Market Overview:

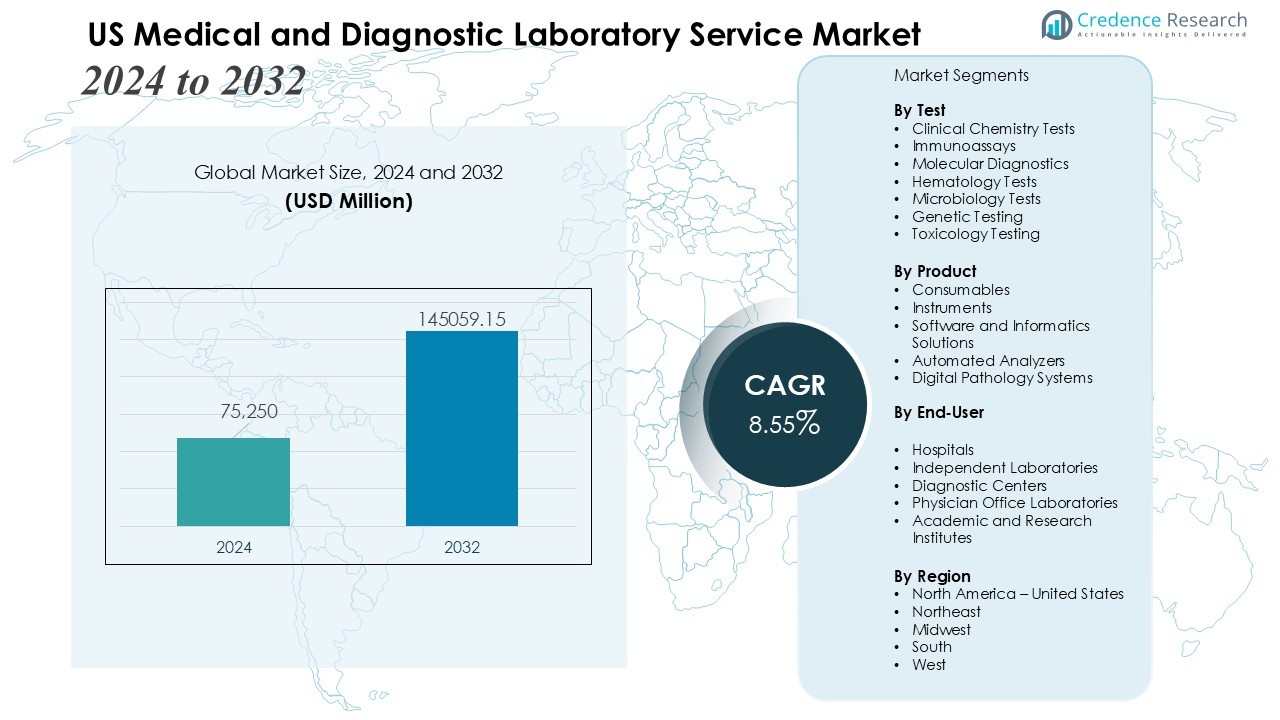

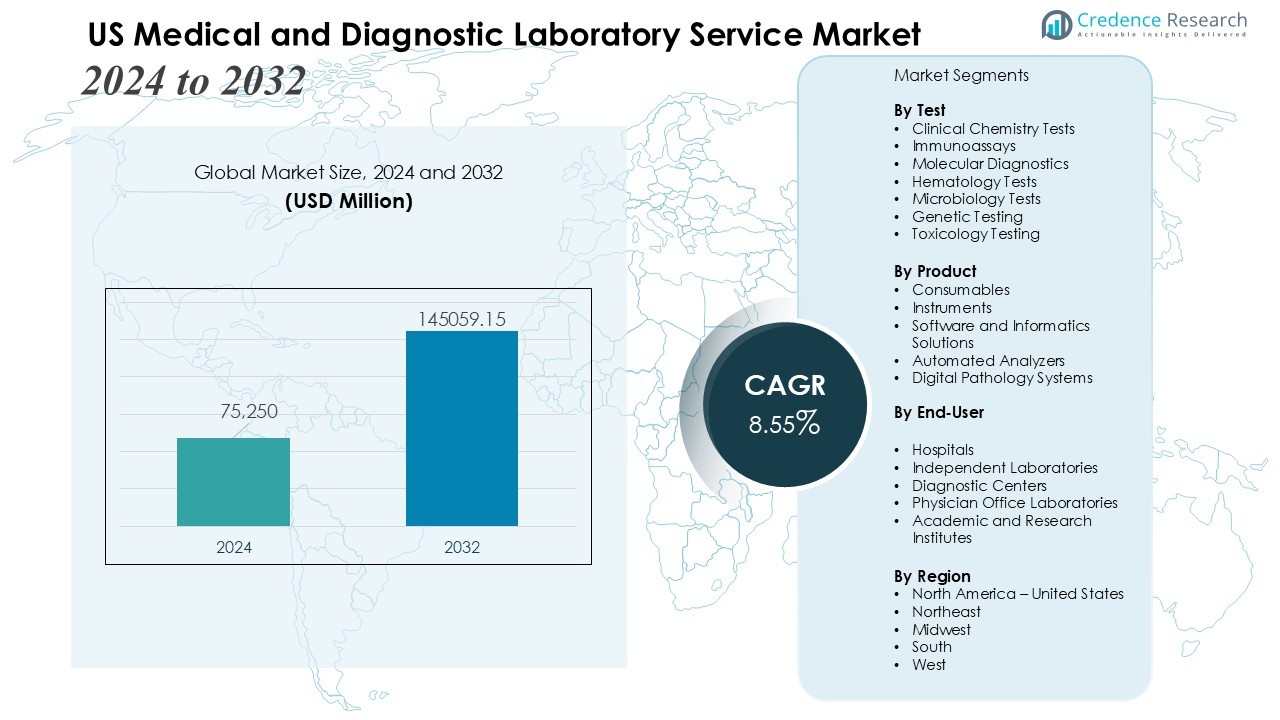

The US Medical and Diagnostic Laboratory Service Market size was valued at USD 75,250 million in 2024 and is anticipated to reach USD 145059.15 million by 2032, at a CAGR of 8.55 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| US Medical and Diagnostic Laboratory Service Market Size 2024 |

USD 75,250 Million |

| US Medical and Diagnostic Laboratory Service Market, CAGR |

8.55% |

| US Medical and Diagnostic Laboratory Service Market Size 2032 |

USD 145059.15 Million |

Strong market drivers include rising chronic disease prevalence, increasing emphasis on preventive healthcare, and expanding test volumes supported by an aging population. Higher adoption of genomic testing, companion diagnostics, and point-of-care solutions enhances laboratory efficiency and patient outcomes. Strategic consolidation among national laboratory networks, integration of AI-powered diagnostic tools, and wider reimbursement coverage for advanced tests further accelerate service adoption. Expanding demand for personalized medicine and infectious disease diagnostics continues to shape service innovation and investment patterns.

Regionally, the Southern and Western United States lead market growth due to large patient populations, strong healthcare infrastructure, and high test utilization rates. The Northeastern region maintains significant share supported by established academic medical centers and advanced diagnostic research hubs. The Midwestern United States demonstrates steady demand driven by expanding regional hospital networks and broader adoption of molecular and digital diagnostic technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The US Medical and Diagnostic Laboratory Service Market is valued at USD 75,250 million in 2024 and is projected to reach USD 145,059.15 million by 2032, growing at a CAGR of 8.55% driven by rising chronic and infectious disease incidence.

- Preventive healthcare expansion and wellness screening programs increase demand for metabolic panels, lipid profiles, and genetic predisposition tests across employers, insurers, and healthcare networks.

- Advancements in molecular diagnostics such as PCR, NGS, and liquid biopsy strengthen precision medicine adoption and support high-accuracy clinical decision-making.

- Automation, AI-enabled analytics, digital pathology, and integrated LIS platforms improve workflow efficiency and enhance the scalability of national and regional laboratory networks.

- Persistent cost pressures, reimbursement instability, and compliance requirements challenge margins, particularly for smaller and mid-sized laboratory service providers.

- Workforce shortages, testing backlogs, and infrastructure constraints reduce productivity and limit the deployment of high-throughput diagnostic technologies in constrained facilities.

- Regional growth remains strong in Southern and Western states due to high test utilization, while the Northeast leads in advanced molecular diagnostics and the Midwest maintains steady demand through expanding hospital networks.

Market Drivers:

Market Drivers:

Rising Prevalence of Chronic and Infectious Diseases Boosts Testing Demand

The US Medical and Diagnostic Laboratory Service Market gains strong momentum from the rising incidence of chronic diseases including diabetes, cardiovascular disorders, and cancer. Growing infectious disease surveillance requirements increase test volumes across hospital and independent laboratories. The need for early detection encourages providers to expand clinical chemistry, immunoassay, and molecular testing capabilities. It strengthens demand for routine and specialized diagnostics that support accurate treatment decisions.

- For Instance, Quest Diagnostics uses highly standardized HbA1c testing methods, certified by the National Glycohemoglobin Standardization Program (NGSP), for diabetes management and monitoring.

Expansion of Preventive Healthcare and Wellness Screening Programs

Preventive care initiatives enhance the market outlook by driving higher utilization of health screening panels. Employers, insurers, and healthcare networks promote regular wellness testing to reduce long-term healthcare costs. The focus on early risk identification requires broader access to lipid profiles, metabolic panels, and genetic predisposition tests. The US Medical and Diagnostic Laboratory Service Market benefits from strong interest in proactive health management across all age groups.

- For instance, Fountain Life employs AI-driven diagnostics with whole-body MRI scans that detect anomalies at 3mm resolution across 13 organs, enabling early identification in its preventive screening programs.

Advancements in Molecular Diagnostics and Precision Medicine

Rapid progress in molecular platforms including PCR, next-generation sequencing, and liquid biopsy technologies transforms laboratory workflows. These innovations increase diagnostic accuracy, accelerate turnaround times, and support targeted treatment pathways. Precision medicine programs encourage wider adoption of companion diagnostics across oncology, infectious diseases, and genetic disorders. It enables laboratories to deliver high-value insights that improve clinical decision-making.

Growing Investments in Automation, AI, and Digital Laboratory Infrastructure

Automation and digitalization initiatives improve laboratory efficiency by reducing manual errors and supporting high-volume testing environments. AI-enabled analytics enhance the interpretation of complex diagnostic datasets and speed up clinical reporting. Investments in LIS integration, remote diagnostics, and digital pathology strengthen operational scalability. The US Medical and Diagnostic Laboratory Service Market experiences rising demand for technologically advanced laboratory operations across national and regional networks.

Market Trends:

Accelerated Shift Toward Molecular and Genomic Diagnostics

The US Medical and Diagnostic Laboratory Service Market observes a rapid transition toward molecular and genomic-based testing supported by demand for high-precision diagnostics. Providers expand PCR, NGS, and liquid biopsy capabilities to meet rising requirements for oncology, infectious disease detection, and hereditary risk assessment. It strengthens clinical decision-making by offering actionable insights tied to individualized treatment pathways. Laboratories integrate advanced bioinformatics platforms to handle complex genomic datasets with greater accuracy. Demand increases for multiplex assays that deliver faster and more comprehensive diagnostic information. Healthcare networks adopt precision medicine frameworks that highlight the need for highly specialized laboratory services.

- For instance, Arima Genomics launched Aventa Lymphoma, the first whole-genome NGS-based test detecting gene fusions across 417 genes from limited samples in B- and T-cell lymphomas.

Rising Adoption of Automation, Digital Pathology, and Remote Diagnostic Services

Automation platforms gain strong traction as laboratories upgrade equipment to improve throughput, reduce manual intervention, and support faster turnaround times. AI-assisted image analysis improves accuracy in pathology workflows and supports faster clinical reporting. The US Medical and Diagnostic Laboratory Service Market benefits from enhanced connectivity driven by telehealth expansion and remote test ordering models. It encourages wider uptake of at-home sample collection kits and digital diagnostic interfaces. Digital pathology solutions contribute to workforce optimization and enable collaboration across distributed laboratory networks. National laboratory chains invest in robotics, cloud-based LIS, and virtual diagnostic tools that strengthen operational resilience and improve service efficiency.

- For instance, Philips leverages AI-enabled scanners in digital pathology to automate image analysis, and the use of the combined solution with third-party AI software from Ibex has been shown in some studies to result in overall productivity gains of up to 37% in the diagnostic workflow for certain cases like prostate cancer, compared to manual methods, by reducing administrative tasks and streamlining the process.

Market Challenges Analysis:

Rising Cost Pressures, Reimbursement Uncertainty, and Operational Constraints

The US Medical and Diagnostic Laboratory Service Market faces persistent cost pressures driven by reimbursement cuts, strict billing policies, and rising operational expenses. Laboratories struggle to balance investment requirements for advanced technologies with limited reimbursement growth. It challenges smaller and mid-sized providers that operate on narrow margins. Frequent policy changes under federal and private insurance programs increase administrative burdens and delay payment cycles. High compliance costs linked to regulatory audits, data protection, and quality assurance add further strain. Competition from large national laboratories intensifies pricing pressure across regional providers.

Workforce Shortages, Testing Backlogs, and Infrastructure Limitations

Workforce constraints hinder market performance due to shortages of trained laboratory technicians, pathologists, and molecular specialists. Heavy workloads reduce productivity and increase the likelihood of diagnostic delays. The US Medical and Diagnostic Laboratory Service Market encounters capacity limitations during periods of high testing demand, which strain existing infrastructure. It restricts scalability for advanced molecular platforms and high-throughput systems. Integration of digital tools remains uneven across smaller laboratories that lack sufficient capital. Maintenance of legacy systems and fragmented data environments slows workflow efficiency and limits interoperability.

Market Opportunities:

Growth Potential in Advanced Molecular Testing, Precision Medicine, and Preventive Care

The US Medical and Diagnostic Laboratory Service Market gains strong opportunity from expanding demand for molecular diagnostics, companion testing, and personalized treatment pathways. Healthcare networks invest in NGS, liquid biopsy, and high-sensitivity assays that support early disease detection and targeted therapy decisions. It enables laboratories to differentiate service portfolios and deliver high-value diagnostic insights. Rising interest in preventive healthcare creates scope for broader wellness panels and genetic risk assessment tests. Employers and insurers promote early screening programs that increase test volumes across national and regional laboratories. Strategic partnerships between laboratories and health systems strengthen long-term service integration.

Expansion of Digital Diagnostics, Remote Testing Models, and AI-Driven Workflows

Digital transformation creates new avenues for remote diagnostics, virtual test ordering platforms, and at-home sample collection solutions. The US Medical and Diagnostic Laboratory Service Market benefits from growing patient preference for convenient and decentralized testing formats. It supports wider adoption of connected diagnostic ecosystems that link laboratories with telehealth providers and digital care platforms. AI-driven analytics improve interpretation accuracy and accelerate reporting in pathology and molecular domains. Investments in automation and robotics create significant efficiency gains for high-volume laboratories. Opportunities increase for laboratories that develop interoperable systems and data-driven diagnostic solutions.

Market Segmentation Analysis:

By Test

Clinical chemistry tests hold a dominant share due to their extensive use in routine health assessments and chronic disease management. Immunoassays maintain strong demand supported by widespread application in infectious disease detection and hormone analysis. Molecular diagnostics record the fastest growth rate driven by rising adoption of PCR and NGS platforms. The US Medical and Diagnostic Laboratory Service Market benefits from expanding use of high-sensitivity tests that improve diagnostic precision. It strengthens the role of advanced testing categories across hospital and reference laboratories.

- For instance, Roche Diagnostics’ Cobas c 513 analyzer is a dedicated HbA1c testing solution that processes up to 400 tests per hour (or patient results per hour), with all tests being photometric. This enhances efficiency in high-volume labs by enabling a fully automated workflow with features like closed-tube sampling.

By Product

Consumables including reagents, assay kits, and probes secure the largest revenue share due to high test volumes and recurring procurement patterns. Instruments gain traction through investment in automation systems, digital pathology platforms, and molecular analyzers. Software solutions experience rising demand supported by LIS integration, AI-based analytics, and cloud-enabled diagnostic workflows. Laboratories focus on upgrading product portfolios to enhance efficiency and maintain compliance with evolving quality standards. It increases the strategic value of product innovation within laboratory operations.

- For instance, Roche’s cobas e 801 module processes up to 300 tests per hour, supporting high-volume immunoassay workflows in laboratories worldwide. This achievement enables efficient handling of 24/7 diagnostic demands, and when configured in a series of up to four modules as part of the cobas 8000 modular analyzer series, the system can reach a total throughput of up to 1,200 tests/hour for immunoassay analysis.

By End User

Hospitals remain the leading end-user segment due to high patient throughput, diverse testing needs, and integration with clinical care pathways. Independent laboratories gain significant traction by offering specialized tests, competitive pricing, and scalable service models. Diagnostic centers and physician office laboratories contribute steady demand supported by routine screening and point-of-care requirements. The US Medical and Diagnostic Laboratory Service Market benefits from broader adoption of decentralized testing models. It strengthens service accessibility across urban and semi-urban regions.

Segmentations:

By Test

- Clinical Chemistry Tests

- Immunoassays

- Molecular Diagnostics

- Hematology Tests

- Microbiology Tests

- Genetic Testing

- Toxicology Testing

By Product

- Consumables

- Instruments

- Software and Informatics Solutions

- Automated Analyzers

- Digital Pathology Systems

By End User

- Hospitals

- Independent Laboratories

- Diagnostic Centers

- Physician Office Laboratories

- Academic and Research Institutes

By Region

- North America – United States

- Northeast

- Midwest

- South

- West

Regional Analysis:

Strong Market Presence Across the Southern United States Driven by Expanding Healthcare Networks

The US Medical and Diagnostic Laboratory Service Market records strong activity in the Southern region due to a large patient population and wide distribution of hospital networks. High chronic disease burden elevates test volumes across clinical chemistry, molecular, and immunoassay categories. Regional health systems invest in modern laboratory infrastructure to support faster turnaround times and scalable diagnostic operations. It strengthens demand for automation platforms and integrated LIS solutions. States such as Texas, Florida, and Georgia witness steady growth in independent laboratories and specialty diagnostic centers. The region benefits from rising adoption of preventive screening and employer-driven wellness programs.

Northeastern United States Benefits from Advanced Academic Centers and Specialized Diagnostics

The Northeastern region maintains a significant share supported by strong concentration of academic medical centers, research hospitals, and biotechnology hubs. Demand for advanced molecular diagnostics remains high due to strong focus on oncology, genetic testing, and infectious disease surveillance. Laboratories in this region implement digital pathology and AI-enabled analysis to improve diagnostic precision. It encourages partnerships between hospitals, reference laboratories, and research institutions. States such as New York, Massachusetts, and Pennsylvania drive innovation through investment in genomic programs and precision medicine initiatives. The region continues to adopt next-generation sequencing and companion diagnostics at a rapid pace.

Western and Midwestern United States Gain Momentum Through Technology Adoption and Expanding Access

The Western region grows steadily due to strong uptake of remote diagnostics, virtual test ordering, and digital laboratory solutions. High consumer preference for decentralized testing encourages adoption of at-home sample kits and telehealth-linked diagnostic workflows. The US Medical and Diagnostic Laboratory Service Market benefits from strong activity in states such as California and Washington driven by advanced healthcare ecosystems. It accelerates investment in molecular platforms and robotics. The Midwestern region reports consistent test demand supported by integrated health systems and expanding hospital networks. Regional laboratories strengthen service capabilities through automation upgrades and broader access to specialty testing.

Key Player Analysis:

Competitive Analysis:

Competitive landscape in the US Medical and Diagnostic Laboratory Service Market features strong participation from Quest Diagnostics Incorporated, Thermo Fisher Scientific Inc., BIOMERIEUX, Siemens Medical Solutions USA, Inc., and Laboratory Corporation of America Holdings. These companies expand their service portfolios through investments in molecular diagnostics, digital pathology, and high-throughput testing platforms. It strengthens their capability to meet rising demand for advanced and routine diagnostic services. Leading players focus on strategic partnerships with hospitals, research institutions, and health systems to widen geographic reach and improve sample logistics. Automation, AI-driven analytics, and cloud-based LIS integration remain core areas of innovation for major laboratory networks. Companies pursue acquisitions to enhance specialized testing capacity and reinforce competitive positioning in a consolidating market.

Recent Developments:

- In August 2025, Quest Diagnostics completed the acquisition of select clinical testing assets from Fresenius Medical Care’s Spectra Laboratories, enhancing dialysis-related services for independent clinics.

- In August 2025, Corewell Health and Quest Diagnostics signed a definitive agreement to enter a joint venture for a new state-of-the-art laboratory in Southfield, Michigan, with Quest managing Corewell’s 21 hospital labs starting in phases from late 2025.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Test, Product, End User and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Future outlook highlights strong expansion of advanced molecular and genomic diagnostics as laboratories invest in high-precision testing platforms.

- Digital pathology, AI-supported analytics, and automation gain wider adoption to strengthen accuracy and improve workflow efficiency.

- Remote diagnostics and at-home sample collection models expand access and support higher patient engagement across urban and semi-urban regions.

- Laboratories integrate cloud-based LIS systems to enhance interoperability and streamline reporting between providers and diagnostic networks.

- Growth in preventive healthcare encourages higher demand for wellness panels and early-risk identification tests across diverse population groups.

- Precision medicine accelerates use of companion diagnostics in oncology, infectious diseases, and genetic disorders, strengthening specialized service portfolios.

- Large national laboratories pursue consolidation strategies to expand regional coverage and improve sample logistics infrastructure.

- Investment in robotics and high-throughput platforms increases testing capacity and supports scalable laboratory operations.

- Demand rises for decentralized diagnostic centers and physician office laboratories that deliver faster access to routine tests.

- Collaborations between laboratories, technology firms, and healthcare systems expand innovation pipelines and improve long-term diagnostic capabilities.

Market Drivers:

Market Drivers: