Market Overview

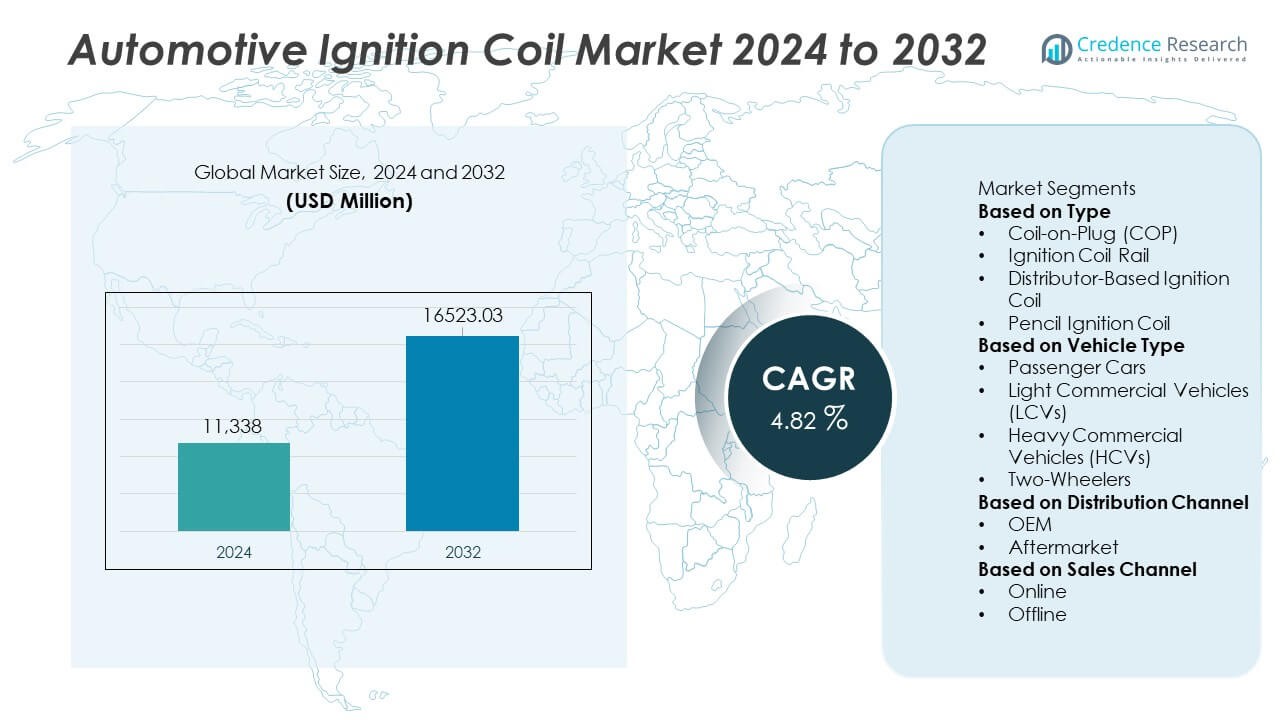

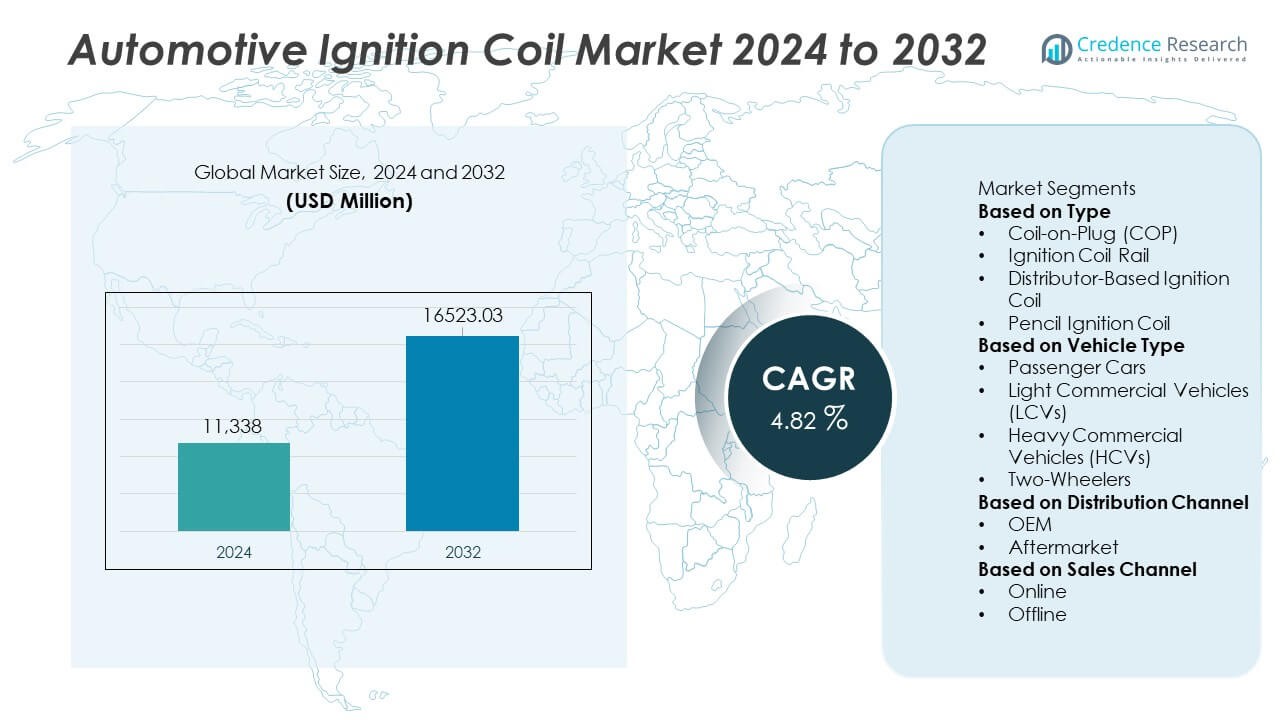

The Automotive Ignition Coil Market was valued at USD 11,338 million in 2024 and is projected to reach USD 16,523.03 million by 2032, expanding at a CAGR of 4.82% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Automotive Ignition Coil Market Size 2024 |

USD 11,338 Million |

| Automotive Ignition Coil Market, CAGR |

4.82% |

| Automotive Ignition Coil Market Size 2032 |

USD 16,523.03 Million |

The Automotive Ignition Coil market is driven by leading players such as Denso Corporation, Bosch, Delphi Technologies, Hitachi Astemo, NGK Spark Plug Co., Ltd., BorgWarner, Federal-Mogul, Marelli, Hella GmbH, and Standard Motor Products, all of which focus on developing high-efficiency coils that support cleaner combustion and improved engine performance. These companies strengthen their position through OEM partnerships, advanced material technologies, and expansion of aftermarket product lines. Asia Pacific leads the market with 34% share, supported by large-scale vehicle production, while North America holds 28% share due to strong replacement demand. Europe follows with 26% share, driven by strict emission standards and high adoption of advanced ignition systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Automotive Ignition Coil market was valued at USD 11,338 million in 2024 and is projected to reach USD 16,523.03 million by 2032, expanding at a CAGR of 4.82% during the forecast period.

- Key drivers include rising production of gasoline-powered vehicles and stricter emission norms, with Coil-on-Plug (COP) ignition coils holding a 46% share due to their efficiency and compatibility with modern engines.

- Major trends include growing use of high-energy ignition systems, increased integration of diagnostic-enabled smart coils, and rising adoption of pencil ignition coils for compact engines.

- The competitive landscape includes Denso, Bosch, Delphi Technologies, Hitachi Astemo, NGK Spark Plug, BorgWarner, Federal-Mogul, Marelli, Hella GmbH, and Standard Motor Products, all focusing on advanced materials, durability, and OEM partnerships.

- Regionally, Asia Pacific leads with 34% share, followed by North America at 28% and Europe at 26%, while Latin America and Middle East & Africa account for 7% and 5%, driven by rising aftermarket demand and expanding vehicle fleets.

Market Segmentation Analysis:

By Type

Coil-on-Plug (COP) ignition coils dominated the market with a 46% share, driven by their superior spark efficiency, reduced energy loss, and improved ignition precision in modern gasoline engines. Automakers increasingly adopt COP systems to meet stringent emission laws and enhance fuel economy. Ignition coil rails also gained traction in multi-cylinder engines used in high-performance vehicles. Distributor-based coils continued to decline due to their mechanical complexity and lower efficiency. Pencil ignition coils expanded in compact engines where space optimization and higher voltage output are required. The dominance of COP reflects the industry’s shift toward compact, high-efficiency ignition systems.

- For instance, Denso’s ignition coils feature advanced designs and superior materials for reliable high-temperature operation and improved magnetic efficiency, which generates a high voltage faster to ensure consistent, high-energy ignition output.

By Vehicle Type

Passenger cars accounted for the largest 57% share, supported by high global production volumes and rapid adoption of advanced ignition technologies in mid-range and premium vehicles. Increasing focus on fuel efficiency and cleaner combustion encourages manufacturers to integrate high-performance coils into gasoline-powered passenger cars. Light commercial vehicles (LCVs) followed as fleet operators prioritized reliable ignition systems for improved uptime. Heavy commercial vehicles (HCVs) used robust coils designed for harsh duty cycles, while two-wheelers demonstrated growing demand in emerging markets. The passenger car segment retains its lead due to continuous advancements in engine design.

- For instance, Bosch’s ignition coils for passenger cars typically support a high voltage output of over 30 kV (some motorsport versions reach up to 40 kV) and are engineered to Bosch’s stringent quality standards, which include tough endurance tests.

By Distribution Channel

OEM distribution held a dominant 68% share, driven by the strong demand for factory-fitted ignition coils aligned with vehicle manufacturing cycles and stringent quality standards. Automakers rely on OEM-grade coils to ensure durability, engine performance, and regulatory compliance. The aftermarket segment also grew steadily as aging vehicle fleets increased replacement needs, especially in regions with high gasoline-vehicle penetration. Independent workshops and online parts suppliers boosted aftermarket availability. While OEMs maintain leadership due to guaranteed compatibility and reliability, the aftermarket benefits from rising consumer focus on cost-effective maintenance solutions.

Key Growth Drivers

Key Growth Drivers

Increasing Vehicle Production and Growing Demand for Fuel-Efficient Engines

Rising global vehicle production strengthens demand for advanced ignition coils that support efficient combustion and improved engine performance. Automakers rely on high-energy coils to meet stricter emission norms and fuel-efficiency targets. Growth in gasoline-powered vehicles, especially in developing regions, drives continuous adoption of Coil-on-Plug and pencil ignition systems. The shift toward downsized turbocharged engines further boosts the need for precise ignition timing and higher voltage output. As OEMs enhance engine efficiency, ignition coils remain a critical component supporting reliable ignition and lower emissions.

- For instance, Hitachi Astemo’s high-output COP coil delivers 40 kV peak voltage, sustains over 120 million firing cycles, and operates under up to 30 g mechanical vibration, enabling stable ignition in downsized turbocharged engines.

Stricter Emission Regulations and Adoption of Advanced Ignition Technologies

Governments worldwide implement tighter emission standards, encouraging manufacturers to use high-performance ignition coils that deliver cleaner combustion. Advanced coils help reduce misfires, improve spark accuracy, and optimize air–fuel mixtures. Technologies such as COP and multi-spark systems gain traction as they support compliance with Euro 6 and similar regulations. Automakers integrate these systems to enhance thermal efficiency and extend component life. Regulatory pressure accelerates innovation, pushing suppliers to develop durable, heat-resistant coils for modern engines.

- For instance, NGK’s ignition coils transform low voltage input (typically 12V) into a high voltage output, with modern coils capable of generating up to 45 kV to produce the necessary spark for combustion.

Growing Aftermarket Demand Due to Aging Vehicle Fleet

An expanding aging fleet increases replacement needs for ignition coils, especially in regions where vehicles remain in service for longer periods. Worn-out coils contribute to poor fuel economy, engine misfires, and reduced power, driving consumers to replace them more frequently. Independent workshops and online automotive parts platforms expand product availability, boosting aftermarket demand. Higher vehicle maintenance awareness and cost-effective repair solutions strengthen market growth. This trend is particularly strong in Asia Pacific, Latin America, and Eastern Europe, where aftermarket networks continue to expand.

Key Trends & Opportunities

Shift Toward Coil-on-Plug and High-Energy Ignition Systems

The growing preference for Coil-on-Plug ignition systems creates opportunities for suppliers offering compact, high-performance solutions. These systems eliminate high-voltage wiring, reduce energy loss, and improve ignition precision. Automakers integrate high-energy coils in turbocharged and direct-injection engines to enhance combustion efficiency. The trend supports development of lightweight materials, improved insulation, and enhanced heat resistance. As engine designs evolve, manufacturers can leverage advanced coil technologies to meet rising standards in durability and performance.

- For instance, Mitsubishi Electric provides ignition coils that convert low voltage into high voltage, typically generating tens of thousands of volts (e.g., 20 kV to 40 kV). These components are designed to meet or exceed OEM specifications for performance and durability, and typically need to withstand temperatures ranging from -40°C to 150°C.

Rising Integration of Digital Diagnostics and Smart Ignition Components

Modern vehicles increasingly use onboard diagnostics and sensor-based monitoring to improve engine management. Smart ignition coils with integrated diagnostics help detect weak sparks, voltage irregularities, and coil degradation in real time. This creates strong opportunities for manufacturers developing electronically controlled and self-monitoring components. Automakers use these features to reduce maintenance costs and improve vehicle reliability. The trend aligns with the broader shift toward connected and intelligent vehicle systems.

- For instance, modern Delphi Technologies ignition coils utilize advanced magnetic design and modeling techniques to deliver energy more efficiently and precisely. They are engineered with high-quality materials and undergo extensive endurance testing, such as a 230-hour thermal cycle test, to ensure durability and consistent engine performance over time.

Key Challenges

Growing Adoption of Electric Vehicles Reducing Demand for Ignition Coils

The rapid rise of battery-electric vehicles poses a long-term challenge as these vehicles do not use ignition coils. Increasing government support for EV adoption, rising charging infrastructure, and falling battery prices accelerate the transition. While hybrid vehicles still require ignition coils, fully electric models directly reduce market potential. This shift pressures ignition coil manufacturers to diversify product offerings to remain competitive in an evolving automotive landscape.

Quality Issues, Counterfeit Products, and Volatility in Raw Material Costs

Low-quality and counterfeit ignition coils in the aftermarket create reliability concerns and reduce trust in non-OEM components. Poor insulation materials and inconsistent voltage output lead to premature failures and engine damage. At the same time, price fluctuations in copper, steel, and high-temperature plastics increase production costs for suppliers. Ensuring consistent product quality while managing cost pressures remains a major challenge. Manufacturers must invest in strict quality controls and supply chain stability to maintain competitiveness.

Regional Analysis

North America

North America held 28% share, driven by strong production of light trucks, SUVs, and gasoline-powered passenger cars that rely on high-performance ignition systems. The region benefits from advanced automotive manufacturing facilities and steady aftermarket demand fueled by an aging vehicle fleet. Strict emission standards encourage adoption of efficient ignition technologies, particularly Coil-on-Plug systems. The United States leads with a large base of premium vehicle brands and strong replacement needs due to high annual mileage. Continuous investments in engine optimization and maintenance services support market growth across OEM and aftermarket channels.

Europe

Europe accounted for 26% share, supported by widespread use of turbocharged gasoline engines that require precise and durable ignition coils. Germany, France, and the UK lead adoption due to strong automotive production and engineering expertise. Euro 6 regulations continue to push automakers toward advanced ignition solutions that improve combustion efficiency. The aftermarket segment grows steadily as vehicle owners prioritize engine performance and emission compliance. Increasing hybrid vehicle adoption, which still relies on ignition coils, further supports demand. Europe’s focus on technological innovation strengthens the region’s market presence.

Asia Pacific

Asia Pacific dominated with 34% share, driven by high vehicle production in China, Japan, India, and South Korea. Rapid expansion of passenger car and two-wheeler segments boosts demand for COP and pencil ignition coils. Growing urbanization, rising income levels, and expanding aftermarket networks further strengthen adoption. Automakers in the region increasingly integrate high-energy coils to enhance fuel efficiency and meet stricter emission norms. The large base of gasoline-powered vehicles and fast-growing maintenance markets position Asia Pacific as the fastest-growing region for ignition coil demand.

Latin America

Latin America held 7% share, influenced by rising demand for reliable ignition systems in passenger cars and light commercial vehicles. Brazil and Mexico lead the region due to large automotive manufacturing bases and increasing aftermarket replacement needs. Economic fluctuations drive consumers toward cost-efficient maintenance solutions, supporting aftermarket coil sales. Adoption of stricter emission protocols encourages automakers to use improved ignition technologies. Although the region faces slower production growth, rising vehicle age and expanding service networks continue to sustain market demand.

Middle East & Africa

The Middle East & Africa region accounted for 5% share, supported by steady demand in countries with strong vehicle reliance, including Saudi Arabia, UAE, and South Africa. The region’s hot climate increases wear on ignition components, driving higher replacement rates. Growth in passenger car imports and expanding independent repair networks also support aftermarket demand. While new vehicle production remains limited, rising fuel-powered vehicle usage and increasing focus on engine performance sustain ignition coil adoption. Gradual improvements in automotive service infrastructure contribute to stable market development.

Market Segmentations:

By Type

- Coil-on-Plug (COP)

- Ignition Coil Rail

- Distributor-Based Ignition Coil

- Pencil Ignition Coil

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Two-Wheelers

By Distribution Channel

By Sales Channel

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape analysis highlights major players such as Denso Corporation, Bosch, Delphi Technologies, Hitachi Astemo, NGK Spark Plug Co., Ltd., BorgWarner, Federal-Mogul, Marelli, Hella GmbH, and Standard Motor Products, all of which play a key role in shaping the Automotive Ignition Coil market. These companies focus on delivering high-performance, heat-resistant, and durable ignition systems that meet modern engine efficiency and emission requirements. Vendors continuously invest in R&D to develop advanced Coil-on-Plug and pencil ignition coils that support turbocharged and direct-injection engines. Strategic partnerships with OEMs enable long-term supply agreements and ensure strong global presence. Players also expand their aftermarket portfolios to address rising replacement demand from aging fleets. With increasing regulatory pressure and evolving engine technologies, competition intensifies as manufacturers prioritize innovation, cost optimization, and quality reliability to strengthen market positioning worldwide.

Key Player Analysis

- Denso Corporation

- Bosch

- Delphi Technologies

- Hitachi Astemo

- NGK Spark Plug Co., Ltd.

- BorgWarner

- Federal-Mogul

- Marelli

- Hella GmbH

- Standard Motor Products

Recent Developments

- In January 2024, Niterra launched its “MOD Performance Ignition Coils” line (10 new part numbers) aimed at performance-vehicle and enthusiast markets in North America, covering approx. 40 million vehicles.

- In May 2023, Niterra Co., Ltd. (formerly NGK Spark Plug Co., Ltd.) launched 29 new ignition-coil part references in major markets, including the EMEA region. The launch expanded coverage for various global automakers like Hyundai, Kia, Mercedes-Benz, Porsche, Toyota, and Opel.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Vehicle Type, Distribution Channel, Sales Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-energy ignition coils will grow as automakers enhance engine efficiency.

- Coil-on-Plug systems will continue gaining adoption across modern gasoline engines.

- Smart ignition coils with built-in diagnostics will expand in connected vehicle platforms.

- Aftermarket demand will rise due to aging vehicle fleets in developing regions.

- Heat-resistant and lightweight coil materials will see greater innovation.

- Hybrid vehicles will sustain ignition coil usage despite the shift toward electrification.

- OEM partnerships will strengthen as automakers seek advanced emission-compliant solutions.

- Digital manufacturing and automation will improve coil precision and durability.

- Expansion of turbocharged engines will drive demand for high-voltage ignition technologies.

- Emerging markets will experience strong growth as vehicle production and service networks expand.

Key Growth Drivers

Key Growth Drivers