Market Overview:

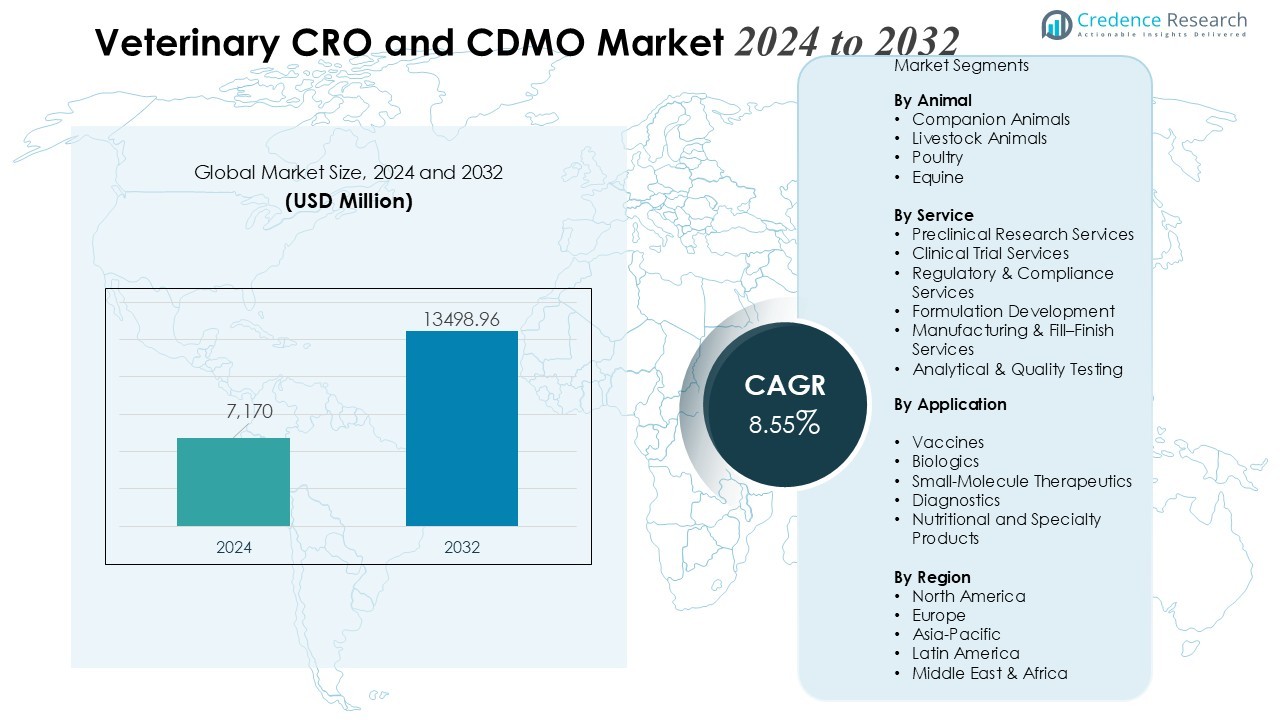

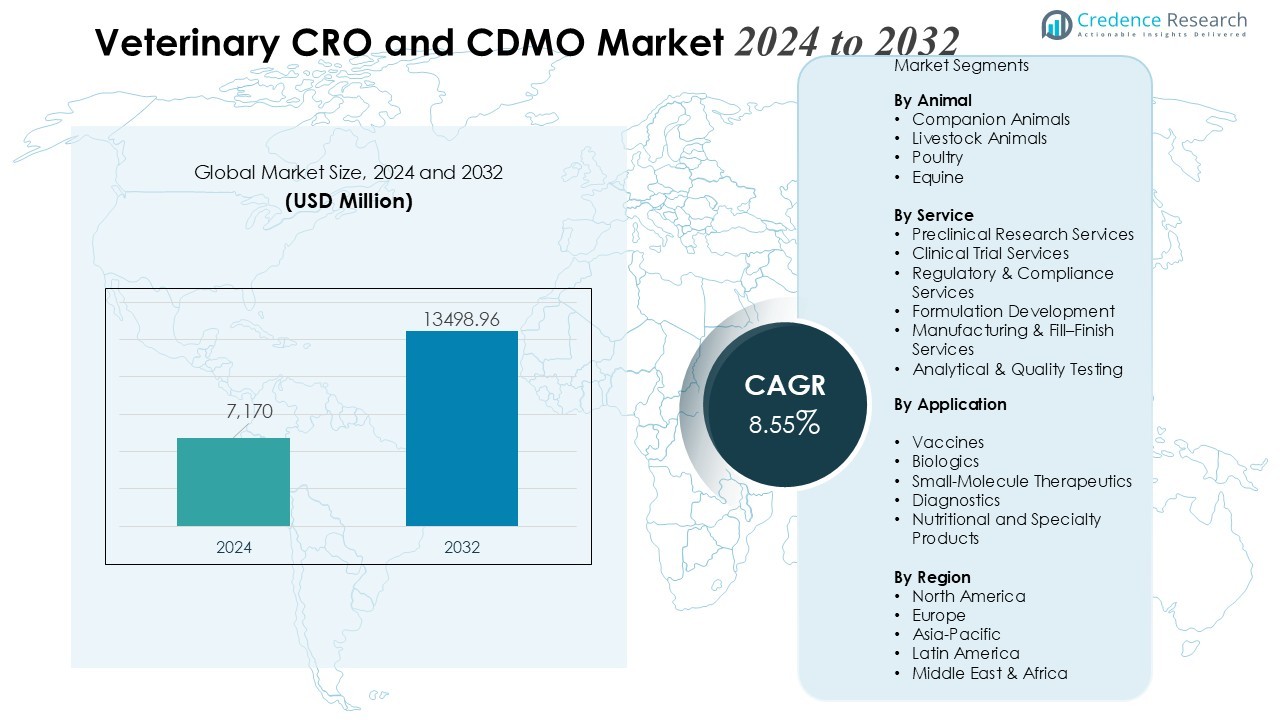

The Veterinary CRO and CDMO Market size was valued at USD 7,170 million in 2024 and is anticipated to reach USD 13498.96 million by 2032, at a CAGR of 8.55 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Aerial Imaging Market Size 2024 |

USD 7,170 Million |

| Aerial Imaging Market, CAGR |

8.55% |

| Aerial Imaging Market Size 2032 |

USD 13498.96 Million |

Key market drivers include a surge in companion animal ownership, rising prevalence of zoonotic and chronic diseases, and greater regulatory emphasis on safety and quality standards in animal health products. Veterinary drug developers increasingly rely on outsourcing to reduce operational costs, access niche scientific expertise, and streamline development timelines. Growth in veterinary biologics, biosimilars, and precision therapeutics further accelerates the need for specialized contract services. Expanding adoption of advanced technologies such as genomics, cell-based assays, and high-throughput screening also enhances the role of CROs and CDMOs in innovation-driven product development.

Regionally, North America leads the market due to strong R&D investment, established animal health companies, and advanced regulatory frameworks. Europe maintains significant share supported by robust biotechnology clusters and rising veterinary pharmaceutical innovation. Asia-Pacific records the fastest growth, driven by expanding pet populations, increasing livestock production, and growing investment in regional manufacturing and research infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Veterinary CRO and CDMO Market is valued at USD 7,170 million in 2024 and is projected to reach USD 13,498.96 million by 2032, supported by an 8.55% CAGR.

- Rising companion animal ownership, higher zoonotic disease burden, and stricter global quality standards strengthen demand for outsourced veterinary R&D and manufacturing.

- Developers increasingly outsource toxicology, formulation, and clinical studies to reduce operational costs, accelerate timelines, and access niche scientific capabilities.

- Rapid expansion of vaccines, biologics, monoclonal antibodies, and gene-based therapies boosts the need for high-containment labs and biologics-specific CDMO capacity.

- Regulatory tightening across GMP, GLP, and biologics categories increases reliance on expert CROs and CDMOs for validated processes, documentation, and compliance management.

- Growth in pet healthcare spending and livestock productivity needs expands pipelines in dermatology, infectious diseases, oncology, and pain management, driving continuous outsourcing.

- North America leads with strong R&D infrastructure, Europe maintains robust biotechnology support, and Asia-Pacific records the fastest growth due to expanding manufacturing and rising pet and livestock populations.

Market Drivers:

Rising Demand for Outsourced R&D and Manufacturing Capabilities

The Veterinary CRO and CDMO Market benefits from a rapid shift toward outsourced research, development, and GMP production. Pharmaceutical and biologics developers rely on external partners to reduce internal R&D burdens and accelerate pipelines. It supports companies seeking specialized expertise in toxicology, clinical trials, and formulation development. Growing focus on operational efficiency strengthens the appeal of flexible, scalable outsourcing models.

- For instance, Zoetis leverages 132 third-party contract manufacturing organizations for specialized veterinary production capabilities, compared to only 29 in-house sites.

Expansion of Veterinary Biologics and Advanced Therapeutics

Rising adoption of vaccines, monoclonal antibodies, gene-based therapies, and precision treatments fuels service demand. It creates a need for CROs and CDMOs with high-containment laboratories, cell culture platforms, and biologics-specific manufacturing capacity. The Veterinary CRO and CDMO Market benefits from developers targeting chronic, infectious, and zoonotic conditions. Strong investment in platform technologies and analytical capabilities further lifts contracting activity.

- For instance, Zoetis acquired Nexvet in 2017 to develop monoclonal antibody platforms for canine osteoarthritis. The resulting product, Librela (bedinvetmab), is an injectable monoclonal antibody that demonstrated a statistically significant reduction in pain compared to a placebo in clinical studies, leading to improved quality of life for many dogs with osteoarthritis.

Increasing Emphasis on Regulatory Compliance and Quality Standards

Stricter global regulations for safety, efficacy, and quality elevate reliance on specialized service providers. It helps animal health companies comply with evolving good laboratory and manufacturing practices. CROs and CDMOs deliver validated processes, documentation systems, and regulatory guidance required for faster approvals. Rising oversight in biologics and veterinary drug categories strengthens demand for expert-led development support.

Growth of Companion Animal Ownership and Livestock Health Needs

Expanding pet ownership, premiumization of animal care, and rising diagnostic spending increase product development activity. It encourages companies to broaden pipelines for dermatology, oncology, pain management, and infectious disease therapeutics. The Veterinary CRO and CDMO Market gains momentum from rising focus on livestock productivity and food safety. Growing demand for preventive vaccines and innovative treatments supports continuous outsourcing growth.

Market Trends:

Increasing Shift Toward Integrated End-to-End Service Models

The Veterinary CRO and CDMO Market reflects a strong movement toward unified service platforms that combine discovery support, preclinical studies, analytical development, and commercial manufacturing. Animal health companies favor single-partner strategies to shorten timelines and eliminate multi-vendor coordination barriers. It strengthens workflow efficiency by aligning scientific, regulatory, and technical functions under one operational structure. Growing complexity in biologics and vaccine development accelerates the need for integrated capabilities. CROs and CDMOs expand high-containment labs, bioprocessing suites, and digital documentation tools to support seamless project transitions. Rising demand for lifecycle management services, including stability studies and post-approval monitoring, reinforces this integrated trend.

- For instance, Wageningen Bioveterinary Research operates a high-containment unit enabling multidisciplinary research on BSL-3 and BSL-4 veterinary pathogens like foot-and-mouth disease virus in integrated lab and animal facilities.

Rapid Adoption of Digital, Data-Driven, and High-Precision Technologies

The Veterinary CRO and CDMO Market experiences rapid adoption of AI-supported modeling, bioinformatics platforms, and predictive toxicology systems. It helps developers refine study design, reduce study failures, and optimize product profiles for companion animals and livestock species. Rising investment in automation, electronic data capture, and remote study oversight improves quality and traceability. CROs expand genomic testing, biomarker identification, and cell-based assay capabilities to support novel therapeutic classes. CDMOs deploy continuous bioprocessing, single-use systems, and advanced purification methods to strengthen biologics manufacturing pipelines. Growing interest in real-time analytics and digital quality control tools drives faster decision-making and lifts efficiency across R&D and production environments.

- For instance, Clinvet implements digital trial management platforms with AI for real-time data collection, achieving 20-25% cost savings in veterinary CRO operations. CROs expand genomic testing, biomarker identification, and cell-based assay capabilities to support novel therapeutic classes.

Market Challenges Analysis:

Rising Operational Complexity and Limited Specialized Infrastructure

The Veterinary CRO and CDMO Market faces operational pressure due to expanding demand for high-containment laboratories, biologics production suites, and advanced analytical platforms. It challenges smaller service providers that lack capital for rapid infrastructure upgrades. Growing diversity of therapeutic modalities requires broader scientific capabilities that many regional players cannot deliver. Regulatory expectations for sterility, data integrity, and batch consistency tighten operational requirements. CROs and CDMOs struggle to balance capacity expansion with cost control. Competition for technologically equipped facilities slows onboarding of complex client programs.

Shortage of Skilled Talent and Increasing Regulatory Burden

The Veterinary CRO and CDMO Market experiences persistent workforce constraints across toxicology, biostatistics, veterinary pathology, and biologics manufacturing roles. It intensifies project delays and raises operational costs for service providers. Evolving global regulations demand extensive documentation, validated processes, and continuous compliance updates. Smaller organizations face difficulty maintaining regulatory readiness while managing growing client expectations. Rising oversight of vaccine and biologics development creates added administrative workloads. Limited availability of cross-functional scientific talent slows innovation and affects delivery timelines.

Market Opportunities:

Expansion of Biologics, Specialty Therapeutics, and Precision Veterinary Medicine

The Veterinary CRO and CDMO Market holds significant opportunity due to rising investment in vaccines, monoclonal antibodies, gene-based therapies, and targeted treatments. It supports developers that aim to address chronic, infectious, and emerging zoonotic conditions. Growing demand for precision diagnostics and species-specific formulations strengthens the need for advanced research platforms. CROs and CDMOs with expertise in cell culture, viral vector systems, and high-containment facilities can secure long-term partnerships. Rising focus on companion animal oncology and immunology expands the scope for specialized studies. Companies that build integrated biologics capabilities can capture expanding high-value contracts.

Growth Potential in Emerging Markets and Digital-Enabled Service Models

The Veterinary CRO and CDMO Market gains new opportunity from rapid modernization of animal health infrastructure in Asia-Pacific, Latin America, and the Middle East. It benefits service providers that expand regional manufacturing, analytical testing, and clinical study networks. Rising livestock production and food safety regulations lift demand for vaccine development and GMP manufacturing in developing economies. Digital platforms, remote monitoring tools, and AI-supported data systems create new service models that elevate speed and quality. CROs and CDMOs that implement automation and predictive analytics strengthen their competitive position. Growing industry adoption of digital quality systems opens pathways for differentiated service offerings.

Market Segmentation Analysis:

By Animal

The Veterinary CRO and CDMO Market records strong demand from the companion animal segment due to rising pet ownership, expanding preventive care needs, and higher spending on chronic and specialty treatments. Livestock species contribute significant growth through increased focus on food safety, productivity enhancement, and vaccine development for endemic diseases. It supports developers targeting both regulated and emerging disease areas across poultry, swine, and cattle. Growing reliance on advanced diagnostics in both segments strengthens service utilization.

- For Instance, Elanco collaborated with Medgene Labs to develop an H5N1 vaccine for dairy cattle, which is currently in the final stages of the USDA’s conditional approval process.

By Service

CRO services dominate due to rising outsourcing of preclinical studies, toxicology assessments, clinical trial execution, and regulatory support. The Veterinary CRO and CDMO Market benefits from expanding CDMO activities in formulation development, sterile fill–finish, and biologics manufacturing. It reinforces the need for integrated service models that combine R&D support with commercial-scale production. Rising adoption of advanced platforms, including genomic analysis and specialty assay development, strengthens value creation across contracted services.

- For Instance, Leading contract research, development, and manufacturing organizations (CRDMOs) such as WuXi AppTec integrate key services like preclinical toxicology testing with bioanalysis and DMPK (Drug Metabolism and Pharmacokinetics) services to support complex small and large molecule (biologics) pipelines.

By Application

Drug development leads the segment due to rising pipelines in vaccines, biologics, small molecules, and precision therapies. It lifts demand for toxicology studies, safety evaluations, stability programs, and large-scale manufacturing. The Veterinary CRO and CDMO Market also sees expansion in nutrition, dermatology, oncology, and infectious disease applications. Growing focus on species-specific therapy design supports advanced preclinical and clinical work across companion animals and livestock.

Segmentations:

By Animal

- Companion Animals

- Livestock Animals

- Poultry

- Equine

By Service

- Preclinical Research Services

- Clinical Trial Services

- Regulatory & Compliance Services

- Formulation Development

- Manufacturing & Fill–Finish Services

- Analytical & Quality Testing

By Application

- Vaccines

- Biologics

- Small-Molecule Therapeutics

- Diagnostics

- Nutritional and Specialty Products

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Strong Market Leadership in North America Driven by Advanced R&D Infrastructure

North America holds the dominant share of the Veterinary CRO and CDMO Market due to high R&D spending, strong regulatory frameworks, and the presence of major animal health companies. It benefits from extensive clinical study networks, specialized laboratories, and large-scale biologics manufacturing capacity. Growing focus on companion animal care and sustained investment in oncology, immunology, and dermatology pipelines strengthens demand for outsourced services. Rising adoption of digital-quality systems and AI-enabled study management tools lifts operational efficiency across service providers. Regulatory clarity from the FDA Center for Veterinary Medicine enables faster development timelines. Expansion of vaccine and monoclonal antibody programs further reinforces regional growth potential.

Europe Maintains Significant Presence Supported by Biotechnology Clusters

Europe maintains a substantial market position driven by well-established biotechnology hubs, strong academic–industry collaboration, and rising innovation in veterinary biologics. It supports growing demand for GMP production, analytical testing, and translational research within leading animal health markets such as Germany, the United Kingdom, France, and the Netherlands. CROs benefit from access to specialized veterinary pathology networks and advanced preclinical infrastructure. Rising focus on antimicrobial stewardship and food safety lifts R&D activity in livestock applications. Harmonized EMA regulations strengthen product development efficiency for multinational companies. Expanding investment in high-containment research facilities supports continued outsourcing momentum.

Asia-Pacific Emerges as the Fastest Growing Region with Expanding Infrastructure

Asia-Pacific records the highest growth rate due to rapid modernization of animal health systems, rising pet ownership, and expanding livestock production. It benefits from increasing investment in manufacturing capacity, clinical study centers, and biotechnology parks across China, India, South Korea, and Australia. Rising demand for vaccines and biologics fuels strong interest in regional CDMO partnerships. Pharmaceutical companies seek cost-effective research and production solutions that align with global quality standards. Growing government initiatives toward zoonotic disease control strengthen R&D intensity. The Veterinary CRO and CDMO Market gains long-term opportunity from digital transformation and expanding regulatory harmonization across regional markets.

Key Player Analysis:

- Fortrea

- Charles River Laboratories

- Clinvet (Clinglobal)

- KLIFOVET GmbH (Argenta Group)

- OCRvet (Clinglobal)

- Knoell – Triveritas

- Veterinary Research Management

- VETSPIN SRL

- Inotiv

- IDEXX

- Vetio

- TriRx Pharmaceutical Services

Competitive Analysis:

Competitive landscape in the Veterinary CRO and CDMO Market features a mix of global research organizations and specialized veterinary service providers that compete on technical expertise, regulatory strength, and biologics capabilities. Key players include Fortrea, Charles River Laboratories, Clinvet (Clinglobal), KLIFOVET GmbH (Argenta Group), OCRvet (Clinglobal), and Knoell – Triveritas. It reflects rising investment in integrated service models that combine discovery support, preclinical research, clinical trial execution, and GMP manufacturing. Companies expand high-containment laboratories, biologics production suites, and digital data systems to secure complex, long-duration contracts. Strategic collaborations with veterinary pharmaceutical firms strengthen access to large study volumes and global trial networks. Players that offer end-to-end capabilities, strong regulatory consulting, and species-specific expertise maintain competitive advantage. Growing demand for vaccines, monoclonal antibodies, and novel therapeutics continues to push providers toward advanced analytical platforms and scalable manufacturing solutions.

Recent Developments:

- In January 2024, Argenta Group combined legacy brands including KLIFOVET GmbH under one brand to advance their animal health partnership offerings.

- In March 2025, FairJourney Biologics acquired Charles River Laboratories’ South San Francisco site to strengthen their antibody discovery and engineering pipelines.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Animal, Service, Application and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The Veterinary CRO and CDMO Market is set to gain momentum through rising demand for biologics, advanced vaccines, and precision therapeutics across companion and livestock species.

- Service providers will expand integrated end-to-end models that combine discovery support, regulatory consulting, and commercial-scale production to reduce development timelines.

- Global players will strengthen high-containment labs, cell culture platforms, and analytical suites to align with growing complexity in veterinary drug pipelines.

- Digital infrastructure will expand through AI-driven study design, predictive toxicology, and real-time quality systems that improve accuracy and operational efficiency.

- R&D investment in oncology, immunology, dermatology, and chronic disease treatments for companion animals will create sustained outsourcing demand.

- CDMOs will scale sterile fill–finish, biologics manufacturing, and advanced formulation capabilities to support next-generation therapeutic classes.

- Regulatory harmonization across regions will lift multinational development activity and enable broader placement of clinical studies.

- Emerging markets will accelerate growth with rising pet ownership, stronger livestock health programs, and expanding biotechnology infrastructure.

- Strategic partnerships between pharmaceutical companies and contract service providers will expand long-term development pipelines and manufacturing commitments.

- The market will maintain strong opportunity for providers that deliver species-specific expertise, advanced platforms, and flexible capacity across the full R&D lifecycle.