| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Compression Sportswear Market Size 2024 |

USD 1,548.01 Million |

| North America Compression Sportswear Market, CAGR |

6.72% |

| North America Compression Sportswear Market Size 2032 |

USD 2,604.92 Million |

Market Overview

North America Compression Sportswear Market size was valued at USD 1,548.01 million in 2024 and is anticipated to reach USD 2,604.92 million by 2032, at a CAGR of 6.72% during the forecast period (2024-2032).

The North America compression sportswear market is driven by the increasing adoption of performance-enhancing apparel among athletes and fitness enthusiasts. The rising awareness of muscle recovery benefits, improved blood circulation, and injury prevention has fueled demand for compression garments. Technological advancements in fabric design, such as moisture-wicking, temperature regulation, and seamless construction, further contribute to market growth. The growing popularity of athleisure, where consumers seek stylish yet functional sportswear for both workouts and casual wear, is a key trend shaping the market. Additionally, the expanding e-commerce sector provides consumers with easy access to a wide range of compression wear, boosting sales. Sustainability initiatives, including the use of eco-friendly and recycled fabrics, are gaining traction, aligning with consumer preferences for sustainable fashion. The increasing participation in sports, coupled with rising health consciousness, continues to drive demand, positioning compression sportswear as an essential segment in the activewear industry.

The North America compression sportswear market is driven by increasing health consciousness and a growing preference for high-performance athletic wear across the U.S., Canada, and Mexico. The United States leads in demand, supported by a strong fitness culture, rising participation in sports, and the presence of major industry players. Canada is witnessing steady growth due to its athleisure trend and emphasis on sustainable sportswear, while Mexico is emerging as a potential market with increasing sports participation. Key players in the market include Under Armour, Nike, Columbia Sportswear, YONEX, PVH Corp., 2XU, A4 Sportswear, Augusta Sportswear, Craft, CW-X, Zensah, and Pacterra Athletics. These companies focus on innovation, advanced fabric technologies, and strategic partnerships to enhance product offerings. E-commerce expansion and direct-to-consumer sales strategies further drive market growth, enabling brands to reach a broader audience and strengthen their competitive positioning across North America.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The North America compression sportswear market was valued at USD 1,548.01 million in 2024 and is expected to reach USD 2,604.92 million by 2032, growing at a CAGR of 6.72% from 2024 to 2032.

- Increasing awareness of fitness, wellness, and recovery is driving the demand for compression wear in sports and rehabilitation.

- The athleisure trend, combining style and functionality, is boosting the popularity of compression garments for both sports and everyday wear.

- Brands are focusing on sustainable and eco-friendly materials to cater to environmentally conscious consumers.

- Intense competition, with multiple established brands and emerging players, is creating pricing pressure and market saturation.

- The U.S. dominates the market, with Canada and Mexico also contributing to regional growth in fitness-conscious populations.

- Key players like Under Armour, Nike, and 2XU are investing in innovation and expanding their e-commerce presence to strengthen market positioning.

Report Scope

This report segments the North America Compression Sportswear Market as follows:

Market Drivers

Growing Popularity of Fitness and Sports Activities

The increasing participation in sports and fitness activities is a key driver of the North America compression sportswear market. With a rising awareness of the benefits of regular exercise, more individuals are engaging in running, cycling, yoga, and high-intensity training, fueling the demand for compression garments. For instance, the Sports & Fitness Industry Association (SFIA) reports that participation in fitness activities such as treadmill workouts, stair-climbing, and rowing machines has seen significant gains, reflecting a broader trend toward active lifestyles. These products offer muscle support, reduce fatigue, and enhance performance, making them essential for both amateur and professional athletes. Additionally, government initiatives promoting physical fitness and corporate wellness programs encouraging employees to adopt healthier lifestyles are further contributing to market growth. As more consumers integrate fitness into their daily routines, the demand for high-performance compression sportswear continues to expand.

Advancements in Fabric Technology and Performance Enhancements

Innovations in fabric technology are playing a crucial role in driving the adoption of compression sportswear. The development of moisture-wicking, breathable, and temperature-regulating fabrics enhances comfort and performance, attracting a broad consumer base. For example, the integration of smart textiles with sensors allows users to monitor vital signs such as heart rate and muscle activity, providing real-time feedback to optimize workouts. Compression garments designed with seamless construction, four-way stretchability, and antimicrobial properties provide users with improved flexibility and hygiene. Furthermore, the integration of smart textiles and nanotechnology, such as fabrics embedded with sensors to monitor muscle activity and hydration levels, is gaining traction. These advancements not only enhance the functionality of compression sportswear but also differentiate premium brands in a competitive market. As fabric technology continues to evolve, the appeal of compression garments as a performance-enhancing and recovery-supporting solution strengthens.

Rise of Athleisure and Consumer Preference for Multi-Functional Apparel

The growing trend of athleisure, where sportswear doubles as casual wear, is significantly influencing the compression sportswear market. Consumers seek versatile apparel that offers both style and performance, driving demand for compression garments suitable for gym sessions, outdoor activities, and everyday wear. Leading brands are responding by designing compression wear with sleek aesthetics, neutral color palettes, and fashion-forward designs that align with contemporary lifestyle trends. The increasing acceptance of casual and comfortable attire in workplaces and social settings further supports this shift. As consumers prioritize convenience and multi-functionality in their clothing choices, compression sportswear is becoming an integral part of daily wardrobes, expanding its market reach beyond traditional athletic users.

Expansion of E-Commerce and Digital Marketing Strategies

The rapid growth of e-commerce and digital marketing has significantly boosted the accessibility and visibility of compression sportswear brands. Online platforms offer consumers a wide range of products, detailed specifications, and personalized recommendations, making it easier to find the ideal compression gear. Additionally, social media marketing, influencer collaborations, and targeted advertising campaigns enhance brand awareness and engagement. The increasing use of AI-driven customization, such as virtual fitting rooms and size recommendations, further improves the online shopping experience. As consumers increasingly prefer the convenience of online shopping, brands investing in digital strategies and direct-to-consumer sales channels are gaining a competitive advantage, driving further growth in the North America compression sportswear market.

Market Trends

Increasing Demand for High-Performance and Recovery-Enhancing Apparel

Consumers in North America are increasingly prioritizing high-performance compression sportswear that enhances athletic endurance and supports post-workout recovery. Compression garments improve blood circulation, reduce muscle fatigue, and minimize injury risks, making them a preferred choice among professional athletes and fitness enthusiasts. Brands are incorporating advanced fabric technologies, such as gradient compression and targeted muscle support, to optimize performance. Additionally, the growing popularity of endurance sports like marathons, triathlons, and high-intensity interval training (HIIT) is further driving demand for specialized compression wear that aids in quicker muscle recovery and reduces soreness.

Expansion of Digital and Direct-to-Consumer Sales Channels

E-commerce and digital marketing strategies are reshaping how compression sportswear brands engage with consumers. Companies are leveraging AI-driven personalization, virtual fitting rooms, and targeted online promotions to enhance customer experiences. For example, brands like Under Armour have successfully utilized digital platforms to build strong brand engagement through content marketing and community building initiatives, such as their Connected Fitness platform. The direct-to-consumer (DTC) model is gaining momentum, enabling brands to offer exclusive collections and competitive pricing through their websites. Social media influencers and professional athletes play a crucial role in brand visibility, with collaborations and sponsored content influencing purchasing decisions. The rise of mobile commerce and subscription-based models further contributes to market growth, making digital platforms a key driver in the expansion of compression sportswear sales across North America.

Growing Integration of Sustainable and Eco-Friendly Materials

Sustainability has become a defining trend in the compression sportswear market, with brands increasingly adopting eco-friendly materials and ethical production practices. Consumers are showing a strong preference for garments made from recycled polyester, organic cotton blends, and biodegradable fabrics that reduce environmental impact. For example, companies like Pressio are leading the way in sustainable fashion by using recycled materials and obtaining certifications like Bluesign, which ensures strict environmental standards in manufacturing processes. Companies are also implementing sustainable dyeing techniques and water-efficient manufacturing processes to align with global sustainability goals. Leading brands are differentiating themselves by promoting transparency in their supply chains and emphasizing their commitment to reducing carbon footprints. As eco-consciousness grows among consumers, sustainable compression sportswear is expected to gain significant traction.

Rise of Athleisure and Everyday Wearability

The athleisure trend continues to blur the lines between activewear and casual fashion, making compression sportswear a staple beyond workouts. Consumers seek apparel that balances functionality with style, leading to an increase in compression garments designed for both exercise and everyday wear. Features like seamless construction, subtle branding, and neutral color palettes make compression leggings, tops, and socks versatile for various occasions. Additionally, the demand for work-from-home comfort has reinforced the appeal of compression wear as a stylish yet practical option. As fashion-forward and multipurpose designs gain popularity, the compression sportswear market is witnessing broader adoption among lifestyle-conscious consumers.

Market Challenges Analysis

High Competition and Market Saturation

The North America compression sportswear market faces intense competition, with numerous established brands and emerging players striving for market share. Leading sportswear companies dominate the industry, offering extensive product lines backed by strong brand loyalty and aggressive marketing strategies. For instance, the presence of strong retail networks and strategic partnerships allows these brands to maintain a robust market presence, making it difficult for new entrants to establish themselves. Additionally, private-label brands and counterfeit products further intensify competition, offering similar compression wear at lower prices. This saturation puts pressure on companies to continually innovate, invest in premium materials, and enhance product functionality to maintain a competitive edge. Without strong brand positioning and unique value propositions, many businesses struggle to sustain long-term growth in this crowded market.

Pricing Pressure and Consumer Sensitivity to Cost

Despite the growing demand for compression sportswear, pricing remains a significant challenge, as consumers are highly cost-sensitive. Premium compression garments with advanced fabric technologies and durability often come at higher prices, limiting their accessibility to budget-conscious buyers. Additionally, the availability of cheaper alternatives, including non-branded and counterfeit products, affects the sales of premium brands. Companies must balance affordability with innovation, ensuring that compression wear remains functional and accessible without compromising on quality. Moreover, fluctuating raw material costs and supply chain disruptions can further impact pricing strategies, requiring brands to optimize production efficiency and maintain competitive pricing while delivering high-performance apparel.

Market Opportunities

The North America compression sportswear market presents significant opportunities driven by the increasing consumer focus on fitness and wellness. As more individuals engage in sports, gym workouts, and outdoor activities, the demand for high-performance apparel that enhances endurance and recovery continues to grow. The rising adoption of compression wear in medical and therapeutic applications, such as improving circulation and reducing swelling, further expands the market scope. Additionally, the growing interest in sportswear infused with smart technology, including embedded sensors for biometric tracking, offers brands a chance to differentiate their products. Companies that invest in research and development to enhance fabric functionality and integrate wearable technology can tap into a growing segment of tech-savvy and performance-driven consumers.

E-commerce expansion and the shift toward direct-to-consumer sales channels present another lucrative opportunity for brands. With increasing digital penetration, consumers prefer online platforms that offer convenience, customization, and competitive pricing. The use of artificial intelligence and data analytics to personalize shopping experiences, recommend suitable compression wear, and improve size accuracy enhances customer satisfaction and boosts sales. Furthermore, the growing trend of sustainable fashion allows brands to introduce eco-friendly compression wear made from recycled and biodegradable materials. By embracing sustainability initiatives and promoting ethical manufacturing practices, companies can attract environmentally conscious consumers and strengthen their brand reputation in the competitive North American market.

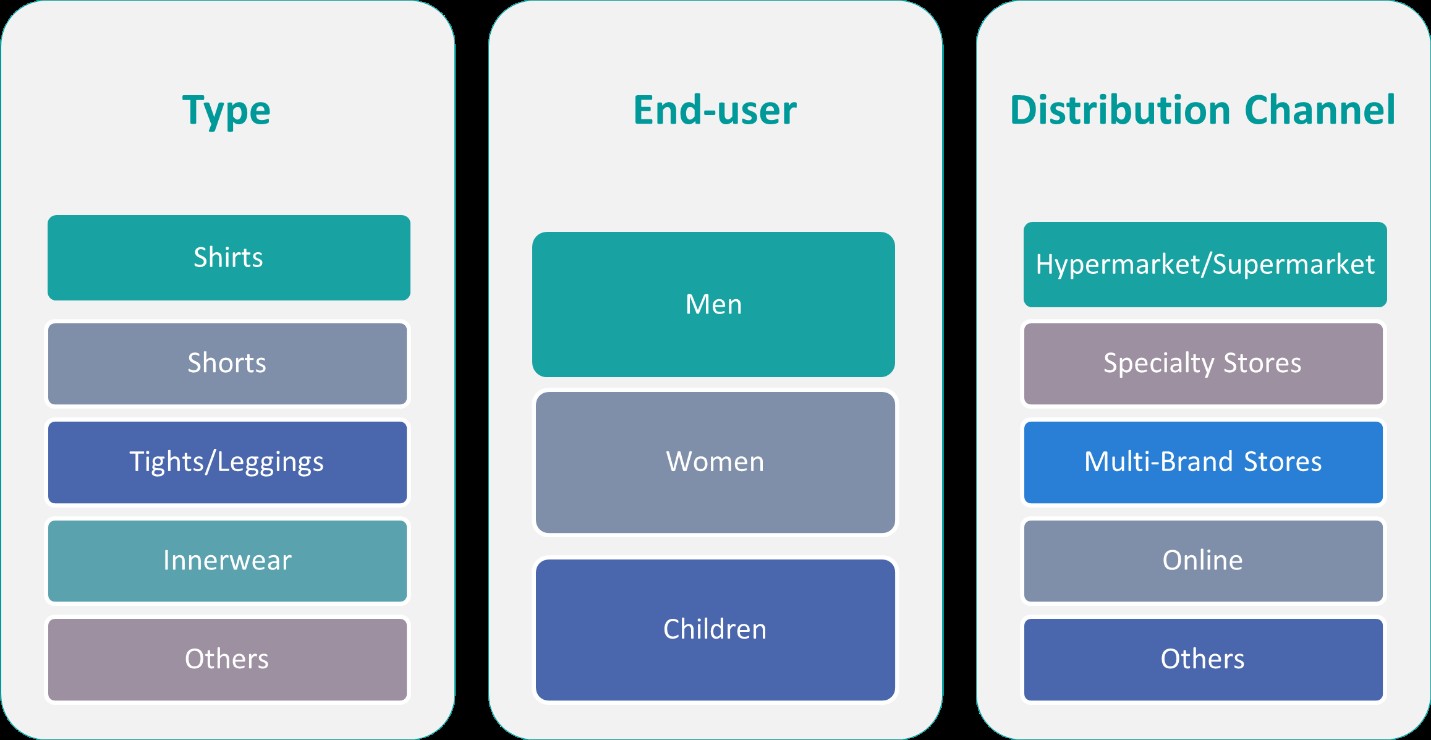

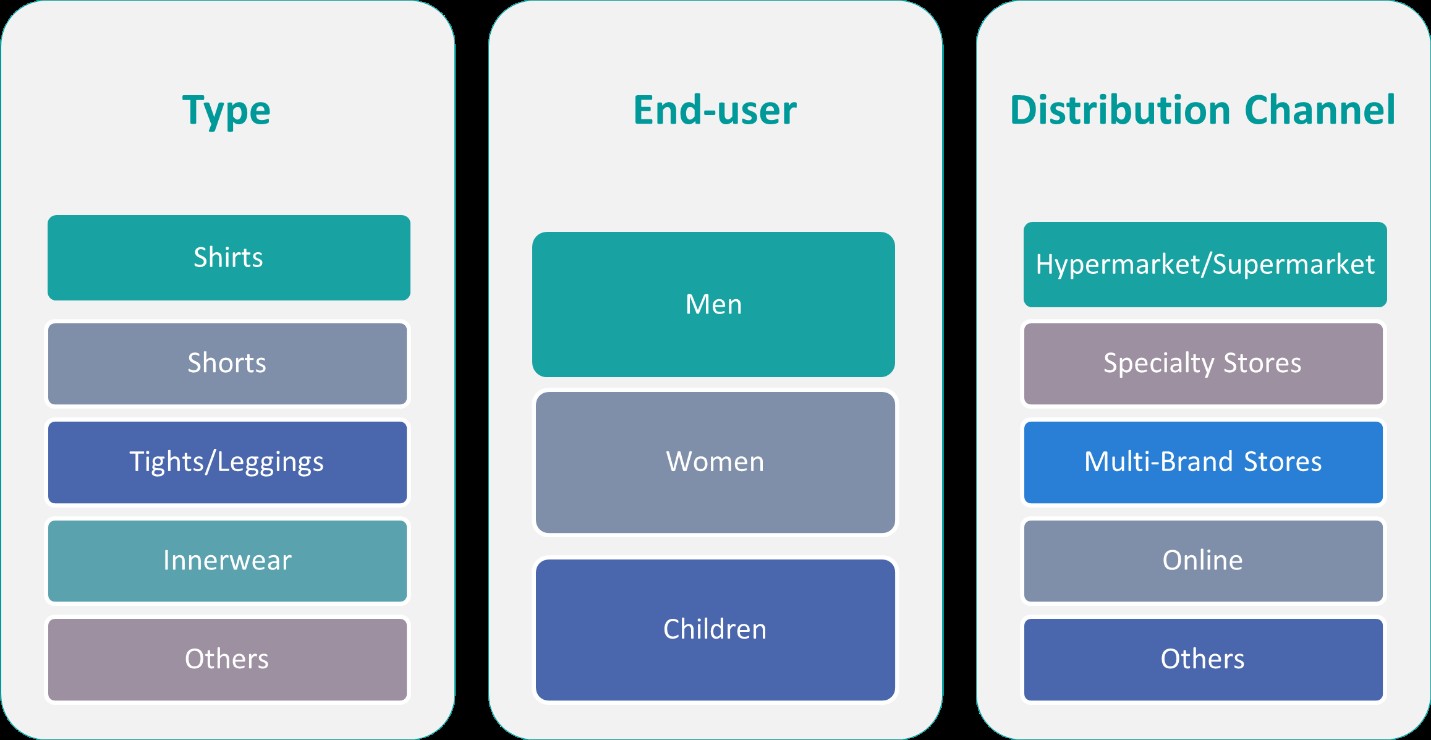

Market Segmentation Analysis:

By Product Type:

The North America compression sportswear market is segmented by product type into shirts, shorts, tights/leggings, innerwear, and others. Among these, tights and leggings dominate the market due to their widespread adoption among athletes, fitness enthusiasts, and everyday users seeking enhanced muscle support and comfort. The rising popularity of athleisure trends has further contributed to the increased demand for stylish yet functional leggings suitable for both workouts and casual wear. Compression shirts are also witnessing strong growth, particularly among professional athletes and gym-goers, as they help improve blood circulation and reduce muscle fatigue. Additionally, compression shorts are gaining traction in high-performance sports like basketball, soccer, and running, where muscle stability and flexibility are essential. Innerwear, including compression socks and base layers, is growing steadily as consumers recognize its benefits in injury prevention and muscle recovery. As consumer preferences shift towards high-performance and multi-functional sportswear, brands continue to introduce innovative designs and fabric technologies to meet evolving market demands.

By End- User:

The compression sportswear market in North America is also segmented based on end-users, including men, women, and children. The men’s segment holds the largest market share, driven by the high participation of male consumers in sports, fitness activities, and gym training. Male athletes and bodybuilders particularly favor compression wear for its muscle-supporting and sweat-wicking properties. However, the women’s segment is experiencing rapid growth, fueled by the increasing number of female consumers engaging in sports, yoga, and fitness regimes. The influence of athleisure trends and the demand for stylish compression leggings, shorts, and tops further contribute to this segment’s expansion. The children’s segment is emerging as an opportunity area, with rising awareness of the benefits of compression wear in preventing injuries and enhancing athletic performance in youth sports. As brands focus on catering to specific needs across different demographics, product diversification, inclusive sizing, and gender-specific designs are becoming key strategies to capture market share.

Segments:

Based on Product Type:

- Shirts

- Shorts

- Tights/Leggings

- Innerwear

- Others

Based on End- User:

Based on Distribution Channel:

- Hypermarket/Supermarket

- Specialty Stores

- Multi-Brand Stores

- Online

- Others

Based on the Geography:

Regional Analysis

United States

The United States holds the dominant share in the North America compression sportswear market, accounting for approximately 75% of the total regional market. The country’s strong market position is driven by a well-established fitness culture, high consumer spending on premium sportswear, and the presence of leading sports apparel brands. A growing number of individuals engage in professional sports, gym workouts, and outdoor activities, fueling demand for high-performance compression wear. The athleisure trend is also prominent in the U.S., with consumers seeking stylish yet functional compression garments for both workouts and casual wear. Additionally, advancements in fabric technology, including moisture-wicking, seamless construction, and smart textiles, further boost product adoption. The expanding e-commerce sector and direct-to-consumer sales strategies also contribute to the market’s growth, allowing brands to reach a wider audience through digital platforms.

Canada

Canada accounts for 12% of the North America compression sportswear market, with a rising demand for fitness apparel driven by increasing health consciousness and government initiatives promoting active lifestyles. Canadians are progressively embracing athleisure, leading to higher sales of compression leggings, shirts, and shorts that offer both performance benefits and everyday comfort. The country’s cold climate also plays a role in the adoption of compression wear, as these garments provide thermal insulation and muscle support for outdoor sports during winter. Furthermore, the growing participation of women in fitness and sports has expanded the demand for gender-specific compression apparel. Canadian consumers also show a strong preference for sustainability, prompting brands to invest in eco-friendly materials and ethical manufacturing practices. The presence of international and local brands in Canada’s retail and e-commerce landscape ensures a competitive market, offering consumers a variety of high-quality compression sportswear options.

Mexico

Mexico represents 8% of the North America compression sportswear market, with significant growth potential driven by increasing participation in sports and fitness activities. The rising middle-class population and improving disposable income levels are enabling more consumers to invest in premium athletic apparel, including compression wear. Football (soccer), running, and gym workouts are among the most popular activities driving market demand in Mexico. Additionally, international brands are expanding their presence in the country through retail stores and e-commerce platforms, making compression sportswear more accessible. However, price sensitivity remains a challenge, leading to higher demand for affordable and locally produced alternatives. As awareness of compression wear’s benefits grows among athletes and fitness enthusiasts, the market is expected to witness steady expansion. Brands that offer cost-effective yet high-performance compression garments will likely gain a competitive edge in this developing market.

Key Player Analysis

- Under Armour, Inc.

- Nike Inc.

- Columbia Sportswear Company

- YONEX Co. Ltd.

- PVH Corp.

- 2XU

- A4 Sportswear

- Augusta Sportswear

- Craft

- CW-X

- Zensah

- Pacterra Athletics

Competitive Analysis

The North America compression sportswear market is highly competitive, with several established brands vying for dominance. Under Armour, Nike, Columbia Sportswear, YONEX, PVH Corp., 2XU, A4 Sportswear, Augusta Sportswear, Craft, CW-X, Zensah, and Pacterra Athletics are key players in the market, each leveraging unique strategies to maintain their market position. Under Armour and Nike are industry leaders, known for their innovation in compression wear technology, premium product offerings, and strong brand recognition. They continuously invest in research and development to enhance fabric functionality, breathability, and muscle support, catering to both professional athletes and fitness enthusiasts. The North America compression sportswear market is highly competitive, with several major and emerging brands competing for market share. Leading companies in the industry focus on innovation and differentiation through advanced fabric technologies, such as moisture-wicking, muscle compression, and smart textiles. These brands continuously invest in research and development to enhance product performance, offering solutions that cater to athletes, fitness enthusiasts, and everyday consumers. Market leaders differentiate themselves by offering a wide range of products, from high-performance compression wear for professional athletes to stylish and functional options for casual wear. Smaller players in the market are gaining momentum by offering specialized compression garments tailored to specific sports, such as running, cycling, and recovery. They often focus on providing products that deliver comfort, flexibility, and support while maintaining affordable price points. As competition intensifies, companies are also increasingly investing in e-commerce platforms, improving online shopping experiences, and leveraging direct-to-consumer sales channels to enhance market reach. Moreover, sustainability has become a critical factor, with many companies adopting eco-friendly manufacturing processes and materials to appeal to environmentally conscious consumers.

Recent Developments

- In February 2025, Adidas AG launched several new products, including the Lightblaze shoe and the Mystic Victory pack for football boots. Adidas continues to focus on innovative designs and collaborations.

- In January 2025, Nike showcased innovative recovery footwear at CES 2025, featuring compression and heat technology, and is also developing a compression and heat vest as part of its wearable line, collaborating with Hyperice to boost athlete warm-up and recovery.

Market Concentration & Characteristics

The North America compression sportswear market exhibits a moderate level of concentration, with several leading brands holding significant market share. While major players dominate the market, there is still ample room for emerging companies offering specialized or niche products. The market is characterized by strong competition, with brands focusing on innovation in fabric technology, performance enhancement, and stylish designs. Companies are increasingly differentiating themselves through advancements in compression wear, such as moisture-wicking fabrics, muscle support, and temperature regulation. The rise of athleisure trends has also expanded the market, encouraging brands to offer compression wear suitable for both sports performance and casual wear. Additionally, the market is seeing a shift toward e-commerce and direct-to-consumer sales models, enabling brands to reach a broader audience and strengthen customer loyalty. Sustainability is a growing focus, with more companies adopting eco-friendly materials and ethical manufacturing practices to appeal to environmentally conscious consumers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, End-User, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The North America compression sportswear market is expected to grow steadily, driven by increasing consumer interest in fitness and wellness.

- Innovation in fabric technology, such as enhanced breathability, muscle support, and moisture-wicking properties, will continue to drive product development.

- The popularity of athleisure and multifunctional sportswear will further expand the market as consumers seek comfort and performance both in sports and casual settings.

- E-commerce and direct-to-consumer sales channels will play a more significant role in reaching wider audiences, especially in the wake of increasing digital shopping trends.

- Sustainable and eco-friendly materials will become a key focus, with brands adopting environmentally responsible manufacturing processes.

- Personalized and customized compression wear, leveraging advancements in technology, will cater to specific performance needs and individual preferences.

- The growing adoption of compression wear for medical and therapeutic purposes, including injury recovery and muscle support, will boost market demand.

- The increasing popularity of fitness tracking and wearable technology will lead to integration of smart textiles in compression sportswear.

- The market will see further regional expansion, especially in emerging areas within North America like Mexico and smaller U.S. regions.

- Competitive pricing, along with premium product offerings, will continue to drive consumer choice, as brands strive for differentiation in a crowded market.