| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia Industrial Fasteners Market Size 2024 |

USD 1,385.32 Million |

| Australia Industrial Fasteners Market, CAGR |

3.65% |

| Australia Industrial Fasteners Market Size 2032 |

USD 1,844.80 Million |

Market Overview

The Australia Industrial Fasteners Market is projected to grow from USD 1,385.32 million in 2024 to an estimated USD 1,844.80 million by 2032, with a compound annual growth rate (CAGR) of 3.65% from 2025 to 2032. This growth is driven by increasing demand across various sectors, including construction, automotive, and manufacturing.

Key drivers of this market include robust growth in construction and infrastructure development, which boosts the demand for fasteners used in building and civil engineering projects. Additionally, the automotive industry’s need for lightweight, high-strength fasteners to enhance vehicle performance contributes significantly to market expansion. Technological advancements in fastener manufacturing also play a role in meeting evolving industry requirements.

Geographically, Australia leads in market share within the Asia Pacific region, with significant contributions from sectors like automotive, aerospace, and building & construction. Key players in the Australian industrial fasteners market include Prendergast Fasteners PTY Ltd., Allthread Industries, EJOT, CMI Fasteners Ltd., and South Australian Fasteners Engineers PTY Ltd., all of which play vital roles in meeting the country’s industrial fastening needs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The market is projected to grow from USD 1,385.32 million in 2024 to USD 1,844.80 million by 2032, with a CAGR of 3.65% from 2025 to 2032.

- Demand from construction, automotive, and aerospace sectors, along with technological advancements in fastener manufacturing, is fueling market expansion.

- Volatility in raw material prices and intense market competition, particularly from low-cost imports, may challenge market stability.

- New South Wales holds the largest market share, driven by the state’s strong manufacturing and construction industries.

- Increasing adoption of lightweight, corrosion-resistant materials in fasteners is reshaping product offerings, especially in automotive and aerospace sectors.

- The integration of automation and 3D printing technologies is improving manufacturing efficiency and customization capabilities.

- Key players include Australian Fasteners, ITW Proline, and ARP Fasteners, with a focus on innovation and high-quality products to maintain market position.

Market Drivers

Technological Advancements in Fastener Manufacturing

Technological advancements in manufacturing processes are significantly influencing the Australian industrial fasteners market. Innovations in fastener materials, such as the development of corrosion-resistant coatings and lightweight alloys, have led to improvements in the durability and performance of fasteners. These innovations cater to the increasing demand for high-performance and long-lasting solutions across various industries, including aerospace, defense, and manufacturing. Moreover, the adoption of automation and 3D printing in fastener production is enhancing production efficiency and customization capabilities. These technological advancements allow manufacturers to produce fasteners with more precise specifications, greater strength-to-weight ratios, and better performance in extreme environmental conditions. As industrial fasteners continue to evolve with the latest technologies, they are able to meet the increasingly stringent requirements of industries such as automotive and aerospace, thus fueling the market’s growth.

Growth of the Manufacturing and Aerospace Sectors

Australia’s manufacturing and aerospace industries are another major driving force behind the demand for industrial fasteners. The aerospace sector, in particular, is experiencing steady growth, supported by both government and private sector investments in the development of defense and commercial aviation. Fasteners are critical in aircraft manufacturing, where precision and safety are paramount. The increasing demand for both domestic and international air travel has led to greater production requirements for aircraft, which in turn, drives the need for specialized fasteners. Additionally, the Australian manufacturing sector continues to diversify and modernize, with growth in industries such as machinery, electronics, and metal fabrication. These industries require various fasteners for assembly, maintenance, and repair of their products. As both the aerospace and manufacturing sectors continue to expand, the demand for industrial fasteners in these fields is expected to rise correspondingly, further propelling market growth.

Rising Demand from the Construction and Infrastructure Sectors

The construction and infrastructure industries are significant contributors to the demand for industrial fasteners in Australia. As the country continues to experience growth in urbanization and infrastructure development, the need for high-quality fasteners has surged. For instance, the Australian government’s initiatives, such as the Western Sydney Airport and the Melbourne to Brisbane Inland Rail project, highlight the extensive use of industrial fasteners in large-scale infrastructure projects. These projects require fasteners like bolts, nuts, screws, washers, and rivets to ensure structural integrity in buildings, bridges, and highways. Additionally, investments in transportation and energy infrastructure, along with smart city developments, further accelerate the demand for robust and cost-effective fastening solutions. As a result, the construction sector remains a pivotal driver of the industrial fasteners market in the region.

Growth in the Automotive Industry

The Australian automotive industry also plays a crucial role in driving the demand for industrial fasteners. The country’s automotive sector is evolving, with a shift towards electric vehicles (EVs) and an increasing focus on lightweight materials to improve fuel efficiency and performance. For instance, automotive manufacturers are now integrating advanced fastening technologies to support the assembly and maintenance of vehicles, including body panels, engine components, electrical systems, and interiors. As these manufacturers demand higher precision and advanced materials in their products, the need for specialized fasteners with specific strength, corrosion resistance, and performance attributes increases. Furthermore, the growing trend towards vehicle customization boosts the demand for customized fasteners. With the rising number of automotive production lines and aftermarket services, the automotive industry’s contribution to the industrial fasteners market is substantial and continues to grow.

Market Trends

Automation and 3D Printing in Fastener Manufacturing

The integration of automation and 3D printing technology into the fastener manufacturing process is another significant trend in the Australia Industrial Fasteners Market. These innovations are improving the speed, accuracy, and cost-effectiveness of fastener production. Automation through the use of robotic systems, CNC (Computer Numerical Control) machines, and other advanced technologies helps manufacturers streamline production processes, reduce human error, and increase production capacity. Moreover, 3D printing is revolutionizing the way fasteners are designed and produced, particularly in industries that require highly customized fasteners. For example, aerospace and automotive manufacturers increasingly use 3D printing to produce complex fasteners that are lighter, stronger, and more tailored to specific applications. This technology allows manufacturers to create prototypes faster and test them before mass production, thus reducing time to market and costs associated with traditional manufacturing processes. The adoption of automation and 3D printing is expected to continue growing in the Australian fastener market, driving efficiency and meeting the demand for customized, high-performance products.

Sustainability and Eco-Friendly Fasteners

Sustainability is a growing trend in the Australian industrial fasteners market, reflecting the broader global shift toward environmentally responsible manufacturing. The fastener industry is aligning itself with sustainability goals by focusing on producing eco-friendly fasteners that reduce the environmental impact of industrial processes. Manufacturers are increasingly adopting sustainable practices such as using recycled materials, reducing energy consumption, and minimizing waste in fastener production. Additionally, there is an increasing focus on developing fasteners that are reusable, recyclable, or biodegradable, particularly for industries like construction and automotive, where large quantities of fasteners are used. The rise of green construction projects in Australia is one example of this trend, as builders and developers seek eco-friendly materials to reduce the environmental footprint of their projects. Furthermore, regulatory pressures and consumer preferences for sustainable products are encouraging companies to invest in research and development aimed at creating fasteners that support green building initiatives, renewable energy applications, and low-carbon technologies. This trend aligns with broader sustainability goals in Australia’s industrial sectors and is expected to influence the market moving forward.

Shift Toward Lightweight and High-Strength Fasteners

The Australian industrial fasteners market is witnessing a significant shift toward lightweight and high-strength materials. This trend is driven by the increasing demand for weight reduction in industries like automotive and aerospace. For instance, companies such as those involved in the aerospace sector are focusing on using materials like titanium and advanced composites to reduce weight without compromising strength or durability. In the automotive industry, manufacturers are adopting lightweight fasteners to enhance fuel efficiency and meet stringent emissions standards. Additionally, the development of electric vehicles (EVs) relies heavily on minimizing vehicle weight, making lightweight fasteners crucial for improving battery efficiency and overall performance. Similarly, in aerospace, these fasteners contribute to better fuel efficiency and reduced operational costs. This shift is prompting manufacturers to innovate and offer high-performance fasteners that cater to the evolving needs of industries prioritizing sustainability and operational efficiency.

Increasing Demand for Corrosion-Resistant Fasteners

As industries in Australia, particularly those in marine, construction, and oil & gas, expand into harsher environments, the demand for corrosion-resistant fasteners has increased notably. For instance, government surveys highlight the importance of using corrosion-resistant fasteners in coastal construction projects due to Australia’s extensive coastline and high salinity levels. Fasteners used in industries like oil & gas and marine are often exposed to extreme conditions, including high humidity and saltwater, making corrosion resistance critical. In response, manufacturers are developing fasteners with specialized coatings that provide superior protection against rust and corrosion. This trend is evident in the growing infrastructure and mining sectors, where construction and machinery are frequently exposed to corrosive environments. Companies like Austain Fasteners specialize in providing corrosion-resistant stainless steel fasteners to meet these demands, serving industries such as mining and marine.

Market Challenges

Intense Market Competition and Price Pressure

Another challenge in the Australian industrial fasteners market is the intense competition, both from local and international players. The market is characterized by the presence of numerous small and medium-sized enterprises (SMEs), as well as large multinational corporations. This high level of competition drives aggressive pricing strategies, which can lead to price pressure across the market. Manufacturers and suppliers are often compelled to offer discounts and competitive pricing, which can erode profit margins and make it challenging to maintain long-term sustainability. Furthermore, the rise of low-cost imports from countries with cheaper production costs, particularly from Asia, adds to the competitive landscape, creating additional challenges for domestic manufacturers. While price competition is a natural element of the market, it can hinder investments in research, development, and technological innovation, limiting the ability of companies to differentiate their products. As a result, players in the Australian fasteners market must balance price competitiveness with the need to maintain quality, innovation, and profitability.

Volatility in Raw Material Prices

Volatility in raw material prices remains a critical challenge for the Australian industrial fasteners market, heavily reliant on metals like steel, stainless steel, and aluminum. These materials form the backbone of fastener production, and their price fluctuations disrupt cost structures for manufacturers. Factors such as global supply chain disruptions, geopolitical events, and environmental regulations contribute to this volatility. For instance, the post-pandemic recovery and ongoing geopolitical tensions have caused supply shocks in global metal markets, leading to unpredictable pricing trends. Additionally, domestic challenges like labor shortages and rising energy costs exacerbate production expenses. Manufacturers face a dilemma: absorbing increased costs reduces profit margins, while passing them onto customers risks lowering demand. This unpredictability complicates long-term planning, discouraging investments in capacity expansion or innovative product development. Supply chain bottlenecks further intensify the issue, with delays in shipping and raw material shortages impacting production schedules and customer commitments. To mitigate these challenges, companies are exploring strategies such as diversifying suppliers, adopting advanced inventory management systems, and investing in research to develop cost-efficient materials. However, such measures require substantial resources and time, leaving smaller players particularly vulnerable to market uncertainties. These dynamics underscore the pressing need for industry-wide solutions to stabilize supply chains and raw material costs.

Market Opportunities

Expansion in Construction and Infrastructure Development

Australia’s ongoing investments in infrastructure development present a significant opportunity for the industrial fasteners market. As the country continues to expand its urban infrastructure, including residential, commercial, and public construction projects, the demand for reliable and high-quality fasteners is expected to rise. Fasteners are integral to building structural integrity, and with large-scale projects in areas like transportation, energy, and civil engineering, the need for durable and specialized fastening solutions is poised for growth. Additionally, Australia’s growing focus on smart cities and green building projects will further create opportunities for fasteners designed for sustainable, high-performance applications.

Technological Advancements and Product Innovation

Advancements in materials and manufacturing technologies offer substantial opportunities for innovation in the Australian industrial fasteners market. With increasing demand for lightweight, high-strength, and corrosion-resistant fasteners, particularly in industries such as automotive and aerospace, companies can capitalize on the development of new materials like titanium alloys and composite fasteners. The rise of 3D printing and automation in manufacturing also provides opportunities for fastener manufacturers to produce customized, high-precision products more efficiently. By investing in R&D and adopting cutting-edge technologies, companies can meet the evolving needs of diverse industries, thus expanding their market share and establishing themselves as leaders in high-tech fastener solutions.

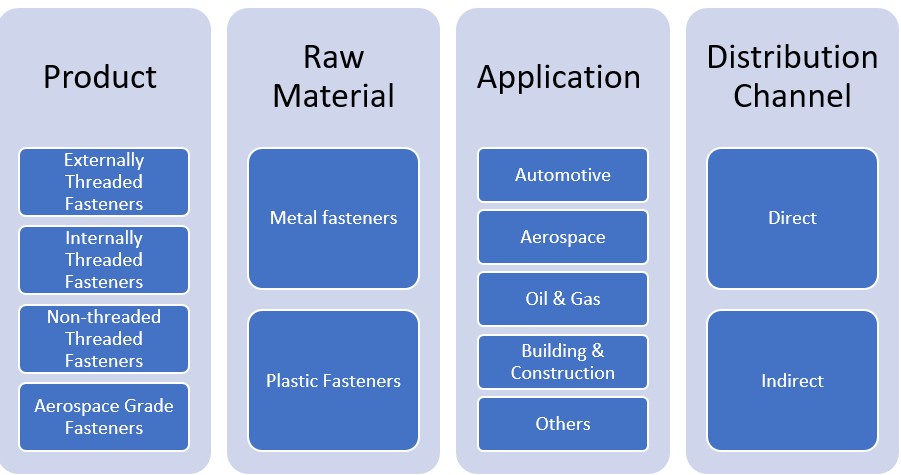

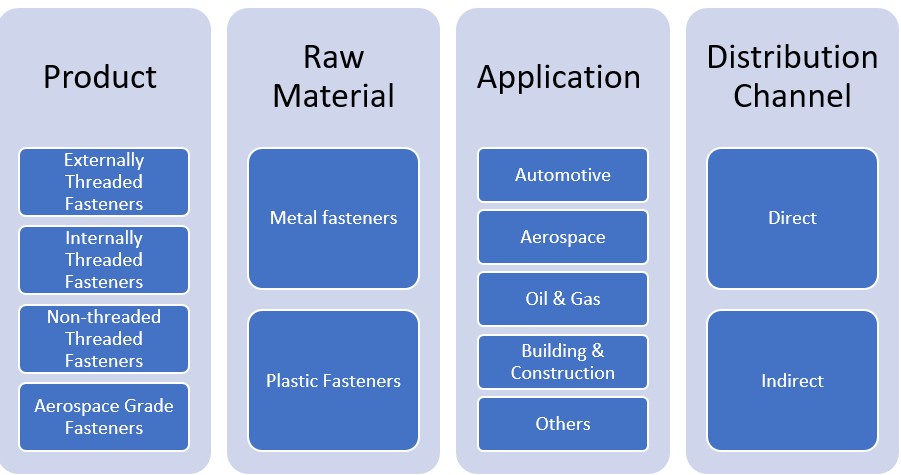

Market Segmentation Analysis

By Product

Externally threaded fasteners are among the most commonly used fasteners in the Australian market. These include bolts, screws, and studs, which are used extensively in industries such as automotive, construction, and manufacturing. Externally threaded fasteners are preferred for their strong holding capacity and versatility in a wide range of applications.Internally threaded fasteners, such as nuts and inserts, are used in conjunction with externally threaded fasteners. They provide essential functions in machinery, automotive components, and structural frameworks. The demand for internally threaded fasteners is growing due to their critical role in ensuring secure and precise fastening in applications requiring high tolerance and precision.Non-threaded fasteners, including washers, clips, and rivets, are integral to various industrial applications where threading is not required. These fasteners are essential in assembly operations, where fasteners are needed to secure components without the need for threads, such as in the aerospace and automotive industries.Aerospace grade fasteners are specialized fasteners used in the aviation and defense sectors, where strength, reliability, and resistance to extreme conditions are critical. These fasteners are typically made from high-performance materials such as titanium and special alloys to meet stringent industry standards, contributing to the increasing demand from Australia’s aerospace industry.

By Raw Material

Metal fasteners dominate the Australian industrial fasteners market, with materials such as stainless steel, carbon steel, aluminum, and titanium being the most common. These fasteners offer high strength, durability, and corrosion resistance, making them essential in industries such as automotive, construction, and oil & gas.Plastic fasteners are increasingly being used in applications where lightweight solutions and resistance to corrosion are essential. They are particularly popular in the electronics and automotive sectors, where plastic fasteners are preferred for their non-corrosive properties and ability to reduce the overall weight of the products.

Segments

Based on Product

- Externally Threaded Fasteners

- Internally Threaded Fasteners

- Non-threaded Threaded Fasteners

- Aerospace Grade Fasteners

Based on Raw Material

- Metal fasteners

- Plastic Fasteners

Based on Application

- Automotive

- Aerospace

- Oil & Gas

- Building & Construction

- Others

Based on Distribution Channel

Based on Region

- New South Wales

- Victoria

- Queensland

- South Australia

- Western Australia

Regional Analysis

New South Wales (35%)

New South Wales holds the largest share of the industrial fasteners market in Australia, accounting for approximately 35% of the total market share. The state’s robust industrial base, which includes significant manufacturing, construction, and automotive sectors, drives the demand for fasteners. Sydney, the economic hub of NSW, is home to a variety of industries that rely on high-quality fasteners for their operations, including commercial and residential construction, machinery manufacturing, and vehicle assembly. Additionally, the state’s expanding infrastructure projects, such as transportation and energy initiatives, continue to boost demand for industrial fasteners.

Victoria (25%)

Victoria is the second-largest market for industrial fasteners, contributing around 25% to the total market share. The state’s manufacturing and construction sectors are particularly significant, with a strong emphasis on residential and commercial building projects. Melbourne, Victoria’s capital, is a major center for both large-scale construction and the automotive industry, both of which rely heavily on fasteners for assembly and structural integrity. Furthermore, Victoria is home to a growing number of aerospace and defense-related projects, contributing to increased demand for specialized fasteners, including aerospace-grade solutions.

Key players

- Australian Fasteners

- The Nut and Bolt Factory

- ARP Fasteners

- ITW Proline

- Bolts and Nuts Fasteners Pty Ltd.

Competitive Analysis

The Australian industrial fasteners market is highly competitive, with key players focusing on product innovation, customer satisfaction, and robust distribution networks to maintain their market positions. Companies like Australian Fasteners and ITW Proline leverage their extensive product portfolios, offering a range of fasteners suited for automotive, aerospace, and construction applications. These players distinguish themselves through advanced manufacturing techniques and specialized solutions such as corrosion-resistant and aerospace-grade fasteners. The Nut and Bolt Factory and ARP Fasteners excel in serving niche markets by providing high-quality fasteners for heavy-duty applications, particularly in industries such as mining and oil & gas. Bolts and Nuts Fasteners Pty Ltd. is known for its extensive reach and ability to offer competitive pricing strategies, making it a formidable competitor in the market. Overall, market players must focus on innovation, sustainability, and customer service to stay ahead in this evolving industry.

Recent Developments

- In December 2024, Nitto Seiko reported progress under its medium-term business plan “Mission G-second,” focusing on automation and electrification demands. Despite economic slowdowns in regions like the U.S. and Thailand, the company improved operating income through price adjustments for screw fastening machines.

- In December 2024, ARP launched an upgraded high-strength fastener kit for DART LS Next engine blocks. This kit uses 8740 chromoly steel, offering improved fatigue strength and reliability, catering to high-performance automotive applications.

- In February 2024, ITW reported its financial results for 2023, highlighting a 2% organic growth and a 130 basis point increase in operating margin to 25.1%. While the report emphasizes customer-focused innovation, it does not specifically detail advancements in fastener product lines.

Market Concentration and Characteristics

The Australia Industrial Fasteners Market is moderately concentrated, with a mix of established players and smaller, specialized companies operating across various segments. Major players like Australian Fasteners, ITW Proline, and ARP Fasteners dominate the market by offering diverse product portfolios, including high-performance fasteners for automotive, aerospace, and construction industries. The market is characterized by strong competition, with companies focusing on technological advancements, such as corrosion-resistant and lightweight materials, to meet evolving customer demands. While a few large companies hold significant market share, numerous small and medium-sized enterprises (SMEs) contribute to the market’s fragmentation by catering to specific niches and regional demands. This dynamic market landscape encourages innovation, customization, and competitive pricing, enabling companies to differentiate themselves and maintain their position in a rapidly changing industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product, Raw Material, Application, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The expansion of Australia’s infrastructure projects will significantly increase the demand for industrial fasteners, especially in construction and transportation sectors. This trend is expected to continue, driving steady market growth.

- The shift toward electric vehicles will boost the need for lightweight, high-performance fasteners, particularly in automotive applications. This change presents a new growth opportunity for fastener manufacturers.

- Innovation in materials such as corrosion-resistant alloys and high-strength composites will drive demand for specialized fasteners across industries. These advanced materials will offer increased durability and performance.

- 3D printing technologies will enable more precise and customized fasteners, meeting the unique needs of industries like aerospace and automotive. This technology will improve efficiency and reduce lead times for production.

- Growing environmental concerns will push the demand for eco-friendly fasteners made from recyclable or biodegradable materials. Manufacturers will increasingly focus on developing sustainable fastener solutions.

- Australia’s expanding aerospace sector, particularly in defense and commercial aviation, will continue to drive the need for aerospace-grade fasteners. The demand for high-quality, precision fasteners will remain strong.

- As automation and robotics continue to play a key role in manufacturing, the need for high-precision fasteners in automated systems will increase. This trend will enhance demand for high-quality, specialized fasteners.

- Diversification in global supply chains will offer Australian manufacturers greater access to raw materials and competitive pricing. This will help meet the growing domestic demand for fasteners at competitive prices.

- The demand for plastic fasteners in automotive, electronics, and construction applications will rise, driven by the need for lightweight, corrosion-resistant solutions. These fasteners will complement traditional metal options.

- Regional growth, particularly in Queensland and Western Australia, will continue to diversify the market. Smaller, specialized companies will thrive by serving niche markets, fostering competition and innovation.