Market Overview:

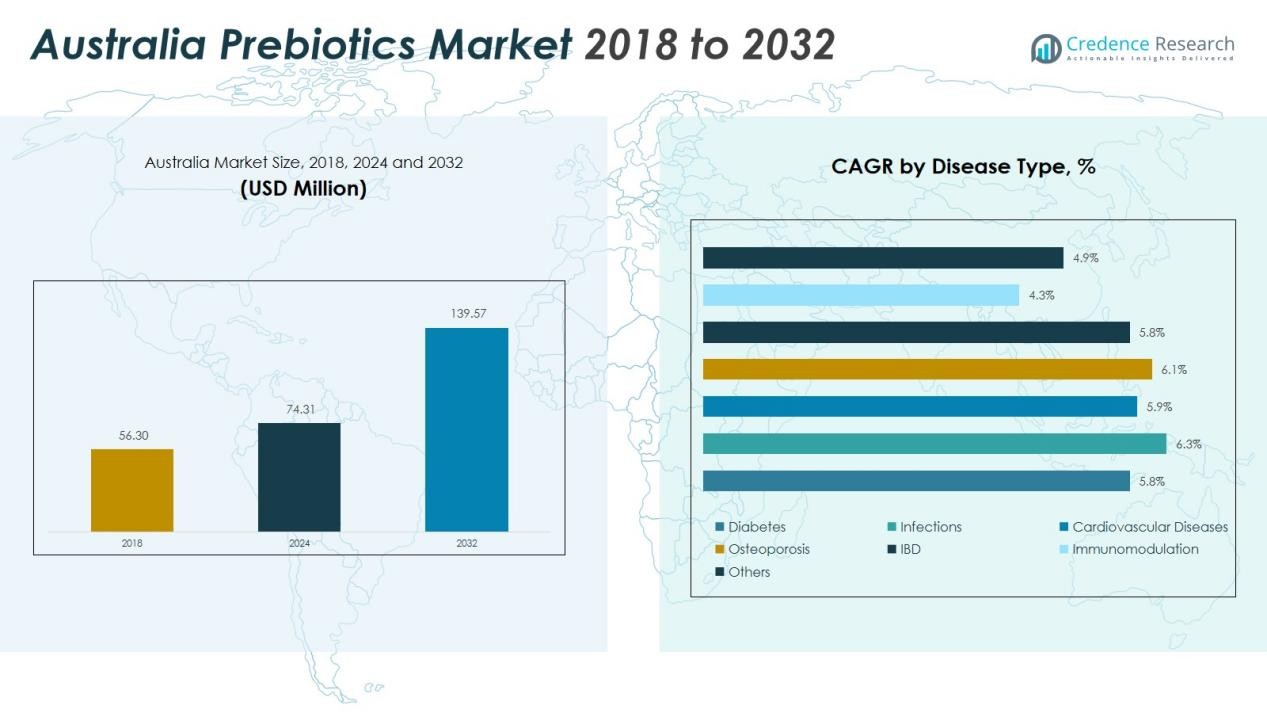

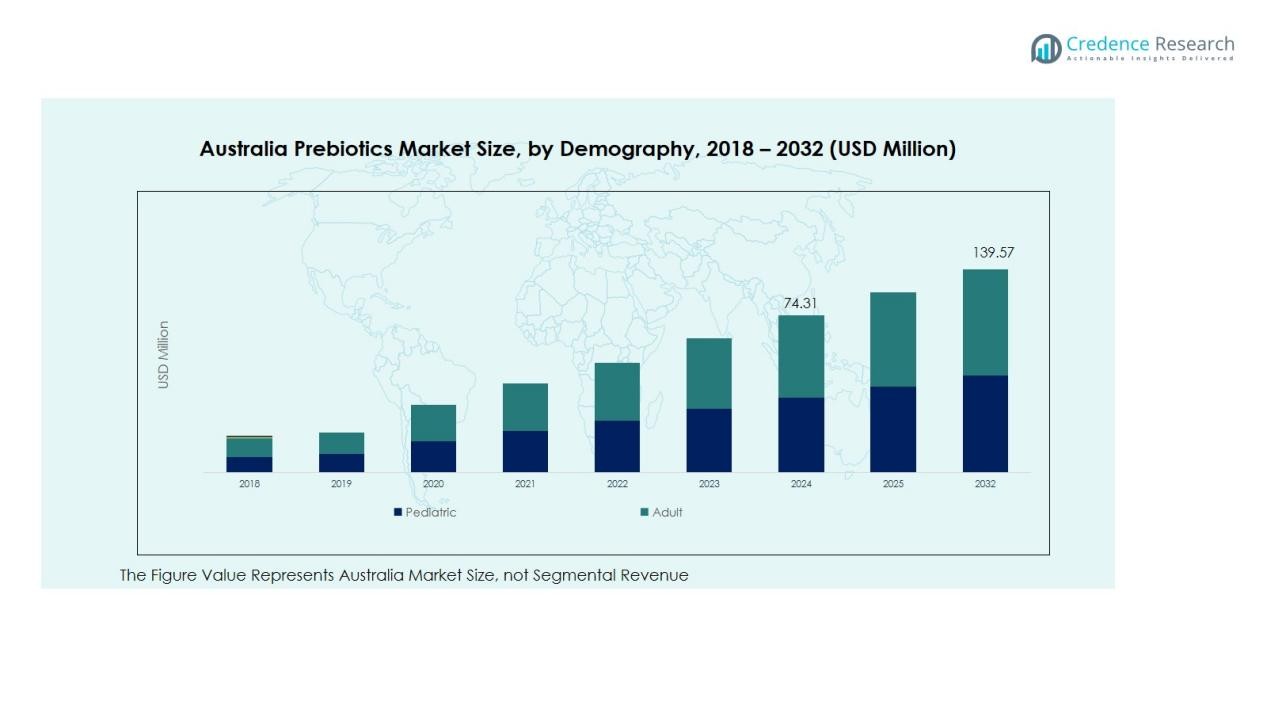

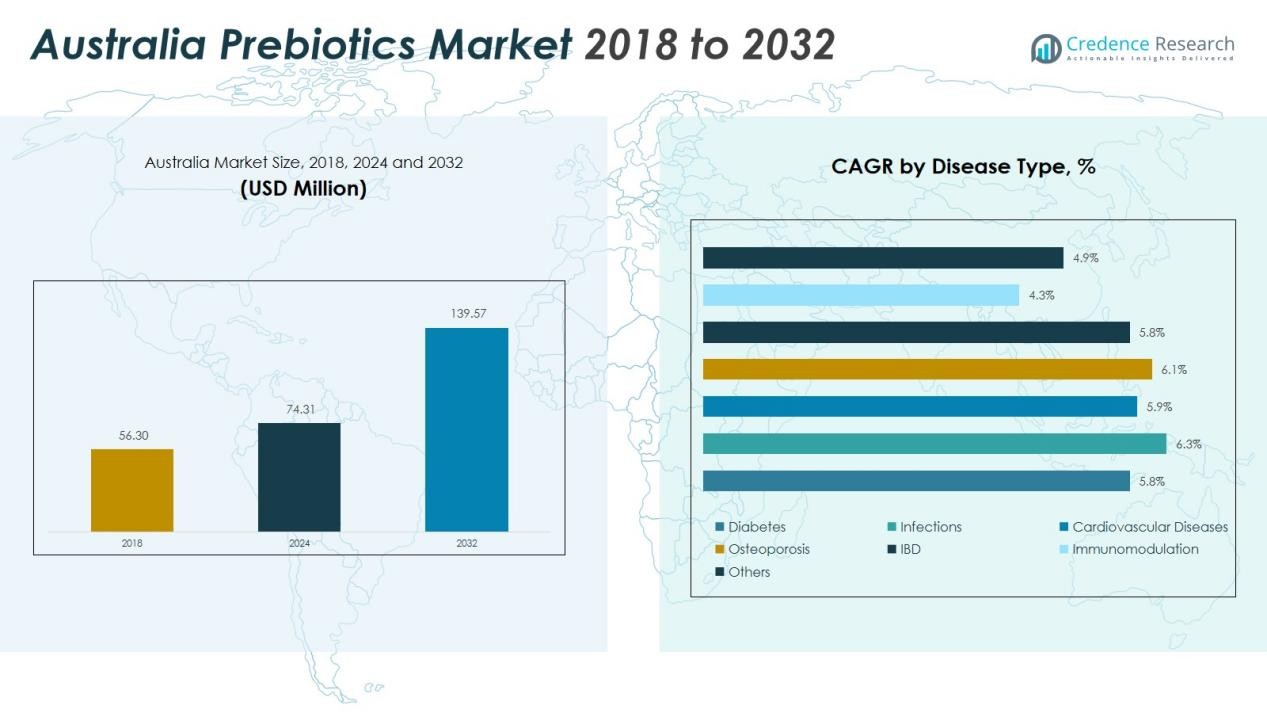

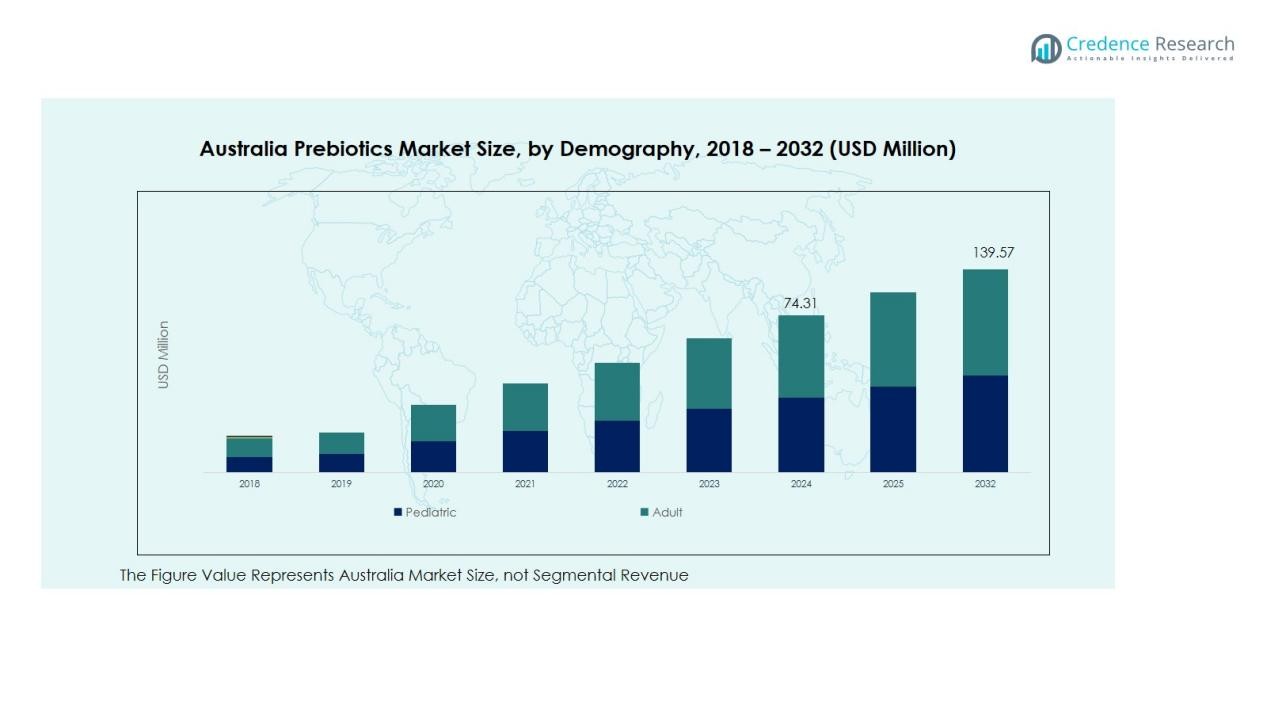

The Australia Prebiotic Market size was valued at USD 56.30 million in 2018 to USD 74.31 million in 2024 and is anticipated to reach USD 139.57 million by 2032, at a CAGR of 8.20% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia Prebiotic Market Size 2024 |

USD 74.31 Million |

| Australia Prebiotic Market, CAGR |

8.20% |

| Australia Prebiotic Market Size 2032 |

USD 139.57 Million |

Market growth is primarily driven by increasing health consciousness, the preference for science-backed formulations, and advancements in strain technology. Companies are investing in microencapsulation and stabilization techniques to enhance product efficacy and shelf life. Rising adoption of dairy-based and plant-based Prebiotic beverages, supplements, and functional foods continues to attract diverse consumer groups, including younger and aging populations.

Regionally, New South Wales and Victoria dominate the Australia Prebiotic Market, supported by high urbanization, organized retail networks, and the presence of leading manufacturers. Queensland and Western Australia are emerging as fast-growing regions, driven by rising disposable incomes, expanding e-commerce penetration, and growing demand for dietary supplements. Together, these factors position Australia as one of the most dynamic Prebiotic markets in the Asia-Pacific region.

Market Insights:

- The Australia Prebiotic Market was valued at USD 56.30 million in 2018, reaching USD 74.31 million in 2024, and is projected to attain USD 139.57 million by 2032, growing at a CAGR of 8.20% during the forecast period.

- New South Wales (32%), Victoria (27%), and Queensland (18%) hold the largest regional shares, supported by strong healthcare infrastructure, high urbanization, and organized retail networks that enable widespread product availability and consumer reach.

- Western Australia (12%) is the fastest-growing region, driven by rising disposable incomes, expanding e-commerce access, and increasing awareness of Prebiotic supplements in semi-urban and regional areas.

- By type, Prebiotic Food & Beverages account for 63% of total revenue, led by dairy-based and non-dairy formulations catering to diverse dietary preferences and convenience demand.

- Prebiotic Dietary Supplements represent 29% of the market, supported by growing adoption among adults and elderly consumers seeking clinically backed digestive and immune health benefits.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Health Awareness and Preventive Wellness Focus

Growing public concern for digestive and immune health is a major driver of the Australia Prebiotic Market. Consumers are becoming more aware of the link between gut microbiota and overall wellness. This awareness has shifted purchasing behavior toward functional foods and supplements with proven clinical benefits. Healthcare professionals are also recommending Prebiotic use for preventive health, increasing acceptance across multiple age groups. The rising preference for science-backed nutrition supports sustained market demand.

- For Instance, Blackmores’ parent company, Kirin Holdings, reported strong overall sales growth for the Blackmores brand in Australia and New Zealand, which contributed to the improved performance of its Health Science business segment.

Technological Advancements Enhancing Product Efficacy and Shelf Life

Innovation in microencapsulation and strain stabilization is strengthening product reliability and consumer trust. Manufacturers are developing multi-strain formulations with improved bioavailability and resistance to environmental stress. These advancements ensure better shelf stability and performance, expanding product use in beverages, capsules, and functional foods. It encourages consistent product adoption among consumers seeking reliable Prebiotic solutions. The focus on quality and efficacy is reinforcing competitive differentiation in the market.

- For instance, in October 2024, Probi launched its Metabolic Health solution combining two proprietary strains (Lactiplantibacillus plantarum 299v and Lacticaseibacillus paracasei 8700:2), with LP299V® supported by over 230 publications demonstrating enhanced cardiovascular health benefits.

Expanding Range of Dairy and Plant-Based Prebiotic Products

The growing preference for natural and lactose-free alternatives is fueling product diversification. Manufacturers are introducing plant-based Prebiotic beverages and fortified dairy products to meet evolving dietary trends. The expansion of non-dairy options is attracting lactose-intolerant and vegan consumers. It is helping brands reach broader demographics through varied product formats such as drinks, yogurts, and supplements. This trend enhances accessibility and drives higher market penetration.

Strengthening Retail and E-Commerce Distribution Channels

The expansion of retail networks and online sales platforms is significantly improving market accessibility. Organized supermarkets, specialty health stores, and digital marketplaces are enabling widespread consumer reach. E-commerce growth allows easy access to diverse Prebiotic products, including premium and international brands. It supports market expansion beyond metropolitan areas into semi-urban and regional markets. The integration of digital retail strategies continues to strengthen the industry’s overall growth momentum.

Market Trends:

Increasing Popularity of Functional and Plant-Based Prebiotic Products

The Australia Prebiotic Market is witnessing strong momentum toward functional and plant-based formulations that align with modern dietary habits. Consumers are favoring lactose-free and vegan Prebiotic products that support digestive and immune health without compromising on taste or convenience. It is driving food and beverage manufacturers to expand portfolios beyond dairy-based offerings into juices, snacks, and fortified beverages. The rising number of consumers with lactose intolerance or plant-based preferences is accelerating innovation across new Prebiotic categories. Companies are investing in advanced encapsulation and fermentation technologies to maintain product potency and extend shelf life. Growing demand for clean-label, natural, and sustainable products continues to shape the country’s Prebiotic landscape.

- For instance, Biome Australia launched Activated Prebiotics Biome Daily Prebiotic containing 9 billion live bacteria across six clinically trialled dairy-free and vegan-friendly strains including Lactobacillus plantarum and Bifidobacterium animalis.

Integration of Digital Health and E-Commerce Platforms in Product Distribution

The rapid expansion of online health retail and digital engagement is transforming how Prebiotic products reach Australian consumers. It is enabling brands to educate buyers, promote transparency, and offer tailored supplement subscriptions through data-driven platforms. E-commerce growth allows niche and premium Prebiotic brands to reach rural and semi-urban consumers efficiently. Personalized recommendations based on microbiome analysis and lifestyle tracking are improving consumer trust and retention. Health professionals and influencers are reinforcing this digital trend by promoting science-backed Prebiotics through social media and wellness campaigns. The integration of technology and retail innovation is expected to play a key role in shaping future market competitiveness and accessibility.

- For instance, gutgutgoose launched Australia’s first truly customised Prebiotic service offering up to 32 scientifically validated strains tailored to individual microbiome test results.

Market Challenges Analysis:

Regulatory Complexity and Lack of Standardized Product Guidelines

The Australia Prebiotic Market faces challenges due to varying regulatory frameworks and product classification standards. Differences in labeling, strain identification, and health claim approvals create uncertainty for manufacturers. It increases the time and cost required for product registration and market entry. Smaller players often struggle to meet compliance requirements, limiting innovation and competitiveness. Inconsistent regulation also affects consumer trust, as claims about Prebiotic benefits differ among brands. This regulatory fragmentation slows product launches and market expansion efforts.

High Production Costs and Limited Consumer Education in Regional Areas

Production of high-quality Prebiotics involves costly fermentation processes, cold-chain logistics, and specialized packaging. It raises final product prices, reducing affordability for price-sensitive consumers. The challenge is stronger in regional and rural areas, where awareness of Prebiotic benefits remains low. Limited access to health education and fewer retail options restrict market penetration outside major cities. Many consumers still associate Prebiotics only with yogurt, overlooking advanced supplements and plant-based products. The combination of high cost and limited awareness continues to restrain broad-scale adoption and long-term market growth.

Market Opportunities:

Dominance of New South Wales and Victoria Driven by Urbanization and Retail Strength

New South Wales and Victoria hold the largest share of the Australia Prebiotic Market, supported by high population density, advanced healthcare infrastructure, and well-developed retail networks. These regions benefit from strong consumer awareness of preventive health and access to diverse Prebiotic products across pharmacies, supermarkets, and specialty health stores. It is home to several leading manufacturers and distributors that drive continuous innovation and product availability. Rising disposable incomes and strong purchasing power enable consumers to prefer premium Prebiotic supplements and functional beverages. The dominance of these regions is expected to continue with sustained demand from health-conscious urban populations.

Emergence of Queensland and Western Australia as Fast-Growing Regions

Queensland and Western Australia represent the most rapidly expanding regions within the market. The growth is supported by increasing awareness of digestive and immune health, aided by digital marketing and healthcare education programs. E-commerce expansion is allowing broader access to Prebiotic supplements and fortified foods across semi-urban and rural areas. It has encouraged local retailers to introduce diverse Prebiotic product lines catering to varied dietary needs. The rise of plant-based alternatives and functional food innovation is gaining strong consumer traction in these regions. Economic growth and improving distribution infrastructure continue to enhance market potential.

Rising Potential Across Regional and Semi-Urban Areas Supported by Digital Access

Regional and semi-urban areas are showing promising potential for future market expansion. Improved digital connectivity and the growth of online health retail platforms have increased awareness of Prebiotic benefits among rural consumers. It enables access to high-quality products that were earlier limited to metropolitan centers. Government wellness initiatives and community healthcare programs are fostering preventive health adoption. Expanding education on gut health and natural supplements is expected to sustain growth in these emerging areas. Together, these dynamics position Australia as one of the most vibrant Prebiotic markets in the Asia-Pacific region.

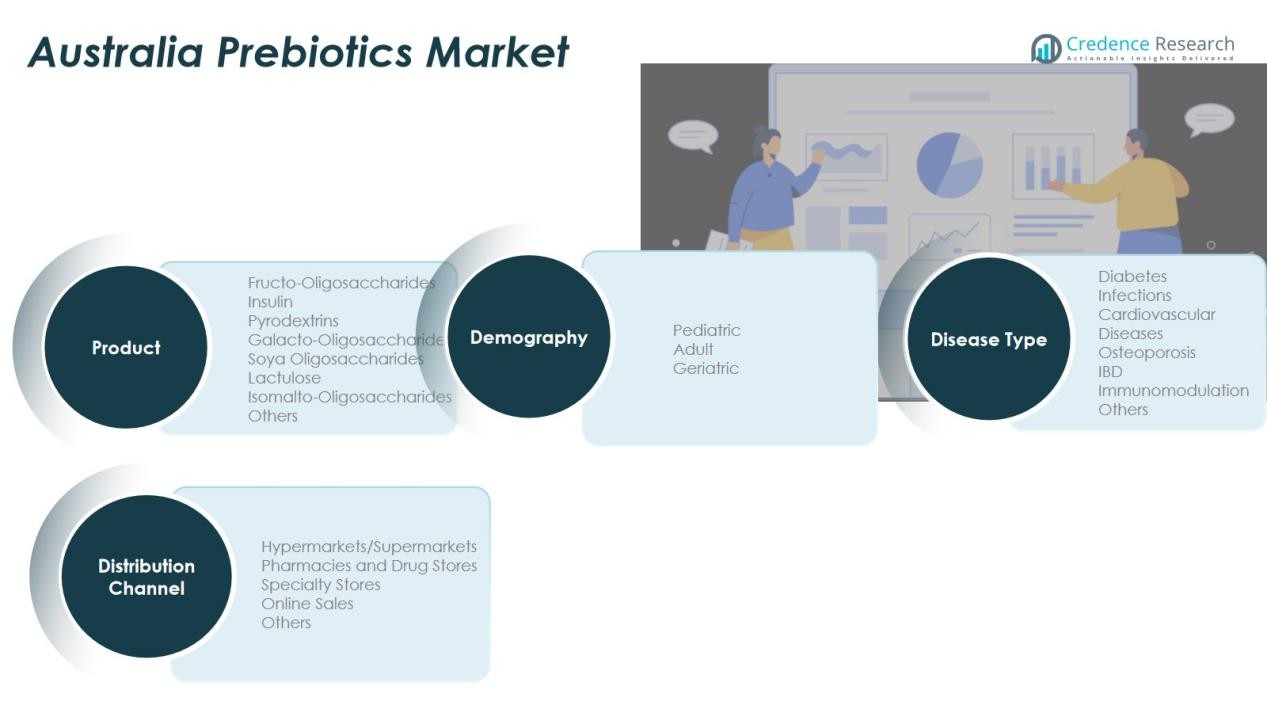

Market Segmentation Analysis:

By Type

The Australia Prebiotic Market is segmented into Prebiotic food and beverages, dietary supplements, and animal feed. Prebiotic food and beverages hold the largest share, led by dairy and non-dairy products such as yogurts, drinks, and fermented foods. Consumers favor these due to convenience, taste, and proven digestive health benefits. Prebiotic dietary supplements, including capsules and powders, are gaining popularity among adults and elderly groups seeking targeted wellness solutions. Animal feed Prebiotics show steady growth with increasing focus on livestock health and productivity.

- For instance, ADM received approval from Australia’s Therapeutic Goods Administration (TGA) for its spore-forming Bacillus subtilis Prebiotic DE111 in December 2024, marking the first Bacillus subtilis strain to be approved by the TGA in Australia.

By Ingredient

The market is classified into bacteria and yeast-based Prebiotics. Bacterial strains, particularly Lactobacillus and Bifidobacterium, dominate due to their established efficacy and wide use in food and supplements. It supports gut health, immune function, and nutrient absorption, strengthening consumer trust. Yeast-based Prebiotics, such as Saccharomyces boulardii, are expanding rapidly because of their stability and resistance to harsh storage conditions. Their growing use in clinical and dietary applications is widening the product scope.

- For instance, in January 2023, Lallemand Health Solutions launched the world’s first organic Saccharomyces boulardii strain, certified for 12-month stability at 25°C, offering a sustainable and high-efficiency yeast platform for digestive health formulations.

By Distribution Channel

The market distribution includes hypermarkets/supermarkets, pharmacies, specialty stores, online stores, and others. Pharmacies and drugstores lead due to consumer trust in professional health recommendations. Hypermarkets and specialty stores provide easy access and diverse product choices. It is expected that online retail will grow the fastest, supported by convenience, product variety, and rising digital health awareness across Australia.

Segmentations:

By Type

Prebiotic Food & Beverages

- Dairy Products

- Non-Dairy

- Cereals

- Baked Food

- Fermented Meat

- Dry Foods

Prebiotic Dietary Supplements

- Food Supplements

- Nutritional Supplements

- Specialty Supplements

- Infant Formula

- Animal Feed

By Ingredient

By End-Use

- Human Prebiotics

- Animal Prebiotics

By Distribution Channel

- Hypermarkets/Supermarkets

- Pharmacies/Drugstores

- Specialty Stores

- Online Stores

- Others

Regional Analysis:

Dominance of New South Wales and Victoria Driven by Urbanization and Retail Strength

New South Wales and Victoria hold the largest share of the Australia Prebiotic Market, supported by high population density, advanced healthcare infrastructure, and well-developed retail networks. These regions benefit from strong consumer awareness of preventive health and access to diverse Prebiotic products across pharmacies, supermarkets, and specialty health stores. It is home to several leading manufacturers and distributors that drive continuous innovation and product availability. Rising disposable incomes and strong purchasing power enable consumers to prefer premium Prebiotic supplements and functional beverages. The dominance of these regions is expected to continue with sustained demand from health-conscious urban populations.

Emergence of Queensland and Western Australia as Fast-Growing Regions

Queensland and Western Australia represent the most rapidly expanding regions within the market. The growth is supported by increasing awareness of digestive and immune health, aided by digital marketing and healthcare education programs. E-commerce expansion is allowing broader access to Prebiotic supplements and fortified foods across semi-urban and rural areas. It has encouraged local retailers to introduce diverse Prebiotic product lines catering to varied dietary needs. The rise of plant-based alternatives and functional food innovation is gaining strong consumer traction in these regions. Economic growth and improving distribution infrastructure continue to enhance market potential.

Rising Potential Across Regional and Semi-Urban Areas Supported by Digital Access

Regional and semi-urban areas are showing promising potential for future market expansion. Improved digital connectivity and the growth of online health retail platforms have increased awareness of Prebiotic benefits among rural consumers. It enables access to high-quality products that were earlier limited to metropolitan centers. Government wellness initiatives and community healthcare programs are fostering preventive health adoption. Expanding education on gut health and natural supplements is expected to sustain growth in these emerging areas. Together, these dynamics position Australia as one of the most vibrant Prebiotic markets in the Asia-Pacific region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Australia Prebiotic Market is moderately consolidated, with competition driven by product innovation, scientific validation, and brand reputation. Key players include Swisse Wellness, Blackmores, Nature’s Way, Morinaga Milk Industry Co., Ltd., Nestlé Australia Ltd., Lonza Group Ltd., and DSM-Firmenich. It is characterized by strong investments in R&D, clinical trials, and advanced strain technologies to strengthen consumer trust and efficacy claims. Companies focus on expanding Prebiotic formulations across dairy, non-dairy, and supplement formats to target different consumer groups. Strategic mergers, acquisitions, and collaborations with biotechnology firms are enhancing innovation and global reach. Leading brands are also emphasizing sustainability, clean-label ingredients, and online retail strategies to maintain market leadership. The growing demand for personalized nutrition and preventive health solutions continues to drive competitive differentiation among both established and emerging players.

Recent Developments:

- In October 2025, Nature’s Way introduced Sambucus Ultra Immune Juicy Burst, an innovative supplement featuring a soft, chewy shell with a fast-absorbing liquid core.

- In June 2024, Morinaga Milk’s Vietnamese subsidiary introduced the Morinaga Zero Fat Drink Yogurt in Vietnam, targeting the country’s growing health-conscious consumer base and expanding their product portfolio to meet regional demand.

Report Coverage:

The research report offers an in-depth analysis based on Type, Ingredient, End-Use and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Australia Prebiotic Market is expected to experience sustained growth driven by preventive healthcare awareness.

- Consumers will increasingly prefer science-backed, clinically validated Prebiotic formulations for daily wellness.

- Product innovation will focus on multi-strain blends that enhance digestive, immune, and mental health.

- Manufacturers will expand plant-based and lactose-free Prebiotic options to meet dietary diversity.

- E-commerce and subscription-based health platforms will strengthen product accessibility and brand loyalty.

- Collaboration between biotechnology firms and food manufacturers will accelerate new strain development.

- Digital marketing and influencer-driven health education will improve consumer understanding and adoption.

- Functional foods and beverages infused with Prebiotics will gain strong traction among younger consumers.

- Regional and semi-urban markets will see rapid growth due to expanding online retail and awareness.

- Sustainability in packaging and clean-label product positioning will become key brand differentiators.