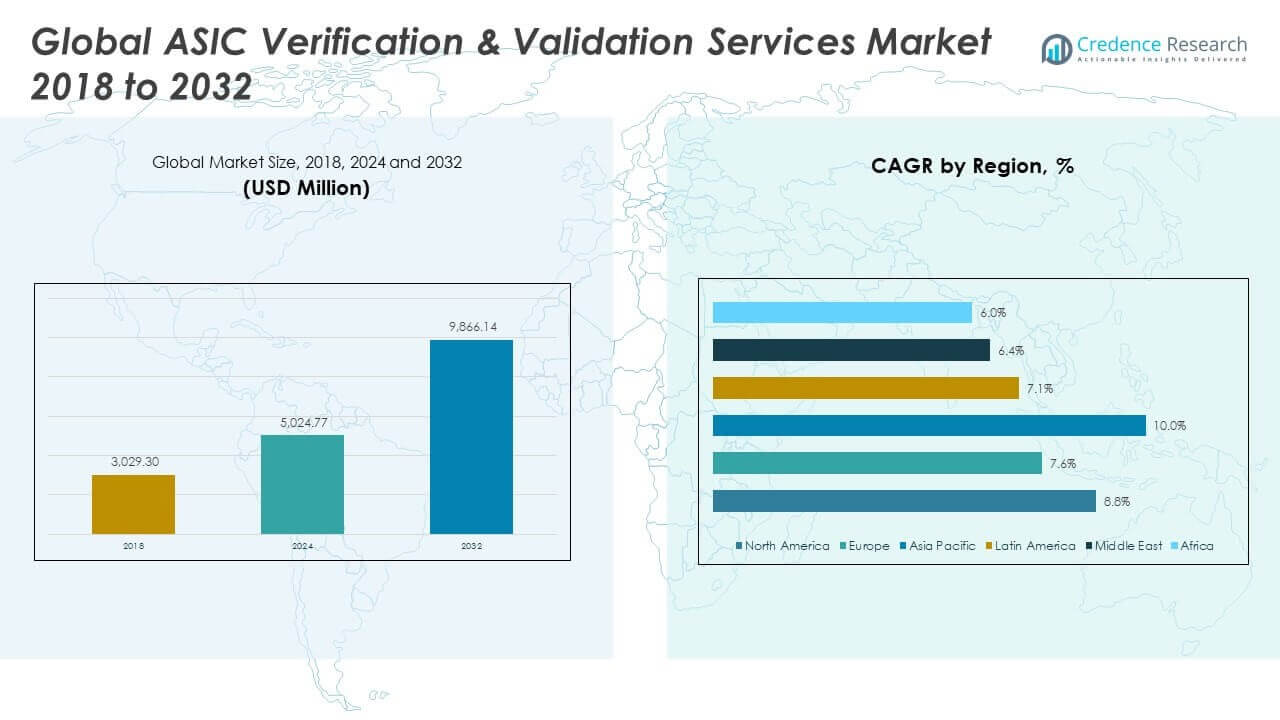

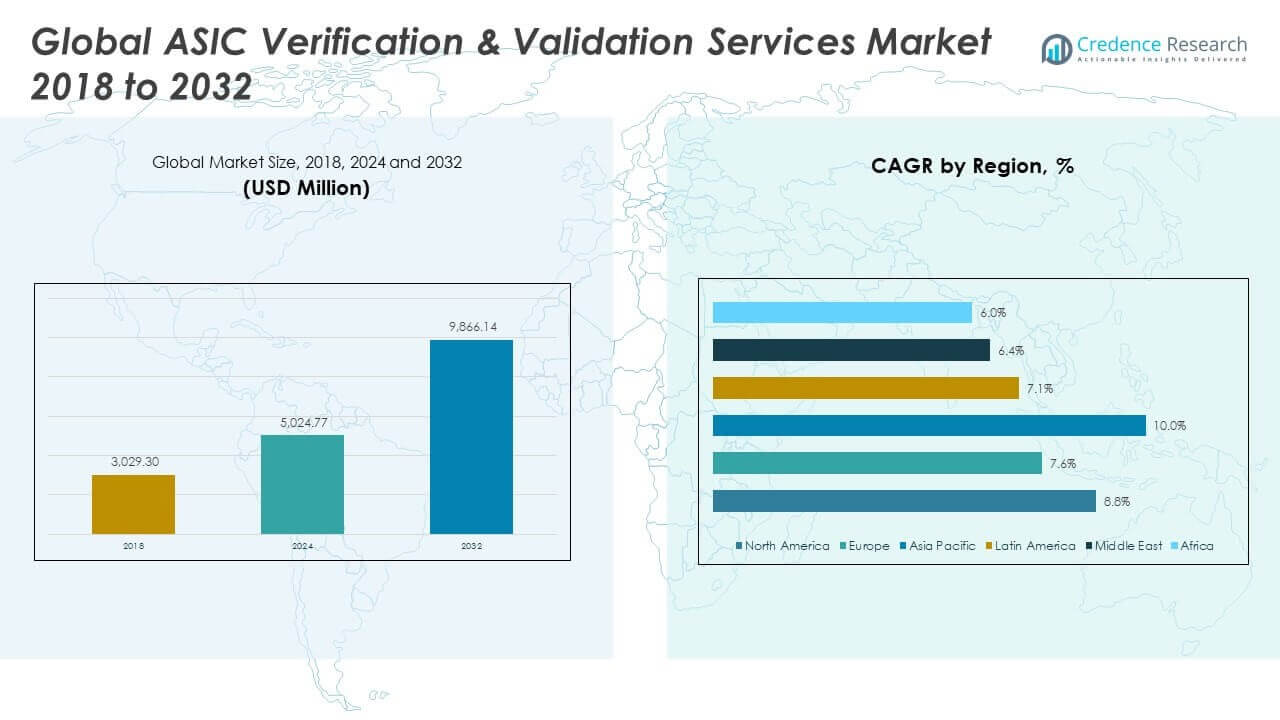

The Global ASIC Verification & Validation Services Market size was valued at USD 3,029.30 million in 2018 to USD 5,024.77 million in 2024 and is anticipated to reach USD 9,866.14 million by 2032, at a CAGR of 8.80% during the forecast period.

The growth of the Global ASIC Verification & Validation Services Market is primarily driven by the increasing complexity of ASIC designs across applications such as AI, 5G, automotive, and industrial automation. As chip architectures integrate diverse IP blocks, analog-digital interfaces, and low-power modes, ensuring functional correctness, timing accuracy, and compliance becomes more challenging, necessitating robust V&V methodologies. Companies face growing pressure to reduce time-to-market while maintaining high quality and regulatory compliance, which has led to a surge in outsourcing V&V tasks to specialized service providers. Additionally, the widespread use of automation tools, simulation platforms, and AI-driven verification engines enhances productivity and lowers costs, encouraging broader adoption. The shift toward fabless semiconductor business models and increasing use of third-party IP cores also contribute to the demand for independent, end-to-end verification and validation services.

North America holds the largest share of the ASIC Verification & Validation Services Market, supported by its leadership in semiconductor R&D, presence of key industry players, and high adoption of advanced chip technologies in sectors like cloud computing, defense, and automotive. Europe follows with strong growth in regulated industries, especially in Germany, France, and the UK, where compliance-driven design processes are common in automotive and aerospace sectors. The Asia-Pacific region is emerging as the fastest-growing market due to expanding chip design ecosystems in China, India, Taiwan, and South Korea, driven by government initiatives and investments in semiconductor self-sufficiency. These countries are increasingly outsourcing V&V services to accelerate innovation while managing costs. Meanwhile, Latin America and the Middle East & Africa are at a nascent stage, with moderate growth potential tied to developing telecom infrastructure and smart technology adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global ASIC Verification & Validation Services Market is projected to grow from USD 5,024.77 million in 2024 to USD 9,866.14 million by 2032, registering a CAGR of 8.80% driven by rising demand for advanced chip validation.

- Increasing complexity in ASIC architectures across AI, automotive, and 5G applications is accelerating the adoption of functional, formal, and physical verification services.

- Outsourcing verification tasks is becoming essential due to time-to-market pressures and the need for cost-efficient access to expert talent and scalable infrastructure.

- Safety-critical industries such as automotive, aerospace, and medical electronics are driving demand for traceable and standards-compliant validation frameworks.

- Emerging technologies like AI-driven verification engines, cloud-based simulation, and emulation platforms are enhancing test coverage and reducing verification cycles.

- High cost and toolchain complexity remain major barriers, especially for small and mid-sized design firms lacking access to advanced EDA infrastructure.

- North America leads the market with over 33% share, while Asia-Pacific is the fastest-growing region, fueled by government-backed semiconductor initiatives in China, India, and South Korea.

Market Drivers:

Rising Complexity of Semiconductor Architectures Demands Advanced V&V Support

The growing intricacy of modern ASIC designs is a major force shaping the Global ASIC Verification & Validation Services Market. With integration of heterogeneous IP cores, low-power modes, mixed-signal components, and AI-driven accelerators, the need for comprehensive and early-stage validation has increased significantly. Traditional verification techniques are no longer sufficient to cover edge cases and performance bottlenecks in time-critical applications such as autonomous vehicles, 5G infrastructure, and smart devices. It becomes essential for design teams to implement functional, formal, and physical verification methodologies. The demand for first-time-right silicon intensifies the focus on exhaustive simulation, emulation, and regression testing. The Global ASIC Verification & Validation Services Market continues to benefit from this upward shift in design complexity and the urgency to minimize post-silicon failures.

- For example, NVIDIA’s Hopper H100 GPUincorporates 80 billion transistors, 132 streaming multiprocessors, and fourth-generation Tensor Cores for AI workloads, necessitating exhaustive verification to ensure functional correctness across diverse operating modes.

Time-to-Market Pressures and Competitive Differentiation Fuel Outsourcing of V&V

Shortening product development cycles and increased competition in the semiconductor sector have amplified the demand for faster, high-quality V&V services. Semiconductor companies face growing expectations to release innovative chips under strict timelines while ensuring reliability and safety. Outsourcing verification and validation functions helps address resource constraints and allows internal teams to focus on innovation and architecture. It enables access to specialized engineering talent, leading-edge tools, and scalable infrastructure without the overhead of in-house expansion. This operational efficiency contributes to shorter time-to-market and higher design confidence. It positions verification service providers as critical enablers in the broader chip development ecosystem.

- For example, TSMC’s advancements in process technology directly impact time-to-market cycles. With its N3E (3nm) FinFET process, launched for customer volume production in 2024, TSMC highlights ecosystem partnerships and customer enablement as central to rapid tapeout validation. Specific process enhancements such as a transistor density of 216 million transistors/mm² enable customers to accelerate design integration and early tapeout.

Growing Adoption of Safety-Critical Applications Requires Rigorous Validation

The expanding use of ASICs in safety-critical sectors including automotive, aerospace, industrial robotics, and medical electronics drives demand for certified and reliable V&V processes. Regulatory standards such as ISO 26262, DO-254, and IEC 60601 necessitate traceable, documented, and validated verification workflows. Any failure in these applications can result in life-threatening outcomes or significant system disruption, which intensifies the focus on formal verification, fault injection testing, and code coverage analysis. The Global ASIC Verification & Validation Services Market benefits from this shift toward mission-critical validation frameworks and third-party auditing. It strengthens the case for using domain-specific verification providers with compliance expertise and proven methodologies.

Technological Advancements in Verification Tools Enhance Efficiency and Coverage

Emerging technologies in AI-based verification, hardware emulation, simulation acceleration, and cloud-based regression are transforming how V&V tasks are executed. These innovations allow greater coverage, earlier detection of logic flaws, and automation of repetitive tasks, reducing overall verification cycles. It enables design houses to manage increasingly complex designs with limited manpower. Scalable platforms like UVM (Universal Verification Methodology) and ML-driven test pattern generation are now integral to V&V workflows. These advancements contribute to more predictive, faster, and efficient verification cycles. The integration of these tools into the Global ASIC Verification & Validation Services Market enhances the overall value proposition for both chip designers and service providers.

Market Trends:

Integration of Cloud-Based Verification Platforms Across Design Workflows

Cloud adoption is reshaping verification and validation workflows by enabling scalable, on-demand infrastructure for compute-intensive processes. Design teams are moving away from traditional on-premise EDA tools toward hybrid and fully cloud-native environments. This shift allows for faster execution of simulation, regression, and emulation tasks while ensuring flexibility in resource allocation. Cloud platforms also facilitate real-time collaboration among globally distributed teams, reducing delays in the design-review loop. The Global ASIC Verification & Validation Services Market is increasingly incorporating cloud-based verification-as-a-service (VaaS) models into its offerings. It supports faster iteration cycles, better version control, and greater cost efficiency.

- For example, Cadence Design Systems, Inc., a leader in EDA tools, publicly highlights its cloud-native verification platform, Cadence Cloud, which supports on-demand scaling of compute resources for large-scale regression testing and emulation.

Growing Use of Digital Twins to Simulate and Validate ASIC Functionality

Digital twin technology is gaining traction in ASIC validation by enabling real-time replication of chip behavior in virtual environments. These digital counterparts help simulate the actual performance of chips under varying operational scenarios before physical prototypes are available. Industries with mission-critical applications are embracing this approach to ensure product behavior aligns with intended functionality and performance expectations. It enhances predictive maintenance, identifies latent design flaws, and strengthens early-phase validation. The Global ASIC Verification & Validation Services Market is seeing increased integration of digital twin models into complex simulation workflows. It allows service providers to deliver higher-value insights beyond conventional testbench coverage.

Convergence of System-Level and Software-Centric Validation Approaches

The boundary between hardware verification and software validation is narrowing, prompting a unified approach to ensure total system reliability. Designers are adopting system-level verification strategies that account for firmware, operating systems, and driver behavior alongside core logic. This convergence addresses hidden interoperability issues and performance anomalies that emerge only during real-world use. It reflects the growing relevance of software-aware validation, particularly in embedded and application-specific devices. The Global ASIC Verification & Validation Services Market is adapting to this trend by offering co-simulation, hardware-in-the-loop (HIL), and virtual prototyping services. It strengthens the alignment between hardware and software deliverables.

Rise of Open-Source Verification Frameworks and Ecosystem Collaboration

Open-source tools and methodologies are entering the V&V landscape, fostering innovation and standardization across the verification ecosystem. Communities are actively developing reusable libraries, testbenches, and coverage models under open-source licenses. This trend is driven by the need for transparency, flexibility, and interoperability across EDA environments. Companies are engaging with collaborative forums and initiatives like CHIPS Alliance and OpenROAD to reduce verification overhead and improve toolchain adaptability. The Global ASIC Verification & Validation Services Market is evolving to incorporate these open frameworks into proprietary flows. It enhances vendor neutrality and accelerates the development of next-generation verification methodologies.

- For example, Google’s OpenTitan project, a prominent open-source silicon root of trust, published detailed metrics in their 2024 Annual Report demonstrating that its fully open-source verification environment, built using the RISC-V-based Ibex core and leveraging riscv-dv and UVM-based testbenches, achieved 98% functional coverage and flagged zero safety violations over 6,000 hours of continuous regression testing on cloud CI platforms.

Market Challenges Analysis:

High Cost and Complexity of Advanced Verification Toolchains

One of the most significant challenges in the Global ASIC Verification & Validation Services Market is the escalating cost of advanced verification infrastructure and tools. High-performance simulation engines, emulation platforms, and formal verification tools require substantial capital investment and ongoing licensing expenses. Small and mid-sized design firms often struggle to access or maintain these capabilities, limiting their ability to adopt best-in-class verification practices. The complexity of integrating heterogeneous toolchains into a cohesive workflow adds further barriers, especially when dealing with custom IP blocks or multi-vendor environments. It forces service providers to continuously invest in upgrading capabilities to stay competitive. The need for specialized expertise to operate these platforms also increases operational overhead, impacting cost-effectiveness for clients and vendors alike.

Talent Shortage and Scalability Issues in Project Execution

The limited availability of experienced verification engineers remains a persistent bottleneck in the Global ASIC Verification & Validation Services Market. Verifying increasingly complex chips requires deep domain knowledge in protocols, verification methodologies, scripting, and debug processes. However, the talent pipeline has not scaled in proportion to market demand, creating hiring delays and workload imbalances. It becomes difficult for service providers to scale teams quickly to accommodate large or urgent client projects without sacrificing quality. High attrition rates and the need for continuous upskilling further burden internal resource management. These workforce constraints limit the ability of V&V providers to deliver consistent outcomes across multiple concurrent engagements.

Market Opportunities:

Expansion of AI, 5G, and Automotive Electronics Creates High-Value Use Cases

The rapid expansion of AI accelerators, 5G infrastructure, and automotive electronics presents a significant opportunity for the Global ASIC Verification & Validation Services Market. Each of these domains involves highly specialized chips that demand rigorous verification standards due to their performance-critical and safety-sensitive roles. Service providers can capitalize on this demand by offering domain-specific V&V frameworks tailored to protocols like PCIe, LPDDR5, or ISO 26262. Growth in edge computing and autonomous systems also opens pathways for simulation-based testing, hardware-in-the-loop (HIL) verification, and real-time validation. It strengthens the market’s relevance in next-generation semiconductor deployments. Companies that align their offerings with sector-specific standards and emerging technologies stand to gain a competitive advantage.

Rising Demand for Design Reuse and IP-Centric Development Models

The increasing use of third-party IPs and design reuse across projects introduces fresh opportunities for verification services. As integration complexity grows, validating interface compatibility, performance consistency, and functional integrity across reused blocks becomes more critical. The Global ASIC Verification & Validation Services Market can expand by providing reusable verification components, VIPs (Verification IPs), and customizable testbenches. It supports faster validation while reducing design risk for clients working with mixed IP portfolios. Vendors that invest in modular verification frameworks and automation-driven regression platforms can serve a broader customer base and support faster design turnarounds.

Market Segmentation Analysis:

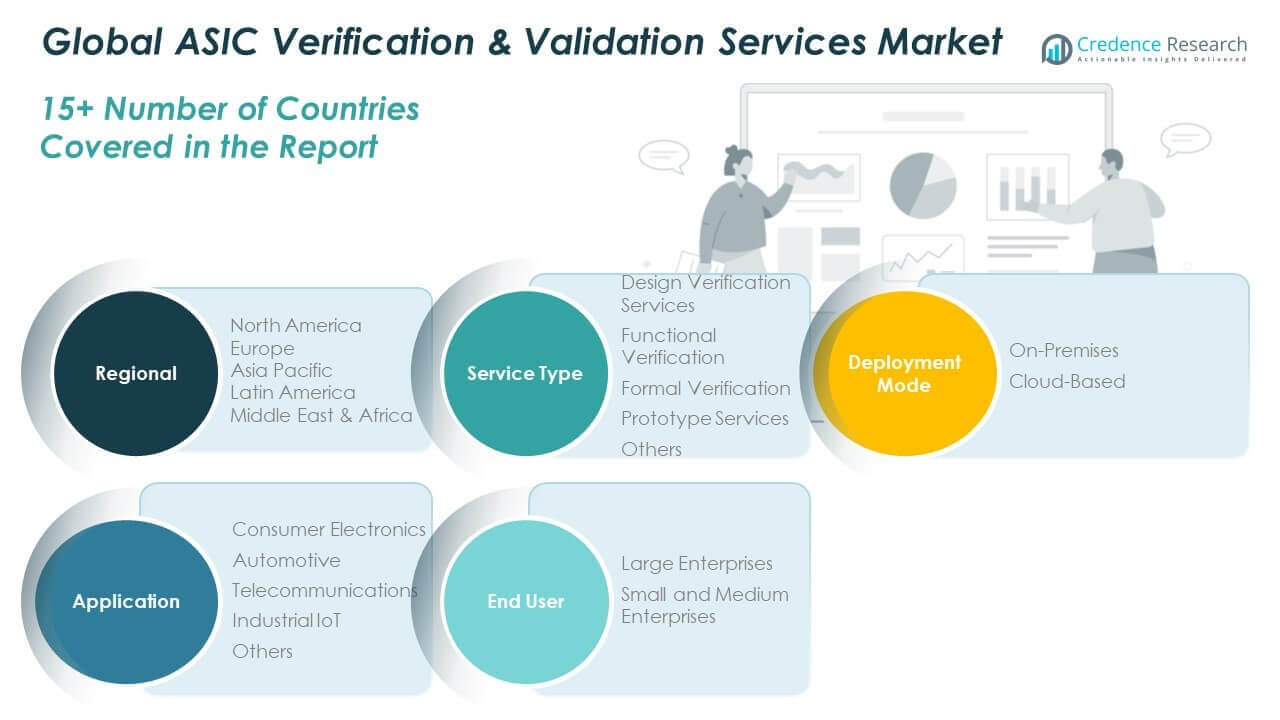

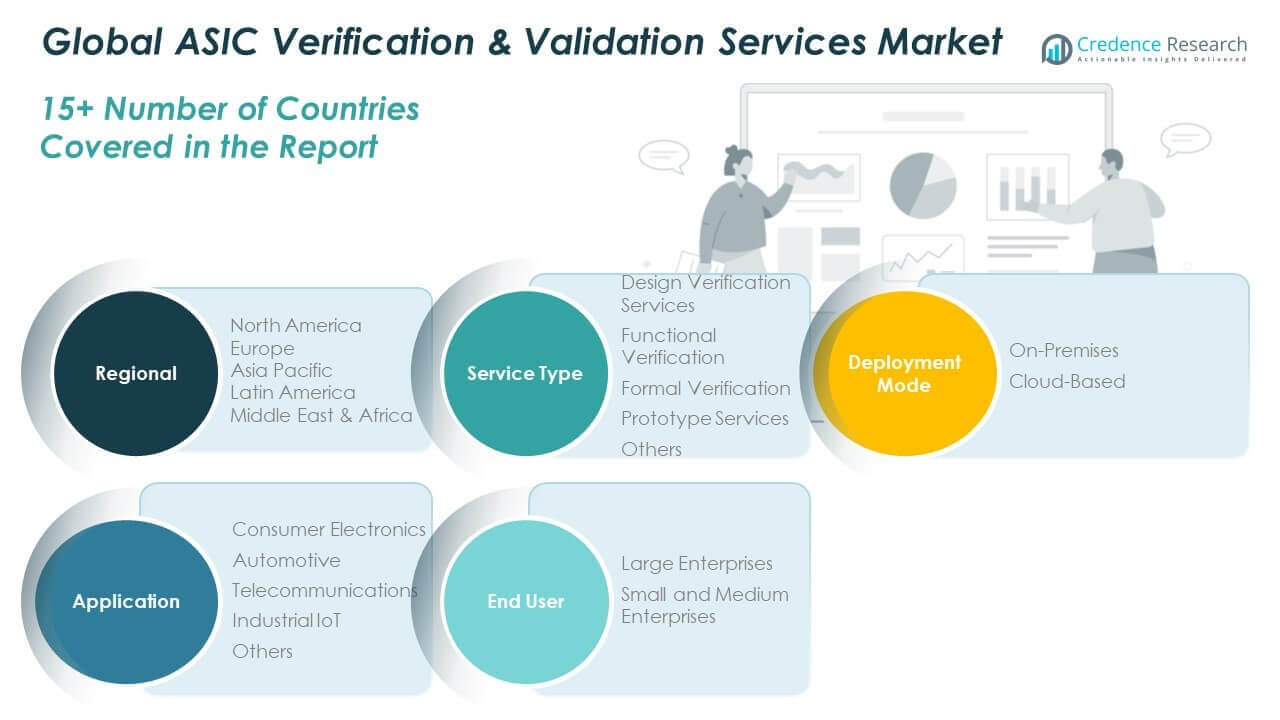

The Global ASIC Verification & Validation Services Market is segmented by service type, deployment mode, application, and end user, each contributing uniquely to the market’s expansion.

By service type, design verification services hold the largest share due to their foundational role in ensuring functional integrity early in the development cycle. Functional verification and formal verification segments are growing steadily, supported by demand for deeper test coverage and logic accuracy in complex SoCs. Prototype services and others represent emerging needs in physical validation and custom testing scenarios.

- For example, Arm, in collaboration with Cadence and Synopsys, offers physical prototype services (like FPGA prototyping with Arm Cortex-M85) allowing pre-silicon validation of complex IP designs. In its public case study (2024), Arm documents using Synopsys HAPS systems to validate machine learning inference engines, reducing simulation bottlenecks and enabling real-silicon behavior emulation before actual tapeout.

By deployment mode, on-premises solutions dominate due to their control and security advantages in handling sensitive IPs. However, cloud-based verification is gaining strong traction for its flexibility, scalability, and cost-efficiency, especially among SMEs and globally distributed design teams.

- For example, Apple’s M-series chip verification is predominantly on-premises due to the stringent confidentiality of proprietary hardware. According to the conference talk by Apple Silicon Security (2023), all verification of sensitive SoC IP is contained within hardened, isolated compute clusters in Apple’s secure facilities, with third-party tools (Cadence and Synopsys) custom-integrated but never cloud-hosted for critical workloads.

By application, the market sees strong adoption in consumer electronics and automotive, driven by rapid innovation cycles and the need for safety compliance. Telecommunications and industrial IoT segments follow, supported by the growth of 5G and edge computing applications.

By end user, large enterprises lead the market with high-volume chip design requirements and access to advanced verification infrastructure. Small and medium enterprises are increasingly outsourcing verification tasks to remain competitive, creating new opportunities for service providers.

Segmentation:

By Service Type

- Design Verification Services

- Functional Verification

- Formal Verification

- Prototype Services

- Others

By Deployment Mode

By Application

- Consumer Electronics

- Automotive

- Telecommunications

- Industrial IoT

- Others

By End User

- Large Enterprises

- Small and Medium Enterprises

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Regional Analysis:

The North America ASIC Verification & Validation Services Market size was valued at USD 1,288.15 million in 2018 to USD 2,113.89 million in 2024 and is anticipated to reach USD 4,162.47 million by 2032, at a CAGR of 8.8% during the forecast period. North America holds the highest market share of the Global ASIC Verification & Validation Services Market, accounting for 33.5% in 2024. It benefits from the concentration of semiconductor giants, fabless companies, and EDA tool providers across the U.S. and Canada. The region’s leadership in high-performance computing, AI chips, and automotive-grade ASICs continues to drive verification outsourcing. Strong investment in R&D, coupled with mature compliance frameworks, supports the adoption of formal verification, emulation, and co-simulation services. It also attracts global demand for advanced verification IPs and cloud-based simulation infrastructure. The market in North America remains a hub for innovation in V&V methodologies.

The Europe ASIC Verification & Validation Services Market size was valued at USD 603.19 million in 2018 to USD 949.14 million in 2024 and is anticipated to reach USD 1,705.78 million by 2032, at a CAGR of 7.6% during the forecast period. Europe holds a 15.0% share of the Global ASIC Verification & Validation Services Market in 2024, driven by the demand for functional safety and compliance in automotive, aerospace, and industrial electronics. Countries such as Germany, France, and the UK lead the region with robust engineering hubs and system integrators that rely on outsourced verification services. The growing focus on electric vehicles, ADAS, and renewable energy control systems intensifies the need for precise ASIC verification. It enables V&V service providers to build expertise around ISO and IEC safety standards. European design teams often prioritize formal verification, traceability, and test automation, contributing to steady market growth.

The Asia Pacific ASIC Verification & Validation Services Market size was valued at USD 867.41 million in 2018 to USD 1,519.87 million in 2024 and is anticipated to reach USD 3,256.96 million by 2032, at a CAGR of 10.0% during the forecast period. Asia Pacific commands a 24.0% share of the Global ASIC Verification & Validation Services Market in 2024 and is projected to be the fastest-growing region. The rise of fabless startups, government-backed chip manufacturing initiatives, and strong talent pools in India, China, Taiwan, and South Korea support rapid service adoption. It plays a key role in serving the needs of local design houses as well as global clients outsourcing complex verification workloads. Growth in consumer electronics, mobile SoCs, and IoT-based ASICs contributes to consistent demand. APAC service providers increasingly leverage automation and AI-driven validation tools to scale efficiently. The region is set to lead in volume-based and high-throughput verification projects.

The Latin America ASIC Verification & Validation Services Market size was valued at USD 137.03 million in 2018 to USD 224.34 million in 2024 and is anticipated to reach USD 387.61 million by 2032, at a CAGR of 7.1% during the forecast period. Latin America accounts for 3.5% of the Global ASIC Verification & Validation Services Market in 2024. Brazil and Mexico lead in regional adoption, supported by emerging demand for telecom infrastructure, smart devices, and automotive electronics. Limited local semiconductor manufacturing capacity constrains rapid expansion, but nearshoring and regional engineering centers drive interest in verification services. It enables global firms to reduce costs by engaging local V&V talent for entry- and mid-level tasks. The region’s growth depends on stronger ecosystem development, training programs, and partnerships with global service providers. Latin America presents a moderate opportunity for expansion with scalable service models.

The Middle East ASIC Verification & Validation Services Market size was valued at USD 82.15 million in 2018 to USD 124.18 million in 2024 and is anticipated to reach USD 204.36 million by 2032, at a CAGR of 6.4% during the forecast period. The Middle East represents a 2.0% share of the Global ASIC Verification & Validation Services Market in 2024. Countries such as the UAE, Israel, and Saudi Arabia are investing in AI, defense electronics, and smart city infrastructure, spurring interest in advanced chip development. Demand for localized verification services is growing as the region focuses on digital transformation and semiconductor self-reliance. It provides opportunities for V&V firms to support national innovation programs and pilot projects. The regional market is still nascent but shows potential with increased government support and global partnerships. Verification demand is likely to grow in alignment with chip design capabilities.

The Africa ASIC Verification & Validation Services Market size was valued at USD 51.36 million in 2018 to USD 93.35 million in 2024 and is anticipated to reach USD 148.95 million by 2032, at a CAGR of 6.0% during the forecast period. Africa contributes just 1.5% to the Global ASIC Verification & Validation Services Market in 2024, reflecting early-stage market conditions. Limited local design capacity and infrastructure remain primary barriers to market expansion. South Africa and Nigeria show pockets of growth, driven by smart grid, fintech, and satellite communications initiatives. It offers small-scale opportunities for pilot projects and low-cost verification outsourcing. Capacity building, education, and partnerships with global design houses will shape future market viability. Africa remains a long-term opportunity zone with modest current adoption.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Analog Devices

- Maxim Integrated

- ON Semiconductor

- Qualcomm

- Intel

- Texas Instruments

- Xilinx (AMD)

- Synopsys

- Cadence Design Systems

- ARM

Competitive Analysis:

The Global ASIC Verification & Validation Services Market is highly competitive, driven by a mix of established semiconductor service firms, EDA tool vendors, and specialized verification providers. Leading players such as Synopsys, Cadence Design Systems, Siemens EDA, and Wipro offer end-to-end V&V solutions with global delivery models. It includes capabilities across simulation, emulation, formal verification, and post-silicon validation. Mid-sized firms and niche players focus on protocol-specific expertise, faster turnaround, and customized testbench development. Strategic collaborations with fabless design companies and IP vendors strengthen market presence. The rise of AI-driven verification platforms and cloud-based services intensifies competition by enabling scalable and cost-efficient delivery. The Global ASIC Verification & Validation Services Market favors vendors that combine domain knowledge, toolchain proficiency, and operational agility. Market players differentiate by offering reusable verification IPs, automation frameworks, and compliance-focused validation to support evolving chip design requirements across verticals such as automotive, telecom, and industrial electronics.

Recent Developments:

- In January 2025, Cadence Design Systems finalized the acquisition of Secure‑IC, an embedded security IP platform provider. This deal complements Cadence’s existing IP portfolio by adding security modules crucial for automotive, telecom, and IoT applications. It enhances Cadence’s ability to offer secure V&V services tailored to evolving compliance demands.

- In February 2025, Synopsys expanded its hardware-assisted verification portfolio by launching two next-gen systems: the HAPS-200 prototyping platform and the ZeBu-200 emulation system, built on AMD Versal Premium adaptive SoC. These products deliver faster compile times, enhanced debug productivity, and exceptional scalability— capable of handling designs beyond 60 billion gates—solidifying its position in high-performance ASIC validation

- In November 2024, AMD (Xilinx) introduced the Versal Premium Series Gen 2, a new generation of adaptive SoCs that support CXL 3.1, PCIe Gen6 interfaces, and LPDDR5X memory. These high-performance FPGAs and SoCs are designed to address rapidly growing data movement and acceleration needs in data centers and communications infrastructure.

- In Jan 2024, Synopsys finalized its acquisition of Ansys, a leader in simulation and analysis software, in a $35 billion deal. This move uniquely positions Synopsys to accelerate innovation in semiconductor design and verification. By integrating Ansys’ simulation expertise with Synopsys’ silicon design technologies, the combined company aims to offer comprehensive, AI-powered solutions that enhance ASIC verification and validation, streamlining the path from silicon to system for chipmakers and their customers.

Market Concentration & Characteristics:

The Global ASIC Verification & Validation Services Market exhibits a moderately concentrated structure, with a few dominant players holding significant market share and numerous specialized firms operating in niche segments. It features high technical complexity, strong entry barriers, and demand for continuous innovation, favoring vendors with deep domain expertise and access to advanced EDA tools. The market is characterized by long-term client relationships, project-based contracts, and a growing preference for outsourced verification partnerships. Service providers differentiate through IP reuse, automation capabilities, and industry-specific compliance knowledge. It continues to evolve with trends in AI integration, cloud-based simulation, and design reuse, reinforcing the need for scalable and adaptive verification methodologies.

Report Coverage:

The research report offers an in-depth analysis based on service type, deployment mode, application, and end user. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for verification services will rise with increased adoption of AI, 5G, and automotive ASICs.

- Integration of AI and machine learning into V&V tools will enhance efficiency and test coverage.

- Cloud-based verification platforms will gain traction for scalable, cost-effective deployments.

- Formal verification and safety-critical compliance will become standard in regulated sectors.

- Growing use of third-party IPs will drive demand for interoperability and integration testing.

- Emerging markets in Asia Pacific and Latin America will attract outsourcing-driven growth.

- Collaboration between EDA tool vendors and service providers will expand integrated offerings.

- Talent development and training programs will be crucial to address the engineering skill gap.

- Open-source verification frameworks will support greater customization and innovation.

- Sustainability goals and power-aware design will influence verification methodologies globally.