Market Overview

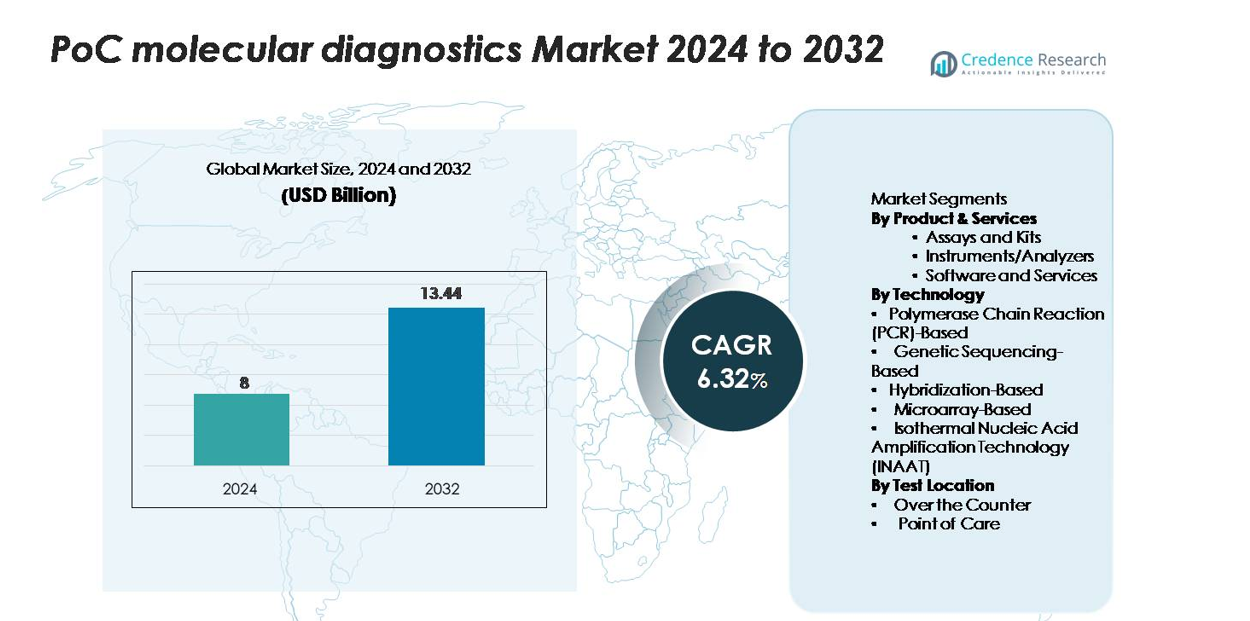

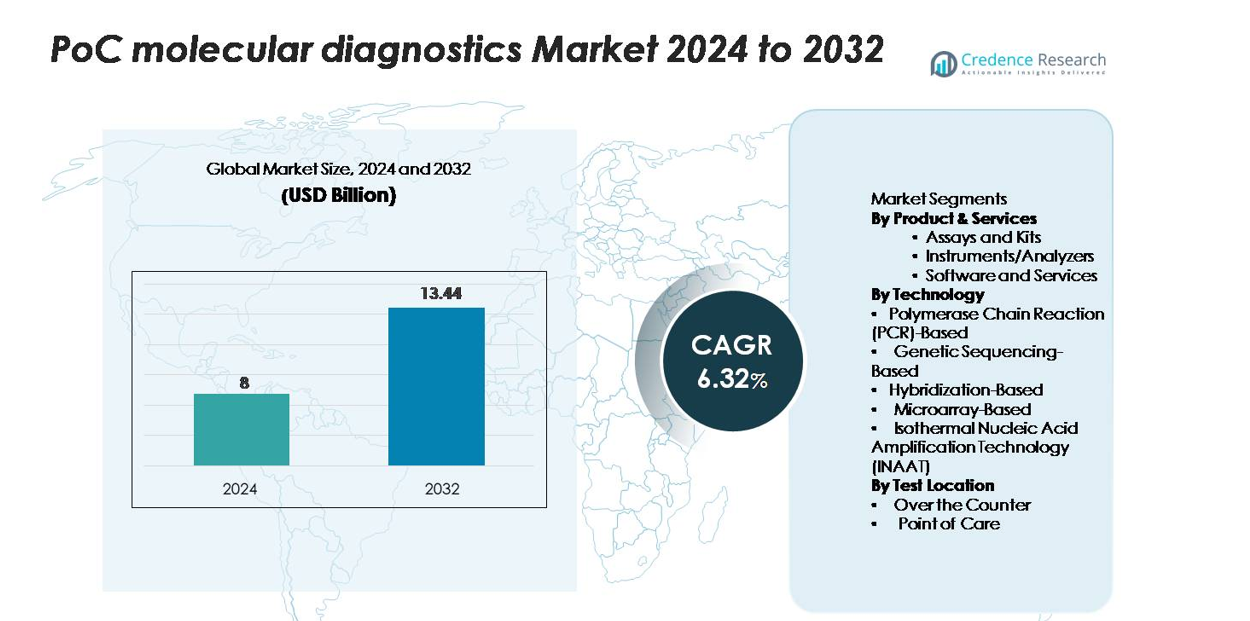

The point-of-care (PoC) molecular diagnostics market was valued at USD 8 billion in 2024 and is anticipated to reach USD 13.44 billion by 2032, registering a CAGR of 6.32% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| PoC Molecular Diagnostics Market Size 2024 |

USD 8 billion |

| PoC Molecular Diagnostics Market, CAGR |

6.32% |

| PoC Molecular Diagnostics Market Size 2032 |

USD 13.44 billion |

The global PoC molecular diagnostics market is shaped by a handful of leading players—Danaher Corporation, bioMérieux SA, F. Hoffmann‑La Roche Ltd., Abbott Laboratories, and QIAGEN N.V.—who emerge as dominant incumbents thanks to their broad product suites and global distribution networks. Danaher leads the pack with its rapid-molecular testing subsidiary and extensive field infrastructure. The North American region commands the largest share of the market—accounting for approximately 40 %–45 % of global revenue—and remains the strategic core due to mature healthcare systems, favorable reimbursement and early adoption of decentralized molecular platforms.

Market Insights

- The PoC molecular diagnostics market was valued at USD 8 billion in 2024 and is projected to reach USD 13.44 billion by 2032, registering a CAGR of 6.32%, supported by rising adoption of rapid decentralized testing.

- Growing demand for fast infectious disease detection, expansion of home-based testing, and increased investment in portable PCR and INAAT platforms continue to drive market momentum across clinical and retail settings.

- Key trends include integration of AI-enabled result interpretation, connectivity with EMR systems, and expansion of multiplex assay menus, strengthening the competitive edge of leading players.

- Market restraints include high instrument and consumable costs, limited reimbursement in emerging regions, and regulatory complexity that slows commercialization of advanced PoC molecular systems.

- Regionally, North America leads with 40–45% share, followed by Europe at 20–25%, while Asia Pacific captures 15–20% with the fastest growth; among product segments, assays and kits dominate with the highest share due to recurring usage.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product & Services

Assays and kits dominate the PoC molecular diagnostics market, holding nearly 55% market share, driven by their recurring demand, rapid test adoption, and expanding infectious disease panels. Their ease of use, compatibility with compact analyzers, and high testing throughput make them the preferred choice for decentralized care settings. Instruments and analyzers also contribute significantly as portable, battery-operated, and fully automated systems gain traction. Software and services continue to grow due to rising integration of cloud-based connectivity, data management solutions, and remote diagnostics support across clinics, pharmacies, and home-care environments.

- For instance, Cepheid’s GeneXpert Xpress system supports cartridge-based molecular assays capable of processing results in 30 minutes and accommodates up to 4 independent test modules operating simultaneously, enabling scalable point-of-care workflows.

By Technology

Polymerase Chain Reaction (PCR)-based testing leads the market with over 60% share, supported by its superior accuracy, rapid amplification capability, and strong use in respiratory, sexually transmitted, and bloodstream infection diagnostics. The availability of compact real-time PCR platforms enhances its adoption in near-patient settings. INAAT is gaining momentum as a complementary technology due to its fast workflow and minimal instrumentation needs. Genetic sequencing, hybridization, and microarray-based methods remain niche but are steadily expanding with increasing demand for pathogen genotyping and antimicrobial resistance detection at the point of care.

- For instance, the Cepheid GeneXpert Omni platform—engineered for true point-of-care PCR—runs single-use cartridges that deliver fully automated sample-to-result workflows in under 60 minutes, with certain assays generating positive results in approximately 20 minutes

By Test Location

Point-of-care (PoC) settings account for about 70% of market share, driven by the growing shift toward rapid decentralized testing in clinics, emergency rooms, urgent care centers, and hospital bedside environments. Faster clinical decision-making, reduced turnaround times, and increasing adoption of portable analyzers support their dominance. The over-the-counter (OTC) segment is expanding rapidly as self-testing becomes widespread, especially for respiratory and viral infections. Rising consumer awareness, regulatory approvals for home-use molecular platforms, and greater retail pharmacy accessibility continue to strengthen the OTC testing landscape.

Key Growth Drivers

Rising Demand for Rapid Infectious Disease Testing

The demand for rapid and accurate infectious disease diagnosis continues to serve as a major growth driver for the PoC molecular diagnostics market. Increasing global outbreaks of respiratory, gastrointestinal, and sexually transmitted infections have accelerated the need for decentralized, high-sensitivity testing. Healthcare providers are prioritizing PoC molecular systems because they drastically reduce turnaround time from several hours to under 30 minutes, supporting faster clinical decisions in emergency care and primary healthcare settings. The growth of antimicrobial resistance management further reinforces the shift toward precise molecular testing over conventional rapid antigen methods. Additionally, the adoption of compact, battery-operated PCR and INAAT platforms in rural clinics and low-resource environments expands market reach. Governments and health organizations are increasingly investing in decentralized testing infrastructures, strengthening the market’s trajectory. Together, these factors create strong demand for rapid molecular diagnostics as routine tools in disease surveillance, outbreak control, and patient triage workflows.

- For instance, Abbott’s ID NOW™ molecular platform delivers positive COVID-19 results in approximately 5 minutes and negative results in 13 minutes, processing a single assay through an isothermal amplification chamber containing a reaction volume of 50 µL, enabling true near-patient molecular detection.

Expansion of Decentralized Healthcare and Retail Diagnostics

The expansion of decentralized healthcare models, including pharmacy-based testing, home-based diagnostics, and mobile medical units, significantly drives market growth. Patients increasingly prefer accessible and immediate testing solutions, reducing dependence on centralized laboratories. Retail pharmacies have emerged as major testing hubs due to extended operating hours, wider geographic reach, and growing regulatory approvals for PoC molecular devices. Telehealth integration further enhances convenience by enabling digital result reporting and remote physician consultation. Manufacturers are also targeting home-care users with simplified, single-step molecular test kits that deliver clinical-grade accuracy without trained personnel. This decentralization benefits chronic disease monitoring, infectious disease screening, and preventive care initiatives. The shift toward consumer-led testing, combined with rising healthcare digitalization, strengthens adoption across both developed and emerging countries. As healthcare systems emphasize patient-centric models, PoC molecular diagnostics gain strategic relevance in bridging gaps in timely and equitable diagnostic access.

- For instance, the Lucira Check-It molecular test kit—cleared for home use—generates NAAT results in approximately 30 minutes and operates through a single-use test unit containing a calibrated 2.5 mL sample buffer chamber with integrated amplification components, enabling lab-quality molecular detection without trained personnel.

Growing Technological Innovations in Portable Molecular Platforms

Technological advancements in portable molecular diagnostic systems significantly accelerate market growth. Manufacturers are developing compact, automated analyzers integrating microfluidics, advanced biosensors, and AI-enabled result interpretation, enabling rapid and reliable molecular testing outside laboratories. Innovations such as multiplex PCR cartridges, isothermal amplification-based handheld analyzers, and cloud-connected data dashboards improve clinical utility and operational efficiency. Battery-operated devices with closed-system reagent cartridges enhance safety by minimizing contamination risks. In addition, improvements in assay chemistry allow broader pathogen detection, including viral, bacterial, and genetic markers, using a single consumable. Connectivity enhancements also support seamless integration with hospital information systems, electronic medical records, and remote monitoring platforms. These technological improvements not only expand test menus but also reduce operator dependency, making molecular diagnostics more accessible to primary care settings, rural healthcare networks, and non-clinical environments. As performance parallels centralized lab systems, adoption of portable PoC platforms continues to accelerate.

Key Trends & Opportunities

Increasing Adoption of At-Home Molecular Testing Solutions

A major trend shaping the market is the rapid expansion of at-home molecular diagnostics, driven by growing consumer awareness and increasing regulatory approvals for self-administered tests. The COVID-19 pandemic accelerated acceptance of home-use molecular systems, demonstrating their feasibility and reliability. As consumers seek greater autonomy in managing respiratory, viral, and chronic conditions, companies are developing easy-to-use molecular kits that require minimal sample handling and deliver results within minutes. Retail pharmacies and e-commerce platforms are becoming critical distribution channels for these devices. Integration with smartphone apps enables digital result access, symptom tracking, and seamless telehealth consultations. The trend toward self-testing presents substantial opportunities for manufacturers to expand product portfolios and address unmet needs in preventive healthcare, long-term disease management, and remote monitoring. With digital health integration and increased investment in home diagnostics infrastructure, at-home molecular testing is poised to become a mainstream diagnostic modality.

- For instance, the Cue Health Molecular COVID-19 Test—authorized for home use—delivers nucleic acid amplification results in approximately 20 minutes using a single-use cartridge containing a reaction chamber of 70 µL and pairs with a portable reader weighing about 150 grams, enabling true at-home molecular testing.

AI Integration and Data Connectivity in Molecular Testing

The integration of artificial intelligence and cloud-based connectivity in PoC molecular diagnostics represents a transformative opportunity. AI-driven algorithms enhance system accuracy by interpreting amplification curves, identifying anomalies, and predicting test validity, reducing operator errors. Connectivity features enable automatic reporting to clinicians, public health databases, and electronic health records, supporting real-time disease surveillance and improving care coordination. These advancements are particularly beneficial in emergency departments, urgent care centers, and remote healthcare environments where rapid clinical decisions are essential. Manufacturers are incorporating predictive maintenance tools, automated calibration, and cloud-based analytics to improve device uptime and user experience. As digital health ecosystems expand globally, PoC molecular diagnostics equipped with AI and connected platforms will play a pivotal role in improving outbreak monitoring, supporting personalized treatment pathways, and enabling population-level health insights.

- For instance, the Cue Health Monitoring System uses onboard algorithms to analyze NAAT signal curves in real time and transmits encrypted results to its cloud platform in under 2 seconds, while its mobile app supports storage of up to 1,000 test records per user—enabling seamless digital integration for decentralized molecular testing.

Key Challenges

High Cost of Molecular Instruments and Consumables

High costs associated with PoC molecular diagnostic instruments and consumables remain a significant challenge limiting broader adoption, particularly in low- and middle-income countries. Advanced molecular platforms require precision engineering, sophisticated biosensors, and high-quality reagents, increasing overall system costs compared with conventional rapid tests. Healthcare providers also face recurring expenses for single-use cartridges and assay kits, which can strain budgets in resource-limited settings. Limited reimbursement coverage for PoC molecular testing in many regions further restricts utilization. Additionally, cost barriers hinder adoption in rural clinics where budgets are constrained. To address this challenge, manufacturers must focus on cost-efficient production, scalable reagent manufacturing, and strategic partnerships with global health organizations. Without affordability improvements, widespread implementation of PoC molecular diagnostics in primary care and public health programs may continue to face constraints.

Operational and Regulatory Complexity

Operational complexity and regulatory hurdles pose major challenges for the PoC molecular diagnostics industry. While molecular systems are becoming increasingly automated, they still require careful sample handling, controlled environmental conditions, and adherence to quality assurance protocols. Training non-laboratory personnel to correctly operate these devices remains a barrier in decentralized settings. Regulatory pathways for PoC molecular devices are also stringent, requiring proof of accuracy comparable to centralized laboratory systems. Achieving consistent performance across varying environmental conditions—temperature, humidity, and sample variability—adds to validation complexity. Furthermore, global markets have differing approval requirements, extending development timelines and increasing compliance costs. These challenges may slow market expansion, especially for newer entrants and innovative technologies seeking rapid commercialization.

Regional Analysis

North America

North America accounts for the largest share, with approximately 40-45% of the global PoC molecular diagnostics market in 2024. The region benefits from strong healthcare infrastructure, widespread reimbursement frameworks, and early adoption of decentralized molecular technologies. High incidence of infectious diseases, well-funded public health programs, and rapid uptake of home-testing solutions further support growth. The presence of major device manufacturers and a favorable regulatory environment accelerate commercialization of advanced PoC molecular platforms. As a result, North America remains the growth leader while also serving as a benchmark for other regional markets.

Europe

Europe trails North America but holds a significant share—estimated around 20-25% of the global market. The region’s growth is underpinned by strong public health initiatives, widespread national screening programs, and increasing investment in point-of-care molecular diagnostics. The United Kingdom, Germany, France and the Nordics are early adopters of decentralized testing. Regulatory harmonization through the In Vitro Diagnostic Regulation (IVDR) and rising demand for rapid diagnostics in outpatient care amplify adoption. However, varying reimbursement frameworks and country-specific adoption rates present some segmentation across Europe’s national markets.

Asia Pacific

The Asia Pacific region commands roughly 15-20% of the global PoC molecular diagnostics market and exhibits the highest growth potential over the forecast period. Growth drivers include rising healthcare expenditure, improving access in emerging economies (such as India, China, and Southeast Asia), and expanding decentralised testing infrastructure. Governments across the region are promoting infectious disease screening and disease surveillance programs, while local manufacturing of test kits is beginning to strengthen. Despite some infrastructure challenges, the large population base, growing private healthcare sector, and unmet diagnostics demand position Asia Pacific as a key region for future market expansion.

Latin America

Latin America captures about 6-8% of the global PoC molecular diagnostics market. While growth is more moderate compared to mature regions, increasing awareness of rapid molecular testing in hospital and clinic settings drives adoption. Countries such as Brazil, Mexico and Argentina are upgrading healthcare facilities and expanding point-of-care capabilities. Limited reimbursement frameworks and budget constraints remain challenges, but the region offers opportunities for cost-effective molecular platforms tailored to emerging-market needs. As diagnostics infrastructure improves, Latin America stands to benefit from decentralised testing trends.

Middle East & Africa (ME)

The Middle East & Africa region holds approximately 4-6% of the global market share but is projected to grow steadily. Growth is driven by government investments in healthcare infrastructure, public-private partnerships in diagnostics, and increasing mobile testing units in remote areas. The region’s demand for affordable, rapid molecular diagnostics—especially for infectious disease outbreaks and remote rural healthcare—creates opportunities. However, challenges such as variable healthcare infrastructure, regulatory fragmentation, and limited reimbursement hinder market acceleration. Targeted deployment of portable PoC molecular devices could help overcome these barriers.

Market Segmentations:

By Product & Services

- Assays and Kits

- Instruments/Analyzers

- Software and Services

By Technology

- Polymerase Chain Reaction (PCR)-Based

- Genetic Sequencing-Based

- Hybridization-Based

- Microarray-Based

- Isothermal Nucleic Acid Amplification Technology (INAAT)

By Test Location

- Over the Counter

- Point of Care

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The PoC molecular diagnostics market exhibits a moderately consolidated competitive landscape, with global players competing on test menu breadth, turnaround time, and platform versatility. Leading companies such as F. Hoffmann-La Roche, Abbott Laboratories, Danaher (Cepheid), QIAGEN, and bioMérieux focus on integrated cartridge-based systems that combine sample preparation, amplification, and detection in closed formats to reduce contamination risk and user error. Firms increasingly invest in multiplex panels for respiratory, sexually transmitted, and bloodstream infections, while expanding into at-home and pharmacy-based testing channels. Strategic moves include partnerships with hospital networks, acquisitions of niche assay developers, and co-development agreements with digital health platforms. Competition also intensifies around price-sensitive emerging markets, prompting vendors to introduce lower-cost analyzers and region-specific test menus.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BD (U.S.)

- Trinity Biotech plc (Ireland)

- Abbott (U.S.)

- EKF Diagnostics (U.K.)

- Hoffman-La Roche Ltd. (Switzerland)

- Chembio Diagnostics (U.S.)

- Siemens Healthineers AG (Germany)

- Instrumentation Laboratory (U.S.)

- Danaher (U.S.)

- Quidel Corporation (U.S.)

Recent Developments

- In August 2025, the company Trinity Biotech plc (Ireland) announced breakthrough clinical trial results for a next-generation CGM+ sensor-platform, which, while more in the monitoring space, indicates its diagnostics R&D expansion.

- In February 2025, BD announced its board had authorized the separation of its Biosciences & Diagnostic Solutions business from the rest of BD to enhance strategic focus and unlock value.

- In December 2023, Roche entered into a definitive agreement to acquire selected parts of LumiraDx Group related to its point-of-care diagnostics technology.

Report Coverage

The research report offers an in-depth analysis based on Product & services, Technology, Test location and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue shifting toward decentralized and home-based molecular testing as consumers demand faster and more accessible diagnostics.

- Portable PCR and INAAT platforms will gain broader adoption due to improved speed, accuracy, and ease of use.

- AI-driven result interpretation and automated workflows will enhance diagnostic precision and reduce operator dependency.

- Multiplex molecular panels will expand, enabling simultaneous detection of multiple pathogens in a single test.

- Connectivity with electronic medical records and telehealth platforms will strengthen remote patient management.

- Increased government investment in infectious disease preparedness will boost deployment of rapid molecular systems.

- Pricing innovations and local manufacturing will improve accessibility in emerging and low-resource regions.

- Competition will intensify as companies introduce compact analyzers suitable for pharmacies and mobile clinics.

- Regulatory pathways will evolve to support faster approvals of home-use molecular technologies.

- Public health programs will increasingly integrate PoC molecular tools for surveillance and outbreak response.