Market Overview:

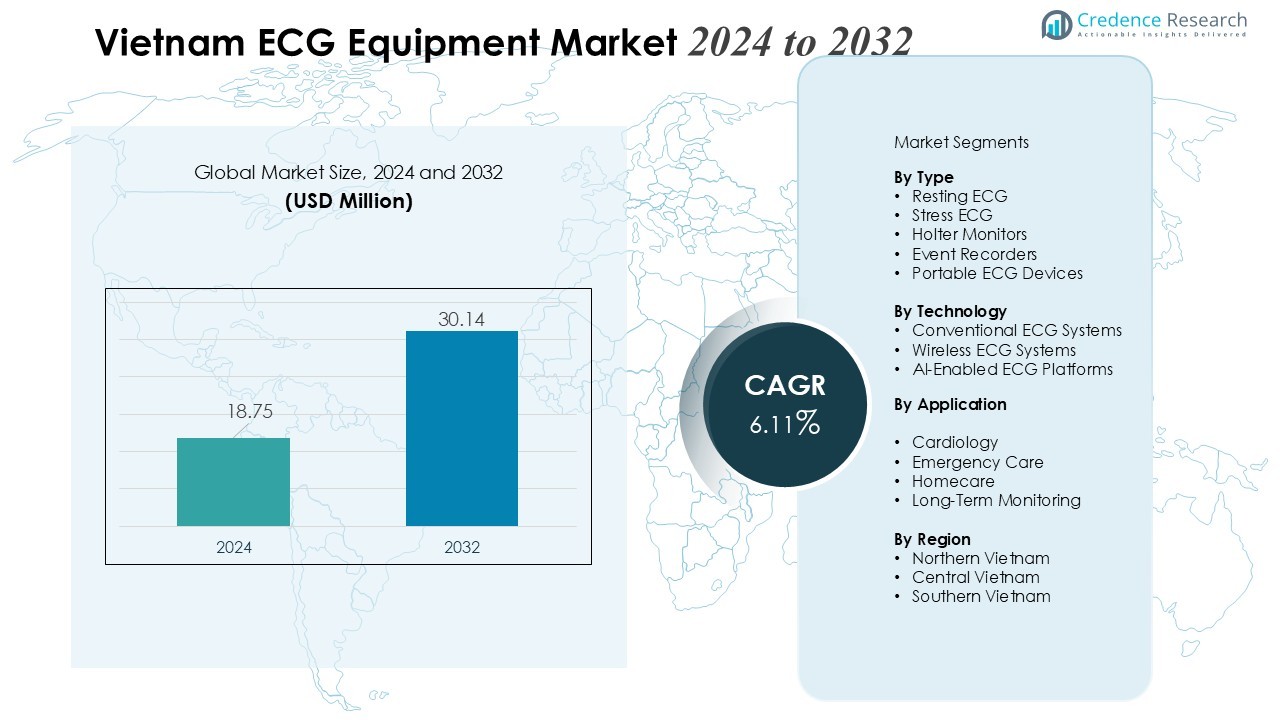

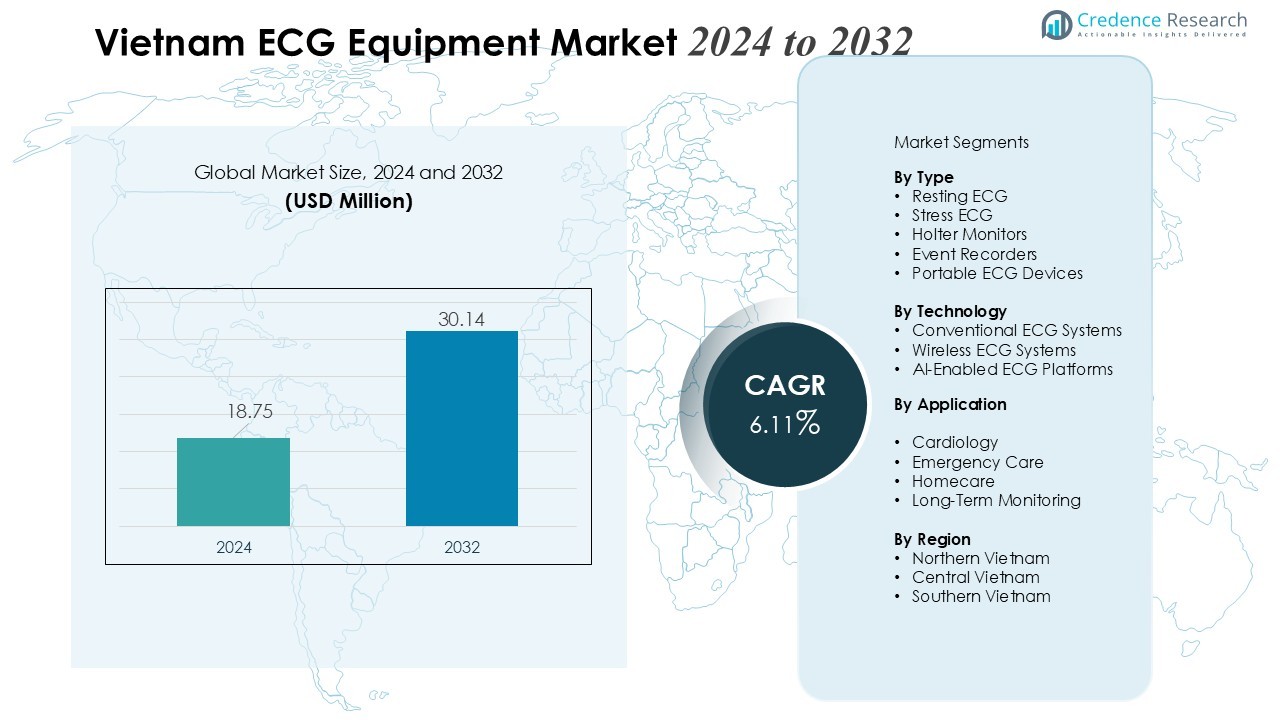

The Vietnam ECG Equipment Market size was valued at USD 18.75 million in 2024 and is anticipated to reach USD 30.14 million by 2032, at a CAGR of 6.11 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Vietnam ECG Equipment Market Size 2024 |

USD 18.75 Million |

| Vietnam ECG Equipment Market, CAGR |

6.11% |

| Vietnam ECG Equipment Market Size 2032 |

USD 30.14 Million |

Key market drivers include rapid growth in the aging population, higher incidence of hypertension, diabetes, and lifestyle-related cardiac disorders, and expanding access to diagnostic services. Healthcare providers prioritize portable and wireless ECG systems to improve patient mobility and enhance real-time monitoring accuracy. Demand strengthens further due to telehealth adoption, wider use of cloud-based data management, and government-led initiatives promoting diagnostic modernization. Local procurement policies and private sector expansion also support steady equipment upgrades and replacement cycles.

Regionally, northern Vietnam maintains strong market participation led by Hanoi’s advanced hospital networks and significant public healthcare spending. Southern Vietnam, particularly Ho Chi Minh City, witnesses rising adoption driven by private healthcare growth and higher patient volumes. Central Vietnam records gradual improvement with increasing investments in secondary care facilities and growing awareness of early cardiac screening.

Market Insights:

Market Insights:

- The Vietnam ECG Equipment Market is projected to grow from USD 18.75 million in 2024 to USD 30.14 million by 2032, reflecting a CAGR of 6.11%.

- Rising cardiovascular disease rates linked to hypertension, diabetes, and lifestyle risks continue to boost demand for reliable ECG diagnostics across hospitals and clinics.

- Adoption of portable, wireless, and cloud-enabled ECG systems accelerates due to growing telehealth use, enabling real-time monitoring and improved clinical decision-making.

- Healthcare infrastructure expansion and modernization initiatives increase procurement of digital and AI-supported ECG platforms across primary and secondary care settings.

- Government-backed diagnostic standardization and rising private healthcare investments strengthen replacement cycles and promote wider use of advanced equipment.

- High equipment costs, limited funding, and slow replacement cycles remain major constraints, particularly in public hospitals and small clinics in rural regions.

- Regional growth varies, with strong adoption in Northern Vietnam driven by major hospitals, rising private sector investments in Southern Vietnam, and gradual technology uptake in Central Vietnam.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Burden of Cardiovascular Diseases and Rising Need for Early Diagnosis

The Vietnam ECG Equipment Market gains momentum due to a sharp increase in cardiac disorders linked to hypertension, diabetes, stress, and lifestyle risk factors. Hospitals and clinics elevate diagnostic capacity to manage rising patient loads that require accurate and rapid cardiac assessment. Demand for ECG systems grows because providers prioritize early detection to reduce mortality and improve treatment outcomes. It strengthens adoption of both standard and advanced ECG platforms across primary and secondary care settings.

- For instance, researchers at Vietnam National Heart Institute and Hanoi Heart Hospital conducted ECG exercise testing on 60 patients with sinus bradycardia below 50 beats/minute from January 2020 to September 2021 to assess permanent pacemaker needs.

Expansion of Healthcare Infrastructure and Upgrading of Diagnostic Capabilities

Continuous investments in public and private healthcare facilities support large-scale equipment modernization. The Vietnam ECG Equipment Market benefits from new hospitals, expanded cardiology departments, and greater procurement of digital monitoring technologies. Providers replace outdated machines with portable, wireless, and AI-supported ECG devices that deliver faster interpretation and higher precision. It improves workflow efficiency and strengthens diagnostic readiness across urban and semi-urban regions.

- For instance, Vietnam National Heart Institute professionals recorded 12-lead ECGs from 28 probands with hypertrophic cardiomyopathy and 56 relatives after 10–15-minute rest periods, enabling an ECG-based model for detecting mutation carriers when combined with clinical data.

Shift Toward Telehealth, Remote Monitoring, and Digital Health Integration

Growing acceptance of telemedicine encourages wider adoption of connected ECG systems. The Vietnam ECG Equipment Market experiences rising demand for cloud-enabled platforms that store, transmit, and analyze patient data in real time. Clinicians value remote diagnostics for continuous cardiac monitoring, especially for elderly patients and those in underserved regions. It supports faster clinical decisions and enhances overall patient management.

Increasing Government Support and Strong Participation from Private Healthcare Providers

Government programs focus on strengthening early diagnosis, standardizing cardiac care, and improving equipment availability across provinces. The Vietnam ECG Equipment Market benefits from regulatory support that encourages procurement of advanced technologies. Private hospitals accelerate purchases to meet higher patient expectations and remain competitive. It drives steady replacement cycles and expands opportunities for manufacturers and distributors.

Market Trends:

Rapid Transition Toward Advanced, Portable, and Connected ECG Systems

The Vietnam ECG Equipment Market moves toward compact, wireless, and multi-parameter diagnostic tools that support faster and more flexible cardiac assessments. Healthcare providers adopt portable ECG units to improve bedside evaluation and extend diagnostic reach to remote areas. Demand increases for smartphone-compatible and Bluetooth-enabled devices that support real-time data transfer. It strengthens clinical efficiency by reducing manual data handling and improving response time in emergency care. AI-supported ECG interpretation gains traction because clinicians seek higher accuracy for early identification of arrhythmias. Manufacturers introduce feature-rich systems that integrate analytics, cloud storage, and automated reporting. Hospitals and clinics accelerate replacement of analog models with digital platforms that deliver higher consistency and better patient outcomes.

- For Instance, GE HealthCare offers connected wireless ECG systems in Vietnam that support integration with hospital information systems and EMR platforms for seamless data sharing and remote review by clinicians

Growing Emphasis on Preventive Cardiology, Remote Monitoring, and Patient-Centric Care Models

The Vietnam ECG Equipment Market sees strong influence from preventive healthcare programs that promote early screening of high-risk populations. Healthcare organizations prioritize long-term monitoring solutions for elderly patients and individuals with chronic cardiac conditions. It increases adoption of wearable ECG patches and home-based monitoring devices that enable continuous rhythm tracking. Providers invest in platforms that consolidate patient records, improve interoperability, and support seamless data exchange between care teams. Demand rises for technologies that enhance patient engagement and encourage proactive management of cardiovascular health. Medical device companies focus on ergonomic designs and user-friendly interfaces to improve patient compliance. The trend supports a broader shift toward decentralized care and strengthens the national effort to reduce cardiac complications.

- For instance, iRhythm Technologies’ Zio ECG sensor patch enables continuous ambulatory monitoring for up to 14 days with AI-powered arrhythmia detection, supporting remote cardiac care in decentralized settings.

Market Challenges Analysis:

High Cost Barriers, Limited Funding, and Slow Technology Replacement Cycles

The Vietnam ECG Equipment Market faces constraints due to high acquisition costs for advanced ECG systems and limited budgets across public hospitals. Many healthcare facilities rely on basic models because they struggle to allocate funds for digital upgrades. It slows replacement cycles and delays modernization efforts that could improve diagnostic accuracy. Import duties and supply chain fluctuations further elevate costs for premium devices. Providers often prioritize essential medical equipment before investing in advanced cardiac technologies. Variations in reimbursement coverage reduce the incentive for small clinics to adopt newer ECG platforms. These constraints create gaps in diagnostic capacity across rural and semi-urban regions.

Shortage of Skilled Technicians, Maintenance Gaps, and Uneven Access to Training Programs

The Vietnam ECG Equipment Market encounters operational challenges due to a shortage of trained personnel capable of handling digital and portable ECG systems. Many facilities lack dedicated technicians who can manage calibration, troubleshooting, and data interpretation. It increases the risk of equipment downtime and limits consistent use of advanced features. Limited access to structured training programs restricts the ability of smaller clinics to upgrade diagnostic practices. Rural regions experience more pronounced skill shortages, which widen disparities in cardiac care. Manufacturers and distributors struggle to provide continuous training support across widespread locations. These gaps reduce the overall efficiency of ECG deployment and impact patient outcomes.

Market Opportunities:

Expansion of Digital Health, Remote Cardiac Monitoring, and Home-Based Diagnostics

The Vietnam ECG Equipment Market creates strong opportunities through rising demand for telehealth, wearable monitoring devices, and smartphone-integrated diagnostic platforms. Healthcare providers seek scalable solutions that support continuous cardiac evaluation outside hospital settings. It encourages adoption of cloud-enabled ECG systems that facilitate faster data sharing and real-time alerts. Growing interest in home-based care strengthens the market for compact and user-friendly devices. Medical technology companies can introduce AI-supported algorithms that improve rhythm interpretation and enhance clinical decision support. Wider use of preventive screening programs expands opportunities across both urban and semi-urban regions. These advancements support the shift toward patient-centric cardiac care.

Increasing Investments in Healthcare Infrastructure and Growing Private Sector Participation

The Vietnam ECG Equipment Market benefits from rising capital flows into hospitals, diagnostic centers, and specialty cardiac units. New facility development creates sustained demand for advanced ECG platforms with strong interoperability features. It drives procurement of portable and wireless systems that enhance diagnostic workflows. Private healthcare groups pursue equipment upgrades to improve service quality and strengthen competitive positioning. Manufacturers can leverage these trends by offering tailored service contracts and training support. Expansion of regional hospital clusters opens new opportunities for market penetration. This environment enables steady long-term growth for global and local suppliers.

Market Segmentation Analysis:

By Type

The Vietnam ECG Equipment Market includes resting ECG, stress ECG, Holter monitors, event recorders, and portable ECG devices. Demand increases for portable and handheld units because healthcare providers prioritize mobility and rapid cardiac assessment. Hospitals continue to depend on resting ECG systems for routine diagnostics across high-volume departments. It supports consistent adoption of multi-channel models that deliver improved accuracy. Holter and event monitors gain traction due to rising cases of arrhythmias that require long-term rhythm evaluation.

- For instance, GE Healthcare’s portable ECG device enables real-time monitoring with 12-lead capability in a compact form, supporting diagnostics in remote areas.

By Technology

This segment includes conventional ECG systems, wireless ECG platforms, and AI-enabled diagnostic devices. Wireless ECG systems record strong momentum because they support remote monitoring and faster data transfer. It improves workflow efficiency and facilitates real-time evaluation in critical care settings. AI-supported platforms gain interest due to higher accuracy in rhythm interpretation and reduced manual review time. Conventional systems retain steady demand in budget-restricted facilities that prioritize affordability.

- For instance, Powerful Medical’s PMcardio STEMI AI ECG model earned FDA Breakthrough Device Designation for detecting STEMI and equivalents missed by standard ECGs, enabling triage in 10 seconds with 96% sensitivity.

By Application

The Vietnam ECG Equipment Market covers applications in cardiology, emergency care, homecare, and long-term patient monitoring. Cardiologists rely heavily on multi-parameter systems to detect arrhythmias, ischemia, and other cardiac abnormalities. Emergency departments adopt fast-response ECG tools to accelerate triage and improve treatment initiation. It boosts uptake of portable devices that support rapid mobility. Homecare adoption grows due to rising elderly populations and strong interest in preventive cardiac screening.

Segmentations:

By Type

- Resting ECG

- Stress ECG

- Holter Monitors

- Event Recorders

- Portable ECG Devices

By Technology

- Conventional ECG Systems

- Wireless ECG Systems

- AI-Enabled ECG Platforms

By Application

- Cardiology

- Emergency Care

- Homecare

- Long-Term Monitoring

By Region

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

Regional Analysis:

Strong Demand Driven by Advanced Healthcare Ecosystems in Northern Vietnam

The Vietnam ECG Equipment Market records strong adoption in Northern Vietnam due to the concentration of major hospitals, teaching institutions, and public health programs. Hanoi leads procurement activities with large tertiary care centers that prioritize modern diagnostic systems. Providers integrate wireless ECG platforms to improve efficiency in emergency and cardiology departments. It strengthens demand for data-linked ECG systems that support better clinical coordination. Government-funded upgrades accelerate replacement of outdated machines across district hospitals. Preventive screening initiatives further expand the need for portable ECG devices. Northern provinces continue to set the pace in technology adoption and early diagnostic integration.

Growing Private Sector Influence and High Patient Volumes in Southern Vietnam

Southern Vietnam represents one of the most dynamic regional clusters due to strong private healthcare growth and high patient inflows. Ho Chi Minh City drives rapid procurement of AI-enabled and portable ECG systems that support fast-paced clinical workflows. Providers invest heavily in advanced cardiac units to address rising cases of heart disease. It encourages wider use of multi-channel ECG devices that improve diagnostic precision. Expansion of private hospitals intensifies competition and increases demand for premium technologies. Telemedicine platforms gain traction due to strong digital infrastructure. Southern Vietnam remains a key market for manufacturers offering high-performance ECG solutions.

Infrastructure Expansion and Gradual Technology Uptake in Central Vietnam

Central Vietnam experiences steady improvement driven by ongoing investments in general hospitals, specialty centers, and diagnostic care facilities. Provincial hospitals begin to transition from analog ECG systems to digital and cloud-supported platforms. It supports gradual expansion of long-term monitoring solutions for elderly and chronic-care patients. Public health initiatives promote wider access to screening programs, which increases demand for portable and user-friendly devices. Skill development programs influence greater confidence in technology adoption among clinicians. Remote districts generate opportunities for mobile ECG units that extend diagnostic reach. Central Vietnam moves toward broader modernization, supported by rising awareness of early cardiac assessment.

Key Player Analysis:

- Nihon Kohden

- Natus Medical

- Hunan Yi Ling

- Stellate Systems

- NCC

- NR Sign

- SMICC

- CONTEC

- Noraxon

- EB NEURO

- Cadwell Ind

- RMS

- EGI

- SYMTOP

- NeuroSky

Competitive Analysis:

The Vietnam ECG Equipment Market features strong competition among global manufacturers and emerging regional suppliers that target hospitals, specialty clinics, and diagnostic centers. Key players include Nihon Kohden, Natus Medical, Noraxon, EB NEURO, Cadwell Industries, NCC, and NR Sign, each offering diverse portfolios covering resting, portable, and wireless ECG systems. Manufacturers focus on product reliability, precision, and workflow integration to secure contracts across high-volume cardiology and emergency departments. It strengthens competitive intensity as companies invest in training support, localized service networks, and user-friendly interfaces that improve adoption rates. Global brands emphasize AI-enabled analytics and cloud compatibility to differentiate their offerings, while regional suppliers compete on affordability and faster delivery. Demand for portable and remote-monitoring devices encourages firms to expand digital features and strengthen after-sales support. Competitive positioning depends on technology leadership, pricing strategy, and long-term service value.

Recent Developments:

- In July 2025, Nihon Kohden announced the acquisition of additional shares in NeuroAdvanced Corp. to increase its ownership stake.

- In September 2025, Natus Medical acquired Holberg EEG to expand its neurodiagnostics capabilities with AI-driven EEG interpretation solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type, Technology, Application and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The market will advance through wider adoption of wireless and AI-enabled ECG platforms that improve diagnostic precision and workflow speed.

- Demand for portable and handheld ECG devices will rise due to growing emphasis on rapid assessment and decentralized cardiac care.

- Digital health integration will strengthen real-time monitoring capabilities and support broader use of cloud-based ECG data systems.

- Telemedicine expansion will increase adoption of remote ECG monitoring tools, particularly for elderly and chronic-care patients.

- Hospitals will prioritize technology upgrades that replace aging equipment and improve interoperability across departments.

- Preventive cardiac screening initiatives will create stronger demand for long-term monitoring and home-based ECG solutions.

- Private healthcare investment will accelerate procurement of advanced multi-channel ECG systems to enhance service quality.

- Manufacturers will introduce user-friendly interfaces and automated analysis features to improve clinician productivity.

- Regional hospitals will expand diagnostic capacity through wider deployment of portable ECG units in underserved areas.

- The market will benefit from stronger collaborations between device suppliers, healthcare providers, and digital health platforms that support integrated cardiac care solutions.

Market Insights:

Market Insights: